Franco Fontana Praga 1967

Feels like someone is trying not to let the US dollar rise too fast.

• Emerging Market Currencies Feel The Heat As US Economy Brightens (SCMP)

A stream of broadly upbeat US economic data is opening up fissures in the foreign exchange markets. Market participants are recognising that the balance of risk is changing. Emerging markets, which have enjoyed substantive capital inflows, will not be immune to this process, and certain currencies are already feeling the heat. Emerging markets were major beneficiaries of inward capital flows last year, as evidenced in data from the Bank for International Settlements on 30 April. Overall “foreign currency credit continued to grow during 2017, with US dollar credit rising by 8% to US$11.4 trillion and euro credit by 10% to €3 trillion (US$3.57 trillion),” the bank wrote. US dollar credit to emerging market economies rose by 10% to US$3.67 trillion in the year to end-2017, it added.

This US-dollar dominance is critical, as the main currency moving into any markets, not just emerging markers, will also be the main mover out of them. [..] It seems an age ago now but, in June 2017, Argentina could issue a US dollar-denominated 100-year government bond receiving US$9.75 billion of orders for a US$2.75 billion issue with a coupon of 7.125%. Foreign investors had a taste for Argentina but now want out. Last Friday, with inflation in Argentina in April at 25.4%, the local central bank had to raise its benchmark interest rate to 40% in an attempt to arrest the pace of the peso’s decline. It had fallen 7.83% versus the US dollar on Thursday alone.

Friday also saw the Turkish lira hit a record low against the US dollar, beset by 11% year-on-year inflation and, among other factors, investor concerns that Turkey’s central bank could come under political pressure not to tighten monetary policy as far as they might. [..] Markets can behave like predators, pursuing what they perceive as the weakest prey first. Argentina and Turkey are currently filling that not-to-be-envied role in the wider emerging markets space. But they probably won’t be the last. Billions of US dollars of capital have flowed into emerging markets in recent years but the tide may be turning. It would be easy to just characterise Argentina and Turkey as special cases but that would be naive.

Oh, sure. Never better.

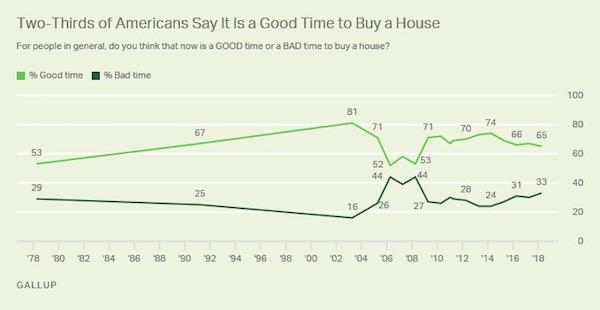

• Two-Thirds Of Americans Believe It’s A Good Time To Buy A Home (MW)

House prices are soaring and, despite warnings from some analysts, most Americans believe they will continue to soar. A majority of U.S. adults (64%) continue to believe home prices in their local area will increase over the next year, a survey released Monday by polling firm Gallup concluded. That’s up 9 percentage points over the past two years and is the highest percentage since before the housing market crash and Great Recession in the mid-2000s. The level of optimism is edging closer to the 70% of adults in 2005 who said prices would continue rising. That, of course, was less than one year before the peak of the housing market bubble in early 2006, which was largely fueled by a wave of subprime lending. (Roughly one-quarter of respondents in both 2005 and 2018 said they believed house prices would remain the same.)

In 2009, during the depths of the Great Recession, only 22% of Americans believed house prices would rise. But optimism about the housing market has made a slow recovery—along with the market itself—in the intervening years. Today, only 10% in the Gallup survey believe prices will fall. That compares to 5% who felt similarly pessimistic in 2005, just two years before the crash. Opinions vary between the West and East coasts, and renters and homeowners. Some 70% of homeowners see prices continuing to rise versus 59% of renters. Only 59% of Western residents see prices increasing, compared to a range of 65% to 68% in the other parts of the U.S. (The median sale price of a home in California is more than double that in the rest of the country.)

About that house you were planning to buy…

• Obamacare Premiums May Soar As Much As 91% Next Year (ZH)

Residents of Maryland and Virginia face double-digit percentage increases in premiums for individual Obamacare plans in 2019, according to rate requests made by insurers. The largest hikes are being sought by CareFirst, which is seeking a 64% increase in Virginia, and a whopping 91% increase in Maryland for its PPO. Other insurers are following suit in the two states, with Kaiser requesting hikes of 32% and 37% respectively, followed by CareFirst’s HMO offering. “In Maryland, CareFirst wants to raise rates by 91% on a plan covering 15,000 people, Insurance Commissioner Al Redmer Jr. said. If approved, premiums for a 40-year-old could reach $1,334 a month.” -Bloomberg

That’s over $16,000 per year for an individual plan in a state with an average personal income of $59,524. “We have folks in Maryland that are struggling, that are trying to do the right thing, and they’re paying more for their health insurance than they are for their mortgage,” Redmer said on a call with reporters. “Maryland is seeking permission from the federal government to create a reinsurance program that would use $975 million in state and federal funds over five years to lower rates. That would help only temporarily, Redmer said.” -Bloomberg “I believe we’ve been in a death spiral for a year or two,” he said, adding that a permanent solution requires Congress to fix the Affordable Care Act.

Virginia and Maryland are the first two states in which 2019 rate requests – which are subject to regulatory approval and may change – have been made public, however increases are anticipated across the country as insurers adjust to the post-ACA battle. Final premium increases will need to be approved ahead of the November 1 open-enrollment period. The hikes are being blamed in part by the expectation that the elimination of the Obamacare stipulation forcing all Americans to have health coverage would leave insurers with a smaller pool of sicker clients.

“..the collusion of multiple intelligence agencies with social media companies and what used to be the respectable organs of the news..”

It was refreshing to read the response of Federal Judge T. S. Ellis III to a squad of prosecutors from Robert Mueller’s office who came into his Alexandria, Virginia, court to open the case against Paul Manafort, erstwhile Trump campaign manager, for money-laundering shenanigans dating as far back as 2005. Said response by the judge being: “You don’t really care about Mr. Manafort’s bank fraud. You really care about getting information that Mr. Manafort can give you that would reflect on Mr. Trump and lead to his prosecution or impeachment or whatever.”

Judge Ellis’s concise summation was like a spring zephyr clearing out a long winter’s fog of unreality in our national politics — the idea that Mueller’s mission has been anything but the Deep State’s ongoing crusade to nullify the 2016 election. In the meantime of the past year, Mueller has been additionally burdened by obvious misconduct in the FBI and its parent agency, the Department of Justice, which makes Mueller himself look like the instrument of a cover-up, or at least a massive organized distraction from the misdeeds of the Deep State itself.

I was never a Trump supporter or voter, but it seems to me he deserves to succeed or fail as President on his own merits (or lack of). It’s much more disturbing to me to see the runaway train that federal prosecution has turned into, along with orchestrated intrigues of FBI and DOJ officials at the highest level. These are of a piece with the creeping surveillance of all Americans, and the collusion of multiple intelligence agencies with social media companies and what used to be the respectable organs of the news, especially The New York Times, The Washington Post, and CNN — all of which are behaving like Grand Inquisitors in a medieval religious hysteria.

Stockman does a Trump: “Simple Steve Mnuchin”.

• The Donald’s Fabulous Fiscal Folly, Wall Street’s Wile E. Coyote (Stockman)

There has never been a more fiscally clueless team at the top than the Donald and his dimwitted Treasury secretary, Simple Steve Mnuchin. After reading the latter’s recent claim that financing Uncle Sam’s impending trillion dollar deficits will be a breeze, we now understand how he sat on the Board of Sears for 10-years and never noticed that the company was going bankrupt. In any event, fixing to borrow upwards of $1.2 trillion in FY 2019, Simple Steve apparently didn’t get the memo about the Fed’s unfolding QT campaign and the fact that it will be draining cash from the bond pits at a $600 billion annual rate by October. After all, no one who can do third-grade math would expect that the bond market can “easily handle” what will in effect be $1.8 trillion of homeless USTs:

“U.S. Treasury Secretary Steven Mnuchin said he’s unconcerned about the bond market’s ability to absorb rising government debt after his department said it borrowed a record amount for the first quarter. ‘It’s a very large, robust market — it’s the most liquid market in the world, and there is a lot of supply,” he said… ‘But I think the market can easily handle it.’ Then again, Simple Steve is apparently not alone in his fog of incomprehension. Even if you did get the memo—like most of the Wall Street day traders—you might still be under the delusion that the Fed is your friend and that when push comes to shove, it will put QT on ice in order to forestall any unpleasant hissy-fitting in the casino.

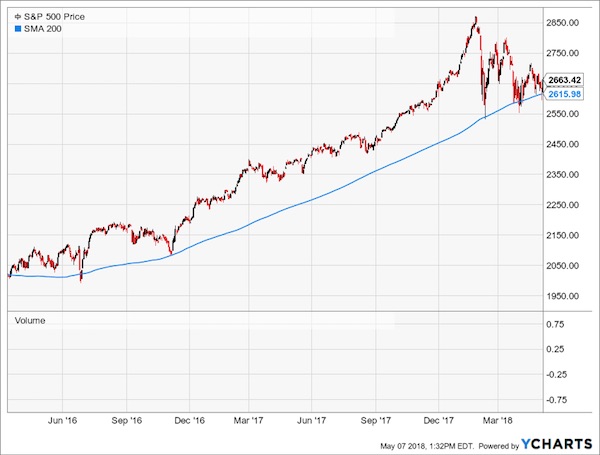

That is, it’s allegedly still safe to buy the dips or play the swing trade between the 50-DMA and 200-DMA because the Powell Put undergirds the latter. So never fear dear punters: At about 2615 on the S&P 500 (the current 200-DMA), the Eccles Building cavalry will ride to the rescue. That would appear to be the meaning of the chart below—except it isn’t. What it really says is that after nine years of buying the dips successfully, Wall Street has essentially deputized its own cavalry. [..] there is in our judgment 15-20% of downside before the Fed relents, but by that point it will be too late.

China and Russia stand behind Iran.

• Trump To Unveil Iran Decision Tuesday; Europeans Move His Way (R.)

President Donald Trump will announce on Tuesday whether he will withdraw from the Iran nuclear deal and a senior U.S. official said it was unclear if efforts by European allies to address Trump’s concerns would be enough to save the pact. Trump has repeatedly threatened to withdraw from the deal, which eased economic sanctions on Iran in exchange for Tehran limiting its nuclear program, unless France, Germany and Britain – which also signed the agreement – fix what he has called its flaws. The senior U.S. official said the European allies had moved significantly in Trump’s direction on what he sees as the defects – the failure to address Iran’s ballistic missile program, the terms under which international inspectors visit suspected Iranian sites, and “sunset” clauses under which some terms expire.

The official did not know, however, if the Europeans had done enough to convince Trump to remain in the deal. “The big question in my mind is does he think the Europeans have moved far enough so that we can all be unified and announce a deal? That’s one option,” said the official. “Or (does he conclude) the Europeans have not moved far enough and we say they’ve got to move more?” European diplomats said privately they expected Trump to effectively withdraw from the agreement, which was struck by six major powers – Britain, China, France, Germany, Russia and the United States – and Iran in July 2015.

[..] Under the deal, formally known as the Joint Comprehensive Plan of Action (JCPOA), the United States committed to easing a series of U.S. sanctions on Iran and it has done so under a string of “waivers” that effectively suspend them. Under U.S. law, Trump has until Saturday to decide whether to reintroduce U.S. sanctions related to Iran’s central bank and Iranian oil exports. The reimposition of sanctions would dissuade foreign companies from doing business with Iran because they could be subject to U.S. penalties.

The Rudy show. There won’t be a sequel.

• State Dept.: Giuliani Doesn’t Speak For US On Foreign Policy (AP)

The Trump administration sought to distance itself Monday from Rudy Giuliani’s dramatic public statements about Iran and North Korea, saying that President Donald Trump’s new lawyer does not speak for the president on matters of foreign policy. Since joining Trump’s legal team last month and becoming its public face, Giuliani has raised eyebrows for a series of startling assertions not only about his legal strategy and the special counsel investigation, but also about global affairs and Trump’s policies. That spurred widespread confusion over whether the former New York mayor, now on Trump’s payroll, was disclosing information he’d been told by the president, stating U.S. government policy or merely describing his own impression of events.

“He speaks for himself and not on behalf of the administration on foreign policy,” State Department spokeswoman Heather Nauert said Monday. It was the clearest sign to date that Trump’s administration is seeking to draw a line between itself and Giuliani on matters of government policy, even as he continues to act as his spokesman on matters related to special counsel Robert Mueller’s Russia probe. It comes as Trump prepares for a series of high-stakes moments in the coming weeks on Iran, North Korea and the Mideast conflict — the type of delicate and potentially explosive regions where events can easily be upended by an errant remark by an emissary of the U.S. president. Giuliani’s perplexing and sometimes conflicting remarks have increasingly become a cause of consternation for Trump’s aides.

Asked last week whether Giuliani’s portfolio included foreign policy, White House spokeswoman Sarah Huckabee Sanders said simply, “Not that I’m aware of.” [..] Giuliani’s remarks have been watched with equal concern at the State Department, the Pentagon and other national security agencies, starting last week when he said on television that North Korea would release three Americans detained in the country. “We got Kim Jong Un impressed enough to be releasing three prisoners today,” Giuliani told Fox News. Although Trump has hinted that such a move could be coming, there has been no formal announcement by the U.S. government, which is in detailed talks with North Korea at the moment to plan a historic summit between Kim and Trump. The detainees have not yet been released as predicted by Giuliani.

Bullshitization.

• Are You in a BS Job? In Academe, You’re Hardly Alone (David Graeber)

For a number of years now, I have been conducting research on forms of employment seen as utterly pointless by those who perform them. The proportion of these jobs is startlingly high. Surveys in Britain and Holland reveal that 37 to 40% of all workers there are convinced that their jobs make no meaningful contribution to the world. And there seems every reason to believe that numbers in other wealthy countries are much the same. There would appear to be whole industries — telemarketing, corporate law, financial or management consulting, lobbying — in which almost everyone involved finds the enterprise a waste of time, and believes that if their jobs disappeared it would either make no difference or make the world a better place.

Generally speaking, we should trust people’s instincts in such matters. (Some of them might be wrong, but no one else is in a position to know better.) If one includes the work of those who unwittingly perform real labor in support of all this — for instance, the cleaners, guards, and mechanics who maintain the office buildings where people perform bullshit jobs — it’s clear that 50% of all work could be eliminated with no downside. (I am assuming here that provision is made such that those whose jobs were eliminated continue to be supported.) If nothing else, this would have immediate salutary effects on carbon emissions, not to mention overall social happiness and well-being.

Even this estimate probably understates the extent of the problem, because it doesn’t address the creeping bullshitization of real jobs. According to a 2016 survey, American office workers reported that they spent four out of eight hours doing their actual jobs; the rest of the time was spent in email, useless meetings, and pointless administrative tasks. The trend has much less effect on obviously useful occupations, like those of tailors, steamfitters, and chefs, or obviously beneficial ones, like designers and musicians, so one might argue that most of the jobs affected are largely pointless anyway; but the phenomenon has clearly damaged a number of indisputably useful fields of endeavor. Nurses nowadays often have to spend at least half of their time on paperwork, and primary- and secondary-school teachers complain of galloping bureaucratization.

Nice going, Boris: “..the foreign secretary dismissed May’s customs partnership proposal as “crazy” “

• Theresa May Faces Renewed Turmoil Over Brexit Options (G.)

Theresa May is facing renewed cross-party pressure to accept membership of the European Economic Area (EEA) or risk defeat in the Commons. Peers vote on Tuesday night on a series of amendments as officials work to try to find a deal on May’s preferred option of a customs relationship with Europe that is acceptable to Brexiters and remainers in her cabinet, as well as MPs and EU negotiators. The policy paper rejected by the inner cabinet on the Brexit subcommittee last week has been withdrawn for further work and will not be discussed at this week’s regular meeting.

A Downing Street source said: “It was agreed on Wednesday that more work needed to be done to flesh out the general principles agreed – no hard border and as frictionless trade as possible. “We realise the urgency. But as Greg Clark [the business secretary] said on Sunday, it is a crucial question to get right.” The prime minister also came under pressure from Boris Johnson, who is currently in Washington trying to persuade Donald Trump to stick with the Iran nuclear deal. In an interview with the Daily Mail, the foreign secretary dismissed May’s customs partnership proposal as “crazy” and said it would create massive bureaucracy. The scheme involves the UK levying border tariffs on imports on behalf of the EU and refunding them where the imported goods stay in Britain.

Johnson also condemned any system that prevented the UK from establishing its own trade policy and negotiating deals with non-EU countries, which is also the principle objection of Conservatives led by Jacob Rees-Mogg in the European Research Group. Meanwhile, the Irish government is concerned that many MPs and peers still believe that Dublin will back down at the last minute on the hard border. One parliamentarian who visited Westminster recently said he was surprised by how confident MPs were that there could be a frictionless border between north and south without a customs union. “Both May’s proposals for maximum facilitation and a customs partnership have been rejected by [the EU negotiator] Michel Barnier as magical thinking,” he said.

Horse. Barn.

• Shocks From Australian Banks’ Inquiry May Squeeze A Nation (R.)

Australia and New Zealand Banking Group last week said that in the wake of the Royal Commission, which has uncovered wide-spread examples of careless and at times fraudulent lending practices, it would likely be harder for customers to borrow money. And National Australia Bank said net interest margins on its all-important mortgage book were falling; while Westpac told Reuters it had recently increased scrutiny of borrowers’ living expenses, including asking them to disclose such items as gym memberships and pet insurance, when making loan assessments. The inquiry has come at a time when there was already a push for increased controls on lending and new capital requirements.

Those had helped spark a wave of divestments of cash-intensive wealth management, insurance and financial planning arms. Borrowers have begun to feel the squeeze, according to Sydney real estate agent Peter Wong, as banks dig through credit histories and ask borrowers for bigger deposits. “The residential sector has become very, very cautious and so, obviously, they’re making sure that they dot their i’s and cross their t’s, and before it wasn’t like that,” said Wong, who runs an agency in inner-city Chinatown. “I’ve got property on the market and I’ve had it on for over three months whereas previously, being a popular area, people would buy fairly quickly.”

Australia has an oligopoly banking system – Commonwealth Bank of Australia sits alongside Westpac, NAB and ANZ making up the so-called “Big Four” – which collectively dominate property, investment and business lending, giving Australians limited options when seeking credit.

Hudson warns China not to become the west.

• “Creating Wealth” Through Debt (Michael Hudson)

Western capitalism has not turned out the way that Marx expected. He was optimistic in forecasting that industrial capitalists would gain control of government to free economies from unnecessary costs of production in the form of rent and interest that increase the cost of living (and hence, the break-even wage level). Along with most other economists of his day, he expected rentier income and the ownership of land, natural resources and banking to be taken out of the hands of the hereditary aristocracies that had held them since Europe’s feudal epoch. Socialism was seen as the logical extension of classical political economy, whose main policy was to abolish rent paid to landlords and interest paid to banks and bondholders.

A century ago there was an almost universal belief in mixed economies. Governments were expected to tax away land rent and natural resource rent, regulate monopolies to bring prices in line with actual cost value, and create basic infrastructure with money created by their own treasury or central bank. Socializing land rent was the core of Physiocracy and the economics of Adam Smith, whose logic was refined by Alfred Marshall, Simon Patten and other bourgeois economists of the late 19th century. That was the path that European and American capitalism seemed to be following in the decades leading up to World War I. That logic sought to use the government to support industry instead of the landlord and financial classes.

China is progressing along this “mixed economy” road to socialism, but Western economies are suffering from a resurgence of the pre-capitalist rentier classes. Their slogan of “small government” means a shift in planning to finance, real estate and monopolies. This economic philosophy is reversing the logic of industrial capitalism, replacing public investment and subsidy with privatization and rent extraction. The Western economies’ tax shift favoring finance and real estate is a case in point. It reverses John Stuart Mill’s “Ricardian socialism” based on public collection of the land’s rental value and the “unearned increment” of rising land prices.

A new threatened species every single day. So far this week: mountain gorillas, right whales and koalas.

• Australia Pledges Millions To Help Save The Koala (AFP)

Australia unveiled on Monday a US$34 million plan to help bring its koala population back from the brink, following a rapid decline in the furry marsupial’s fortunes. The Australian Koala Foundation estimates there may be as few as 43,000 koalas left in the wild, down from a population believed to number more than 10 million prior to European settlement of the continent in 1788. “Koalas are a national treasure,” said Gladys Berejiklian, premier of New South Wales state, in announcing her government’s conservation plan. “It would be such a shame if this nationally iconic marsupial did not have its future secured.”

Habitat loss, dog attacks, car strikes, climate change and disease have taken their toll on one of Australia’s most recognisable animals. Studies show a 26% decline in the koala population in New South Wales over the last 15-20 years. The state lists the species as “vulnerable”, while in other parts of the country they are effectively extinct. Under the Aus$45 million plan, thousands of hectares will be set aside to preserve the marsupial’s natural habitat.

The madness of it. After 44 years of active use, they’re finally being tested (!). But their formulas remain confidential business information, so they don’t even know what they’re testing.

• Glyphosate-Based Weedkillers Much More Toxic Than Their Active Ingredient (G.)

US government researchers have uncovered evidence that some popular weedkilling products, like Monsanto’s widely-used Roundup, are potentially more toxic to human cells than their active ingredient is by itself. These “formulated” weedkillers are commonly used in agriculture, leaving residues in food and water, as well as public spaces such as golf courses, parks and children’s playgrounds. The tests are part of the US National Toxicology Program’s (NTP) first-ever examination of herbicide formulations made with the active ingredient glyphosate, but that also include other chemicals. While regulators have previously required extensive testing of glyphosate in isolation, government scientists have not fully examined the toxicity of the more complex products sold to consumers, farmers and others.

Monsanto introduced its glyphosate-based Roundup brand in 1974. But it is only now, after more than 40 years of widespread use, that the government is investigating the toxicity of “glyphosate-based herbicides” on human cells. The NTP tests were requested by the Environmental Protection Agency (EPA) after the International Agency for Research on Cancer (IARC) in 2015 classified glyphosate as a probable human carcinogen. The IARC also highlighted concerns about formulations which combine glyphosate with other ingredients to enhance weed killing effectiveness. Monsanto and rivals sell hundreds of these products around the world in a market valued at roughly $9bn.

Mike DeVito, acting chief of the National Toxicology Program Laboratory, told the Guardian the agency’s work is ongoing but its early findings are clear on one key point. “We see the formulations are much more toxic. The formulations were killing the cells. The glyphosate really didn’t do it,” DeVito said. [..] “This testing is important, because the EPA has only been looking at the active ingredient. But it’s the formulations that people are exposed to on their lawns and gardens, where they play and in their food,” said Jennifer Sass, a scientist with the Natural Resources Defense Council.

One problem government scientists have run into is corporate secrecy about the ingredients mixed with glyphosate in their products. Documents obtained through Freedom of Information Act requests show uncertainty within the EPA over Roundup formulations and how those formulations have changed over the last three decades. That confusion has continued with the NTP testing. “We don’t know what the formulation is. That is confidential business information,” DeVito said. NTP scientists sourced some samples from store shelves, picking up products the EPA told them were the top sellers, he said.