Edward Hopper New York movie 1939

Scary.

• The Smart Money Gets Ready for the Next Credit Event (WS)

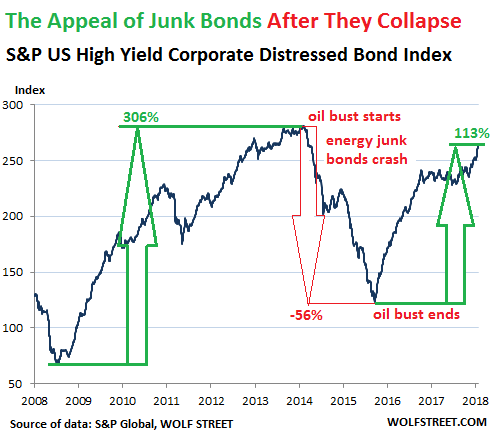

As corporate indebtedness in the US has reached precarious heights, and as risks are piling up, in an environment of rising interest rates and a hawkish Fed, the smart money is getting ready. The smart money is preparing for the moment when the air hisses out of the exuberant junk-bond market, when liquidity dries up for over-indebted companies, and when their bonds collapse. The smart money is preparing for the arrival of “distressed debt” – it’s preparing now because these preparations include raising billions of dollars for their funds, and that takes some time. “Distressed debt” is defined as junk-rated debt that sports yields that are at least 10 percentage points above equivalent US Treasury yields.

Distressed-debt investors can make a killing by buying bonds for cents on the dollar during times of economic stress, of companies that they believe will make it through the cycle without defaulting. In this scenario, a distressed bond might sell for 40 cents on the dollar, and two years later, the company is still intact and the credit squeeze is resolved, and now the bond is worth face value. For those two years, the bond paid a huge yield to investors that bought at 40 cents on the dollar – and the profit might be 200% in capital gains and interest. The thing is: The junk-bond market has been booming. There’s no credit squeeze yet. And the riskiest end is flush as the “dumb money” is still chasing yield.

And for the smart money, there’s not much to pick at the moment; but down the road, the future looks bright. S&P Global tracks distressed debt in its US High Yield Corporate Distressed Bond Index. The index peaked in early July 2014, on the eve of the oil bust. Over the next 18 months, it plunged 56% as the oil bust was wreaking havoc on oil-and-gas bonds. But on February 11, 2016, the index bottomed out. New money began flowing into the oil-and-gas sector. Banks started lending again. The surviving bonds soared. And the index skyrocketed 113% in 28 months:

Really? The IMF?

• Global Debt Has Hit A High – Can Financial Regulators Cope? (Davies)

At the end of May, the International Monetary Fund launched its global debt database. For the first time, IMF statisticians have compiled a comprehensive set of calculations of public and private debt, country by country, constructing a time series stretching back to the end of the second world war. It is an impressive piece of work. The headline figure is striking: global debt has hit a new high of 225% of world GDP, exceeding the previous record of 213% in 2009. So, as the IMF points out, there has been no deleveraging at the global level since the 2007-08 financial crisis. In some countries, the composition of debt changed, as public debt replaced private debt in the post-crisis recession, but that shift has mostly stopped.

Are these large figures alarming? In aggregate terms, perhaps not. At a time when economic growth is robust almost everywhere, financial markets are relaxed about debt sustainability. Long-term interest rates remain remarkably low. But the numbers do tend to support the hypothesis that the so-called debt intensity of growth has increased: we seem to need higher levels of debt to support a given rate of economic growth than we did before. Perhaps that is partly because the growth in income and wealth inequality in developed countries has distributed spending power to those with a propensity to spend less than their income. That trend has levelled off recently, but the implications are still with us. It also seems that productivity growth has slowed, so a given quantum of investment generates less output than it used to do.

The IMF’s recommendation to governments is that they should fix the roof while the sun is shining: accumulate a fiscal surplus, or at least reduce deficits, in good times so that they are better prepared for the next downturn, which will surely come before too long. The current upturn is now quite mature. That puts the IMF on a collision course with the tax-cutting US administration and now with Italy’s new government. If the Italians’ grandiose plans for a minimum income and more public investment are implemented, they might soon find themselves in difficult discussions with the IMF. The team that has been in Athens for the past few years might soon be booked on a flight to Rome.

Keep negotiating.

• Stock Markets Roiled As US-China Trade Dispute Escalates (G.)

The trade dispute between the US and China escalated on Tuesday, with a senior Trump official accusing China of “theft” and Beijing accusing the US of blackmail. The news roiled global stock markets as investors feared that escalating tensions could trigger an international trade war. Donald Trump threatened to impose an additional $200bn in levies on Chinese goods on Monday evening, days after the US announced $50bn in tariffs aimed at punishing what the US administration sees as unfair trade practices. China has already said it will retaliate for last week’s move and said it would escalate its response if further tariffs were imposed.

In a call with reporters Peter Navarro, White House trade adviser and a longtime critic of China’s trade practices, said China had had numerous opportunities to address Washington’s concerns but had failed to do so. “Since China joined the World Trade Organisation in 2001, the working men and women of America have watched as more than 70,000 factories and millions of manufacturing jobs have moved offshore,” said Navarro. He called Trump’s plans’ “courageous” and “visionary” and said they were aimed at halting China’s plans to dominate the hi-tech industries of the future – a plan, known as China 2025, that Navarro said that would mean America “will have no economic future”.

“As its economy matures, the longstanding inefficiencies in China’s business environment are rendered all the more glaring..”

• European Firms Say China Business ‘More Difficult’ (AFP)

European companies complain they still face a tough business climate in China despite Beijing’s pledges of openness, with about half saying it has become tougher in the past year, according to a survey released Wednesday. The study comes as President Xi Jinping looks to portray the world’s number two as being at the forefront of the globalisation cause just as the United States appears to be stepping back from the world stage. Among the litany of complaints were the uncertain legal environment, higher cost of labour, regulatory headaches and the “Great Firewall” that censors much of the global internet. “As its economy matures, the longstanding inefficiencies in China’s business environment are rendered all the more glaring,” according to the report by the EU Chamber of Commerce in China.

Mats Harborn, the chamber’s president, echoed those concerns, telling journalists that “the regulatory environment is actually holding the economy back.” New cybersecurity regulations make it more costly to jump the firewall, requiring businesses to sign up for expensive government-approved virtual private networks that allow users to circumvent filters and access the global internet. Two-thirds of companies believe that censorship and blocking of certain sites has a negative impact on their business. This is the “great contradiction,” said Harborn. “We have China which claims itself a leader in globalisation, talking of the importance of integration, but the cybersecurity law is creating problems.”

Unstoppable force by now. But do follow the money.

• Canada Legalises Recreational Marijuana Nationwide (Ind.)

Canada has legalised the use of recreational marijuana nationwide, making it the first G7 country to do so. The Senate voted 52-29 on Tuesday to pass the Cannabis Act, which allows people over the age of 18 to grow, buy, and use the drug for recreational purposes. It also regulates the growth and sale of marijuana, putting strict limits on packaging and limiting home growth to four plants at a time. The bill passed the House of Commons earlier on Tuesday, and now goes to Prime Minister Justin Trudeau – an outspoken supporter of the legalisation effort – to decide when it will take effect.

The vote makes Canada the second country to legalise recreational marijuana nationwide, after Uruguay. It is the first of the world’s seven most advanced economies – also known as the G7 – to do so. Nine US states allow for recreational use, and several other G7 nations allow it for medical purposes. Medical marijuana has been legal in Canada since 2001.

Wonder what happened at the UN human rights commission talk yesterday in Geneva.

• Smearing A Dissident Journalist Is As Good As Killing Him (CJ)

As I write this, demonstrations around the world are taking place in protest of WikiLeaks editor Julian Assange’s arbitrary detention and silencing by the US-centralized power establishment that has been actively pursuing his destruction for over a decade. The demonstrations will be well-attended, but not a fraction as well-attended as they should be. They will receive international attention, but not a fraction as much attention as they should. This is because the manipulators and smear merchants who have made their careers paving the way for oligarchic agendas have been successful in killing off sympathy for the plight of Assange. As we discussed yesterday, sympathy is key for getting narratives to take hold in public consciousness.

This is why western corporate media will circulate pictures of dead children all day long when it’s in the interests of advancing longstanding imperialist agendas, but never when those children were killed by western weapons. If you can tug at someone’s heart strings while telling them a story, the story you tell them will slide right in with minimal scrutiny. And it works the other way, too: if you can prevent someone’s heart strings from being plucked while hearing about a legitimately heartbreaking story, you can prevent that story from taking hold. Kill all sympathy for a dissident journalist and you kill all belief in his side of the story.

And Assange’s side of the story is indeed devastating to the preferred narrative of the US-centralized empire. A journalist (yes, journalist, per definition) who publishes 100 percent authentic documents exposing the inner mechanics of power structures all over the world, who was forced to seek political asylum at the Ecuadorian embassy in London in order to avoid extradition by the same government which brutalized Chelsea Manning, is on its face a highly sympathetic story. And it does tremendous damage to the narrative that America and its close network of allies are freedom-loving democracies whose systems of government are nothing like those naughty, oppressive regimes they seek to topple.

“When you watch the television the television isn’t watching you. When you see the billboard the billboard isn’t seeing you… ”

• “Delete Your Account” Warns Virtual Reality Founding Father (ZH)

In a new explosive interview, Silicon Valley tech pioneer and creator of the virtual reality ‘avatar’ Jaron Lanier tells people to delete your social media accounts due to the strong correlation between persistent social media usage and a dramatic societal rise in depression, anger, and anxiety that he says is the result of internet-induced modified forms of behavior. The warning comes in the wake of his new book which details how the creators of social media and the early engineers behind the internet “foolishly laid the foundations for global monopolies.” Jaron Lanier is best known as a founding father of the field of virtual reality and throughout his polymath career has written extensively on human-computer interaction, including most recently in his book Ten Arguments for Deleting Your Social Media Accounts Right Now.

Lanier explained in a recent UK Channel 4 interview: “When you watch the television the television isn’t watching you. When you see the billboard the billboard isn’t seeing you… When you use these new designs — social media, search, YouTube — when you see these things, you’re being observed constantly and algorithms are taking that information and changing what you see next.” According to Lanier’s bio, he coined the term ‘Virtual Reality’ (VR) and in the early 1980s founded VPL Research, the first company to sell VR products. In the late 1980s he led the team that developed the first implementations of multi-person virtual worlds using head mounted displays, as well as the first “avatars,” and developed the first widely used software platform architecture for immersive virtual reality applications.

As he defiantly asserts on his personal website, Lanier himself has “no social media accounts at all and all purported ones are fake.” He’s elsewhere said that most internet and social media pioneers in Silicon Valley “have regrets right now” after perfecting what is essentially mass human behavioral engineering and that that internet addiction is not only ruining people’s lives but the political process as well. This is what I could call almost a stealthy addiction. It’s a statistical addiction. What it says is we will get the broad population to use the services a lot, we’ll get them hooked through a scheme of rewards and punishment, and the rewards are when you’re retweeted and the punishment is when you’re treated badly by others online, and then within that we’ll very gradually start to leverage that, to change them. It’s this very kind of stealthy manipulation of the population.”

Inglan is a bitch.

• 1 In 3 UK Primary School Teachers Provide Pupils With Toothpaste, Soap (Ind.)

One in three teachers are providing pupils with basic hygiene products such as toothpaste and soap amid soaring child poverty rates, a new study shows. Eight in ten primary school teachers have said they had seen a rise in the numbers of children coming to school unwashed or not looking presentable in the last five years and have found themselves intervening at an increasing rate. A survey carried out by UK charity In Kind Direct also revealed nearly one in five (18 per cent) of teachers say they have to resort to doing this every single week, with the problem starkest in London – where 50 per cent do this weekly – and in the North East, where the figure stands at 29 per cent.

It comes as child poverty rates have surged in recent years, with one million more children in working households now growing up in poverty than did so in 2010, largely because of cuts to in-work benefits and public sector pay freezes. Nicola Finney, head teacher at St Paul’s Primary School in Stoke on Trent, told The Independent around 18 per cent – or nearly one in five – of her pupils’ families were receiving products from the school, as growing numbers of households are “falling on hard times”.

And the other 17 must follow.

• Merkel, Macron Agree On Eurozone Budget (CNBC)

Chancellor Angela Merkel said she and French President Emmanuel Macron agreed on Tuesday to create a euro zone budget charged with boosting investment in the currency bloc and promoting economic convergence between its 19 member states. “We are opening a new chapter,” Merkel said after talks with Macron on European reform ahead of a June 28-29 EU summit. She said euro zone reform was the toughest issue in their talks. “We are working to make sure that the euro zone budget will be used to strengthen investment, also with the aim of strengthening convergence within the euro zone,” she added.

Like those in Libya you mean?

• EU To Consider Plans For Migrant Processing Centres In North Africa (G.)

The EU is to consider the idea of building migrant processing centres in north Africa in an attempt to deter people from making life-threatening journeys to Europe across the Mediterranean, according to a leaked document. The European council of EU leaders “supports the development of the concept of regional disembarkation platforms”, according to the draft conclusions of an EU summit due to take place next week. The EU wants to look at the feasibility of setting up such centres in north Africa, where most migrant journeys to Europe begin. “Such platforms should provide for rapid processing to distinguish between economic migrants and those in need of international protection, and reduce the incentive to embark on perilous journeys,” says the document seen by the Guardian.

Although the plan is winning influential support, it faces political and practical hurdles, with one expert saying it is not clear how the EU would get foreign countries to agree to be “vassal states”. Migration is high on the agenda of the two-day summit, which opens on 28 June. EU leaders will attempt to reach a consensus on how to manage the thousands of refugees and migrants arriving each month. The German and French leaders, Angela Merkel and Emmanuel Macron, met near Berlin on Tuesday to agree on a common approach, amid fears in their camps that the European project is unravelling. Before the meeting France’s finance minister, Bruno Le Maire, said Europe was “in a process of disintegration. We see states that are turning inward, trying to find national solutions to problems that require European solutions.”

It’s not about money, but that’s all they can think of.

• EU Rebuked For €36 Billion Refugee Pushback Gambit (G.)

The European Union is to increase its spending in Africa by more than 20% over the next seven years to a minimum of €36bn in an attempt to reduce the number of migrants and refugees crossing the Mediterranean. But a succession of reports funded by the EU or written by leading MEPs say European efforts to stem the flow is characterised by misdirected finances, lack of accountability and repeated breaches of basic human rights, including an inability to undermine the business model of human trafficking, an industry worth as much as £35bn a year. Special concern has been expressed that EU funds are being used to give bonuses to the Italian-trained Libyan coastguard to force boats back to Africa.

The arrival of millions of refugees in Europe – and the deaths of thousands more attempting the crossing – has become the continent’s biggest policy headache, now threatening the stability of the German government and the cohesion of the EU. The biggest challenge is Libya, where deepening political chaos has led to more than 500,000 people crossing into Italy in recent years, hastening the election of a populist government in Rome that is now threatening to form an anti-migrant “axis of the willing” with like-minded central and eastern European countries.

Politicians are scrambling for a new formula not just to distribute the people who have reached Europe but also to return those whose asylum claims are refused. The EU is also searching for a credible means to reduce the incentive for people to come to Europe. The fate of mainstream social democratic and centrist parties in next spring’s European elections may rest on the outcome. A detailed examination of EU efforts to tackle the issue finds a “mismatch between the grandiloquent declarations and the action actually implemented on the ground”.

The real number is much higher.

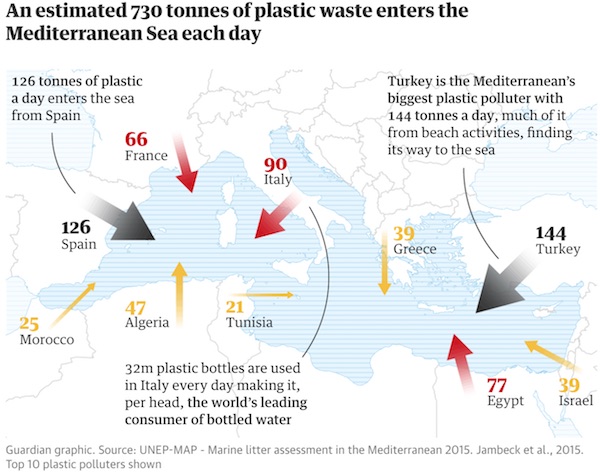

• 34,361 And Rising: Tallying Europe’s Migrant Bodycount (G.)

The vast majority of migrants who have died trying to reach Europe have drowned. Volunteers have logged more than 27,000 deaths by drowning since 1993, often hundreds at a time when large ships capsize. These account for nearly 80% of all the entries. The list points up the marked increase in drownings that occurred after 2014, when the conflict in Syria accelerated, adding to numbers from south Asia and sub-Saharan Africa. In 2013, it reports more than 900 deaths by drowning. By 2017 that number had increased to around 3,500. A wave of public sympathy for the plight of refugees in Europe was quickly displaced by a backlash against the rising number of arrivals in 2015 and 2016, when almost three million people claimed asylum in Europe.

The EU responded by trying to export the problem back to Africa, with a €2bn (£1.75bn) EU-Africa trust fund designed to encourage African countries to stop people making the journey to Europe. The figures show the impact of this policy shift: in 2014, there were around 1,700 deaths recorded in and off the coast of Africa ascribed to migrants trying to get to Europe; by 2017 this had almost doubled, while deaths in Europe halved over the same period. “Some would say there are fewer deaths in Europe, and the EU’s policy is working”, says Ann Singleton, an academic specialising in migration data at the University of Bristol. “But there’s so much that’s unknown. Deaths are less likely to be reported if they occur in remote areas of Africa, and the number of people are dying inland, or in Libyan detention camps, isn’t recorded.

“If you look at maps, it looks as though the Mediterranean is the most dangerous area of the world for migrant journeys. But we can never say if that’s true, because we simply don’t know what’s happening elsewhere,” says Singleton. For those who get to Europe, the danger is not over. The List records more than 500 deaths in the asylum process, detention centres, prisons and camps. Among this group, the most common cause of death is suicide.

Swifts eat flying insects.

• The Vanishing Of The Swifts (G.)

It is the most miraculous bird, the ultimate winged messenger, exploring our globe, spending its life on the breeze. Sickle-shaped wings silhouetted against the sky, the swift is the fastest of all birds in level flight and remains entirely airborne for 10 months, or more, feeding, sleeping and mating on the wing. These long-lived creatures can clock up 4 million miles, commuting between English summers and African winters. Something has changed though. June is erupting as gloriously as it ever did: roadsides are waving with oxeye daisies and blackbirds flute during the endless evenings. But summer is a shadow of its former self. The swifts aren’t here. Well, they are. Only not as we knew them. I heard a scream just now, felt that start of wonder, and glanced up. One swift. No – three, darting through the blue. Three birds.

It’s like returning to the place where you grew up and finding your old home bulldozed. Reality does not compute with the picture you remember. I knew the swift for its screaming parties, marvellous groups of 20 or 40 or 60 or uncountable numbers of birds racing together through the sky, flicking their wings, calling in apparent glee. But this bird is in freefall. A graph produced by the British Trust for Ornithology is terrifying: the British population declined by 51% between 1995 and 2015. And the rate of decline is increasing: down 24% in the five years to 2015. The decline of globalised animals is always global, and complicated. So the disappearance of other equally charismatic long-distance migrants such as nightingales, cuckoos and swallows is bound up in habitat loss or changes in Africa, as well as Britain, and climatic changes en route.

Living in roofs, swifts have also suffered from the conversion of derelict buildings, and our desire for more energy-efficient, impermeable homes. But the biggest cause of changes in animal populations is always food supply. And guess what? Swifts feed on flying insects. We are belatedly waking up to the global calamity that is the loss of insect life. The German study showing a 76% decline in flying insects since 1989 is no anomaly. In Britain, for instance, three-quarters of butterfly species have declined over 40 years, while moth abundance has fallen by more than 40% in the southern half of the country.