Arthur Rothstein ‘Fruit tramps’ living in tents, Yakima, Washington July 1936

Looking around us today, it would – or at least could – seem obvious that we live in a new world. Which we don’t recognize – as being new – because we don’t want that world. We instead want more of what we used to know, with icing and a cherry on top. We want to go back, not forward, though we don’t phrase or see it that way. The underlying issue is that the ‘forward’ we do want is not available, and we have no problem fooling ourselves into believing we can still achieve it.

We want a world controlled by America, with Europe as a sort of hunchbacked sibling obediently limping in its footsteps. That is familiar, and that feels safe. Like it was in days gone by, went things seemed to go well for us. We want what we had back then, we just want more of it. We want growing economies, and better lives for our kids than we had, just like our parents did. When there’s a crisis, we want it solved, so we can return to what we had, and add to it.

Because we so obviously and one-dimensionally want this and only this, it’s very easy for those who try, to make us do whatever it is they like, as long as they hold forth the promise of delivering our ideal world of more of the same and then some. There’s no-one who promises a world of less, or a world that is genuinely new, not just in name, who stands a chance of being taken serious, much less of being voted into office.

There’s not an economist who doesn’t promise a return to growth, or to prosperity, if only some model (s)he believes in is followed. More stimulus, less stimulus, the ideas and theories and models seem to run the gamut, but actually they’re all the same. They’re goal-seeked. Economics as a whole, as a field, is. There are no theories that seek not to return us to growth. As if eternal growth is a natural law or a god given right.

We are already paying a huge price for having these contorted and convoluted images presented and sold to us as real, and for us to buy into them. In Japan, Shinzo Abe is busy unleashing an economic Fukushima upon his people, just so their country can return to growth. In China, the amounts of credit with which markets are flooded just so the illusion of growth can be maintained are stupendous.

Europe can’t wait for its crisis to be finally over, so more of the same, plus a bunch of added gadgets, is there for everyone to grab onto. In the US, the media-induced consensus is that the return to growth has already been realized. Hail the centra; bankers. More of the same, in various stages of ‘development’, can be seen in many other countries across the globe. All geared towards additional growth, towards hopes and dreams.

But everywhere, save perhaps in a few very poor places, the illusion of growth can only be bought with debt. And debt, how ironic, is the opposite of growth once there is too much of it. So they just have us believe there’s no such thing as too much.

A report from two St. Louis Fed economists this week blames low inflation levels in the US on ‘consumers’ hoarding money. With 40+ million Americans on food stamps, they could think of nothing else than a local version of Ben Bernanke’s insane notion of ‘excessive savings’ in China holding back the world economy.

Without even considering the option that people simply don’t have money to hoard. That they instead are buried in debt. That the money pumped into the system only reaches the top part of it, and gets stuck there. If people don’t spend, it must be because they have tons of cash sitting in their mattresses, not that they don’t have it. A sadder picture of the state of economics could not be painted. What even more sad is that these are the kind of yokels who determine economic policy.

We don’t stand a chance. At first, I liked to see them address velocity of money in their inflation ideas, but then found they had no idea what it was or meant. US velocity of – base- money is at a record low. People are not spending. The same goes for Japan and Europe. But that’s not because people are wallowing in endless piles of cash. It’s because they’re at the end of the line.

A somewhat related piece has PIMCO bond manager Bill Gross explain how it all works according to the book he talks:

Two variables figure in the monetary straitjacket Gross describes: credit creation and credit velocity. The former must constantly expand at a high enough rate to pay interest on previously issued liabilities so as not to trigger the need for the sale of existing assets. If the current rate on outstanding debt in the U.S. is 4.5%, the Fed should target credit expansion of at least 4.5% per year.

Nevertheless, credit expansion has averaged just 2% for the past 5 years and only 3.5% in the past year. U.S. underachievement in credit creation is to blame for today’s economic stagnation, where the economy struggles to reach 2% real GDP growth.

A second variable of monetary policy is the velocity of money. Gross says no central banker knows how fast money should be changing hands in the economy and must therefore only dial the level up or down cautiously in order to avert a credit collapse.

But as a general rule, he writes, “the projected return on financial assets (relative to their risk) must be sufficiently higher than the return on today’s or forward curve levels of cash (overnight repo), otherwise holders of assets sell longer-term maturities and hold dollar bills in a mattress — lowering velocity and creating a recession/debt delevering.”

Now you know: The US doesn’t create enough additional debt. That’s why the economy is doing so poorly. Where is other times the economy was founded and built on production, on people working and producing things, it’s now debt that makes it tick.

And since people don’t have money, contrary to what the St. Louis Fed guys claim, they will need to borrow, says Gross. But they don’t. Not even at historically low rates. And if people don’t have money, and don’t borrow, they don’t spend, and you’re not going to get either growth or inflation.

By the way, why inflation at certain levels has achieved such a mantra-like status is beyond me, certainly in the way it’s supposed to be manipulated by central bankers. I always thought a central bank’s main task was to make sure just enough ‘money’ was in circulation in an economy to let it function. Not to set a goal for inflation levels. Which undoubtedly is why they predictably always fail to achieve whatever goal it is they set.

Of course, as per Bill Gross just now, central bankers must tamper in a similar way with the velocity of money (consumer spending) and ‘dial the level up or down cautiously’. As if Bernanke can make Americans spend more, or less, as and when he sees fit. How crazy do ideas get? Is that mere wishful thinking, is it goal seeking, or is it an elementary lack of intelligence?

It’ll take us forever and a day to pay down our debts and achieve some, any, kind of growth again. But that should not be the end of the world, it’s merely a transition to a new world, which has already dawned (just not on us).

We’re in a new world, one without – economic -growth, but we see it through old eyes, and it’s ruled through old politics. If we don’t recognize the dangers of that discrepancy in time, we’re going to enter an era – we may already have – of many more botched western interventions like the ones in Ukraine and Iraq. Where our leaders, who always were power hungry to begin with, turn out to be blood thirsty as well, when it comes to re-establishing the power structures of old, which belong in times gone by, and which will never come back.

The task of – central – governments, central bankers, and certainly alliances like NATO, should be to make sure as few people get hurt in this transition as possible. They should be the keepers of the peace, and the protectors of the weak as well as the natural environment in their part of the world. So far, they’re 180º off in every single respect.

As long as we insist on seeing the world through our old eyes, focused on growth and on more of whatever we feel we need even more of, we will continue to pick the leaders who promise us that. That may have been sort of fine 50 years ago, but in today’s world it can only lead to destruction, bloodshed, poverty and misery.

We’ve seen our world change, and we’ve failed to keep to up with the changes. We don’t want to be content with less, no matter how much we already have. What we possess has become our self-image, and the one we portray upon the world. But be careful: it we don’t change that, fast, it’ll lead us to places we don’t want to go.

• Draghi Sees Almost $1 Trillion Stimulus as QE Fight Waits (Bloomberg)

Mario Draghi signaled at least €700 billion ($906 billion) of fresh aid for his moribund economy and left a fight with Germany over sovereign-bond purchases for another day. Pledging to “significantly steer” the European Central Bank’s balance sheet back toward the €2.7 trillion of early 2012 from 2 trillion euros now, the ECB president yesterday announced a final round of interest-rate cuts and a plan to buy privately owned securities. His mission: to revive inflation in the 18-nation euro area. Fully-fledged quantitative easing as deployed in the U.S. and Japan wasn’t enacted amid a split on the 24-member Governing Council, with Bundesbank President Jens Weidmann opposing the new stimulus and others seeking more. The latest round of measures pushed the euro below $1.30 for the first time since July 2013 and sent European bond yields negative. The steps “probably reflect that President Draghi does not have unanimity, or a large enough majority for quantitative easing,” said Andrew Bosomworth, portfolio manager at PIMCO. and a former ECB economist.

“The ECB is ready to do more if more is needed.” The ECB’s fresh monetary easing may help encourage companies and households to spend rather than save. It could also attract greater participation in a targeted lending program for banks that was unveiled in June and starts this month. Banks can borrow from the ECB for as much as four years at a small premium to the benchmark rate. The rate cuts mark the bottom line for conventional monetary policy. Declaring that the ECB can now reduce them no more, Draghi committed to buying so-called asset-backed securities and covered bonds in the hope that will funnel cash into an economy which stalled in the second quarter and where lending has been shrinking for more than two years.

Don’t worry, someone’ll issue more.

• Bond Drought Seen Challenging Draghi’s ABS Stimulus Plan (Bloomberg)

To appreciate the challenge Mario Draghi faces reviving Europe’s ailing economy by buying asset-backed securities, listen to Frank Erik Meijer. As head of ABS at Aegon Asset Management, which oversees €240 billion ($311 billion), Meijer says it takes him about three months to buy 1 billion euros of securities. “The number that’s circulating the market is €500 billion, but where is he going to get it from?” said Meijer, who is based in The Hague. “Existing bonds are unavailable so he might have to ask banks to create new ones.” The European Central Bank president’s plans are being greeted with skepticism by investors who have seen the €1.2 trillion market contract more than 40% since 2010 as regulators cracked down on the debt blamed for deepening the financial crisis. The securities are also typically bought by pension funds, insurers and banks who hold them until maturity.

Draghi said yesterday the ECB will buy a broad portfolio of “simple and transparent securities” that will include ABS and covered bonds as he seeks to free up bank balance sheets and stimulate lending. While declining to disclose the size of the program, he said it would have a “sizable” impact and details would be revealed after policy makers meet in October. “The news is clearly positive but the ECB will have to be careful not to alienate the existing investor base in ABS,” said Patrick Janssen, a fund manager at London-based M&G Investments, which oversees €21 billion of ABS. “There is a risk of us being crowded out.” The ECB is aware of the possibility of pushing investors from the market as it buys bonds. In a March paper, the bank’s researchers found that the U.S. Federal Reserve’s so-called quantitative easing program forced investors out of those sectors where the central bank had intervened.

Crazy. And damaging. Ireland and other broke nations should not borrow for free, and then do just that at breakneck speed. It’ll break their necks.

• Draghi’s Bond Rally Means Bailed-Out Ireland Can Borrow for Free (Bloomberg)

Four years ago, Ireland had to be bailed out by its European Union partners. Today investors are paying to lend it money. Ireland joined nations from Germany to Austria and Finland as its two-year note yield dropped below zero for the first time. Irish 10-year bond rates also dropped to record lows along with Italy’s after European Central Bank policy makers yesterday cut their key interest rate and signaled at least €700 billion ($906 billion) of aid to support the flagging euro-zone economy. A report today confirmed the region’s economic recovery ground to a halt in the second quarter. Negative yields reflect “ECB policy but also reflect a mounting belief in the lack of positive prospect for the European economy,” said Luca Jellinek, head of European rates strategy at Credit Agricole SA’s investment banking unit in London. “This is good news for the periphery.”

• Draghi Reaches The Dead-End Of Keynesian Central Banking (Stockman)

Europe is not growing much because most of its economies have been crushed under a mountain of debt, taxes, welfarism and statist dirigisme. Yet somehow the foolish pettifogger running the ECB thinks that driving the cost of money to the “lower bound” (i.e. zero) will help overcome these insuperable—and government made—barriers to prosperity. Yet in today’s financialized economies, zero cost money has but one use: It gifts speculators with free COGS (cost of goods sold) on their carry trades. Indeed, today’s 10 basis point cut by the ECB is in itself screaming proof that central bankers are lost in a Keynesian dead-end. You see, Mario, no Frenchman worried about his job is going to buy a new car on credit just because his loan cost drops by a trivial $2 per month, nor will a rounding error improvement in business loan rates cause Italian companies parched for customers to stock up on more inventory or machines.

In fact, at the zero bound the only place that today’s microscopic rate cut is meaningful is on the London hedge fund’s spread on German bunds yielding 97 bps—-which are now presumably fundable on repo at 10 bps less.Needless to say, when your only tool is a hammer, everything looks like a nail. And when you are a Keynesian with a hammer, it is presumed that nothing much was hammered before yesterday. That is to say, the whole mindless drive by the ECB toward the zero bound, which Draghi pointedly claimed to have achieved this morning, presumes that balance sheets—–the accumulated record of past actions—don’t matter. Instead, its all about the credit “flow” today and tomorrow. Accordingly, lower interest rates—no matter how trivial the change—are ritualistically presumed to stimulate more borrowing in the real economy, and therefore more spending, income and virtuous circle of Keynesian growth.

It lost a lot more just in falling share prices today.

• BP Found Grossly Negligent In Gulf Spill, Costs To Top $50 Billion (Bloomberg)

BP acted with gross negligence in setting off the biggest offshore oil spill in U.S. history, a federal judge ruled, handing down a long-awaited decision that may force the energy company to pay billions of dollars more for the 2010 Gulf of Mexico disaster. U.S. District Judge Carl Barbier held a trial without a jury over who was at fault for the catastrophe, which killed 11 people and spewed oil for almost three months into waters that touch the shores of five states. “BP has long maintained that it was merely negligent,” said David Uhlmann, former head of the Justice Department’s environmental crimes division. He said Barbier “soundly rejected” BP’s arguments that others were equally responsible, holding “that its employees took risks that led to the largest environmental disaster in U.S. history.” The case also included Transocean and Halliburton , though the judge didn’t find them as responsible for the spill as BP. Barbier wrote in his decision today in New Orleans federal court that BP was “reckless,” while Transocean and Halliburton were negligent.

He apportioned fault at 67% for BP, 30% for Transocean and 3% for Halliburton. U.K.-based BP, which may face fines of as much as $18 billion, closed down 5.9% to 455 pence in London trading. “The court’s findings will ensure that the company is held fully accountable for its recklessness,” U.S. Attorney General Eric Holder said. “This decision will serve as a strong deterrent to anyone tempted to sacrifice safety and the environment in the pursuit of profit.” The ruling marks a turning point in the legal morass surrounding the causes and impact of the disaster. Four years of debate and legal testimony have centered on who was at fault and how much blame each company should carry. BP is “subject to enhanced penalties under the Clean Water Act” because the discharge of oil was the result of its gross negligence and willful misconduct, Barbier held. BP said it “strongly disagrees” with the decision and will challenge it before the U.S. Court of Appeals in New Orleans.

Yup.

• BP Ruling ‘Wakeup Call’ as Risks Mount in Oil Search (Bloomberg)

A U.S. judge’s watershed ruling means the final cost to BP Plc for the 2010 Gulf oil spill may eclipse $50 billion, wiping out years of profits and highlighting the risks of drilling as the industry pushes into more dangerous areas such as deeper waters and ice-bound Arctic fields. Yesterday’s court decision that BP acted with gross negligence in the Gulf of Mexico disaster may hamstring the company financially as the industry’s search for resources becomes more expensive and dangerous. Companies including Exxon Mobil and Shell are also facing increasing pressure to show investors they can still grow as production declines. As producers scour the globe for oil and natural gas, the ruling shows they’ll be held accountable for mistakes that may be inevitable given the complexity of the work, said Edward Overton, professor emeritus at Louisiana State University’s department of environmental sciences in Baton Rouge.

While the judge has yet to rule on how much oil was spilled, a key factor in determining additional fines, millions of barrels of crude from the well harmed wildlife and fouled hundreds of miles of beaches and coastal wetlands. If $50 billion isn’t “a wakeup call to do it right, to slow down, to make sure all your i’s are dotted and t’s are crossed in terms of safety — not just for BP but also for the industry — I don’t know what is,” he said. The companies have little choice in the chase for big, new discoveries as access to resources continues to be limited. Exxon, BP, Shell, Chevron Corp. and Total SA earned more than $1 trillion in total profit during the past decade, almost all of which has been spent in the search for new pools of oil and natural gas.

Since 2004, the five companies have tripled capital spending and their combined output has fallen by 1.4 million barrels a day, according to data compiled by Bloomberg. Problems have arisen as companies drill deeper and in more perilous conditions. Shell last week submitted a plan for drilling in Alaska’s Arctic, after a vessel ran aground in 2012. The ultra-deep Davy Jones well in the Gulf, among the most expensive ever drilled, has yet to produce what operator Freeport-McMoRan Copper & Gold Inc. has said may be trillions of cubic feet of gas. The complexity of deep drilling or navigating Arctic waters means that further accidents may be inevitable, said Ed Hirs, an energy economist at the University of Houston. “People may say this will never happen again, but it probably will, although it will happen in a different way,” said Hirs, who also founded his own production company. “It happened again in space travel, which is similar in complexity and scale.”

Not going to happen.

• ‘Bold Action’ Needed On Europe Unemployment (CNBC)

European employment targets are “unrealistic” and “bold action” is needed to boost job creation, according to a report published by the Ambrosetti Forum ahead of the open of its international economics conference. About 5.6 million jobs have been lost across the 28 countries that belong to the European Union (EU) since the global financial crisis of 2008, Ambrosetti’s economists say. “The economic crisis produced growing unemployment levels in the EU, which now requires bold action from policymakers to boost labor demand as well as to implement labor market structural reforms,” the economists wrote in their “Labor market scenario in Europe” report. Europe’s high unemployment, low price rises and stagnant growth is likely to be a hot topic at this year’s Ambrosetti Forum—the annual get-together of heads of states, top business people and academics at Lake Como in Italy.

The Organization of Economic Co-operation and Development warned this week that unemployment in its member countries will remain well-above pre-crisis levels until 2016 at the earliest. Unemployment averaged 10.3% across the EU in July—the same as in June. Nearly one-quarter (24.5%) of Spaniards were unemployed during the month, along with 12.6% of Italians and 11.5% of Irish citizens. With statistics like these in mind, the Ambrosetti report’s authors cast doubt on the likelihood of the EU meeting its target of creating 20 million new jobs by 2020. “This seems a particularly unrealistic target for Spain, Italy and France: they need to create 4.4 million, 2.5 million and 2 million new jobs respectively,” they wrote.

Break it will.

• Fears Resurface Over Europe Breakup (CNBC)

On Thursday morning, the European Central Bank surprised markets with a raft of stimulative measures including cuts in interest rates and the commencement of asset purchases. The news sent the euro currency much lower, but currency expert Boris Schlossberg of BK Asset Management identifies another reason why the euro could call even further: fresh concerns over a European Union breakup. ECB president Mario Draghi, in announcing the measures, mentioned that the vote was not unanimous. The strongest economy in the eurozone, Germany, is widely expected to have dissented. “It’s a very, very tenuous union in many ways, and we see the conflict come to the forefront anytime we have these issues,” Schlossberg said Thursday on CNBC’s “Futures Now.”

At this point, German unease over ECB stimulus “could become a very, very serious problem,” he said. “We’ll be watching the conflict very carefully in the fall and into the winter to see just how serious the Germans are in their opposition to this move.” Ironically, Schlossberg notes that it was the very reticence of the Germans that forced the ECB into action. The central bank is “the only institution within the eurozone that is able to act in concert. There is is simply no other way for Europeans to stimulate growth, because they have all these disparate governments with different points of view.” But while Schlossberg expects the euro/dollar to fall all the way to 1.2850, he does note that it is “extremely oversold,” and could bounce in the near-term.

• European Businesses Call For No More Sanctions (RT)

The Association of European Businesses has urged the governments of the European Union and Russia to protect foreign investors from any “further retaliatory measures.” The Moscow-based lobby group represents the interests of more than 600 European businesses in Russia, and has written a letter to all 28 heads of state and governments of the EU, as well to the Russian and Ukrainian leadership stressing that among its members “are global companies with businesses in sectors which would be directly affected by these measures.” The group has requested a meeting with European Commission President Jose Manuel Barroso in Kiev next week. “The introduction of such measures could lead to a serious decline in production and jobs, affecting not only manufacturers, but also suppliers and retailers working in these sectors,” the letter, published Thursday, reads. The lobby group says it’s politically neutral, but is interested in keeping business between the two functional.

“All this would harm not only the business of the companies concerned, but also fiscal revenues through the loss of tax and duty payments,” the letter said. Sanctions are putting a brake on business activity in Europe which is plugged into the Russian economy. Trade between Russia and the EU is $440 billion and thousands of companies do regular day-to-day business in Russia. The EU has imposed three rounds of sanctions against Russian individuals and business, most recently expanding the blacklist to include sanctions against key industries- energy, banking, and weapons. Russia retaliated with an embargo on agriculture products from the EU, which could cost $6.6 billion per year in lost exports. EU ministers will meet on Friday to discuss new sanctions against Russia for its perceived role in the Ukraine conflict.

• UK Says New Russian Sanctions Could Be Lifted If Ceasefire Holds (Reuters)

Britain’s Foreign Secretary Philip Hammond said on Friday the West would push ahead with new sanctions against Russia over the crisis in Ukraine but said these could be lifted should a proposed ceasefire take hold. NATO demanded on Thursday that Moscow withdraw its troops from Ukraine, and the European Union and the United States are preparing a new round of economic sanctions against Russia for its incursion. “There will be another step up of the pressure today when the EU meets in Brussels to decide on the next round of sanctions,” Hammond told Sky News from Wales where NATO leaders are meeting. “Our economies are fundamentally more robust and resilient than the Russian economy and if Russia ends up in an economic war with the West, Russia will lose.”

However, he said measures against Russia could be eased if a proposed ceasefire between Ukraine and pro-Russian rebels expected to be agreed later on Friday takes hold. “If there is a ceasefire, if it is signed and if it is then implemented, we can then look at lifting sanctions off but … there is a great degree of scepticism about whether this action will materialise, whether the ceasefire will be real,” Hammond told BBC TV. “We can always take the sanctions off afterwards, I don’t think we want to be distracted from our determination to impose further sanctions in response to Russia’s major military adventure into Ukraine.”

Exactly.

• ‘West Should Take Responsibility for Escalating Ukrainian Crisis’ (RIA)

Western leaders meeting at this week’s NATO summit are almost wholly responsible for the ongoing crisis in Ukraine, Jan Oberg, co-founder of the Sweden-based Transnational Foundation for Peace and Future Research, told RIA Novosti on Friday. “The US, NATO and European Union carry at least 80% of the responsibility for Ukraine’s crisis due to the foreign-provoked regime change in Kiev and the EU ultimatum to Ukraine about either joining the EU or the eastern Customs Union,” Oberg said. “And over the longer term – because of NATO’s expansion from the Baltic republics to Tbilisi.

These policies lack statesmanship, are reckless in the perspective of promises given to ex-Soviet president Mikhail Gorbachev when the old Cold War ended and can be seen only as provocative in the eyes of Russia,” he added. NATO leaders gathered in Wales on Thursday, September 4, for two days of talks focused on Ukraine and the rapid rise of Islamic extremists in Iraq and Syria. They have criticized Russia, calling its influence on the conflict in eastern Ukraine “destabilizing.”

The battle for financial control.

• Russia Sees Serious Threat In FATCA (RT)

Russia’s financial system is “threatened” by America’s new tax law that demands foreign banks report on all American citizens’ banking activities, the Russian Federal Financial Monitoring Service said Thursday. The head of the financial monitoring authority Yury Chikhanchin likened the one-sided data exchange to turning Russian banks into spies for the Americans. “Essentially, our financial institutions are becoming tax informants for the American economy. As similar systems start spreading to other countries, they can bring serious risks to our financial system,” Chikhanchin said at a banking forum in Sochi. FATCA requires foreign banks to provide information on American clients, who have over $10,000 in deposits, to the US Internal Revenue Service (IRS). If a bank does not comply; it can be subject to a 30% fine. Before client information is sent to America, it will pass through the Central Bank of Russia and other local financial or government agencies, which still have the right to keep the information private.

On June 30, just before the deadline, Russia signed a law that allows Russian banks to share the tax data of American clients with US tax authorities, but participation isn’t mandatory. The law simply gives Russian banks the ability to work with FATCA, but does not deem it obligatory. In Russia, only 10% of capital in the financial system is owned by foreigners or foreign entities. Participating Russian banks had to register by May 5, 2014. The Russian financial watchdog believes the American tax law is itself a form of sanctions. The head of the authority believes that such mechanisms can exist, but should be multilateral. Originally Russia planned a bilateral information exchange with the US over FATCA after the law was passed in 2010 but the US Treasury Department suspended negotiations with Russia in March 2014 over the Ukrainian conflict.

Yikes.

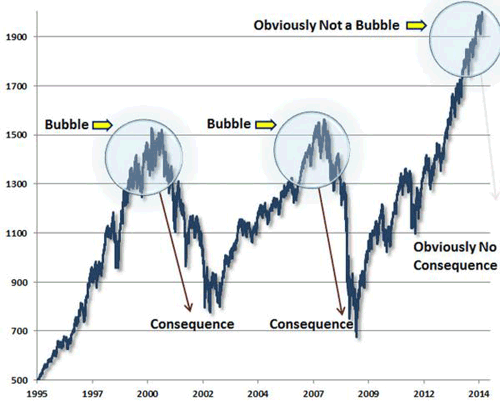

• Obviously Not A Bubble (Zero Hedge)

Via John Hussman… no bubble, no consequences…

• Dallas Fed Chief Repeats Gross Portrayal Of Yellen As ‘Hindu Goddess’ (MW)

Dallas Fed President Richard Fisher knows a good phrase or two when he hears one. So at a speech in front of the U.S.-India Chamber of Commerce and Ambassador S. Jaishankar, Fisher of course trotted out this description of Federal Reserve Chairwoman Janet Yellen’s speech at Jackson Hole, Wyo. on the labor market.

Bill Gross, one of our country’s preeminent bond managers, made a rather pungent comment about our efforts. He noted that President Harry Truman “wanted a one-armed economist, not the usual sort that analyzes every problem with ‘on the one hand, this, and on the other, that.’” Gross claimed that Fed Chair (Janet) Yellen, in her speech given recently at the Fed’s Jackson Hole, Wyo., conference, introduced so many qualifications about the status of the labor market that “instead of the proverbial two-handed economist, she more resembled a Hindu goddess with a half-dozen or more appendages.”

In keeping with the theme of the night, Fisher also pointed out — in calling Texas a job-creating juggernaut — that the term juggernaut is derived from the word Jaganmatha, a title of Krishna. Fisher repeated his concern about the central bank’s policy, saying “we have overshot the mark” on interest rates.

NZ should focus on feeding itself, not the Chinese.

• New Zealand Greens See Road to Ruin in Rivers of Milk (Bloomberg)

New Zealand Prime Minister John Key sees milk and oil driving economic growth for years to come. The Green Party says he’s running a “pollution economy” that’s destroying the country’s clean-green brand. The debate about the future shape of New Zealand’s economy is at the heart of the campaign for the Sept. 20 election, in which the Greens could prove pivotal in denying Key a third term in office. The ruling National Party’s growth plan relies on increasing export earnings from the dairy and fossil-fuel industries, which generate more than NZ$18 billion ($15 billion) a year and employ 60,000 people. Oil prospectors scouring marine sanctuaries and cow urine polluting rivers are at odds with New Zealand’s “100% Pure” tourism pitch and the pristine scenery depicted in the Lord of the Rings and Hobbit movies. “We’re doing exactly the wrong thing,” Greens co-leader Russel Norman said in an interview. “People want food that is clean, green and safe. New Zealand has a great opportunity to provide that. Instead, we’re pursuing a pollution economy.”

New Zealand’s 180,000 kilometers (112,000 miles) of rivers are a vital source of water for the dairy industry, which has expanded from pastures in the North Island’s Waikato region into the rolling hills and patchwork plains of the South Island. The number of cows has almost doubled in the past 20 years to 4.8 million. Effluent from the animals has discolored waterways, while the nitrogen from their urine is soaking through the soil to contaminate groundwater, spoil rivers and choke lakes with algal bloom, a parliamentary report said last year: “The large-scale conversion of more land to dairy farming will generally result in more degraded fresh water”. “New Zealand does face a classic economy versus environment dilemma.” Norman, 47, says dairy farming focused on volume is destroying New Zealand’s environmental credentials and hurting the industry itself. “It’s very shortsighted to maximize production of milk powder,” he said. “We need to accept we’re never going to feed the world and focus on selling to people who want high-value products. The long-term future of dairying is dependent on protecting the brand.”

I know I say this a lot, but: Not surprised.

• Secret Network Connects Harvard Money to Payday Loans (Bloomberg)

Alex Slusky was under pressure to put the money in his private-equity fund to work. The San Francisco technology financier had raised $1.2 billion in 2007 to buy and turn around struggling software companies. By 2012, investors including Harvard University were upset that about half the money hadn’t been used, according to three people with direct knowledge of the situation. Three Americans on the Caribbean island of St. Croix presented a solution. They had built a network of payday-lending websites, using corporations set up in Belize and the Virgin Islands that obscured their involvement and circumvented U.S. usury laws, according to four former employees of their company, Cane Bay Partners VI LLLP. The sites Cane Bay runs make millions of dollars a month in small loans to desperate people, charging more than 600 percent interest a year, said the ex-employees, who asked not to be identified for fear of retaliation.

Slusky’s fund, Vector Capital IV LP, bought into Cane Bay a year and a half ago, according to three people who used to work at Vector and the former Cane Bay employees. One ex-Vector employee said the private-equity firm didn’t tell investors the company is in the payday-lending business, where borrowers repay loans out of their next paychecks. Vector’s investment in Cane Bay shows the continuing allure of the payday-loan business, even after most states from California to New York restricted or banned it to protect consumers. The crackdown has driven borrowers online. Internet payday lending in the U.S. has doubled since 2008 to $16 billion a year, with half made by lenders based offshore or affiliated with American Indian tribes who say state laws don’t apply to them, according to John Hecht, an analyst at Jefferies Group LLC in San Francisco.