Salvador Dali Crepuscular old man 1918

Sink

Entering Twitter HQ – let that sink in! pic.twitter.com/D68z4K2wq7

— Elon Musk (@elonmusk) October 26, 2022

Can’t shake the idea that Hedges is stuck in his cold war past. I don’t think there will be nuclear war. Threat, sure, but…

• Stop Worrying & Love the Bomb (Chris Hedges)

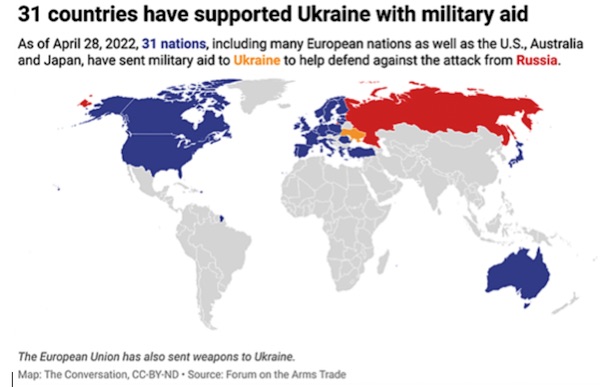

I have covered enough wars to know that once you open that Pandora’s box, the many evils that pour out are beyond anyone’s control. War accelerates the whirlwind of industrial killing. The longer any war continues, the closer and closer each side comes to self-annihilation. Unless it is stopped, the proxy war between Russia and the U.S. in Ukraine all but guarantees direct confrontation with Russia and, with it, the very real possibility of nuclear war. U.S. President Joe Biden, who doesn’t always seem to be quite sure where he is or what he is supposed to be saying, is being propped up in the I-am-a-bigger-man-than-you contest with Russian President Vladimir Putin by a coterie of rabid warmongers who have orchestrated over 20 years of military fiascos. They are salivating at the prospect of taking on Russia, and then, if there is any habitation left on the globe, China.

Trapped in the polarizing mindset of the Cold War — where any effort to de-escalate conflicts through diplomacy is considered appeasement, a perfidious Munich moment — they smugly push the human species closer and closer toward obliteration. Unfortunately for us, one of these true believers is Secretary of State Antony Blinken. “Putin is saying he is not bluffing. Well, he cannot afford bluffing, and it has to be clear that the people supporting Ukraine and the European Union and the Member States, and the United States and NATO are not bluffing neither,” E.U. foreign policy chief Josep Borrell warned. “Any nuclear attack against Ukraine will create an answer, not a nuclear answer but such a powerful answer from the military side that the Russian Army will be annihilated.” Annihilated. Are these people insane?

You know we are in trouble when former Donald Trump is the voice of reason. “We must demand the immediate negotiation of a peaceful end to the war in Ukraine, or we will end up in world war three” the former U.S. president said. “And there will be nothing left of our planet — all because stupid people didn’t have a clue … They don’t understand what they’re dealing with, the power of nuclear.” I dealt with many of these ideologues — David Petraeus, Elliot Abrams, Robert Kagan, Victoria Nuland — as a foreign correspondent for The New York Times. Once you strip away their chest full of medals or fancy degrees, you find shallow men and women, craven careerists who obsequiously serve the war industry that ensures their promotions, pays the budgets of their think tanks and showers them with money as board members of military contractors.

They are the pimps of war. If you reported on them, as I did, you would not sleep well at night. They are vain enough and stupid enough to blow up the world long before we go extinct because of the climate crisis, which they have also dutifully accelerated. If, as Joe Biden says, Putin is “not joking” about using nuclear weapons and we risk nuclear “Armageddon,” why isn’t Biden on the phone to Putin? Why doesn’t he follow the example of John F. Kennedy, who repeatedly communicated with Nikita Khrushchev to negotiate an end to the Cuban missile crisis? Kennedy, who unlike Biden served in the military, knew the obtuseness of generals. He had the good sense to ignore Curtis LeMay, the Air Force chief of staff and head of the Strategic Air Command, as well as the model for General Jack D. Ripper in “Dr. Strangelove,” who urged Kennedy to bomb the Cuban missile bases, an act that would have probably ignited a nuclear war. Biden is not made of the same stuff.

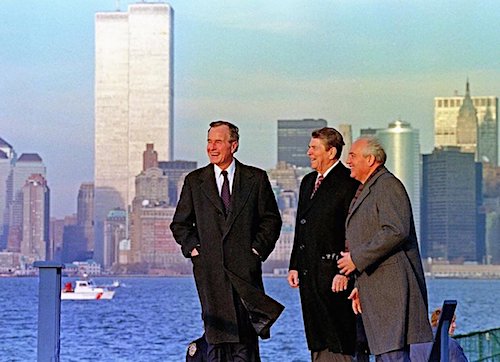

[..] The West has been baiting Moscow for decades. I reported from Eastern Europe at the end of the Cold War. I watched these militarists set out to build what they called a unipolar world — a world where they alone ruled. First, they broke promises not to expand NATO beyond the borders of a unified Germany. Then they broke promises not to “permanently station substantial combat forces” in the new NATO member countries in Eastern and Central Europe. Then they broke promises not to station missile systems along Russia’s border. Then they broke promises not to interfere in the internal affairs of border states such as Ukraine, orchestrating the 2014 coup that ousted the elected government of Victor Yanukovich, replacing it with an anti-Russian — fascist aligned — government, which, in turn, led to an eight-year-long civil war, as the Russian populated regions in the east sought independence from Kiev.

“We have eight different 155mm artillery systems in the field … so it’s like a competition between systems” to see which one proves best..”

• Ukraine Is Test Range For Western Arms – Russia Defense Minister (RT)

The conflict in Ukraine gives Western arms producers a chance to see which products fare best in a real fight against Russia, the country’s defense minister has said.“We have a combat testing field in Ukraine during this war,” Aleksey Reznikov explained. “We have eight different 155mm artillery systems in the field … so it’s like a competition between systems” to see which one proves best. The comments came in an interview with Politico published on Tuesday. The testing ground idea was previously expressed by Reznikov’s deputy, Vladimir Gavrilov, who claimed that some American defense contractors were fielding their prototypes in Ukraine.Kiev expects military aid from NATO members to continue flowing into the country for years and wants to benefit more from it, Reznikov said. For example, Ukraine could start joint ventures with Poland, the UK, or Germany to produce weapons.

“We have to develop a UAV (unmanned aerial vehicle) industry not only for aerial drones but also on land and in the sea because it’s the future” of warfare, he noted. He was also skeptical about restrictions under which Ukraine’s supporters are shipping arms to Kiev. As the conflict with Russia unfolded, the US and its allies have repeatedly reconsidered previous decisions not to send heavier weapons, the defense minister pointed out. “I’m really optimistic that Abrams tanks are possible in the future and I am sure that fighter jets like F-16s, F-15s, or Gripen from Sweden will also be possible,” he said. Washington was initially reluctant to provide lethal aid to Ukraine out of concern that Russia would consider it an escalation but gradually reconsidered and supplied increasingly sophisticated weapons, which Reznikov sees as a favorable trend.

Western officials cited logistical issues with training Ukrainian pilots and maintenance of the fighter jets among the reasons why Ukraine can’t get F-16s or F-15s. But according to media reports, Kiev may get them in the long run. Reznikov said European NATO allies were looking to the US in their aid decisions, so it was up to Washington to up the ante. “After the first Abrams [arrives] I’m sure we will have Leopards, Marders, and other types of heavy armored vehicles like tanks,” he told the news outlet. Among the weapons the US most recently designated for Ukraine are the NASAMS air defense systems. Washington is also reportedly considering sending some old HAWK surface-to-air missiles it has stockpiled to see if they are still effective.

“..70% of weapons supplied to Ukraine never make it to the front lines as they have to pass through a network of “power lords, oligarchs and political players.”

• Weapons Sent To Ukraine End Up On Black Market – Putin (RT)

Western weapons flowing into Ukraine have begun to make their way onto black markets, Russian President Vladimir Putin said during a meeting with the heads of security and special services of the Commonwealth of Independent States (CIS) countries on Wednesday. The Russian leader called on the participants of the meeting to bolster cooperation in anti-terrorism efforts and noted that there were “serious challenges” posed by the emerging black arms markets in Ukraine. Putin claimed that “cross-border criminal groups” were actively involved in smuggling weapons to other regions and that it wasn’t just small firearms. “There is a persistent risk of criminals getting hold of more powerful weapons, including portable air defense systems and precision weapons.”

The president’s statement comes after Russia’s permanent representative to the UN, Vassily Nebenzia, warned last month that corrupt Ukrainian officials had established channels to deliver Western-supplied weapons onto the global black market. Meanwhile, the West’s top military officials have admitted that it is nearly impossible to effectively track where the billions of dollars worth of arms delivered to Ukraine actually end up. Pentagon Inspector General Sean O’Donnell told Bloomberg in August that there was almost no fidelity as the Ukrainians still used paper “hand receipts” to trace supplied weapons. CBS News also reported that some 70% of weapons supplied to Ukraine never make it to the front lines as they have to pass through a network of “power lords, oligarchs and political players.”

“There is really no information as to where they’re going at all,” Donatella Rovera, a senior crisis adviser with Amnesty international told the outlet, adding that it was “really worrying” that the countries supplying these weapons do not find it necessary to put in place robust oversight mechanisms. CBS was later pressured, however, to pull the documentary and amend the story after the channel was accused of spreading “Russian propaganda.” Ukrainian presidential adviser Mikhail Podoliak has insisted there is “no proof” that weapons entering the country were unaccounted for. Ukraine has insisted that an uninterrupted flow of Western weapons is the key to the country’s survival on the battlefield. Russia, meanwhile, has warned on multiple occasions that pumping Kiev with weapons will only prolong the conflict.

As Russia spoke just once about self protection.

• US Vows To Protect Allies With Nukes (RT)

The US military will unleash its full arsenal, including nuclear weapons, to protect South Korea and Japan from attack, a top State Department official has said, also blasting Pyongyang for its “dangerous” and “destabilizing” weapons tests, while vowing “ironclad” cooperation with allies in Asia. Speaking ahead of multiple rounds of talks in Japan’s capital with her South Korean and Japanese counterparts on Tuesday, US Deputy Secretary of State Wendy Sherman said Washington would deploy its “nuclear, conventional and missile defense” forces should the two allies ever come under attack, emphasizing the US’ ‘nuclear umbrella’ policy.

Sherman went on to condemn recent missile launches by North Korea – a major focus of this week’s meetings – slamming the DPRK’s record number of weapons tests this year as “deeply irresponsible, dangerous, and destabilizing.” During a separate meeting held with Sherman before the three-way sit-down alongside Japan, South Korean First Vice Foreign Minister Cho Hyundong said Pyongyang’s actions were “creating serious tension on the Korean Peninsula,” sounding the alarm over an update to North Korea’s nuclear weapons policies last month.In addition to a flurry of weapons tests and shows of force in retaliation to joint US-South Korean war games, the North recently announced that it had carried out a drill simulating the loading of tactical nuclear warheads into a silo hidden below a reservoir, part of a series of exercises launched in September to ensure the readiness of its nuclear forces.

North Korea maintains its nuclear arsenal is intended only for self-defense, and has criticized joint US-South Korean military drills time and again as rehearsals for an invasion. US officials have repeatedly predicted an imminent North Korean nuclear test in recent months, though the country has refrained from any live detonations since 2017. Nonetheless, the forecasts come amid a major spike in tensions between the two Koreas, as both sides continue to issue threats and carry out military demonstrations. On Wednesday, Washington, Seoul, and Tokyo pledged deeper military ties amid “provocations” by Pyongyang, and also “agreed that an unparalleled scale of response would be needed in case North Korea conducts a seventh nuclear test,” a South Korean official told reporters.

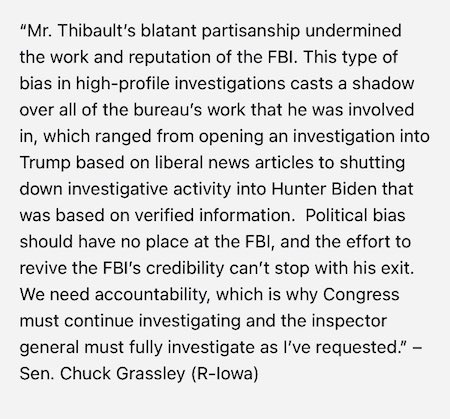

“To the demented minds of the Neocons, total chaos would look better than total defeat, right?”

• About The “Dirty Bomb” Thesis And The Role Of Hatred (Saker)

[Sidebar: right now, NATO simply does not have the forces needed to attack Russia with any hope of success. One single Airborne Brigade Combat Team won’t make *any* difference here. And even if the US decides to go to a full mobilization (which is really impossible, good luck with that!), it would have to bring those forces to Europe. And even if the US can bring in, say, 1’000’000 million men, it will be far easier for Russia to mobilize, say, 3’000’000 men in response. Then what? And did I mention that as soon as the US ships set sail, Russia will obliterate any ports and facilities expecting to receive the US forces. Try this: take the full Polish, 3B, Romanian and Ukronazi armed forces, then add the FULL 101st and 82nd and what do you get? A multinational (“combined”) force which was never designed to operate in such a convoluted way, especially against the better-than-peer united military under a single command! And I won’t even go into such thorny issues as assembly points, maneuver, logistics, air defenses, etc. As I have said, this is all optics, optics and more optics, nothing more]

While zombies like Brandon and his “genius” VP are clueless about any of that, there must be at least a few folks in the Pentagon or the letter soup agencies who understand the simple fact that the way things look now, the Hegemony has three options: • Be defeated • Declare victory and leave (same deal, just with a tiny fig leaf for modesty) • Commit suicide by attacking Russia directly. Not very good perspectives. So here is one more: how about creating total chaos and hope that something advantageous comes out of it? In other words, while setting off a dirty bomb will do nothing in purely military terms (it sure won’t stop the Russian military), it will create such a huge political reaction that the current situation will turn into total chaos, panic, rumors, lies, etc. To the demented minds of the Neocons, total chaos would look better than total defeat, right?

Yes, I know, nobody with half a brain will ever sincerely believe that the Russians did it. But if past behavior is the best predictor of future behavior, I would submit that there will always be enough doubleplusgoodshitheaters in the Hegemony to believe literally *anything* no matter how self-evidently stupid and preposterous that *anything* is. We do, after all, live in a society were nobody teaches how to think anymore (schools just make kids dumber and dumber) and the vast majority of people still reply on legacy corporate propaganda machine to get what they think is “information”. Not to mention that on a psychological and spiritual level, we live not only in a post-Christian society, but even a post-Truth society in which true and false have simply lost any objective meaning other than “like it” or “I don’t like it”. We could even call this a “post-reality” society!

NATO is an empty echo chamber.

• NATO Warns Russia And Iran (RT)

Russia now falsely claims Ukraine is preparing to use a radiological “dirty bomb” on its own territory, said NATO Secretary General Jens Stoltenberg, Report informs, citing NATO. NATO Allies reject this transparently false allegation: “Russia often accuses others of what they intend to do themselves. We have seen this pattern before. From Syria to Ukraine. Russia must not use false pretexts for further escalation.” According to Stoltenberg, the world is watching closely: “Russia’s brutal war and illegal war is at a pivotal moment. President Putin is responding to his failures on the battlefield with more aggression. Strikes on civilians, on civilian energy infrastructure. And drone and missile attacks on residential areas.” “In recent days, we have also seen Iran provide military support to the Russian war effort. This is unacceptable. No country should be helping the aggressor in an illegal war. So I welcome that Allies and the European Union are implementing strong sanctions on Tehran,” he said.

“..Washington has “worked collaboratively to improve Ukraine’s biological safety, security, and disease surveillance for both human and animal health,” by providing support to “46 peaceful Ukrainian laboratories, health facilities, and disease diagnostic sites over the last two decades.”

I like how they fit in animal health.

• Moscow Urges UN Probe Into Ukrainian Biolabs (RT)

Russia is calling on the UN Security Council to establish a commission to investigate alleged violations of the convention prohibiting the production or use of biological weapons by Ukraine and the United States.“We requested a meeting in two days in line with Article VI of the Biological Weapons Convention,” the Russian mission to the United Nations said on Tuesday. Moscow’s ambassador, Vassily Nebenzia, circulated a draft resolution ahead of a meeting set for Thursday, along with “a variety of documents and evidence that shed light on the true nature of military biological activities of the US and Ukraine on the Ukrainian territory.”

Russia was forced to invoke Article VI of the convention to raise the issues with the Security Council after its repeated inquiries were largely ignored by Washington and Kiev, who “have not provided necessary explanations, nor have they taken immediate measures to remedy the situation,” Nebenzia explained. Moscow has alleged that the two countries conducted secretive, joint biological research on Ukrainian soil, claiming it had obtained incriminating evidence of those activities during the ongoing military operation. The Russian Defense Ministry has gradually released said materials to the public in batches since March.“The data analysis gives evidence of non-compliance by the American and Ukrainian sides with the provisions” of the BWC, Nebenzia said.

Last month, Russia convened a meeting of BCW member states in Geneva, which failed to provide any tangible result, with delegates from 35 out of 89 nations either dismissing the Russian claims or expressing support for the kind of research the US and Ukraine were conducting, according to the US State Department. Only seven nations expressed support for Russia: Belarus, China, Cuba, Iran, Nicaragua, Syria and Venezuela. In the wake of the meeting, Moscow proposed amendments to the BWC, floating three ideas to reinforce the landmark international agreement and make it more legally binding for its parties. Namely, Russia called for negotiations on a “legally binding protocol,” an “effective verification mechanism” and a “scientific advisory committee” within the group.

Russia also proposed making the control mechanisms more transparent, with additional “confidence-building measures,” suggesting BWC participants must be obliged to declare their “activities in the biological sphere outside the national territory.” The US and Ukraine have dismissed Russia’s bioweapons claims as disinformation and a conspiracy theory. Back in June, the Pentagon published the ‘Fact Sheet on WMD Threat Reduction Efforts with Ukraine, Russia and Other Former Soviet Union Countries’. The US military claimed that following the collapse of the Soviet Union, Washington has “worked collaboratively to improve Ukraine’s biological safety, security, and disease surveillance for both human and animal health,” by providing support to “46 peaceful Ukrainian laboratories, health facilities, and disease diagnostic sites over the last two decades.” These programs have allegedly focused on “improving public health and agricultural safety measures at the nexus of nonproliferation.”

“A democratic mandate was overturned in the name of democracy..”

• The EU Is Driving Polexit (RMX)

It now looks certain that the money from the EU Recovery Fund owed to Poland will not arrive in Warsaw before the 2023 parliamentary elections. This dramatic move is a purely political decision taken in Brussels and Berlin to “starve” the unruly Poles. Now, there are leaks in the media that the remaining EU funds owed to Poland will also be frozen. This is no surprise given that the EU establishment has abandoned any pretense of even-handedness. It is logical that Brussels brings out all available weapons against the hated conservative Law and Justice (PiS) government. The objective is to make Poles vote the right way and choose the right government. It is meddling in the internal and sovereign affairs of a member state, which has little to do with democracy. This is not in the spirit of EU treaties and founding principles.

Principles such as subsidiarity and the notion of a Europe of equal and sovereign member states — a voluntary union that pools rather than takes away sovereignty. Now, the EU seems to be about breaking rebellious provinces and making them accept central decision-making authority. This is not the first time this has happened. The same was done to the Syriza government in Greece in 2015. It was forced to adopt policies imposed by the troika of the European Commission, IMF, and European Central Bank. A democratic mandate was overturned in the name of democracy. It would all be funny if it was not so serious.European institutions have also done this to Italy, changing governments to ones that followed its strictures. Pressure was also applied to Ireland, Portugal, and Spain. Now, it is Poland’s and Hungary’s turn.

The EU establishment is determined to avoid any change to the way it does things. It has learned nothing from the financial crisis of 2008, the euro crisis, Brexit, or the total collapse of its energy policy as a result of the war in Ukraine. They do not welcome calls for reform that would make them share power. When that kind of challenge arises, they react sharply, calling opponents extremists and anti-Europeans who must be stopped. The EU elites are always right and never at fault for anything. We cannot rule out that they will succeed in breaking Poland in the same way as they broke Athens and Rome. But if they do, it will not be without consequences. Polexit could become a self-fulfilling prophecy as the people turn against the EU or as the EU establishment effectively pushes Poland out of the EU. The groundwork for this is being laid before our very eyes.

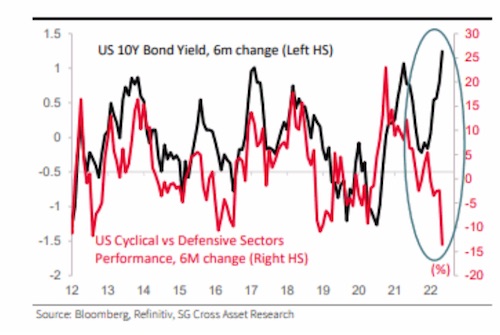

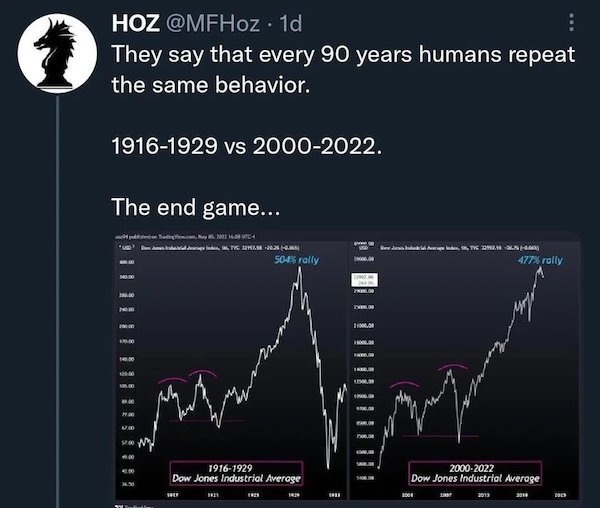

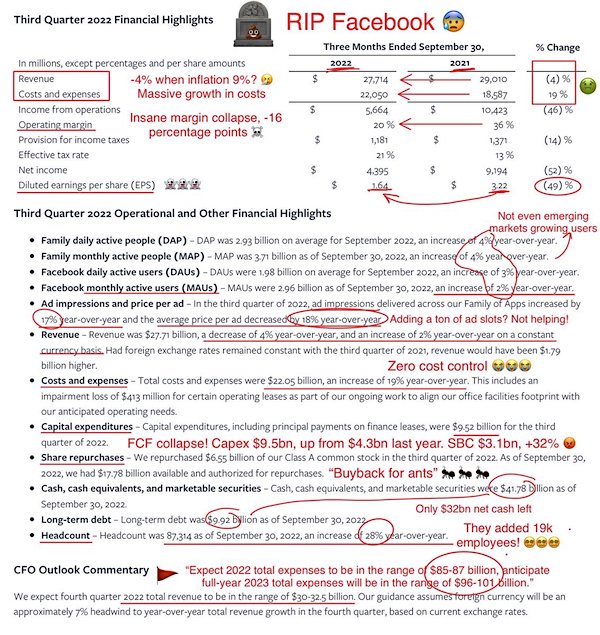

The tech sector is taking major hits.

• Google and Microsoft Hit By Slowing Economy (BBC)

Sales at the tech giants Alphabet and Microsoft have slowed sharply, adding to fears of a downturn in the economy. Alphabet, which owns Google and YouTube, said sales rose just 6% in the three months to September, to $69bn, as firms cut their advertising budgets. It marked the US firm’s weakest quarterly growth in nearly a decade outside of the start of the pandemic. Microsoft meanwhile said demand for its computers and other technology had weakened. Its sales rose by 11% to $50.1bn, marking its slowest revenue growth in five years. Consumers and businesses around the world are cutting back as prices rise and interest rates go up, fuelling fears of a global recession. A strong US dollar has also hurt American multinationals, making it more expensive to sell products abroad.

Profits at Alphabet dropped nearly 30% to $13.9bn in the quarter, as YouTube ad revenues declined for the first time since the firm started to report them publicly. Sales growth at the firm has slowed for five consecutive quarters. Boss Sundar Pichai said that Alphabet was “sharpening” its focus and “being responsive to the economic environment”. “When Google stumbles, it’s a bad omen for digital advertising at large,” said Evelyn Mitchell, principal analyst at Insider Intelligence, noting that Google’s core website has in the past been more resilient to ad spending downturns than social media sites like Facebook or Snap. “This disappointing quarter for Google signifies hard times ahead if market conditions continue to deteriorate.”

And that tech sector is a very large part of the financial market.

• Apple Slashes Production As Consumer Spending Drops (RT)

US tech giant Apple will cut back the assembly of the recently launched iPhone 14 Plus to counter softness in smartphone sales, market researcher TrendForce reported on Tuesday. The company will reportedly focus instead on high-end models. According to the report, the manufacturer will increase output of the more expensive iPhone 14 Pro, the share of which has increased to 60% of total output from the initially planned 50%. It could reportedly further rise to 65% in the future.The researcher indicated that Apple’s Pro and Pro Max premium tier devices have been strong sellers at a time when a global chip crisis is unfolding, helping the company push margins higher.

It also warned that rising US interest rates could crimp consumer spending, undermining demand for iPhones in the first quarter of 2023. This could reportedly lead to a 14% year-on-year drop in production to 52 million units.Data by research firm Canalys shows that Apple was the only vendor in the top five to register growth in shipments in the third quarter. The company has improved its share of the global smartphone market to 18% from 15% a year ago despite the shrinking market. Last month, Apple said it would manufacture the iPhone 14 in India, as it moves some of its production out of China to mitigate the risks arising from the growing tensions between Washington and Beijing.

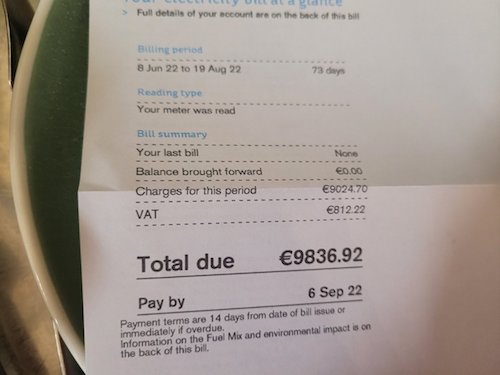

“..nobody is going to invest in a 20, 30 or 40 year lifetime plant when it can be ripped out from under them in two years..”

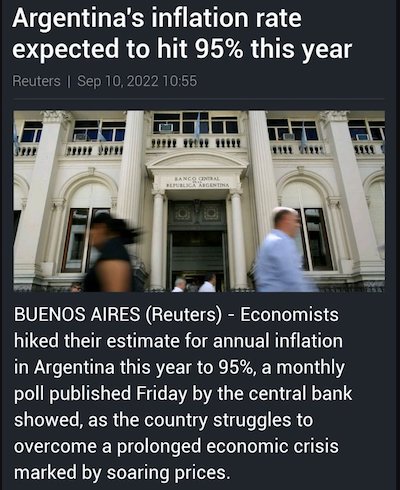

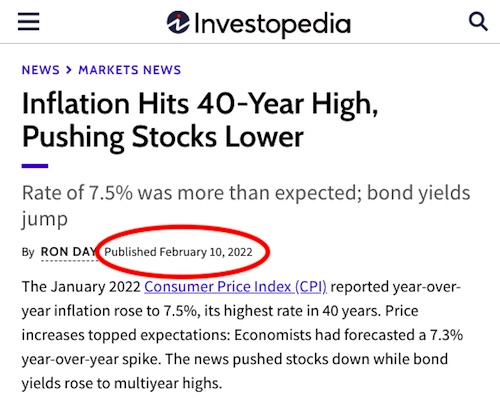

• No, Inflation Is NOT Over (Denninger)

I’ve heard plenty of it. The rally Friday was predicated on yet another “rumor” that The Fed was going to “step down” its rate hikes. It’s bunk.Folks, what’s the inflation rate you’ve been quoted for food on an annualized basis for the last 12 months? 10, 12%? Really? What planet are you on? It’s not “sticker price”, its as sold price that matters. That is if the “shelf” price is $2.49 for an 8oz bar of cheese but the store has a “use five times” coupon for $1.69 the price is $1.69.If suddenly the coupons disappear what is the actual inflation in as-sold price? It’s not 11% — it’s close to fifty percent.If eggs are routinely $0.99/dz and now they’re $2.09 that’s more than a double.Look at the price of a can of pumpkin for a pie coming up in a few weeks. More than a double from last year; now over $5 where I am. Can you blunt this by “trading down” and similar? Sure. For a while.

You can also burn through your freezer, if you have one. But eventually this shows up in your grocery bill and if you think this has been 11% or somesuch over the last 12 months I want some of whatever you’re smoking. Until the Pavlovian response of the markets to any rumor The Fed will slow down breaks and Congress stops thinking it can blow $2.067 trillion on Medicare and Medicaid in a fiscal year while collecting just $339 billion in tax to pay for that inflation is not done. Further, until The Federal Government not only rescinds its declaration that carbon-based energy shall be extinguished and puts into law protections preventing them from threatening to ruin the entire field again which cannot be changed at the simple whim of the majority energy companies would be committing rank fraud to invest in further production, refining and transport — and they will not, as a result, do so.

They will instead do the only rational thing under that paradigm and run their existing plant to ruin which means that problem won’t get resolved either — nor will the high prices.If your thesis is that this will reverse “in three weeks” on a “Red Hurricane” in the mid-term elections you’re nuts Neither Republicans or Democrats have done a single thing over the last twenty years about the source of the budget issues — in fact they have, each and every year, made it worse. The war on energy cannot be rescinded with a simple majority because nobody is going to invest in a 20, 30 or 40 year lifetime plant when it can be ripped out from under them in two years as happened this time. Sorry folks but if you’re buying into that — you’re wrong.

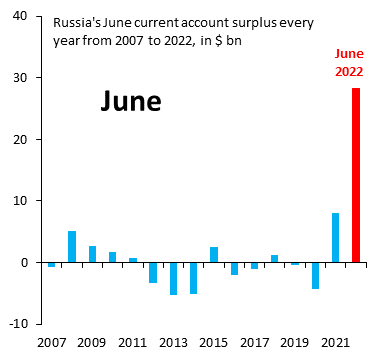

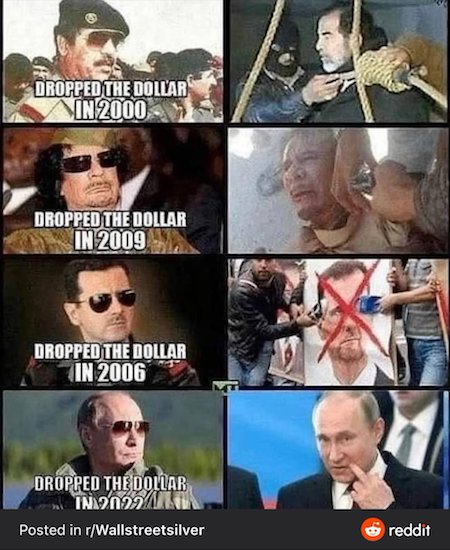

The love affair is over. No more petro dollar.

• Saudi Arabia Slams US For Manipulating Oil Prices (RT)

Saudi Arabia’s energy minister, Prince Abdulaziz bin Salman, has criticized nations for tapping their emergency oil stockpiles in order to manipulate prices, and warned of consequences if the reserves run dry. “It is my profound duty to make clear to the world that losing emergency stocks may be painful in the months to come,” the Saudi minister told the Future Initiative Investment conference in Riyadh on Tuesday. He noted that the US’ Strategic Petroleum Reserve (SPR) was not intended to relieve price pressures, but instead was meant to address emergency supply constraints. The comments come after US President Joe Biden announced the sale of another 14 million barrels from the SPR, following the release of 180 million barrels of oil since April.

Last week, the US authorities said they would release additional crude from the SPR to keep a lid on America’s gasoline prices and then replenish the reserves. The historic use of emergency stocks has worried investors around the world, as excessive volumes of oil could flood the market and put it under pressure. According to an oil analyst at Energy Aspects, Amrita Sen, the SPR is now “absolutely being used to keep prices lower even though that’s not what it’s meant to be used for.” The Biden administration has reportedly indicated that further tapping of the strategic reserves could be linked to the recent decision of OPEC+ to cut oil production.

OPEC+ announced that countries comprising the group will cut oil production by 2 million barrels per day starting in November. The cuts will be distributed based on quotas under the OPEC+ deal as of August 2022. The curtailing of output is aimed at stabilizing the global oil market ahead of a seasonal drop in demand, and amid fears of a global recession.

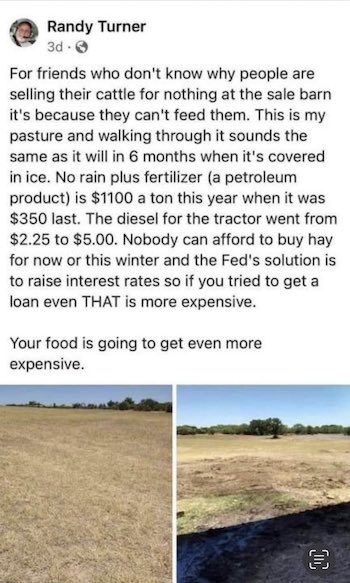

All the trucks that deliver all the products.

• US Diesel Shortage Worsens (RT)

US diesel shortages are spreading along the East Coast amid a ban on imports from Russia, raising fears of further surges in prices for the fuel as consumers brace for the winter heating season. Mansfield Energy, one of the nation’s major fuel distributors, instituted emergency measures on Tuesday and warned its customers that carriers were being forced to visit multiple terminals in some cases to find supplies, delaying deliveries. With shortages spreading from the Northeast to the Southeast, the company advised customers to give 72-hour notice for their orders to avoid having to pay above-market prices. “In many areas, actual fuel prices are currently 30-80 cents higher than the posted market average because supply is tight,” said Mansfield, which delivers over three billion gallons of oil products annually.

With the relatively low-cost suppliers running out of diesel, distributors are forced to draw from higher-cost sources, resulting in unusually wide spreads in pricing. Mansfield’s advisory came just six days after US National Economic Council director Brian Deese told Bloomberg News that diesel supplies were “unacceptably low” and that President Joe Biden’s administration had “all options” on the table to reduce prices. However, as Bloomberg and other media outlets have noted, it’s not clear how those options would provide long-term relief. Diesel supplies in New England, the US region most reliant on distillate fuels for heating, have reportedly dwindled to about one-third of normal levels for this time of year. Nationwide, the US has only 25 days’ worth of diesel supplies, the lowest level since 2008.

Deese told Bloomberg that the US could tap its Northeast Home Heating Oil Reserve, which holds one million barrels of diesel for emergency use. But, as the Washington Post noted, demand for the fuel is so high in the Northeast that those reserves would be depleted in fewer than six hours. The White House has also considered banning or restricting exports of refined fuels – a strategy that industry trade groups claimed would backfire “Banning or limiting the export of refined products would likely decrease inventory levels, reduce domestic refining capacity, put upward pressure on consumer fuel prices, and alienate US allies during a time of war,” the American Petroleum Institute and the American Fuel and Petrochemical Manufacturers said earlier this month in a letter to US Secretary of Energy Jennifer Granholm.

The shortages also put the US at risk of further spikes in prices if there’s a supply disruption, such as a refinery breakdown. Higher prices for the fuel would ripple through the US economy because 18-wheelers and other diesel-powered vehicles carry about 70% of the nation’s freight tonnage. Diesel prices are currently averaging nearly $5.32 per gallon nationwide, down 8.6% from the all-time high set in June, according to the AAA auto club. By comparison, the average gasoline price has dropped 25% from its record high to $3.76 per gallon. Diesel prices are up 47% from a year ago.

“Whatever the length, dimensions and outcome, Ukraine has exposed already present major differences in the world.”

• A Disordered World – Part 1: Fracture (Satyajit Das)

The avoidable Ukraine conflict, with its unnecessary destruction and human suffering, is best seen as a catalyst. Unwillingness to recognise core interests of parties, increasingly entrenched positions, and lack of interest in negotiations means a spiral into a wider confrontation is not impossible. With escalation difficult to calibrate, the evolution from a proxy into a real war between the US and Russia, which might draw in China, all nuclear-armed, remains possible.The West’s expressed desire for engineering regime change within Russia is dangerous. Any new regime may not be more amenable to Western pressure. History, most recently the Arab Spring and Colour Revolutions, shows that a dangerous political void is more likely than liberalisation.

Whatever the length, dimensions and outcome, Ukraine has exposed already present major differences in the world. In particular, the West’s response -trade restrictions, sanctions and asset seizures- will outlive the military actions and prove more damaging. The weaponization of trade and finance, modern gunboat diplomacy, has a long lineage. Sanctions and blockades were used in World War 1 and influenced Japan’s entry into World War 2. Western embargoes against communist bloc countries were common during the Cold War. Since 1979, the US has sought to isolate the Islamic Republic of Iran established by a popular revolution which overthrew the Shah, who had been installed by an American coup d’état. Measures against Russia commenced in 2014. The US has imposed progressively more stringent restrictions on China covering exports and sales of critical technologies since 2018.

In the short term, the measures have affected Covid19 disrupted supply chains, aggravating shortages and price inflation, especially in food, energy and raw materials. In the longer-term, the interaction with other stresses may prove significant. The effects of climate change driven extreme weather – droughts, floods, storms, wildfires- on food production and transportation links is accelerating. A triple dip La Niña alone threatens large scale disturbance with a potential global cost of $1 trillion (around 1 percent of global GDP). Resource scarcity – water, food, energy, raw materials- is simultaneously rising due to natural limits. The decisions by major producers to increasingly stockpile or limit foreign sales to ensure domestic supply and control local costs are adding to disruptions to food production.

“Civil rights activists in the 1950s sat at lunch counters and demanded to be treated like full adults. Notably, it was racist counterprotesters who poured milkshakes over them. Today, it’s the protesters who are spilling milk and throwing food.”

• Infantilization Of The Apocalypse (Shellenberger)

On Sunday, after climate activists in Germany threw mashed potatoes on a Monet painting, they screamed at the nearby museum-goers. “We won’t be able to feed our families in 2050” because of climate change, they alleged. But Volkswagen already agreed last year to end the sale of vehicles with internal combustion engines by 2035, and the UN Food & Agriculture Organization (FAO) predicts rising yields under even very high temperatures so long as farmers keep using fertilizer, irrigation, and tractors. That is, yields will continue under climate change so long as farmers don’t take the advice of climate activists. The activists who keep degrading precious works of art, and themselves, claim to be concerned about food and energy supplies, but in opposing oil, gas and fertilizer production they are actively reducing both. Over the last several months, I have described the demands of climate activists as fanatical and pointed to a large body of evidence suggesting that nihilism, narcissism, and feelings of personal inadequacy are the primary motives.

But nihilism, narcissism, and personal inadequacy alone do not explain why climate activists have chosen temper tantrum tactics. After all, the greatest protest movements of all time engaged in far more grown-up and dignified tactics. Think of the Salt March led by Gandhi, the Montgomery Bus Boycott led by Martin Luther King, and the anti-whaling protests of Greenpeace. Where protesters in the past asked to be treated like adults, climate protesters today demand to be treated like children. Civil rights activists in the 1950s sat at lunch counters and demanded to be treated like full adults. Notably, it was racist counterprotesters who poured milkshakes over them. Today, it’s the protesters who are spilling milk and throwing food. Why is that, exactly? Why have Left-wing activists regressed in their tactics? The people in the protests are themselves apparently dignified people.

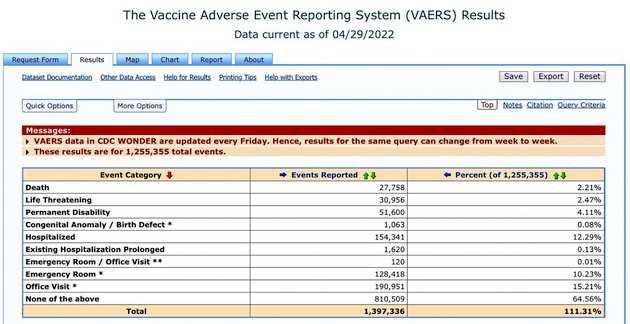

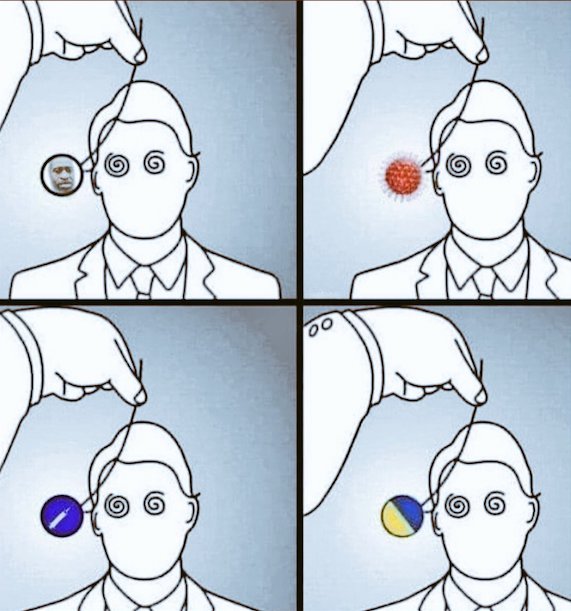

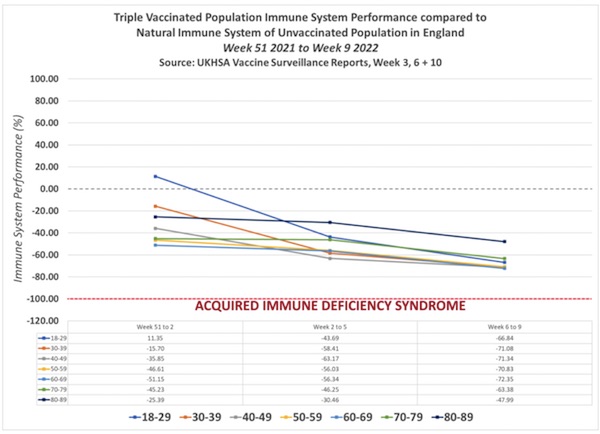

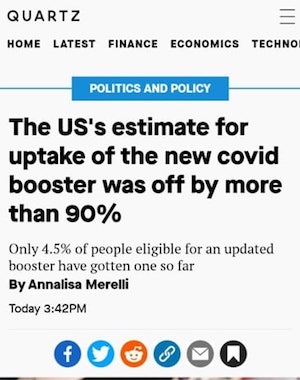

Pfizer’s sales department. What’s the uptake in kids so far? 2%? It’s over.

• Biden Launches #VaxUpAmerica Tour (CHD)

Flanked by Dr. Anthony Fauci, other top U.S. public health officials and the CEOs of major pharmacy chains including CVS, Rite-Aid and Walgreens, President Biden today urged “all Americans” to get an updated COVID-19 vaccine and pleaded with Congress to continue funding the vaccines and COVID-19 treatments, such as Pfizer’s Paxlovid. “If you’re fully vaccinated, get one more COVID shot — once a year, that’s it,” Biden said, likening it to an annual flu shot. “If you get it you’re protected, and if you don’t, you’re putting yourself and other people at unnecessary risk,” he said. Biden, who last month declared the “pandemic is over,” also urged people to get their kids the flu shot and the COVID-19 shot, stating “you can get them at the same time.” Biden ended his speech by getting the COVID-19 booster shot live on camera.

Commenting on Biden’s speech, Robert F. Kennedy, Jr., founder, chairman of the board and chief legal counsel for Children’s Health Defense, said: “It’s troubling President Biden is so captive of a false and discredited narrative that he continues to aggressively promote a high-risk, zero-liability, experimental medical intervention with a product that doesn’t work as advertised and is causing horrendous health problems in Americans. “It’s even more dismaying that he has used the prestige and moral authority of the presidency to recruit America’s corporations into a racketeering enterprise.” Biden’s speech coincided with today’s announcement that the U.S. Department of Health and Human Services (HHS) on Wednesday will launch a #VaxUpAmerica Family Vaccine Tour that will feature pop-up vaccination events across the country.

As part of this tour, the White House said: “HHS will work with national and community-based organizations and others to reach families where they are with information on COVID-19 vaccines, and will host pop-up vaccination events and distribute toolkits at venues such as Head Start provider locations, nursing homes and community health centers around the country.” According to the White House, administration officials and others will “share information and encourage schools, community-based organizations, faith-based organizations, employers and others to host their own vaccination events.”The #VaxUpAmerica Tour will be accompanied by a big advertising push. “The U.S. Department of Health and Human Services (HHS) is launching new national and local TV, radio and print ads geared at reaching Black and Latino audiences in more than 30 markets in English and Spanish. New football and country music-themed radio ads geared at reaching rural communities will run in 15 local markets,” the White House said.

More from Pfizer’s sales department.

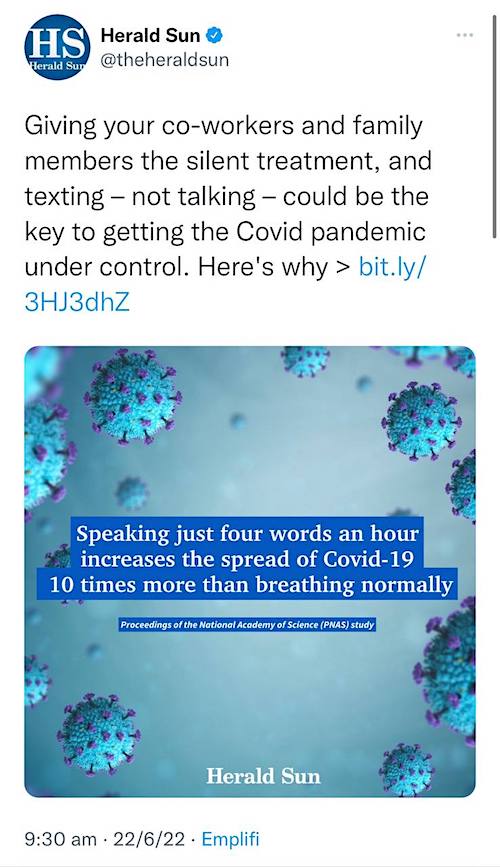

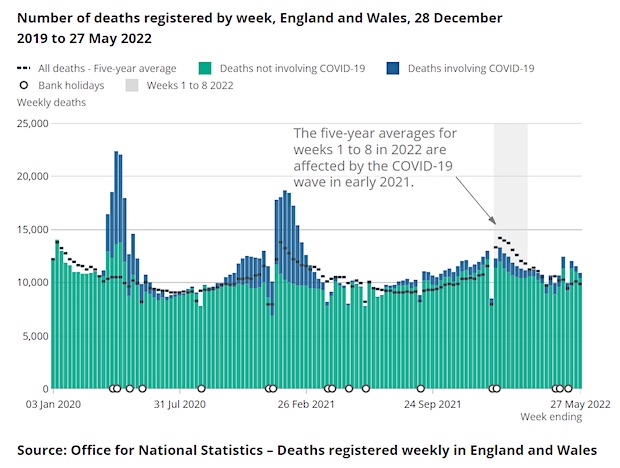

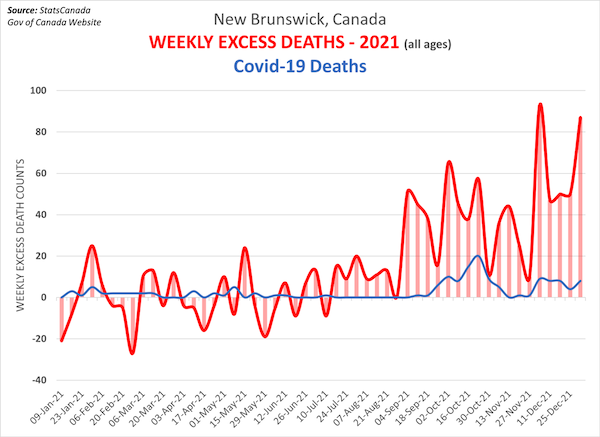

• People Who Caught Mild Covid Had Increased Risk Of Blood Clots (CNBC)

People who caught mild cases of Covid-19 during the first year of the pandemic had a higher risk of developing blood clots than those who were not infected, according to a large study published by British scientists this week. Patients with mild Covid, defined as those not hospitalized, were 2.7 times more likely to develop blood clots, according to the study published in the British Medical Journal’s Heart on Monday. They were also 10 times more likely to die than people who did not have Covid. Scientists affiliated with Queen Mary University of London followed 18,000 people who caught Covid during the first year of the pandemic and compared their health outcomes with nearly 34,000 people who didn’t contract the virus.

Participants were tracked until they developed cardiovascular disease, died or until the study ended in March 2021. Most of the study was conducted before the vaccines rolled out in the Britain in December 2020. While people with mild Covid had an increased risk of blood clots, patients hospitalized with the virus had a significantly higher risk of cardiovascular disease in general. The risk of cardiovascular disease for mild and severe cases was highest in the first 30 days after infection but continued later. In addition, patients hospitalized with Covid were 28 times more likely to develop blood clots, 22 times more likely to suffer heart failure and 17 times more likely to have a stroke, according to the study. Overall, they were over 100 times more likely to die than people who didn’t have Covid.

The scientists said their findings highlight the importance of monitoring even people who had mild Covid for cardiovascular disease over the long term. “Our findings highlight the increased cardiovascular risk of individuals with past infection, which are likely to be greater in countries with limited access to vaccination and thus greater population exposure to COVID-19,” the authors of the study wrote.

In the Dutch language, seal=zeehond (sea dog)

Seals are the dogs of the sea.pic.twitter.com/M3aKX3tR88

— Wonder of Science (@wonderofscience) October 26, 2022

Male elephants are normally 6000 kg max. This one is estimated at 8000 kg.

Massive 8,000 KG elephant in Tanzania pic.twitter.com/PH5KF3BCdu

— Historic Vids (@historyinmemes) October 26, 2022

Leanne Cooke photographed a deadly venomous Stephen’s Banded snake in Maitland, Australia

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.