Piet Mondriaan Trees by the Gein at Moonrise 1908

A lot of seemingly serious people are commenting on the bad theater the Democratic debate has become. Nothing better to do with your lives?! It doesn’t matter what any of the ‘candidates’ says or does, the DNC will pull another Bernie 2016. It’s bad theater, it’s cheap, you’re being had, and everyone who watches it should watch themselves instead.

Yeah, just like the central banks. To clean up the US economy, you have to take -most of- the Fed’s powers away. To clean up US politics, you have to burn down the DNC. Or Trump will win forever.

• Jerome Powell Finds Another Way To Please Nobody (R.)

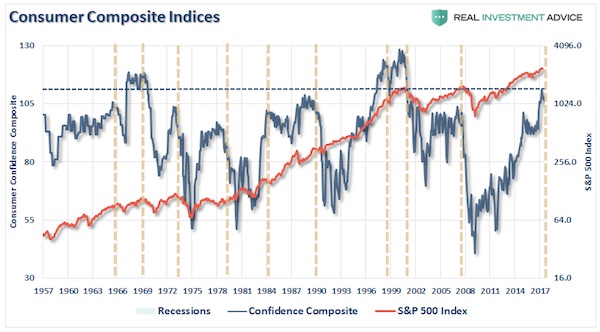

The Federal Reserve has turned. The U.S. central bank on Wednesday cut its target overnight interest cost by a quarter percentage point, to a range of 2% to 2.25%. For some, like U.S. President Donald Trump, that’s surely not enough. For others – and going by most economic statistics – it’s too much. Fed Chairman Jerome Powell has found another way to please nobody. The last federal-funds rate reduction was in 2008, as the financial crisis cut deep. It then bounced along near zero for seven years before Powell’s predecessor, Janet Yellen, oversaw the start of a period of gradual rate hikes in late 2015. Since a quarter-point hike last December, the Fed had held steady at 2.25%-2.5%, until now.

The proximate causes of the move are external – mainly the threat to economic activity from Trump’s confrontational stance on trade. It’s a telling irony that a president who claims the Fed is damping the benefits of his policies by holding rates too high is providing one of the few reasons for the U.S. central bank to cut them. Wednesday’s modest move by the Federal Open Market Committee surely won’t satisfy him. Yet seen through the lens of the Fed’s dual mandate – full employment and stable prices – everything is still humming as the longest expansion in U.S. history enters its second decade, with economic growth steady, unemployment at historic lows and inflation tame. Prices increased just 1.4% in the year to June by the personal consumption expenditures measure, released on Tuesday.

The Fed would prefer inflation nearer its 2% target but that’s a somewhat flimsy rationale for lower rates given the backdrop. A significant minority of traders, meanwhile, expected a half-point cut, according to CME data, so they’ll be disappointed, too – even though buoyant stock and credit markets are hardly crying for help. Two of Powell’s colleagues also dissented, preferring not to cut rates, so they’re unhappy for a different reason.

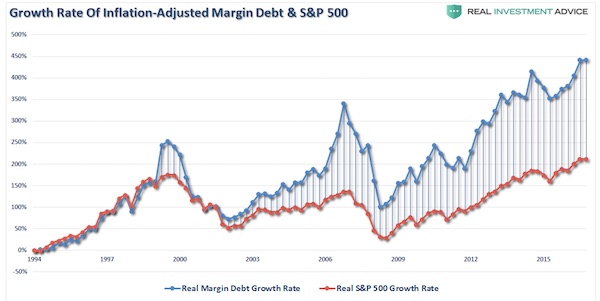

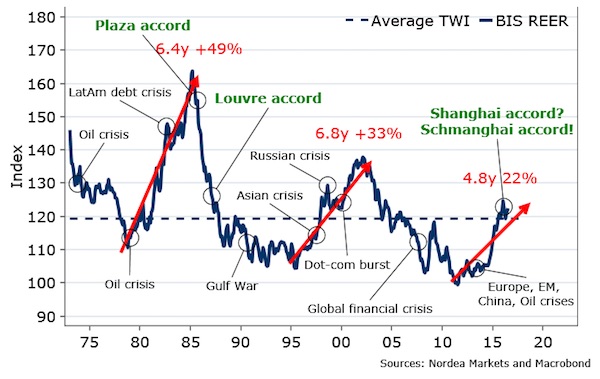

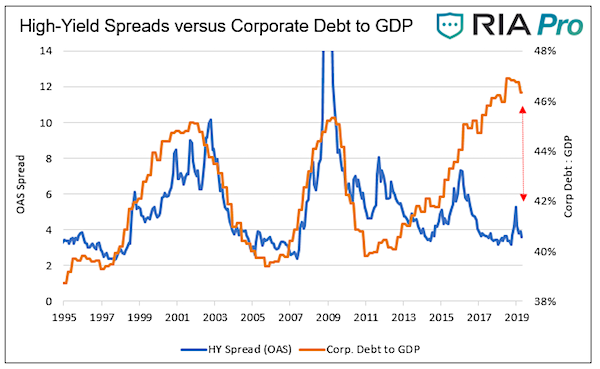

As everyone is staring at a 25 bps cut, here’s where the action is. An economy distorted beyond recognition.

• The Fed’s Massive Debt for Equity Swap (RIA)

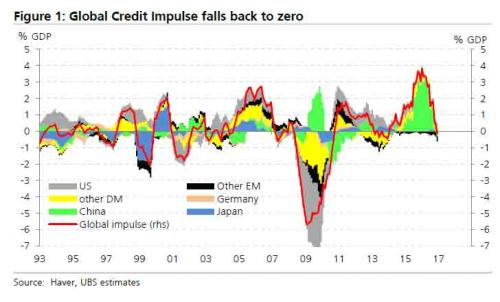

Since QE began, nearly 30% of the new corporate debt issued was used for stock buybacks. Putting the pieces of the mosaic together, it is fair to say the most intense corporate debt-for-equity swap in recorded history was enabled by the Fed via monetary policy and the federal government through tax-cuts. This is symptomatic of a variety of issues that have been created by prolonged extraordinary monetary policy. In the same way that corporate behavior has been seriously altered as described above, every central bank in the developed world has undertaken even more extreme measures to foster growth, dictating that the behavior of market participants transform in some manner.

The chart below is a stark reminder of how the Fed has changed the natural order of the corporate debt market. Over the past 25 years, when corporate debt loads became onerous, investors required higher yields and wider spreads to compensate them for the added risks. Today, despite the extreme amount of corporate leverage and the low quality of corporate credit, junk spreads remain near all-time lows. As shown below and highlighted by the red arrow, the long-standing correlation between leverage and high yield spreads is broken.

Making sure Lagarde must stick with the program. Draghi is the craziest of them all.

• Mario Draghi Lays Out Plan For A Dangerous Round Of Stimulus (Sinn)

Expectations – and, for many economists, rather bad ones – have been confirmed: the European Central Bank has decided to inflate the eurozone. Following the ECB’s latest policy meeting on 25 July, the outgoing president Mario Draghi made it clear that the bank’s seemingly harmless inflation target of 1.9% will in fact be the basis for a new phase of expansionary monetary policy over the next few years. This will go well beyond the ECB’s stimulus measures to date and is likely to pose further risks to the European economy. We should remember that the Maastricht treaty assigned the ECB the single, non-negotiable goal of maintaining stable prices, which, if taken literally, would mean an inflation rate of zero.

This is very different from the mandate given to other central banks. The introduction of the euro, however, caused interest rates in southern Europe to fall, leading to an inflationary bubble that raised annual price growth to well over 2% in some countries. The ECB’s governing council then argued that the goal of price stability could not be achieved exactly and also pointed to several measurement errors that complicate policymaking. So, the authorities said, they would tolerate average inflation of up to 2% for the eurozone as a whole. The governing council did not fancy a restrictive monetary policy aimed at reducing inflation, as it gave only little weight to the risk of reducing competitiveness in some countries and did not want to slow down countries in stagnation such as Germany.

Then came the euro crisis. With inflation plummeting, the ECB turned the still-tolerable upper limit for the inflation rate into its target. Suddenly, it was argued, the bank would seek to achieve inflation of “close to, but below 2%”. Draghi even went before the television cameras to claim in all seriousness that this was the ECB’s mandate. And now, at the end of his term of office, Draghi is seeking to bind his successor, Christine Lagarde, to a council decision that will force her to aim for 1.9% inflation with a symmetrical concern about potential deviations. In plain language, this means the ECB will try to achieve this figure on average over time, netting out future above-average inflation rates with below-average inflation in recent years.

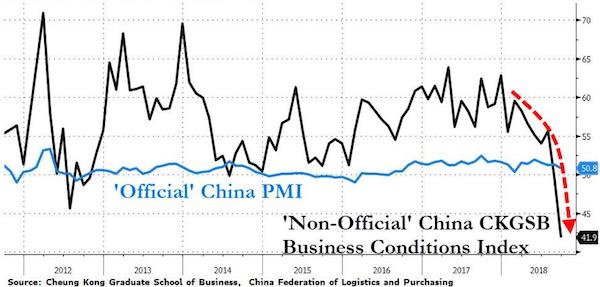

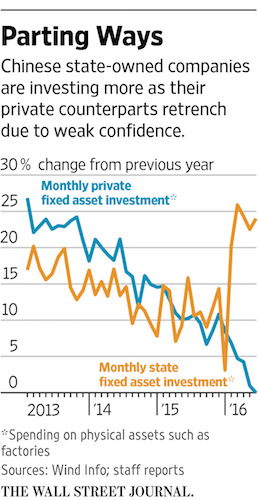

Xi demands total control. Trump wants Powell to make him look good, Xi demands that tripled and cubed. And he gets no dissent.

• PBOC Keeps Powder Dry After Fed Rate Cut, But More Easing Expected (R.)

China’s central bank kept its main policy rates on hold on Thursday, opting not to follow an overnight benchmark rate cut by the U.S. Federal Reserve as policymakers wait to see if earlier support measures start to stabilize the economy. But market watchers say continued support is still needed, and expect more modest forms of policy easing from the People’s Bank of China (PBOC) in coming months if pressure on the economy persists. Amid mounting worries about risks to global growth, the Fed lowered its benchmark rate by a quarter-point on Wednesday, as expected, but the head of the U.S. central bank ruled out a long series of cuts.

Though China’s central bank does not always follow the Fed’s moves in lockstep, some analysts had thought a token PBOC cut, likely in one of its short-term rates, was a possibility. However, no move was apparent by midday on Thursday. The PBOC refrained from daily open market operations (OMOs) early in the session, saying banking system liquidity was “reasonably ample”. “The PBOC skipped OMOs and hence there was no rate adjustment,” said Frances Cheung, head of Asia macro strategy at Westpac in Singapore. “The market may need to wait until mid-August when the next tranche of medium term lending facility (MLF) matures to see if there is any action. Arguably they can adjust policy parameters anytime, and are not constrained by any meeting schedule, but we see no pressure on OMO rates.”

No-deal Brexit is a big headache for Carney. He still has a full three months to go after Halloween. It will be messy.

• Bank of England To Lean Against Market Rate Cut Bets As Brexit Nears (R.)

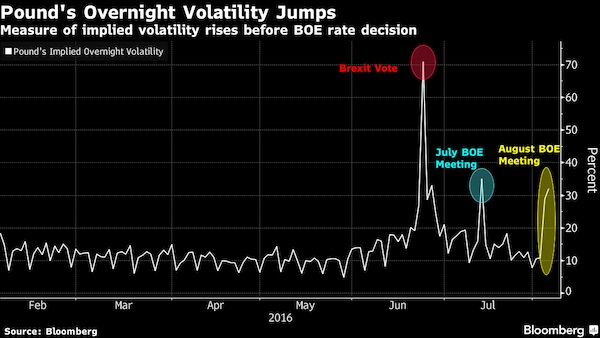

The Bank of England is likely to push back on Thursday against investors who bet that it will follow other central banks and cut rates in the coming months, even as the risk of a messy Brexit darkens growth prospects. Economists polled by Reuters are almost certain that the BoE’s Monetary Policy Committee will vote 9-0 to keep rates on hold at 0.75%. But it is less clear how Governor Mark Carney will tackle the challenge posed by a possible no-deal Brexit. New Prime Minister Boris Johnson has said he will take Britain out of the European Union on Oct. 31 without a transition deal if Brussels does not rewrite the deal it hammered out with his predecessor Theresa May.

The risk of a disruptive no-deal Brexit that could push Britain into a recession means interest rate futures now price in an almost 90% chance of a 25 basis point rate cut before Carney steps down at the end of January. The U.S. Federal Reserve reduced its main interest rate by a quarter of a percentage point on Wednesday, and the European Central Bank is expected to take similar action next month, as both battle a slowdown driven by the U.S.-China trade conflict. But the BoE says Britain is a special case. Chief economist Andy Haldane highlighted last week how British rates had not risen to anything like the extent they had in the United States, while Britain’s job market and inflation were much more buoyant than in the euro zone.

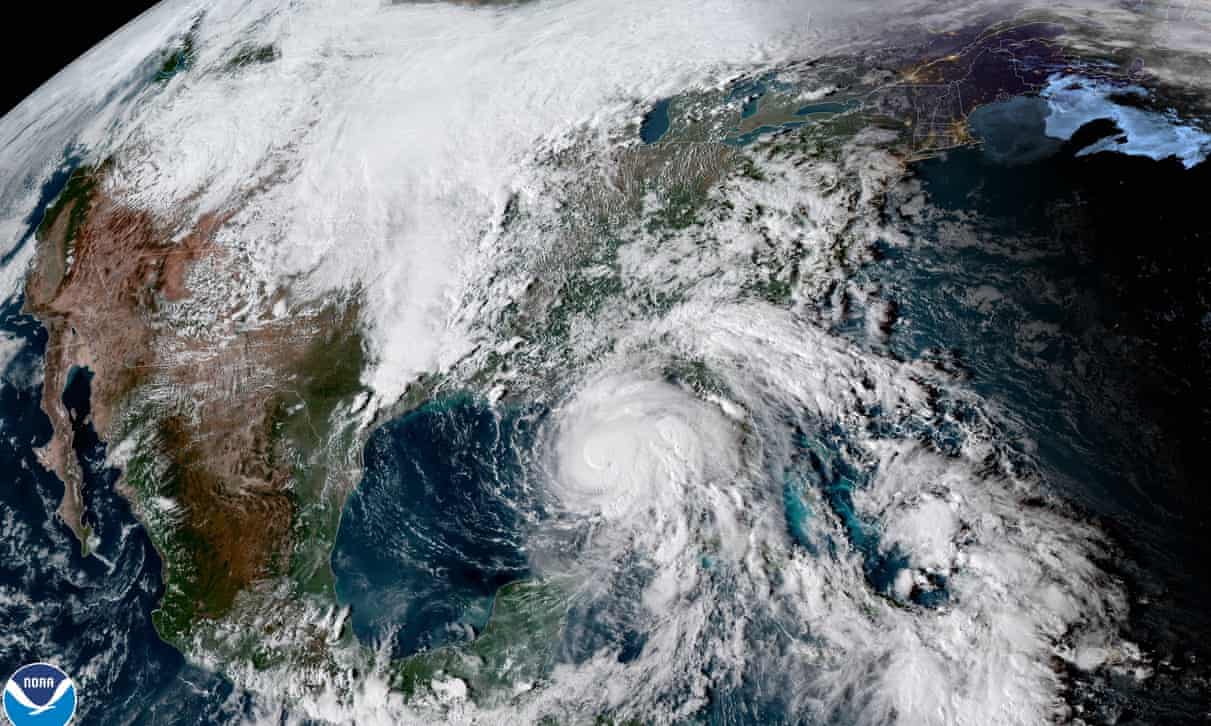

Carney wrote that article with Michael Bloomberg talking about how to make a profit off of disaster. And here again: ..there will be great fortunes made along this path aligned with what society wants.” Dangerous.

• Capitalism Is Part Of Solution To Climate Crisis, Says Mark Carney (G.)

Capitalism is “very much part of the solution” to tackling the climate crisis, according to the governor of the Bank of England, Mark Carney. Challenged in an interview by the Channel 4 News presenter Jon Snow over whether capitalism itself was fuelling the climate emergency, Carney gave a strident defence of the economic system predicated on private ownership and growth but said companies that ignored climate change would “go bankrupt without question”. “Capitalism is part of the solution and part of what we need to do,” he said in the interview broadcast on Wednesday.

The economist, who previously worked for Goldman Sachs, said he recognised the costs of ignoring climate change were rising, but stressed there were increasing opportunities for “doing something about it”, and that capital would shift in this direction. “Now there is $120tn of capital behind that framework that is saying to companies: ‘Tell us how you are going to manage these risks’ – that’s the first thing,” Carney said.

“The second thing the capitalist system needs to do is to manage the risks around climate change, be ready for the different speeds of the adjustment. And then the most important thing is to move capital from where it is today to where it needs to be tomorrow. The system is very much part of the solution.” He added: “Companies that don’t adapt – including companies in the financial system – will go bankrupt without question. [But] there will be great fortunes made along this path aligned with what society wants.”

Corrupt to the core.

• UK’s Biggest Financial Scandal Bites Its Biggest Bank – Again (Coppola)

To the surprise of markets and the chagrin of shareholders, the U.K.’s largest lender, Lloyds Banking Group, has reported disappointing profits for the second quarter of 2019. And no, it’s not because of Boris Johnson’s antics or the prospect of no-deal Brexit. It’s the final flourish of a much older issue – the U.K.’s long-running PPI scandal. Lloyds has had to take an additional provision of £550m ($670m) to cover a flurry of new PPI claims. This reduced its half-year profit to a paltry £2.2bn ($2.7bn). The share price dropped 5% on the news. Mis-selling of payment protection insurance (PPI) is by far the U.K.’s biggest financial scandal.

The Financial Conduct Authority (FCA) says that since January 2011, British banks and financial institutions have paid out £37.5bn ($45.73bn) in compensation to customers who were wrongly sold PPI insurance. Lloyds Banking Group alone accounts for more than half of this total. The origins of the scandal date back to the 1990s, when financial institutions in the U.K. started selling PPI on lending products including mortgages, car loans and credit cards. PPI was meant to cover loan interest and repayments if the customer became unable to pay, for example due to illness or unemployment. As it was highly profitable for lenders and insurance companies, it was, unsurprisingly, heavily promoted. By 2005, there were an estimated 20 million PPI contracts in existence with annual gross premiums of over £5bn ($6.1bn).

PPI was expensive: premiums could raise the cost of a loan by up to 50%. And it mostly didn’t work. In 2005, the U.K.’s Citizens’ Advice Bureau (CAB) complained that there were so many exclusion clauses in the contracts and administrative barriers to claiming that many people couldn’t make successful claims. Furthermore, the CAB reported, people were being sold policies that they did not need or were unsuitable for them.

Over a million pages of evidence. Ghislaine Maxwell must have bought an industrial scale shredder.

• Jeffrey Epstein Could Spend At Least A Year In Jail Before Trial (F.)

A Wednesday court hearing determined that Jeffrey Epstein’s trial for two federal counts of sex trafficking and conspiracy will begin no sooner than June 8, 2020, while his lawyers requested more time to prepare “a case of this magnitude.” Prosecutors said in the hearing that bringing the case to trial quickly is in the public’s interest. Epstein’s lawyer, Martin Weinberg, said they expect to review more than one million pages of evidence while preparing his case. Given the large amount of evidence, Epstein’s team asked for his trial to begin in September 2020, after Labor Day.

Wednesday’s hearing was Epstein’s first court appearance after a possible suicide attempt, and a day after he was reportedly served a new lawsuit from a woman claiming he raped her as a 15-year-old. He showed no signs of injuries, specifically bruising on his neck, from the potential suicide attempt. Epstein is being held in a Manhattan jail without bail, and will likely remain there until his trial begins next year. If convicted, he could spend up to 45 years in prison.

Horowitz was ready to go. Barr said too soon.

• James Comey’s Next Reckoning Is Imminent — This Time For Leaking (Solomon)

The Justice Department’s chief watchdog is preparing a damning report on James Comey’s conduct in his final days as FBI director that likely will conclude he leaked classified information and showed a lack of candor after his own agency began looking into his feud with President Trump over the Russia probe. Inspector General (IG) Michael Horowitz’s team referred Comey for possible prosecution under the classified information protection laws, but Department of Justice (DOJ) prosecutors working for Attorney General William Barr reportedly have decided to decline prosecution — a decision that’s likely to upset Comey’s conservative critics.

Prosecutors found the IG’s findings compelling but decided not to bring charges because they did not believe they had enough evidence of Comey’s intent to violate the law, according to multiple sources. The concerns stem from the fact that one memo that Comey leaked to a friend specifically to be published by the media — as he admitted in congressional testimony — contained information classified at the lowest level of “confidential,” and that classification was made by the FBI after Comey had transmitted the information, the sources said. Although a technical violation, the DOJ did not want to “make its first case against the Russia investigators with such thin margins and look petty and vindictive,” a source told me, explaining the DOJ’s rationale.

But Comey and others inside the FBI and the DOJ during his tenure still face legal jeopardy in ongoing probes by the IG and Barr-appointed special prosecutor John Durham. Those investigations are focused on the origins of the Russia investigation that included a Foreign Intelligence Surveillance Act (FISA) warrant targeting the Trump campaign at the end of the 2016 election, the source said.

It all hinges on Julian helping -and failing- Chelsea (Bradley) find an identity to hide behind.

• Judge’s Ruling Throws Huge Spanner Into Assange Extradition Proceedings (Can.)

A US judge has ruled that WikiLeaks was fully entitled to publish the Democratic National Congress (DNC) emails, which means no law was broken. The ruling is highly significant as it could impact upon the US extradition proceedings against WikiLeaks founder Julian Assange, as well as the ongoing imprisonment of whistleblower Chelsea Manning. On 30 July, federal judge John G. Koeltl ruled on a case brought against WikiLeaks and other parties in regard to the alleged hacking of DNC emails and concluded that: “If WikiLeaks could be held liable for publishing documents concerning the DNC’s political financial and voter-engagement strategies simply because the DNC labels them ‘secret’ and trade secrets, then so could any newspaper or other media outlet.”

In other words, if WikiLeaks is subject to prosecution, then every media outlet in the world would be. The judge argued that: “[T]he First Amendment prevents such liability in the same way it would preclude liability for press outlets that publish materials of public interest despite defects in the way the materials were obtained so long as the disseminator did not participate in any wrongdoing in obtaining the materials in the first place.” Significantly, the judge added that it’s not criminal to solicit or “welcome” stolen documents, and how: “A person is entitled to publish stolen documents that the publisher requested from a source so long as the publisher did not participate in the theft.”

[..] Greg Barns, a barrister and longtime adviser to the Assange campaign, told The Canary: “The Court, in dismissing the case, found that the First Amendment protected WikiLeaks’ right to publish illegally secured private or classified documents of public interest, applying the same First Amendment standard as was used in justifying the The New York Times publication of the Pentagon Papers. That right exists, so long as a publisher does not join in any illegal acts that the source may have committed to obtain that information. But that doesn’t include common journalistic practices, such as requesting or soliciting documents or actively collaborating with a source. So this case is important in restating what is and is not protected under the First Amendment. But does it have implications for the extradition hearing? Well it certainly helps to remind the courts in the UK that the First Amendment protection is very broad.”

Moving backward.

• Beijing Orders Arabic, Muslim Symbols Taken Down (R.)

Authorities in the Chinese capital have ordered halal restaurants and food stalls to remove Arabic script and symbols associated with Islam from their signs, part of an expanding national effort to “Sinicize” its Muslim population. Employees at 11 restaurants and shops in Beijing selling halal products and visited by Reuters in recent days said officials had told them to remove images associated with Islam, such as the crescent moon and the word “halal” written in Arabic, from signs. Government workers from various offices told one manager of a Beijing noodle shop to cover up the “halal” in Arabic on his shop’s sign, and then watched him do it.

“They said this is foreign culture and you should use more Chinese culture,” said the manager, who, like all restaurant owners and employees who spoke to Reuters, declined to give his name due to the sensitivity of the issue. The campaign against Arabic script and Islamic images marks a new phase of a drive that has gained momentum since 2016, aimed at ensuring religions conform with mainstream Chinese culture. The campaign has included the removal of Middle Eastern-style domes on many mosques around the country in favor of Chinese-style pagodas. China, home to 20 million Muslims, officially guarantees freedom of religion, but the government has campaigned to bring the faithful into line with Communist Party ideology.