Pieter Brueghel the Younger Construction of the Tower of Babel 1595

Trump straws

https://twitter.com/i/status/1687151866956693514

Pence gold

Do you remember @Mike_Pence was given a challenge coin after he declined to challenge the election results? The videos shows the exchange and @SpeakerPelosi elbow bumping Pence for receiving it. If you have any doubt about what’s happening in this video.

The evil and deception… pic.twitter.com/p37PxFaO2y

— Derek Broes (@WillingWitness) August 3, 2023

Tucker Tulsi

https://twitter.com/i/status/1687123434067673088

Rogan goof

.@JoeRogan: "Joe Biden has been a f—kin goof his entire career. He's been caught lying so many times. He's so full of shit…

There is so much evidence that he is corrupt. Just undeniable evidence of corruption. The stuff with him and his son…

The guy [Devon Archer] who… pic.twitter.com/Pb7xbw8OYr

— KanekoaTheGreat (@KanekoaTheGreat) August 3, 2023

Just a matter of book-keeping then.

• Is Biden Preparing to Dump Ukraine For Taiwan? (Sp.)

US President Joe Biden is reportedly seeking congressional approval for financing military aid for Taiwan as part of the supplemental budget for Ukraine. What’s behind the move? The White House is going to ask the US Congress to fund the arming of the island of Taiwan via the Ukraine budget in order to speed up weapons transfers to Taipei, as per Western media. The request followed the Biden administration’s announcement that the US would deliver $345 million worth of weapons to the island through a mechanism known as the “presidential drawdown authority.” The mechanism has long been used by the US to send arms to Ukraine. Taiwan, an island located at the junction of the East and South China Seas in the northwestern Pacific Ocean, is regarded by Beijing as an inalienable part of the People’s Republic of China.

“Well, what it shows is that the Biden administration has no regard or concern for angering China,” Larry Johnson, a veteran of the CIA and the State Department’s Office of Counterterrorism, told Sputnik. “China has made it very clear that it views any effort by the United States to provide weapons or military training to Taiwan as a direct threat to China. And for some reason, the Biden administration refuses to accept or acknowledge the position of the Chinese. In submitting this aid package, I don’t think the Biden administration will have any problem getting it passed. We’ve still not reached a point in the United States where there is opposition to funding the war in Ukraine, or the potential for war in China. So, I think it’s likely to go through, which means it’s going to make relations between China and the United States worse, not better.”

At the same time, the CIA veteran does not consider the development as lessening support for Ukraine. It’s likely that the Biden administration has come under pressure to show support for Taiwan, per Johnson. The expert sees the funding maneuver “as a convenient legislative vehicle to get approval for the funding in a way that expedites it, doesn’t delay it.” “I’m still not clear that it represents a cut in funds for Ukraine and a shifting of those funds to Taiwan. I think it’s more a function of the US legislative process, that Congress must appropriate money before the administration, in theory, can spend it. Because this legislation had already been presented, they were able, I think, decided to carve out some of the funds in that for Taiwan, because they had made prior commitments to Taiwan to provide some kind of support,” Johnson explained.

China has repeatedly urged the US to stop escalating tensions in the Taiwan Strait. Nonetheless, US government officials and congressional leaders continue to send mixed signals to the island and meet with Taiwan’s leadership. Furthermore, the US is encouraging its allies to beef up their military presence in the Asia Pacific, citing the “China threat” to the island. To cap it off, President Joe Biden has repeatedly pledged to protect Taiwan “militarily,” with the White House then downplaying his vows as gaffes. Why is Washington continuing to develop the conflict around Taiwan?

“Well, because, number one, the United States continues to believe that it is the most powerful country in the world and can dictate to other countries reality. It’s a consequence of arrogance and hubris. The United States refuses to accept the fact that China and Russia have an equal say in matters. And I think, unfortunately, the United States, if it persists in taking actions like this, will provoke a conflict that will be very damaging to the United States and will weaken it, not make it stronger. The United States can’t even fund the one proxy war in Ukraine right now. It’s been losing. It can’t provide sufficient artillery shells, for example. The United States fails to recognize that it’s reached the limits of its power,” Johnson concluded.

Waking up.

• Response To Niger Coup May Escalate Into ‘World African War’ (RT)

A Western-driven campaign to force Niger’s acting government to restore former President Mohamed Bazoum to power following last week’s military coup could bubble up into a wider conflict pitting NATO powers against Russia and China, an activist has told RT. “We are now at the door of a world African war,” African Freedom Institute President Franklin Nyamsi said on Thursday in an RT interview. He added that should the Economic Community of West African States (ECOWAS) take military action, as threatened, to remove Niger’s new government, such allies as Burkina Faso and Mali will likely come to the country’s defense. ECOWAS and the West African Economic and Monetary Union (WAEMU) imposed sanctions on the new Nigerien government last week, suspending all financial transactions and freezing the country’s assets in ECOWAS-member states.

Regional development banks cut off all assistance, as did the EU and France. The US and the African Union also threatened to follow suit. ECOWAS demanded that the junta restore Bazoum, who has been under house arrest since the coup, by August 6 or face military action by the regional bloc. Nyamsi argued that ECOWAS was acting on behalf of US and NATO interests, as did Bazoum, and had no authority in its charter to attack one of its members. The ECOWAS heads of state who back the bloc’s response to the Niger coup are dictators who have been responsible for government overthrows in their own countries, Nyamsi claimed. “They’re working for foreign interests, imperialist neocolonialist interests,” he said. “And the organization is permanently following the decisions of French political powers, of European political powers, of American political powers.”

A military intervention by ECOWAS would be a “declaration of war” not only against Niger, but also against dissenting members, including Burkina Faso, Mali and possibly Guinea, he added. “Those countries have clearly stated that they are against the repetition of what happened against Libya in 2011,” when NATO overthrew the government, killed President Muammar Gaddafi and armed Islamic terrorists, Nyamsi said. The result was greater destabilization of the Sahel region, which continues to this day, the activist claimed. “It is unbelievable that ECOWAS involves itself in a new attack on NATO’s inspiration against African interests and just because capitalistic oligarchy at the head of NATO has a lot of intention of keeping its hand on the wonderful natural resources of Africa,” he said.

The two ECOWAS factions – pro-NATO vs. pan-African – might not only fight each other, but also seek assistance from their powerful allies, Nyamsi said. Niger’s backers would likely call on Russia, China and Iran for help. “Possibly they want to export a world war in Africa between, finally, the two main blocs of the old Cold War,” he warned. “We don’t need that in Africa.” Making the situation even more volatile is the fact that many of the Western weapons sent to Ukraine to use against Russian forces have wound up in West Africa, Nyamsi said. “We are in a dangerous situation for all the planet. If we don’t use negotiation, if we don’t seek consensus, if we don’t respect international law for the powerful countries and the less powerful countries, we are going to collapse for all of humanity.” Nyamsi argued that Western military involvement in Africa, including the US counterterrorism bases in Niger, has further destabilized the continent. “There is no confidence that those who destroyed Libya, who killed Gaddafi in the NATO coalition, are seriously fighting against terrorism,” he said.

For Jack Smith?

• American Democracy Will Pay A Huge Price For Jack Smith’s Insouciance (Stockman)

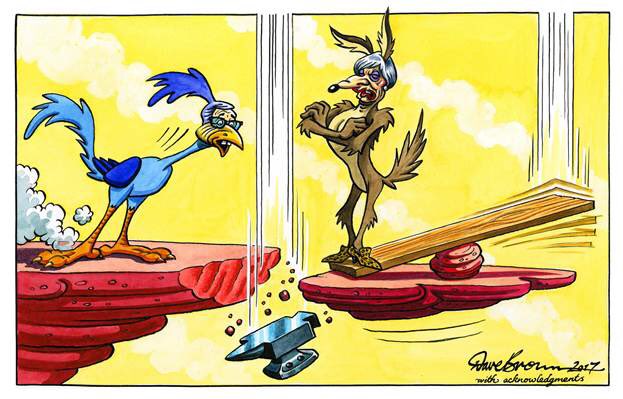

For crying out loud. The criminal prosecution of an ex-president and current election front-runner entails a super-duper heavy burden of proof, not just enough plausibility to get a Mafia don into court. To the contrary, it needs be predicated upon a damn serious “high crime” and provable criminal actions by the target that actively threatened America’s national security or core democratic processes.] By contrast, Jack Smith’s latest indictment is the very opposite. It’s self-evidently another exercise in prosecutorial “I gotcha”, and is even more tortured than the classified documents case. For instance, Trump retweeted a post labeling the Republican leaders of the Pennsylvania legislature as “cowards” on December 4, 2020. By the lights of Jack Smith that exercise in social media dissing was evidence of Trump’s complicity in a felonious conspiracy.

The same thing happened when several weeks later VP Pence called Trump to wish him Merry Christmas and Trump turned the conversation to the vice president’s role in the upcoming electoral vote count. So by merely raising the topic about an event to occur two weeks later, and a potential action by Pence that was still legally in play at least in the minds of a minority of Trump’s advisors, the sitting president of the United States thereby participated in said felonious conspiracy! The indictment is packed with pages on end of such legal humbug. But before you get lost in the utter trivia, it needs be remembered that we are actually in the midst of a fraught exercise in democracy, not a law school Moot Court proceeding on the proposition, taken in splendid abstraction, that no one is above the law.

The plain fact is that Smith’s 45 pages of purported nefarious doings do not embody a criminal conspiracy at all. What the indictment actually describes is TrumpWorld at work in all of its pandemonium, bickering, incompetence and shoot-from-the hip recklessness. The self-evident reason that Trump pursued the election fraud canard right up until the wee hours of January 7th, when the electors finally certified Biden’s victory, is that the man is a megalomaniacal brute who just won’t take “no” for an answer.

After all, by then nearly everyone who knew anything had told him that the election was over, that he had lost and that while the election reeked from the odor of an unprecedented 60 million mail-in votes and massive but dubious Democrat “ballot harvesting”, the level of provable fraud did not rise to anything remotely determinative of a different outcome. In fact, his Attorney General, Bill Barr, had bailed weeks earlier, the White House counsels office had given up the ghost and three days earlier Trump himself had chickened out of the required Saturday Night Massacre redux.

Trump Subpoena

https://twitter.com/i/status/1687290102907555840

“..You now open the door to us being able to ask you questions about the legitimacy of the 2020 election..”

• It’s For The Headline, Not For The Win (ET)

The third indictment of former President Donald Trump could produce unintended consequences for the U.S. Department of Justice (DOJ), one of his lawyers says. Legal experts disagree about the strength of the Aug. 1 indictment itself. But in interviews with The Epoch Times, they concurred with Mr. Trump’s legal spokeswoman, New Jersey attorney Alina Habba, on one point: DOJ prosecutors may have difficulty proving their case. Mr. Trump is scheduled to appear in a Washington federal court today, Aug. 3, on a four-count indictment. It alleges that the former president willfully made untrue claims that the 2020 election of Democrat President Joe Biden was fraudulent.

The election dispute culminated in a protest in Washington; a number of agitators breached the U.S. Capitol on Jan. 6, 2021, against Mr. Trump’s expressed wishes as Congress was preparing to certify Mr. Biden’s victory. More than 1,000 people, including some who committed no violence, were charged. The DOJ is alleging that Mr. Trump orchestrated a conspiracy against the U.S. government during the two months leading to Jan. 6, 2021, the indictment says. Under presidential immunity and free speech rights, Mr. Trump is allowed to dispute the election, Ms. Habba said. She also questions how the government can show that Mr. Trump knew he was making false assertions. “The thing that makes this case the most weak is: How are you going to prove what he actually believed?” Ms. Habba said in an interview with The Epoch Times on Aug. 2, a day after the new indictment was filed.

Mr. Trump has never conceded defeat and has continued to assert that the election was “rigged” or “stolen” ever since Mr. Biden was inaugurated as the 46th president in January 2021. Ms. Habba and many other lawyers are denouncing the latest indictment of Mr. Trump as an attempt to criminalize political disagreements. Attorney Mike Allen, a legal analyst based in Cincinnati, Ohio, told The Epoch Times: “Even if what Trump said was not accurate, he’s allowed to do that; the First Amendment protects lies. It’s not a pretty thing. But that’s the way it is.”Mr. Trump and his supporters say the latest indictment is another example of a “weaponized” justice system’s disparate treatment of him.

They point out that no one was charged for the false statements that fueled the years-long and costly “Russian collusion” investigations of Mr. Trump. The FBI would never have launched that probe if it had followed its own rules, Special Counsel John Durham concluded in a May report. Further, Mr. Trump and his allies point out that Democrats faced no repercussions for their strenuously objecting to the results of several elections and alleging that Mr. Trump “stole” the 2016 election.

[..] Ms. Habba says that, by bringing the latest charges against Mr. Trump, the government is taking a number of risks. “These cases are tough to prove on a good day, but they [the DOJ prosecutors] also forget that they’ve exposed themselves,” she said. “When you bring a lawsuit, you now open the door to subpoenas. You now open the door to us being able to ask you questions about the legitimacy of the 2020 election, for us being able to look at things like that.” “So, you know, it’s a dangerous proposition, and I’m not sure it was well-thought-through, to be honest,” she said. Ms. Habba called the indictment “sloppy” and said the repeated prosecutions of Mr. Trump have made federal prosecutors’ political motivations very clear. “It’s for the headline, not for the win,” Ms. Habba said.

“..maybe Smith was referring to the conspiracist and former president Jimmy Carter. He alleged that Trump in 2016 “lost the election, and he was put into office because the Russians interfered on his behalf.”

• Two Sets of Laws for Two Americas (Hanson)

Two sets of laws now operate in an increasingly unrecognizable America. Consider the matter of unlawfully removing and storing classified papers. Donald Trump may go to prison for removing contested White House files to his home. So far Joe Biden seems exempt from just such legal jeopardy. But as a senator and Vice President with no right, as does a president, to declassify files, Biden removed and, as a private citizen kept for years classified files in unsecure locations. Biden’s team strangely revealed the unlawful removals after years of silence. It did so because the Biden administration found itself in the untenable position of prosecuting the former president for “crimes” that the current president committed as well—albeit far earlier and longer.

Impeachable phone calls? Donald Trump was impeached by a Democratic House for delaying foreign aid until the Ukrainian government guaranteed that Hunter Biden and his family were no longer engaged in corrupt influence peddling in Kyiv. In addition, the Left charged that Trump was targeting Joe Biden, his possible 2020 rival. Yet Biden, with impunity, bragged that he had fired a Ukrainian prosecutor looking into his own son’s schemes by promising to cancel outright American foreign aid.And the Biden administration’s Justice Department is now targeting Trump, currently the frontrunning challenger to Biden in 2024.

Election denialism? Trump was indicted by Special Counsel Jack Smith, in part for supposedly conspiratorially “unlawfully discounting legitimate votes.” Will Smith then also indict Stacey Abrams? For years Abrams falsely claimed that she was the real governor of Georgia. She toured the country in hopes of “discounting” the state vote count. Or maybe Smith was referring to the conspiracist and former president Jimmy Carter. He alleged that Trump in 2016 “lost the election, and he was put into office because the Russians interfered on his behalf.” Will Smith charge Hillary Clinton? She serially libeled Trump as an “illegitimate” president. Clinton hatched the Russian collusion hoax, and bragged she joined the “Resistance” to continue her attacks on an elected president.

Let SCOTUS pause the litigation in the campaigns.

• My Public Advice To President Trump’s Legal Team … (Mark Levin)

The Biden administration has created a legal morass never seen or experienced in American history, as applies to a presidential election. The attorney general, appointed by the Democrat president, is authorizing indictment after indictment of his president’s possible if not likely political opponent in the middle of a presidential election cycle. He is doing so through his appointment of a special counsel, whose appointment was a misapplication of the special counsel regulation, and whose charges must be approved by the attorney general. (By the way, as an important side issue, Jack Smith is not a presidential appointee; he never even stood for confirmation by the Senate to hold the position he holds and to exercise the authority he is exercising against a party opponent.) It should be noted at the same time, the attorney general refuses to appoint an outside special counsel to investigate his client, Joe Biden, despite the fact that the DOJ regulation was originally instituted for these exact circumstances. Of course, this underscores the purpose and motive of what is taking place before us today.

The attorney general is approving the timing of dozens of charges against the former Republican president, who is actively seeking his party’s nomination to challenge the Democrat president for whom he directly reports, which are intended to cripple the ability of Donald Trump to effectively run for president, regardless of what polls show today. And regardless of what the commentariat say, and despite President Trump’s strength within the Republican Party, the outcome of the election is unknown. Therefore, the polls are irrelevant in this regard. Moreover, as further evidence that these indictments are being used as political weapons are the timing of the charges — specifically, all of these charges by the separate grand juries, all controlled by the special counsel, should have been filed AFTER the election, as there was no possibility the statute of limitations would run on any of them. Further, the special counsel repeatedly insists that the charges must be quickly adjudicated, meaning before the people vote, for the purpose of having maximum influence on the election.

In addition, the charges have resulted in the significant depletion of Trump’s campaign funds to pay for millions in legal fees. Trump has to take significant time from campaigning to address the dozens of charges dropped on him by the Biden administration — that is, he has to expend an enormous amount of time working with his lawyers in order to defend himself from charges that, collectively, would result in his imprisonment until his death.

The fact is that this kind of legal warfare against a presidential and possible if not likely opponent to the present president, is not only unprecedented in the history of our republic it will destroy our electoral system for all time. It is not something that should left to various district courts or local courts to sort out in the course of regular judicial proceedings. In fact, that is part of the intended strategy by the prosecutors who are engaged in this assault on our electoral system. They must not be rewarded for their behavior. They must not be rewarded for their treachery and exploitation of the legal system and the courts to achieve their political ends.

Even without getting to the merits of these multitude of charges, which are easily unraveled from my perspective, the process is what is being used to interfere with the election. And the near silence by those who are orchestrating this shocking legal warfare, when the American people are left in the dark, is untenable.

Therefore, I want to publicly encourage the Trump legal team to seek an emergency hearing before the U.S. Supreme Court, not to resolve legal disputes, but to at least temporarily halt the abomination of this legal warfare that is unfolding in front of us — where Democrats and anti-Trump Republicans are unashamedly celebrating the use of the courts by the Biden administration and Democrat DA’s to further their political wishes, as the rest of the nation watches in shock. This unprecedented legal warfare requires an unprecedented response by the only constitutional body left that can do something about it — the Supreme Court.

Everything’s for sale..

• Chinese Wanted Biden Family Name To Help Acquire US Energy Assets (JTN)

Text messages provided to the FBI show that a Chinese energy conglomerate that struck a controversial deal in 2017 with Hunter Biden began its pursuit of a relationship with the future first family back in late 2015 when Joe Biden was still vice president, hoping to seize on the name of one of America’s most famous political dynasties to provide cover for its ambitious plan to buy up energy assets inside the United States. “There will be a deal between one of the most prominent families from US and them (China) constructed by me,” Hunter Biden’s business partner James Gilliar texted future partner Tony Bobulinski on Christmas Eve 2015, shortly after Hunter Biden had been alerted to CEFC China Energy’s overture and its wealthy leader Ye Jianming.

“I think this will then be a great addition to their portfolios as it will give them a profile base in NYC, then LA, etc,” Gilliar added in the text message obtained by Just the News. “For me it’s a no brainer but culturally they are different, but smart so let’s see. … Any entry ticket is small for them. Easier and better demographic than Arabs who are little anti US after trump,” Gilliar wrote. [..] The text messages obtained by Just the News provide fresh evidence that the Biden family name and “influence” were key to foreign clients like CEFC in communist China. It also corroborates bombshell testimony earlier this week to Congress from another of Hunter Biden’s business partners Devon Archer, who claim Hunter Biden and Joe Biden came as a “brand” package to help foreign clients seeking influence.

The courtship between the Chinese energy firm and Hunter Biden started slowly, according to the text messages and separate emails from a Hunter Biden laptop the FBI seized in December 2019. Hunter Biden didn’t connect with Ye for a planned dinner in Washington D.C. on Dec. 6, 2015 that was going to be hosted by Serbian businessman named Vuc Jeremic, according to the emails and news reports. But the vice presidential son did meet later that month with CEFC Executive Director Jianjun Zang, according to Hunter Biden’s schedules on his now-infamous laptop. By mid-March 2016 – 10 months before Joe Biden would leave office – the discussions had advanced far enough that two of Hunter Biden’s business partners, Rob Walker and Gilliar, had drafted a memo for Hunter Biden to sign and send to CEFC, according to an email on Hunter Biden’s laptop entitled “H to Zang Draft.”“Take a look and let me know. Very simple. Once ok’d. I’ll send to Joan to sign?” Walker wrote Hunter Biden. “Yes,” Hunter Biden replied.

“..a year ago, the West was screaming about the necessity to urgently feed those starving, and when nobody was fed besides [the West] itself, they are screaming that Russian grain is superfluous in the market..”

• Zakharova Slams Borrell’s Remarks On Russia Creating ‘New Dependencies’ (TASS)

Russian Foreign Ministry Spokeswoman Maria Zakharova has branded EU foreign policy chief Josep Borrell’s recent remarks that Russia was purportedly creating the dependency of developing nations on its grain shipments as a farce. “Am I not getting something, has hunger already been conquered? Aren’t there any problems with food security? This is some kind of a farce, a year ago, the West was screaming about the necessity to urgently feed those starving, and when nobody was fed besides [the West] itself, they are screaming that Russian grain is superfluous in the market,” the diplomat wrote on her Telegram channel. On August 1, according to Reuters, the EU sent a letter to developing countries and the Group of 20 saying that Russia was offering cheap grain “to create new dependencies by exacerbating economic vulnerabilities and global food insecurity.”.

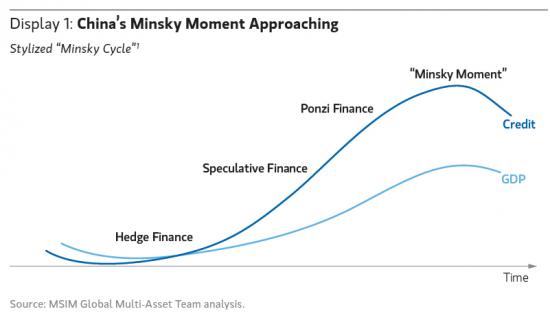

They don’t need a currency; they have plenty intruments.

• Kremlin Pours Cold Water On BRICS Currency Speculation (RT)

Introducing a single currency in the BRICS group of developing countries would be difficult to do in the short term, Kremlin spokesman Dmitry Peskov said on Thursday. The economic bloc comprising Brazil, Russia, India, China, and South Africa has been debating the feasibility of creating a common currency for global trade as an alternative to the US dollar. The idea is supported by numerous other nations that want to join BRICS. “Certainly, expert discussions are underway about the possibility, expediency and feasibility of plans to introduce the national currency of some kind of integration processes. This is still a discussion process; it is clear that it will be protracted in time,” Peskov stated.

He, however, added that while “in the short term, this is hardly feasible, the use of national currencies is already a reality that is growing on a global scale, and this practice is resorted to not only by countries that face sanction limitations, but by those that do not.” According to Peskov, countries understand the benefits of this when conducting foreign trade. The BRICS nations have been seeking to shift further away from the US dollar in mutual trade, with the de-dollarization trend gaining momentum following sanctions that effectively cut Russia off from the Western financial system.

Brazilian President Luiz Inacio Lula da Silva has stated that developing nations should move away from the greenback in favor of their own currencies in order to push back against American dominance over the global financial system. Meanwhile, South Africa’s Foreign Minister Naledi Pandor has said that the bloc should carefully discuss the idea, warning that de-dollarization would be complex and that there would be no guarantee of success. Moscow floated the idea of introducing a BRICS currency last year. President Vladimir Putin said last June that member states were working on developing a new reserve currency based on a basket of the national currencies used by the five-nation bloc.

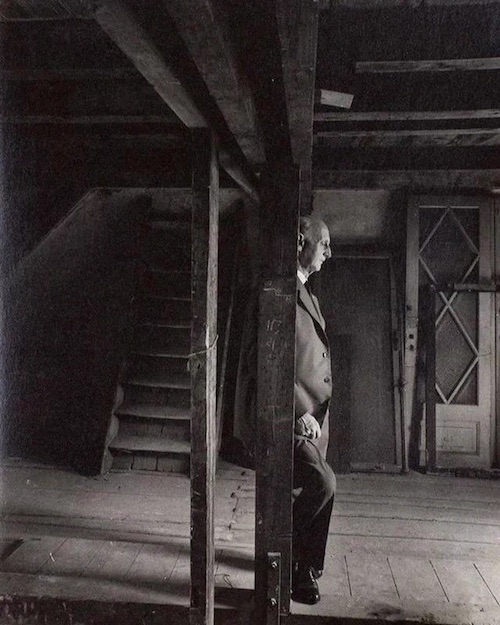

Otto Frank 1960

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.