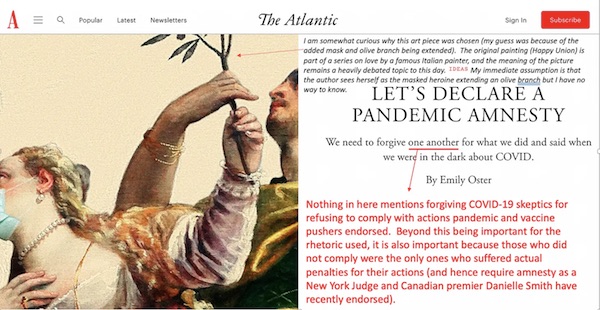

Giovanni Battista Tiepolo Allegory of the Planets and Continents 1752

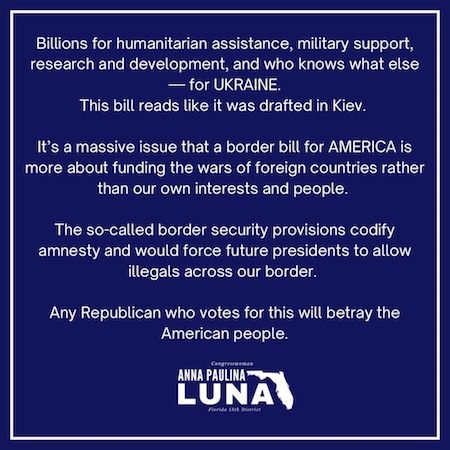

Congresswoman Luna about the new bipartisan Senate bill:

Farmers

German and French protestors are just next level. pic.twitter.com/QO0FNkeXDn

— NO CONTEXT HUMANS (@HumansNoContext) February 4, 2024

Weinstein Border

‘It is frightening to see a disproportionately young male population, of what appear to be Chinese nationals, moving towards the US.'

Bret Weinstein recalls his experience witnessing the mass migration of people making the 'treacherous' journey through the Darién Gap crossing. pic.twitter.com/YbPT5tpeo8

— GB News (@GBNEWS) February 4, 2024

RFK Jr

https://twitter.com/i/status/1754107987000500379

RFK/Smith

A little preview:pic.twitter.com/xOmBbf6obF

— Dave Smith (@ComicDaveSmith) February 3, 2024

Elon Musk: “In the “bet-you-didn’t-know” category,

Homeland Security Secretary Mayorkas issued written guidance making it clear that:

1. Illegal presence alone is not grounds for deportation.

2. Criminal charges, convictions or gang membership alone are not enough for deportation.

You basically have to be a convicted axe murderer to be deported! That’s because every deportation is a lost vote.”

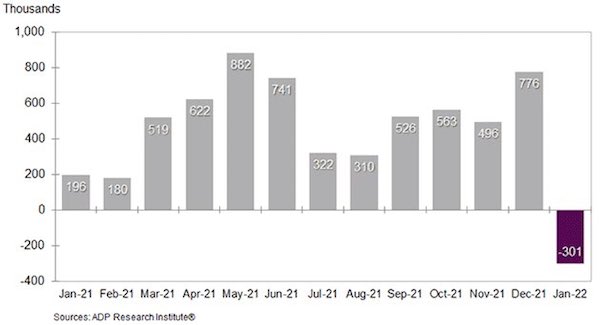

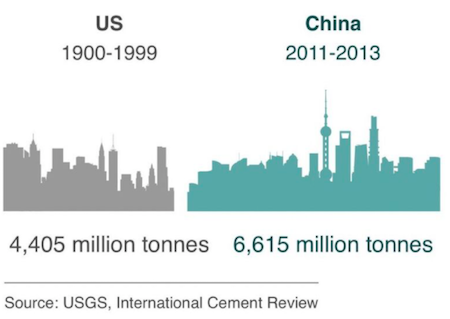

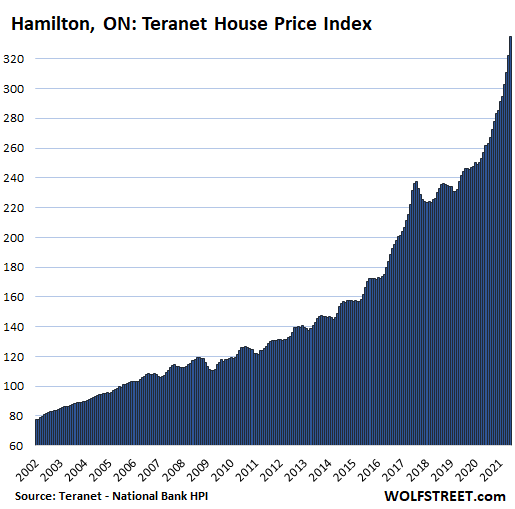

Not much to do with Trump’s promised new tariffs, I would think. This has been coming for a while.

Zerohedge thinks it’s serious though: “..every day that Beijing is just more talk and no action brings us closer to the world’s biggest and most violent social revolt seen in history…”

• Beijing Powerless As Chinese Stocks Crater (ZH)

The China Securities Regulatory Commission vowed on Sunday to prevent abnormal fluctuations, saying it would guide more medium- and long-term funds into the market and crack down on illegal activities including malicious short selling and insider trading. The brief statement followed a sudden plunge of as much as 3.4% in the benchmark CSI 300 Index on Friday — and an outpouring of frustration on social media from individual investors just days before families across the country gather to celebrate the Lunar New Year. “The statement sought to stabilize investor sentiment, but didn’t touch on fundamental problems including a lack of confidence and huge economic uncertainty,” said Shen Meng, director at investment bank Chanson & Co. “Those issues are the causes of abnormal market fluctuation.”

While authorities have taken piecemeal steps to support the economy and markets in recent months and have discussed a potential stock stabilization fund, they’ve yet to announce any major moves to stop the selloff. Weak economic data, simmering geopolitical tensions with the US, a worsening property crisis and an opaque crackdown on the financial sector have all weighed on investor sentiment. As reported last week, China’s CSI 300 tumbled 6.3% in January, a record sixth straight month of losses. Shares then rallied briefly toward the end of the month after Bloomberg reported that authorities were seeking to mobilize about 2 trillion yuan ($278 billion) for a stabilization fund, but the market has since renewed its decline, reaching the lowest level since January 2019 as once again the Beijing trial baloon was just that, and nothing more. .

Meanwhile, the hail mary media bullshit and lies continued, and over the weekend, 21st Century Business Herald daily newspaper reported that authorities should set up a stabilization fund as soon as possible to boost market confidence, with an aim to get its size to 10 trillion yuan or more. Next up it will be 100 trillion in promises, then 1 quadrillion, only by then the SHCOMP will hit 0. Meanwhile, in a sign of how exasperated some investors have become, thousands flocked to a social media account of the US embassy in Beijing to vent their frustrations over the economy and slumping share prices. In the comment section of the embassy’s Weibo post on giraffe protection on Friday evening, some 53,000 users added remarks by Saturday evening, winning over 300,000 likes. China’s internet users often struggle to find a venue to air grievances about the economy or government performance, with official accounts of Chinese state agencies or media usually either disabling the comment function or only showing selected feedback.

In the end, the outcome is a clear one: either Beijing will watch powerless as 1 billion furious Chinamen start rioting in the streets as both the real estate and capital markets crater – and only then, after countless are dead, will it inject trillions into the economy, or someone in Beijing will come to their senses and do so before there is bloodshed… Not that that’s a viable solution of course: at best, that’s kicking the can by a few years, but in the grand scheme of things, can kicking is all the world has left. And now all eyes are now on China and every day that Beijing is just more talk and no action brings us closer to the world’s biggest and most violent social revolt seen in history.

It was Brzezinski who invented the plot of a war between Ukraine and Russia.

• Brzezinski’s Barbaric Dream. A Broader War, “Spreading Towards Iran” (Stea)

In a recent interview, Paul Craig Roberts, former economic adviser (US Department of the Treasury) to the late President Ronald Reagan, outlined, with astonishing foresight, the trajectory that the current Middle East crisis may follow, and his insight is both brilliant and terrifying. To paraphrase Roberts’s analysis, the Israeli-Gaza conflict is merely the beginning of a widening conflict in the Middle East, spreading toward the neocon’s main target, Iran. Though Iran is extremely powerful now, the conflict will greatly weaken the country, making possible the West’s stealthy infiltration of jihadists into the Central Asian countries which border Iran and extend to both the Russian borders and, indeed the Chinese border, with Xinjiang, bordering Kazakhstan. Though Roberts does not mention China, the logic of his thesis would extend to China.

The purpose of these jihadists, infiltrated into countries neighboring Russia, with large Islamic populations which have, historically lived in peace with citizens of very diverse ethnic and religious identities, including Russian, Catholic, Jewish citizens, often intermarrying, will be, as Brzezinski planned. This purpose will be,[..] to incite violent, extremist religious separatist movements, destabilizing these peaceful Central Asian countries, fomenting “color revolutions” (as was tried, but failed in Kazakhstan recently), and engineering bloody putsch, in these countries, similar to the one incited in Ukraine in 2014 with the ensuing devastating wars. These infiltrated jihadists would spread and continue inciting violent separatist movements, next, within the Russian Federation itself, with Bashkortostan and Tartarstan on the Volga, with large Islamic populations, again, also hitherto living peacefully with other extremely diverse religious and ethnic citizens.

If successful in inciting separatist movements on the Volga, Russia could be isolated from the enormously rich resources in Siberia, and reduced in size to less than the area of France, and impoverished, accordingly. Though Russia may be aware of this lethal Western agenda, the militarization of the rabidly Russophobic Baltics, to the North, Latvia, Lithuania and Estonia, and the recent accession of Finland and Sweden into Nato, with planned “Steadfast Defender 2024, including 31 NATO participants, will threaten Russia from the north and west, reducing its ability to protect itself from threats from destabilized Central Asian neighbors, and demanding that Russia fight for its survival on two fronts.

Although Brzezinski, in “The Grand Chessboard”, describes a partnership between Russia and China as a disaster to be avoided at all costs, NATO’s provocation of Russia has forced a war between Russia and Ukraine, which Brzezinski fiercely advocated in order to isolate Russia from Europe. Though the Russia-China friendship would appear to protect Russia from the aforementioned crisis, at least now, if the deadly agenda Paul Craig Roberts describes becomes a reality, the infiltration of jihadists would likely spread to China, which has, also, a large Islamic population, hitherto living peacefully with diverse citizenry.

However, as violent, externally engineered separatist movements have already occurred in Xinjiang, in the West of China, these could be exacerbated by further outside infiltration of jihadists, and could metastasize throughout China. Further, the eastern part of China could be existentially threatened by the new “Axis” of Japan, South Korea and the United States, menacing China’s survival, and again forcing China to divert its defenses from the West to the East, increasing its vulnerability, and diminishing its ability to assist Russia, amidst the rampant chaos created by the Brzezinski plan, and Washington’s current neocon agenda, world domination.

“The United States, its assets across Iraq would be crushed. It would be overrun and by extension Syria as well and Lebanon. The world has changed. This is not just Iran, by the way. This is the whole of West Asia.”

• US Not Prepared for War Against Iran and ‘Axis of Resistance’ (Sp.)

US officials have reportedly signaled that plans have been approved for a series of strikes against targets in Iraq and Syria. That would be in response to a recent drone attack on US personnel in the Middle East — which claimed the lives of three soldiers and left 34 wounded. In the wake of the strike Bloomberg claimed the Biden administration was considering a covert strike on Iran or Iranian officials as possible options. But University of Tehran Professor Seyed Mohammad Marandi told Sputnik that directly targeting Iran would be a major mistake and a major miscalculation by Washington. He suggested that scenario was very unlikely, given Iran’s missile defense and drone capabilities, as well as the vulnerability of US bases which are scattered across the Middle Eastern region.

“Let’s assume that the United States strikes Iran,” Marandi said. “The United States has bases all across the Persian Gulf. The Iranians will hit out at those bases, and then the Iranians will also punish those countries that host those bases.” The professor warned the fallout from the tit-for-tat attacks would send oil and gas prices “through the roof.” “The Red Sea would no longer be safe for oil and gas. The Western economies would collapse if there was a major escalation in our region,” Marandi underlined. “The United States, its assets across Iraq would be crushed. It would be overrun and by extension Syria as well and Lebanon. The world has changed. This is not just Iran, by the way. This is the whole of West Asia.” Given the latest US media reports, it appears far more plausible that the US would attack targets in Iraq and Syria, Marandi continued.

“[The US] will claim some sort of ‘victory over terrorists’ and that sort of nonsense which they usually say,” the professor said. “But it will be like in Yemen, they will have very little impact because the resistance to the US occupation, the illegal occupation in Iraq and Syria is very well hidden. Their assets are underground, they are spread out. And all the United States would do would be to make people angrier and make the resistance more popular, both at home and abroad. That’s exactly what we saw in Yemen.” Marandi noted that most recently instead of pushing the Israeli regime to end the slaughter in the Palestinian Gaza Strip, the US tried to facilitate the genocide by attacking Yemen. Since early January the US and its allies conducted a series of strikes against the Ansar Allah-led government in the Yemeni capital Sana’a, also known as the Houthis after their leader.

“They launched many missiles, wasted a lot of money, but they were incapable of changing the balance of power. And Yemen continues to easily strike ships. Why?” the professor asked. “Because all of their assets are underground. Their mobile radar is well-protected underground. Their missiles and drones are well protected underground. They come out, strike the target and go back underground. So the Americans failed in Yemen. They made ‘Ansar Allah,’ or what the West likes to call the Houthis, very popular across the region and across the world, and they’ll only do the same in Iraq and Syria.”

Just like the US..

• EU Needs An Enemy – Kremlin (RT)

Recent statements by EU politicians about the possibility of a war with Russia serve their own domestic interests and distract the population from internal issues like tanking economies, Kremlin spokesman Dmitry Peskov has suggested. At the same time, claims of an allegedly imminent conflict with Moscow also help to justify continued funding for Kiev, he said. On February 1 EU leaders signed off on a €50-billion ($54-billion) package of economic aid to Ukraine. This followed months of back-and-forth on the matter. “They [politicians in EU countries] need to continue to construct an image of the enemy, to do it in a textured, prominent way, in order to justify the increase in spending. And, you see, the allocation of 50 billion – on the one hand, for the EU this amount is not a very big deal, but on the other hand it is still noticeable against the backdrop of the crisis markers manifesting themselves in the economies of EU countries,” Peskov told journalist Pavel Zarubin on Sunday.

This effort to distract populations from domestic problems with talk about a purportedly looming conflict with Russia has been undertaken by multiple countries of the bloc, the spokesman pointed out. In particular, Germany has clearly taken such an approach to hide the internal issues it has been facing lately, he suggested. “Germany is an economic engine of the EU, and now whole sectors of the German economy are losing their attractiveness and competitiveness. And, of course, against this backdrop, it is best to divert attention by creating some kind of enemy and maintaining its image. And for this there is probably no one better than [Russia] in their opinion,” the spokesman explained.

In recent months, senior officials from various EU countries have been urging their citizenry to brace for an allegedly inevitable conflict with Russia, with governments redirecting funding towards their militaries. Berlin has actively taken such a route, adopting a new military and strategic doctrine late last year that aims for “war-ready” forces. At the time, Chancellor Olaf Scholz claimed the country needed “a long-term, permanent change of course,” with the goal of creating “a powerful Bundeswehr” actually able to fight in the war that has been flagged as imminent. Russia has repeatedly dismissed claims that it is somehow seeking to attack any EU or NATO countries, describing such allegations as “absurd.” Late last year, for instance, Russian President Vladimir Putin reiterated that Moscow has “no interest… geopolitically, economically or militarily… in waging war against [the US-led NATO bloc].”

“..They don’t actually believe there will be a war with Russia but it’s a great story to put out there which pays dividends…”

• EU Gives Zelensky Life Support for Himself and His Regime. But .. (Jay)

So by hook or by crook, the EU got its funding for Ukraine agreed. But before you get too excited, perhaps it’s worth pondering the amount. A pathetic 50bn euros spread over four years! Is this money really for Zelensky and his cabal to keep the war going though, or simply a massive bribe for him to pass most of it on, in order for him to stay in power? What is the West worried about with Zelensky leaving office too early, some astute analysts will no doubt ask. From a military perspective it would be too little too late and so it’s all destined for public services and what some EU apparatchiks are calling “keeping the lights on”. But EU leaders should be aware that a good part of this money – probably at least half of it – will go directly to Zelensky and his circle of close aides and ministers whose only job is to keep him in power.

As president, he has control over the budgets of the government ministries including the finance ministry and it would be absurd to assume that most of this money will not be diverted in a regime which redefines the scales of corruption and embezzlement. Even the CIA chief Bill Mad Dog Burns had to fly in recently to Kiev to tell Zelensky personally to “not steal too much” from the next bundle which the Biden administration is expected to sign off in the coming weeks, which is expected to be around 65 billion dollars in military aid. And so the Americans appear to be ready to continue to give the military kit, despite much of it, according to my own investigation is ending up on the black market in Libya, while the EU is happy to pay the bills of the government and salaries. The Atlantic Council sums it up thus:

“This agreement is also an important signal to Washington that Europe is stepping up and is with Ukraine for the long run. Coincidentally, debates over aid packages to Ukraine on both sides of the Atlantic unfolded at the same time last year in December and now”. “Europe missed an opportunity to better impact the U.S. debate then. The EU hit the mark this time, showing Washington that Europe is doing its part”. But doing what part exactly? The EU default position on Ukraine is to blindly follow the Biden administration and its fatalistic support of the Ukraine regime until the abyss approaches. Indeed, most of last year Biden could only repeat the mantra over and over again “whatever it takes” and the EU followed, with many member states devastated by the decision. Germany’s economy is looking like a basket case while folks in the UK pay sky-high utility bills which in most cases look like a zero has been incongruously added by mistake.

Most EU countries have no military stock left to defend themselves against any threat – which does tend to take away the credibility of the absurd narrative that Russia is about to invade at any moment. And the EU itself continues to borrow money that has to be paid back by the next generation of taxpayers long after corrupt elitists like Ursula von der Leyen have left office and only have their dirty vaccine deals to fund their retirement plan while Europe starves. There is much talk in Brussels and on member state level that more money needs to be found for the EU project and that it needs to develop its own defence policy, without using the words EU army. Even in Britain, the conservative party are preparing for war with Russia. Well, strictly speaking senior officials are preparing the media narrative. They don’t actually believe there will be a war with Russia but it’s a great story to put out there which pays dividends.

When you bomb bakeries, yes…

This is what Ukraine will switch to: targeting civilians.

• EU Citizens’ Taxes Going To Terrorists – Moscow (RT)

The West is complicit in the Ukrainian military’s killing of civilians in Donbass, Russian Foreign Ministry Spokeswoman Maria Zakharova has claimed. The diplomat was referring to a Ukrainian attack on a bakery in the city of Lisichansk, apparently involving weaponry provided by Kiev’s allies, which claimed the lives of at least 28 civilians. Following the attack, the acting head of the Lugansk People’s Republic, Leonid Pasechnik, accused the Ukrainian military of deliberately targeting the building on a weekend to maximize civilian casualties. In a post on his Telegram channel, he added that “emergency services have managed to rescue ten people from under the rubble,” with doctors doing their best to save their lives. In a statement on Saturday, Zakharova said that “according to preliminary information, the strike was conducted using Western weaponry.”

She described the shelling as a “terrorist attack” meant to convey Kiev’s “gratefulness for the ‘generous’ financial support by EU countries.” The foreign ministry spokeswoman added that the EU nations’ citizens should be cognizant of what their taxes are being spent on, namely “deadly weapons systems” used by the Ukrainian military to “kill civilians.” “We suggest that Parisians imagine how they go in the morning for a baguette, and Rome’s residents – to have a cup of coffee with cornetto – but instead of freshly-baked pastry return home with relatives wounded or killed by Ukrainian terrorists,” Zakharova charged. Echoing Pasechnik, the diplomat alleged that Kiev’s forces had been well aware that civilians, including families with children and the elderly, would typically flock to the bakery on Saturdays. She added that the building had been razed to the ground as a result of the shelling.

According to Zakharova, the deadly incident is “further proof of the criminal nature of the Kiev regime.” She went on to quote Russian President Vladimir Putin, who on Friday characterized the Ukrainian military as a “terrorist organization that attacks ambulances.” He was referring to several attacks on paramedics working in Donbass last month. The foreign ministry spokeswoman concluded by saying that Moscow will inform “international organizations of yet another terrorist attack on the part of Zelensky’s gang.” The official noted that Russia expects a swift and unequivocal condemnation of Kiev’s actions. Authorities in the LPR declared Sunday a day of mourning for the 28 victims of the attack on the bakery, which include one child. Pasechnik vowed that those responsible would eventually be brought to justice “for this horrible tragedy, for every death.”

“..Russia has complete air dominance, escalatory dominance, logistical dominance, ammunition dominance..”

• Possible NATO Corps Deployment to Ukraine May Become ‘Suicide Mission’ (Sp.)

The UK has urged its NATO allies to consider sending the alliance’s expeditionary force to Ukraine, an informed source told Sputnik. According to the source, the alleged move came “in connection with the unfavorable developments in the Ukrainian theater of military operations for Kiev”. The insider added that Britain also called on NATO to consider imposing a no-fly zone over the territory controlled by the Zelensky regime and to increase military aid to Ukraine. ”The UK’s reported plans about deploying NATO’s expeditionary corps to Ukraine is “a fantastical delusion on the part of the Brits and has no foundation in reality,” retired CIA intelligence officer and State Department official Larry Johnson told Sputnik. “But just because the Brits are insane does not mean Russia can ignore them. It is a serious proposal,” he added.

Johnson was partly echoed by Matthew Gordon-Banks, an international relations consultant, former member of Parliament and retired senior research fellow at the UK Defence Academy, who said he didn’t think the rumors of a NATO force in Ukraine should be taken seriously. “The suggestions I have heard are quite unrealistic at present,” Gordon-Banks stated. Asked to comment on the “unfavorable development of events” for Kiev on the battlefield, he emphasized that “things are collapsing in Kiev quite quickly”. “[Ukrainian President Volodymyr] Zelensky has not been able to fire his top general, and I think he is now very much a ‘lame duck’ president,” Gordon-Banks argued, referring to the commander-in-chief of Ukraine’s armed forces, Valery Zaluzhny.

The same tone was struck by Earl Rasmussen, a retired US Army lieutenant colonel turned geopolitical and military affairs consultant, who warned that if the information about London’s plans is true, and “if this is somebody’s dream, it could quickly become a nightmare for British and NATO forces.”But it is not a realistic solution or proposal. Russia has complete air dominance, escalatory dominance, logistical dominance, ammunition dominance. This would be catastrophic for any UK forces and definitely would show a symbol of direct NATO involvement, which could really be dangerous, as far as escalation goes,” Rasmussen emphasized, noting that “the British forces would probably be wiped out, fairly rapidly.” The US Army veteran suggested that someone in the UK military might be having “some type of delusional experience” for even suggesting such a scenario. “It’s a suicide mission for those troops. And it definitely would pull NATO into a much more dangerous situation and direct confrontation [with Russia],” Rasmussen concluded.

“When the Western Roman Empire was overrun, Rome ceased to exist. How can it be any different for America?”

• What Powerful Force Prevents the US from Defending its Borders? (PCR)

Israel can evict Palestinians from the the Palestinians’ villages in Palestine. Tiny Latvia can deport Russian ethnics born in Latvia for not learning to speak Latvian, but mighty America cannot prevent millions of immigrant-invaders from illegally entering the US each year and remaining. How can this be? Clearly the US government is in a conspiracy with the NGOs that are recruiting and funding the invasion in order to replace the white American population. Why is the US government cooperating with anti-American NGOs to steal America from Americans? Why do Americans sit on their butts and permit their country to be stolen? Why do a majority of American women vote for the Democrats who are aiding and abetting the theft of America? When Washington speaks of “American national interests,” whose interests is meant?

The military/security complex’s interest? How does a tower of babel have a national interest? Why is it in America’s national interest to be overrun by invaders? Why is Washington worried about attack from Russia and China but not from the vastly larger army of the anti-American NGOs? Does the US military have any role other than protecting the profits of the military/security complex? How can the United States be a country when it has no borders? How can something as abnormal as a country without borders continue to exist? When the Western Roman Empire was overrun, Rome ceased to exist. How can it be any different for America? Why are voices that speak for American identity, such as VDARE, suppressed by American prosecutorial authorities?

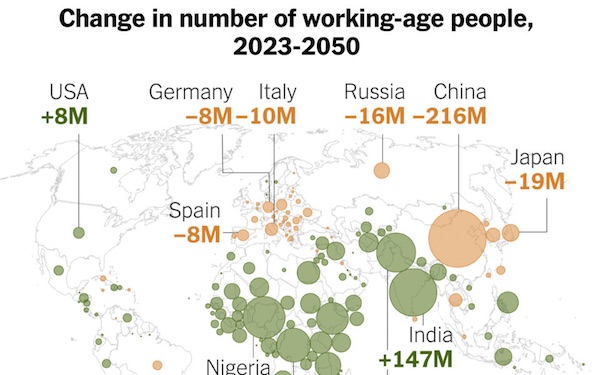

3rd day in a row that we’re talking about birth rates.

• Shrinking Populations Fuel Divisive Politics (NYT)

In the 2000 film “Almost Famous,” Cameron Crowe’s comedy-drama about rock musicians in the 1970s, the character played by Zooey Deschanel gives her younger brother some advice. “Listen to ‘Tommy’ with a candle burning, and you’ll see your whole future,” she says. I’m going to borrow that thought: Stare at the map accompanying this article with — or without — a candle burning, and you’ll see your whole future. The map shows how the number of working-age people around the world is forecast to change by 2050. Europe’s working-age population will shrink. So will that of Brazil, China, Chile, Japan and Russia, among others. And that change could have extremely negative consequences for those societies, without mitigation. “Working-age population” can sound technical and abstract. But these are the people who staff our offices and factories, work farms, treat the sick, care for the very old and the very young.

They are the ones who have children and raise them; who build new things and fix old ones. When that population shrinks, those activities become more difficult, more expensive and less frequent. The economy slows down. Fewer workers getting paid generates less tax revenue. As the population ages, more people rely on government social security programs to fund their retirements and health care, putting those vital programs further under strain. This is mostly a story about birthrates. As countries get richer, people have fewer children; and it turns out that once birthrates fall, it’s really hard to get them back up again. Although a number of countries have tried to boost fertility through tax breaks, cash bonuses and even awards for heroism given to women who bear many children, none of those programs have made more than a marginal difference.

But look at the map a little longer, and you see the phenomenon that has allowed a few wealthy countries to cushion the blow of demographic change: immigration. Australia, Canada and the United States have small green dots, denoting modest growth in their working-age populations. That’s largely because those countries take in relatively high numbers of immigrants, who not only bolster population numbers directly when they arrive, but also tend to have more children than the native-born population. In the United States, for instance, the modest increase in births since the 1970s was entirely driven by births to immigrant mothers. In Canada, immigration is the sole driver of population growth, according to government statistics.

Immigration, to be clear, can only ever be a partial solution to this demographic shift. To put the numbers in perspective, just to stay level by 2050, Europe would have to absorb about half of the entire working-age population growth in India, the world’s most populous country. China, facing an even bigger shortfall, could take all the growth of Pakistan and all that of Nigeria — Africa’s most populous country — and still be 2 million short of where it stands now. At the same time, this map strongly suggests that being able to attract and integrate large numbers of immigrants will be an important competitive advantage for countries in the coming decades. Doing so, however, will require overcoming political barriers that arise, partly, out of the same demographic shifts.

Gretarded.

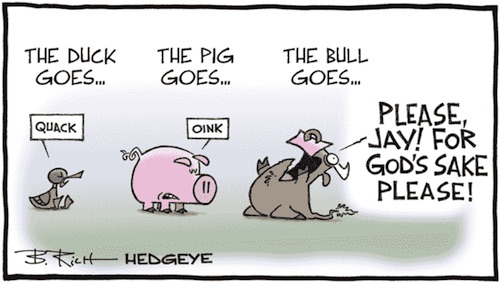

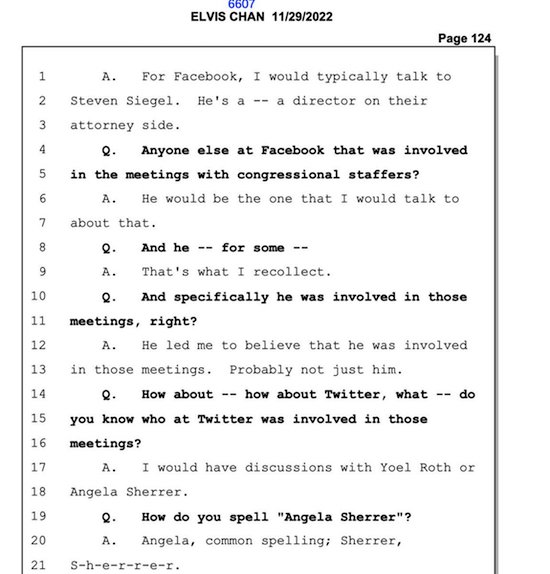

• Facebook: Tool for State Censorship, Goldmine for US Intel (Sp.)

As Americans, Europeans and others around the world signed up, logged on and voluntarily offered up private information that companies and intel agencies would have paid a fortune to get their hands on just a few short decades ago, powerful forces quickly realized the importance of collecting and engineering this new form of online human interaction. “It is clear that intelligence agencies throughout the world, not only the US, can use Facebook to their advantage,” Ryan Hartwig, Facebook contractor-turned whistleblower and co-author of ‘Behind the Mask of Facebook: A Whistleblower’s Shocking Story of Big Tech Bias and Censorship,’ told Sputnik in an interview. “The government launders their censorship through various NGOs and institutions on behalf of the US government,” Hartwig said, pointing, for example, to a 2021 report by the Stanford Internet Observatory entitled “Combating Information Manipulation: A Playbook for Elections and Beyond,” which plainly outlines tools the company uses to “remove the spread of malign information” from social media.

In his book, coauthored with attorney Kent Heckenlively, Hartwig documents how, while working as a content moderator for Facebook in the 2010s, he had witnessed the platform’s disturbing transformation after the 2016 US elections into a tool for systematically suppressing conservative viewpoints while elevating liberal ones, and cracking down on some forms of suspected hate speech while amplifying others. Of course, conservatives aren’t the only ones targeted by the social media giant’s censorship leviathan, with non-liberal left groups, critics of the US military-industrial complex, Big Pharma, Big Tech and other elite forces which run America and much of the world also falling victim. Documented instances of censorship by Facebook include the scrubbing of criticism of US and European immigration policy, climate policies, vaccines and vaccine mandates, criticisms of Facebook itself, and the vagaries of US foreign policy, with posts on these issues occasionally deleted outright, but more often hidden or deranked without users being informed using the platform’s complex, non-open source algorithm.

In 2022, Facebook rolled out a special carve-out of exceptions to its anti-hate speech rules to allow users to make explicitly Russophobic posts, issue death threats against Russian officials, use dehumanizing language to refer to Russian troops, and even offer praise for the neo-Nazi Azov** Regiment, despite the social media giant’s ban on content featuring Nazi and neo-Nazi ideology. “Facebook manipulates public opinion by suppressing unpopular opinions, or allowing newsworthy exceptions for the people they like,” Hartwig explained, noting this extends not just to big name issues, but even extremely minute details bordering on psychopathy. “For example, they made a specific rule to protect Greta Thunberg from being attacked or called ‘Gretarded’,” the former content moderator recalled, referring to the WEF-promoted climate activist. “Normally, public figures, even young individuals like Greta are allowed to be called retarded. Facebook made an exception to protect her,” Hartwig said.

I heard a similar story last year about another company 🙂 : “The company’s headcount decreased by 22% year-over-year, following layoffs, indicating a strategic shift in its workforce.”

• Get The Zuck Out Of Here: 20 Years Later (RT)

As Facebook approached its adolescence and entered the realm of maturity, its impact on society became increasingly significant. The platform, once a college-focused social hub, had evolved into a global information-sharing powerhouse, shaping not only individual interactions but also influencing broader societal dynamics. Despite the controversies, Facebook’s financial triumphs were undeniable. Meta’s Q4 2023 earnings report showcased a strong rebound in its online ad business, with a 25% year-over-year increase in sales. The company’s expenses decreased, and its operating margin more than doubled, reflecting successful cost-cutting measures. Net income also saw a significant increase, reaching $14 billion.

In addition to the positive financial results, Meta announced its first-ever dividend payment and a $50 billion share buyback, signaling confidence in its financial standing. However, the financial success was not without challenges. Meta’s Reality Labs unit, responsible for virtual reality and augmented reality technologies, generated over $1 billion in sales but recorded a $4.65 billion loss, highlighting the risks associated with cutting-edge technologies. Looking ahead this year, Meta anticipates first-quarter sales in the range of $34.5-37 billion, with expenses in 2024 projected at $94-99 billion. The company’s headcount decreased by 22% year-over-year, following layoffs, indicating a strategic shift in its workforce.

Zuckerberg has trumpeted the role of artificial intelligence in the company’s growth trajectory, emphasizing continued investments in AI and computing infrastructure. However, he has also acknowledged the company’s commitment to maintaining a relatively lean workforce, balancing technological innovation with operational efficiency. The confluence of financial triumphs, persistent challenges, and controversies marked the pivotal phase in Facebook’s transformation into Meta. The rebranding aimed to thrust the company to the forefront of the metaverse. However, this strategic maneuver encountered skepticism and formidable challenges, notably in light of substantial losses associated with metaverse-related technologies.

During its adolescent years, Facebook endeavored to stay relevant among younger generations. By introducing features like ‘Reels’, it sought to emulate the success of competitors such as TikTok. Yet, these initiatives met with only limited success, as the platform’s user base continued to age, resulting in diminished engagement, particularly from Generation Z. The challenges extended beyond shifting demographics. Facebook’s reputation suffered amid data privacy controversies. Younger users, in particular, perceived the platform as less trustworthy, further impinging on engagement. In response, the company embarked on a broader identity shift.

He can’t seem to decide if Skripal is alive or not. But certainly strange that we’ve never seen father nor daughter again.

• Novichok Public Inquiry Turns Into A Secret Farce Before It Begins (Helmer)

In a London courtroom on Friday, Lord Anthony Hughes, the retired judge whom the British government has appointed to run a public inquiry into the alleged Novichok poisonings of March and June 2018, collapsed into a farce of state secrecy. Not even the open hearings which are now scheduled to start later this year, on October 14, will in fact be open, Hughes told lawyers for the Home Office and for the family of Dawn Sturgess. This is because the police and the security services have told the judge they want a livestream default or broadcasting delay of at least fifteen minutes, possibly longer when “the police will decide if any disclosure at all will be made”, a government lawyer told the judge.Hughes announced: “I absolutely accept how difficult it is when you are batting in the dark…but it is a situation which has simply got to be coped with.”

Follow the archive on the official investigation of the cause of Dawn Sturgess’s death in June 2018, allegedly from a Novichok poison which Russian assassins left behind after they had attacked Sergei and Yulia Skripal the previous March. The Skripals have been assigned a lawyer, Adam Chapman, to represent them in the Hughes proceeding, but he wasn’t present in court on Friday. To date, Chapman hasn’t asked a question, made a written submission, or reported what the Skripals want to say about the Novichok affair. Chapman’s silence confirms that if the Skripals are still alive, they are being held by the British government incommunicado. Hughes has yet to rule on whether they will be called to testify as witnesses, and if so, whether their testimony will be given in open or secret session.

Hughes ran Friday’s hearing to just under 90 minutes. A switch of stream engineering companies and a failure by Paul Dunlay, the judge’s technician in charge of live-streaming, excluded reporters who had registered to hear the proceeding from their offices. Hughes’s spokesman apologized for the “confusion”. Dunlay said “we are not responsible for your IT systems security which may have blocked this auto response.” “My starting point,” Hughes claimed, “has always been that this is a public hearing and everything is in public unless there is a necessity for it not to be. But given the circumstances of this Inquiry – involving as it does the use of a chemical weapon on British soil – it will be of no surprise that there will inevitably be some material that will be CLOSED. Indeed that was the reason for the conversion of the original Inquest to a public Inquiry.”

Just how little will be open — and just how large “the necessity for it not to be” — were revealed in Friday’s hearing. Closed circuit television (CCTV) tapes from Salisbury and Amesbury which the police seized after the Skripal attack and the Sturgess death, and which have not been released to date, are to be allowed in evidence in the open hearing, but only, Judge Hughes has conceded, in the form of a “compilation”. What has been withheld will remain a state secret. A police report combining the Skripal incident in Salisbury of March 4, 2018, and the Sturgess incident in Amesbury four months later, on June 30, 2018, has been partially released to the Sturgess family’s lawyers, led by Michael Mansfield KC. But on Friday he told Hughes the evidential value of the report has already been compromised.

“There are 17 pages of redactions,” Mansfield said, “not all of them total pages, although the further you go into the report, starting at page, for example — it should be the same on yours, so that is page 53 onwards. There is nothing visible there, or the 20 succeeding pages. Altogether 17 pages in which, again, if we can just say, there must be questions arising there and in relation to the open and closed divide, it would be of great help if we did have a gist.” Mansfield went on to refer to a section he has read in the police report entitled “Target”. “I hope I am not exaggerating it, there are some pretty astonishing observations in this section alone and if what is said in this section alone about the target, there is and must be very much more material, or absence of material.”

Mansfield was intimating in public that the police report he has seen is missing the key elements of how the alleged Russian-made Novichok got into Dawn Sturgess’s hands and killed her, as well as the police account of how their searches of Sturgess’s house failed to detect the Novichok in a perfume bottle standing on the kitchen table until July 11, 2018 – eleven days after Sturgess had collapsed and been taken to Salisbury District Hospital, and after police reported their search of the house for suspected narcotics.

Dawn Sturgess, died between June 30 and July 8, 2018; Sergei Skripal, died in British custody at an unknown date after his last telephone call to Russia on June 19, 2019; Adam Chapman, the London lawyer appointed by the British government on March 25, 2022 — without evidence of Skripal consent.

What am I supposed to make of this?

• E Jean Carroll Lawyer Says Trump Used Coded Version Of C-Word Against Her (G.)

E Jean Carroll’s attorney says Donald Trump used a coded expression to call her the C-word during a deposition before she helped the magazine columnist win an $83.3m verdict in her defamation case against the former president. Roberta Kaplan shared the anecdote during an appearance Friday on the George Conway Explains It All podcast, saying it happened while Trump was deposed at his Mar-a-Lago resort as part of an unrelated, since-dismissed case in which he faced accusations of collaborating with a fraudulent marketing company. As Kaplan told it, at the end of the questioning, Trump’s attorneys ensured the two sides were no longer on the record before he looked at her and remarked: “See you next Tuesday.” The phrase is well-known, thinly veiled code for perhaps the most offensive misogynistic insult that can be directed at a woman, combining words that sound like the first two letters of the slur – “C” and “U” – along with words that start with the letters “N” and “T”.

Kaplan told Conway that she initially didn’t understand the meaning of what Trump said because the opposing sides weren’t scheduled to meet that upcoming Tuesday. “I, thank God, had no idea what that meant, so I said to him, ‘What are you talking about? I’m coming back on Wednesday,’” Kaplan remarked. “Literally, it was an honest answer. I had no idea what he’s talking about.” Colleagues of Kaplan informed her what the former president had meant by saying “see you next Tuesday” once they were all in their car driving away from Trump’s property, she said. “That is a teenage boy-level joke,” the podcast co-host Sarah Longwell said. Kaplan replied: “Had I known, I for sure would have gotten angry … I looked like I was being above it all, which I wasn’t. I just did not know.”

Conway – a conservative attorney formerly married to Trump’s White House counsellor Kellyanne Conway – punctuated Kaplan’s recollections by saying: “So that’s just an amazing story.” According to Kaplan, Trump had also thrown a temper tantrum that day when his legal team offered to provide lunch to Kaplan and her associates. “There was a huge pile of documents, exhibits, sitting in front of him, and he took the pile and he just threw it across the table – and stormed out of the room,” Kaplan said. That claim about Trump throwing papers across a table in particular called to mind another anecdote produced by testimony to the congressional committee that investigated the Capitol attack staged by the ex-president’s supporters after he lost the 2020 election to Joe Biden. A former White House aide testified that Trump angrily threw a plate of food at a wall in the White House – smearing it with ketchup – after his attorney general at the time publicly denied Trump’s lies that there had been voter fraud in the race won by Biden.

Friday’s remarks from Kaplan were also sure to open Trump to renewed criticism over his mistreatment of women. Conway went on CNN later Friday and said Trump was “a pig” for how he addressed Kaplan, according to the attorney. Kaplan represented Carroll in a separate legal matter that saw the former Elle magazine writer sue Trump on accusations that he sexually abused her in a department store changing room in the mid-1990s. Carroll’s lawsuit asserted that Trump then defamed her as he attacked her credibility.

If and when you say about an outlet that takes itself very seriously that it “..is not fit to line a parrot cage for bird [poop emoji]..”, then you get this. Which sorta proves your point. And the rest will chime in, too.

• Musk Took Drugs With Tesla, SpaceX Execs – WSJ (RT)

Tesla and SpaceX CEO Elon Musk has been taking illegal drugs for years, on many occasions alongside the board members and directors of his companies, the Wall Street Journal reported on Saturday, citing sources who claimed to have either witnessed the drug use or had knowledge of it. According to the report, Musk has attended a number of social gatherings in recent years with Tesla board member Joe Gebbia, where he recreationally took ketamine, an anesthetic commonly used to euthanize house pets. Other directors, Antonio Gracias, Kimbal Musk and Steve Jurvetson, have reportedly consumed drugs like ecstasy and LSD with him at several parties, including those held at Hotel El Ganzo, a boutique hotel in Mexico allegedly known for its drug-fueled events.

According to several sources, some of the directors felt pressured to consume drugs with Musk either because refraining could upset the billionaire, or result in them “losing the social capital” of being in the CEO’s circle. Sources told the news outlet that Musk’s drug use was common knowledge among several current and former Tesla and SpaceX officials, and the volume of his consumption has become concerning in recent years. However, the companies’ boards haven’t investigated Musk’s alleged drug use nor documented any claims. On the one hand, the use of illegal substances violates antidrug policies at both firms, while on the other, official board minutes could become public, and if they mentioned Musk’s drug problems, it could put SpaceX’s federal contracts and Musk’s security clearance at risk, the report notes.

The WSJ already reported on Musk’s alleged illegal drug use last month, claiming that the CEO has a history of using drugs including cocaine, ecstasy, LSD and psychedelic mushrooms. In response to that news piece, Musk lashed out at WSJ on X, saying that the news outlet “is not fit to line a parrot cage for bird [poop emoji].” Musk noted that he regularly took random drug tests at SpaceX, which he never failed. This claim was backed by his lawyer, Alex Spiro.Later, Musk also tweeted: “If drugs actually helped improve my net productivity over time, I would definitely take them!”

https://twitter.com/i/status/1754340103873564988

• FREEMAN DYSON Emeritus Professor, Princeton Institute for Advanced Studies (2009)

THERE IS NO GLOBAL WARMING, THERE IS ONLY REGIONAL WARMING (AND IT’S A GOOD THING!):“The change that’s now going on is very strongly concentrated in the Arctic. In fact in three respects, it’s not global, which I think is very important. First of all, it is mainly in the Arctic. Secondly, it’s mainly in the winter rather than summer. And thirdly, it’s mainly in the night rather than at the daytime. In all three respects, the warming is happening where it is cold, not where it is hot. The people in Greenland love it. They tell you it’s made their lives a lot easier. They hope it continues. I am not saying none of these consequences are happening. I am just questioning whether they are harmful. There’s a lot made out of the people who died in heat waves. And there is no doubt that we have heat waves and people die. What they don’t say is actually five times as many people die of cold in winters as die of heat in summer. And it is also true that more of the warming happens in winter than in summer.

So, if anything, it’s heavily favorable as far as that goes. It certainly saves more lives in winter than it costs in summer.So that kind of argument is never made. And I see a systematic bias in the way things are reported. Anything that looks bad is reported, and anything that looks good is not reported.A lot of these things are not anything to do with human activities. Take the shrinking of glaciers, which certainly has been going on for 300 years and has been well documented. So it certainly wasn’t due to human activities, most of the time. There’s been a very strong warming, in fact, ever since the Little Ice Age, which was most intense in the 17th century. That certainly was not due to human activity.

And the most serious of almost all the problems is the rising sea level. But there again, we have no evidence that this is due to climate change. A good deal of evidence says it’s not. I mean, we know that that’s been going on for 12,000 years, and there’s very doubtful arguments as to what’s been happening in the last 50 years and (whether) human activities have been important. It’s not clear whether it’s been accelerating or not. But certainly, most of it is not due to human activities. So it would be a shame if we’ve made huge efforts to stop global warming and the sea continued to rise. That would be a tragedy. Sea level is a real problem, but we should be attacking it directly and not attacking the wrong problem.”

Leash

https://twitter.com/i/status/1754050063498682513

Honeybees

Giant honeybees 'shimmering' waves behaviour when a predator approaches, A chemical called Nasonov pheromone is released to embolden them to stay togetherpic.twitter.com/hr52VsgcND

— Science girl (@gunsnrosesgirl3) February 4, 2024

Belly rubs

https://twitter.com/i/status/1754116371951001767

Bucket sheep

Bucket: 1 Sheep: 0 pic.twitter.com/HML4zxvoMR

— Nature is Amazing ☘️ (@AMAZlNGNATURE) February 4, 2024

Baby hippo

Baby hippo meets giraffe.. 😊 pic.twitter.com/9U25iF6Zwg

— Buitengebieden (@buitengebieden) February 4, 2024

Doomsday fish

Divers discover giant 'Doomsday Fish' off the coast of Taiwan pic.twitter.com/lltwWK4mq8

— Historic Vids (@historyinmemes) February 4, 2024

Fast car

Tracy Chapman and Luke Combs – Fast Car#GRAMMYs pic.twitter.com/WWztcov2tJ

— Craig R. Brittain (@RealBrittain) February 5, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.