Odilon Redon Wild Flowers in a Vase c1910

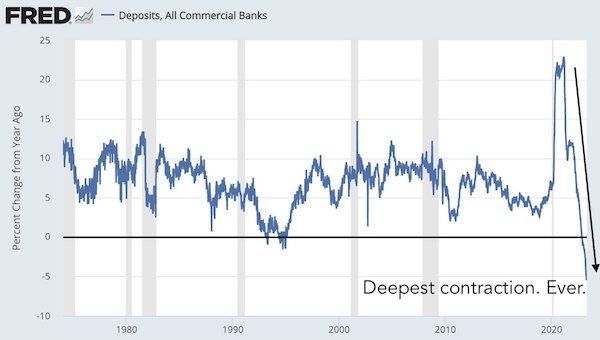

Nap Macgregor

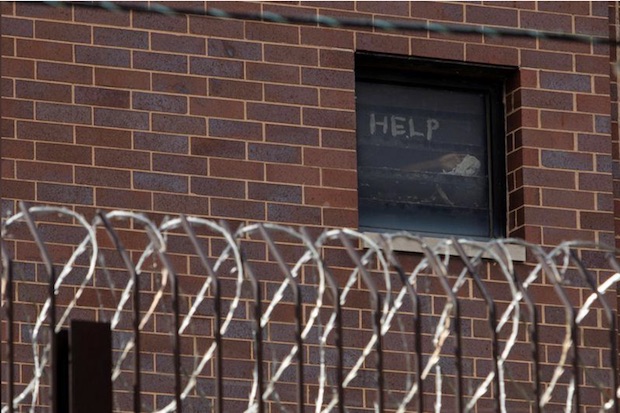

https://twitter.com/i/status/1664035666118803456

Death wish in disguise- Patrick Moore

Dan Bishop

https://twitter.com/i/status/1663891540240900096

Not Zelensky, but the US.

• Zelensky Issues Ultimatum To NATO – FT (RT)

Ukrainian President Vladimir Zelensky will skip a NATO meeting in Lithuania in July unless the alliance provides Kiev with the security guarantees it wants, the Financial Times reported on Wednesday, citing people familiar with the matter. Zelensky has “made clear to NATO leaders that he will not attend the Vilnius summit without concrete security guarantees and a road map for accession,” the newspaper said. Ukraine formally applied to join the US-led bloc in September 2022, arguing that the collective defense it provides to members is necessary for Kiev’s security against Russia. Article 5 of the North Atlantic Treaty stipulates that an armed attack against one NATO member “shall be considered an attack against them all.”

While Ukraine’s bid has been strongly endorsed by the Nordic and Baltic states, as well as Poland, French President Emmanuel Macron suggested on Wednesday that Kiev could be offered “something between the security provided to Israel and full-fledged membership.” FT cited four unnamed officials in April as saying that the US and Germany were against offering Kiev “deeper ties” to the alliance, including a potential roadmap. “We will look for ways to support Ukraine’s Euro-Atlantic aspirations but right now the immediate needs in Ukraine are practical and so we should be focused on building Ukraine’s defense and deterrence capabilities,” Dereck Hogan, the top State Department official responsible for European affairs, said last month.

Lithuanian Prime Minister Ingrida Simonyte, who will host the NATO event on July 11-12, was quoted by Reuters as saying on Friday that it would be “very sad” if anyone could interpret the outcome of the Vilnius summit as “a victory of Russia.” Moscow views NATO’s eastward expansion as a threat to its national security and has cited the bloc’s open-door policy as a reason for the military conflict with Ukraine. Russian Deputy Foreign Minister Mikhail Galuzin said recently that Ukraine’s neutrality was one of the conditions for a lasting peace between Ukraine and Russia.

Read more …

Macron wants Article 5 without mentioning it.

• Macron Wants ‘Tangible’ Security Guarantees For Ukraine (RT)

French President Emmanuel Macron has argued that Ukraine is “protecting Europe” and should be provided security guarantees by NATO. “That is why I’m in favor .. to offer tangible and credible security guarantees to Ukraine,” Macron said on Wednesday at a forum in Bratislava, Slovakia. He added that it would be in the interest of NATO members to provide such assurances while Kiev awaits approval to join the Western military alliance. France and other Western powers have provided billions of dollars’ worth of military aid to Ukraine since the conflict with Russia began in February 2022. But they have stopped short of offering the blanket protection afforded to NATO members. Article 5 of the bloc’s founding treaty stipulates that an attack on one member is considered an attack on all.

“We have to build something between the security provided to Israel and full-fledged membership,” Macron said. The French president, who once described the Brussels-based alliance as “braindead,” said the Ukraine crisis had “jolted NATO awake.” Macron called on the bloc’s members to “intensify” military aid to Kiev so it would have everything it needs for an effective counter-offensive against the Russian forces. While acknowledging that US contributions have been key in enabling Ukraine to defend itself, Macron argued that Europe must build up its own defense industry rather than relying on Washington for protection. Polish leaders have criticized Macron in the past for negotiating with Russian President Vladimir Putin and suggesting that the West should avoid “humiliating” Russia. Moscow, meanwhile, has repeatedly said that it views NATO’s expansion eastward as a threat and has named Ukraine’s neutrality as one of the conditions for a lasting peace.

Read more …

It will. It can’t afford it.

• West May Change Aid To Ukraine If Conflict Becomes Protracted – Macron (TASS)

The West may reconsider its aid for Ukraine, if the conflict turns into a protracted one, French President Emmanuel Macron said during the Globsec international security conference in Bratislava, adding that high hopes are being placed on the potential Ukrainian counter-offensive. “We prepare for this conflict to become protracted, to the consequences of such development of events,” he said. “We must prepare the public opinion for long-term support of Ukraine in a high-and medium-intensity conflict in accordance with the situation. To that extent we must reconsider and analyze the nature of our support together with our partners during this summer, and to realize what we need to achieve the desired result.” Meanwhile, the French leader refrained from publicly discussing the perspectives in case of failure of the expected Ukrainian counter-offensive, expressing his hope that it will be successful.

Read more …

Everything about this is certifiably nuts. Take this beauty:

“..Zelensky’s top adviser, Mikhail Podoliak, demanded that China “make a choice” to back Ukraine and the West or “lose its influence” in world affairs..”

• Zelensky and Macron Planning ‘Peace Summit’ Without Russia – WSJ (RT)

Ukrainian President Vladimir Zelennsky and his European patrons are organizing a summit to build support for Kiev’s peace plan, the Wall Street Journal reported on Wednesday. The plan’s demands have been deemed unacceptable by Russia, and the document has been met with indifference by non-Western leaders. French President Emmanuel Macron has offered to host the summit in Paris, while the governments of Denmark and Sweden have also put themselves forward as hosts, the newspaper reported. Although no guest list has emerged, European officials have reached out to Brazil, India, China, and other non-Western countries, with one anonymous diplomat stating that “no Russians” would be invited, “but everybody else will be welcomed.”

“We require a unified plan of the responsible civilized world that really wants to live in peace,” Zelensky’s chief of staff, Andrey Yermak, told the Wall Street Journal. Russia has already emphatically rejected Ukraine’s so-called pace plan. Published late last year, the plan demands that Russia hand back the territories of Donetsk, Lugansk, Kherson, and Zaporozhye to Kiev, while also relinquishing control of Crimea, which voted overwhelmingly to join the Russian Federation in 2014. The plan also demands that Russia pay reparations to Ukraine and hand over its officials to face international tribunals. It is highly unlikely that a European summit to which Russia is not invited, organized by countries currently bankrolling the Ukrainian military, will change any minds in the Kremlin. Russian Foreign Minister Sergey Lavrov stated last week that the Ukrainian plan essentially involves “the capitulation of Russia.”

European officials are aware of this, and told the Wall Street Journal that they plan on watering down Ukraine’s plan to “make it more acceptable” to non-Western powers such as Brazil, China, India, and Saudi Arabia, if not to Russia itself. Yermak acknowledged that the peace process “is not possible without the whole world, including the leaders of the Global South,” and Zelensky has recently made overtures to the non-Western world, addressing the Arab League in Saudi Arabia this month and speaking to Chinese President Xi Jinping the month before. However, this outreach has come across ham-fisted at times, with Zelensky accusing Arab League members of succumbing to “Russian influence,” before skipping out on a meeting with Brazilian President Luiz Inacio Lula da Silva at the G7 summit in Japan.

Last month, Zelensky’s top adviser, Mikhail Podoliak, demanded that China “make a choice” to back Ukraine and the West or “lose its influence” in world affairs. China has released its own 12-point peace plan, which despite being rejected by the US and its NATO allies, has found favor in much of the world, including Russia. Lula has backed Beijing’s plan, while a coalition of African leaders has urged Ukraine to agree to a ceasefire followed by peace talks, which Kiev has refused to do unless Moscow’s troops withdraw to Russia’s pre-conflict borders.

Read more …

“The United States is consciously and irretrievably descending into the abyss of hostilities in Europe. By the way, to generate confrontation between NATO and Russia is an old-cherished dream of Nazi radicals in Kiev.”

• US Statements On Moscow Drone Attack Encourage Kiev Terrorists – Envoy (TASS)

Washington’s statements on the terrorist drone attack on Moscow encourage Ukrainian terrorists, Russian Ambassador to the US Anatoly Antonov said. “We have taken note of Washington’s statements regarding the terrorist attack in Moscow involving drones. In fact, they sound like an encouragement for Ukrainian terrorists,” the envoy said, “Just consider the US officials’ attempts to hide behind the phrase that they are gathering information about what happened! And then they immediately switch to a media attack against our country.” “So really, doesn’t the administration understand that no one believes their slogans about non-support of Ukrainian strikes on Russian territory?! Especially, when these words are pronounced somehow bashfully and hesitantly,” the ambassador pointed out,

“The United States is consciously and irretrievably descending into the abyss of hostilities in Europe. By the way, to generate confrontation between NATO and Russia is an old-cherished dream of Nazi radicals in Kiev.” According to Antonov, the abovementioned terrorist attack of the Kiev regime “was senseless from a military perspective.” “The assault was inflicted on the residential buildings of ordinary Russian citizens. This onslaught unequivocally and without exaggeration must be considered as an act of terrorism,” the Russian diplomat pointed out. Ukrainian drones attacked Moscow and the Moscow Region on Tuesday morning.

According to the Russian Defense Ministry, the attack involved eight unmanned aerial vehicles, five of which were shot down by the Pantsir-S missile system and the remaining three were suppressed by electronic warfare. Two people in Moscow sought medical attention for minor injuries. A number of buildings sustained minor damage. White House press secretary Karine Jean-Pierre said at a regular briefing on Tuesday that the American side does not support Ukrainian attacks on Russian territory with the use of US-made weapons. According to the press secretary, Washington publicly and privately communicates this to Kiev. Jean-Pierre also pointed out that the US is allegedly gathering information on the incident.

Read more …

“..based on international law, “including the Hague and Geneva Conventions with their additional protocols,” Britain “can also be qualified as being at war.”

• Britain ‘De Facto’ At War With Russia – Medvedev (RT)

Former Russian President Dmitry Medvedev has described the UK as waging an “undeclared war” against Russia. The comment came after Britain’s foreign secretary condoned a large-scale drone attack on Moscow earlier this week. In a Twitter post on Wednesday, Medvedev accused London of being Moscow’s “eternal enemy.” The former leader, who currently serves as deputy chair of Russia’s Security Council, claimed that based on international law, “including the Hague and Geneva Conventions with their additional protocols,” Britain “can also be qualified as being at war.” The former president argued that by providing Ukraine with weapons and training, the UK “de facto is leading an undeclared war against Russia.” Medvedev hinted that this could have direct ramifications for “public officials” in Britain.

His tweet cited remarks made on Tuesday by UK Foreign Secretary James Cleverly, who said Ukraine has the right to “project force beyond its borders to undermine Russia’s ability to project force into Ukraine itself.” Cleverly further claimed that striking “legitimate military targets” in Russia is an acceptable part of Ukraine’s self-defense. According to the Russian Defense Ministry, eight UAVs were detected in Moscow’s airspace on Tuesday morning, in what officials described as a “terrorist attack” by Kiev. The ministry reported that three drones were suppressed by electronic warfare measures and deviated from their intended course before crashing, while the other five were shot down by Pantsir-S air defense systems outside the city.

Several residential buildings sustained superficial damage and two people suffered minor injuries as a result of the raid. Kremlin spokesman Dmitry Peskov accused Kiev of launching the attack in an attempt to avenge a recent series of Russian missile and drone strikes on Ukrainian airfields, ammunition dumps, and “decision-making centers.” Russian President Vladimir Putin revealed on Tuesday that the headquarters of the Ukrainian military’s Main Intelligence Directorate (GUR) had been among the targets hit in the strikes.

Read more …

“The Ukrainian Navy operated about 25 combat ships, including five patrol and six artillery boats before Russia launched its special military operation in Ukraine.”

• Russian Forces Wipe Out Last Ukrainian Combat Ship In Odessa (TASS)

Russia’s Aerospace Forces destroyed the last Ukrainian combat ship in the Odessa port in the special military operation in Ukraine, Defense Ministry Spokesman Lieutenant-General Igor Konashenkov reported on Wednesday. “On May 29, the Ukrainian Navy’s last combat ship Yury Olefirenko was destroyed as a result of a strike by the Russian Aerospace Forces’ precision weapons against the anchorage of naval ships in the Odessa port,” the spokesman said. The Ukrainian Navy operated about 25 combat ships, including five patrol and six artillery boats before Russia launched its special military operation in Ukraine.

In addition, the Ukrainian Navy’s combat assets included the Gola Pristan anti-saboteur boat and the Svatovo assault boat. Upon Kiev’s attempt to storm Snake Island in the Black Sea on May 9 last year, Russian forces sank three Ukrainian Centaur-class armored assault boats and each of them could have carried a marine infantry platoon. The Ukrainian Navy also operated nine armored gunboats, one of which, the Akkerman, was abandoned by the crew in Berdyansk, according to information of the Rossiyskaya Gazeta daily. The Vinnitsa corvette and the Yury Olefirenko medium amphibious assault ship were sunk.

Read more …

Cato: Carthago delenda est – “Carthage must be destroyed” – was a Roman strategic aim 2,200 years ago. It was regularly repeated in his public speeches by Marcus Porcius Cato in his advocacy of putting an end to the Punic Wars by destroying the Carthaginian adversary entirely, not just militarily, so that it could never rise again to challenge Roman power. The opposition slogan was Carthago servanda est – “Carthage must be saved”. Its author, Publius Cornelius Scipio Nasica Corculum, meant don’t rule by force if it can be avoided..

• Annexation Of Kharkov – Ukraine To Shrink Westward (Helmer)

Because Russia is the only functioning democracy on the two sides of this war, where military tactics and war aims are openly argued in parliament and the media, the debate between the Cato delenda war aim, and the Corculum servanda war aim is an active one. Sworn to destroy President Vladimir Putin, the Russian army and economy, the US, European and western allies misinterpret this debate to be vacillation and vulnerability. Dialectically speaking, this encourages the Cato line faction in Moscow at the expense of the Corculum line faction. In this way the US and NATO axis provokes its own defeat. This process has taken the war well beyond the 300-kilometre range of some of the US, French or British weapons which have been deployed and fired to date. The debate over the 300-km westward defence line was winding up in Russia, not beginning, when winter started last year.

Medvedev made this official last week, following the intensification of artillery, rocket, and drone attacks on Russian cities, including Moscow. This week the governor of Belgorod, Vyacheslav Gladkov, went further. Then yesterday President Putin tried to pull Gladkov and Medvedev back in line — that’s the Corculum line, not the Cato line. “We live in a state of de facto war. Whether we like it or not, it’s happening,” Gladkov said on the Rossiya 24 television channel. Asked what can be done to increase public security in the Russian border regions, he said one option is “to attach Kharkov to Belgorod Region. This is the best way to solve the issue of the shelling of Belgorod Region.” That was a public, political challenge to the Kremlin. It was polite compared to those who use other names when they mean to criticize Putin’s conduct of the war.

Governor Gladkov is a southerner by birth, education, and career. Born in the Penza region, he has worked in high administrative posts in Penza, Crimea, Stavropol, and for almost three years now in Belgorod. The first Kremlin reply to Gladkov was Dmitry Peskov’s, the spokesman. He was opposed, he intimated, to annexation of more regions along the front line by repeating the restrictive limits of the war. “This already belongs to the category of issues related to the conduct of Special Military Operation. Therefore, I cannot comment on this in any way.” Peskov said in his piece on Monday morning. On Tuesday afternoon, after Ukrainian drones had landed in Moscow, Putin said more; he also said the same thing. “We all had to respond by launching the special military operation. We are striking at the territory of Ukraine, but with long-range precision weapons, at military infrastructure facilities only, either at ammunition or fuel and lubricants warehouses used for combat operations. We have talked about the possibility of striking at decision-making centres. Of course, the headquarters of Ukrainian military intelligence is one of them, and a strike at this target was carried out two or three days ago.”

Read more …

“..Saudi Energy Minister Prince Abdulaziz bin Salman was behind the exclusion of prominent news organizations..”

• OPEC Snubs Major Western News Outlets (RT)

The Organization of the Petroleum Exporting Countries (OPEC) has refused to invite reporters from Bloomberg News and Reuters to its event in Austria later this week, both outlets said on Wednesday. Correspondents from the Wall Street Journal were also snubbed, according to Reuters and Bloomberg. Though staff from the three media agencies typically cover major OPEC meetings, Bloomberg said that this time organizers decided to send invitations directly to reporters, as opposed to providing accreditation to any journalist seeking to attend an event. “We are disappointed that Reuters has not been invited,” a spokesperson said, adding that the agency has “reached out to OPEC for clarity on the matter.” “We believe that a free press serves readers, markets and the public interest,” the spokesperson added.

Bloomberg said it had contacted the OPEC secretariat, but received no reply. The agencies are still expected to send reporters to Austria, even if they cannot access the OPEC Secretariat, where ministers meet, according to the Financial Times (FT), which noted that it did receive an invitation. The newspaper added that Dow Jones was also denied an invitation. FT cited people familiar with the matter as saying Saudi Energy Minister Prince Abdulaziz bin Salman was behind the exclusion of prominent news organizations. Reporters from other outlets, including CNBC, as well as pricing agencies Argus and Platts, told Reuters that they were invited to the Vienna event.

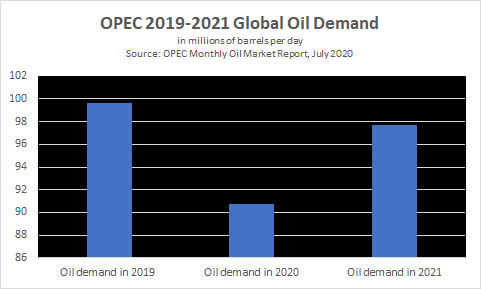

OPEC – along with its partners in the broader OPEC+ bloc, which includes Russia – have been under pressure to support Western sanctions imposed on Moscow in response to its military operation in Ukraine. OPEC members have worked with Russia to reach an agreement on coordinated production cuts, which drew criticism from Washington. OPEC members will gather on Saturday and Sunday for a regular biannual meeting to determine next steps after US crude prices dropped below $70 per barrel this week. The decline comes despite an agreement to further slash production in April, expanding output cuts initially set last year.

Read more …

“No matter how many dialogues, there will be no fundamental improvement [they have said]. I think it is a very honest assessment.”

• Xi Jinping Warns Of ‘Worst-Case’ Situation (SCMP)

China is facing more complex and difficult national security concerns, President Xi Jinping warned on Tuesday, in comments analysts said showed the country harboured no “illusions” about the possible damaging effects of its rivalry with the US and had little hope of a lasting improvement in ties. The remarks from Xi came as he chaired a meeting of the National Security Commission, his first since securing an unprecedented third term as leader of China’s ruling Communist Party at its 20th congress in October. Xi heads both the commission and the Chinese military. He said the country’s security apparatus needed to stay “keenly aware” of the complicated and challenging circumstances facing national security, and correctly grasp major related issues, according to state news agency Xinhua.

The national security issues facing China were “considerably more complex and much more difficult” to deal with, Xinhua reported Xi as saying, as he urged officials to be ready to deal with “worst-case and most extreme scenarios”, so that they could withstand “high winds and waves and even perilous storms”. Xi’s remarks come as rival powers China and the United States continue to lock horns on many fronts. Both sides have stepped up national security scrutiny, especially in the technology sector, with the US slapping sanctions on a slew of Chinese companies in the past few years citing security concerns. In March, in a rare public comment on the US tech rivalry, Xi directly named Washington for leading the Western suppression of China. China recently prohibited its key infrastructure operators from buying products made by US memory chip maker Micron Technology, citing “relatively serious” cybersecurity risks.

[..] Xi had also sounded a warning then about choppy waters and “dangerous storms” ahead, as he highlighted the challenges and risks facing the country. According to Xie Maosong, senior fellow at Beijing’s Taihe Institute and a senior researcher at Tsinghua University’s National Strategy Institute, Xi’s latest remarks showed China had “no rosy illusions” about the potentially devastating outcome of the US rivalry and was making serious efforts to prepare for it. “The ‘worst-case scenarios’ might include a nuclear war, a devastating war that ruins China’s coastal economic belts [or] Western sanctions on China’s energy, finance and food supply,” Xie said. [..] Alfred Wu, an associate professor at the National University of Singapore’s Lee Kuan Yew School of Public Policy, said Xi’s remarks meant Beijing was convinced that recent minor improvements in Sino-US relations would be short-lived.

“Xi has named the US as the culprit behind China’s problems,” Wu said. “Some mainland scholars have also openly expressed pessimism about the Sino-US relationship, saying the deterioration was due to domestic political dynamics in China and the US. No matter how many dialogues, there will be no fundamental improvement [they have said]. I think it is a very honest assessment.”

Read more …

On Twitter Escobar calls him the Sultan of Swing.

• The Sultan 2.0 Will Heavily Tilt East (Pepe Escobar)

The collective west was dying to bury him – yet another strategic mistake that did not take into account the mood of Turkish voters in deep Anatolia. In the end, Recep Tayyip Erdogan did it – again. Against all his shortcomings, like an aging neo-Ottoman Sinatra, he did it “my way,” comfortably retaining Turkiye’s presidency after naysayers had all but buried him. The first order of geopolitical priority is who will be named Minister of Foreign Affairs. The prime candidate is Ibrahim Kalin – the current all-powerful Erdogan press secretary cum top adviser. Compared to incumbent Cavusoglu, Kalin, in theory, may be qualified as more pro-west. Yet it’s the Sultan who calls the shots. It will be fascinating to watch how Turkiye under Erdogan 2.0 will navigate the strengthening of ties with West Asia and the accelerating process of Eurasia integration.

The first immediate priority, from Erdogan’s point of view, is to get rid of the “terrorist corridor” in Syria. This means, in practice, reigning in the US-backed Kurdish YPG/PYD, who are effectively Syrian affiliates of the Kurdistan Workers’ Party (PKK) – which is also the issue at the heart of a possible normalization of relations with Damascus. Now that Syria has been enthusiastically welcomed back to the Arab League after a 12-year freeze, a Moscow-brokered entente between the Turkish and Syrian presidents, already in progress, may represent the ultimate win-win for Erdogan: allowing control of Kurds in north Syria while facilitating the repatriation of roughly 4 million refugees (tens of thousands will stay, as a source of cheap labor).

The Sultan is at his prime when it comes to hedging his bets between east and west. He knows well how to profit from Turkiye’s status as a key NATO member – complete with one of its largest armies, veto power, and control of the entry to the uber-strategic Black Sea. And all that while exercising real foreign policy independence, from West Asia to the Eastern Mediterranean. So expect Erdogan 2.0 to remain an inextinguishable source of irritation for the neocons and neoliberals in charge of US foreign policy, along with their EU vassals, who will never refrain from trying to subdue Ankara to fight the Russia-China-Iran Eurasia integration entente. The Sultan, though, knows how to play this game beautifully.

Read more …

Zero Hedge labels Epstein a “pedophile”??

• Epstein Pal Jes Staley Throws Jamie Dimon Under The Bus (ZH)

Former JPMorgan Chase executive Jes Staley has thrown CEO Jamie Dimon under the bus over the bank’s relationship with Jeffrey Epstein – claiming in legal documents that he and Dimon communicated about the convicted sex offender. Dimon maintains he had no such conversations, the Wall Street Journal reports, while Staley claims he knew about Epstein’s sex trafficking operation and that he regrets his friendship with Epstein. According to the filing, Staley says that he and Dimon communicated when Epstein was arrested in 2006 and 2008 when Epstein pleaded guilty to soliciting and procuring a minor for prostitution, and served 13 months in a work-release program. Staley also claims that Dimon communicated with him several times through 2012 about whether to maintain Epstein as a client.

“There is no evidence that any such communications ever occurred—nothing in the voluminous number of documents reviewed and nothing in the nearly dozen depositions taken, including that of our own CEO,” said a spokeswoman for JPMorgan, adding that Dimon doesn’t believe such conversations with Staley ever happened. “The one person who claims this to be true is currently accused of horrific acts and dishonesty.” “The statements arose as part of a pair of lawsuits against the bank in a federal court in Manhattan. The government of the U.S. Virgin Islands and an unnamed woman, who said she was abused by Epstein, sued JPMorgan last year, claiming that the bank facilitated Epstein’s alleged sex trafficking. The bank has sought to pin the bulk of the relationship on Staley and sued him claiming he misled executives about Epstein. The bank in its lawsuit identified Staley as the “powerful financial executive” accused of sexual assault by the woman who is suing JPMorgan. Staley’s lawyers have said the allegations against him are baseless.”: -WSJ

“Rather than mislead anyone about what was or was not said, why don’t they just agree to release the whole transcript?” said an Epstein accuser’s attorney, Brad Edwards, referring to Dimon’s deposition. [..] The pedophile, who became a JPMorgan client around 1998 – bringing the bank hundreds of millions of dollars, formed a close bond with Staley, who eventually oversaw JPMorgan’s investment bank. In August 2008, a few weeks after Epstein’s guilty plea, a JPMorgan employee sent an email that suggested Dimon would review the Epstein relationship, according to the U.S. Virgin Islands lawsuit. The email states, “I would count Epstein’s assets as a probable outflow for ’08 ($120mm or so?) as I can’t imagine it will stay (pending Dimon review).” The bank has said that there is no record of such a review and that Dimon doesn’t recall one.” -JPMorgan

Read more …

“..all that will be needed to avoid long-term “legal complications” will be a check with several zeroes on it… or maybe some political immunity..”

• Jamie Dimon Hints At Run For Public Office; Bill Ackman Endorses Him (ZH)

JPMorgan’s CEO may be getting swept up in the Jeffrey Epstein scandal, but for a billionaire like Jamie Dimon, whose catch phrase is “that’s why I’m richer than you” and may as well be “that’s why I will always be freer than you”, all that will be needed to avoid long-term “legal complications” will be a check with several zeroes on it… or maybe some political immunity. Which may be why the head of the largest US bank is already hinting that after he is done gobbling up all the small and regional banks and gets tired of running JPM, he is considering running for public office. “I love my country, and maybe one day I’ll serve my country in one capacity or another,” he said in a Bloomberg Television interview, when asked if he’s ever considered a public office position.

His comments, made at the bank’s annual Global China Summit in Shanghai on Wednesday, come as the US gears up for its 2024 presidential race. For now, he’s focused on his job running the largest US bank, a role he’s “quite happy” in. “I love what I do,” he said. JPMorgan does “a great job for helping Americans, for helping countries around the world.” Dimon also reiterated his view that “business can be a force for good,” and said he’s an American patriot who would follow the US government: “Everyone knows I am a patriot,” he said. “I am a red-blooded, full-throated, free enterprise capitalist.”

As BBG notes, the billionaire Wall Street banker is among a group of long-tenured Wall Street chiefs that also includes Brian Moynihan, 63, who’s led Bank of America Corp. since 2010, and Morgan Stanley’s James Gorman, 64, who became CEO at the start of 2010 and is stepping down within 12 months. Dimon, 67, who has been head of JPMorgan since 2005, has repeatedly said that he plans to remain atop the biggest US bank for five more years. And while in the past, Dimon has been quick to publicly shut down speculation that he planned a presidential run, shortly after the story about Dimon’s “public run” broke, none other than weepy Bill Ackman, who one year ago sold his NFLX impulse buy locking in losses of $400 million when he would have broken even had he sold it yesterday, endorsed Dimon for president in one of his lengthy, trademark Twitter posts.

Read more …

He does a good speech.

• Six Texas Attorney General Aides Take Leave Of Absence To Defend Paxton (JTN)

Six staffers from the Office of the Texas Attorney General have taken a leave of absence to defend their former boss, Ken Paxton, who was impeached by the Texas House on Saturday. Their temporary departure was first reported by The Daily Wire and independently confirmed by Hearst Newspapers. Paxton was suspended from office until the outcome of a Senate trial determines if he returns to or is removed from office. In the interim, First Assistant Attorney General Brent Webster is the acting head of the agency. Six employees taking leaves of absence include Solicitor General Judd Stone, Assistant Solicitor General Joseph N. Mazzara, Assistant Solicitor General Kateland Jackson, Senior Attorney Allison Collins, Executive Assistant Jordan Eskew, and Division Chief of the General Litigation Division Chris Hilton, who’s been outspoken in Paxton’s defense.

Hilton attempted to present evidence to the House General Investigating Committee, which refused to interview Paxton or anyone from his staff as part of its investigation. Hilton told reporters last Thursday that the committee was engaged in an “illegal investigation” and a report it issued was “filled with falsehoods and misrepresentations.” One week ago, the committee held a three-hour hearing at which four attorneys hired by the committee presented the findings of their investigation. The attorneys, some of whom are registered Democrats, had all worked in the offices of the Harris County District Attorney and U.S. Attorney’s Office for the Southern District of Texas in Houston. They presented no sworn testimony and no documentation; no witnesses were interviewed by the committee.

On Thursday, the committee issued 20 articles of impeachment and within 24 hours the full House voted to impeach Paxton by a vote of 121-23. The Texas GOP, Paxton and others argue the impeachment didn’t follow basic due process, was political, illegal, unethical and unjust. An outside law firm also found that Paxton didn’t break any laws or violate procedure. The House has announced its prosecutorial team and the Senate its committee to establish trial rules. The rules are expected to be announced June 20. Lt. Gov. Dan Patrick has said the trial will start no later than August 28.

Paxton

https://twitter.com/i/status/1663727925789589504

Read more …

“..The foundation “began acting as an agent of foreign governments early in its life and throughout its existence..”

• Judge Breathes New Life Into Clinton Foundation Whistleblower Case (JTN)

Just a few weeks after Special Counsel John Durham revealed significant failures to investigate allegations against Hillary Clinton’s family charity, a U.S. Tax Court judge has once again breathed new life into a years-long whistleblower case alleging IRS improprieties involving the controversial Clinton Foundation. U.S. Tax Court Judge David Gustafson has already once before denied an IRS request to dismiss the whistleblower case, first brought in 2017. And three years ago, he ordered the tax agency to reveal whether it criminally investigated the foundation, citing a mysterious “gap” in its records. The IRS filed a new motion to dismiss, and all parties filed arguments over the last year.

But on Monday, Gustafson postponed ruling on those motions, instead asking for new arguments in light of three recent precedent-setting court rulings, once again frustrating IRS efforts to make the case go away. The three recent rulings in other tax cases “may affect the parties’ positions as to the pending motions,” Gustafson wrote. “We will order further filings so that the parties may address those recent opinions.”The judge gave whistleblowers John Moynihan, a former federal agent, and Larry Doyle, a corporate tax compliance expert, until June 30 to update their arguments and the IRS until July 28 to respond. That means the case will almost certainly stretch on for many more months.

The judge also noted the IRS hasn’t responded to a request to update the court record with new evidence. Monday’s ruling adds new intrigue in a case that first surfaced nearly five years ago when Doyle and Moynihan, two respected forensic financial investigators, revealed the existence of their 2017 IRS whistleblower complaint against the foundation during a congressional hearing. Moynihan and Doyle testified to a House committee in December 2018 that they believed the foundation wrongly operated as a foreign lobbyist by accepting overseas donations, then trying to influence U.S. policy. The foundation “began acting as an agent of foreign governments early in its life and throughout its existence,” Moynihan testified at the time. “As such, the foundation should’ve registered under FARA (Foreign Agents Registration Act).

Read more …

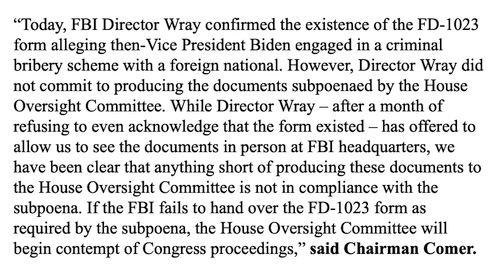

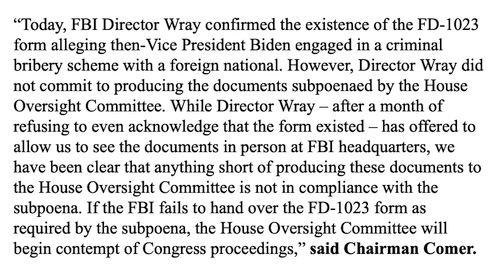

”..he would allow lawmakers to visit FBI headquarters and look at it in a private room..”

• FBI Chief Wray Rolls Dice With Congress Over Contempt (JTN)

Just hours after informing Congress he wouldn’t comply with a subpoena and turn over an informant document on the Biden family investigation, FBI Director Christopher Wray hopped on the bureau’s Gulfstream jet and ferried off to the more friendly confines of Las Vegas. The flight manifest for the FBI’s official jet shows Wray left the Washington suburb of Manassas, Va., at about 4 p.m. ET on Wednesday and landed about four hours later in Nevada’s most famous tourist city. Agency officials said the jaunt was for official business and that Wray would be speaking to a conference of counterterrorism officials, meeting with the FBI’s Las Vegas field office, and attending a law-enforcement memorial ceremony.

[..] The trip allows the FBI boss to escape an increasingly hostile atmosphere for himself in Washington, where congressional Republicans announced Wednesday that they would seek to hold Wray in contempt of Congress for refusing to turn over a subpoenaed memo that lays out bribery allegations against President Biden. The memo, known as a FD-1023 form, includes information provided to the bureau in June 2020 by a confidential human source alleging a bribery scheme involving Biden when he was vice president. Lawmakers learned about the existence of the memo from FBI whistleblowers.

Wray tried to defuse the situation earlier Wednesday in a phone call with House Oversight and Accountability Committee Chairman James Comer, R-Ky., and Sen. Chuck Grassley, R-Iowa, saying that while he would not comply with the subpoena by turning over the memo to Congress, he would allow lawmakers to visit FBI headquarters and look at it in a private room. The two lawmakers, who have been leading an investigation into the Biden family’s foreign business dealings, said Wray’s offer was unacceptable and that Congress had every right to demand at the memo be turned over under a subpoena. Comer made clear he plans to seek a contempt vote as early as next week in Congress.

“While the FBI has apparently leaked classified information to the news media in recent weeks, jeopardizing its own human sources, it continues to treat Congress like second-class citizens by refusing to provide a specific unclassified record,” Grassley said. Comer said lawmakers scored one victory Wednesday: Wray confirmed the existence of the FD-1023 memo the whistleblowers identified. “Today, FBI Director Wray confirmed the existence of the FD-1023 form alleging then-Vice President Biden engaged in a criminal bribery scheme with a foreign national,” the powerful House committee chairman said. “However, Director Wray did not commit to producing the documents subpoenaed by the House Oversight Committee.

https://twitter.com/i/status/1663988796600340481

Read more …

” .. I was excited by the opportunity to engage in free political debate and to make my contribution as a citizen and a scholar.”

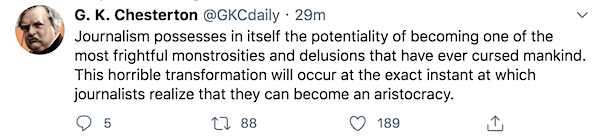

• Fifty Years Later, Free Speech No Longer Exists In The West (Rabkin)

Fifty years ago I left the Soviet Union for one reason: My desire for freedom. I was disgusted by the one-sided world view fostered by the banning of foreign publications and the jamming of Western radio stations. The obedient media, toeing the party line, repulsed me and made me laugh. Fear of the authorities (even if they were far more “vegetarian” than in Stalinist times) restricted open discussion of politics to the “kitchen cabinet,” with a small circle of trusted friends. I left behind my hometown (then Leningrad, now St Petersburg), my friends, my brother and the graves of my parents and grandparents. Applying to emigrate meant taking a risk, because you almost always risked losing your job, many friends and even relatives, with no guarantee that you would even be granted an exit visa.

[..] What struck me most in the newspapers and on television was the diversity of opinion. Letters to the editor offered a wide range of viewpoints, some of which not only criticized Western policies but also offered alternatives. It wasn’t long before I began to express my own views, first in letters to publications and then in articles. I was excited by the opportunity to engage in free political debate and to make my contribution as a citizen and a scholar. After all, society had created the conditions for me to share the results of my research and observations broadly. However, things have changed. Today, when it comes to some important issues of international politics, freedom of discussion is severely restricted.

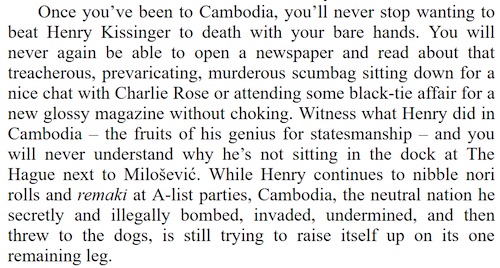

[..] An even more important issue that has disappeared from rational discussion is policy towards Russia. This issue is all the more important because Moscow has the largest nuclear arsenal in the world. Long before February 2022, when President Vladimir Putin announced the military campaign in Ukraine, most NATO countries (as well as Kiev itself) had restricted access to Russian media, something that did not happen in the West even during the Cold War. Just as the Soviets justified their jamming of Western radio broadcasts with the need to protect against “ideological sabotage,” many institutions have been created in recent years by NATO and its member states to protect citizens from, so-called, “Russian disinformation.”

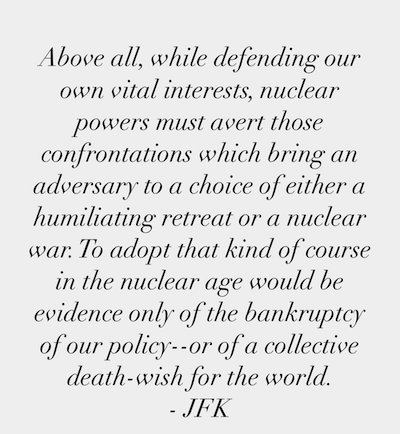

[..] Freedom of speech is not just a democratic right. It is also a way of defining and weighing alternatives. When conflict becomes an epic struggle between good and evil, rationality is replaced by moral judgment and noble indignation. This undermines all diplomacy and, in turn, exacerbates the danger of nuclear war, the inevitable consequence of which, as US military strategists recognized as early as 1962, is Mutually Assured Destruction, or ‘MAD’. Unanimity, una voce, one-sided debate – call it what you like. But this is about more than just the denial of free speech. The climate it has created threatens the very survival of humanity.

Read more …

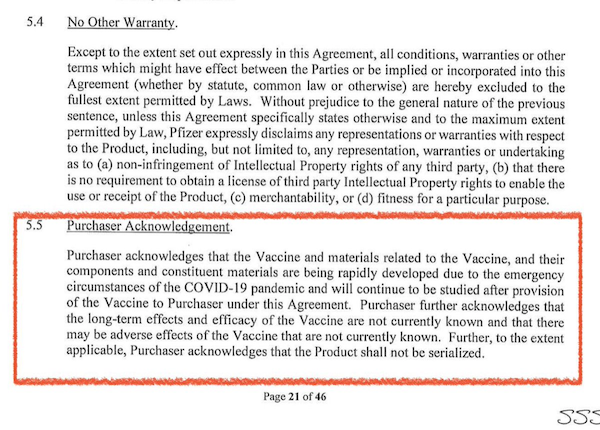

Maybe Pfizer can grow some.

• Australian Garlic Kills Covid-19, Says Doherty Institute (AFR)

Garlic might not just be good for keeping vampires away, but also COVID-19 and the common flu, according to new research being released on Wednesday by The Peter Doherty Institute. Scientists at Doherty have been researching garlic properties over the past 18 months and have discovered a certain Australian grown garlic variety demonstrates antiviral properties with up to 99.9 per cent efficacy against the viruses which cause COVID-19 and the common flu. The world-first research, commissioned by the Australian Garlic Producers organisation, involved in-vitro testing against the SARS-CoV-2 and Influenza type A viruses, using garlic ingredients extracted from exclusive Australian grown garlic varieties.

The most efficacious garlic varieties and their extracted proprietary garlic ingredient are being commercialised. They will be able to be taken as a soft capsule supplement similar to vitamin C or fish oil and are subject to a recently lodged International Patent. Dr Julie McAuley, manager of the Doherty’s high containment facility COVID-19 research lab, said the results were striking. “We wanted to know if these strains had the possibility of killing COVID-19,” she told The Australian Financial Review. “I thought it might fail miserably. We blindly tested over 20 varieties. We found one of AGP’s products could reduce the infectious titre of SARS-CoV-2 and influenza by 3-log-fold (99.9 per cent). We barely detected any remaining virus genome, indicating nearly complete virucidal activity.”

https://twitter.com/i/status/1663504437984505856

Read more …

Impaw

https://twitter.com/i/status/1663916994691776515

Anthill

Odd couple

The Taiwan blue magpie is a species of bird of the crow family. Also known as “long-tailed mountain lady”, is considered a rare and valuable species and has been protected by Taiwan

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.