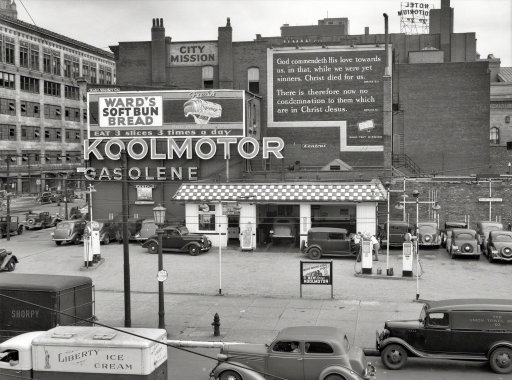

John Vachon Koolmotor, Cleveland, Ohio May 1938

History says so.

• The Stock Market, Inevitably, Is Going To Crash (MarketWatch)

And you thought stock-market crashes were a thing of the past. One ancillary benefit of this week’s turmoil has been to remind us that a market crash could occur at any time. We had been lulled into a false sense of security by the markets’ exceptionally good performance in recent years, coupled with our too-short memories. At one point during the air pocket that hit during Wednesday’ session, the Dow Jones Industrial Average had fallen almost 508 points — which, coincidentally, was the same decline during the 1987 stock market crash, the worst in U.S. history. Piling on: This weekend marks the 27th anniversary of that crash.

Of course, 508 points in 1987 represented a far bigger drop than Wednesday’s intra-day decline, since the Dow at that time was trading for just a fraction of where it stands today. To decline as much in percentage terms today as it did then, the Dow would have to fall by more than 3,700 points. And, believe it or not, declines that big are also an inevitable, if rare, feature of the investment landscape. And we’re kidding ourselves if we think that market reforms will be able to prevent it. The only real solution is to devise investment strategies with the knowledge that big daily drops are unavoidable.

Liquidity. The magic word.

• One Simple Reason Why Global Stock Markets Are Reeling (AEP)

It is no mystery why global liquidity is evaporating. Central banks have turned off the tap. They have reduced net stimulus by roughly $125bn a month since the end of last year, or $1.5 trillion annualized That is a shock for the financial system. The ratchet effect has been incremental, but relentless. We are finally seeing the consequences, with the usual monetary policy lag The Fed and People‘s Bank of China (PBOC) have stopped their two variants of global QE altogether (for now). Others have chopped their purchases of bonds by half or more. The Brazilians are net sellers, and in a sense they carrying out reverse QE. The Russians have just joined them again. Fed tapering has taken out $85bn a month. The markets are having to go it alone as of this month, without their drip feed. Less understood is the effect of global reserve accumulation by the BRICS, emerging Asia, and the Petro-states. This has collapsed. Nomura’s Jens Nordvig has crunched the latest numbers for Q3.

They show that China’s PBOC has completely withdrawn from global asset markets. In fact, it may have sold almost $9bn of bonds, (even adjusting for currency effects). This is a policy shift by Beijing. Premier Li Keqiang said in May that China’s $4 trillion foreign reserves are already so big they have become a “burden“. China bought $106bn as recently as the first quarter of 2014, so this is a very sudden shift. Yes, I know, China’s purchases of US Treasuries, Gilts, Bunds, French bonds, and Japanese JGBs are not quite the same as QE. There are complex sterilization effects. Yet there is a fungible effect whether the Fed is buying Treasuries or whether the Chinese central bank is buying them. It is all a form of global QE. It all helps to inflate asset prices, and vice versa if it reverses. This was really what Ben Bernanke meant when he first began talking of the “global savings glut“. The flood of money into the bond markets was compressing yields for everybody.

Hence the subprime debt crisis in the US, and hence too the Club Med debt bubble. The money had to go somewhere as the rising world powers boosted global FX reserves to $11.3 trillion from under $1 trillion in 2000. It went into safe-haven bonds, displacing that money into everything else. Over the latest quarter, almost every country has been choking back: the Bank of Korea has cut net purchases from $25bn to $9bn; the Reserve Bank of India from $43bn to $12bn; the petro-states have cut from $19bn in Q1 to $11bn. (That must surely turn steeply negative with oil at $86 a barrel). Net sellers were: China (-$9bn), Brazil (-$7bn), Singapore (-$7bn), Malaysia (-$5bn), Thailand (-$3bn), Turkey (-$1bn). Overall FX accumulation worldwide fell from $106bn to $22bn.

Word: “we are all going to pay a terrible price for all this money-printing and debt.”

• Jim Rogers: Sell Everything And Run For Your Lives (Zero Hedge)

From Bitcoin to the Swiss gold referendum, and from Chinese trade and North Korean leadership, Jim Rogers covers a lot of ground in this excellent interview with Boom-Bust’s Erin Ade. Rogers reflects on the end of the US bull market. citing a number of factors from breadth to the end of QE, adding that he agrees with Albert Edwards’ perspective that now is the time to “sell everything and run for your lives,” as the “consequences of [The Fed] are now being felt.” Most notably though, Rogers believes the de-dollarization is here to stay as Western sanctions force many nations to find alternatives. Simply put, Rogers concludes, “we are all going to pay a terrible price for all this money-printing and debt.” Excerpts:

On US stocks: This is the end of the bull market. Stocks will fall 20%. Market breadth is waning as evidenced by the lower number of stocks hitting new highs and trading above their 200-day moving averages. Small cap stocks have already corrected over 10 percent and almost half of the Nasdaq is down 20 percent – a bear market already. Where is this headed? Consolidation is the bare minimum. But, depending on the real economy, it could be worse. “Any pension plans, endowments, etc., are suffering because they invest for the futures and are finding that their situation has gotten worse,” he says.

On The Fed: “We are all going to pay a terrible price for all this money-printing… They are doing this at the expense of people who save and invest. They are doing it to bail out the people who borrowed huge amounts of money. The consequences are already being felt.”

On de-dollarization: The move away from the U.S. dollar is yet another reaction to Western sanctions placed on Russia since it annexed Crimea from Ukraine in March. Russia and Iran have agreed to use their own national currencies in bilateral trade transactions rather than the U.S. dollar. An original agreement to trade in rials and rubles was made earlier this month in a meeting between Russian Energy Minister Alexander Novak and Iranian Oil Minister Bijan Namdar Zanganeh. Similarly, Russia and China also agreed to trade with each other using the ruble and yuan in early September, following a Russian deal with North Korea in June to trade in rubles

Yeah, but you would have expected a move into gold as well, and that never happened. Maybe there’s isn’t that much fear yet?!

• The Return Of The ‘Fear Trade’ (MarketWatch)

Halloween came early this October. A vicious midweek selloff shows that investors can be still be scared out of their wits, at least for a few hours. And while the monster is now back in its cage, it is unlikely the “fear trade” has completely run its course. But first, what triggered the carnage? For once, few pundits were offering a pat, one-size-fits-all answer. That’s because there wasn’t one. Instead, it came down to a combination of nagging but interrelated worries surrounding Europe, collapsing oil prices, the threat of global deflation, and the Fed’s rate path. Throw in a steady drumbeat of Ebola headlines and suddenly folks were streaming toward the exits. But the most attention-grabbing moment occurred in the bond market. The rally in Treasurys that accompanied the stock-market selloff, temporarily dropped the yield on the 10-year note below 2%. While a flight to quality would be expected, the sharp one-third of a point drop in the yield had market veterans scratching their heads.

Yields have since rebounded as Treasurys gave back most of the Wednesday rally. Wall Street is enjoying a sharp Friday rebound as oil prices bounce from multiyear lows. But that still leaves traders to make sense of the mayhem. In a note, Eric Green, head of U.S. rates at TD Securities, succinctly summarized the midweek market turmoil as the extension of two competing forces: One was the continuation of a post-quantitative-easing correction in stocks “that should be viewed as healthy.” The other “is a fear trade that has been gathering momentum over the past several weeks, one that has its roots in a global recovery that looks to be weakening outside of the U.S., especially in Europe.” Indeed, Europe is still a primary source of anxiety. And for a good reason.

First, let’s see you fog that mirror!

• Fannie, Freddie Plan Measures to Ease Lending to Riskier Borrowers (Bloomberg)

Fannie Mae, Freddie Mac and their regulator are nearing agreement with mortgage issuers on efforts to boost lending and ease banks’ concerns that they will get stuck with bad loans when borrowers default. The initiatives include a consensus on when defaulted loans are so flawed that lenders must buy them back from the two mortgage-finance companies, a key sticking point in efforts to unlock credit, according to three people familiar with the discussions. The steps are part of a broader push to increase lending after banks had to repurchase billions of dollars of mortgages that were issued during the housing bubble. The banks’ reticence has kept first-time homebuyers and others with weak credit out of the real-estate market and created a drag on the fragile housing recovery.

Melvin L. Watt, the director of the Federal Housing Finance Agency, will clarify in a Oct. 20 speech at the Mortgage Bankers Association conference in Las Vegas how some loans can be permanently exempted from the threat of buybacks, said the people, who asked not to be identified because the plans aren’t public. Watt will also discuss an effort that would allow borrowers to put down as little as three% of the purchase price on loans backed by Fannie Mae and Freddie Mac, enabling borrowers with lower incomes to access the mortgage market, the people said. The two companies currently require a 5% down payment on most loans.

Loading up on Treasuries. Sure, risky down the line, but a bit overdone here.

• Why US Banks Are Now Extremely Vulnerable (Simon Black)

For a casual observer of the US economy (most “experts”), you could say that things look pretty good. Unemployment is at its lowest rate in six years. Earnings of S&P 500 companies are higher than ever, while their debt is lower than it’s been in the last 24 years. Nonetheless, rather than getting excited for good economic times, the big commercial banks are all battening down the hatches. They’re preparing for bad times ahead. I often stress the importance of being prepared, so in theory, that should be a great sign. But then, you look at what they are “defensively” investing in, and you see that what they consider as prudence is simply insanity. What banks are stockpiling these days are US government bonds, and they’re not doing this casually, they’re going nuts for them. In just the last month alone American banks increased their holdings of US treasuries by $54 billion, to a record $1.99 trillion. Citigroup, for example, held $103.8 billion worth of bonds at the end of June, up 19% from the end of last year.

This is like preparing for an earthquake by running out and buying whole new sets of porcelain dishes and glass vases. All it’s going to do is make things more dangerous, and even if you somehow make it through the disaster, you have a million more shards to clean up. With government bonds you are guaranteed to lose both in the short-term and the long-term. Bonds keep you consistently behind inflation (even the deceptively named TIPS—Treasury Inflation Protected Securities), so the value of your savings is slowly being chipped away. But that’s nothing compared to the long-term threats of the US government not being able to repay the loans. Facing $127 trillion in unfunded liabilities – which is nearly double 2012’s total global output – and with no inclination to reduce those numbers at all, at this point disaster for the US is entirely unavoidable. Never before in history has a government stretched itself so thin and accumulated anywhere close to this amount of debt.

So when the day comes, it won’t be a minor rumble. It will be completely off the Richter scale. These facts about the US government are in no way secret. Every bank out there knows it, yet they keep piling in. Why do they keep buying bonds that they know the government will never be good for? Even though people know in their guts that the government has no earthly possibility to ever repay its debt, on paper it’s a no risk investment. The US government’s sovereign debt has an AA+ rating after all. They might not make money off it, but no fund manager and investment banker is going to get fired for investing in “risk-free” US government debt.

What is the truth in refinancing these days? Two articles that leave a lot of questions:

• Just Try to Refinance. I Dare You (Ritholtz)

The bond market seems to have had its own flash crash this week. The yield on the 10-year U.S. Treasury bond dipped briefly below 2%, as panicked equity sellers looked for a safe place to park their cash. Treasuries, of course, are the world’s option of choice, the safest and most liquid port during the storm. Demand for bonds has helped drive down mortgage rates as well. Bloomberg News reported that “U.S. mortgage rates plunged, sending borrowing costs for 30-year loans below 4% for the first time in 16 months, as signs of a slowing global economy drove investors to the safety of government bonds.” Almost immediately, lower rates worked their way through the entire credit complex. The average rate on 30-year fixed home loan is now 3.97%. To put this into context, the median U.S. home price is $219,800. Put down 10% and that $200,000 mortgage costs the homebuyer $951 a month. A decade ago the same mortgage would have cost this buyer as much as 6.34%. The monthly payment would have been more than 25% higher at $1,243.

Under normal circumstances, this decrease in rates should have far reaching and beneficial effects on the economy. It would spur increased investment in real estate. Mortgage refinancings also would rise, and that would put a little more discretionary cash in the hands of consumers each month. As rates fall, one would expect sales of new and existing homes to rise. Lower financing costs should mean higher sales volume, along with some price increases as well. An increase in home sales tends to boost purchases of washing machines, furniture, TVs, cars and other durable goods. The increased economic activity eventually results in more hiring, increased wages, higher spending, all leading to a virtuous cycle. The key phrase in the prior paragraph is “Under normal circumstances.” These are decidedly not normal circumstances today, thus the unsatisfying economic growth we confront today.

• Rates Below 4% Leave U.S. Refinancing Banker Sleepless (Bloomberg)

The drop in mortgage rates below 4% has cut into Debra Shultz’s sleep. The New York City banker is busier than she’s been in months, working with three dozen homeowners eager to lower their payments. Shultz helped a Greenwich Village homeowner on Wednesday lock in a 3.63% interest rate for a 30-year fixed jumbo mortgage of more than $900,000. An hour later, the rate jumped to 3.75%. One lender changed its rate sheet six times that day. “It just went crazy,” said Shultz, a senior vice president of mortgage lending at Guaranteed Rate in New York. “I sent out a blast e-mail to 1,600 clients and had 30 responses right away.” Mortgage rates are following a slide in 10-year Treasury yields as weaker-than-expected economic data from Germany to China combine with concern about the Ebola virus, sparking demand for safe investments.

The average rate for a 30-year fixed mortgage dropped to 3.97%, the lowest since June 2013, Freddie Mac said yesterday. Borrowing costs spiked in September before dropping for the last four weeks, giving owners a new opportunity to refinance. “This is bizarro world,” said Anthony B. Sanders, an economics professor at George Mason University in Fairfax, Virginia. “Usually we associate lower interest rates with lower volatility. Now you’re seeing the opposite.” A gauge of U.S. mortgage refinancing jumped 10.6% last week, the most since early June, the Mortgage Bankers Association said Wednesday. The share of home-loan applicants seeking to refinance climbed to 58.9%, the highest since mid-February, from 56.4%, the group said. In December of 2012, after the 30-year average rate hit a record low of 3.31% in November, borrowers wanting to refinance accounted for 84% of applications.

Times turn desperate.

• ECB Policymakers Clash Over How To Treat Eurozone (Reuters)

European Central Bank policymakers clashed on Friday over what policy medicine to administer to the sickly euro zone economy, laying bare deep-seated tensions within the Governing Council. Bundesbank President Jens Weidmann said he saw no need for fiscal stimulus in Germany, rejecting a thinly veiled appeal from ECB President Mario Draghi for Berlin to increase its public investment levels to help support the euro zone. Germany, a strong advocate of fiscal austerity, has come under pressure from other countries including the United States, and finance officials around the globe to use its large current account surplus and budgetary room for manoeuvre to invest. Earlier, Draghi’s lieutenant at the ECB, Benoit Coeure, said governments could help counteract lower prices with “fiscal policy, when it is available without questioning long-term debt sustainability” – a cue for governments like Germany to invest.

The discord between the hawkish Weidmann and policymakers closer to Draghi such as Coeure highlights deep divisions within the Council about how far the ECB should go to support the economy, and comes just as jittery markets look for reassurance.

Weidmann brushed off the suggestion that more German public investment could help other euro zone economies, and also took aim at ECB plans to buy asset-backed securities, or bundled loans — a dig that a further ECB policymaker rejected. “The boost to the peripheral countries from an increase in German public investment is … likely to be negligible,” Weidmann told a conference in Riga, where Coeure also spoke. “And with the economy operating at normal capacity utilisation, Germany is not in need of stimulus either – and this will remain the case with the revised forecasts that still foresee growth in line with potential,” he added. On Tuesday, German Chancellor Angela Merkel rejected calls for Berlin to ditch its plans for a balanced budget next year.

A great overview of five years of utter failure.

• Eurozone: Five Years Of Bailouts, Market Turmoil And Protests (Guardian)

The eurozone crisis didn’t emerge from a clear blue sky five years ago. Greece’s economic problems were well known; in 2004, it admitted fudging its deficit figures to qualify for euro membership, and a year later Athens brought in an austerity budget to, it hoped, bring down borrowing. But the left-wing Pasok government still shocked the financial markets and its EU neighbours on 18 October. Fresh from winning a general election, it announced that Greece’s budget problems were far worse than imagined; a deficit equal to 12% of national output, not the 6% forecast by the previous government. That admission triggered market panic, tumbling share prices, credit rating downgrades – setting the tone for the years ahead.

They signal the hopelessness of the whole project, of the idea that Greece will be as rich as Germany.

• Greece’s Latest Woes Signal Next Stage Of The Eurozone Crisis (Telegraph)

If Greece is the canary in the coal mine, then we are all in trouble. Interest rates on Greek debt have jumped in recent days, rocketing to around 9pc on 10-year bonds, an unsustainable financing cost for such a troubled government. The last time this sort of thing happened, in 2010, the eurozone was soon plunged into near-fatal crisis. Four years later, the debt crisis in the eurozone’s periphery was meant to be over, so Greece’s sudden relapse is one reason why so many equity, bond and commodity investors are running for the hills. Unlike last time, no hidden debt has been discovered, and Greece’s budget deficit has actually fallen significantly. While not quite a model student, Greece had at least been trying to mend its ways. The proximate trigger for the surge in bond yields is that the Athens government had been over-exuberant since the start of the year, hoping to leave the bail-out programme early, partly for the wrong, anti-austerity reasons.

None of this will now happen, and the European Central Bank has promised to help out, which may temporarily calm matters down. The stark reality is that Greece is not out of the woods, contrary to what many had claimed – yet its crisis is containable. Its economy is too small; even under a worst-case scenario it would not be able to take down the whole of the eurozone. But what this latest flare-up confirms is that merely reducing budget deficits is not enough. Having an excessive national debt remains a major problem, especially now that economists are slashing their growth forecasts for the eurozone as a whole and continent-wide deflation is looming. In such a Japanese-style scenario, the traditional debt-eroding mechanisms of inflation and growth no longer apply. Falling prices – caused by a defective, one-size-fits-all monetary policy, and thus insufficient demand – will push up debt ratios as a share of GDP, especially when economic output is stagnating at best.

As Capital Economics points out, any eurozone country with high and rising debt ratios is vulnerable; Italy and Portugal, which both have debt to GDP ratios of about 130pc, could be next in the firing line. Once again, excess debt is the problem – though this time, burdens are rising for partly different reasons. The euro has seen its value slide by 5pc against a trade-weighted basket of currencies since March, with Citigroup predicting that the total depreciation will hit 10pc over the next 12 months. In the past, this would have generated a 5pc boost to exports, translating to a 1pc rise in GDP over three years. Sadly, the impact this time around is likely to be far more muted. Demand for the sorts of goods the eurozone exports has weakened significantly. A greater share of the value of the region’s exports is in turn made up of imported components or raw materials, limiting the beneficial impact of the weaker euro, Citigroup correctly points out.

“The biggest bottleneck for growth in the euro area is not monetary policy, nor is it the lack of fiscal stimulus: it is the structural barriers that impede competition, innovation and productivity ..” Eh, what about the debt, Mr Weidmann?

• Kudos To Herr Weidmann For Uttering Three Truths In One Speech (Stockman)

Once in a blue moon officials commit truth in public, but the intrepid leader of Germany’s central bank has delivered a speech which let’s loose of three of them in a single go. Speaking at a conference in Riga, Latvia, Jens Weidmann put the kibosh on QE, low-flation and central bank interference in pricing of risky assets. These days the Keynesian chorus in favor of policy activism is so boisterous that a succinct statement to the contrary rarely gets through – especially at Rupert Murdoch’s Wall Street yarn factory. But here’s what penetrated even Brian Blackstone’s filters:

“The biggest bottleneck for growth in the euro area is not monetary policy, nor is it the lack of fiscal stimulus: it is the structural barriers that impede competition, innovation and productivity,” he said.

Needless to say, that is not only the truth but its one that is distinctly unwelcome to the policy apparatchiks in Brussels and the politicians in virtually every European capital. Self-evidently, printing money and running up the public debt are pleasurable and profitable tasks for agents of state intervention. But reducing “structural barriers” like restrictive labor laws, private cartel arrangements and inefficiency producing crony capitalist raids on the public till are a different matter altogether. In the political arena, they involve too much short-term pain to achieve the long-run gain.

But implicit in Weidmann’s plain and truthful declaration is an even more important proposition. Namely, rejection of the mechanistic Keynesian notion that the state is responsible for every last decimal point of the GDP growth rate. Indeed, the latter has now become such an overwhelming consensus in the political capitals that to suggest doing nothing on the “stimulus” front sounds almost quaint – a throwback to the long-ago and purportedly benighted times of laissez faire. But perhaps stolid German statesmen like Weidmann remember a thing or two about history, and have noted that what is failing in the present era is not private capitalism, but the bloated omnipresent public state. And having almost uniquely among DM nations resisted the siren song of Keynesian activism, Germans can also observe that their economy has not plunged into some depressionary dark hole for want of sufficient fiscal activism.

A line that will soon return (stress test results due out October 26): “It was not the governing council’s job to keep afloat banks that were awaiting recapitalization and were not currently solvent .. ”

• Before Bailout, ECB Had Doubts Over Keeping a Cyprus Bank Afloat (NY Times)

As the Cypriot economy reeled from the collapse of its second-largest bank in 2013, the European Central Bank faced a thorny question: Should it keep the institution, Cyprus Popular Bank, alive with short-term loans or pull the plug? By many financial measures, the bank was failing. Stung by a disastrous bet on Greek government bonds, Cyprus Popular Bank had been in trouble for the better part of 2012 and depositors were withdrawing their savings in ever larger numbers. It needed cash and fast. Under E.C.B. rules, troubled banks that can no longer raise funds on the open markets are allowed to borrow from their national central bank, which assumes responsibility for this so-called emergency liquidity assistance, or E.L.A. Still, strict rules govern this process. The bank in question must be solvent. And if the loans surpass 2 billion euros, or $2.56 billion, the E.C.B. reserves the right to refuse additional requests for money. The methodology for valuing the collateral used to secure the credit also has to be disclosed.

Fearing possible contagion if the bank failed, the E.C.B.’s governing council, a decision-making arm consisting of 24 members, had approved an emergency loan request by one its members, the Central Bank of Cyprus, in late 2011. As 2013 approached, the short-term loans to Cyprus Popular Bank had grown to €9 billion, about two thirds the size of the Cypriot economy, and Jens Weidmann, the hawkish head of the German Bundesbank, had begun to forcefully argue that this exposure was too large, according to the minutes of governing council meetings. By approving the loans – which were disbursed by the central bank of Cyprus – Mr. Weidmann said that the E.C.B. was violating a core tenet. That rule holds that banks on the verge of failure should not be bailed out with additional loans. “It was not the governing council’s job to keep afloat banks that were awaiting recapitalization and were not currently solvent,” he said at a meeting in December 2012, according to internal documents from the bank.

It’s not just increased competition, the economy is reeling. But that is largely overlooked.

• Moody’s Report Makes Grim Reading For British Supermarkets (Guardian)

Britain’s big four supermarkets will be forced to cut prices further in a race to the bottom with the German discounters Aldi and Lidl, according to a report from the credit ratings agency Moody’s. Tesco, Sainsbury’s, Morrisons and Asda will have to reduce prices to slow the pace of falling sales and loss of business to Aldi and Lidl, Moody’s said. But the big grocers will not win the war as their operating margins halve from their historical averages, Moody’s said. Despite the expected price cuts, the discounters will continue to take market share from the big four. Though Aldi’s and Lidl’s sales growth will probably slow, they will open more branches, putting extra pressure on the big grocers’ larger stores, which shoppers are abandoning, Moody’s predicted.

Moody’s analysts Sven Reinke and Michael Mulvaney said in the report: “We believe the big four will have to cut prices further to stem their sales declines and slow market share losses… We believe Aldi and Lidl are now entrenched and their combined market share could reach 10% over the next couple of years from 8.3% today. Over time the discounter’s UK market share could be similar to that of discounters in other European countries at around 12%-15%.” After decades of growth, Britain’s supermarkets are in crisis as they battle to compete with Aldi and Lidl. Customers changed their habits during the recession and started shopping locally, and little and often to reduce waste. Squeezed by falling real wages, they opted to save money at the German discounters’ small branches instead of making a weekly trip to the big four’s vast stores.

[..] … “certain participants” had taken an “absolutely biased, non-flexible, non-diplomatic” approach to Ukraine …

• Putin Talks With EU, Ukraine ‘Difficult, Full Of Misunderstandings’ (Reuters)

Talks between Russia, Ukraine and European governments on Friday were “full of misunderstandings and disagreements”, the Kremlin said, undercutting more upbeat messages from leaders hoping for a breakthrough in the Ukraine crisis. Russian President Vladimir Putin shook hands with his Ukrainian counterpart Petro Poroshenko at the start of a meeting with European leaders aimed at patching up a ceasefire in eastern Ukraine and resolving a dispute over gas supplies. The various leaders emerged an hour later telling reporters some progress had been made and promising further talks. “It was good, it was positive,” a smiling Putin told reporters after the meeting, held on the margins of a summit of Asian and European leaders in Milan.

However, Kremlin spokesman Dmitry Peskov later poured cold water on hopes of any breakthrough, saying “certain participants” had taken an “absolutely biased, non-flexible, non-diplomatic” approach to Ukraine. “The talks are indeed difficult, full of misunderstandings, disagreements, but they are nevertheless ongoing, the exchange of opinion is in progress,” he said. A similar message emerged overnight after Putin met German Chancellor Angela Merkel, a formerly cordial relationship that has come under heavy strain from Moscow’s support for pro-Russian rebels in eastern Ukraine. The meeting was reported by both sides to have made little progress, with the Kremlin saying “serious differences” remained in their analysis of a crisis. Putin, Poroshenko, Merkel and French President Francois Hollande were due meet later in the day, their aides said.

They all just seem to want Putin to say he did it. Not going to happen. There’s still zero proof.

• West Unwilling To Be Objective On Ukraine, Says Russia (WSJ)

German Chancellor Angela Merkel sparred with Russian President Vladimir Putin over Ukraine in front of other world leaders Friday, as the most intense diplomatic effort in months aimed at defusing tensions there ended with little sign of progress. Mr. Putin’s arrival in Milan late Thursday for a two-day summit of Asian and European leaders spurred a flurry of top-level meetings over the crisis in Ukraine, but both sides sounded pessimistic afterward. “On this, I can’t see any kind of breakthrough whatsoever,” Ms. Merkel said at a news conference Friday, referring to differences over implementing the cease-fire and peace plan signed Sept. 5 between Ukraine and Russia-backed rebels. Kremlin spokesman Dmitry Peskov said Friday that “there was a complete unwillingness to be objective on the part of some participants.”

The mood was illustrated by what two European officials described a curt exchange between Ms. Merkel and Mr. Putin at a private retreat with Asian and European leaders. Mr. Putin had spoken of Russia’s annexation of Ukraine’s Crimea region in March as being lawful, and Ms. Merkel contested that in front of the other leaders, said one senior European Union official. Another official confirmed a terse exchange between the two. In a news briefing after the talks, Mr. Putin referred several times to the rebels in eastern Ukraine as representatives of “Novorossiya,” a tsarist-era term that spans large swaths of what is now southern and eastern Ukraine. The term has been widely used by Russian nationalists to justify claims on much of Ukraine’s territory.

Capitalism at war with the planet.

• 1,000 Years Of Dust Bowls Now Inevitable (Paul B. Farrell)

Yes, capitalism’s at war, fighting against all efforts to limit global warming and climate change. This is WWIII, the defining moment of the 21st century. Why? “One word in the latest draft report from the United Nations Intergovernmental Panel on Climate Change (IPCC) sums up why climate inaction is so uniquely immoral: Irreversible.” Irreversible? Not to capitalists. They’re betting the future of the human race they’re right. Big Oil, the GOP and right-wing fundamentalists are all climate-science deniers, absolutely certain they are right, they will win WWIII: Exxon Mobil is spending $37 billion annually on new drilling. U.S. Chamber of Commerce CEO Tom Donohue says we have enough oil to last over two centuries. Texas Gov. Rick Perry’s a Luddite. Oklahoma GOP Senator Jim Inhofe published “The Greatest Hoax: How the Global Warming Conspiracy Threatens Your Future.” But, what if the Right is wrong? What if global warming really is irreversible? What if their gamble doesn’t pay off? Too bad. Too late. Capitalism has no Plan B.

So billions of humans just won’t survive the 1,000-year Dust Bowl that’s ahead if Plan A fails. Yes, it’s that huge a bet. The damage to our civilization is irreversible. And inaction is immoral. Soon we’ll pass a point of no return. After that, the damage takes 1,000 years to repair, warns ClimateProgress editor Joe Romm. Why? Because of today’s “ongoing failure to cut carbon pollution: The catastrophic changes in climate we are voluntarily choosing to impose on our children and grandchildren, and countless generations after them, cannot be undone for hundreds of years or more.” Conservative opposition is based on the economics of Big Oil and the energy industry. They believe any regulations or taxation of carbon emissions will have a negative impact on corporate earnings, shareholder dividends, production costs. As California Gov. Jerry Brown put it: There’s “virtually no Republican” in Washington that accepts climate science. And most GOP governors “openly deny climate science” despite widespread scientific evidence. Worse, Big Oil deniers spend hundreds of millions annually on lobbying for GOP votes.

“That would be like a bad science fiction movie”.

• ‘We Have A Worst-Case Ebola Scenario, And You Don’t Want To Know’ (Bloomberg)

There could be as many as two dozen people in the U.S. infected with Ebola by the end of the month, according to researchers tracking the virus with a computer model. The actual number probably will be far smaller and limited to a couple of airline passengers who enter the country already infected without showing symptoms, and the health workers who care for them, said Alessandro Vespignani, a Northeastern University professor who runs computer simulations of infectious disease outbreaks. The two newly infected nurses in Dallas don’t change the numbers because they were identified quickly and it’s unlikely they infected other people, he said.

The projections only run through October because it’s too difficult to model what will occur if the pace of the outbreak changes in West Africa, where more than 8,900 people have been infected and 4,500 have died, he said. If the outbreak isn’t contained, the numbers may rise significantly. “If by the end of the year the growth rate hasn’t changed, then the game will be different,” Vespignani said. “It will increase for many other countries.” The model analyzes disease activity, flight patterns and other factors that can contribute to its spread. “We have a worst-case scenario, and you don’t even want to know,” Vespignani said. “We could have widespread epidemics in other countries, maybe the Far East. That would be like a bad science fiction movie.”

Home › Forums › Debt Rattle October 18 2014