NPC Fire at Thomas Somerville plant, Washington DC 1926

And Europe’s falling faster.

• Asian Markets Drop As Pessimism Increases Ahead Of OPEC Meeting (MW)

Asian shares were broadly lower Monday, as relief over a delay by the U.S. Federal Reserve in raising interest rates wore off. Japan’s Nikkei was down 0.8%, while Hong Kong’s Hang Seng Index retreated 0.7%. South Korea’s Kospi slipped 0.4%. “Asia Pacific investors are bracing for a sell day after European and U.S. traders took some hard won risk off the table,” wrote Michael McCarthy, chief market strategist at CMC Markets, in a note. On Friday, the S&P 500 and Nasdaq both fell 0.6% and the Dow Jones Industrial Average shed 0.7% as energy stocks slid with oil prices Friday. Investors were also pessimistic on Monday over any breakthroughs in oil-production cuts when OPEC gathers for an informal meeting later this week.

Merkel’s comments weigh in.

• Deutsche Bank Slumps to Fresh Record Low on Capital Concerns (BBG)

Deutsche Bank shares dropped to a record low amid concerns that the lender’s capital buffers will be undermined by mounting legal charges including a settlement tied to the sale of U.S. securities The shares dropped 4.2% to €10.93 at 9:15 a.m. in Frankfurt, an all-time low. The 38-member Bloomberg Europe Banks and Financial Services Index slipped 1.5%, with Deutsche Bank the worst performer. A potential $14 billion bill to settle a U.S. probe into residential mortgage-backed securities is more than twice the €5.5 billion ($6.2 billion) Deutsche Bank has set aside for litigation. The lender also faces inquiries into legal issues including currency manipulation, precious metals trading and billions of dollars in transfers out of Russia, complicating CEO John Cryan’s efforts to bolster profitability and capital ratios.

Germany’s biggest bank would be “significantly under-capitalized” even assuming enough provisions to cover an eventual settlement with the U.S. Justice Department, Andrew Lim at Societe Generale said in a note earlier this month. A settlement range of $3 billion to $3.5 billion would leave the German lender room to settle other legal issues, while any additional $1 billion in litigation charges would erode 24 basis points in capital, JPMorgan analysts wrote. Chancellor Angela Merkel has ruled out any state assistance for Deutsche Bank in the year heading into the national election in September 2017.

Big warning sign. Circle jerking tail eating snakes.

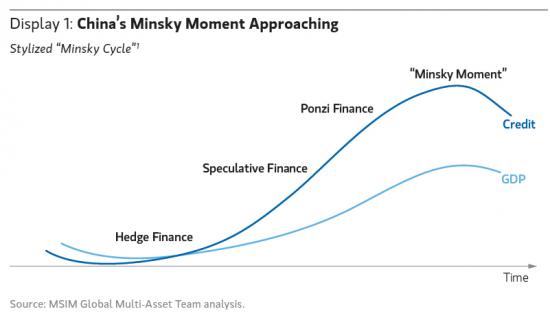

• China’s Smaller Banks Are Funding Each Other’s Lending (BBG)

[..] China’s banking regulator told city banks last week to learn the lesson of the global financial crisis and get back to traditional businesses. CLSA estimates total debt may reach 321% of GDP in 2020 from 261% in the first half. “Contagion risks are definitely rising,” said Liao Qiang, Beijing-based senior director for financial institution ratings at S&P Global Ratings. “The pace of the development is concerning. If this isn’t stopped in time, the central bank will lose some control and flexibility of its monetary policy.” Shanghai Pudong Development Bank said in an e-mailed response on Sept. 24 it has been using appropriate financing and its regular deposits and interbank borrowing have been developing properly and in synchronization.

Total liabilities will be kept under control in the long run and all liquidity gauges meet regulatory requirements, it said. Rising short-term borrowing doesn’t mean its risks have climbed as well, the bank said. “City commercial banks should change as soon as possible the situation of allocating more funds into investing than lending, and developing their off-balance-sheet businesses too fast,” Shang Fulin, chairman of the China Banking Regulatory Commission, said. The PBOC resumed longer-term reverse repos to boost borrowing costs in August and deputy governor Yi Gang said in a television interview earlier this month that the nation’s short-term goal is to curb leverage. It gauged demand for such auctions today. The benchmark 10-year government bond yield climbed slightly, to 2.73% from a decade low of 2.64% on Aug. 15.

[..] The higher the reliance on wholesale funds and investment in illiquid assets, the greater the risk of a liquidity crunch, said Christine Kuo at Moody’s. “When banks face fund withdrawals by other financial institutions, this will in turn prompt them to call back their own funds,” she said. Banks are also buying each others’ wealth-management products and accounting for the transactions as investment receivables. A record 26.3 trillion yuan of WMPs were outstanding as of June 30, doubling over two years, official data showed. Investment receivables at 25 listed banks grew 13.4% in the first half to 11 trillion yuan.

Doesn’t sound like real restructuring.

• China Launches $52.5 Billion Restructuring Fund For State-Owned Firms (R.)

A private equity fund worth 350 billion yuan ($52.5 billion) has been launched in China to help with the restructuring of state firms, a newspaper run by Xinhua news agency reported on Monday. The China State-owned Enterprises Restructuring Fund will be managed by the State-owned Assets Supervision and Administration Commission (SASAC), according to the Economic Information Daily. The report said 10 state-owned enterprises have established the fund to help with restructuring of state firms, including M&A deals, as part of government efforts to advance supply side reform. The 10 firms have provided initial registered capital of 131 billion yuan, the newspaper said.

No detail was provided on the source of the rest of the equity fund. The 10 firms include China Mobile, China Railway Rolling Stock, China Petroleum & Chemical and China Chengtong, a restructuring platform supervised by SASAC that will lead the fund. China is embarking on a revamp of its massive but debt-ridden state sector, which has struggled under a system that requires firms to maximize economic gains while fulfilling government policy objectives. The government has vowed to create innovative and globally competitive enterprises through mergers, asset swaps and management reforms.

Caveat: a weak currency doesn’t automatically spur more exports. But they should also ask where exports would be if the currency had remained strong. Maybe they would have plummeted. Maybe global trade is falling fast.

• A Weaker Currency Is No Longer the Economic Elixir It Once Was (BBG)

A weaker currency, once the cure-all for ailing economies around the world, isn’t the panacea it once was. Just look at Japan, where the yen plunged 28% in the two years through 2014, yet net exports to America still fell by 10% in the span. Or at the U.K., where the pound’s 19% tumble in the two years through 2009 couldn’t stave off a 26% decline in shipments to the U.S. In fact, since the turn of the century, the ability of exchange-rate movements to affect trade and growth in major economies has fallen by more than half, according to Goldman Sachs. The findings suggest that weaker currencies may not provide much assistance to officials in countries like Japan and the U.K. that are relying on unprecedented easy-money policies to help boost tenuous growth and inflation.

On the flip side, the data also indicate that concerns U.S. growth will be derailed as rising interest rates drive investors into the dollar are also overblown. A shift in the structure of advanced-economy trade to less price-elastic goods and services, combined with the prolonged effects of the financial crisis, have stunted the sensitivity of trade volumes relative to global exchange rates, according to Goldman Sachs analysts led by Jari Stehn. “If you’re a central banker, yes you’re paying attention to currency levels, but the more-developed market economies aren’t reacting to currency debasing policies like they used to,” said Philippe Bonnefoy, the founder of hedge fund Eleuthera. “The impact has been diluted.”

Global central banks have cut policy rates 667 times since 2008, according to Bank of America Corp. During that period, the dollar’s 10 main peers have fallen 14%, yet Group-of-Eight economies have grown an average of just 1%. Since the late 1990s, a 10% inflation-adjusted depreciation in currencies of 23 advanced economies boosted net exports by just 0.6% of GDP, according to Goldman Sachs. That compares with 1.3% of GDP in the two decades prior. U.S. trade with all nations slipped to $3.7 trillion in 2015, from $3.9 trillion in 2014.

“Since 1999 year-end through 2015 home prices have risen 76% while household mean real income has grown less than 2%..”

• US Home Prices Rose 76% Since 1999 As Real Income Grew Less Than 2% (BBG)

U.S. home prices appear to be getting out of hand again as the gap between home price growth and household real income growth is close to where it was just before the housing collapse. It’s also notable, and worrying, that the housing market is back in a “flipping frenzy” with non-bank actors climbing aboard to fund the speculation. Since 1999 year-end through 2015 home prices have risen 76% while household mean real income has grown less than 2%; the millennium-to-date gap between the two growth rates peaked at 84% during 2005-2006 and has risen back to 74% as of 2015 year-end. Gap at year-end 2007 was 75%. This millennium through 2015 has seen average new and existing home sale prices rise 84% and 55%, respectively, despite the lack of income growth.

Existing and new home sales average prices peaked at $280.2k in June 2015 and $384k in Oct. 2014, respectively; both peaks exceeded levels seen during housing boom. Over the same period outstanding home mortgage debt has risen 14%, though it’s notable that with the end of easy mortgage credit it has fallen 11% from its June 2008 peak. Concurrent with this 11% fall, the homeownership rate (63.8% at 2015 year-end) has slid back to levels last seen in the mid-1960s. Monthly U.S. single-family home price y/y growth hit a post-crisis peak of 10.85% in Oct. 2013 and has since leveled off at ~5% each month since July 2015; this is still easily outpacing growth in real income.

The disconnect between home price growth and the lack of real income growth has led homebuilders’ to turn to the higher-end of the market and for Ginnie Mae to take the lead in mortgage lending. GNMA offers taxpayer-guaranteed loans to first-time homebuyers who have lower credit scores and smaller down payments than those who obtain loans through Fannie Mae or Freddie Mac. Whereas from 2005-2007 GNMA pct share of net MBS issuance was ~2% each year, during 2014, 2015 and 2016 YTD it is ~67%, according to BofAML data. Another severe downturn in home prices would be unlikely to play out in the agency MBS market in like manner to 2007-2008 as the Fed now holds ~33% of the outstanding universe and the U.S. taxpayer now guarantees almost all of the market with Fannie and Freddie remaining under government conservatorship.

A big bad hornet’s nest. And that’s before the economic poisoned chalice is served.

• Justin Trudeau’s Canadian Honeymoon Is About to End (BBG)

Along Canada’s evergreen-draped west coast, the fate of a multi-billion-dollar energy project and a nation’s reconciliation with its dark, colonial past hang in the balance. Beating rawhide drums and singing hymns, occupiers of Lelu Island—where Malaysia’s state oil company plans a $28 billion liquefied natural gas project—assert indigenous claims to the area where trees bear the markings of their forefathers and waters run rich with crimson salmon they fear the project will obliterate. “The blood of my ancestors is on my hands if I don’t defend this land,” says Donald Wesley, 59, a hereditary chief of the Gitwilgyoots tribe which has inhabited the area for more than 6,000 years.

That claim is about to test Justin Trudeau, the country’s telegenic 44-year-old prime minister, who swept to power a year ago vowing to be many things to many people—to tackle climate change, revive the economy, and reset Canada’s fraught relationship with its indigenous communities. Those pledges are set for collision in British Columbia—home to more First Nations communities than any other province and the crucible where a resource economy seeks to reinvent itself. Trudeau has promised to decide on the LNG project on Lelu Island by Oct. 2. He has big spending plans to spur growth in a commodities downturn, and B.C., the birthplace of Greenpeace, is where most energy projects able to support that growth are located.

Indigenous groups, essential to public support, are divided, with some seeking to preserve their habitat and traditions, and others arguing that the projects offer a path out of poverty, addiction and suicide. Facing five major energy initiatives in B.C., Trudeau will choose which constituency to abandon. He’s allowed a hydroelectric dam to proceed; pending are decisions on Enbridge’s Northern Gateway crude pipeline, Petroliam Nasional’s LNG project on Lelu Island, a pipeline expansion by Kinder Morgan, as well as a ban on crude oil tankers. He’s said to want at least one pipeline, and favor Kinder Morgan. Trudeau says regularly it’s a prime minister’s job to get the country’s resources to market, and a pipeline approval would demonstrate Canada can get major projects completed as warnings mount that the complex web of regulatory rules is spurring a flight of capital.

“It was refreshing to hear that Trump economic adviser Stephen Moore responded to a question from Pethokoukis about all the red ink in Trump’s plan with, “Whether it’s going to pay for itself, I don’t really care.”

• The Know-Nothing Economists Who Created This Mess Blast Trump’s Plan (MW)

Establishment economists ranging from austere neoliberals to spendthrift Keynesians are united in branding Donald Trump’s proposed economic policies as “disastrous.” He must be on to something. These economists are the distinguished experts, after all, who have championed the globalization that gutted American manufacturing, promoted the offshoring and outsourcing of American jobs, encouraged American companies to keep trillions (trillions!) of dollars of profit abroad, and enabled the tax inversions allowing American companies to move to the country most willing to beggar its neighbor. These are the celebrity academics who have championed the deficit-reducing, budget-balancing, tax-cutting policies that have crippled our infrastructure, degraded our schools, and cut public services from police and fire protection to garbage collection.

And now this gaggle of Washington insiders is warning us that Trump’s policies will throw the country into recession, ignite a trade war, launch the national debt into the stratosphere, and create more unemployment rather than jobs. Why, really, should anyone listen to them? There is Mark Zandi, whose title as chief economist of Moody Analytics makes this sometime adviser to Barack Obama and backer of Democratic nominee Hillary Clinton seem nonpartisan, even though he clearly is not. Not surprisingly, Zandi had his team at Moody’s produce some modeling this summer that concluded that Trump’s economic proposals would result in a less global economy, lead to larger government deficits and more debt, will largely benefit very high-income households, and will result in a weaker U.S. economy.

The implication is that these are all bad things. Those for whom Trump’s economic message resonates might consider a less global U.S. economy a good thing. To brand deficits and debts as terrible you would first have to prove that they do more harm than good.

[..] those establishment economists who through several administrations have served so ably on the president’s Council of Economic Advisers, in the Treasury Department and the Federal Reserve — the people, in short, who have delivered us into the economic morass they blithely call secular stagnation — are training their heavy artillery on poor, dumb Trump. Progressive economist Joseph Stiglitz, who chaired the CEA under President Bill Clinton, gives Trump an “F” in economics because the nominee apparently doesn’t understand the principle of comparative advantage in global trade — as if we lived in a world where currency manipulation, dumping subsidies, and substandard environmental and labor conditions don’t keep this pristine economic principle from working its magic.

And conservative analyst James Pethokoukis, a fellow at the American Enterprise Institute, labeled Trump’s economic plan “a complete and utter joke” as he took the Republican nominee to task for potentially adding $2.6 trillion to $3.9 trillion to the national debt over the next 10 years — even though the $9 trillion in debt added during the 7.5 years of the Obama administration has caused no detectable harm. It was refreshing to hear that Trump economic adviser Stephen Moore responded to a question from Pethokoukis about all the red ink in Trump’s plan with, “Whether it’s going to pay for itself, I don’t really care.” High time someone influencing policy fully appreciated the dynamic flexibility of a fiat currency in government finance. We don’t really need to care whether the plan “pays for itself” in the short term, if it does indeed produce the accelerated growth promised.

For entertainment purposes only.

• Amazon “Tweaks” Hillary Book Stats: ‘5-Star’ Reviews Double Overnight (ZH)

Two short weeks ago, we exposed the gaping difference between Amazon reader reviews of Hillary Clinton’s “Stronger Together” book (14% 5-Stars) and Donald Trump’s “Great Again” book (74% 5-Stars)… As The New York Times reported at the time, the book was a disaster. Both Mrs. Clinton and her running mate, Senator Tim Kaine, have promoted the book on the campaign trail, but the sales figure, which tallies about 80% of booksellers nationwide and does not include e-books, firmly makes the book what the publishing industry would consider a flop. [..] So, as with everything else in this ‘new normal rigged’ world, something had to be done and WaPo-owner Jeff Bezos’ Amazon reviews appear to have been ‘tweaked’ – more than doubling Hillary’s top reviews.

But, as WND.com explains, Amazon’s steps to ‘fix’ Hillary’s book rviews has resulted in 5-star ratings with scathingly negative comments… If you can’t even win when the rules are changed in your favor, things must be REALLY bad. That’s how it looks for Hillary Clinton’s new 2016 campaign book, “Stronger Together,” co-authored with running mate Tim Kaine. WND reported just days ago when the book was being savaged on Amazon.com with negative reviews, with 81% one-star ratings and an average of only 1.7. Clinton supporters lashed out at “trolls” they said were criticizing the book only because they oppose the Democrat’s presidential candidacy. WND previously reported there were more than 1,200 reviews, and the number grew to than 2,000.

But Thursday afternoon, there were only 255, with many of the most critical reviews removed by Amazon, whose CEO, Jeff Bezos, owns the Washington Post, which created an army of 20 reporters and researchers to investigate the life of Donald Trump. Victory for the Clinton book, however, remains out of grasp, with the negative, one-star responses, outnumbering positive, five-star responses nearly 2-1. The one-star ratings Thursday were 62%, to 35% for five-star ratings.

“..the political landscape in Germany has become decidedly more toxic for the ECB over the past months.”

• Cracks Showing In Germany’s Fragile Truce With The ECB (R.)

Michael Stuebgen, a conservative member of the German parliament, was speaking with the head of a local savings bank recently about the ECB’s QE program. “He told me the bond market was being emptied out,” Stuebgen recalled. “He likened it to going into a supermarket where everything has been bought up. You might find a shriveled old carrot or potato. Pretty soon you’re starving.” Stuebgen, a spokesman on European affairs for Chancellor Angela Merkel’s party in the Bundestag, credits the ECB and its President Mario Draghi with saving the euro zone from collapse four years ago. But conversations like the one with the banker have convinced him that its policies, in particular the massive bond-buying program known as QE, have gone too far. He is not alone.

[..] Instead of changing course, as Stuebgen and his colleagues want, the ECB is widely expected to announce an extension of its QE program by the end of the year. The program is due to expire in March. As early as next month, it could also announce steps to broaden the scope of what it can buy in response to a dwindling pool of available assets. The most controversial change would be abandoning the so-called “capital key”, which limits the proportion of government bonds the ECB can buy from any given member state, based on its size and economic weight. “The big challenge for Mario Draghi will be to prepare the Bundestag and German public for a further easing of monetary policy,” said Marcel Fratzscher, head of the DIW economic institute and a former senior official at the ECB.

That message is unlikely to go down well in Berlin. In addition to concerns about the distorting effects of QE on financial markets and the impact of low interest rates on German savers and insurers, the political landscape in Germany has become decidedly more toxic for the ECB over the past months.

Better get rid of the EU before they acutally do this.

• German Minister: Britain Won’t Stop EU Army (Pol.)

Ursula von der Leyen, Germany’s defense minister, does not believe the U.K. will stand in the way of deepened defense cooperation between EU member countries, she told Reuters in an interview Sunday night. Von der Leyen said she was confident Britain would “make good its promise that it will not hinder important EU reforms.” Michael Fallon, Britain’s defense secretary, said earlier this month Britain will veto measures to build an EU army for as long as it remains a member of the bloc. Von der Leyen said she told Fallon the plans were not directed against Britain, but “designed for a strong Europe” instead.

Martin Schulz, the president of the European Parliament, said during a speech in London last week that a British veto was “counterproductive and anyway not possible in this case.” EU defense ministers will discuss common military proposals on Monday and Tuesday. Federica Mogherini, the European Commission’s foreign policy chief, said earlier this month that member countries could combine their defense capabilities via a so-far unused provision in the Lisbon Treaty.

Feel safe?

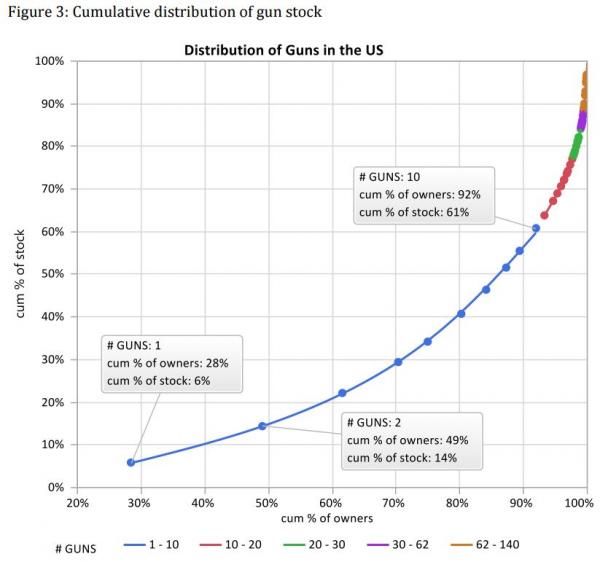

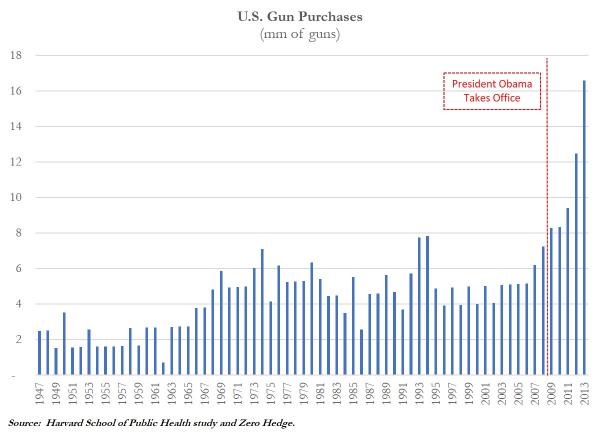

• 50% Of Guns In America Owned By Just 3% Of Population (ZH)

A recent Harvard study of the demographics of gun ownership in the United States yielded a fairly shocking discovery, namely the emergence of the Obama gun “Super Owner.” The study, entitled “The Stock and Flow of US Firearms: Results from the 2015 National Firearms Survey”, was conducted by the Harvard School of Public Health and found that just 14% of all gun owners, or 7.6mm adults and 3% of the total U.S. population, possessed 50% of all guns owned by civilians in the country. Moreover, with a total stock of 270mm civilian-owned guns in the U.S., that implies that these “super owners” possess an average of nearly 18 guns per person.

“Gun owning respondents owned an average of 4.85 firearms (range: 1-140); the median gun owner reported owning approximately two guns. As can be seen in Figure 3, approximately half (48%) of gun owners report owning 1 or 2 guns, accounting for 14% of the total US gun stock, while those who own 10 or more guns (8% of all gun owners), own 39% of the gun stock. Put another way, one half of the gun stock (~130 million guns) is owned by approximately 86% of gun owners, while the other half is owned by 14% of gun owners (14% of gun owners equals 7.6 million adults, or 3% of the adult US population).”

Another startling discovery in the data, though “oddly” not highlighted in the report, is that the surge in gun ownership per capita seemed to coincide with the start of the Obama presidency and growing rhetoric over new gun regulations. Per the chart below, over the past 20 years, gun ownership per U.S. adult hovered around 1 from 1993 through 2007 but then surged starting in 2008 as an Obama presidency became increasingly likely. This trend is also reflected in annual guns sales which floated between 4-6mm units per year before surging in 2008.

Tears. I still have tears left.

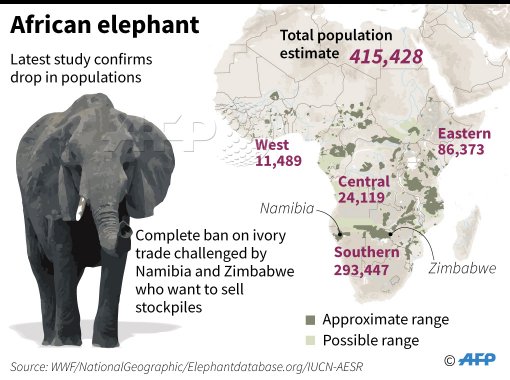

• African Elephants ‘Suffer Worst Decline In 25 Years’ (AFP)

Africa’s elephant population has suffered its worst drop in 25 years, the International Union for Conservation of Nature (IUCN) said Sunday, blaming the plummeting numbers on poaching. Based on 275 estimates from across the continent, a report by the conservation group put Africa’s total elephant population at around 415,000, a decline of around 111,000 over the past decade. It is the first time in 25 years that the group’s African Elephant Status Report has reported a continental decline in numbers, with the IUCN attributing the losses in large part to a sharp rise in poaching. “The surge in poaching for ivory that began approximately a decade ago – the worst that Africa has experienced since the 1970s and 1980s – has been the main driver of the decline,” said IUCN in a statement.

Habitat loss is also increasingly threatening the species, the group said. IUCN chief Inger Andersen said the numbers showed “the truly alarming plight of the majestic elephant”. “It is shocking but not surprising that poaching has taken such a dramatic toll on this iconic species,” she said. The IUCN report was released at the world’s biggest conference on the international wildlife trade, taking place in Johannesburg. Thousands of conservationists and government officials are seeking to thrash out international trade regulations aimed at protecting different species. A booming illegal wildlife trade has put huge pressure on an existing treaty signed by more than 180 countries – the Convention on International Trade in Endangered Species (CITES).

Home › Forums › Debt Rattle September 26 2016