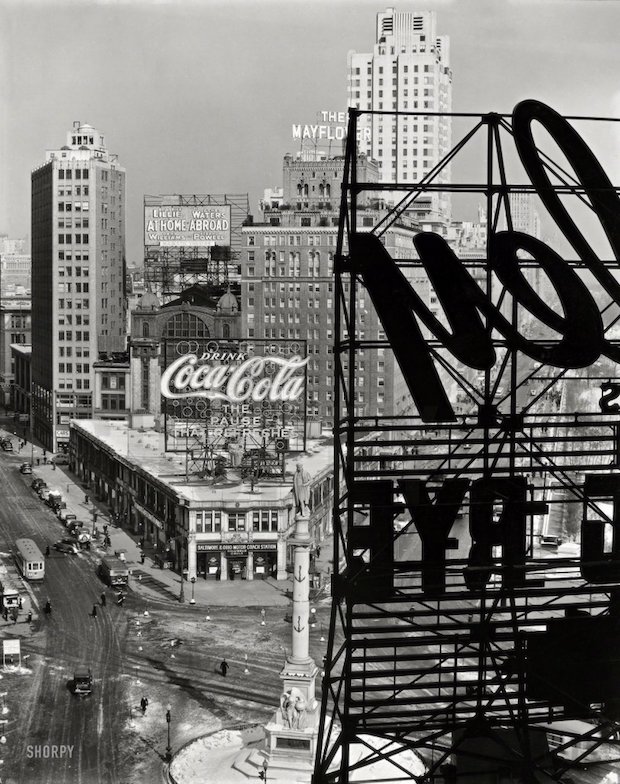

Johannes Vermeer The art of painting 1666-8

Plenary

https://twitter.com/i/status/1501673748151390214

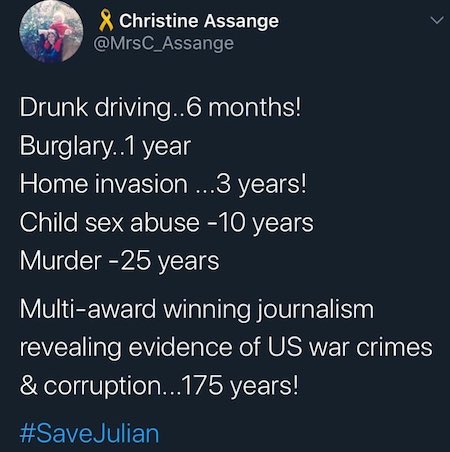

Assange

Julian Assange: "Populations dont like wars…and have to be fooled into war" pic.twitter.com/E2MuvzLwSc

— WikiLeaks (@wikileaks) March 9, 2022

“We could be looking at real chaos over the next decade or two.”

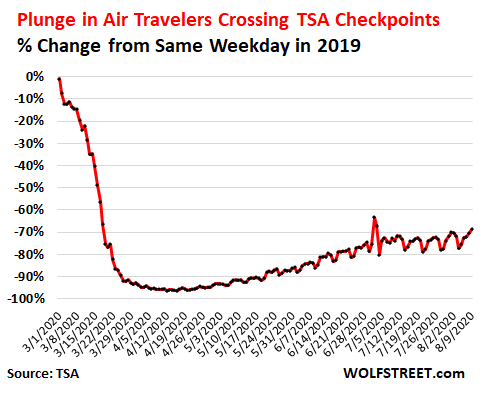

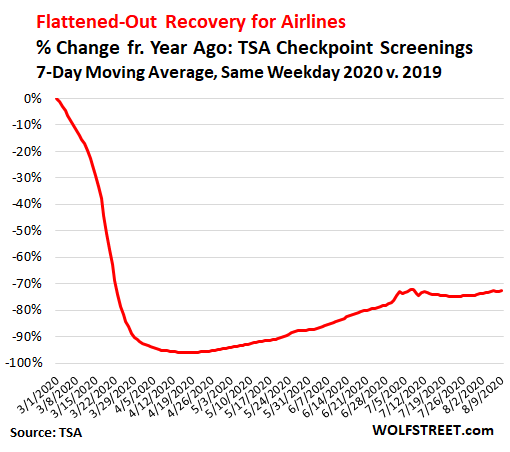

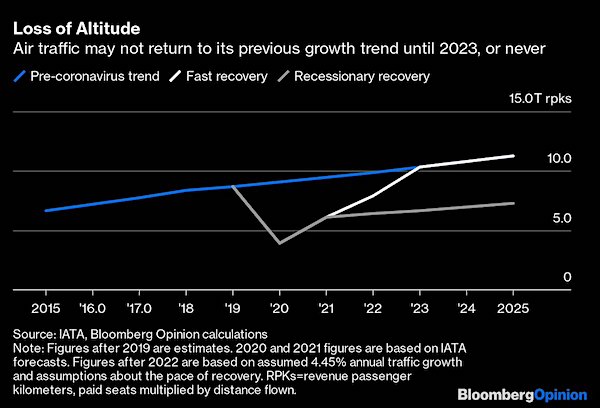

• Doug Casey: U.S. Empire Collapsing, Greatest Danger in World Today (G&E)

Doug Casey talks Great Reset, says we’re in for a tough time, that trends in motion tend to stay in motion, and fears the stage is being set for some authoritarian leader to rise to power. He feels the people who love liberty (e.g. libertarians) are an anomaly or rounding error compared to the rest of society. He gives his thoughts on being an international man in the brave new world where air travel has collapsed and authority has become more digital and centralized. We discuss Ukraine…he believes the Russians are on the right side of all this. The U.S. Government is a collapsing empire and has become the greatest danger in the world today. We could be looking at real chaos over the next decade or two. He gives us some tips on surviving the apocalypse.

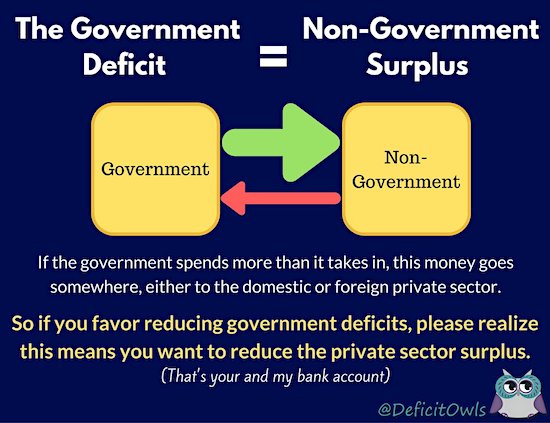

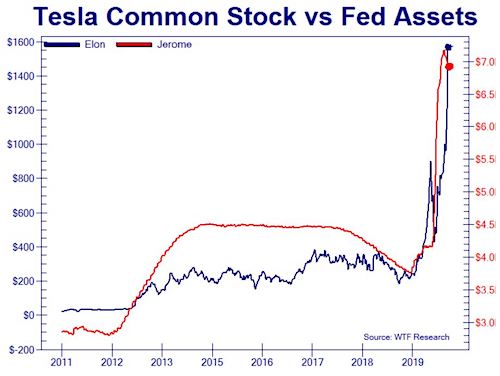

“..the government’s debt to GDP ratio soaring to 125 percent. For perspective, that ratio was just 53 percent back in 1960, and only 58 percent as recently as 2000..”

• A Recession Unlike Any Other (Pento)

The U.S. economy is already deteriorating due to the humongous fiscal and monetary cliffs. These cliffs are now being compounded by the war in Eastern Europe and near record-high inflation. And, the Fed’s “PUT” is much lower and smaller in size than Wall Street believes. The war in Ukraine will exacerbate the negative supply shocks that are already in place due to COVID-19. Worsening bottlenecks will combine with rising inflation to produce a contraction in global growth. Russia produces 12 percent of the world’s oil supply and exports 18 percent of the world’s wheat consumption. Ukraine accounts for 25 percent of global wheat production. Sanctions and war will serve to slow the economy further and send prices for these vital commodities even higher.

But the upcoming recession will be extraordinarily unique. Not only will it occur while inflation is at a multi-decade high, it will be the first U.S. economic contraction to take place while the Federal Reserve had its target interest rate at or near zero percent. For comparison, look at how much room the Fed had to reduce borrowing costs during previous economic contractions. The following historical data indicates the level of the Fed Funds Rate just prior to the outset of all 10 U.S. recessions since WWII: 1957 3.5 percent, 1960 4.0 percent, 1969 10.5 percent, 1973 13.0 percent, 1979 16.01 percent, 1981 20.61 percent, 1989 10.71 percent, 2000 6.86 percent, 2007 5.31 percent, and 2019 2.45 percent.

In addition, the swoon in GDP will occur after the Fed has just finished printing $4.5 trillion over the past two years and with the national debt vaulting over $30 trillion due to the massive increase in government deficits in the wake of the COVID-19 pandemic. Such borrowing helped send the government’s debt to GDP ratio soaring to 125 percent. For perspective, that ratio was just 53 percent back in 1960, and only 58 percent as recently as 2000. Inflation is destroying real wages, and rising borrowing costs are destroying consumers’ ability to consume. Consumption is 70 percent of GDP, and that means the rate of economic growth is set to plunge. This would normally spur the government into remediative action. But the fact remains that the ability of the Treasury and Federal Reserve to turn around a recession expeditiously by borrowing trillions of dollars and having that debt monetized by the Fed has become greatly fettered this time around.

$35.4 trillion in notional derivatives..

“derivative weapons of mass destruction”

• Deutsche Bank Has Lost 38% of Its Market Value in a Month (Martens)

Deutsche Bank closed at $16.50 on the New York Stock Exchange on February 10 of this year. It closed at $10.23 yesterday – a decline of 38 percent in a month’s time. That’s a big problem because Deutsche Bank is heavily interconnected to Wall Street banks via derivatives. According to Deutsche Bank’s most recent annual report, as of December 31, 2020, it held $35.4 trillion in notional derivatives. (Notional means face amount.) Deutsche Bank, a large German bank, was among the global banks bailed out by the Fed during the financial crash of 2008 as well as during the (still unexplained) liquidity crash that saw the Fed pump trillions of dollars in cumulative loans into global banks from September 17, 2019 through July 2, 2020.

In June 2016, The International Monetary Fund (IMF) released a report with a finding that Deutsche Bank posed the greatest threat to global financial stability than any other bank because of its interconnections to Wall Street mega banks and large banks in Europe. The largest bank in the United States, JPMorgan Chase, was shown as one of the banks with the largest amount of exposure. Despite that finding by the IMF in 2016, Deutsche Bank has been allowed by regulators in Europe and the U.S. to continue engaging in high-risk Over-the-Counter derivatives. It also has an uncomfortable history of suicides and rogue behavior. See a sampling of its history since 2014 below. Yes, President Joe Biden’s administration has a lot on its plate. But if it doesn’t get serious about reforming Wall Street and its derivative weapons of mass destruction, it will have a lot more to deal with eventually.

“Return of the Putin-Nazis! Revenge of the Putin-Nazis! Return of the Revenge of the Bride of the Putin-Nazis!”

• Revenge of the Putin-Nazis! (CJ Hopkins)

And they’re back! It’s like one of those 1960s Hammer Film Productions horror-movie series with Peter Cushing and Christopher Lee … Return of the Putin-Nazis! Revenge of the Putin-Nazis! Return of the Revenge of the Bride of the Putin-Nazis! And this time they are not horsing around with stealing elections from Hillary Clinton with anti-masturbation Facebook ads. They are going straight for “Democracy’s” jugular! Yes, that’s right, folks, Vladimir Putin, leader of the Putin-Nazis and official “Evil Dictator of the Day,” has launched a Kamikazi attack on the United Forces of Goodness (and Freedom) to provoke us into losing our temper and waging a global thermonuclear war that will wipe out the entire human species and most other forms of life on earth!

I’m referring, of course, to Putin’s inexplicable and totally unprovoked invasion of Ukraine, a totally peaceful, Nazi-free country which was just sitting there minding its non-Nazi business, singing Kumbaya, and so on, and not in any way collaborating with or being cynically used by GloboCap to menace and eventually destabilize Russia so that the GloboCap boys can get back in there and resume the Caligulan orgy of “privatization” they enjoyed throughout the 1990’s. No, clearly, Putin has just lost his mind, and has no strategic objective whatsoever (other than the total extermination of humanity), and is just running around the Kremlin shouting “DROP THE BOMBS! EXTERMINATE THE BRUTES!” all crazy-eyed and with his face painted green like Colonel Kurtz in Apocalypse Now … because what other explanation is there?

Or … OK, sure, there are other explanations, but they’re all just “Russian disinformation” and “Putin-Nazi propaganda” disseminated by “Putin-apologizing, Trump-loving, discord-sowing racists,” “transphobic, anti-vax conspiracy theorists,” “Covid-denying domestic extremists,” and other traitorous blasphemers and heretics, who are being paid by Putin to infect us with doubt, historical knowledge, and critical thinking, because they hate us for our freedom … or whatever. Let’s take a quick look at some of that “Russian disinformation” and “propaganda,” purely to inoculate ourselves against it. We need to be familiar with it, so we can switch off our minds and shout thought-terminating clichés and official platitudes at it whenever we encounter it on the Internet. It might be a little uncomfortable to do this, but just think of it as a Russian-propaganda “vaccine,” like an ideological mRNA fact-check booster (guaranteed to be “safe and effective”)!

OK, the first thing we need to look at, and dismiss, and deny, and pretend we never learned about, is this nonsense about “Ukrainian Nazis.” Just because Ukraine is full of neo-Nazis, and recent members of its government were neo-Nazis, and its military has neo-Nazi units (e.g., the notorious Azov Battalion), and it has a national holiday celebrating a Nazi, and government officials hang his portrait in their offices, and the military and neo-Nazi militias have been terrorizing and murdering ethnic Russians since the USA and the Forces of Goodness supported and stage-managed a “revolution” (i.e., a coup) back in 2014 with the assistance of a lot of neo-Nazis … that doesn’t mean Ukraine has a “Nazi problem.” After all, its current president is Jewish!

Sort of new for us, but the Russians have known this all along.

“..if a biological attack were to occur, everyone should be “100% sure” that it was Russia who did it..”

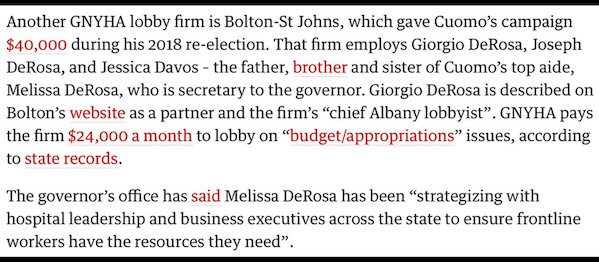

• Victoria Nuland: Ukraine Has “Biological Research Facilities” (Greenwald)

Self-anointed “fact-checkers” in the U.S. corporate press have spent two weeks mocking as disinformation and a false conspiracy theory the claim that Ukraine has biological weapons labs, either alone or with U.S. support. They never presented any evidence for their ruling — how could they possibly know? and how could they prove the negative? — but nonetheless they invoked their characteristically authoritative, above-it-all tone of self-assurance and self-arrogated right to decree the truth and label such claims false. Claims that Ukraine currently maintains dangerous biological weapons labs came from Russia as well as China. The Chinese Foreign Ministry this month claimed: “The US has 336 labs in 30 countries under its control, including 26 in Ukraine alone.”

Nuland

"Ukraine has biological research facilities," says Under Secretary Victoria Nuland. She has "no doubt" that in the event of a biological or chemical attack, #Russia would be responsible. pic.twitter.com/dHQ2Iy3Xxz

— In Context (@incontextmedia) March 9, 2022

The Russian Foreign Ministry asserted that “Russia obtained documents proving that Ukrainian biological laboratories located near Russian borders worked on development of components of biological weapons.” Such assertions deserve the same level of skepticism as U.S. denials: namely, none of it should be believed to be true or false absent evidence. Yet U.S. fact-checkers dutifully and reflexively sided with the U.S. Government to declare such claims “disinformation” and to mock them as QAnon conspiracy theories. Unfortunately for this propaganda racket masquerading as neutral and high-minded fact-checking, the neocon official long in charge of U.S. policy in Ukraine testified on Monday before the Senate Foreign Relations Committee and strongly suggested that such claims are, at least in part, true.

Yesterday afternoon, Under Secretary of State Victoria Nuland testified before the Senate Foreign Relations Committee. Sen. Marco Rubio (R-FL), hoping to debunk growing claims that there are chemical weapons labs in Ukraine, smugly asked Nuland: “Does Ukraine have chemical or biological weapons?” Rubio undoubtedly expected a flat denial by Nuland, thus providing further “proof” that such speculation is dastardly Fake News emanating from the Kremlin, the CCP and QAnon. Instead, Nuland did something completely uncharacteristic for her, for neocons, and for senior U.S. foreign policy officials: for some reason, she told a version of the truth. Her answer visibly stunned Rubio, who — as soon as he realized the damage she was doing to the U.S. messaging campaign by telling the truth — interrupted her and demanded that she instead affirm that if a biological attack were to occur, everyone should be “100% sure” that it was Russia who did it. Grateful for the life raft, Nuland told Rubio he was right.

Tucker Carlson – Bio-Weapons Labs in Ukraine

Yeah, right.

• US: Russia Could Launch Biological or Chemical Attack in Ukraine (Antiwar)

On Wednesday, the White House claimed without evidence that Russia might use chemical or biological weapons to create a false flag operation in Ukraine. The White House also dismissed Moscow’s accusations that the US is involved in biological weapons research in Ukraine even though there are Pentagon-linked labs in the country. On Twitter, White House Press Secretary Jen Psaki said to be on the lookout “for Russia to possibly use chemical or biological weapons in Ukraine, or to create a false flag operation using them.” She said Russia’s claim of the US having biological weapons labs in Ukraine is “preposterous.” Psaki’s denial comes a day after Undersecretary of State Victoria Nuland said there are “biological research facilities” in Ukraine the US is concerned Russian forces might seize.

Nuland made the comments after being asked if there are bioweapons in Ukraine and said the US is working with the Ukrainians to keep “research materials” out of Russia’s hands. The Russian military has claimed that it uncovered 30 biological laboratories in Ukraine linked to the Pentagon’s Defense Threat Reduction Agency (DTRA). On Wednesday, Russian Foreign Ministry spokeswoman Maria Zakharova said Russia has documents that show Ukraine ordered the destruction of samples of plague, cholera, anthrax, and other pathogens before Russia launched its attack on February 24. According to a February 25 article from the Bulletin of Atomic Scientists, the US government has worked with 26 biological research facilities in Ukraine. The article quoted Robert Pope of the DTRA’s Cooperative Threat Reduction Program, who warned some of the labs could have Pathogens leftover from the Soviet Union’s bioweapons program.

Lavrov biological weapons

Russia FM Lavrov:"We have information that US built two biological warfare labs in Kiev & Odessa. pic.twitter.com/wgB1YXzjqZ

— Wittgenstein (@backtolife_2022) March 9, 2022

The US is insane.

• The Documents the US Embassy in Ukraine Scrubbed on Biolabs (BN)

Russian accusations of a U.S.-funded and administered ‘biowarfares’ laboratory research program in Ukraine has led to rampant speculation about the nature of these Pentagon-funded laboratories. The Russians’ insistence that it has evidence of such a bioweapons program has become a major hurdle at the diplomatic negotiations between Russia and Ukraine in Belarus. Russian foreign minister Sergei Lavrov charged at a press conference last week that “the Pentagon built two biowarfare labs and they have been developing pathogens there in Kyiv and in Odessa.” Lavrov also compared the presence of the laboratories to the United States’ Weapons of Mass Destruction program allegations that led it to invade Iraq in 2003 and topple dictator Saddam Hussein.

Leonid Slutsky, head of the Duma Committee on International Affairs and a member of the Russian delegation at the talks with Ukraine, argued that the purported development of biological weapons components “confirm that the Russian Federation had good reasons for conducting a special military operation to demilitarize Ukraine.” Major General Igor Konashenkov, an official representative of the Russian Ministry of Defense, charged on Sunday that “components of biological weapons were being developed in Ukraine, in close proximity to Russian territory.” Amid the Russians’ accusations, the U.S. Embassy in Ukraine has scrubbed a number of documents related to the Ukrainian “Biological Threat Reduction” program. Those documents have been retrieved and can be read below. The documents show both the locations of the Ukrainian laboratories and the Department of Defense’s listing as a “donor” to the program.

They were fine with Poland handing them over directly. That way nobody could point at the US. It would still have been WWIII. And Poland didn’t fall for that trap.

• US Won’t Give Poland’s Jets to Ukraine (ET)

The United States won’t act on a proposal from Poland to take fighter jets from the ally and transfer them to Ukraine because of concerns Russian officials would view the move as “escalatory,” a U.S. official said March 9. “The intelligence community has assessed the transfer of MiG-29s to Ukraine may be mistaken as escalatory, and could result in significant Russian reaction that might increase the prospects of a military escalation with NATO,” John Kirby, the U.S. Department of Defense’s spokesman, told reporters in Washington. Based on the assessment, with which Defense Secretary Lloyd Austin concurs, the military assesses the transfer as “high-risk” and will not carry it out, at least for now.

The proposal from Poland was Polish officials would transfer jets to the United States, which could then send the jets to Ukraine. Poland’s government also called on NATO allies to send jets to U.S. bases. But U.S. officials quickly rejected the proposal, though they had not detailed the intelligence assessment until Wednesday. Kirby also framed the decision as in Ukraine’s best interests, arguing that Ukraine would benefit more in the conflict with Russia by receiving anti-armor and air defense weapons. While Russia’s air force has significant capabilities, air assaults have been met with resistance in the air and on the ground, according to U.S. officials. Additionally, the Ukrainian Air Force was also said to have several squadrons of fully capable aircraft already, and a U.S. assessment concluded “giving them more is not likely” to make a big impact, according to Kirby.

Austin conveyed the position to Polish Defense Minister Mariusz Blaszczak in a call and also spoke with a top Ukraine official about similar matters. U.S. officials had previously said Poland was welcome to transfer planes to Ukraine directly and Kirby said each nation “can decide for themselves what they want to do.” Ukraine’s public position is that getting fighter jets would help tremendously against Russia, which invaded its neighbor on Feb. 24. “That’s absolutely the way we see it,” Vadym Prystaiko, Ukraine’s ambassador to the United Kingdom, said on Sky News on Wednesday when asked if jets would give Ukraine the advantage it needs.

“..stabilize the market..”

• Ukraine Bans Exports Of Wheat, Oats And Other Food Staples (AP)

Ukraine’s government has banned the export of wheat, oats and other staples that are crucial for global food supplies as authorities try to ensure they can feed people during Russia’s intensifying war. New rules on agricultural exports introduced this week also prohibit the export of millet, buckwheat, sugar, live cattle, and meat and other “byproducts” from cattle, according to a government announcement. The export ban is needed to prevent a “humanitarian crisis in Ukraine,” stabilize the market and “meet the needs of the population in critical food products,” Roman Leshchenko, Ukraine’s minister of agrarian and food policy, said in a statement posted on the government website and his Facebook page.

It’s the latest sign that the Russia’s invasion of Ukraine threatens the food supply and livelihoods of people in Europe, Africa and Asia who rely on the farmlands of the Black Sea region — known as the “breadbasket of the world.” Russia and Ukraine together supply nearly a third of the world’s wheat and barley exports, which have soared in price since the invasion. The products they send are made into bread, noodles and animal feed around the world, and any shortages could create food insecurity in places like Egypt and Lebanon. The export ban will likely reduce global food supplies just when prices are at their highest level since 2011.

The start.

• Iraqis Protest Rise In Food Prices, Officials Blame Ukraine War (AlJ)

Protests have erupted in Iraq’s impoverished south over a rise in food prices that officials attributed to the conflict in Ukraine. For about a week, the price of cooking oils and flour have skyrocketed in local markets as government officials have sought to address growing anger with various statements and measures. More than 500 protesters gathered on Wednesday in a central square in the southern city of Nasiriya – a flashpoint of anti-corruption protests that gripped the country in 2019. “The rise in prices is strangling us, whether it is bread or other food products,” retired teacher Hassan Kazem told AFP news agency. “We can barely make ends meet.” On Tuesday, the Iraqi government announced measures to confront the increase in international prices.

These included a monthly allowance of about $70 for pensioners whose incomes do not exceed one million dinars (almost $700), as well as civil servants earning less than 500,000 dinars ($343). The authorities also announced the suspension of customs duties on food products, basic consumer goods and construction materials for two months. Trade ministry spokesman Mohamed Hanoun attributed the rise in cooking-oil prices to the conflict in Ukraine. “There’s a major global crisis because Ukraine has a large share of [the world market in cooking] oils,” he said. On Tuesday, a protester was seriously injured in a demonstration in the central province of Babil that was marred by violence, a security source said. The interior ministry announced it had arrested 31 people accused of “raising the prices of food commodities and abusing citizens”. A protester in Nasiriya on Wednesday denounced the “greed of traders who manipulate prices”.

“This is the beast that Putin is,” Pelosi said.

• Dems Drop Covid-19 Funds, Clear Way For OK Of $13.6b Ukraine Aid (AP)

The House approved a massive spending bill Wednesday night that would rush $13.6 billion in U.S. aid to battered Ukraine and its European allies, after top Democrats were forced to abruptly drop their plan to include fresh funds to battle COVID-19. Passage of the Ukraine aid and the $1.5 trillion government-wide legislation carrying it let both parties lay claim to election-year victories for their priorities. Democrats won treasured domestic initiatives, Republicans achieved defense boosts, and both got their imprint on funds to counter Russia’s brutal invasion of its western neighbor. Senate approval was assured by week’s end or perhaps slightly longer.

Hours earlier, House Speaker Nancy Pelosi, D-Calif., had to abandon the bill’s $15.6 billion for combating the pandemic, a decision she called “heartbreaking” and that spelled defeat for a top priority of President Joe Biden and party leaders. The money was mostly to bolster U.S. supplies of vaccines, treatments and tests and battle the disease around the world, but a Democratic revolt over Republican-demanded state aid cuts to cover the new initiatives’ costs forced her to scrap that spending. “We’ve got a war going on in Ukraine,” Pelosi told reporters, explaining the urgency Democrats felt in making concessions in bargaining with Republicans. “We have important work that we’re doing here.” She said with her party in the 50-50 Senate needing at least 10 GOP votes to pass legislation, Democrats “are going to have to know there has to be compromise.”

The House approved the overall bill in two separate votes. The measure’s security programs were overwhelmingly approved by 361-69, the rest by 260-171, with most Republicans opposed. The Ukraine aid included $6.5 billion for the U.S. costs of sending troops and weapons to Eastern Europe and equipping allied forces there in response to Russian President Vladimir Putin’s invasion and bellicose threats. There was another $6.8 billion to care for refugees and provide economic aid to allies, and more to help federal agencies enforce economic sanctions against Russia and protect against cyber threats at home. Biden had requested $10 billion for Ukraine.

Pelosi said she talked to Ukrainian President Volodymyr Zelenskyy for 45 minutes Wednesday. She said they discussed the weapons and other assistance his country needs and “the crimes against humanity that Putin is committing,” including a Russian airstrike that destroyed a maternity hospital. “This is the beast that Putin is,” Pelosi said. While enmity toward Putin and a desire to send assistance to the region is virtually universal in Congress, lawmakers have had a harder time finding unity on other steps. In one area where both parties were eager to demonstrate action, the House voted 414-17 to banning Russian oil imports, a prohibition that Biden imposed this week.

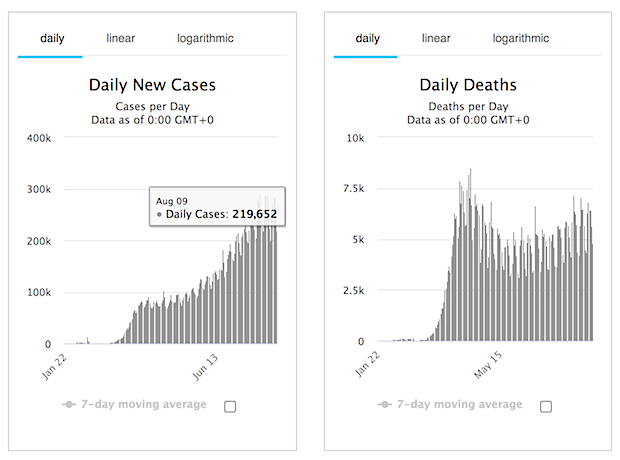

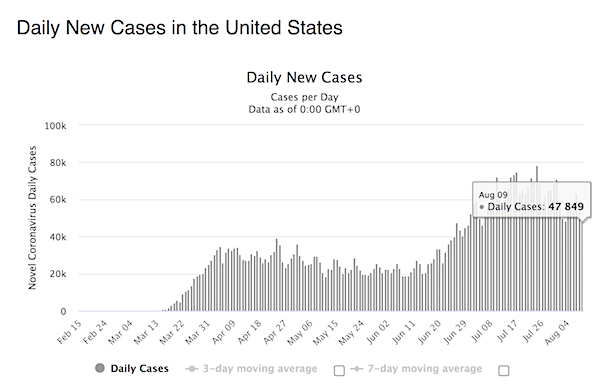

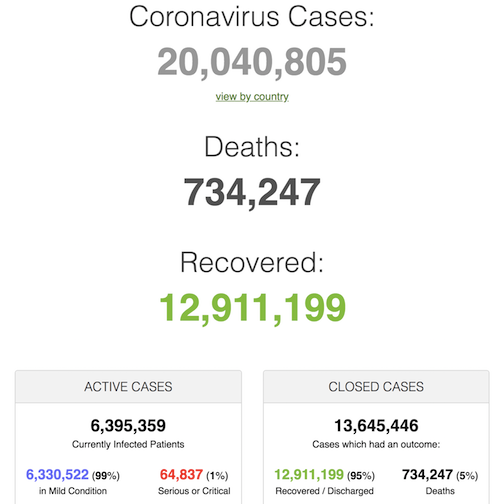

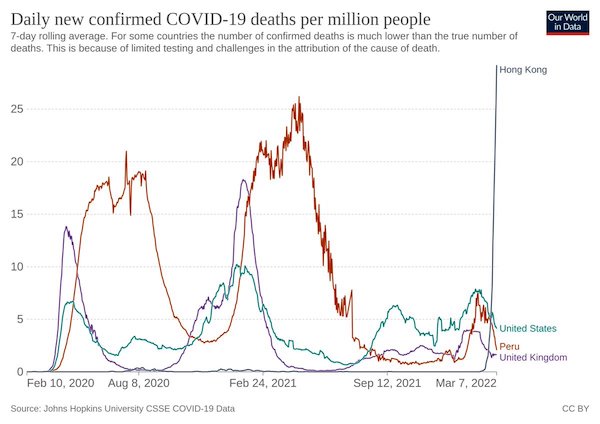

“..the case fatality rate in Hong Kong is 16 times HIGHER than in the US..”

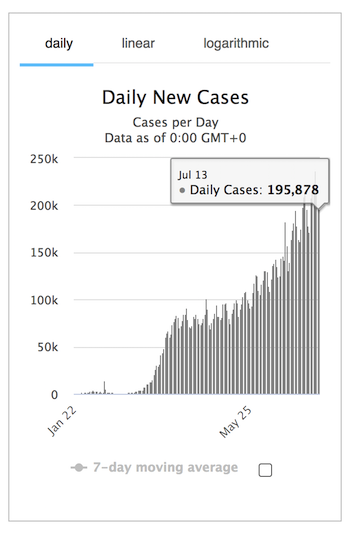

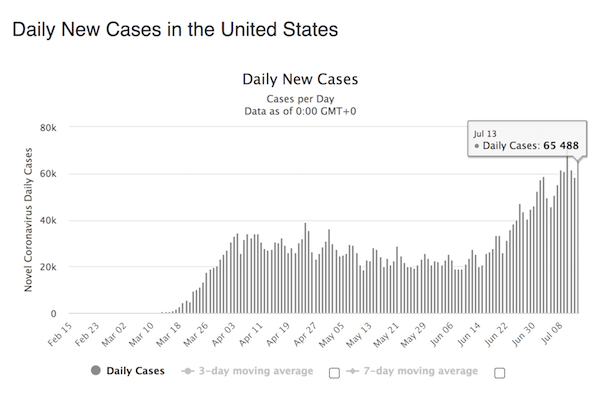

• Bad News from Hong Kong (Chudov)

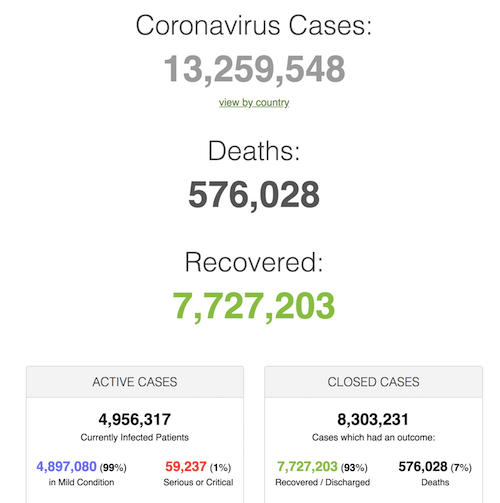

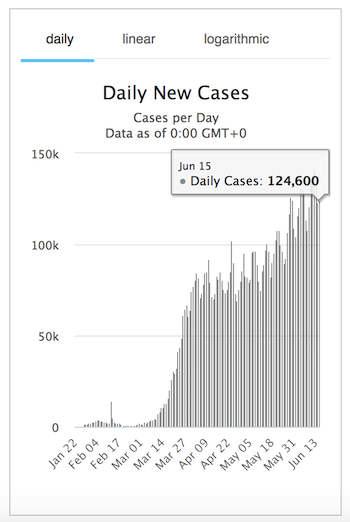

Something very strange is happening in Hong Kong. I am not the first to write about it, but I wanted to do a good job compiling the information and informing my readers so this post is somewhat complete. I will include additional reading below. Hong Kong’s stringent “Zero Covid” policy, stopped to work in mid-February and a “wall of cases” curve exploded in the territory. Now, we have seen such “walls of cases” before, but nothing close ever happened to deaths. You can see that deaths per million in Hong Kong are basically three TIMES the highest death rate in the US or Israel. Cases between Feb 13-Feb 17: 18,493 Deaths between Feb 28-March 4: 895 Calculated Case Fatality Rate: 4.83%

The relevant case fatality rate in the US for our recent Omicron peak is roughly 0.3%, or 16 TIMES lower. Slow down and let it sink in: the case fatality rate in Hong Kong is 16 times HIGHER than in the US. That should make you curious. Hong Kong is vaccinated just as much as the United States or Israel, sitting closely between them. Clearly, something else is in play and not the vaccine. Just as cases and deaths in HK skyrocketed, a new sub-variant called “BA.2 + S:I1221T” has taken over. Not much is known about that variant, other than it is minimal elsewhere. Every Hong Konger who is diagnosed with Covid must be taken away and isolated for 21 days in a very bleak and sad place called “Penny Bay”, where they do not even have working wi-fi.

This, naturally, creates an incentive to NOT report a case of Covid and hide out at home with working wi-fi, for those lucky enough to be able to do it. This creates a bias of healthy people with mild cases not being reported, and may explain a part of high mortality. Here in the West, most people already had exposure to Covid. It is a mystery who gets infected first and why some people do not get Covid until later in the pandemic. It is possible that here in the US or UK, the least healthy people already caught Covid and some, sadly, died. Thus, subsequent waves seem to be less deadly, partly because several waves of Covid already went through the population, and some immunity already exists. Not so in HK, where everyone is now vulnerable.

While, so far, I have not seen any evidence of ADE affecting anyone, it is possible that such incredibly high mortality rates are due to ADE from this new variant. The S:i1221T mutation does change a spike amino acid and it is possible that vaccine spike antibodies are assisting infection instead of suppressing it. While it is still speculation, such a possibility need not be dismissed. Overall, Hong Kong is a story worth watching.

Remdesivir kills 26.9% of patients

In New York State, 26.9% of Medicare-Aged Patients Who Received Fauci's 5-Day Remdesivir Protocol Died. pic.twitter.com/CWjbV0I9BD

— The Prisoner (@Prisoner004) March 9, 2022

Hmmm .. what changed so dramatically? The polls?

• Austria Scraps Covid-19 Vaccine Mandate (RTE)

Austria said it is suspending mandatory Covid-19 vaccinations for all adults saying the pandemic no longer poses the same danger, just weeks after the law took effect in an EU first. The Alpine nation of nine million people was among few countries in the world to make jabs against the coronavirus compulsory for all adults. The law took effect in February and called for fines up to €3,600 from mid-March for those who do not comply. But minister Karoline Edtstadler said the law’s “encroachment of fundamental rights” could no longer be justified by the danger posed by the pandemic. “After consultations with the health minister, we have decided that we will of course follow what the (expert) commission has said,” Ms Edtstadler told reporters after a Cabinet meeting.

“We see no need to actually implement this compulsory vaccination due to the (Omicron) variant that we are predominantly experiencing here.” The highly-contagious variant is widely believed to be less severe than previous strains of the virus, and so far Austrian hospitals have been able to cope with a surge in cases. This has led to the government to drop most coronavirus restrictions in recent weeks. The government has stressed it needs to act flexibly in line with the epidemiological situation. “Just like the virus keeps on changing, we need to be flexible and adaptable,” Ms Edtstadler said. The decision to suspend the law will be reviewed in three months, said Johannes Rauch, who took over as health minister this week as the third since the start of the pandemic.

Synthetic RNA

Dr. Robert Malone explains synthetic LNP RNA nucleoside analogue caps at the 5' and 3' ends of the strands work to create a widely distributed and durable product that stays in the body far longer than ever conceived producing Spike protein at much greater levels than the URI. pic.twitter.com/DCpj1xb9s7

— Peter McCullough, MD MPH (@P_McCulloughMD) March 10, 2022

“..in both cities he regularly invited Ukrainian singers and conductors because “we never even thought about our nationalities. We were enjoying making music together.”

• Bolshoi Conductor Resigns Over Free Speech Controversy (Turley)

Now that assault on free speech has reached the highest levels of ballet after Tugan Sokhiev, the chief conductor at Bolshoi Theatre and the Orchestre National du Capitole de Toulouse, resigned rather than be coerced into such public statements. The Munich Philharmonic also dismissed chief conductor Valery Gergiev after he failed to condemn the invasion. Sokhiev is one of the most celebrated and respected conductors in the world. He also happens to be Russian. For many, his musical contributions became secondary when he failed to publicly condemn Putin. They demanded that he speak or resign. He resigned. Sokhiev wrote on Facebook “during last few days I witnessed something I thought I would never see in my life. In Europe, today I am forced to make a choice and choose one of my musical family over the other.”

As we previously discussed, it is during wartime and periods of social discord that the greatest abuses can occur for those with dissenting or unpopular views. Despite my strong support for Ukraine and condemnation of Putin, it is important for advocates of civil liberties and free speech to stand against such blacklisting and compelled speech. For many, this is hardly a new movement. For years, powerful politicians, academics, and even some in the media have demanded more censorship. This move against Russian performers and athletes may draw the unwitting into this anti-free speech movement. The response to those of us who are raising concerns is the same and predictable. You are called an apologist for Putin or a traitor to the cause. It is an effort to create a glacial chilling effect on dissenting voices.

Once again, it is important to address the rationalization on the left for attacks on free speech in recent years: the First Amendment only protects speech from government crackdowns. The First Amendment is not the full or exclusive embodiment of free speech. It addresses just one of the dangers to free speech posed by government regulation. Many of us view free speech as a human right. Corporate censorship of social media clearly impacts free speech, and replacing Big Brother with a cadre of Little Brothers actually allows for far greater control of free expression. As I have noted earlier, while liberal writers and artists were blacklisted and investigated in the 1950s, liberal activists have succeeded in censoring opposing views to an unprecedented degree in recent years. Rather than burn books, they have simply gotten stores to ban them or blacklist the authors, athletes, and artists.

Figures like the great singer Paul Robeson found themselves barred from performances due to their refusal to condemn others or Russia. Some, however, are not intimidated but rather incensed by the attack on free speech. In the meantime, at least one opera lover is boycotting the Met after it cancelled another great Russian artist for not publicly reciting the official line against Putin. I recently received the attached letter from a donor at the Met who stated that he was changing his will over the controversy involving soprano Anna Netrebko. He would no longer leave his estate to the Met and pledged to stop his regular contributions to the institution. As for Sokhiev, he noted that in both cities he regularly invited Ukrainian singers and conductors because “we never even thought about our nationalities. We were enjoying making music together.”

The response from the mayor of Toulouse, Jean-Luc Moudenc, was particularly telling. While denying that they demanded that Sokhiev “make a choice between his native country and his beloved city of Toulouse,” the mayor added: “However, it was unthinkable to imagine that he would remain silent in the face of the war situation, both vis-à-vis the musicians and the public and the community.” It is not “unthinkable.” He may support the invasion or fear for himself or his family in opposing this tyrant. It does not matter his reasons. He should have a right to hold opposing views or to remain silent. What is unthinkable is that artists are being blacklisted for refusing to recite political statements like some reeducation camp in the Cultural Revolution. It is a curious way to fight tyranny by denying free speech.

It’s like a cartoon now.

The Cardiff Philharmonic has cancelled an all-Tchaikovsky programme as ‘inappropriate at this time’. The concert included his decidedly apolitical second symphony, known as the Little Russian. The orchestra says: ‘: In light of the recent Russian invasion of Ukraine, Cardiff Philharmonic Orchestra, with the agreement of St David’s Hall, feel the previously advertised programme including the 1812 Overture to be inappropriate at this time. The orchestra hope you will continue to support them and enjoy the revised programme.’

This is unutterably stupid. At the start of the First World War, the Proms conductor Sir Henry Wood informed the British government that he would continue performing Wagner and other Germans. The same rule prevailed in the Hitler war. Only the Nazis ever banned Tchaikovsky. Welcome to Cardiff 2022.

Elon Musk tweet

Nate Hagens Human superorganism

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.