Amedeo Modigliani Nu allongé 1917

Trump immunity

https://twitter.com/i/status/1782847341952729139

Watters trial

Jesse Watters: "Trump's gagged and there's no cameras, so voters have to trust what the reporters in the room say. The same reporters who pushed the Russia, laptop, and lab leak hoaxes. Biden’s fingerprints are all over this, as we learn Trump's team is accusing the White House… pic.twitter.com/W4QrbF0YJC

— Real Mac Report (@RealMacReport) April 24, 2024

Alina

https://twitter.com/i/status/1782784975521120376

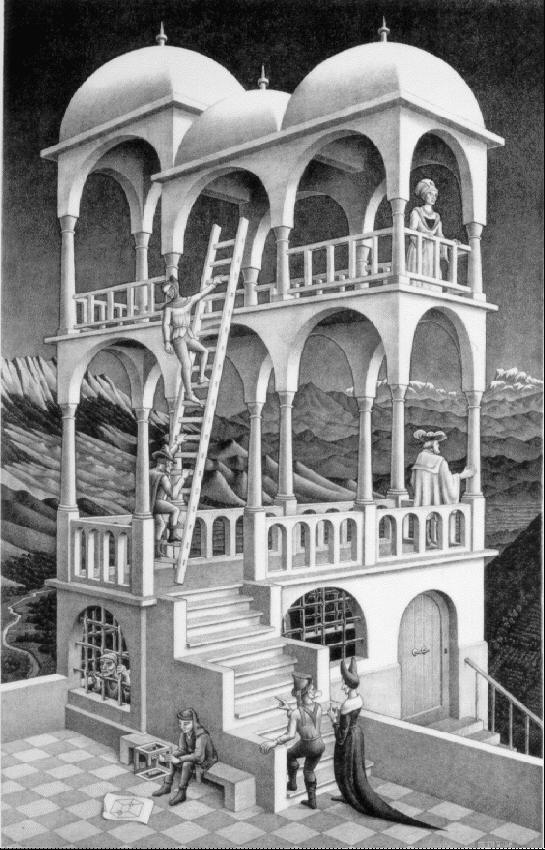

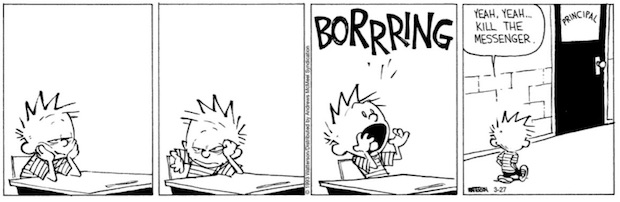

Tucker Weak men

Tucker Carlson: "Here's the illusion we fall for time and again. We imagine that evil comes like fully advertised as such, like evil people look like Anton Lavey…Evil is an independent force that exists outside of people, that acts upon people…What vessel do they choose? The… pic.twitter.com/ugF3bMgxcx

— Camus (@newstart_2024) April 21, 2024

Julie Kelly

Blockbuster News@julie_kelly2 tells of a more than three month battle involving Judge Aileen Cannon, the Department of Justice, Special Counsel Jack Smith, and President Trump's attorneys and co-defendants. The objective: to unseal and make public documentation and records that… pic.twitter.com/Dh4QE9KGiA

— Real America's Voice (RAV) (@RealAmVoice) April 23, 2024

https://twitter.com/i/status/1783175943831367849

Arizona

BREAKING: Arizona Attorney General Kris Mayes announces that a Grand Jury has just indicted 18 Republicans, including Donald Trump, over ALLEGED attempt to change the 2020 elections' results. WATCH pic.twitter.com/CMH8MR9miH

— Simon Ateba (@simonateba) April 25, 2024

mask

https://twitter.com/i/status/1783164740459762075

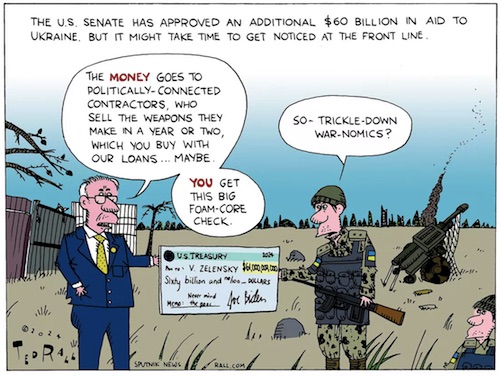

“..the US government has effectively been funneling billions of dollars into its own defense industry through the aid scheme..”

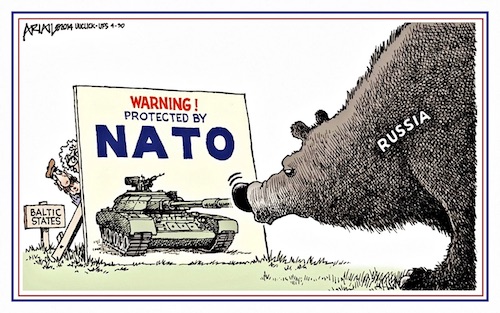

• US Sided With Evil And Fascism – Russian Envoy (RT)

The US government has made its choice in favor of war, siding with evil and supporting fascism, the Russian ambassador to Washington Anatoly Antonov has said, in comments on the latest massive American military aid package for Ukraine. On Wednesday, US President Joe Biden signed a long-stalled $95-billion foreign-aid package, including $61 billion for Ukraine. Biden said the US would start sending weapons and military equipment to Ukraine “in the next few hours.” Washington is balancing on the brink of a direct clash between nuclear powers, Ambassador Antonov told reporters following the news. The development strikes a severe blow to prospects for a hypothetical revival of Russian-American relations in the future, Antonov believes.

“For the sake of its greedy and insatiable defense industry, the [Biden] administration sacrifices the lives of ordinary people. With their decision, local politicians actually put an end to the fate of the entire state [of Ukraine], which is used as a ‘battering ram’ against Russia,” he stated. The high-ranking Russian diplomat accused the US administration of violating the UN Charter’s obligation to maintain ‘primary responsibility for international peace and security.’

“American aid will not save [Ukrainian President] Zelensky” he stressed, adding that any new weapons being sent by Washington to Kiev would be destroyed, and that the tasks and goals of Moscow’s military operation will be realized. The Kremlin has repeatedly warned that Washington’s lethal aid will not change the situation on the battlefield in Ukraine’s favor. According to Kremlin spokesperson Dmitry Peskov, the US government has effectively been funneling billions of dollars into its own defense industry through the aid scheme.

Cheers

Biden says "there were reports of cheers breaking out in the trenches in Eastern Ukraine as they watched the House vote in support of Ukraine." pic.twitter.com/kZl819GvvT

— Greg Price (@greg_price11) April 24, 2024

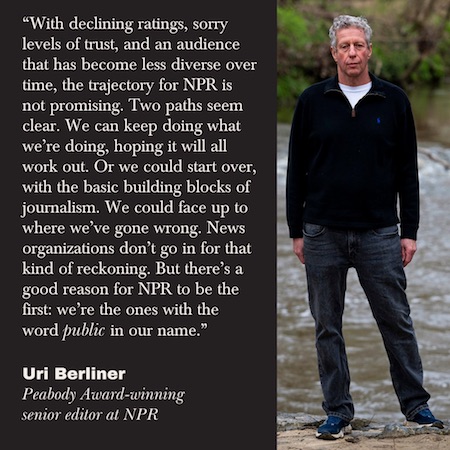

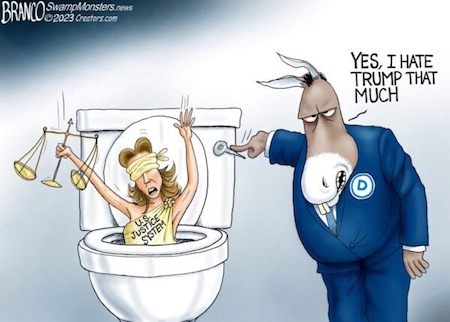

“We’ve never seen a case like this one where a dead misdemeanor from 2016 could be revived as a felony just before the 2024 election..”

“Cohen will soon go on the stand and tell the jury it should send his former client to jail for following his legal advice.”

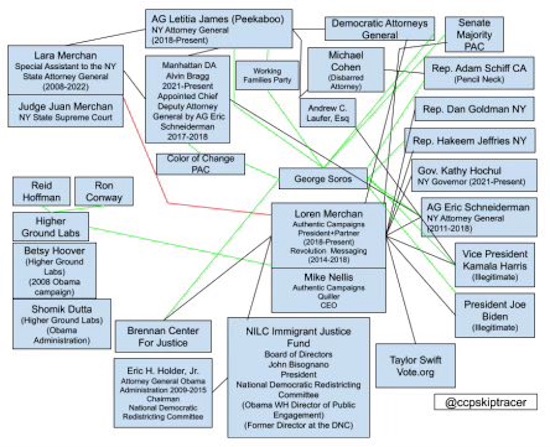

• Alvin Bragg Has His Trump Trial, All He Needs Now Is A Crime (Turley)

For many of us in the legal community, Manhattan District Attorney Alvin Bragg’s case against former President Donald Trump borders on the legally obscene: an openly political prosecution based on a theory even legal pundits dismiss. Yet Monday the prosecution seemed to actually make a case for obscenity. It wasn’t the gratuitous introduction of an uncharged alleged tryst with a former Playboy Bunny or expected details on the relationship with an ex-porn star. It was the criminal theory itself that seemed crafted around the obscenity stan- dard Supreme Court Justice Potter Stewart famously described in 1984’s Jacobellis v. Ohio: “I shall not today attempt further to define [it]. . . . But I know it when I see it. The prosecution must show Trump falsified business records in “furtherance of another crime.” After months of confusion on just what crime underpinned the indictment, the prosecution offered a new theory so ambiguous and undefined, it would have made Justice Stewart blush.

Prosecutor Joshua Steinglass told the jury that in listing Stormy Daniels payments as a “legal expense,” Trump violated this New York law: “Any two or more persons who conspire to promote or prevent the election of any person to a public office by unlawful means and which conspiracy is acted upon by one or more of the parties thereto, shall be guilty of a misdemeanor.” So Trump committed a crime by conspiring to unlawfully promote his own candidacy, by paying to quash a potentially embarrassing story and then reimbursing his lawyer Michael Cohen with other legal expenses. Confused? You are not alone. It’s not a crime to pay for the nondisclosure of an alleged affair. It’s also not a federal election offense (the other underlying crime Bragg alleges) to pay such money as a personal or legal expense. Federal law doesn’t treat it as a political contribution to yourself. Yet somehow the characterization of this payment as a legal expense is an illegal conspiracy to promote one’s own candidacy in New York.

In New York, prosecutors are expected to have extreme legal myopia: They can see no farther than Trump to the exclusion of any implication for the legal system or legal ethics. Of course, neither Bragg nor his office has ever seen this type of criminal case in any other defendant. Ever. We’ve never seen a case like this one where a dead misdemeanor from 2016 could be revived as a felony just before the 2024 election, The statute of limitations for this case’s misdemeanors, including falsifying payments, has expired. But Bragg (with the help of counsel and former top Biden Justice Department official Matthew Colangelo) zapped it back into life by alleging a federal election crime the Justice Department itself rejected as a basis for any criminal charge. It’s not clear Trump even knew how this money was characterized in records. He paid it to his lawyer, who had put together the settlement over the nondisclosure agreement.

Cohen will soon go on the stand and tell the jury it should send his former client to jail for following his legal advice. Besides running for president, Trump was married and had hosted a hit television show. There were ample reasons to secure an NDA to bury the story. Even if it was done with the election in mind, it is not unusual or illegal. There is generally no need to list such payments as a campaign contribution because the federal government doesn’t see them as a campaign contribution. It’s not even clear how this matter was supposed to be noted in records. What if the Trump employee put “legal settlement in personal matter” or “nuisance payment”? The crime itself may not be clear or even comprehensible. But the defendant’s identity could not be clearer, and the prosecutors are hoping the jury, like themselves, will look no further

A case about nothing.

• Romney and the Wrong Question (Turley)

Yesterday, Sen. Mitt Romney (R-UT) had a much covered interaction with CNN’s Manu Raju who asked him about Trump’s criminal trial and whether he was guilty of the underlying criminal conduct. Romney responded “I think everybody has made their own assessment of President Trump’s character, and so far as I know you don’t pay someone $130,000 not to have sex with you.” I have previously defended Romney in his votes on impeachment despite our disagreement on the constitutional standard. I also understand that he was making a more general comment on character. However, his response is precisely what Manhattan District Attorney Alvin Bragg is seeking from the jury: a verdict on Trump as a person rather than the underlying criminal allegations. Trump is currently facing 34 counts of falsifying business records in the first degree regarding payments made to Daniels during the 2016 presidential election.

As I discuss today in the New York Post, many of us (including liberal legal experts) still question whether there is any crime alleged by Bragg. Raju reasonably asked Romney for his own view. Romney is an interesting person to ask. He is not only a critic of the President from within his own party but he is a former businessman who has had to deal with complex reporting and business obligations. Romney’s response must be encouraging for Bragg. Rather than address the ambiguous criminal allegation, Romney suggested that Trump was guilty as charged in having a tryst with a former porn star. The defense is not contesting the payment and the fact of the affair is not central to the allegations. The question is whether the payments were unlawfully denoted as legal expenses with the intent to somehow steal the 2016 election.

It is not a crime to use a NDA or other means to quash an embarrassing story. Bill Clinton had a host of lawyers quashing allegations of affairs and sexual assaults throughout his presidency. He ran into trouble when he committed perjury in the effort to hide what Hillary Clinton called one of his “bimbo eruptions.” Moreover, denoting this as a legal expense, on the advice of counsel, is not necessarily wrong. It is not clear how it should have been to be denoted as, according to Bragg. A “nuisance payment”? The campaign of Hillary Clinton and its general counsel Marc Elias hid the funding of the Steele dossier as a legal expense and was fined by the government for doing so. They litigated the question and insisted that that is precisely what it was. Romney is precisely what Bragg is looking for in these jurors. Smart and savvy, he still viewed the question of the trial as whether Trump had an affair with Stormy Daniels.

If so, it was not a legal expense. Yet, quashing the story and avoiding any litigation was a legal matter with the eventual crafting of the NDA. There are a lot of motivations for NDAs of this kind. Trump was married. He was the host of a hit television show (with a clause on termination for scandalous conduct). And, yes, he was also seeking to be president. He wanted these stories killed and friends like David Pecker were helping in that effort. What those facts say about the former president’s “character” will remain a matter of public debate and, as Romney said, most long ago reached their own conclusions. Yet, it is the crime not the character of Trump that is at issue in Manhattan.

Alvin Bragg would like the trial to remain a verdict on character, which is why he started the trial discussing not the Daniels matter but an uncharged affair and settlement with a former Playboy bunny. It is why he fought hard (and succeeded) in being able to question Trump about past cases involving an alleged assault and fraudulent conduct. As legal experts continue this week to debate if there is even a crime alleged in the indictment, Bragg is making a case that Trump’s lack of character is beyond a reasonable doubt. To be fair, Romney was not giving a full interview on the case in his statement to CNN and may well have some reservations about the Bragg indictment. However, Bragg is likely hoping that “everybody has made their own assessment of President Trump,” including twelve jurors currently sitting in the Manhattan courtroom.

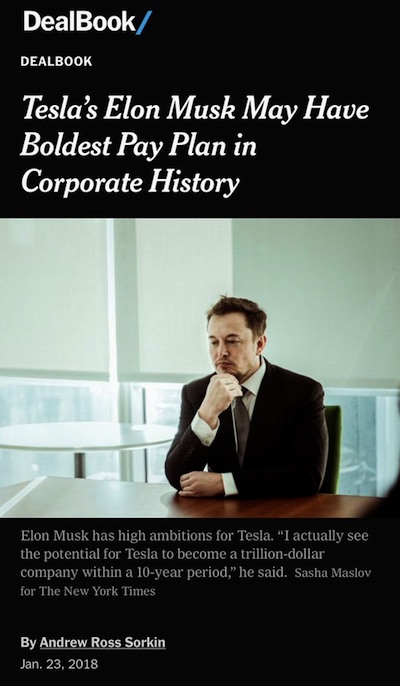

“Musk said that migration issues in the US are threatening the very existence of the American state..”

• Musk Concurs That Civil War Looming In West (TASS)

US entrepreneur and one of the world’s wealthiest people Elon Musk has asserted that a civil war will break out in the West over the situation around migrants. “War will come whether we want it or not,” he wrote on the X social network commenting on remarks by Gad Saad, a Canadian professor of Lebanese origin, who insisted that “the path that the West is taking will result in civil war.” Saad said that Western countries are committing “civilizational suicide.” “Many Western men who are currently asleep at the wheel will wake up, and realize that they don’t like being pushed around in their homelands; they don’t like their women attacked; they don’t like their freedoms curtailed; they don’t like their faiths disrespected,” he noted. Earlier, Musk said that migration issues in the US are threatening the very existence of the American state. He also branded the US migration policy as insane because over the past three years it allowed more than 7 mln illegal migrants enter the country.

Australia is just a little country. With little brains.

• Musk Warns Australia Against ‘Controlling Entire Internet’ (Sp.)

The X chief executive earlier denounced that a video of a stabbing attack on an orthodox bishop had been censored in Australia, with Canberra threatening X with a daily fine of $510,000 over the company’s reluctance to completely remove the footage. Elon Musk has made it clear he will not comply with Australia’s order to remove a video of a terror attack against a Sydney cleric from X (formerly Twitter). “Our concern is that if any country is allowed to censor content for all countries, which is what the Australian ‘eSafety Commissar’ is demanding, then what is to stop any country from controlling the entire Internet?” the tech billionaire tweeted. The Tesla and SpaceX CEO added that X has “already censored the content in question for Australia, pending legal appeal, and it is stored only on servers” in the US.

Per X, Canberra threatened it with a daily fine of $510,000 over the company’s unwillingness to remove the video across the globe. Musk’s remarks came after Australian Prime Minister Anthony Albanese slammed the X owner as an “arrogant billionaire who thinks he’s above the law, but also above common decency.” Speaking to broadcaster ABC, Albanese added that “the idea that someone would go to court for the right to put up violent content on a platform shows how out-of-touch Mr. Musk is.” This followed Australia’s eSafety Commission calling for X to completely remove the video from its platform for all users rather than just block the footage in the world’s sixth-largest country.

According to Australia’s eSafety commissioner, Julie Inman Grant, “Every minute counts, and the more this content is up there, the more it is reshared, the more the velocity and the virality continues and we need to stem that.”

In the video, Bishop Mar Mari Emmanuel of the Assyrian Orthodox Church is seen being stabbed during a church service in the suburbs of Sydney that was being livestreamed on April 15. The non-fatal attack, which the authorities said was a terrorist act motivated by suspected religious extremism, quickly garnered multiple views online and reportedly led to protests near the crime scene.

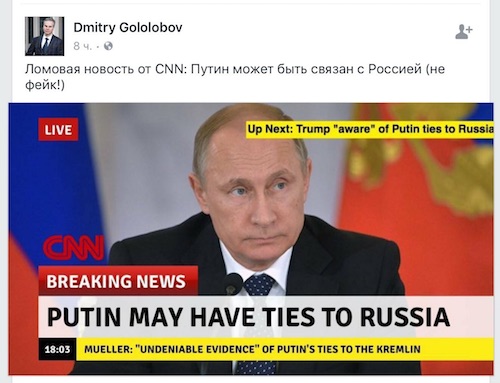

“I think the demonization of Ukraine began by Tucker Carlson..”

• Mitch McConnell Blames Tucker Carlson For Delaying Ukraine Cash (RT)

The top-ranking Republican in the US Senate, Mitch McConnell, has claimed Tucker Carlson’s interview with Russian President Vladimir Putin convinced too many “rank-and-file Republicans” that spending billions of taxpayer dollars on arming Kiev against Moscow was harming Americans and wrecking the economy. As a new multibillion-dollar US aid package to Ukraine was clearing the last procedural hurdles on Tuesday, Senate Minority Leader McConnell attempted to pin the blame for months of delays on former Fox News anchor Carlson and former President Donald Trump. “I think the demonization of Ukraine began by Tucker Carlson, who in my opinion ended up where he should have been all along, which was interviewing Vladimir Putin,” McConnell told a press briefing.

“He convinced a lot of rank-and-file Republicans that maybe this was a mistake,” he added, arguing that Trump’s “mixed views” on Ukraine aid further fueled confusion over the official narrative in Washington. “And then our nominee for president didn’t seem to want us to do anything at all,” McConnell claimed. “That took months to work our way through it.” Carlson recorded a lengthy interview with Putin in February, a first by a Western reporter since the conflict with Ukraine began. The pair discussed the ongoing hostilities and Moscow’s standoff with NATO. The exchange went viral globally, garnering over 200 million views on X (formerly Twitter) alone, yet critics accused Carlson of not being confrontational enough with the Russian leader. The American journalist argued that most Western media outlets lie to their audiences, mainly by omission, and that the point of his interview was “to have more information brought to the West so people could make their own decisions.”

“I reject the whole premise of the war in Ukraine from the American perspective,” Carlson said in February, looking back at his conversation with Putin. “There’s a war going on that is wrecking the US economy in a way and at a scale that people do not understand.” US President Joe Biden requested additional cash for Ukraine last October after burning through $113 billion in previously approved spending bills. However, the request had been stalled until this week due to opposition from Republican lawmakers, who argued that Biden was merely prolonging Kiev’s conflict with Russia while offering no clear strategy for victory or a peace agreement. Most Republicans voted against the aid bill on Saturday, but House Speaker Mike Johnson (R-Louisiana) overrode his own party by enabling a vote and pushing it through with unanimous Democrat support.

“Everyone understands that today’s Ukraine is a military range, where the future of the world order is partially decided..”

• Future Of The World Will Be Decided In Ukraine – Lukashenko (RT)

The Ukraine conflict is among the major events that will determine the future of the world, and the West is emerging weaker from it, Belarusian President Alexander Lukashenko claimed on Wednesday. The leader of Belarus, a close Russian ally, addressed the situation in Ukraine during a keynote speech to the All-Belarusian People’s Assembly, a gathering of officials and public figures. He contrasted Kiev’s policies with those of Minsk, arguing that unlike its southern neighbor, his nation has preserved its independence under Western pressure. “Everyone understands that today’s Ukraine is a military range, where the future of the world order is partially decided. The largest nuclear powers indirectly, and now even directly, are waging a war on its territory,” Lukashenko stated.

“Meanwhile its authorities have sunk to the level of striking a bargain with the West to exchange weapons for the lives of Ukrainians. Watching this is painful,” he added. Kiev has miscalculated, Lukashenko argued, because “whoever is willing to serve a master for scraps will sooner or later lose.” Ukraine is risking its statehood after betraying its past and traditions, he also warned. The Belarusian leader described the entire conflict as the latest clash “between the West and the East,” and suggested that neither side has become stronger. The outcome of the confrontation “will not save the existing order,” Lukashenko further predicted. He urged the US and its allies to accept that their future role will be restricted as one of several centers of power that determine world affairs.

“And they grew rich, but only very few, in the very ‘best’ traditions of Western European democracies..”

• All Ukrainian Presidents Are Thieves – Lukashenko (RT)

Ukraine has devolved into a Western-style oligarchy where all of its leaders are only interested in “plundering” the country and getting rich, Belarusian President Alexander Lukashenko has claimed. The president made the remarks on Wednesday during an address to the All-Belarusian People’s Assembly, a gathering of high-profile officials and public figures. Lukashenko fired a broadside at the neighboring country, accusing its presidents and “oligarchs” of stealing Ukraine’s riches. The process began immediately after Ukraine became an independent state following the collapse of the Soviet Union and has worsened over time, Lukashenko argued. “Just think – a prosperous country. The land is fertile, half of the periodic table in its soil, two seas, mines, industrial giants. The people are creative, hard-working. Live, be happy and grow rich. And they grew rich, but only very few, in the very ‘best’ traditions of Western European democracies,” the Belarusian leader said.

Every Ukrainian president, from “the first to the last one,” has been “plundering and stealing,” Lukashenko asserted, claiming that this inevitably led to political infighting and enduring unrest. “The oligarchs and those in power have gathered all the resources under their control. The oligarchs, having received the wealth created by the people, wanted power. They went into politics and began to drag bandits and people into their squabbles. The Maidans have begun,” Lukashenko stated. Ukrainian leaders, however, have consistently blamed the internal turmoil they created on foreign powers, primarily Russia and to a lesser extent Belarus, Lukashenko alleged. “They created the necessary image of the enemy, ‘the culprit behind the hardships and poverty of the people’ – Russia, as well as us, Belarusians. We, you see, are now somehow to blame,” the leader said.

Hunt Them Down

• Poland Ready To Help Ukraine Hunt Down Military-Aged Men (RT)

Polish Defense Minister Wladyslaw Kosiniak-Kamysz has said Warsaw is willing to “help” Kiev repatriate men of fighting age, an unspecified portion of some 950,000 Ukrainians granted temporary sanctuary in Poland. Earlier this week, the Ukrainian Foreign Ministry banned all men between the ages of 18 and 60 from receiving or renewing their documents, including passports, at consular offices outside the country. The Polish defense chief told the Polsat broadcaster on Wednesday that he was “not surprised” and supports Kiev’s move. “The Ukrainian authorities are doing everything to provide new soldiers to the front, because the needs are huge,” Wladyslaw Kosiniak-Kamysz said. The Polish official said that Warsaw had previously offered to help Kiev track down those who dodge their “civic duty,” but noted that “the form of assistance depends on the Ukrainian side.”

“I think that many of our compatriots were and are outraged when they see young Ukrainian men in cafes and hear about how much effort it takes us to help Ukraine,” he added. Kosiniak-Kamysz also echoed Kiev’s official narrative that Ukrainians who could not avoid the draft have “justified grievances against their peers who have scattered around the world.” Foreign Minister Dmitry Kuleba claimed on Tuesday that the decision to strip Ukrainian men of their rights was “fair” and in line with controversial military mobilization reforms, which President Vladimir Zelensky signed into law this month. Zelensky’s reforms, set to take effect next month, will lower the draft age from 27 to 25, tighten exemptions, and oblige all men, regardless of eligibility, to report to a conscription office to “update” their personal data. According to EU officials, an estimated 650,000 Ukrainian men of fighting age are living in the bloc. Kiev has identified that pool as a significant untapped source of manpower for the armed forces. However, asked in early April how many troops Kiev intended to mobilize, Zelensky dodged the question.

“When new technology meets the brutality of old-fashioned trench warfare, the results are rarely what Pentagon planners expected..”

• Ukraine Conflict ‘A Bonanza’ For US Military – NYT (RT)

The US military is reportedly using the Ukraine conflict to test a new artificial intelligence technology that helps detect targets on the battlefield using drone footage, the New York Times reported on Tuesday. Dubbed Project Maven, research into the technology was initially picked up as a government contract by Google six years ago, according to the outlet. However, after pushback from engineers and employees, who did not want to take part in building an AI tool for military use, the tech giant stepped away from the project, which was picked up by other contractors. Now, the technology is being tested on the front line in Ukraine, the NYT claims, as Western and Ukrainian officers, along with some of Silicon Valley’s top military contractors, are “exploring new ways of finding and exploiting Russian vulnerabilities.”

So far, the results of the testing have reportedly been “mixed.” While Project Maven allows commanders to identify the movements of Russian forces and use AI algorithms to predict their next steps, it has apparently been “difficult” to bring “21st-century data into 19th-century trenches.” One of the main barriers, the Times said, is that due to restrictions imposed by US President Joe Biden, the US military can only provide Ukrainians with a “picture of the battlefield” without giving precise targeting details. It is also unclear if the new technology would even be able to change the course of the conflict, given Russia’s ability to quickly adapt to technologies being used by the Ukrainian side.

“When new technology meets the brutality of old-fashioned trench warfare, the results are rarely what Pentagon planners expected,” the outlet said. Nevertheless, the Ukraine conflict remains “a bonanza for the US military” in the minds of American officials, and a testing ground for rapidly evolving technologies. “At the end of the day this became our laboratory,” Lt. Gen. Christopher T. Donahue, who commands the US Army’s 18th Airborne Division, told the NYT. Russia, meanwhile, has repeatedly decried increasing US involvement in the conflict. Moscow describes it as a proxy war being waged by Washington and its partners, using Ukrainians as “cannon fodder” to further Western interests.

“..it’s almost impossible to immediately make them as economically efficient as those in Russia. It had taken decades for Russia to set up its [nuclear fuel] production.”

• G7 Could Take 10 Years to Catch Up With Russian Nuclear Fuel Output (Sp.)

US President Joe Biden and his G7 have vowed to end imports of Russian nuclear fuel, but leading Western economies still lag behind Moscow in innovative atomic technologies, nuclear expert Valery Menshikov told Sputnik. The US Office of Nuclear Energy (NE) asserted in a recent press release that the Biden-Harris administration is doing whatever it takes to ensure the nation’s independence in terms of secure nuclear fuel supplies as well as to “re-establish US leadership in nuclear energy more broadly.” The agency stressed that President Joe Biden’s government is leading the “Sapporo 5” group, consisting of the US, the UK, France, Japan and Canada to support the growth of nuclear energy deployment around the world “free of Russian influence.” But the NE was forced to admit that Russia presently supplies around 44 percent of global uranium enrichment services and 20 to 30 percent of enriched uranium products used in the US and Europe.

To complicate matters further for the Sapporo 5, Russia is the only country selling high-assay low-enriched uranium (HALEU), which is indispensable for advanced nuclear reactors, on a commercial scale. President Joe Biden stated on April 19 that a US plant had managed to produce the first 200 lbs (90 kg) of HALEU and would make nearly a ton of the “powerful” nuclear fuel by the end of 2024. Given that in 2020 the US Department of Energy (DoE) projected that more than 40 metric tons of HALEU will be needed before the end of the decade to meet Washington’s pressing climate goals, those amounts are a drop in the ocean. “Undoubtedly, the speeches that Biden is now delivering are just another contribution to his collection of campaign promises. And since, the United States still depends on the supply of fresh enriched fuel for nuclear power plants, this task is one of the most important, including in political terms,” Valery Menshikov, member of the Public Council of Rosatom Corporation and member of the Council of the Center for Russian Environmental Policy, told Sputnik.

Russia maintains leadership in global uranium enrichment services, Sputnik’s commentator stressed, adding that neither US nor European scientists have been able to achieve enrichment capacities matching those of their Russian peers. Russian nuclear fuel is also comparatively cheaper, Menshikov pointed out. The expert recalled that the Russo-US nuclear fuel trade started immediately after the collapse of the USSR: the 1992 Megatons to Megawatts Program envisaged the recycling of weapons-grade uranium from dismantled Russian nuclear warheads into low-enriched uranium used to produce fuel for American nuclear power plants. Over the decades, Russia routinely delivered large volumes of enriched uranium to the US.

The expert expressed doubts that the US will be able to completely stop purchases of Russian nuclear fuel by 2028, as Biden has pledged. “The problem is that the process [of making nuclear fuel] is very complex,” Menshikov said. “The most important thing is that while it is possible to launch such productions, it’s almost impossible to immediately make them as economically efficient as those in Russia. It had taken decades for Russia to set up its [nuclear fuel] production.” When it comes to the European Union (EU), the situation is complicated by the fact that there are 19 Russia-designed reactors within the bloc. The list of countries which have Russian-made nuclear equipment includes Slovakia, Hungary, Finland, Bulgaria and the Czech Republic. Although some European countries, such as Finland, have recently halted cooperation with Russia, others — like Hungary — are proceeding with new projects.

“What appears on the horizon, without any in-depth national discussion, after being approved by the Council and the European Parliament, is a global austerity package, on a European scale..”

• European Bureaucrats Serve America’s Economic Interests (Dionísio)

Once again, the European bureaucracy is living up to the saying that “what has born crooked, late or never is straightened out”. This is the case with the European Union, which was built as a political response to a reality that is no longer there — the socialist bloc — and which, when faced with the absence of its vital force, embarked on an erratic process of enlargement, aimed above all at provoking Russia, creating the conditions for NATO expansion and responding to the monopolies’ growing need for new markets and new sources of skilled and cheap labor, as is the case in Eastern Europe.

Within this framework and in response to the same needs, the EU is once again reissuing a recipe already widely known to the peoples of the South. While there is widespread recognition that the budgetary criteria contained in the Stability and Growth Pact constitute a stranglehold on public investment and is responsible for the short-term vision that has left the member states hostage to the financial authoritarianism of Brussels, at a time when the European bloc is losing more and more ground to the economies with which it has to compete, the unelected supranational power of the EU is once again proposing, this time to all Europeans, something that none of these peoples would ever vote for: austerity for the next four years (at least).

What appears on the horizon, without any in-depth national discussion, after being approved by the Council and the European Parliament, is a global austerity package, on a European scale, applicable to almost all the countries of the Union, which has been given the pompous name of “New Economic Governance Framework” and which is based on instruments such as the “Debt Sustainability Analysis” and “Specific Fiscal Plans” per member state, which will be developed within the framework of a 4-year adjustment period, which can be extended to 7. If the Stability Pact was not enough to bring most of the countries to austerity, this time EU autocracy is working to leave no one behind. Every country must bring to an end every evidence or memory that a social state has once worked with huge success.

That’s why we have to say that “it’s coming in handy”! At a time when countries should be investing absolutely decisively in industrialization, innovation and conquering a place at the top of the future technological chain, as China and Russia are doing and the US is going into brutal debt to do, what do the accountants in Brussels decide to do? Postpone the race, calling into question the targets they themselves have set for 2030 and 2050. Once again, the story of the well-behaved and thrifty countries versus those that don’t know how to govern themselves is being repeated. But this time, with the exception of five countries (Cyprus, Sweden, Estonia, Denmark and Ireland), all the others will have to tighten their belts and cut 100 billion from their public budgets right in the first year of adjustment. Incidentally, 100 billion is more or less what the EU has offered the Kiev regime to date (in January 2024 it was 85 billion euros according to the Kiel Institute). And any of those lucky countries is important for the financing of the pluriannual European budget.

Assuming that this mass economic destruction is the continuation of a process that began with subprime, from which European economies had to pay for the losses of American banks, and continued with the NATO/Russia conflict in Ukraine, which has not only deprived European countries of important production factors, at a low price and with guaranteed quality and quantity… How should the European Union act, especially knowing that in Biden’s USA, the implementation of Inflation Reduction Act is well underway, with a vast investment program in key technological areas such as electric vehicles, lithium batteries, photovoltaic panels and semiconductors?

“..Iran’s nuclear doctrine is based on a fatwa (a ruling based on Islamic law) issued by the country’s Supreme Leader..”

• Iran’s Nuclear Plans Are Clear. Just Read Its Own Islamic Law (Juma)

In light of the direct conflict that broke out between Israel and Iran, rumors that the Islamic Republic could produce nuclear weapons began circulating again. In addition, just a few days ago Reuters and other media outlets quoted a senior commander of the Islamic Revolutionary Guard Corps (IRGC) saying that Iran may review its nuclear doctrine following Israeli threats. The US, EU, and Israel have long feared that Iran may produce nuclear weapons, and have used this threat to justify their actions against the Islamic Republic. However, it is important to understand that Iran’s nuclear doctrine is based on a fatwa (a ruling based on Islamic law) issued by the country’s Supreme Leader. According to this fatwa, the production of nuclear weapons is a sin. However, Iran’s opponents do not believe in the sincerity of this ruling and, they suggest, it can be renounced at any time.

On April 17 and 18, the first Tehran International Conference on Disarmament and Non-Proliferation took place. The motto of this conference was “Nuclear energy for everyone, nuclear weapons for no one.” There, Ali Akbar Velayati, adviser to the Supreme Leader of Iran, read Ayatollah Khamenei’s message in front of officials and members of various international delegations and organizations. “All of you know that, in the absence of the Imam Mahdi, whose coming is expected by the Shiites, the Shiite legal system is based on the opinion of authoritative and highly competent experts in the field of Islamic law (which Iran’s decisions are based on). These religious scholars issue fatwas which clearly indicate whether any action is permissible or not. One [important] issue is the permissibility of the production and use of weapons of mass destruction (chemical, biological, and nuclear weapons) …”.

Ayatollah Khamenei had carefully analyzed the consequences of the use of nuclear weapons by the Americans in Japan as well as the use of chemical weapons against Iran during the Iran-Iraq war, and stated his position on this issue: “We believe that, besides nuclear weapons, other types of weapons of mass destruction, such as chemical and biological weapons, also pose a serious threat to humanity. The Iranian nation, which is itself a victim of chemical weapons, feels more than any other nation the danger that is caused by the production and stockpiling of such weapons, and is prepared to make use of all its facilities to counter such threats. We consider the use of such weapons as haraam [forbidden] and believe that it is everyone’s duty to make efforts to secure humanity against this great disaster.” In the period from 2010 to 2015, other religious authorities, such as ayatollahs Makarem Shirazi, Jafar Subhani, Noori-Hamedani, and Javadi Amoli, also issued fatwas that prohibited the production and use of weapons of mass destruction.

But can the issued fatwas be changed or canceled? Can Iran’s position in this regard change? From a theological point of view, certainly not. Islamic law states clear reasons for this. Nuclear weapons and the radiation which results from their use threaten the environment, causing the destruction of crops and the death of offspring. Verse 205 of Surah al-Baqarah says: “And when he goes away, he strives throughout the land to cause corruption therein and destroy crops and animals. And Allah does not like corruption.” The protection of the environment, the preservation of the life of living beings and plants is every Muslim’s obligation under Sharia, Islamic law. The production and stockpiling of nuclear weapons, even if they are never used, may endanger the lives of people on the planet as a result of human error. According to Islamic law, this is unacceptable. Islam believes that a victory must be achieved by reasonable, lawful, and humane means. As for the rules of warfare, Islam strictly prohibits the killing of civilians, women, children and the elderly, as well as attacks on civilian infrastructure.

“..they prefer to pretend that they are fighting for peace. The very peace for which no stone should be left unturned on this planet. But that will come later..”

• Why Iran Decided Not To Attack Israel Again (Gurevich)

Iran has again threatened Israel with a harsh response to aggression. The army and the Islamic Revolutionary Guard Corps will make those who cross red lines regret it, said the Deputy Chief of the Army for Coordination, Habibollah Sayyari.Meanwhile, Israel has refrained from speaking out against Tehran. Politicians have focused their rhetoric on Hamas. In particular, Prime Minister Benjamin Netanyahu has promised to increase military and political pressure on the Palestinian group in the near future in order to motivate it to release hostages, writes the Times of Israel. The good news is that there will be no Iran-Israel war. At least not at this stage. Tehran has chosen not to react vociferously to the Israeli air force’s retaliatory strike, dismissing all reports of the destruction of the radar protecting the Natanz nuclear centre as Zionist intrigues.

Well, the bottom line is that we have two air raids attributed to Israel and one very large Iranian strike. In the latter case, everything was official and the Islamic Republic can therefore claim an entry in the Guinness Book of Records with an article on the largest number of UAVs and ballistic missiles involved in a single offensive operation. Incidentally, we do not know what the real effect of the large-scale attack was. Iran, like Israel, is carefully hiding data on the damage. However, the political consequences of such events are far more important. And, as usual in the Middle East, a dozen seemingly unrelated problems have become intertwined. After the Iranian strike, for example, Western countries began to advise Israel not to react, and rumour has it that the Jewish State was negotiating for the right to launch a military operation in Rafah, the last Hamas stronghold in Gaza.

Then in the end, it could no longer remain patient and responded. The Iranians had options. The Ayatollahs could have said that Israel had again crossed all the red lines. This would have led to further escalation, but might have protected Hamas. But Iran, for its own reasons, ignored the Palestinians and reported through the press that nothing serious had happened. The reason for this peacefulness is probably that they saw a working alliance between Israel, Jordan and the Sunni monarchies of the Persian Gulf. This is precisely the nightmare that the Iranians have done their utmost to prevent. They even restored diplomatic relations with Saudi Arabia in 2023. But apparently confrontation with the Shiites is more important to moderate Sunnis than dislike of the Jews.

According to military analysts, if the Israeli Air Force did attack Iranian air defences, it means that the Israelis probably flew over Jordan or the Arabian Peninsula to carry out the task, and it is unlikely that this was done without the consent of the Hashemite Kingdom or the Saudis. As a result, the military alliance is not only defensive, which means that virtually all of Iran’s proxies in the region, including Hezbollah, the Houthis and the Shia militias in Iraq and Syria, are at risk. For now, however, this is all a hypothetical picture. Its implementation requires the normalisation of Israel’s relations with Riyadh and, as part of the deal, the signing of a defence agreement with the US, as well as American-Israeli goodwill for the establishment of a nuclear capability in Saudi Arabia. And all this has to happen before the end of June. Otherwise, Washington will not be able to get the relevant decisions through Congress because of the upcoming election. Obviously, the Iranians believe that further escalation will only accelerate the process described above. That is why they prefer to pretend that they are fighting for peace. The very peace for which no stone should be left unturned on this planet. But that will come later.

“..she doesn’t know whether the Israeli leader is “afraid of peace, incapable of peace, or just doesn’t want peace.”

• Netanyahu Should Resign – Nancy Pelosi (RT)

Israeli Prime Minister Benjamin Netanyahu is an obstacle to peace in Gaza and “should resign” from his position, former US House of Representatives Speaker Nancy Pelosi has said. She made the remarks on Monday in an interview with Irish public broadcaster Raidio Teilifis Eireann (RTE) during her visit to the country. Pelosi criticized the Israeli leader’s response to the October 7 Hamas attack which saw Palestinian militants kill over 1,100 people on Israeli territory and take around 250 hostages. The former House speaker cited the recent resignation of Israel Defense Forces (IDF) intelligence chief Major General Aharon Haliva over the failure to prevent the attack, before pointing the finger at Netanyahu.

“We recognize Israel’s right to protect itself. We reject the policy and the practice of Netanyahu – terrible. What could be worse than what he has done in response?” Pelosi told the outlet. “He should resign. He’s ultimately responsible,” she added. When asked if Netanyahu is a “block” to peace, Pelosi replied that “he has been for years,” adding that she doesn’t know whether the Israeli leader is “afraid of peace, incapable of peace, or just doesn’t want peace.” She went on to argue that Netanyahu been an “obstacle to the two-state solution, I emphasize the word, ‘solution.’”

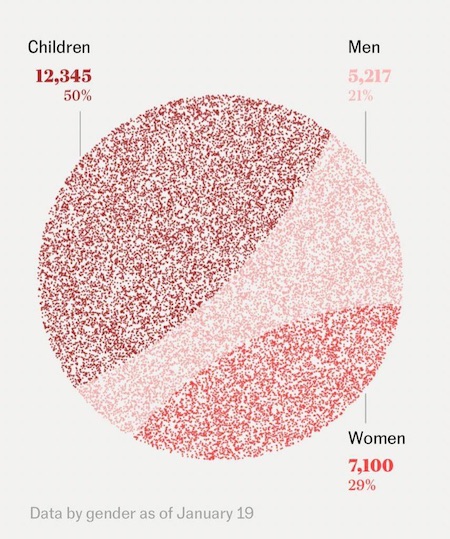

Health authorities in Gaza have estimated that more than 34,000 Palestinians have been killed amid Israel’s siege of the enclave, which has included extensive bombardment as well as a ground incursion. Earlier this month, Pelosi joined more than 30 US Congress members who signed a letter urging President Joe Biden and Secretary of State Antony Blinken to halt weapons transfers to Israel. The change of tune in Washington, Israel’s key ally, followed the killing of six aid workers from the World Central Kitchen humanitarian organization. The IDF targeted the group’s convoy in what it claimed to be a tragic mistake, despite the food supply mission being closely coordinated with the military.

Cyber crime is part of Russian warfare, apparently. Impoverishing grannies…

• Unconventional Russian Warfare Threatening British Grannies – Wallace (RT)

The UK is facing certain forms of “unconventional warfare” waged by its enemies, potentially including Moscow-backed online scams that target the elderly, former British Secretary of Defence Ben Wallace has claimed. The Conservative MP, who resigned from the cabinet last August, told Sky News on Wednesday that the world today reminded him of the interwar periods during the last century. The situation, Wallace explained, is similar to “the 1930s, but with an added challenge of terrorism and a challenge of unconventional warfare.” As examples of the latter, he cited “disinformation campaigns, the enemies in this country using cyber to divide us, to rob from us, to spy on us, and to create frictions in our society.”

When asked by host Kay Burley which nation posed the biggest threat to the UK, Wallace said it was Russia. ”Many of the big cyber-crime syndicates are based in Russia, curiously protected by the Russian state,” he claimed. “They are the ones robbing your granny and my parents with phishing emails. So, Russia is directly challenging us at all levels.” Earlier this month, British police reported busting a UK-founded international ring of scammers, which since 2021 alone has stolen from some 70,000 victims in the country. Thirty-seven people were arrested around the world in the LabHost case, the force reported. The statement didn’t mention Russia.

Climate Emergency

President Biden Considering “National Climate Emergency” Declaration

"If Joe Biden declares a national climate emergency, he would have COVID-like powers. He would impose the Green New Deal on America without a vote in Congress" The AP is urging other news outlets to use the… pic.twitter.com/vpE1E0T0Yo— Camus (@newstart_2024) April 23, 2024

Wealth

https://twitter.com/i/status/1783136306400497981

Your value

https://twitter.com/i/status/1783165842433474992

Cub

Tiger cub pestering his mom. pic.twitter.com/TxJrVSHmCV

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 23, 2024

https://twitter.com/i/status/1782896073578582350

Baby Hippo

https://twitter.com/i/status/1782886328171905240

Scratch

This is Reed. He discovered that the key to the perfect scratch is gravity. 12/10 pic.twitter.com/XfvLyfEjFM

— WeRateDogs (@dog_rates) April 24, 2024

Healed

my heart has been healed! pic.twitter.com/7VBkoTx4KX

— Why you should have a cat (@ShouldHaveCat) April 23, 2024

Adrenochrome

Here is 15 minutes of Adrenochrome being referenced in Movies and Music.

Remember: ‘Adrenochrome is a conspiracy that was created by crazy QAnon Conservatives in 2016.’ pic.twitter.com/wPoEYi3Gby

— Dom Lucre | Breaker of Narratives (@dom_lucre) April 24, 2024

Robotina

https://twitter.com/i/status/1783391212558262482

Cabal full movie

THE FALL OF THE CABAL – FULL MOVIE

This is Potentially the most eye opening documentary ever made.

This is a VERY well researched exposé on the Global Cabal – uncovering the deepest conspiracies and their plan for world dominance

This can be extremely unsettling – be prepared pic.twitter.com/AokRT3RWv5— American Archer (@CalenArcher) April 24, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.