Edward Hopper Summertime 1943

Deficits and reserve currencies. Joined at the hip.

• Why Trump Is Targeting G-7 Nations On Trade (MW)

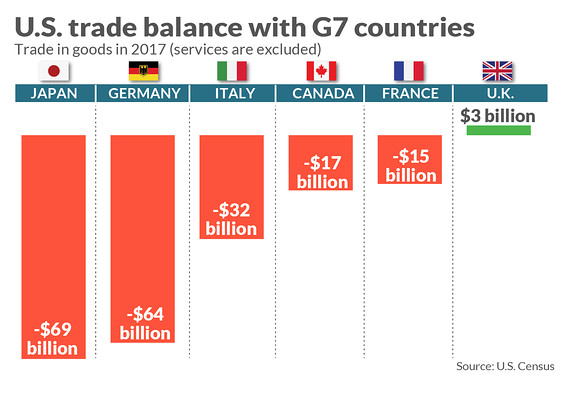

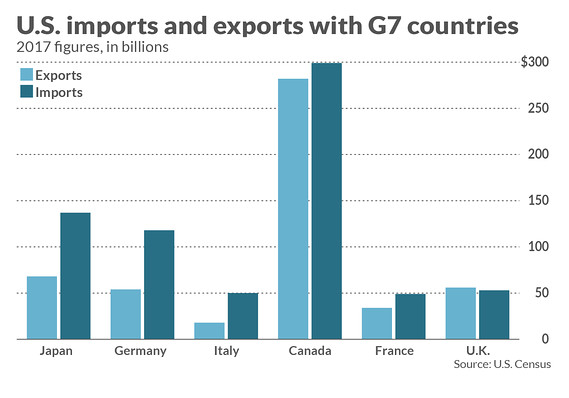

President Trump has threatened Canada and France with higher tariffs if they don’t ease up on what he considers unfair policies, sparking fresh worries that a simmering dispute over trade will boil over and damage the world’s leading economies. The president clashed with Canadian Prime Minister Justin Trudeau and French President Emmanuel Macron in an extraordinary series of tweets ahead of meeting of G-7 leaders in Quebec. The G-7 consists of the U.S., U.K., Canada, France, Germany, Japan and Italy. The U.S. has run huge trade deficits for years through both Republican and Democratic presidents. In 2017, the trade gap in goods rose to a nine-year high of $807 billion (the deficit was a smaller $552 billion if services are included).

China accounted for 47% of the U.S. trade deficit in goods in 2017, but the G-7 countries were responsible for another quarter. Germany ran the biggest trade surplus with the U.S., followed by Japan and Italy. The U.S. runs smaller deficits in goods with France and Canada, according to government figures. The U.S. actually posted a small surplus with Canada in 2017 if services are included, largely reflecting how much Canadians spend when visiting the 50 states. The U.K. is the only country with which the U.S. ran a goods and overall surplus.

Long time pal Jesse Colombo posted this on Twitter. I wrote back:

“Sorry, my friend Jesse, but every single US home is overvalued. It just depends on the vantage point you look from. All prices have been distorted by the Fed’s policies, not just half of them. Arguably some more than others, but can that be the core argument here?”

• More Than Half Of American Homes Are Overvalued, CoreLogic Warns (ZH)

A history of economic cycles dating back to the mid-1800s reveals a troubling outlook for today’s Central Bank induced bull market of hopes and dreams, which could be in the later innings. It is quite evident that Americans have quit saving as their gig-economy jobs have left them in financial ruin – now being squeezed by the higher cost of living. The charades of economic stability could continue for a little longer, with President Trump’s stealth quantitative easing program to Wall Street via debt-financed tax reform, which has induced a massive wave of more than $2.5 trillion in stock buybacks — a gift to corporate America.

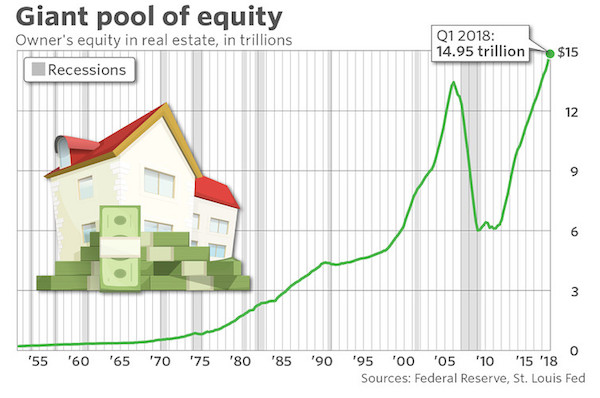

No matter where one looks, the valuation of many financial assets are overextended, and new evidence today from CoreLogicshows this troubling picture very late into an economic cycle: More than half of U.S. residential real estate markets were overvalued in April. CoreLogic reports that residential real estate prices nationwide increased 6.9% year over year from April 2017 to April 2018. The firm’s Home Price Index (HPI) also shows a 1.2% rise on the month-over-month basis from March to April 2018. This has certainly sparked the debate of housing affordability across the nation with many millennials struggling to achieve the American dream.

CoreLogic Market Condition Indicators showed that 40% of the 100 largest metropolitan areas were overvalued in April, compared to 28% undervalued, and 32% in line with valuations. The report uncovers a shocking discovery that of the nation’s top 50 largest residential real estate markets, 52% were overvalued in April.

Since they’re all overvalued, any talk of house-rich is shaky.

• America Is House-Rich But Cash-Poor (MW)

The very same day Lindsay learned he wouldn’t qualify for a refinance, help arrived. It was a direct mail solicitation, in the form of a fake check “payable to Michael Lindsay for $186,000.” A company called Unison was offering money in exchange for an ownership stake in the Lindsay house. Lindsay investigated, and found Unison’s process both “professional” and “informative,” he said. “It had come down to the fact that the only other option I had was to sell the house,” Lindsay told MarketWatch. He hated that idea, since his two boys, who’d already been through so much, were thriving in their school district. And while he didn’t want to rule out downsizing, there was just too much emotion attached to the home where the boys had been born, where he and Vanessa had tracked their growth through pencil marks in the garage.

Ultimately, Lindsay said, “It just felt crazy that there was so much equity in the home and I couldn’t get at it.” He signed on with Unison. After just three weeks, the company had dispersed $200,000 in cash to pay off Lindsay’s creditors and allow him to do much-needed deferred maintenance on the house. Unison’s product, which it calls HomeOwner, has been around for years, but it’s really hit its stride in the past year or so. The housing market has not only recovered from the Great Recession, it’s heated up. According to an analysis from Attom Data, nearly 14 million Americans are now “equity rich” – meaning they have at least 50% equity in their homes. It bears repeating that many owners and communities are not so lucky: over a million Americans are underwater, and some cities and towns are still reeling under the weight of abandoned and vacant homes and stagnant micro-economies.

But for most of the country, rapidly rising home prices and a dearth of anything else to buy means people are staying in their homes longer, allowing them to accrue more and more equity: $15 trillion worth, to be exact. That may sound like a first-world problem, but as Lindsay’s example illustrates, all the equity in the world is worthless if it’s locked in an untouchable asset while medical bills, home improvement costs, and other expenses are mounting. And since home equity is usually most concentrated among those who’ve lived in their homes the longest, that’s often retirees – the people most in need of certain cash flow.

Central banks and Chinese buyers.

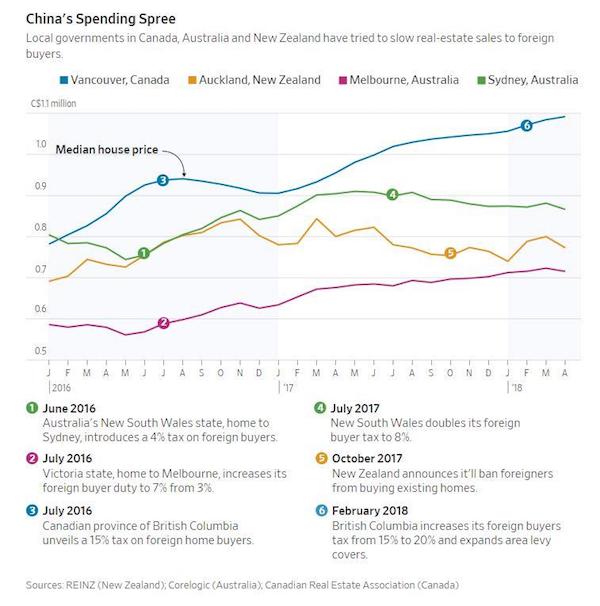

• Cities Struggle To Fend Off “Unstoppable Juggernaut” Of Chinese Homebuyers (ZH)

As we’ve pointed out time and time again, foreign – mainly Chinese – buyers seeking to park their ill-gotten gains beyond the reach of the Communist Party have – in addition to global capitals like New York City and London – favored a handful of cities in the Pacific Northwest, as well as Australia and New Zealand. Many of these cities – for example, Vancouver – have seen property values rise to levels that are unaffordable for local buyers. While the influx of capital helped fuel an economic recovery in the aftermath of the crisis, home values soon reached crisis levels that demanded action by local officials. Some places have tried to use taxes to deter foreign buyers. In some instances, the taxes worked – at least temporarily.

But with the flow of buyers refusing to slow despite efforts by the Chinese government to stop money moving offshore, many of these cities are getting desperate. And after years of occasional headlines, it appears the crisis has finally become dire enough for the mainstream press to start paying attention. To wit, government officials in Canada and Australia who spoke with the Wall Street Journal for a story about how Chinese homebuyers expressed concern that widespread foreign ownership has created bubbles in local real-estate markets. Even as Australia and New Zealand and some Canadian cities have raised taxes on foreign buyers, many are worried that home values will continue to climb, foiling policy makers best efforts to control them.

Since it passed an 8% foreign buyers tax last summer, Sydney says foreign buying hasn’t let up. Jon Ellis, chief executive of Investorist, an online portal for cross-border property transactions, said Chinese property buyers are an “unstoppable juggernaut”. In some markets with large Mandarin-speaking populations, locals can spot real-estate ads in Mandarin at bus stations and benches in the surrounding area. In response, Vancouver imposed a 15% foreign buyers tax back in 2016. When that didn’t work, city officials worked with the province on something more aggressive.

“We’ll be fortunate if we can turn out brooms and scythes twenty years from now, let alone flying Teslas.”

• The Summer of Discontent (Jim Kunstler)

The ill-feeling among leaders of the G-7 nations — essentially, the West plus Japan — was mirrored early this morning in the puking financial market futures, so odious, apparently, is the presence of America’s Golden Golem of Greatness at the Quebec meet-up of First World poobahs. It’s hard to blame them. The GGG refuses to play nice in the sandbox of the old order. Like many observers here in the USA, I can’t tell exactly whether Donald Trump is out of his mind or justifiably blowing up out-of-date relationships and conventions in a world that is desperately seeking a new disposition of things. The West had a mighty good run in the decades since the fiascos of the mid-20th century. My guess is that we’re witnessing a slow-burning panic over the impossibility of maintaining the enviable standard of living we’ve all enjoyed.

All the jabber is about trade and obstacles to trade, but the real action probably emanates from the energy sector, especially oil. The G-7 nations are nothing without it, and the supply is getting sketchy at the margins in a way that probably and rightfully scares them. I’d suppose, for instance, that the recent run-up in oil prices from $40-a barrel to nearly $80 has had the usual effect of dampening economic activity worldwide. For some odd reason, the media doesn’t pay attention to any of that. But it’s become virtually an axiom that oil over $75-a-barrel smashes economies while oil under $75-a-barrel crushes oil companies.

[..] There is also surprisingly little critical commentary on the notion that Mr. Trump is seeking to “re-industrialize” America. It’s perhaps an understandable wish to return to the magical prosperity of yesteryear. But things have changed. And if wishes were fishes, the state of the earth’s oceans is chastening to enough to give you the heebie-jeebies. Anyway, we’re not going back to the Detroit of 1957. We’ll be fortunate if we can turn out brooms and scythes twenty years from now, let alone flying Teslas. This will be the summer of discontent for the West especially. The fact that populism is still a rising force among these nations is a clue of broad public skepticism about maintaining the current order. No wonder the massive bureaucracies vested in that order are freaking out. I’m not sure Mr. Trump even knows or appreciates just how he represents these dangerous dynamics.

Since this is their business model, period, it’s time to stop them.

• Facebook Shared Sensitive User Info Via “Secretive” Data Deals (ZH)

If you feel like there’s been a new embarrassing revelation about Facebook’s privacy practices every day this week, well, you’re not entirely wrong. In the third bombshell report to drop since Moday, the Wall Street Journal is reporting that Facebook struck customized data-sharing deals with a select group of companies, granting several of them special access to user records well after the point in 2015 when Facebook said it had shifted its privacy policies in response to learning that a researcher had improperly taken Facebook user data and sold it to Cambridge Analytica. The unreported agreements were known internally as whitelists.

They reportedly allowed certain companies to access sensitive information like phone numbers and a metric called “friend that measured the degree of closeness between users and others in their network,” the people said. The whitelist deals were struck with companies as diverse as Nissan and RBC Capital. The deals represented Facebook bending over backwards to allow special data access to a broader universe of companies, many of whom were valuable advertisers. Others needed the access to wind down unfinished projects after the new developer regulations. But some were granted the special access for “unspecified reasons” that WSJ apparently couldn’t crack.

WSJ also raises further questions about who had access to the data of billions of Facebook users and why they had access – and, what’s more, why didn’t Mark Zuckerberg mention any of this during the Congressional hearings? Facebook said companies were granted this special access as something of a workaround after Facebook stopped granting unfettered access to developers in 2015. Many of the details published in the report appeared vague – for example, WSJ couldn’t pin down how many Facebook clients had been granted this privilege. Perhaps that’s why they published it after 4 pm Eastern on a June Friday.

Pot and opioids. Many more questions than answers.

• Canada First G7 Nation To Make Marijuana Legal (G.)

Even places that have already taken the legalization plunge are hoping Canada will solve some mysteries. After Colorado legalized marijuana five years ago, for example, organized crime reacted by ramping up supplies of “black tar heroin, opiates and harder drugs”, said Dr Larry Wolk, the state’s top public health official. But Wolk says he is interested to watch that process unfold on a bigger scale in Canada, where the new law is expected to deal a much more significant blow to the black market. Any new mix of illicit drugs in the country could have new effects on public health. “What’s the impact of marijuana legalization on the opioid crisis?” he asked as an example.

“Does it actually act as a substitute so that people can get off opiates for chronic pain? Is there a positive impact? Or is it a negative impact, because as a result there’s more opiates in the black market? Is [pot] a gateway? We don’t really have an answer.” One delicate balance for Canadian authorities has been guessing at what kind of pricing will be low enough to eradicate illicit sales – yet not so low as to entice new users. Canada’s finance minister, Bill Morneau, recently said the goal is “keeping cannabis out of the hands of kids and out of the black market. That means keeping the taxes low so we can actually get rid of the criminals in the system”.

The end of Sessions as AG? We’ll take it. While thinking about all the young black kids whose lives have been screwed for small amounts of pot.

• Trump Voices Support For Bipartisan Pot Legislation (Pol.)

President Donald Trump said Friday he “probably will end up supporting” bipartisan legislation to bar the federal government from interfering with marijuana legalization laws at the state level, putting him at odds with efforts by his own Justice Department to crack down on the substance nationwide. The bill, unveiled by Sens. Cory Gardner of (R-Colo.) and Elizabeth Warren (D-Mass.), lawmakers of two states that have voted to legalize certain types of pot use, would in effect give states the right to determine their own approach to regulating the drug.

Pressed on whether he supports the measure while addressing reporters outside the White House on Friday, the president said he supports it now and will “probably” support it going forward. “I really do. I support Senator Gardner,” Trump said of the lawmaker’s bill. “I know exactly what he’s doing, we’re looking at it. But I probably will end up supporting that, yes.” The remarks stand in contrast to the actions of his own Justice Department, which under the direction of Attorney General Jeff Sessions has moved aggressively to crack down on the proliferation of laws to decriminalize and legalize cannabis.

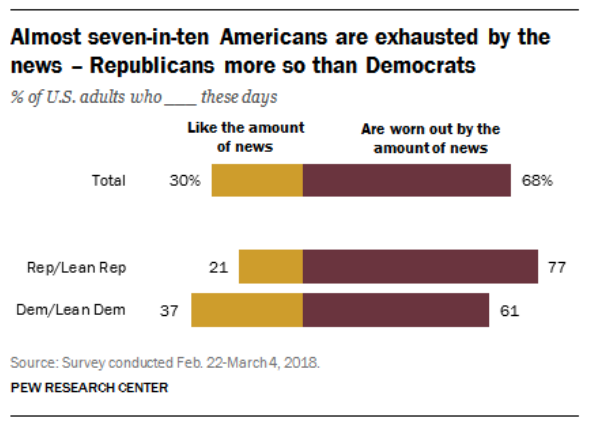

The less news people read, the more exhausted they are?!

• 7 In 10 Americans Are Overwhelmed By News, More Among Republicans (ZH)

In a period in which most Americans feel mentally exhausted by news flow — from Facebook’s trending stories to Twitter’s hashtags to Trump’s spontaneous tweeting — and of course, how could we not forget, the mainstream media’s constant barrage of very fake news, approximately 70% of Americans feel “overwhelmed by the amount of news there is,” according to a Pew Research Center survey conducted from Feb. 22 to March 04, 2018. Nearly 68% of Americans feel mentally exhausted by the high-rate of news in the modern era, compared with just 30% of Americans who enjoyed the amount of news they get.

Pew said today’s “feelings of information overload” is similar to how Americans felt during the 2016 presidential election. While it certainly seems like Americans are consuming too much media, Republicans are experiencing more news fatigue than anyone else. Roughly 77% of Republicans and Republican-leaning independents are mentally drained from the constant bombardment of news headlines, compared with just 61% of Democrats and Democratic-leaning independents, said Pew. The report detailed that avid news watchers were less likely to experience mental fatigue than those who sparingly read headlines. For those who chase headlines “most of the time,” 62% reported psychological exhaustion, meanwhile, 78% of those who less frequently get news say they are overwhelmed.

The human brain which created this modern world is just not wired to process the vast amounts of information from news networks and social media. Americans are sleepwalking into a period of too much stimulation in tense periods, which could result in irrational decision making. America is stressed — its people are stressed — and there is just too much damn news. What could go wrong from here?

That’s a surprise…NOT.

• Berlin Still Has ‘No Evidence’ From UK That Moscow Is Behind Skripal Case (RT)

The German government has zero evidence from the British authorities that could back London’s claims that Moscow was behind the poisoning of the Skripals, German media reports. More than three months since the start of the probe into the poisoning of former Russian double agent Sergei Skripal and his daughter Yulia, the UK is still conspicuously tight-lipped when it comes to any real evidence that could prove its accusations against Russia. On Wednesday, the German government informed a parliamentary oversight committee during a closed hearing that it still has not received any evidence suggesting that Russia might well be behind the incident that took place in early March, German TV station RBB reports.

“It is [still] only known that the poison used in the attack was a nerve agent called Novichok, which was once produced in the Soviet Union,” Michael Goetschenberg, a correspondent of German ARD and an expert on security services, told RBB, commenting on the results of the hearing, which he is familiar with. Apart from this information, which was released by the British authorities soon after the incident, no new data on Russia’s alleged implication in this case was provided to Germany so far, he added. German intelligence has also found no Russian trace in this case so far, Goetschenberg said. “The BND, Germany’s foreign intelligence… has also contacted its own sources and tried to verify the information [about Russia’s potential involvement] in some way,” he told RBB, adding that it eventually failed to find any evidence pointing to Moscow as well.

Following the poisoning, which London blamed on Moscow using the now infamous wording “highly likely,” the UK and its allies expelled dozens of Russian diplomats, with Moscow giving a mirror response. Russia has categorically denied any involvement, and has complained that the victims were not allowed visits by Russian lawyers and diplomats, and the results of the investigation were kept secret. The Russian envoy to the UK has on several occasions alleged that London was even trying to “destroy” evidence in the probe.

It is very easy for governments to simply ban the stuff. But for some reason they don’t. Selling the stuff and then asking people not to use it seems Kafkaesque. At best.

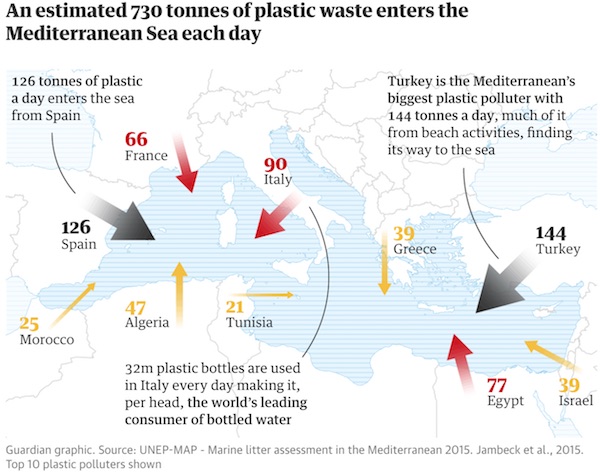

• Tourists To Med Told To Ditch Plastic To Avoid Huge Rise In Beach Litter (G.)

Tourists are being urged to reduce their use of plastic as new figures reveal holidaymakers cause a 40% spike in marine litter in the Mediterranean each summer. Nearly all the waste created by the surge in tourism over the summer months in countries like Italy, France and Turkey is plastic litter, says WWF in a new report. In a matter of weeks over the holiday season the rise in plastic marine pollution contributes to the estimated 150m tonnes of plastic in the ocean. WWF said in its report the majority of plastic waste polluting the Mediterranean Sea comes from Turkey and Spain, followed by Italy, Egypt and France – countries to which more than 34 million British holidaymakers are preparing to travel this year.

Tanya Steele, chief executive of WWF, said holidaymakers were leaving behind a toxic legacy of plastic waste. “The birds, fish and turtles of the Mediterranean are choking on plastic … plastic is ending up in the fish and seafood we eat on holiday. “We’re asking people to think about how they can cut down on the amount of single-use plastic they use and throw away on holiday,” she said. Steele urges holidaymakers to drink tap water where it is safe to do so, refuse plastic straws and skip the purchase of inflatable pool toys. “We can all be part of the solution and not the problem,” she said. In Europe plastics account for 95% of the waste in the open sea, posing a major threat to marine life, says WWF.

After China, Europe is the second largest producer of plastic in the world, producing 27m tonnes of plastic waste. The continent dumps up to an estimated 500,000 tonnes of macroplastics and 130,000 tonnes of microplastics in the sea every year, the report says. But delays and gaps in plastic waste management in most Mediterranean countries mean only a third of the 60m tonnes of plastic produced is recycled. Half of all plastic waste in Italy, France and Spain ends up in landfills. Home to almost 25,000 plant and animal species – of which 60% are unique to the region – the Mediterranean holds only 1% of the world’s water but contains 7% of all of the world’s microplastic waste. Plastics have also been found in oysters and mussels, while crisp packets and cigarettes have been found in large fish, WWF says.

“Shakespeare’s Ariel looked down into the ocean and saw “something rich and strange”; we look down and see our consuming society reflected back at us.”

• Microplastics In Our Mussels: The Sea Is Feeding Human Garbage Back To Us (G.)

Shellfish are the natural filter systems of our seas, mechanisms of purity. So, to discover in a report released on World Oceans Day that mussels bought from UK supermarkets were infested with microplastic seems like a final irony in the terrible story of the plasticisation of the sea. According to the study by the University of Hull and Brunel University London, 70 particles of microplastic were found in every 100 grams of mussels. There’s a vital disconnection here – highlighted by the bottled water you drink to wash down your moules-frites, and the fact that 89% of ocean trash comes from single-use plastic. No sea is immune from this plague, nor any ocean creature, from the modest mussel or zooplankton to the great whales.

I have just returned from Cape Cod, where, due to pollution and other anthropogenic effects, the North Atlantic right whale may be extinct by 2040 – a huge mammal about to vanish from the sight of the shores of the richest, most powerful nation on Earth. On the pristine, remote Cisco Beach on Nantucket, I watched a grey seal watching me – only to realise the sleek pelage of its midriff was bound with an orange plastic bag. Last month, off St Ives in Cornwall, I saw a cormorant tugging helplessly at a monofilament of fishing line that had trussed its bill to its arched neck. The underwater photographer Andrew Sutton sends a selfie from Costa Rica: he is holding miles of illegal plastic long line, tangled like a grotesque bouquet.

From Sri Lanka to the Mediterranean, our summer holiday idylls become places of mortality. That we cannot look underneath what Herman Melville called “the ocean’s skin” is part of the problem. It is as if, defeated by the sea’s mystery, we punish it for defying our dominion. And so, it wreaks its revenge, feeding our own rubbish back to us. Shakespeare’s Ariel looked down into the ocean and saw “something rich and strange”; we look down and see our consuming society reflected back at us.