René Magritte After the water, the clouds 1926

Stillbirths

86 stillbirths in 6 months in fully vaccinated mothers in Waterloo, Ontario

13 stillbirths in 24 hours in B.C.

Dr. Daniel Nagase exposes an emerging public health disaster being ignored and suppressed by govts, public health & the mainstream media. pic.twitter.com/IUhdS3H8t0

— Bright Light News (@BLNewsMedia) November 23, 2021

“If human nature & history teach anything, it is that civil liberties face grave risks when governments proclaim indefinite states of emergency”

– Judge Doughty in his order blocking Vaccine mandate.

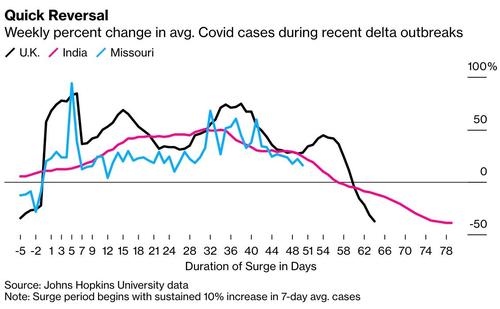

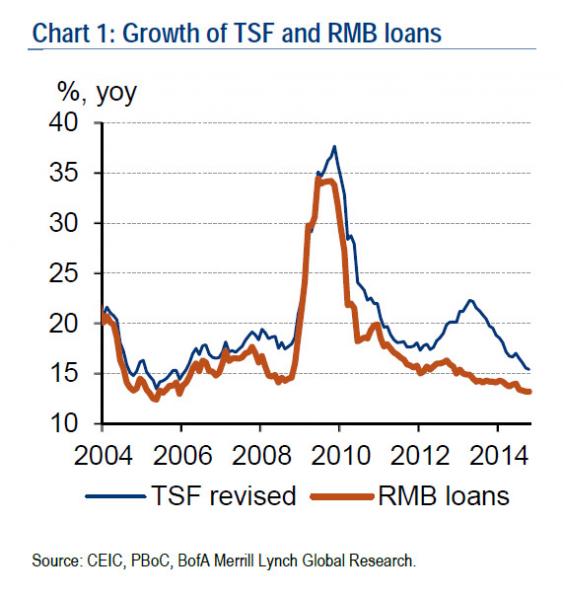

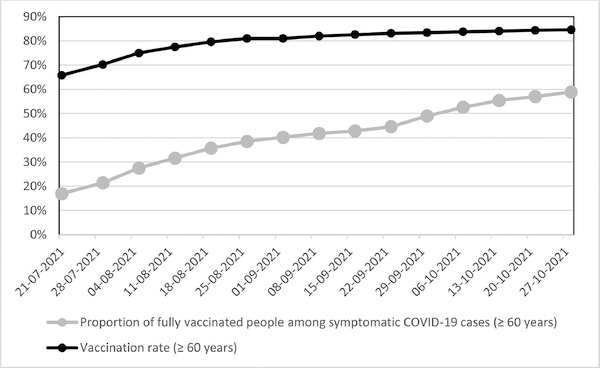

“..reported weekly since 21. July 2021 and was 16.9% at that time among patients of 60 years and older. This proportion is increasing week by week and was 58.9% on 27. October 2021..”

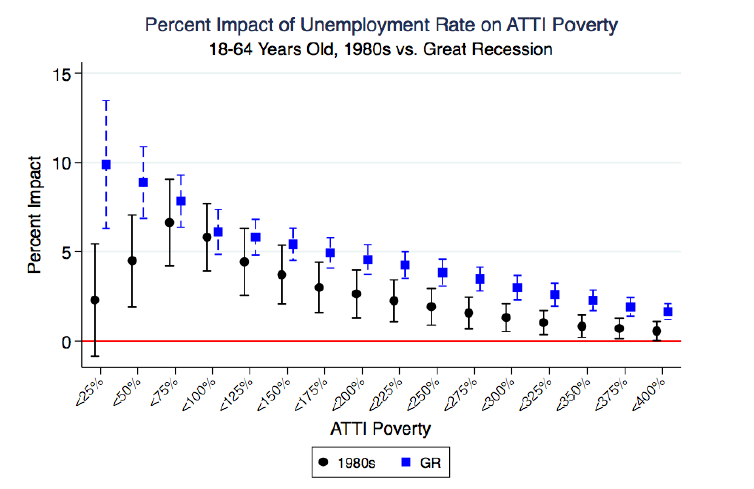

• The Epidemiological Relevance Of The Vaccinated Population Increase (Lancet)

High COVID-19 vaccination rates were expected to reduce transmission of SARS-CoV-2 in populations by reducing the number of possible sources for transmission and thereby to reduce the burden of COVID-19 disease. Recent data, however, indicate that the epidemiological relevance of COVID-19 vaccinated individuals is increasing. In the UK it was described that secondary attack rates among household contacts exposed to fully vaccinated index cases was similar to household contacts exposed to unvaccinated index cases (25% for vaccinated vs 23% for unvaccinated). 12 of 31 infections in fully vaccinated household contacts (39%) arose from fully vaccinated epidemiologically linked index cases. Peak viral load did not differ by vaccination status or variant type.

In Germany, the rate of symptomatic COVID-19 cases among the fully vaccinated (“breakthrough infections”) is reported weekly since 21. July 2021 and was 16.9% at that time among patients of 60 years and older. This proportion is increasing week by week and was 58.9% on 27. October 2021 (Figure 1) providing clear evidence of the increasing relevance of the fully vaccinated as a possible source of transmission. A similar situation was described for the UK. Between week 39 and 42, a total of 100.160 COVID-19 cases were reported among citizens of 60 years or older. 89.821 occurred among the fully vaccinated (89.7%), 3.395 among the unvaccinated (3.4%). One week before, the COVID-19 case rate per 100.000. was higher among the subgroup of the vaccinated compared to the subgroup of the unvaccinated in all age groups of 30 years or more.

In Israel a nosocomial outbreak was reported involving 16 healthcare workers, 23 exposed patients and two family members. The source was a fully vaccinated COVID-19 patient. The vaccination rate was 96.2% among all exposed individuals (151 healthcare workers and 97 patients). Fourteen fully vaccinated patients became severely ill or died, the two unvaccinated patients developed mild disease [[4]]. The US Centres for Disease Control and Prevention (CDC) identifies four of the top five counties with the highest percentage of fully vaccinated population (99.9–84.3%) as “high” transmission counties. Many decisionmakers assume that the vaccinated can be excluded as a source of transmission. It appears to be grossly negligent to ignore the vaccinated population as a possible and relevant source of transmission when deciding about public health control measures.

Figure 1- Vaccination rates and proportions of fully vaccinated people among symptomatic COVID-19 cases (≥ 60 years) in Germany between 21. July and 27. October 2021 based on the weekly reports from the Robert Koch-Institute.

Part 2.

Norman Fenton is Professor in Risk Information Management. Martin Neil is Professor in Computer Science and Statistics.

No idea how they figured this out, or why, but it’s interesting. A one week delay in reporting changes the entire picture.

• The Impact Of Misclassifying Deaths In Evaluating Vaccine Safety (Fenton)

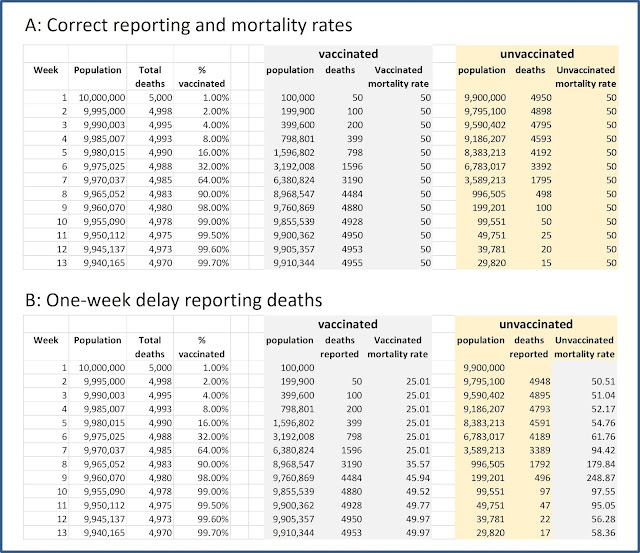

In a previous post we showed that if there was a one-week delay in reporting deaths then a vaccine that was a placebo would be seen to have a decreased mortality rate for the vaccinated compared to the unvaccinated. In other words, an illusion of effectiveness is created by the one-week delay in reporting. This is shown in Figure 1 with our hypothetical example comparing the correct figures to the reported figures based on a one-week delay. The example assumes that in this population of 10 million people there is a (constant) weekly mortality rate of 50 deaths per 100,000 people. Each week the population reduces by the number of deaths the previous week. All death numbers (which are simply the relevant population multiplied by 50/100000) are rounded to whole numbers.

Figure 1: Hypothetical example of a placebo vaccine introduced into a population. A) shows correct results; B) shows results reported if there is a one-week delay in reporting deaths

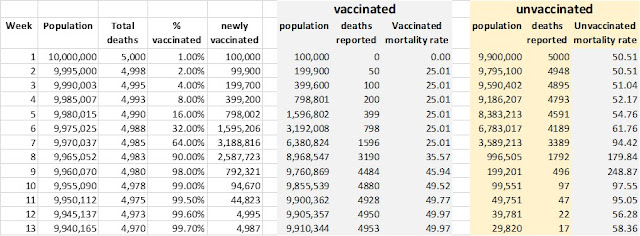

It turns out that, under the same hypothetical assumptions, the same results arise if, instead of a one-week delay in death reporting there is a misclassification of newly vaccinated deaths; specifically, any death of a person occurring in the same week as the person is vaccinated is treated as an unvaccinated, rather than vaccinated, death.

Table 1: Reported deaths and mortality rate if newly vaccinated deaths are reported as unvaccinated

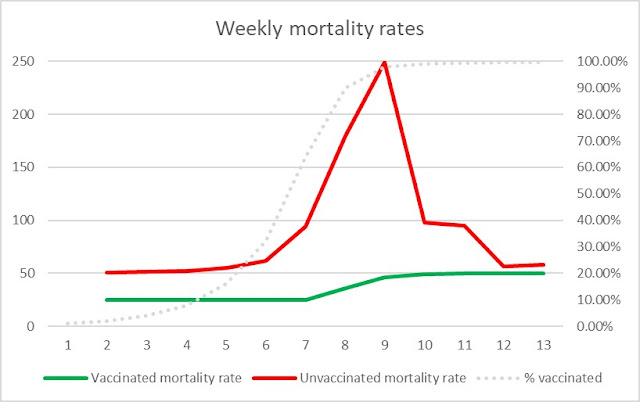

Figure 2 Plot of weekly mortality rates under either the delayed death reporting or death misclassification scenarios

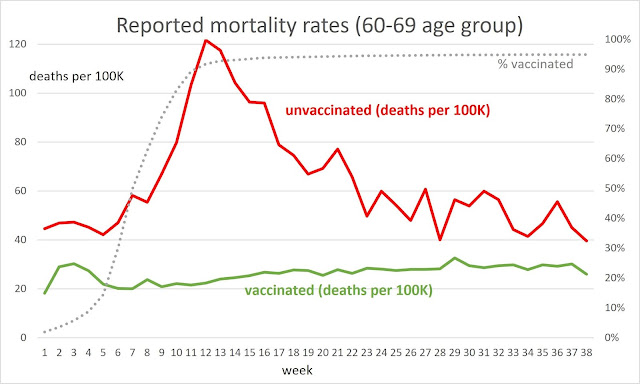

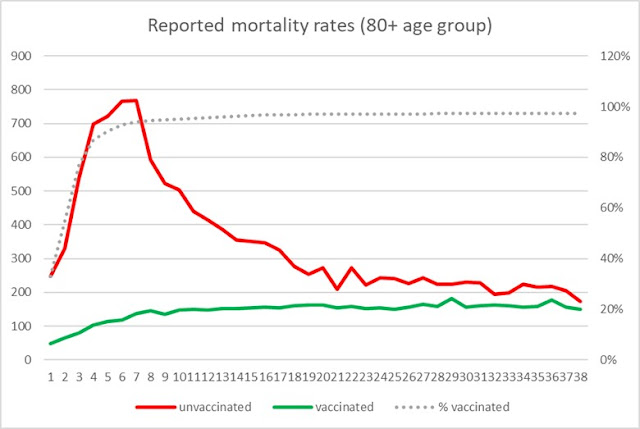

It shows the apparently clear life-saving benefit of the ‘vaccine’. But there is an obvious indication that these results are not real. If they were, why would the mortality rate in the unvaccinated peak at about the same time as the vaccine programme reaches its peak? It turns out that the plots for mortality rates from the ONSreport (weeks 1-38) for the Covid-19 vaccination programme in each of the older age categories look remarkably similar to the plot in Figure 2, i.e. with the same peaks in unvaccinated mortality coinciding with when the vaccination programme reached its peak for this age group. For example, Figure 3 shows the 60-69 age group (for which vaccination peak was reached in week 11) and Figure 4 shows the 80+ age groups (for which vaccination peak was reached in week 6).

Figure 3 Plot of weekly mortality rates for Covid19 vaccinated v unvaccinated (this is all-cause mortality but the plots have the same shape even if deaths classified as Covid are removed)

Figure 4 Plot of weekly mortality rates under either the delayed death reporting or death misclassification

Why are the theoretical results important? Because they at least partly explain how the strange observed ONS results could occur even if the mortality rate of the vaccinated was the same (or even higher) than that of the unvaccinated. While it seems that deaths in the ONS report are being reported by date of death (hence are not delayed), newly vaccinated deaths are being classified as unvaccinated. Indeed, it is likely that any death within the first 14 days of vaccination may be classified as unvaccinated.

“Anyone infected with a ‘mild’ Covid virus — one unlikely to cause serious disease — will still develop antibodies to guard against future infection.”

• Why Is Omicron Being Treated Like Ebola? (Dalgleish)

As I listened to ministers react nervously in recent days to the new Omicron Covid variant, I began to experience an all-too-familiar sinking feeling. Shall I put it into words? Here we go again, I thought. Mask mandates have been reimposed in shops, schools and hairdressers, and new swingeing £200 fines will be levied on those who dare to break the rules. Meanwhile, the inevitable chorus of gloomy voices has begun to sing again: that unholy alliance of scientific ‘experts’ who have been given blanket coverage by the BBC and Left-wing media so often during this pandemic. The Government has used these voices as justification to impose fresh restrictions on our lives — as well as to threaten more in future. Right now, the key question is: are any of the new measures actually necessary?

Yes, there remains much we don’t know about Omicron, but the early signs are distinctly encouraging. Many patients have reportedly recovered quickly from what have been very mild symptoms. Southern Africa, where the variant emerged, has largely avoided panicking. One German epidemiologist, Professor Karl Lauterbach, who is running to be Germany’s next health minister, has even said that a mild strain would be an ‘early Christmas gift’. Given all that, how much can the Government’s hawkish approach truly be justified? Very little, I would submit. The real danger for most of us now comes not from Omicron or any other coronavirus variant. Instead, it comes from ministers and officials apparently flirting with taking us into yet another era of ruinous restrictions, cancelling Christmas or other cherished holidays, dashing all hope of foreign travel, wrecking the economy and otherwise immiserating our lives at the whim of the state.

Yes, a new, heavily mutated coronavirus variant has been identified. But Professor Lauterbach, a highly respected clinical epidemiologist, suggested yesterday that the variant might even be good news. Why? Because its numerous mutations — twice as many as the Delta variant that swept the world this year — mean that though it may well be more infectious, it could also be less deadly. In layman’s terms, this means that more people might catch it, but not suffer serious illness. And that is a good thing — certainly compared to a very infectious, very virulent virus with the capacity to sicken or kill large numbers of people. Anyone infected with a ‘mild’ Covid virus — one unlikely to cause serious disease — will still develop antibodies to guard against future infection. And the more people with such antibodies, the closer we are to the fabled ‘herd immunity’.

This, coupled with the help of our highly successful vaccination programme, could even spell the eventual end of the pandemic — though not, it must be said, the end of Covid. This is the sort of grown-up discussion ministers should be having with us. Instead, by announcing new restrictions over the weekend, flanked by his two familiar harbingers of doom, Professor Chris Whitty and Sir Patrick Vallance, the Prime Minister risked terrifying large swathes of the nation all over again — just as they were beginning to catch their breath as the worst of the pandemic was lifting.

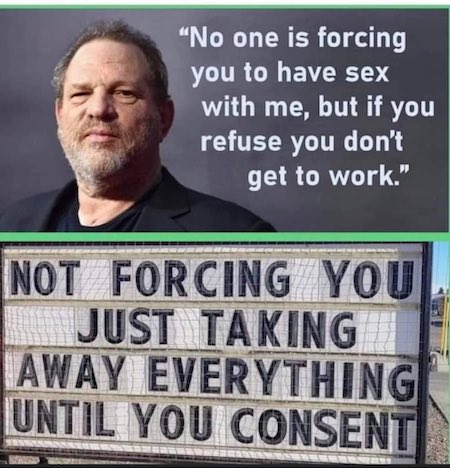

“..when Fauci declares himself a representative of Science, it’s a statement of his religious devotion.”

• Fauci The Omnipotent (Miller)

What does Anthony Fauci have to do with a starship? The good doctor’s staggering claims and admissions during his Sunday interview with Face the Nation’s Margaret Brennan recall a classic scene from Star Trek V: The Undiscovered Country. The crew of the Enterprise are taken to a mysterious realm to face a being claiming to be an all-powerful god. To question the being would be to question God himself. The being, of course, turns out not to be a god or the God, but rather an alien entity, trapped and trying to escape. Now, Dr. Fauci seems to be borrowing from the alien’s playbook.

When Fauci was asked recently about Senator Ted Cruz recommending prosecutorial action against him to the attorney general, he grew incensed and defensive, even throwing in a reference to the Capitol riot on January 6 for some reason. It was a nakedly partisan attack, the kind you might expect from our politicians and bureaucrats, but not the nation’s bedside doctor, who should be led by the Hippocratic Oath and not Jim Acosta. Then came a broad swipe at anyone who dared to question the omnipotent Anthony Fauci, despite his many, many backtracks over the last two years. Fauci decreed that to question him, his decisions or his motives, is to question the very foundations of science itself.

When Brennan referenced Fauci’s testimony to Congress, he responded, “I’m just going to do my job. I’m going to be saving lives and they are going to be lying.” He continued, “If they get up and really aim their bullets at Tony Fauci. It’s easy to criticize. But they are really criticizing science. Because I represent science and that’s dangerous.” Tony Fauci has apparently anointed himself the Science, or at least the ambassador speaking on behalf of Science. This is the second time he has made such a declaration. “Attacks on me, quite frankly, are attacks on science,” he told Chuck Todd on Meet the Press in June. This is where most criticism of Fauci misses the mark. Breathless tweets from anonymous accounts depict him as a war criminal, worse than Hitler. Senators threaten him with jail time over misleading testimony to Congress.

But when Fauci declares himself a representative of Science, it’s a statement of his religious devotion. He’s not referring to the science of, say, the human manipulation of viruses that can lead to a global pandemic, research Fauci once said he believed was worth the risk. Or to the science that has possibly led to eleven million deaths worldwide and altered the lives of every citizen of every industrialized nation on the planet. Fauci believes himself to be a force for good, no matter how many people or puppies have to die to achieve that good. He does not believe in the laws of Congress or man, which is why when pressed, even by Brennan in that same interview, about the origins of this virus and why it seems engineered differently than other SARS viruses, he retreats once again and pushes a wet market theory that not even the Chinese government is willing to stand by anymore.

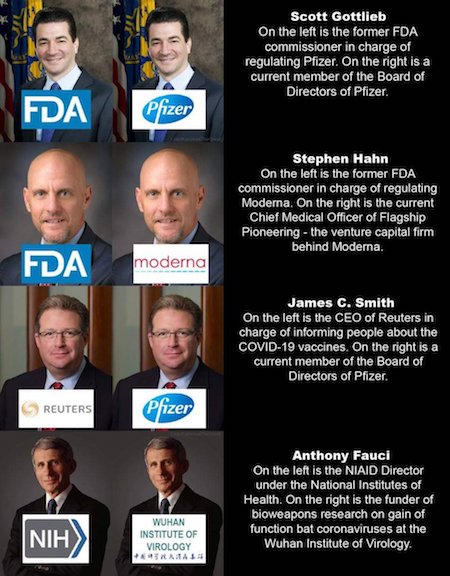

Fauci’s staying power demonstrates the power of Pfizer. The FDA receives 45% of its budget from the pharmaceutical industry.

• Sen. Blackburn: Fauci ‘Around Too Long,’ Should Retire to Florida (NM)

Dr. Anthony Fauci has been in his position as the director of the National Institute of Allergy and Infectious Diseases for “much too long” and should “just retire” to Florida, which has the lowest COVID-19 case and death numbers in the United States, Sen. Marsha Blackburn said on Newsmax Tuesday. “He knows the agency he has led has invested U.S. taxpayer money into gain of function research, and now he doesn’t want people to be aware of that,” the Tennessee Republican said on Newsmax’s “Wake Up America,” while accusing the doctor of covering up for himself and slamming the politically charged comments Fauci made in a Sunday interview.

“It is time for him to leave his job,” she added. “It is time for him to move on. What we need to do is get to the bottom of how this started. What are the origins of this particular strain of coronavirus? This is … something that we’re going to have to handle, learn how to manage, and unfortunately, live with like we do the common flu.” During an interview with CBS News Sunday, Fauci said that “anybody who spins lies and threatens and all that theater that goes on with some of the investigations and the congressional committees and the Rand Pauls and all that other nonsense, that’s noise.” And when he was asked about Sen. Ted Cruz, R-Texas, and his call for an investigation, Fauci said that he would “have to laugh at that. I should be prosecuted? What happened on Jan. 6, Senator?”

Blackburn said that Fauci has been slamming anyone who questions his judgment for months and that he has accused her and others of “criticizing science” when they criticize him. “Well, newsflash to Dr. Anthony Fauci; he is not science. What he has done over the course of the pandemic is to turn himself into a politician and a pundit thinking he can belittle people,” said Blackburn. “The American people have looked at him. They watched him and they formed an opinion of him. They found him to be untruthful. And they don’t consider his advice to be something that they should be following because he’s been all over this.”

Last week’s story of Mr. Ng gets more attention.

• Dying COVID-19 Patient Recovers After Court Orders Ivermectin Treatment (ET)

An elderly COVID-19 patient has recovered after a court order allowed him to be treated with ivermectin, despite objections from the hospital in which he was staying, according to the family’s attorney. After an Illinois hospital insisted on administering expensive remdesivir to the patient and the treatment failed, his life was saved after a court ordered that an outside medical doctor be allowed to use the inexpensive ivermectin to treat him, over the hospital’s strenuous objections. Ivermectin tablets have been approved by the U.S. Food and Drug Administration (FDA) to treat humans with intestinal strongyloidiasis and onchocerciasis, two conditions caused by parasitic worms. Some topical forms of ivermectin have been approved to treat external parasites such as head lice and for skin conditions such as rosacea. The drug is also approved for use on animals.

Remdesivir has been given emergency use authorization by the FDA for treating certain categories of human patients that have been hospitalized with COVID-19. But the use of ivermectin to treat humans suffering from COVID-19 has become controversial because the FDA hasn’t approved its so-called off-label use to treat the disease, which is caused by the CCP virus also known as SARS-CoV-2. Critics have long accused the FDA of dragging its heels and being dangerously over-cautious and indifferent to human suffering in its approach to regulating pharmaceuticals, a criticism that led to then-President Donald Trump signing the Right to Try Act in May 2018. The law, according to the FDA, “is another way for patients who have been diagnosed with life-threatening diseases or conditions who have tried all approved treatment options and who are unable to participate in a clinical trial to access certain unapproved treatments.”

Medical doctors are free to prescribe ivermectin to treat COVID-19, even though the FDA claims that its off-label use could be harmful in some circumstances. Clinical human trials of the drug for use against COVID-19 are currently in progress, according to the agency. The drug “most definitely” saved the elderly patient’s life “because his condition changed right immediately after he took ivermectin,” attorney for the family, Kirstin M. Erickson of Chicago-based Mauck and Baker, told The Epoch Times. Sun Ng, 71, who was visiting the United States from Hong Kong to celebrate his granddaughter’s first birthday, became ill with COVID-19 and within days was close to death. He was hospitalized on Oct. 14 at Edward Hospital, in Naperville, Illinois, a part of the Edward-Elmhurst Health system. His condition worsened dramatically and he was intubated and placed on a ventilator a few days later.

Ng’s only child, Man Kwan Ng, who holds a doctoral degree in mechanical engineering, did her own research and decided that her father should take ivermectin, which some medical doctors believe is effective against COVID-19, despite the FDA’s guidance to the contrary. But against the daughter’s wishes, the hospital refused to administer ivermectin and denied access to a physician willing to administer it. The daughter went to court on her father’s behalf and on Nov. 1, Judge Paul M. Fullerton of the Circuit Court of DuPage County granted a temporary restraining order requiring the hospital to allow ivermectin to be given to the patient. The hospital refused to comply with the court order.

The mandate’s dead.

• Conservatives Eye Government Shutdown to Stop Vaccine Mandate Funding (NM)

Senate conservatives are reportedly considering a forced government shutdown this Friday in hopes of defunding the Biden administration’s private sector vaccine mandate, with House conservatives planning measures to support the effort, according to several Republican sources. The Senate conservatives plan to object to the quick consideration of a plan to extend funding until early next year if Democrat leaders don’t agree to refuse the funding needed for the mandate, the sources told Politico’s Playbook. The senators think they’ll be able to delay the process until past midnight Friday when the funding for the mandate would officially expire.

Sen. Mike Lee, R-Utah, told Politico in a statement that while he’s sure the Senators would all like to “simplify the process” to resolve the continuing resolution, he “can’t facilitate that without addressing the vaccine mandates.” “Given that federal courts across the country have raised serious issues with these mandates, it’s not unreasonable for my Democratic colleagues to delay enforcement of the mandates for at least the length of the continuing resolution,” Lee added. It was not made clear how many of the Senate’s conservatives are willing to follow through on the threat to shut down the government, but in early November, 15 conservatives signed a letter, led by Sen. Roger Marshall, R-Kan., to “use all means at our disposal” to block the passage of any continuing resolution that doesn’t stop the vaccine mandate.

Because of Senate rules requiring unanimous consent to move the CR through quickly, only one senator is needed to object to go past the Friday midnight deadline. Meanwhile, the House Freedom Caucus voted Tuesday night to pressure Minority Leader Kevin McCarthy to take a more hard-line stance on the continuing resolution unless Democrats pull the funding to enforce the vaccine mandate, according to sources familiar with the matter. “There is leverage immediately in the Senate, and we think that House Republicans ought to be backing up any number of Senate Republicans … to use all procedural tools to deny the continuing resolution passage Friday night unless they restrict the use of those funds for vaccine mandates,” Rep. Chip Roy, R-Texas, told Politico.

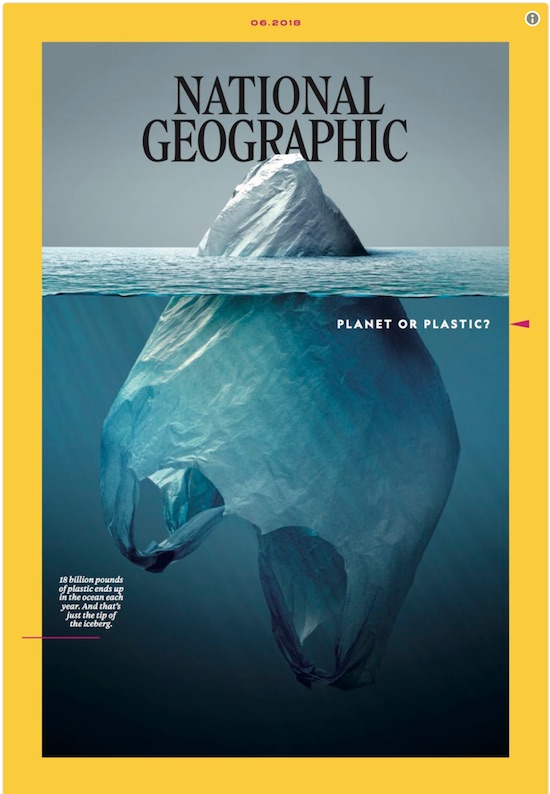

Betcha many will line up for this. Just like for the vaxx. It’s all about how you tell the story.

• Some Swedes Are Getting Vaccine Passports On Implantable Microchips (SN)

Footage out of Sweden shows people willingly having COVID vaccine passports placed onto implantable microchips in their hands. Yes, really. The chips started out as a convenience fad. Those with an implant can open doors without keys, pay without cash, carry gym memberships and ID without cards and wallets. And so naturally, why not have their precious COVID vaccination status applied to the implantable chip too, so they can participate in society. One of Sweden’s most popular daily newspapers, Aftonbladet, reports “Get your Covid certificate in a chip in your hand or elsewhere under the skin. It is increasingly popular to insert a chip into the body with different types of information and now you can also insert your Covid certificate in the chip.”

Sweden: Get your vaccine passports in a chip in your hand or elsewhere under the skin.

It is increasingly popular to insert an #IoB chip into the body with different types of data and now you can insert your covid certificates in the chip.https://t.co/woSzB6zeRC pic.twitter.com/6QWEYlgRlz

— 'Sikh For Truth'. (@SikhForTruth) November 29, 2021

While Sweden has largely avoided lockdowns and mask mandates, creating some pretty spectacular stats compared to the rest of Europe, the government there announced recently that starting December 1st vaccine passports will be required for events with over 100 people in attendance. Given the obsequiousness displayed by some billions of people around the world in taking the COVID vaccine, don’t be surprised to see governments push implantable microchips for bio-security next. Cellphone apps are already used as vaccine passports, which are de facto identity cards, so it’s not a huge leap to suggest that within a decade, a huge public relations campaign will be launched urging everyone to get chipped.

Whether that is predicated on banking and lifestyle restrictions being placed on those who refuse to take the chip or whether it will be introduced off the back of a new pandemic remains to be seen. Don’t forget that ‘Great Reset’ pioneer himself Klaus Schwab acknowledges in his own book that an implantable microchip is the ultimate aim. “Some of us already feel that our smartphones have become an extension of ourselves. Today’s external devices—from wearable computers to virtual reality headsets—will almost certainly become implantable in our bodies and brains,” wrote the World Economic Forum founder.

Not new, but still relevant.

• Reuters Chairman is Pfizer Investor and Board Member (NP)

The chairman and former Chief Executive Officer (CEO) of the Reuters news agency – James C. Smith – is a top investor and board member for pharmaceuticals giant Pfizer. He was elected to the board in 2014, as well as joining Pfizer’s Corporate Governance and Science and Technology Committees. The news raises serious conflict of interest concerns as corporate media outlets such as Reuters continue to promote Pfizer products, defend pharmaceuticals companies from criticism, and move to silence skeptics. Smith is currently the Chairman of the Thomson Reuters Foundation, the London-based charity known for providing news and information to billions of readers. He was also the President, Chief Executive Officer, and on the Board of Director of Reuters from 2012 until his retirement in 2020.

He has worked with the organization since 1987, when they were known as the Thomson Newspaper group. He has also served as the CEO of the professional division, overseeing legal, tax and accounting, and intellectual property and science businesses. Later, he went on to lead the North America operations for the news organization. In an official statement at the time, Ian Read, Pfizer’s chairman and CEO said: “We are pleased to have Jim Smith join Pfizer’s Board of Directors. He brings leadership and operational and international business experience to Pfizer’s Board, and will be an excellent asset to the company. The addition of Jim to our Board helps ensure that Pfizer will continue to benefit from a breadth and variety of experience.”

In the last year alone, Reuters has published more than 22,000 articles mentioning Pfizer. The company has only published 8,191 articles related to Moderna, and 18,000 related to Johnson & Johnson. Many of the articles about Johnson & Johnson were negative in sentiment, unlike their Pfizer reporting. Smith is also linked to the World Economic Forum (WEF), where he serves on the board of Partnering Against Corruption Initiative. He’s also a member of WEF’s International Business Advisory Boards of British American Business and the Atlantic Council. According to the Wall Street Journal, Smith also holds the position of President & CEO of Refinitiv Transaction Services, Ltd, who boasted $6.25 billion in revenue with more than 40,000 customers and 400,000 end users across 190 countries. Refinitiv was a member of the Thomson Reuters Group until 2018.

Vitamin D could have prevented all of this.

• Lockdown Prevented as Many as 740,000 UK Urgent Cancer Care Referrals (SN)

People avoiding hospitals or being unable to obtain healthcare due to lockdown prevented as many as 740,000 urgent cancer care referrals in the UK, it has been revealed. Medics are warning of “the biggest cancer catastrophe ever to hit the NHS” after a report by the report by the National Audit Office (NAO) found that from the start of the pandemic “millions of people have avoided seeking, or been unable to obtain, healthcare.” “By June 2021, NHS cancer services activity had recovered to pre-pandemic levels. However, in September 2021 only 68% of patients requiring treatment within 62 days of urgent referral by their GP were receiving that treatment on time,” the NAO said.

In total, between 240,000 and 740,000 urgent referrals for suspected cancer cases were missed. The report also warned that with the flood of missing referrals returning to place a further burden on the system, the waiting list could grow to 12 million by March 2025. Catchup With Cancer co-founder Professor Pat Price described the situation as “frightening.” “There is a deadly cocktail of delays across the board, a regional lottery of cancer inequality and a growing cancer backlog. And it feels like the Government and NHS leaders have their heads in the sand,” she said.

While people who oppose face masks, lockdown measures and other interventions are routinely blamed for exacerbating COVID deaths, vehement advocates for lockdown rarely ever face condemnation for supporting policies that have drastically increased excess deaths. We previously highlighted the comments of Richard Sullivan, professor of cancer and global health and director of its Institute of Cancer Policy, who said that missed cancer treatments would claim more lives than COVID over the medium to long term. “The number of deaths due to the disruption of cancer services is likely to outweigh the number of deaths from the coronavirus itself over the next five years,” said Sullivan.

Not players this time, and some people will say it happens all the time. The problem is not whether these things happen more, or even what causes them, the problem is we have no systems to keep track of this. Adverse events are a serious issue, and systems like VAERS are not serious systems.

• Two Premier League Matches Hit By Medical Emergencies On Same Night (RT)

The Premier League match between Watford and Chelsea and the meeting between Southampton and Leicester both had to be halted due to medical emergencies in the crowd on Wednesday night. The game at Watford’s Vicarage Road was suspended for more than 30 minutes after a fan suffered a cardiac arrest during the first half. The players left the pitch as medical staff from both teams rushed to attend to the emergency. The two sets of players refused to continue with the match until they had received positive news on the fan, who was eventually stretchered out of the stadium and taken to the nearby Watford General Hospital for further treatment. The game was resumed just over half an hour later, with Chelsea going on to win 2-1 to maintain their position at the top of the Premier League table.

Both clubs shared messages of support for the fan who had been affected. Amid the distressing scenes, footage on social media appeared to show clashes in the Chelsea end of the stadium. There were also reports of unsavory chants regarding the emergency from some members of the crowd. Elsewhere, the second half of the match between Southampton and Leicester at St. Mary’s was delayed by around 15 minutes after a supporter was taken ill. The fan had collapsed during the interval but the issue was not said to be a cardiac arrest. The person received treatment inside the stadium before being taken to hospital. Earlier this season the game between Newcastle United and Tottenham was delayed when Magpies fan Alan George Smith collapsed in the stands during the first half.

Soon there will be no more communication. That can’t be a good thing.

• Russia Tells US Embassy Staff To Leave Moscow (RT)

American embassy workers who have been stationed in Moscow for over three years have been given just weeks to leave the country, Russia’s Foreign Ministry has announced, amid a growing row with Washington over diplomatic visas. Speaking at a briefing on Wednesday, diplomatic spokeswoman Maria Zakharova announced that “by January 31, 2022, employees of the US embassy in Moscow who have been on assignment for more than three years must leave Russia.” The news comes after Washington reportedly denied extending the visas of dozens of family members of Russian diplomats based in the US. According to Zakharova, “we consider the American move to be a clear expulsion and intend to react accordingly.”

She said that “such a game” was started by America’s policy decisions, rather than because Russia was eager to break off ties. “We tried long and hard to reason with them and direct them to some constructive solution to the issue, but they made their choice.” Earlier this week, Deputy Foreign Minister Sergey Ryabkov said Moscow would retaliate over the impasse. The two states have been embroiled in a long-standing spat over the number of diplomats that can be stationed in both countries. US President Joe Biden revealed last month that the amount of American staff in Russia had dwindled to 120 from 1,200 in early 2017, and said it was hard to continue operations there when limited to just a “caretaker presence.”

Washington has also ordered the closure of its consulates across the world’s largest country.Earlier this year, citing limits on hiring local staff, the US Embassy in Moscow stopped processing non-diplomatic visas and listed Russians as “homeless nationalities,” essentially forcing immigrant visa applicants to travel to third countries, such as Poland. Russia, however, has questioned why the US representative offices require so many employees to process consular documents.

“..false accusations that Ukraine is supposedly preparing for a military attack in the Donbass.”

Just as false as those that Russia is?

• Half of Ukraine’s Army Has Now Been Deployed To Donbass – Moscow (RT)

Ukraine has now stationed well over 100,000 troops and large quantities of hardware in the war-torn Donbass region, the Russian Foreign Ministry alleged on Wednesday morning, amid rising tensions. Speaking at a briefing on Wednesday, diplomatic spokeswoman Maria Zakharova claimed that “the Armed Forces of Ukraine are increasing [their] military force, pulling heavy equipment and personnel.” “According to some reports, the number of troops… in the conflict zone already reaches 125,000 people, and this, if anyone does not know, is half of the entire composition of the Armed Forces of Ukraine,” she said. Zakharova also condemned Ukrainian President Volodymyr Zelensky for submitting a bill to the national parliament that would allow units from foreign armed forces to enter the country as part of multinational exercises next year.

According to her, such a move directly contradicts the Minsk agreement, signed in 2014 in a bid to end the fighting between Kiev’s forces and troops loyal to two self-declared breakaway republics. The broadside from the Russian Foreign Ministry comes amid concerns from the Kremlin surrounding the alleged deployment of American anti-tank missiles in the region close to Russia’s borders. At the end of November, the head of Ukraine’s military intelligence service, Kirill Budanov, said advanced US-made Javelin systems had been tested by Kiev’s troops and had been deployed to Donbass. A few hours later, Russian Foreign Minister Sergey Lavrov stated that it was a concerning development that increased the prospect of a full-blown conflict in the region. “In recent weeks, we have seen a stream of consciousness from the Ukrainian leadership – especially when it comes to the military – that is excessively inflamed and dangerous,” he said.

However, Lavrov’s Ukrainian counterpart, Dmitry Kuleba, denied all claims that his country’s troops could soon launch an offensive there and said Kiev’s officials were “committed to finding a political and diplomatic solution to the conflict.” He accused Russia of increasing “intensity of disinformation, including false accusations that Ukraine is supposedly preparing for a military attack in the Donbass.”

What do you see? A man running in the snow, or something else?

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.