DPC Jai alai hall, Havana, Cuba 1904

That graph feels so scary it gives me the shivers. And Deutsche sees ‘healthy’ growth return later this year? Who are they kidding?

• Recession Risks Warn Of ‘Severe’ Drop In The Stock Market (MW)

Another brokerage firm has used the “R” word on Tuesday, warning investors to wake up to the idea that rising risks of a recession could send the stock market over a steep cliff. Based on current valuations, the prices of most stocks don’t appear to have factored in a recession scenario, “hence the downside should we see a recession could be rather severe,” RBC Capital Markets’ global equity team wrote in a research note to clients. Applying a stress test to their coverage universe, using worst-case, price-to-earnings valuations seen during the 2008-to-2009 recession, RBC analysts said they believe the shares of most companies could still fall another 50% or more from current levels. The concern for RBC analysts stems from the recently volatility in the stock market, caused by macro weakness, softness in China and commodity market challenges.

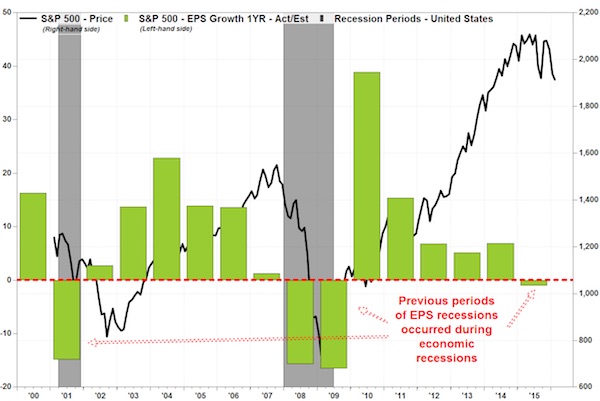

On Monday, Deutsche Bank strategist David Bianco said the second-half of 2015 was “clearly a profit recession” for S&P 500 companies, and suggested it probably won’t be until the second half of this year that “healthy” growth returns. Nearly half of S&P 500 companies have now reported fourth-quarter results through Tuesday morning, and earnings-per-share is headed for a 5.8% decline on the year, according to FactSet, compared with an estimated 5.7% decline as of Friday. That’s the data provider’s blended growth rate, which combines those companies that have reported with the estimates for the rest. That would be the third-straight quarter of an EPS decline, the longest such streak since the Great Recession. Among Tuesday’s culprits for the earnings decline, Exxon Mobil reported a 58% profit plunge and Pfizer reported a 50% earnings drop. Royal Caribbean Cruises reported earnings that nearly doubled, but the stock plunged 16% after the company provided a weak first-quarter outlook.

We write history.

• Exxon Faces First Downgrade in 86 Years (BBG)

Exxon Mobil, one of three U.S. companies with Standard & Poor’s highest rating, is facing its first downgrade in 86 years as the worst crude-market collapse in a generation strangles oil producers of cash. For Exxon, that would be a historic event: the global explorer that traces its roots to the 19th century and John D. Rockefeller’s Standard Oil Trust has been rated AAA by S&P since 1930. The oil giant was placed on credit watch with negative implications because its credit measures probably will remain weak through 2018, S&P said Tuesday.

“We get value from our AAA credit rating in our business,” Exxon’s Vice President of Investor Relations Jeffrey Woodbury said during a conference call with analysts before the credit review was announced. “Whether it be access to financial markets or access to resources, there is a benefit that we get from it, and we see it as being important.” The world’s five largest oil explorers had their credit ratings cut or threatened with downgrade as the market crash undermines their ability to pay debts, dividends and rig leases. For most of the oil industry, slashing drilling budgets and other cost-cutting “are insufficient to stem the meaningful deterioration expected in credit measures over the next few years,” S&P said.

In a sweeping review that also included many of the top U.S. shale drillers, Chevron had its rating cut by S&P, to AA- from AA, for the first time in almost 30 years, a day after Shell’s rating was reduced to the lowest since S&P began coverage in 1990. Exxon, Totaland BP may be next, the rating company said. S&P said it’ll decide whether to downgrade Irving, Texas-based Exxon within 90 days. If it does cut the rating, it’ll probably only be by a single notch, S&P said. Shell’s long-term credit rating was reduced on Monday by one level to A+, the fifth-highest investment grade, from AA-, and was placed on watch for another possible reduction, the ratings company said Tuesday. S&P also assigned negative outlooks to BP, Eni, Repsol, Statoil and Total.

Bail out.

• Iraq Sells Oil At $22, Fiscal Cliff Looms (BI)

The plunge in oil prices is already having far-reaching effects on countries whose economies are dependent on oil exports. But in Iraq, the stakes of cheap oil are even higher than in Saudi Arabia, which is instituting unprecedented taxation and austerity, or in Nigeria, which is now asking for an $11 billion World Bank loan. What little remains of Iraq’s government and social order might collapse if oil remains in its current price trough — with dire consequences. According to a Monday AFP report, Iraq is now selling oil at half of the country’s apparent fiscal break-even price. Right now, Iraq is selling its oil at around $22 a barrel, half of what it would need to fetch for the country to be able to fund the upcoming year of government budgetary obligations, the report said.

But Iraq’s situation is actually even worse. As recently as the 2014 fiscal year, Iraq was formulating its national budget on the assumption that oil would remain at around $90 a barrel and that the country’s oil exports would continue to climb (which they have). Iraqi government revenue experienced dramatic annual increases between 2009 and 2013, almost entirely because of oil. That’s all over, now that oil is expected to stay under $40 a barrel through the end of the year. Though Iraqi oil is comparatively cheap to extract, it also contains unusually high levels of sulfur, meaning that it typically sells for around 10% less than Brent crude, the global price benchmark.

The Iraqi government is still making money pumping oil — just not nearly enough to fund the country’s anticipated national budget. Such a daunting fiscal cliff would be challenging for a stable or politically coherent country. But it’s potentially disastrous in a place like Iraq, where the majority of territory is split between the terrorist group ISIS and the Kurdistan Regional Government. Even the areas still under some semblance of federal control are fought over by a constellation of militia groups with ties to recognized political parties.

Shouldn’t they question the Fed instead?

• Goldman Sachs Questions Capitalism (BBG)

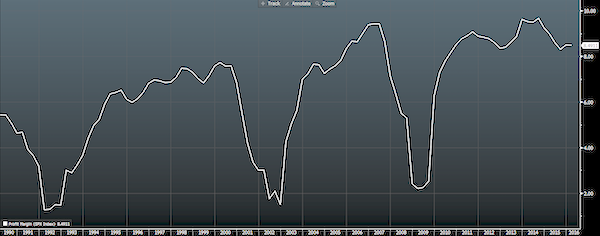

One of the most heated debates among investors is the question of whether corporate profit margins can maintain their elevated level, or whether they will inevitably mean revert. Here’s a quick look at S&P 500 profit margins, for example, going back over 25 years. They remain high by by historical standards.

A new note from Goldman Sachs analysts led by Sumana Manohar looks at the bull and bear arguments for the profit margins debate. Manohar argues that profit margins have expanded thanks to three key trends: strong commodities prices, emerging market cost arbitrage (companies making things more cheaply in emerging markets), demand growth from emerging markets, and improved corporate efficiency driven by the use of new technology. Continuing one of its major analytical themes of recent months, Goldman also notes that the market has rewarded companies that have undertaken mergers and share buybacks, compared to companies that have invested internally, further bolstering margins. So will profit margins inevitably roll over?

Goldman goes through both sides of the argument. On the bull side, the bank says that ongoing consolidation in industries, cost deflation, and tighter purse strings help keep a floor under margins. Ultimately though, it thinks that the above trends, coupled with weak demand and general industrial overcapacity, mean that margins are likely to come down. But what if margins stay elevated? That too is possible, and the implications could be unsettling. Goldman writes: “We are always wary of guiding for mean reversion. But, if we are wrong and high margins manage to endure for the next few years (particularly when global demand growth is below trend), there are broader questions to be asked about the efficacy of capitalism.”

In other words, profit margins should naturally mean-revert and oscillate. The existence of fat margins should encourage new competitors and pricing cycles that cause those margins to erode while conversely, at the bottom of the cycle, low margins should lead to weaker players exiting the business and giving stronger companies more breathing space. If that cycle doesn’t continue, then something strange is taking place. Needless to say, it’s not every day you see a major investment bank say they might have to start asking broader questions about capitalism itself.

Deflation’s in the driver’s seat, and there’s nothing anyone can do. Cutting prices is just one step in the process.

• Eurozone Manufacturing & Service Industries Cut Prices (BBG)

The euro area’s manufacturing and services industries cut prices at the fastest pace in almost a year in January, underlining concerns about weak inflation in the region. Markit Economics said its composite Purchasing Managers Index for January was “disappointing” and raises the prospect that the ECB will once again pump up its stimulus program. The PMI declined to 53.6 – a 4-month low – from 54.3 in December, and the measure of output prices dropped to the lowest since March. “Most worrying of all from a policy maker’s perspective is the intensification of deflationary pressures.,” said Chris Williamson, chief economist at Markit in London. “This raises the question of whether existing stimulus has simply been insufficient, or whether monetary policy is proving ineffective.”

ECB President Mario Draghi has said the Governing Council will review its stimulus in March amid signs that falling oil prices will push the euro region’s inflation rate back to zero. The Bank of Japan has already responded to the deteriorating outlook with negative interest rates and investors see a slower pace of tightening by the Federal Reserve. In the euro area, Markit said the PMI had some “mildly positive signs,” with rising levels of employment and backlogs of work. The headline composite number was also marginally better than the initial estimate, and it remains above the key 50 level that divides expansion from contraction. The services index slipped to 53.6 from 54.2, matching the preliminary reading. The composite report continued to point to divergences in the 19-nation economy, with Spain and Germany leading growth. France offered a disappointing reading, with the index at just 50.2, lower than the 50.5 initial estimate.

They sent them a what? “The PBOC didn’t immediately reply to a fax seeking comment.”

• Plan To Increase The Yuan’s Trading Flexibility Gains Momentum (BBG)

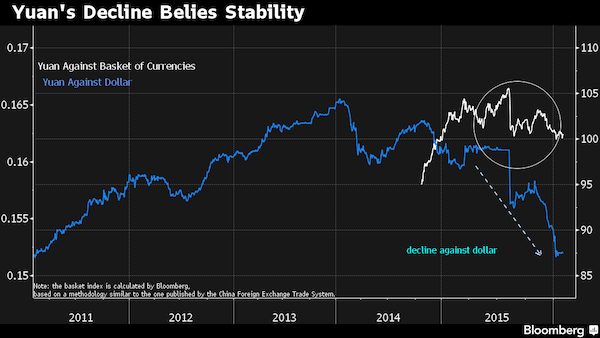

A proposal to fix the yuan’s quandary is gaining momentum among some economists. The plan, put forward by at least three analysts, calls for China to let the yuan fluctuate freely against a basket of currencies within a trading band. Outside the range – which would be as narrow as 4% or as wide as 15% under different versions of the proposal – the central bank will intervene in the market. Similar to what Singapore has adopted, the plan could be China’s get-out-of-jail card after a slew of changes in its opaque currency policy since August whipsawed investors and cost the central bank more than $500 billion in reserves, said the economists, including a former central bank adviser and a visiting scholar from the IMF.

Under the current system, the yuan is allowed to trade 2% above or below a reference rate versus the dollar set by the People’s Bank of China. Critics say that the regime fixates investors’ attention on the dollar-yuan exchange rate, even as the authorities aim to break its tie to the strengthening U.S. currency. The lack of transparency on how it sets the reference rate, or fixing, keeps investors guessing about the intentions of policy makers. “They are sort of stuck, I don’t think the market knows what exactly the policy is,” Tamim Bayoumi, a senior fellow at Peterson Institute for International Economics and an economist at the IMF since 1988, said from Washington. “The proposal is one way out of that,” said Bayoumi, who pitched the idea in a blog in December, favoring a 4% trading band.

By targeting a broader range of currencies and a wider band, the proposed system attempts to give market forces more sway in determining the exchange rates, save foreign reserves while shifting investors’ focus away from the dollar and provide clarity on policy. The PBOC didn’t immediately reply to a fax seeking comment. Chinese policy makers have been struggling to restore calm in the yuan since August when it revamped its currency system to make it more flexible. While the authorities have repeatedly said they aim to keep the exchange rate stable against a basket of currencies even if it falls versus the dollar, they have had little success convincing investors. The onshore yuan’s 5.6% slide versus the dollar over the past six months fueled expectations for a further depreciation and boosted capital outflows.

I see a lot of unhappy people in our future.

• Spring Festival Travel A One-Way Journey For Many Chinese (CNBC)

A giant annual human migration is underway in China, and it’s a bonanza for some but a painful process for others. Some 2.9 billion trips are expected to be undertaken between the start of China’s annual travel season on January 24 and the end on March 3, according to China’s transport ministry, with this week leading up to Spring Festival or Lunar New Year, which starts on February 8, being the busiest. [..] According to a real-time travel map by Chinese internet giant Baidu, the Beijing-to-Shanghai route on Wednesday afternoon in Asia was the most heavily traveled across all forms of transport, followed by Xian to Beijing and Shenyang to Beijing. For many migrant workers, however, this year’s journey home may be their final one, as slowing growth puts paid to their city dreams.

China’s factory activity skidded to a three-year low point in January, adding to gloom about the state of the world’s second-largest economy. Although growth in the service sector held above the key 50 expansionary level, the January official non-manufacturing purchasing manager’s index slowed to 53.5 from 54.4 in December. Restaurant workers Du Lijuan and Song Yaoguo told CNBC that they would not be among the crush of travelers this week. Both are waiting in Beijing for unpaid salaries of about $1,000 each before heading back home to the countryside, after losing their at a restaurant when it ran into financial difficulties in September. “We have no money to buy tickets, to buy gifts for our family or children,” Du said. “Normally, we spend $650 every Lunar New Year. I am not coming back [to Beijing].”

For years, migrant workers have been the backbone of China’s economic growth, by working in factories and constructing buildings, but many are considering new lives in the countryside after this Spring Festival, because they fear being unable to find jobs if they return to the cities. The migrant population fell by 5.7 million to 247 million in 2015, its first drop in about three decades.

It’s the debt, stupid!

• Buying A Home Is Overrated (MW)

Is buying a house instead of renting really the best financial decision? It’s a question that’s frequently debated, with traditional thinking being that renting is akin to throwing money out the window. But there are some good reasons to believe that buying a home instead of renting isn’t as great of an investment as Americans once thought. “Housing is overrated as a financial investment,” according to economist Alex Tabarrok, an economics professor at George Mason University and a research fellow at the university’s Mercatus Center, which conducts research on financial markets. He addressed the question of what economists think about buying compared to renting on Marginal Revolution, a blog he runs with fellow economist and George Mason professor Tyler Cowen.

“First, it’s not good to have a significant share of your wealth locked into a single asset,” he wrote. “Diversification is better and it’s easier to diversify with stocks. Second, unless you are renting the basement, houses don’t pay dividends. Stocks do. You can hope that your house will accumulate in value but don’t count on it. Indeed, you should expect that as an investment your house will appreciate less than does the stock market.” Owning a home makes it harder for many people to change locations for new job opportunities, leading to homeowners holding onto homes even while prices fall, Tabarrok said. Still, Americans don’t seem to be giving up on homeownership yet. Sales of existing homes rose 14.7% in December, the biggest monthly increase ever recorded, after depressed sales in November. Sales in 2015 were the best since 2006, at 5.26 million.

Americans are also buying homes that are larger and pricier; average home size was 2,720 square feet in 2015, up from 2,660 square feet in 2014. And the average price of new homes for sale in 2015 was $351,000, up from $100,000 in 2009. (Still, this doesn’t necessarily reflect the housing market’s strength, as new construction has mostly happened in the high-end market.) Of course, there are some benefits to homeownership, and they aren’t just avoiding unexpected rent hikes and unpredictable landlords. Many people simply enjoy interior decorating and entertaining, Tabarrok added. And perhaps more importantly, home ownership is often tied to access to better public schools. The U.S. tax code also subsidizes houses. Still, he cautioned against the seduction of a large home. “Behavioral economics tells us that we quickly get used to big houses, but we never get used to commuting,” he wrote. “So when you have a choice, go for the smaller house closer to work.”

h/t ZH

• The Bank of Japan Is Selling Out Its People (Gefira)

The Bank of Japan’s unexpected rate cuts to negative are a desperate attempt to help out the FED and to support the dollar at the expense of the aging Japanese population. The negative market reaction to the FED’s rate hike of December shows that investors do not believe an economic recovery in the US is underway. Two reasons make central banks start to raise interest rates. The first is that economy is doing well, and central banks have to prevent an overheated economy. But it is also a signal to investors everything is going well. In this situation, the first reaction of investors will be the opposite as central bankers planned they will and increase their investments and markets will go up. The second reason central banks raise interest rates is the defensive one; the moment the economy is out of control, investors are beginning to abandon the sinking ship.

The continually increasing interest rate has the task of keeping the investors aboard. Central banks in less developed economies raise rates to defend the national currency, thus preventing investors from fleeing. An increase in the interest rate can add fuel to the fire and in many cases has the opposite effect. Investors start smelling angst of the authorities and start abandoning the sinking ship. In such a situation stock markets are coming crashing down because investors withdraw from them. We saw this last pattern happening in the US economy after the December FED’s rate hike. As a result, the dollar-yen exchange rate is starting to decline, with the value of the dollar falling off as Japanese investors start panicking and fleeing the US market. Surely, Japanese investors know that a rate hike without an accompanying economic growth will erode every existing investment.

There is a general misconception according to which countries drive their currency down to generate growth. People adhere to the simplistic belief that a weak currency drives exports and helps the nation to prosper. The fact is that a cheap currency creates growth by giving away real goods in exchange for IOU (I Owe Yous) or paper debt obligations that will never be repaid. The US is the beneficiary or the receiving end of the weak yen policy. Because the US continues to maintain its world hegemony, it needs a strong dollar. A strong dollar makes everything the US empire buys in the world cheap. A strong dollar causes the world to be willing to exchange real goods for printed paper dollars that have no intrinsic value, and that are issued by a country that does not have the industrial capacity to ever repay what it owes its debtors.

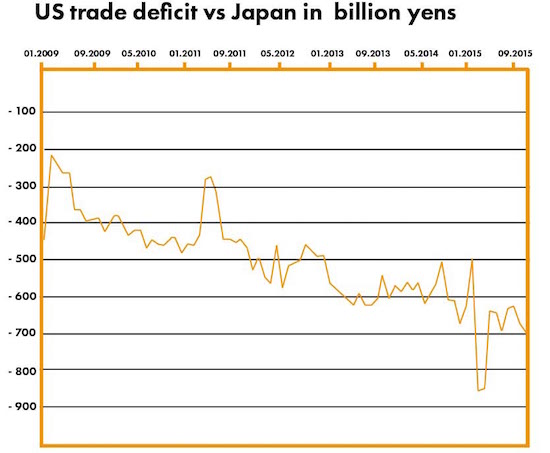

The endless trade deficit the US has with Japan shows how the Japanese are prepared to provide the US with real goods without demanding tangible goods in return. Because the international press publishes trade data in dollars, the trade balance deficit seems to have been shrinking over the last years. The actual situation becomes apparent if we look at the trade deficit in yens. The US trade deficit with Japan is growing bigger and bigger year after year, as Japanese producers are giving away a big chunk of their production to US consumers in return for more and more US paper debt. By manipulating the yen, Japanese authorities are giving away a real part of their GDP that they take from their people to the US empire.

Very good. Do read the whole thing. The socialists have been asked to form a government.

• Hedge Funds, Wall Street not Happy with the New Spain (Don Quijones)

Plunging shares, shrinking profits, and a spate of new regulations and court cases that could end up setting it back billions of euros – that’s what the Spanish banking sector is facing. But now, banks are also grappling with the complete absence of a friendly central government to insulate them from the cruel vagaries of the global economic downturn. And the strain is beginning to show. “The political parties must reach an agreement as soon as possible and form a government that is stable,” pleaded Francisco González, president of Spain’s second biggest bank, BBVA. Such a government must not “think about utopias, which only serve to create frustration,” must be “realistic” and (most important of all) must “continue with the policies of the last three of four years.”

González cautioned that foreign investors “are phoning less often” than before. Those “investors” probably include firms like Blackstone and Goldman Sachs, which made a fortune in the immediate aftermath of Spain’s real estate collapse and EU-funded bailout, by picking up publicly subsidized housing on the cheap and either flipping them or renting them at much higher rates. In those days, the city council was led by Ana Botella, the then Mayor and wife of Spain’s former President José María Aznar. One of the main brokers in the deals struck between the city council’s two housing agencies and international funds like Goldman and Blackstone was José María Aznar Botella – their son!

Despite his lack of investment banking experience, Aznar Botella served as an advisor and go-between at the Madrid-based real estate firm Gesnova Gestión Inmobiliaria Integral, which enjoyed close ties with firms like Blackstone subsidiary Fidere, Lone Star, Apollo, KKR, Goldman’s Madrid-based subsidiary Azora, and U.S. private equity firm Cerberus Capital Management LP, whom Aznar-Botella also serves as an advisor. Here’s how the scheme worked: in the aftermath of Spain’s real estate bust, the Rajoy government set up a bad bank by the name of Sareb, a public-private venture responsible for managing distressed assets transferred from the four nationalized financial institutions BFA-Bankia, Catalunya Banc, NGC Banco-Banco Gallego, and Banco de Valencia.

As soon as the bad bank was operational, global investment firms began flocking to Madrid to pick up the juiciest pieces at the best prices, part-subsidized by Spanish taxpayers. To get their hands on the really good stuff, however, investors needed someone on the inside, which is presumably where the Aznar-Botello mother & son partnership came in. But it’s one thing to sell tranches of unoccupied or foreclosed properties to foreign investors to help put a floor under Spain’s property market; it’s quite another when you start selling huge batches of social housing at a ridiculous discount to some of the biggest financial firms on the planet, in a country that has one of the smallest stocks of social housing in Europe. It didn’t take long before rents began soaring and the police began knocking doors down.

The Troika making sure Greece will never recover.

• Thousands Of Greek Firms Flee To Bulgaria (Kath.)

According to the president of the Hellenic Confederation of Professionals, Craftsmen and Merchants (GSEVEE), some 6,000 Greek enterprises have emigrated to Bulgaria in the last couple of years alone. At the same time, the GSEVEE chief says, Greeks are behind about 60,000 new tax registrations and bank accounts in the neighboring country. Giorgos Kavathas on Tuesday cited the above figures from an ongoing survey by GSEVEE, adding that the interventions planned for the social security system can only be expected to lead to more Greek firms emigrating. The survey will be presented in the next few days, he noted.

He was speaking at a press conference held jointly by GSEVEE and the Hellenic Confederation of Commerce and Enterprises (ESEE) regarding their participation in tomorrow’s general strike against the government’s planned pension reforms. The two unions warned that manufacturers and merchants will not stop at this strike, and will escalate their industrial action further. “The social security matter is a major national issue and we agree there has to be a reform, although no actuarial study would lead to safe conclusions given the existence of 1.5 million jobless,” argued the president of ESEE, Vassilis Korkidis.

Trying to rival the EU in inhumanity.

• Australian Asylum Ruling Paves Way For Deportation Of Infants (Reuters)

Australia’s High Court threw out a challenge to offshore immigration detention camps on Wednesday, clearing the way for the deportation of dozens of infants born in Australia to detained asylum seekers. The court rejected a legal test case brought by an unidentified Bangladeshi woman that challenged Australia’s right to deport detained asylum seekers to the tiny South Pacific island nation of Nauru. The detention centre on Nauru houses about 500 people and has been widely criticised by the United Nations and human rights agencies for harsh conditions and reports of systemic child abuse. The Bangladeshi woman was on a boat intercepted by Australian authorities in October 2013. She was detained on Australia’s remote Christmas Island and later sent to Nauru.

She gave birth to a daughter after she was transferred to Australia for medical treatment in 2014 and has remained there with her child. Other families with children born in Australia in similar circumstances are now in line to be returned to the camps. Lawyers from the Human Rights Law Centre (HRLC) acting for the Bangladeshi woman had argued it was illegal for Australia to operate and pay for offshore detention in a third country. “I hope that the immigration minister and the prime minister, just like other decent Australians, can see that there is simply no excuse to take 37 babies, to rip children from their classrooms, and warehouse them on a tiny island,” HRLC Director of Legal Advocacy Daniel Webb told reporters. “Now, the legality may be complex. The politics may be complex. But the morality is simple. It is fundamentally wrong.”

It’s all aimed at streamlining the process to move refugees north. But that’s not what Europe wants.

• Greek Military To Oversee Response To Refugee Crisis (Kath.)

Defense Minister Panos Kammenos on Tuesday heralded the creation of a central body to oversee and improve Greece’s response to the migration and refugee crisis and ensure the country safeguards its position in the Schengen passport-free area, noting that the new body will be led by a senior military official. Greece’s military is to have the oversight of the “Central Coordinating Body for the Management of Migration” until the Migration Ministry and the Hellenic Police gain the necessary know-how and experience to tackle the problem independently, Kammenos indicated at Tuesday’s press conference.

The center, which is to be operational by February 15, is to be based at the Defense Ministry headquarters and coordinate with the Hellenic Police, Coast Guard, Migration Ministry and nongovernmental organizations working with migrants and refugees. The aim is to increase the efficiency of transferring migrants from the islands to the mainland, to improve the provision of food as well as medical and healthcare to migrants, and to monitor the creation of five screening centers, or hot spots, for migrants on the eastern Aegean islands of Lesvos, Chios, Samos, Kos and Leros. Referring to the growing pressure on the islands of the eastern Aegean that receive thousands of migrants daily from neighboring Turkey, Kammenos explained that the new plan aims to spread the burden.

The five hot spots to be set up on the islands are to accommodate migrants for only 24 hours while two relocation centers, on the outskirts of Athens and Thessaloniki, will host new arrivals for up to 72 hours. The screening and relocation centers are to operate in a similar way to the central body, under a local military official who is to coordinate with police and coast guard officers. As the European Union increases the pressure on Greece to manage its borders more effectively, French Interior Minister Bernard Cazeneuve is due in Athens on Thursday and Friday for talks expected to focus on the migration crisis.

Wow! Imagine what spring will bring.

• More Than 62,000 Migrant Arrivals In Greece Last Month (Reuters)

The total number of migrants and refugees arriving in Greece in January topped 62,000, the International Organization for Migration said on Tuesday. “(It) is many, many times what we saw a year ago in the previous January,” IOM spokesman Joel Millman said. He added that there were more than 360 deaths among migrants in the waters off Greece, Turkey and Italy during the month.

When are we going to get real about this?

• UN Says One-Third Of Refugees Sailing To Europe Are Children (Guardian)

Children now make up over a third of the people making the perilous sea crossing from Turkey to Greece, the UN has said, as two more babies drowned off Europe’s shores. For the first time since the start of the migration crisis in Europe, there are also now more women and children crossing the border from Greece to Macedonia than adult males, according to UN children’s agency Unicef. The figures emerged as Europe struggles with its biggest movement of people crisis since the second world war, with more than a million people fleeing war, violence and poverty risking life and limb to reach its shores last year. “Children currently account for 36% of those risking the treacherous sea crossing between Greece and Turkey,” the Unicef spokeswoman Sarah Crowe said.

“Children and women on the move now make up nearly 60%” of those entering from Macedonia, she added. The figures mark a significant shift since June, when 73% of refugees were adult males and only one in 10 were under the age of 18. Marie Pierre Poirier, Unicef’s special coordinator for the refugee and migrant crisis in Europe, said women and children were even more vulnerable to the dangers of trying to travel to Europe. “The implication of this surge in the proportion of children and women on the move are enormous,” she said in a statement. “It means more are at risk at sea, especially now in the winter, and more need protection on land.” Underlining her point, the International Organisation for Migration (IOM) said on Tuesday that one in every five who drowned last month while trying to sail from Turkey to Greece was a child, with minors accounting for 60 of the 272 deaths.

Including January, a total of 330 children have died in those waters over the last five months, many of them just metres from shore, the organisation said. The drownings continue a grim trend that accelerated last year when nearly 4,000 people died trying to reach Europe by sea. The plight of children was brought home last year when the body of Syrian toddler Alan Kurdi was found washed up on the shore close to Bodrum, Turkey, horrifying the international community. The bodies of two more babies were recovered by the Turkish coastguard in the Izmir province on Tuesday along with seven dead adults, just days after another 37 people drowned off another part of the coast.

Europe will not be pardoned for this.

• Nine Migrants, Including Two Babies, Drown En Route To Greece (Reuters)

The bodies of nine people, including two babies, were found drowned off the coast of western Turkey on Tuesday, after a boat carrying refugees and migrants to Greece partly capsized, the Turkish coast guard said in a statement. The fiberglass vessel partially capsized at 0535 local time (0335 GMT) off the coast of Seferihisar in Izmir province, close to the Greek Island of Samos. Two people were rescued swimming to the shore, the coast guard said. A crackdown on illegal crossing and the dangerous winter conditions has failed to deter tens of thousands from boarding flimsy boats and attempting to cross the Mediterranean waves in the first few weeks of the year.

Home › Forums › Debt Rattle February 3 2016