Claude Monet Éretrat sunset 1882-3

A bunch of views on the trade war. I’d say take your pick. Something for everyone.

• The Trade War Is Smart Geopolitics (NR)

Why is our industrial supply chain located inside of an adversary? Why does our military readiness therefore depend on that adversary? Why are American companies allowed to transfer critical technologies to China in exchange for short-term market access? Why can Tesla build self-driving cars in Shanghai? Why can Google run an AI lab in Beijing after canceling an AI contract with the Pentagon? The free traders have an answer: because the market wills it. But of course, markets have no reason to prefer one global power over another, and there’s no market rule barring a surveillance state from winning the competition. In that competition, our ideological commitment to free trade is nearly as great a handicap as the Soviet Union’s commitment to central planning was during the Cold War.

Free trade with China means allowing its distortions into our market. Refusing to allow our government to “pick winners” by rejecting industrial-policy support to key sectors means that Beijing will pick winners for us. Depending on Ricardian comparative advantage to organize supply chains means, in effect, that we will watch helplessly as American innovations are transformed into growth-boosting industries elsewhere, as firms reap efficiency gains by locating their engineering and management operations next to their manufacturing. Inevitably, the innovation will depart too. A recent survey of 369 manufacturers found that American firms are moving their R&D operations to China not just to take advantage of lower costs, but to be in close proximity to their supply chains.

Some 50 percent of foreign R&D centers in China are now run by American companies, helping China achieve first place in market share for manufacturing R&D. If we remain neutral as to where supply chains are located, “we innovate, they build” will become “they innovate, they build.” China’s rise may be inevitable. But given the danger represented by that rise, America can choose to minimize its risk. It can reduce opportunities for China to erode the long-term competitive advantage of American firms through forced technology transfer and R&D migration, and reduce our dependence on Chinese manufacturing for crucial industrial and military supply chains. In a word: decoupling.

China’s problem is the dollar. It’s not dependent on the US for its GDP, but that is a problem in itself. If exports to the US were larger, it would receive more dollars.

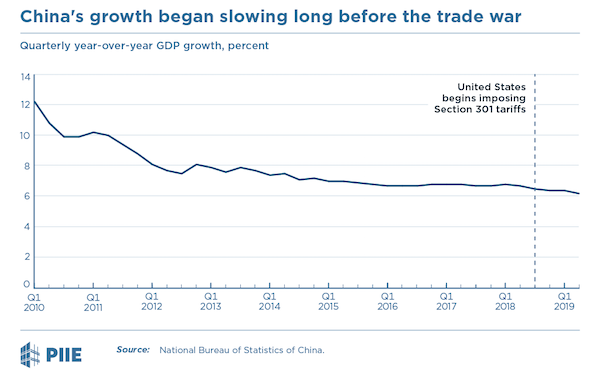

• China’s Growth Is Slowing, but not Because of the Trade War (PIIE)

First, as is well known, US taxpayers, not Chinese consumers and companies, are bearing the burden of Trump’s tariffs. The president acknowledged as much when he postponed new tariffs on goods (such as toys and consumer electronics) likely to be purchased during the US holiday shopping season. US tariffs on imports from China will likely subtract about half a percentage point from US GDP growth in 2019.

But second, China’s growth began to slow long before the trade war started (see figure). The pace of growth has moderated from the double-digit pace of 2010 to only 6.2 percent in the most recent quarter. As for the assertion that the trade war has accelerated China’s economic decline, the facts show the opposite. As shown in the figure, the pace of the slowdown has moderated since the initial imposition of tariffs by the United States in July 2018. Most of the slowdown is the result of President Xi Jinping’s ill-advised policy choice of allocating credit and other resources to less efficient state firms rather than private firms. Moreover, since 2017, China has reduced the growth of credit overall in order to reduce financial risk at a time of growing corporate indebtedness, a trend that also contributes to slowing growth throughout the economy.

Third, properly measured, China’s dependence on exports to the United States is not as large as some, including President Trump, may think. China’s exports to the United States before tariffs were imposed ran at $500 billion annually, or 4 percent of its $12.25 trillion GDP, which in theory is a significant number. In fact, the percentage is far less. The potential impact of US tariffs on China’s growth needs to be adjusted to measure only value added by China. GDP is measured in value-added terms; US imports from China are measured in gross sales. The value-added share in US imports from China is about one-half, so the direct contribution to China’s GDP from its sales to the United States is approximately $250 billion or only 2 percent of China’s GDP.

Brandon Smith doesn’t appear to fully agree with PIIE.

• The Ugly Truth About The Trade War (Alt-M)

The US only comprises around 18% of Chinese exports. While this is a nice piece of the pie, it’s hardly enough leverage to bring down China’s economy. China would suffer profit losses in certain sectors as well as a recession, but not the kind of crisis that some in the alternative media are predicting. Around 40% of China’s GDP is generated domestically, and 80% of its GDP growth comes from private consumption. For quite some time I have warned that China was shifting its economic model from an export based system to a more self reliant domestic based system, and that this might be an indication of a coming economic war with the US. As it turns out, this is exactly what has happened. Since 2010, China’s domestic market has grown dramatically, indicating that China has no intention of relying on the US consumer as an economic pillar.

The US consumer is almost tapped out. While retail sales in certain areas remain steady and this has been used by the mainstream media and the Fed to promote the idea that the economy is still “going strong”, this is not the big picture. The reality is that US consumption is driven by historic levels of debt. Household debt is now FAR above levels last seen after the last financial crisis, with total debt at $1.2 trillion higher today than its last peak in 2008. The downturn in retail is more obvious in the steady closings of thousands of outlets in 2019 alone. This year has seen a 29% increase in store closings compared to 2018, even though 2018 saw a considerable spike in store shutdowns. Around 12,000 stores are slated to close this year.

So the question is, with the US consumer stretched thin by debt and US retail on the verge of a recessionary plunge, why would China feel threatened by the loss of the American consumer market? They are losing it already by attrition. The truth is they aren’t threatened, which is why, as I predicted last year, the trade war continues unabated despite the fact that so many people argued that China would “quickly fold” to Trump’s demands. I realize this is not what many people want to hear, but it is foolish to get caught up in a farcical mob mentality and ignore the fundamentals in the trade war. If you think that the US is going to “win” based on leverage, you are sorely mistaken. The US is in no better shape economically than China; in many ways we are much worse off.

Close down the place before it can do even more harm.

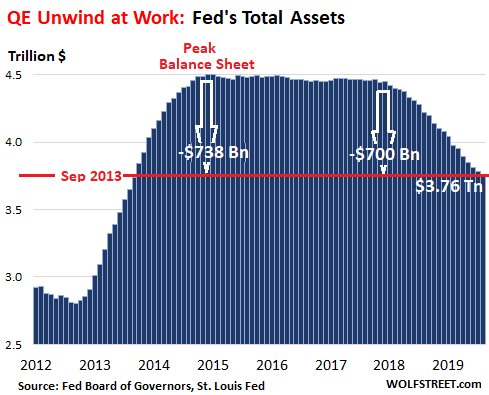

• Fed QE Unwind Continues Via Sharp Drop In MBS (WS)

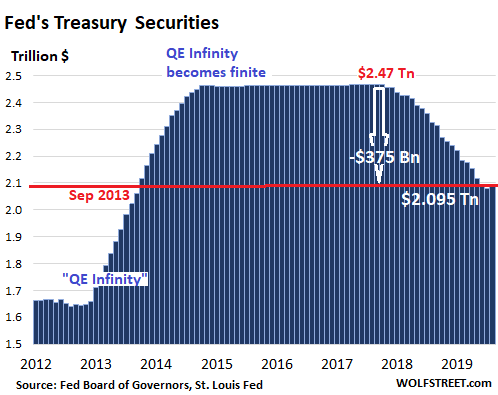

In August, the Fed shed Mortgage Backed Securities (MBS) at a rate that exceeded its self-imposed “cap” of $20 billion for the fourth month in a row, but added some Treasury securities, with a new emphasis on short-term Treasury bills. Total assets on the Fed’s balance sheet fell by $20 billion, to $3.76 trillion, as of the balance sheet for the week ended September 4, released this afternoon. This brought the balance sheet to the lowest level since September 2013. So far this year, the Fed has shed $314 billion in assets. Since the beginning of the “balance sheet normalization” process, the Fed has shed $700 billion. Since peak-QE in January 2015, it has shed $738 billion:

During the month of August, $70 billion in Treasury securities in the Fed’s portfolio matured and were redeemed by the US Treasury Department. The Fed replaced all those with new Treasury securities. This replacement would have kept its holdings level. Per its new plan to replace its MBS securities with Treasury securities – more on that in a moment – it added about $15 billion in Treasury securities, bringing the total to $2.095 trillion. This was the first monthly increase since the end of 2017, bringing its Treasury holdings back to the level of last July, and just above the September 2013 level:

As part of its new regime to shorten the overall maturity of its holdings, the Fed’s holdings now include $3 billion in Treasury bills (maturing in one year or less), up from zero a few months ago. After “Operation Twist,” which was layered between QE-2 and “QE Infinity,” the Fed had not held any Treasury bills. About four months ago, it started dabbling in them again, but in August it got serious. These T-bills replaced some of the MBS that ran off its balance sheet.

Trump giveth and the Fed taketh away. End the Fed AND Fannie and Freddie.

• Trump Administration Backs Privatizing Fannie Mae And Freddie Mac (MW)

The Trump administration said it would support returning mortgage-finance giants Fannie Mae and Freddie Mac to private hands, a development that could keep the companies at the center of the housing market for decades to come. The principles announced Thursday represent a major reversal from what leaders of both parties over the past decade promised — to abolish the companies, which guarantee roughly half the U.S. mortgage market. The approach, which doesn’t require approval by Congress, would mark an important win for investors who have been betting politicians wouldn’t follow through on those promises. Treasury officials said they would aim to privatize the government-controlled firms without making it tougher and more expensive for people to get mortgages.

They generally avoided making specific policy recommendations on how to accomplish these goals in a report released Thursday. They said they would work with federal regulators to flesh out the details on how to put Fannie and Freddie on a sounder financial footing as well as to curtail the firms’ roles in housing finance. The process could take years to implement and won’t affect existing mortgages. “Our view is that the government footprint has become too big,” Treasury Secretary Steven Mnuchin said in an interview ahead of Thursday’s report. ”There are people in Washington who are happy to leave this the way it is for another 10 or 20 years, and that’s not us. We feel an obligation to try to fix this.”

“The direction of European history would seem to have changed – shifting away from convergence and back to delineation.”

• Is Armed Conflict Possible in Today’s Europe? (Spiegel)

“The war changed everything.” This statement by the late British historian Tony Judt contains the kernel of modern-day Europe. It was the war that made possible an extended period of peace. Things had to get extremely bad before they could get good again. For the last 75 years, there has been peace on the Continent, with just a few exceptions. Now, this Europe finds itself in crisis. It is no longer the Europe where national thinking is slowly dwindling. It is no longer the Europe that is growing together step by step. It is no longer the Europe in which all countries seem to be committed to democracy forever. The direction of European history would seem to have changed – shifting away from convergence and back to delineation.

What does that mean for the most important of all questions, the question of war or peace? At the moment, it doesn’t look at all as though the long period of peace is going to come to an end. There is no reason for alarm. But if the direction of European history is changing, we should take a close look at what that could mean. Not in the immediate future, but in the long term. History is a snail that persistently crawls along its path. Exactly 80 years ago, the war that changed everything began — on Sept. 1, 1939, with Adolf Hitler’s Germany invading neighboring Poland. Almost six years later, more than 60 million people around the world were dead as a result of the violence, huge portions of the Continent were destroyed, millions of Europeans had been forced from their homes and millions more were plunged into poverty. A state of shock reigned.

When will he quit?

• Boris Johnson: I’d Rather Be Dead In a Ditch Than Delay Brexit (BBC)

Boris Johnson has said he would “rather be dead in a ditch” than ask the EU to delay Brexit beyond 31 October. But the PM declined to say if he would resign if a postponement – which he has repeatedly ruled out – had to happen. Mr Johnson has said he would be prepared to leave the EU without a deal, but Labour says stopping a no-deal Brexit is its priority. The prime minister’s younger brother, Jo Johnson, announced earlier that he was standing down as a minister and MP. Speaking in West Yorkshire, Boris Johnson said Jo Johnson, who backed Remain in the 2016 referendum, was a “fantastic guy” but they had had “differences” over the EU.

Announcing his resignation earlier in the day, the MP for Orpington, south-east London, said he had been “torn between family loyalty and the national interest”. During his speech at a police training centre in Wakefield, the prime minister reiterated his call for an election, which he wants to take place on 15 October. He argued it was “the only way to get this thing [Brexit] moving”. “We either go forward with our plan to get a deal, take the country out on 31 October which we can or else somebody else should be allowed to see if they can keep us in beyond 31 October,” Mr Johnson said.

This is absolutely explosive and absolutely spot on!

Brexit has made the Westminster political scene into a hard nosed English Nationalist movement.

Please share this heavily. It’s us truly incredible. pic.twitter.com/E9c8KyycEU

— Hope Over Fear (@hopeoverfear01) September 5, 2019

Mutti? You here?

• Hong Kong Braces For More Protests As Merkel Calls For Peaceful Solution (R.)

Hong Kong is bracing for more demonstrations this weekend, with protesters threatening to disrupt transport links to the airport, after embattled leader Carrie Lam’s withdrawal of a controversial extradition bill failed to appease some activists. Germany’s Chancellor Angela Merkel raised Hong Kong with Chinese premier Li Keqiang in Beijing on Friday, saying a peaceful solution is needed. “I stressed that the rights and freedoms for (Hong Kong) citizens have to be granted,” said Merkel. “In the current situation violence must be prevented. Only dialogue helps. There are signs that Hong Kong’s chief executive will invite such a dialogue. I hope that materializes and that demonstrators have the chance to participate within the frame of citizens’ rights,” she said during a visit to Beijing.

Li told a news conference with Merkel: “The Chinese government unswervingly safeguards ‘one country, two systems’ and ‘Hong Kong people govern Hong Kong people’”. He said Beijing supported the Hong Kong government “to end the violence and chaos in accordance with the law, to return to order, which is to safeguard Hong Kong’s long-term prosperity and stability”. Protesters plan to block traffic to the city’s international airport on Saturday, a week after thousands of demonstrators disrupted transport links, sparking some of the worst violence since the unrest escalated three months ago. Many protesters have pledged to fight on despite a withdrawal of the extradition bill, saying the concession is too little, too late.

The Pentagon will protect you from “large-scale, automated disinformation attacks” by publishing “large-scale, automated disinformation attacks..”

• The Pentagon Wants More Control Over the News. What Could Go Wrong? (Taibbi)

If there’s a worse idea than the Pentagon becoming Editor-in-Chief of America, I can’t remember it. But we’re getting there: From Bloomberg over Labor Day weekend: “Fake news and social media posts are such a threat to U.S. security that the Defense Department is launching a project to repel “large-scale, automated disinformation attacks,” as the top Republican in Congress blocks efforts to protect the integrity of elections.” One of the Pentagon’s most secretive agencies, the Defense Advanced Research Projects Agency (DARPA), is developing “custom software that can unearth fakes hidden among more than 500,000 stories, photos, video and audio clips.”

Once upon a time, when progressives still reflexively distrusted the military, DARPA was a liberal punchline, known for helping invent the Internet but also for developing lunatic privacy-invading projects like LifeLog, a program to “gather in a single place just about everything an individual says, sees, or does.” DARPA now is developing a semantic analysis program called “SemaFor” and an image analysis program called “MediFor,” ostensibly designed to prevent the use of fake images or text. The idea would be to develop these technologies to help private Internet providers sift through content. It’s the latest in a string of stories about new methods of control over information flow that should, but for some reason do not, horrify every working journalist.

From the Senate dragging Internet providers to the Hill to demand strategies against the sowing of “discord,” to tales of hundreds of Facebook sites zapped for “coordinated inauthentic behavior” following advice by government-connected groups like the Atlantic Council, it’s been clear the future of the information landscape is going to involve elaborate new forms of algorithmic regulation. Stories about the need for such technologies are always couched as responses to the “fake news” problem. Unfortunately, “fake news” is a poorly-defined, amorphous concept that the public has been trained to fear without really understanding.

Why wait 4 years?

• Germany Announces Plan to Ban Glyphosate (CD)

The German government announced Wednesday it had agreed on a plan to phase out the use of glyphosate—the key chemical in the weedkiller Roundup—with a total ban set to begin by the end of 2023. “Way to go, Germany!” tweeted the U.S.-based advocacy group Organic Consumers Association. Chancellor Angela Merkel’s cabinet agreed to the plan Wednesday. The proposal, reported Bloomberg, also says that the “government intends to oppose any request for the E.U. to renew the license to produce the weedkiller, according to a release by the environment ministry.” The European Commission, the E.U.’s rules and regulations body, in 2017 renewed the license for glyphosate in the bloc through the end of 2022.

Germany’s environment Minister, Svenja Schulze, framed the new move as necessary to protect biodiversity, and said that “a world without insects is not worth living in”. “What harms insects also harms people,” Schulze said at a press conference. “What we need is more humming and buzzing.” Glyphosate is no longer exclusive to Monsanto’s Roundup, as it “is now off-patent and marketed worldwide by dozens of other chemical groups including Dow Agrosciences and Germany’s BASF,” as Reuters noted. That’s despite the World Health Organization’s International Agency for Research on Cancer’s 2015 designation of glyphosate as a “probable carcinogen,” increasing concerns over its health effects, and mounting legal woes for Bayer, which acquired Monsanto last year, as multiple juries have found Roundup to have been a factor in plaintiffs’ cancers.

Stop calling them conservatives.

• Targeting the Tongass National Forest for Amazon-like Destruction (CP)

Alaskan politicians, the governor, Mike Dunleavy, and the two senators, Lisa Murkowski and Dan Sullivan, all Republican, convinced Trump to dismantle federal protections of the Tongass National Forest. The Trump administration ordered the Forest Service to approve this process of destruction. In March 16, 2019, the Forest Service designed a 15-year logging project in the Prince of Wales Island that included the opening of 164 miles of new roads in 67 square miles of land and the clearcutting of up to 23,000 acres of old-growth trees – trees several centuries old.

Environmental organizations like Earthjustice, Sierra Club, Alaska Wilderness League, Southeast Alaska Conservation Council, Alaska Rainforest Defenders, National Audubon Society, Natural Defense Council, Defenders of Wildlife, and the Center for Biological Diversity sued the Forest Service and the US Department of Agriculture for violating the National Environmental Policy Act and other environmental laws. They pointed out that such massive timber sale from the projected clearcutting of old growth trees was “wasteful, destructive, and a giveaway” to a timber industry contributing less than 1 percent to the economy of Alaska.

In addition, clearcutting 23,000 acres of ancient trees would harm the Alexander Archipelago wolf, flying squirrels, and birds like Goshawk. Why this violent attack on a forest these environmental organizations call the crown jewel of America? The Alaskan politicians, like Bolsonaro of Brazil, have a distorted and selfish vision: satisfy the landowners in Brazil and the timber barons in Alaska. Do these politicians, including Trump, ever think about the real bad effects, ecological and social, of their actions? They must have heard of the inferno in the Brazilian Amazon and its potentially horrific consequences on the planet. They cannot really assume or believe that adding quite a bit more carbon to the atmosphere from logging Tongass would be a good thing for America or the world? Or could they?

The only reasonable explanation of the murky world of Trump and the Republican politicians (of Alaska and the rest of the country) is that they reject science. Certainly, the Evangelicals do. These Christian Republicans support Trump. They make no secret they expect Jesus to rise up, thus signaling the end of life on Earth. This delusion gets scary as high officials of the Trump administration are its fervent believers.

Long-time Assange confidant Stefania Maurizi talks to Roger Waters.

• They Want Him Dead As A Warning (Maurizi)

He is one of the legends of rock famous for his progressive battles. At seventy-six, the Pink Floyd co-founder, Roger Waters, has not given up at all and does not hesitate to call his country, Great Britain, “disgusting” for its treatment of Julian Assange. Last Monday, Waters sang his great classic, “Wish You Were Here” in front of the UK Home Office in London in support of Assange, while the Australian journalist, John Pilger, explained the serious risk the WikiLeaks founder runs of being extradited to the US, and Assange’s brother, Gabriel, described an emotional meeting with Julian Assange. Roger Waters is currently in Venice to present his film “US + Them”. Repubblica interviewed him.

What made you go very public about Julian Assange’s situation? “Clearly, there has been a really powerful and international smear campaign, really since the Collateral Murder video. I have been watching it developing. Assange is the pet hate of Western governments, particularly the government of the United States, because he published evidence that shows the United States to have committed heinous war crimes, crimes against humanity in a big way. This smear campaign against him is all about getting him extradited to the US. They want him dead as a warning: they want to persuade any young person who might be thinking about the work of Julian Assange, or any whistleblower or any investigative journalist, that to pursue the path of truth-telling is extremely bad for your health. The message is: if you tell the truth, we will kill you, watch! The same with Chelsea Manning”.

Withdrawing the extradition bill is no longer enough: