G. G. Bain On beach near Casino, Asbury Park 1911

Might as well give up on Japan. 3 years of horrible policy failure, and Abe’s as popular as ever.

• Japan July Consumer Prices Post Biggest Annual Fall In 3 Years (R.)

Japan’s consumer prices fell in July by the most in more than three years as more firms delayed price hikes due to weak consumption, keeping the central bank under pressure to expand an already massive stimulus program. The gloomy data reinforces a dominant market view that premier Shinzo Abe’s stimulus program have failed to dislodge the deflationary mindset prevailing among businesses and consumers. The nationwide core consumer price index, which excludes volatile fresh food prices but includes oil products, fell 0.5% in July from a year earlier, the fifth straight month of declines, data showed on Friday. It exceeded a median forecast for a 0.4% decline and June’s 0.4% drop.

While falling energy costs were mainly behind the slide in consumer prices, rises in imported food prices and hotel room rates moderated in a sign that weak consumption is discouraging firms from passing on rising costs. A strong yen also pushed down import costs, offering few justifications for retailers to raise prices of their goods. “While economic activity is on the mend, the slump in import prices suggests that underlying inflation will continue to fall in coming months,” said Marcel Thieliant, senior Japan economist at Capital Economics. “The Bank of Japan will find it increasingly difficult to blame falling energy prices for the decline in overall consumer prices.”

Where the propaganda fails.

• Dollar Stores’ Admission: Half Of US Consumers Are In Dire Straits (ZH)

Both Dollar General and Dollar Tree said pressures on their core lower-income shoppers contributed to the same-store sales misses that both retailers reported. On today’s conference call, Dollar General CEO Todd Vasos said that he was surprised to admit that while on the surface things are supposed to be getting better, the reality is vastly different for low-income US consumers: “I know that when we look at globally the overall U.S. population, it seems like things are getting better. But when you really start breaking it down and you look at that core consumer that we serve on the lower economic scale that’s out there, that demographic, things have not gotten any better for her, and arguably, they’re worse. And they’re worse, because rents are accelerating, healthcare is accelerating on her at a very, very rapid clip.”

Making matters worse, he added that the company’s core consumers base, 65% of which is comprised of lower-income shoppers, has been impacted by the recent reduction or elimination in foodstamps: “now couple that in upwards of 20 states where they have reduced or eliminated the SNAP benefit, and it has really put a toll on [the core consumer].” He elaborated that the reduction in foodstamps benefits promptly filtered through the entire business model, and culminated with Dollar General being forced to cut prices to remain competitive. This is what he said:

“That SNAP benefit reduction and/or elimination happened in April. That was the kickoff, and you could see it immediately in the numbers. So I believe that those are the things that are affecting her today. Again, our core customer, and by the way, we’ve seen this play out before. If you dial the clock back to October of 2013 and coming into November of 2013, when the last large SNAP benefit reduction happened, it happened almost exactly the same way on our comps and in how we saw traffic. Obviously, we’re up at a little higher level at that time, but rest assured, that our traffic slowed tremendously then, very similar to as it did now.

The difference here is we’re going to take aggressive price action to get that consumer back in the store. She needs a little motivation to get back in. We need to help her stretch her budget for a time period until she figures it out. Our core customer is very resilient. They’ll figure it out over time, but they need a little help as they tend to now try to figure out how to make ends meet with less money during the month.”

No, we’ve been in the unknown for years. As soon as Bernanke said ‘Uncharted Territory’, we knew we were lost. Of course they’ve acted ever since as if they know what they’re doing, but that is bull.

• QE Infinity: Are We Heading Into The Unknown? (CNBC)

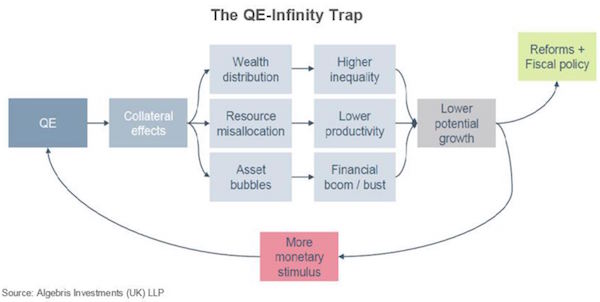

Markets are currently riding on the wave of uncertainty and speculation over whether the world’s central banks will continue to pump in more and more cash into the economy though bond-buying programs known as quantitative easing (QE). But as we go deeper into the world of easy money from central banks, there are other areas of the economy that could see a knock-on effect. Alberto Gallo, manager of the Algebris Macro Credit Fund, describes this paradox as “QE infinity,” whereby low rates and seemingly endless rounds of bond-buying programs encourage cheap borrowing, and investment in financial markets – but not in the real economy. “The problem is rising debt and monetary easing comes with many collateral effects. One is the distortion of asset prices, leading to asset bubbles,” Gallo explained.

“Asset price distortion also has a ripple effect on wealth distribution, increasing inequality by benefitting the already-wealthy who are more likely to hold financial assets. Over time, low rates and QE can also encourage misallocation of resources to leverage-sensitive sectors, including real estate and construction.” Gallo further explained that for the global economy to exit this QE infinity trap, government action and reforms to improve productivity are needed. “But many governments are reluctant to accept the need for these measures, often instead implementing policies that win votes but compound the distortions of easy monetary policy e.g. housing affordability programmes, mortgage subsidies.” Without an adequate fiscal response from governments, growing imbalances make it harder to withdraw stimulus, warned Gallo.

“This is the paradox of current monetary policy: On one hand, it is the best possible response available to central bankers. On the other, it has long-term collateral effects which need to be confronted eventually.” Central banks have seen themselves come up with new ways of stimulating the economy ever since the world plunged into financial crisis in September 2008. Data from JPMorgan shows that the top 50 central banks around the world have cut rates 672 times between them since the collapse of Lehman Brothers, a figure that translates to an average of one interest rate cut every three trading days. This has also been combined with $24 trillion worth of asset purchases. This raises a big question: Will the global economy ever exit QE Infinity?

Dream on. All they have left is weird.

• A Less Weird Time at Jackson Hole? (John Taylor)

I’m on my way to join the world’s central bankers at Jackson Hole for the 35th annual monetary-policy conference in the Grand Teton Mountains. I attended the first monetary-policy conference there in 1982, and I may be the only person to attend both the 1st and the 35th. I know the Tetons will still be there, but virtually everything else will be different. As the Wall Street Journal front page headline screamed out on Monday, “Central Bank Stimulus Efforts Get Weirder”. I’m looking forward to it. Paul Volcker chaired the Fed in 1982. He went to Jackson Hole, but he was not on the program to give the opening address, and no one was speculating on what he might say. No other Fed governors were there, nor governors of any other central bank. In contrast, this year many central bankers will be there, including from emerging markets.

Only four reporters came in 1982 — William Eaton (LA Times), Jonathan Fuerbringer (New York Times), Ken Bacon (Wall Street Journal) and John Berry (Washington Post). This year there will be scores. And there were no television people to interview central bankers in 1982 (with the awesome Grand Teton as backdrop). It was clear to everyone in 1982 that Volcker had a policy strategy in place, so he didn’t need to use Jackson Hole to announce new interventions or tools. The strategy was to focus on price stability and thereby get inflation down, which would then restore economic growth and reduce unemployment. Some at the meeting, such as Nobel Laureate James Tobin, didn’t like Volcker’s strategy, but others did. I presented a paper at the 1982 conference which supported the strategy. The federal funds rate was over 10.1% in August 1982 down from 19.1% the previous summer.

Today the policy rate is .5% in the U.S. and negative in the Eurozone, Japan, Switzerland, Sweden and Denmark. There will be lot of discussion about the impact of these unusual central bank policy rates, as well the unusual large scale purchases of corporate bonds and stock, and of course the possibility of helicopter money and other new tools, some of which greatly expand the scope of central banks. I hope there is also a discussion of less weird policy, and in particular about the normalization of policy and the benefits of normalization. In fact, with so many central bankers from around the world at Jackson Hole, it will be an opportunity to discuss the global benefits of recent proposals to return to a rules-based international monetary system along the lines that Paul Volcker has argued for.

Trapped.

• There May Not Be Too Many Tricks Left For The ECB and Bank of England (BBG)

The European Central Bank and the Bank of England may soon find that their most powerful tool for overseeing lenders doesn’t pack the punch it once did. The European Union is overhauling the way supervisors set bank-specific capital levels for current and potential risks that aren’t covered by the minimum requirements in EU law. A proposal from the European Commission, the EU’s executive arm, would rein in supervisors and give banks the lead in determining their capital needs. The ECB has already followed directions from the commission in splitting its demands into binding requirements and non-binding guidance, reducing the capital burden on euro-area banks. This decision also made it less likely that banks will face restrictions on the payment of dividends, bonuses and additional Tier 1 bond coupons.

“What this boils down to is a complete disarming of the authorities,” said Christian Stiefmueller, a senior policy analyst at Finance Watch, a Brussels-based watchdog. “It makes it effectively impossible for the supervisor to set capital requirements for any risk except those that have already materialized.” Europe’s banks are starting to get some slack from policy makers after years of aggressive regulation. The Brussels-based commission has opened up the entire financial rule book for review, including contentious issues such as the cap on bankers’ bonuses. Faced with weak banks and an anemic economy, regulators have made clear that global standards will be adapted to suit Europe’s needs.

Key: “The processes used to inflate the new bubble suffer from diminishing returns.”

• China’s Great Divide: A New Cultural Revolution? (CH Smith)

The status quo solution (in China, the U.S., Japan, the E.U., etc.) to a weakening bubble-dependent economy is to inflate another even bigger bubble. If debt reached extremes that imploded, the solution is to expand debt far beyond the levels that triggered the implosion. If fudging the numbers triggered a loss of confidence, the solution is to fudge the numbers even more, so they no longer reflect reality at all. If the masses protest their powerlessness, the solution is to push them further from the centers of power. And so on. This blowing new bubbles to replace the ones that popped works for a while, but at the expense of systemic stability. Each new bubble requires pushing the system to new extremes that increase the risk of instability and collapse.

In other words, the stability of the new bubble is temporary and thus illusory. The processes used to inflate the new bubble suffer from diminishing returns. The nature of stimulus-response is that overuse of the stimulus leads to diminishing responses. This is a structural feature that cannot be massaged away. Goosing public confidence in the status quo with phony statistics and rigged markets works splendidly the first time, less so the second time, and barely at all the third time. Why is this so? The distance between reality and the bubble construct is now so great that the disconnection from reality is self-evident to anyone not marveling at the finery of the Emperor’s non-existent clothing. The system habituates to the higher stimulus. If the drug/debt has lost its effectiveness, a higher dose is needed.

This is the progression of serial bubbles. Then the system habituates to the higher dose/debt, and the next expansion of debt must be even greater. This dynamic can be visualized as The Rising Wedge Model of Breakdown, which builds on the well-known Ratchet Effect: the system is greased for easy expansion of debt, leverage, employees, etc., but it has no mechanism to allow contraction. Any contraction triggers systemic collapse. The only question left for China (and every other debt/bubble-dependent nation) is what socio-political consequences will manifest when the credit bubble finally bursts?

More diminishing returns?!

• Backlash Against Chinese Investment Abroad Grows Ahead Of G-20 Summit (BBG)

Forget about Yankee go home. Now it’s Chinese go home. From Australia blocking a bid for a power network to the U.K.’s review of a proposed Chinese-funded nuclear plant, opposition to China’s outward push is opening a thornier and potentially more treacherous front in the country’s economic tug-of-war with the rest of the world. And it’s coming as China prepares to host a Sept. 4-5 summit of Group of 20 leaders. Unlike festering frictions over trade, the new front is in an area – investment – where the global rules of engagement are more amorphous and where national security interests are more prominent. That raises the risk of a rapid escalation of tensions that can’t be so easily contained. “The implicit accusation when rejecting overseas direct investment is much stronger than trade,” said James Laurenceson, deputy director of the Australia-China Relations Institute in Sydney.

Using a national-security rationale to blocking outbound investment by China “is far more confronting. It suggests that China is untrustworthy and has potentially nefarious intentions. That’s what Beijing objects to.” But it’s not just security concerns that are driving the increased backlash against stepped-up Chinese investment abroad, especially by state-owned companies. It’s also the suspicion that the Communist-led government is trying to game the system by snapping up foreign firms in key areas of the economy while blocking others from doing the same in China. China “remains the most closed to foreign investment of the G-20 countries,” David Dollar, a senior fellow at the Brookings Institution and former U.S. Treasury attache to Beijing, said. “This creates an unfairness in which Chinese firms prosper behind protectionist walls and expand into more open markets such as the U.S.”

China’s getting desperate to look like it’s in control of its own economy. It’s not.

• China Has Returned To Reform Mode (BBG)

China has returned to reform mode. This week, plans have been unveiled to quicken the clean-up of excess capacity in state-backed companies, level the playing field for private and foreign investors with new access to previously off-limit sectors, and take the next step in a long-awaited fiscal shake up. Having stabilized the economy with a mix of fiscal support and easy monetary settings, China’s leaders appear to be reviving a stalled reform push that’s key to long-term growth prospects. The rush of announcements comes ahead of China’s hosting of leaders from the world’s 20 biggest economies in Hangzhou on Sept. 4 and 5, allowing it to show progress to officials from nations such as the U.S. and bodies like the IMF that have called for structural changes.

“The pace of reform had been slower than expected,” said Shen Jianguang at Securities in Hong Kong. “Now, policy makers want to speed it up again. With monetary easing proving less effective in propping up the economy, they have realized that there’s no way out if they don’t push forward on reform.” The People’s Bank of China has been upping its communication in recent weeks, signaling ongoing use of liquidity tools rather than big gun moves such as cuts to benchmark interest rates or the percentage of deposits banks must lock away as reserves. With businesses hoarding cash and reluctant to invest, further easing risks fueling financial risks without spurring a pick up in economic growth.

More dividend priests liquidating themselves.

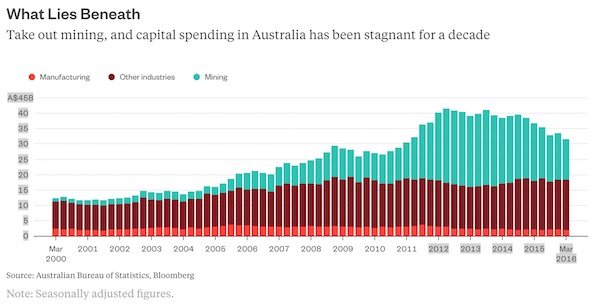

• Australia’s Hunger Games (BBG)

If economies need animal spirits to thrive, what sort of beast is Australia in the aftermath of its mining boom? Something like a wounded bear that would rather hibernate than go hunting for food, if you listen to Treasurer Scott Morrison.Governments need to work at building an economy that “can coax private capital out of its cave,” he said at an event in Sydney Thursday. “Global capital is sitting dormant. How else do you interpret the absurdity of negative bond yields? “Though Australia’s 25 years without a recession represent a remarkable success story, it’s fair to say the country’s going through a rough patch. Interest rates are at a record-low 1.5%, and local businesses are showing more of a tendency to lick their wounds than search for new investment opportunities.

The huge splurge of capital expenditure that accompanied the mining boom helped cover for a while a fact that’s becoming embarrassingly clear as the resource spending recedes: Take out mining, and investment by Australian businesses has barely increased since the global financial crisis. So where’s the money going? Blame the baby boomers. Self-managed super funds – accounts that are controlled by their owners rather than professional fund managers – make up the biggest share of Australia’s pool of retirement savings.The funds, which have benefited from a range of overly generous tax breaks during the past decade, have an outsized influence on the Australian stock market, according to Hasan Tevfik, director of Australian equities research at Credit Suisse.

Retirees’ desire for a steady income from their investments helps explain why certain types of stocks tend to be overvalued in Australia relative to their performance elsewhere, and why local businesses so often fall over themselves to pay dividends above the levels found in other markets. [..] In the long term, companies that dedicate more of their free cash to shareholders rather than finding new ways of making money are robbing the future to pay the present. Countries where that becomes the predominant mode of corporate behavior are in even greater trouble.

Everybody’s scared to death of falling home prices, which happen to be the only thing that can make the market somewhat healthier.

• Fannie, Freddie, Regulator Rolls Out Refinance Program For Homeowners (R.)

The regulator of Fannie Mae and Freddie Mac unveiled on Thursday a program aimed at homeowners who are paying their mortgages on time but whose loan-to-value (LTV) ratios are too high to qualify for traditional refinance programs. To be eligible for this program, which Fannie and Freddie will implement, borrowers must have not missed any mortgage payments in the prior six months; must not have skipped more than one payment in the previous 12 months; must have a source of income and must receive a benefit from the refinance such as a reduction in their monthly loan payment, the Federal Housing Finance Agency said.

“This new offering will give borrowers the opportunity to refinance when rates are low, making their mortgages more affordable and thus reducing credit risk exposure for Fannie Mae and Freddie Mac,” said FHFA Director Melvin Watt in a statement. Because this program for high LTV borrowers will not be available until October 2017, the agency said it will extend the Home Affordable Refinance Program (HARP) until Sept. 30, 2017 as a bridge to the new high LTV program. HARP was introduced in 2009 to help underwater borrowers following the housing bust. More than 3.4 million homeowners have refinanced their mortgage through the program. More than 300,000 homeowners could still refinance through HARP, FHFA said.

Portuguese and Italian banks cannot afford this. Many others can’t either. Question is where the next bailout (bail-in) will happen.

• Eurozone Banks See Net Profit Fall 20% In First Quarter (R.)

Euro area banks saw their profits fall by a fifth in the first three months of this year as they made less money from trading and most other business areas, European Central Bank data showed on Wednesday. The ECB survey painted a gloomy picture, with all the main sources of profit for banks – lending, trading and fees – down from the year before. Net profit fell by 20% year on year to €18 billion ($20.25 billion). The net result from trading and foreign exchange was one of the main culprits for that drop as it fell by 41% to €10.8 billion. Other income streams – such as net interest on loans, dividends, and fees and commissions – also declined, albeit more modestly.

Banks have blamed the ECB’s policy of ultra-low rates, which includes charging banks for the excess cash they park at the central bank, for eating into their profits. In cash-rich Germany, several banks have responded by charging fees on bank accounts or charging corporate clients a percentage charge on large deposits. The ECB has maintained its policy has done more good than harm but it has acknowledged it comes with side effects.

This can not end well.

• Deposits at Bank of Ireland To Face Negative Interest Rates (O’Byrne)

Deposits at Bank of Ireland are soon to face charges in the form of negative interest rates after it emerged on Friday that the bank is set to become the first Irish bank to charge customers for placing their cash on deposit with the bank. This radical move was expected as the ECB began charging large corporates and financial institutions 0.4% in March for depositing cash with them overnight. Bank of Ireland is set to charge large companies for their deposits from October. The bank said it is to charge companies for company deposits worth over €10 million. The bank was not clear regarding what the new negative interest rate will be but it is believed that a negative interest rate of 0.1% will initially be charged to such deposits by Ireland’s biggest bank.

BOI was identified as one of the most vulnerable banks in Europe in the recent EU stress tests – along with Banca Monte dei Paschi di Siena (MPS), AIB and Ulster Bank’s parent RBS. All the banks clients, retail, SME and corporates are unsecured creditors of the bank and exposed to the new bail-in regime. Only larger customers will be affected by the charge for now. The bank claims that it has no plans to levy a negative interest rate on either personal or SME customers but negative interest rates seem likely as long as the ECB continues with zero% and negative interest rates. Indeed, they are already being seen in Germany where retail clients are being charged 0.4% to hold their cash in certain banks such as Raiffeisenbank Gmund am Tegernsee.

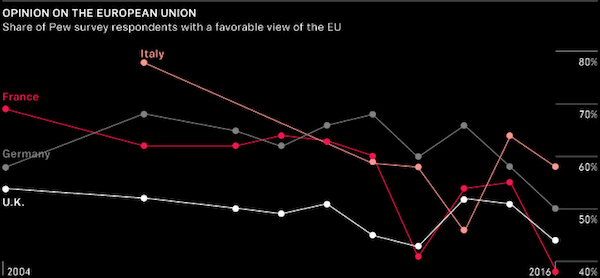

Europe is not lost, but the EU sure is.

• It Was a Union for the Ages, Until Suddenly It Wasn’t. Is Europe Lost? (BBG)

The U.K.’s vote to quit the EU is the enterprise’s worst setback since it was conceived in the 1950s. Until now, the EU has always grown in scale and ambition. For the first time, Brexit shows that Europe’s manifest destiny—ever closer union—may not be destiny after all. Merely knowing that European integration can be reversed is a threat: It makes the unthinkable thinkable. But this isn’t the only danger. The union is increasingly unpopular not only in the U.K. but also in other European countries. Its political capital is depleted. Working through the mechanics of Brexit may deepen divisions, severely testing the union’s ability to adapt. Brexit could conceivably spur support for the union. But this will demand consensus, flexibility, and farsighted calculation, none of which can be taken for granted.

If governments can’t rise to this challenge, Brexit may be the beginning of the end of the European dream. In one way, today’s discontent is nothing new. There has often been a gap between the grandest designs of Europe’s leaders and the readiness of the continent’s citizens to go along. The EU’s remarkable achievements in securing peace and prosperity in the postwar era required brave, visionary leadership, and voters were rarely up to speed. For years, that was fine. The model was top-down institution-building, followed by good results, then popular backing—in that order. It all worked beautifully. Europe’s postwar political and economic reconstruction was a modern miracle. But now the model is failing. The Brits aren’t the proof. They’ve always been uncomfortable in the EU, late to the party and a nuisance throughout; their vote to quit was a shock, but probably shouldn’t have been.

Lately, though, the disenchantment has spread far more widely. According to one recent poll, the EU is less popular in France—France!—than in the U.K. So what went wrong? [..] Even at the design stage, many economists said the euro’s political underpinnings were too weak. Monetary union, they argued, demanded a commitment to a form of fiscal union. (If currency devaluation with respect to other EU currencies was going to be ruled out, fiscal transfers would be needed to help cushion economies from downturns.) This would require a widely shared sense of common purpose—in effect, a more fully developed European identity. Without it, member states would balk at collective fiscal action. And balk they did: Fiscal union, with the need for fiscal transfers across the union’s internal borders, wasn’t part of the plan.

Worried about his legacy?

• The Broken Chessboard: Brzezinski Gives Up on Empire (Whitney)

The main architect of Washington’s plan to rule the world has abandoned the scheme and called for the forging of ties with Russia and China. While Zbigniew Brzezinski’s article in The American Interest titled “Towards a Global Realignment” has largely been ignored by the media, it shows that powerful members of the policymaking establishment no longer believe that Washington will prevail in its quest to extent US hegemony across the Middle East and Asia. Brzezinski, who was the main proponent of this idea and who drew up the blueprint for imperial expansion in his 1997 book The Grand Chessboard: American Primacy and Its Geostrategic Imperatives, has done an about-face and called for a dramatic revising of the strategy. Here’s an excerpt from the article in the AI:

“As its era of global dominance ends, the United States needs to take the lead in realigning the global power architecture. Five basic verities regarding the emerging redistribution of global political power and the violent political awakening in the Middle East are signaling the coming of a new global realignment. The first of these verities is that the United States is still the world’s politically, economically, and militarily most powerful entity but, given complex geopolitical shifts in regional balances, it is no longer the globally imperial power.” (Toward a Global Realignment, Zbigniew Brzezinski, The American Interest)

Repeat: The US is “no longer the globally imperial power.” Compare this assessment to a statement Brzezinski made years earlier in Chessboard when he claimed the US was ” the world’s paramount power.” ““…The last decade of the twentieth century has witnessed a tectonic shift in world affairs. For the first time ever, a non-Eurasian power has emerged not only as a key arbiter of Eurasian power relations but also as the world’s paramount power. The defeat and collapse of the Soviet Union was the final step in the rapid ascendance of a Western Hemisphere power, the United States, as the sole and, indeed, the first truly global power.” (“The Grand Chessboard: American Primacy And Its Geostrategic Imperatives,” Zbigniew Brzezinski, Basic Books, 1997, p. xiii)

A basic income for just 2000 people seems to miss the whole idea.

• 2000 Finns to Get Basic Income in State Experiment Set to Start 2017 (BBG)

Finland is pushing ahead with a plan to test the effects of paying a basic income as it seeks to protect state finances and move more people into the labor market. The Social Insurance Institution of Finland, known as Kela, will be responsible for carrying out the experiment that would start in 2017 and include 2,000 randomly selected welfare recipients, according to a statement released Thursday. The level of basic income would be €560 per month, tax free, and mandatory for those picked. “The objective of the legislative proposal is to carry out a basic income experiment in order to assess whether basic income can be used to reform social security, specifically to reduce incentive traps relating to working,” the Social Affairs and Health Ministry said.

To asses the effect of a basic income, the participants will be held up against a control group, the ministry said. The target group won’t include people receiving old-age pension benefits or students. The level of the lowest basic income to be tested will correspond with the level of labor market subsidy and basic daily allowance. The idea of a basic income, or paying everyone a stipend, has gained traction in recent years. It was rejected in a referendum in Switzerland as recently as June, where the suggested amount was 2,500 francs ($2,587) for an adult and a quarter of that sum for a child. It has also drawn interest in Canada and the Netherlands. Finnish authorities were clear on one thing as they embark on their study: “An experiment means that, at this point, basic income will not be paid to the whole population.”

Whatever the US do, Greece will follow. Unless Berlin decides against it.

• Greece Grapples With More ‘Fugitives’, Seeks To Avoid Tensions With Ankara (K.)

As Greece struggles to strike a balance between international law and Turkey’s demand for the extradition of eight Turkish officers, it was confronted with a fresh challenge this week after seven civilians from the neighboring country arrived in Alexandroupoli and Rhodes late Wednesday and are expected to request asylum. The new arrivals have been charged with illegally entering Greece. According to officials, they include a couple, both university professors, and their two children, who arrived in Alexandroupoli, reportedly via the northeastern border, possibly crossing the Evros River by boat. All four were said to be holding Turkish passports, though only the man’s is valid.

The other three individuals – of whom only one has a valid passport – said they are businessmen, but it was not clear how they made it to the southeastern Aegean island. One of the passports has been listed as stolen by Interpol. Initial reports suggested they are possibly supporters of the self-exiled cleric Fethullah Gulen, whom Turkey claims orchestrated the failed coup attempt in July. Their case is set to put yet more strain on already tense relations between the traditional rivals after eight Turkish officers fled to Greece in the aftermath of the attempted coup. Ankara has demanded their immediate extradition to stand trial as “traitors” and coup plotters. Greece has said the decision will lie with its independent court.