Rembrandt van Rijn The Storm on the Sea of Galilee 1633

On March 18, 1990, the painting was stolen by thieves disguised as police officers. They broke into the Isabella Stewart Gardener Museum in Boston, Massachusetts, and stole this painting, along with twelve other works. The paintings have never been recovered, and it is considered the biggest art theft in history. The empty frames of the paintings still hang in their original location, waiting to be recovered.

Neil Oliver

‘Biden mourned Navalny’s death and said ‘even in prison he was a powerful voice for the truth'.

'An interesting statement while journalist, Julian Assange, who published truth inconvenient to the US and the west, presently rots in Belmarsh Prison.’@thecoastguy pic.twitter.com/84g7c6nFtO

— GB News (@GBNEWS) February 17, 2024

Julian Assange should be freed. Here’s why: #FreeAssange pic.twitter.com/BSLv9OEhvY

— David Sacks (@DavidSacks) February 18, 2024

🚨🇬🇧 Tucker Carlson on Julian Assange

“Mike Pompeo tried to have him murdered”

“Assange has been accused of telling the truth period.”

“They are torturing him to death”

Every time our politicians talk about ‘democracy’ they are absolute hypocrites. pic.twitter.com/Bm0a6OROGD

— Concerned Citizen (@BGatesIsaPyscho) February 17, 2024

Celtic Park, Glasgow, Sat Feb 17

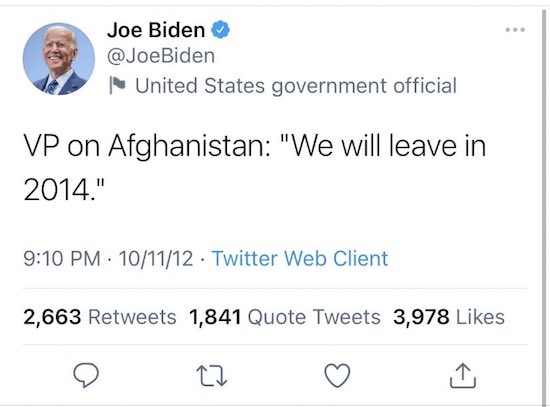

Biden Navalny

BREAKING: In case you did not hear it very well, President Biden, while addressing the death of Alexei Navalny, used the opportunity to say that the impeachment inquiry into his family's alleged corruption should be dropped: "It's just been an outrageous effort." WATCH

NOTE:… pic.twitter.com/v49Simv8Pc

— Simon Ateba (@simonateba) February 16, 2024

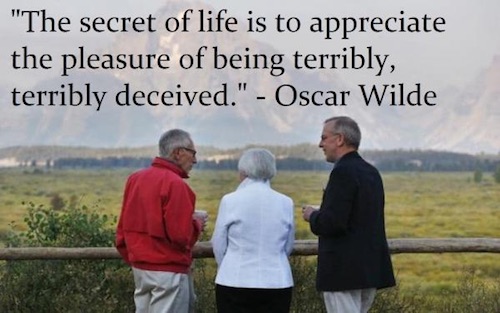

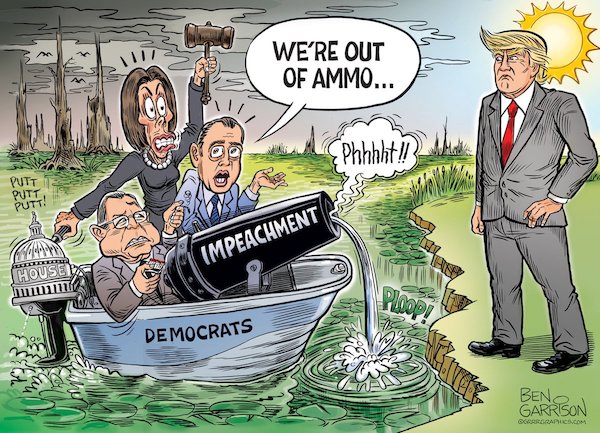

“..Engoron fulfilled Oscar Wilde’s rule that the only way to be rid of temptation is to yield to it. He ordered everything short of throwing Trump into a wood chipper..”

• Obscene Award Vs Trump Is Testing New York Legal System’s Integrity (Turley)

In laying the foundation for his sweeping decision against former President Donald Trump, Judge Arthur Engoron observed that “this is a venial sin, not a mortal sin.” Yet, at $355 million, one would think that Engoron had found Trump to be the source of Original Sin. The judgment against Trump (and his family and associates) was met with a level of unrestrained celebration by many in New York that bordered on the indecent. Attorney General Letitia James declared not only that Trump would be barred from doing business in New York for three years, but that the damages would come to roughly $460 million once interest was included. That makes the damages against Trump greater than the gross national product of some countries, including Micronesia. Yet the court admitted that not a single dollar was lost by the banks from these dealings. Indeed, witnesses testified that they wanted to do more business with Trump, who was described as a “whale” client with high yield business opportunities.

Undervaluing and overvaluing property is a longstanding practice in New York real estate. The forms submitted by the Trump organization cautioned the banks to do their own estimates and the loans were paid in full and on time. Yet, the New York law used by James is a curiosity because it does not actually require a victim. Indeed, everyone can make ample profits and still allow for an investigation into “repeated fraudulent or illegal acts.” Having campaigned on bagging Trump on any basis, James turned the law into a virtual license to hunt him down along with his family and his associates. Engoron proved the perfect judge for the case. The opinion itself seems almost cathartic for the jurist who struggled with Trump inside and outside of court. In the judgment, Engoron fulfilled Oscar Wilde’s rule that the only way to be rid of temptation is to yield to it. He ordered everything short of throwing Trump into a wood chipper.

The size of the damages is grotesque and should shock the conscience of any judge on appeal. Even if the Democrat-appointed judges on the New York Court of Appeals were to ignore the obvious inequity and unfairness, the United States Supreme Court could intervene. State courts tend to get a significant amount of deference in the interpretation of their own laws. After all, if New York wants to turn Wall Street into a remake of “The Hunger Games,” it has only itself to blame as other businesses flee the state. The impact on New York business is likely to be dire. New York is already viewed as a hostile business environment, with the top end of its tax base literally heading south as taxes and crime rises. This draconian award is only going to deepen concerns over the arbitrary application of the law by figures like James, who previously sought to disband the National Rifle Association. (She has shown less interest in cracking down on liberal organizations like Black Lives Matter or the National Action Network of Al Sharpton despite their own major financial scandals.)

As James gleefully uses this law to break up a major New York corporation, it is hard to imagine many businesses rushing to the Big Apple. This follows Democratic politicians such as Rep. Alexandria Ocasio-Cortez (N.Y.) campaigning against Amazon seeking to open new facilities in the city. After this week, drawing new businesses to the city is going to be about as easy as selling country estates during the French Revolution. The one hope for New York businesses may be the U.S. Supreme Court. Despite the deference afforded to the states and their courts, the court has occasionally intervened to block excessive damage awards.

“..as specious allegations come before American courts, folks can’t help noticing that the so-called “oppressed” usually win..”

• Cultural Marxism and the Corruption of Common Law (Brooks)

Legal scholars once insisted that “justice must not only be done, it must be seen to be done.” Everyone should be able to expect a fair trial that’s accurately covered by public news organizations. But unbiased judges and honest reporters are in short supply. While Republican presidential candidate Donald Trump is facing unprecedented indictments, journalists are still insisting that American justice is fair and impartial. The left’s recourse to “lawfare” requires judges and journalists to conceal the truth rather than expose it. Legacy news organizations say there’s no evidence of the “weaponization of justice” or a “two-tiered” legal system. But, as specious allegations come before American courts, folks can’t help noticing that the so-called “oppressed” usually win.

For example, in 2019 American advice columnist E. Jean Carroll suddenly accused Donald Trump of sexually assaulting her in a Bergdorf Goodman department store dressing room in the mid-1990s. Mr. Trump vigorously denied the allegations, but Ms. Carroll was permitted to sue him for defamation and battery. One could have guessed the outcome of this case before it began. The left views Donald Trump as an arch-oppressor, and E. Jean Carroll was seen as an “oppressed” victim. In May 2023, a New York jury found the former president liable for defamation and sexual abuse and awarded E. Jean Carroll $5 million in damages. In January of this year, Mr. Trump was found liable in a second defamation suit, and Ms. Carroll was awarded an additional $83.3 million. The second award was unprecedented. Late in January, Breitbart News reporter Hannah Bleau Knudsen revealed several facts about this case that she said the establishment media didn’t want the public to know.

First, there were no witnesses and no surveillance video of the attack, which was alleged to have occurred in a downtown New York department store. The plaintiff came forward with her story while promoting a book titled “What Do We Need Men For?,” which featured a list of “The Most Hideous Men of My Life.” The dress she claimed to be wearing during the alleged attack was not for sale in the year she initially claimed the event occurred. Despite her public reputation for being very open about sexual matters, she didn’t accuse President Trump until some 30 years after the alleged encounter. Her entire story was very similar to a 2012 “Law & Order: Special Victims Unit” episode, titled “Theatre and Tricks,” in which an individual talks about a rape fantasy in Bergdorf Goodman. In a November 1993 edition of Elle, before the alleged abuse, Ms. Carroll had made a joke associating sex with Bergdorf Goodman.

E. Jean Carroll’s case was financially backed by anti-Trump Democrat mega-donor Reid Hoffman. One of her lawyers is Roberta Kaplan, whose wife is a Democratic Party activist. In fact, her lawsuit was only able to proceed after New York Democrats created a 2022 “Adult Survivors Act,” which allowed judges to overlook the usual statute of limitations for such charges. Judgments in cases that are tried in partisan-charged venues such as New York City or Washington DC, have almost become forgone conclusions. A steep decline of common law principles will not bode well for the future of the American Republic. Who would have thought that in 2024 American citizens would be witnessing a partisan special prosecutor seeking the U.S. Supreme Court’s permission to put the opposing party’s presidential candidate on trial months before a presidential election.

“Can you imagine? Criticize a wind turbine or pandemic lockdowns and find yourself hauled in front of a judge!”

• From Censorship to Criminalizing Dissent (Jeffrey Tucker)

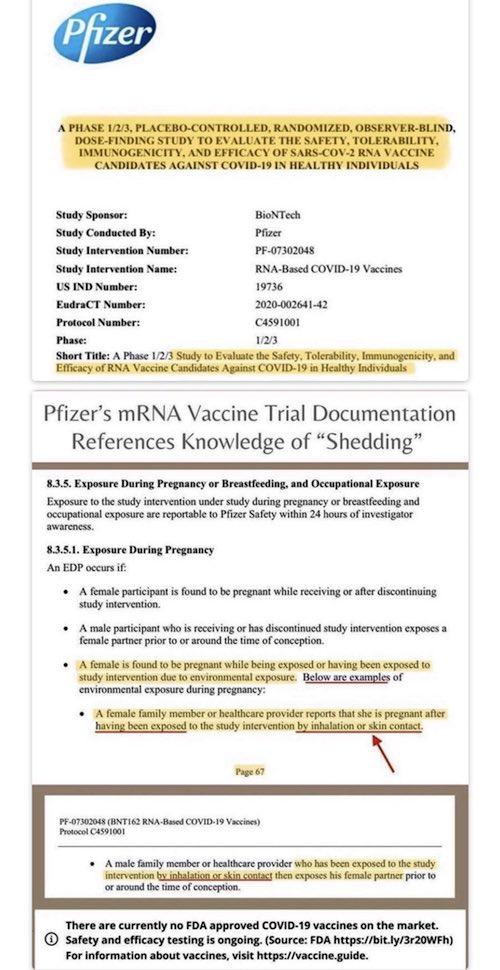

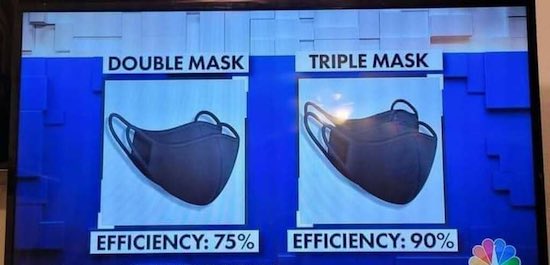

A major battle is brewing throughout the Western world over the basic principle of free speech. Is it going to be protected by law? It’s not entirely clear what the outcome will be. We seem to be on the precipice of a potential calamity if the courts don’t decide the right way. Even if we squeak out a victory, the question is already in play. Our free speech rights have never been more fragile. Turn your attention to France right now. In the dead of night, a new law slipped through the General Assembly that would make it a crime to criticize mRNA shots. Critics call it the Pfizer law. It calls for fines up to 45,000 euros and possibly three years in prison for debunking an approved medical treatment. Like all Western nations, criticism of the mRNA platform has already been subjected to vast social-media censorship. Even given this, there has been a major and global consumer turn against these shots. People are not convinced that they are necessary, safe, or effective. Still, government imposed mandates for everyone, billions of people worldwide.

This was a form of conscription that has driven a deep divide between the rulers and the ruled. Rather than back down, however, governments, which have been captured by pharmaceutical interests, are going to bat for the companies and the technology to threaten imprisonment of anyone who speaks out openly against them. Here is where censorship becomes severely weaponized. It’s the next logical step. First you deploy every power to keep the distribution channels of information free of dissent. When that doesn’t entirely work, simply because people find alternative means of getting the word out, you have to intensify matters and institute outright controls. It stands to reason that this would happen. After all, the whole point of censorship is to curate the public mind to put down opposition to regime priorities. When mainstream corporate media is falling apart and new media is rising, the next stage is to go the full way to flat-out criminalize opinion, like any totalitarian government.

We are very close to that stage. If it can happen in France, it can happen throughout Europe, then the Commonwealth, and then the United States. We know this much about politics today. It is global. The elites that have seized control of our governments coordinate across borders. This is why it is hugely important to pay attention to what’s going on across the pond. As a second item, I’m alarmed to read the lead piece in the New York Times opinion section that celebrates a defamation case about which I had not previously heard. It is by Michael Mann, professor at the University of Pennsylvania. He had sued a writer for the Competitive Enterprise Institute for taking issue with Mann’s climate change model, and the so-called hockey stick in particular.

This is not my area of specialization at all but I have no doubt that mainstream climate science should be subject to vigorous criticism. If the COVID era has taught us anything, it is that the “scientific consensus” can be outrageously wrong and needs a check that comes in the form of writing, some of it zippy and cutting. Dr. Mann filed a defamation lawsuit. Defamation is a very high bar: it means to deliberately lie about something with the intention to harm. One might not suppose that many things could qualify as that, certainly not criticism of a climate model. Indeed, most defamation lawsuits are dismissed outright simply because this country generally values free speech. This one, however, was accepted by the judge in Washington, D.C. court. After a full decade in litigation, and a full hearing, the jury ended up deciding in favor of the plaintiffs. One defendant, Rand Simberg, has been told to pay $1K and the other, Mark Steyn, $1M. Simberg says he will appeal and stands by every word that he wrote. Steyn agrees and is ready to appeal.

Essentially this verdict is criminalizing hyperbole, said the defense attorney. The op-ed writer, however, says this is justice. “Our recent trial victory may have wider implications,” he says. “It has drawn a line in the sand. Scientists now know that they can respond to attacks by suing for defamation.” He mentions in particular people who have disagreed with the COVID consensus—disagreeing with Anthony Fauci—or otherwise make “false claims about adverse health effects from wind turbines.” Can you imagine? Criticize a wind turbine or pandemic lockdowns and find yourself hauled in front of a judge!

There is talk of bloodclot(s). Paul Craig Roberts concludes Navalny died of mRNA.

• Navalny Timeline (Maria Zakharova)

“The reaction of Western leaders, politicians and the media to the news of the death of Alexei Navalny once again demonstrated their hypocrisy, cynicism and unprincipledness. The “in any situation, blame Russia” scheme is in action. Moreover, for each case there is a preparation according to the manual. Let’s look at the chronology. Today at approximately 14:19, a message was published on the website of the Federal Penitentiary Service of Russia for the Yamalo-Nenets Autonomous Okrug about the death of convicted Alexei Navalny in correctional colony No. 3. Literally 15 minutes later, a torrent of carbon-copy accusations began pouring in:

– 14:35 – Swedish Foreign Minister Tobias Billström: “Terrible news about Navalny. If the information about his death in a Russian prison is confirmed, this will be another heinous crime of the Putin regime”;

– 14:35 – Norwegian Foreign Minister Bart Eide: “Deeply saddened by the news of Navalny’s death. The Russian government bears a heavy burden of responsibility for this”;

– 14:41 – Latvian Foreign Minister Edgar Rinkevich: “Whatever you think about Navalny as a politician, he was just brutally murdered by the Kremlin. This is a fact and something that everyone should know about the true nature of the current Russian regime”;

– 14:50 – Czech Foreign Minister Jan Lipavsky: “Russia still treats foreign policy issues the same way it treats its citizens. It has turned into a cruel state that kills people who dream of a beautiful, better future, like Nemtsov and now Navalny, who was imprisoned and tortured to death”;

– 14:51 – French Foreign Minister Stephane Sejournet: “Navalny paid with his life for the fight against the system of oppression. His death in a penal colony reminds us of the realities of Vladimir Putin’s regime”;

– 15:02 – President of the European Council Charles Michel: “The EU holds the Russian regime solely responsible for this tragic death”;

– 15:10 (during a press conference) – leader of the Kyiv regime Zelensky: “Obviously, he was killed by Putin, like thousands of others who were tortured.”

– 15:16 (in the media), 16:50 (in social networks) – NATO Secretary General Jens Stoltenberg: “Russia must establish all the facts, answer very serious questions”;

– 15:20 – Dutch Prime Minister Mark Rutte: “Navalny’s death illustrates the unprecedented cruelty of the Russian regime”;

– 15:30 – President of Moldova Maia Sandu: “Navalny’s death in a Russian prison is a reminder of the regime’s blatant oppression of dissent”;

– 15:35 – German Foreign Minister Annalena Bärbock: “Navalny, like no one else, was a symbol of a free and democratic Russia. That’s why he had to die”;

– 15:43 – European Commission President Ursula von der Leyen: “A grim reminder of what Putin and his regime are”;

– 15:49 – Swedish Prime Minister Ulf Kristersson: “The Russian authorities and President Putin personally are responsible for the fact that Navalny is no longer with us”;

– 16:14 – German Chancellor Olaf Scholz: “Navalny paid with death for his courage. This terrible news once again demonstrates how Russia has changed and what kind of regime is in power in Moscow”;

– 16:25 – US Secretary of State Antony Blinken: “Navalny’s death in a Russian prison, as well as one man’s obsession and fear, only highlight the weakness and rot at the heart of the system that Putin built. Russia bears responsibility for this”;

– 17:28 – French President Emmanuel Macron: “In today’s Russia, free people are placed in the Gulag and sentenced to death.”In a short period of time, within two hours (from 14:19), Western politicians and the media at their side were able, as it were, to obtain the results of a forensic examination that had not yet been carried out, conduct an investigation, blame Moscow and render a verdict. There is no other explanation other than the fact that all these reactions were prepared in advance. [..] “We might be able to believe in this incredible, miraculous speed if the whole world had not just watched the helpless ‘investigation’ of terrorist attacks on the Nord Stream gas pipeline that stretched out over many months and turned up empty,” the ministry added.

Navalny

Here is Navalny trying to scheme his way into a $20M payday from MI6 Officer James William Thomas Ford to start a color revolution in Russia.

This is your hero? A treasonous rat willing to sell out his country and plunge it into chaos for his western masters? pic.twitter.com/m6mSloufx2

— DD Geopolitics (@DD_Geopolitics) February 16, 2024

“The people of Novorossiya, as much as Yemeni Houthis, have Faith imprinted in their DNA..”

• Transcending Adveevka (Pepe Escobar)

Avdeevka. The name sounds like an incantation. Like Debaltsevo, or Bakhmut. The incantation summons the figure of a cauldron. As it stands, and it’s all moving at lightning speed, it takes only 2 km for the cauldron to be closed. Virtually all roads and muddy trails are under massive Russian fire control. There may be up to 6,000 Armed Forces of Ukraine (AFU) soldiers left. They have nowhere to go. They are already in – or are going straight to – Hell.= “The Butcher” Syrsky, who has just been appointed Commander-in-Chief of the AFU amidst a nasty dog fight in Kiev, immediately got himself a fresh cauldron. Old habits die hard. The morale and psychological state of AFU fighters is in tatters. Azov batallion neo-nazis are being decimated by massive artillery, FPVs and FABs. Still, AFU generals are setting up the P.R. stage for another “victory” – a replay of Ilovaisk and Debaltsevo, even as the actual retreat, evacuation or “extraction” will proceed through the Corridors of Hell.

In fact, the only player who has successfully extracted himself from Hell, just in time, was Gen Zaluzhny. To quote Dylan: “Strike another match/ go start anew.” During my vertiginous journey across Donbass, only a few days ago, Avdeevka – the incantation – was omnipresent. At a meeting in a secret compound plunged in darkness in the western outskirts of Donetsk, two top commanders of Orthodox Christian batallions, while discussing tactics, noted that the fall of Adveevka would be a matter of days, maximum weeks. The symbology is quite transcendental. Kiev has been fortifying Adveevka non-stop for nearly 10 years – essentially to keep shelling civilians in Donetsk and other parts of Donbass with impunity, ad infinitum. Donetsk remains extremely vulnerable – and the shelling persists. The strength, resilience and faith of the residents of this historic mining town – and the surrounding countryside – are deeply moving.

In a very special conversation with Alexander Dugin, we both made it clear, directly and indirectly, that the working classes of Novorossiya are spiritual brothers of the oppressed in Palestine and Yemen. Yes, the Axis of Resistance in West Asia is mirrored by the Slavic Axis of Resistance in the black soil of the steppes. As much as Russia may have been drawn to a civilizational war against the collective West, that is also a spiritual war. The proxy war by the Hegemon against Russia in Ukraine is as much a geopolitical gamble as a war of Western nihilism against Russian Orthodoxy. I did mention the parallel between Orthodox Christianity and Shi’ism to a top commander; he may have been bemused, but he definitely got the message. After all, he must have instinctively noticed it was the rejected, harassed and bombed in Orthodox Christianity and Islam who have re-awakened the Orthodox and Islamic civilizations for a transcendental war of survival – supported by faith.

Way beyond the Adveevka incantation – a sort of catalyst of all these times of trouble, as Mother Mary of God eventually comes offering solace – what struck me in this vertiginous journey in Donbass is Almighty People Power. Civilians are the true heroes of the full liberation of Novorossiya, as much as the people scattered across Greater Syria – encompassing Palestine, Syria and Lebanon – Iraq and Yemen. These are the souls who have endured a Hell on Earth much more toxic and much longer than the Adveevka cauldron, since Zionism and its subsequent eschatological garrison-settler colonial offspring took over the Holy Land. The people of Novorossiya, as much as Yemeni Houthis, have Faith imprinted in their DNA. Those deeply committed commanders and soldiers that I met in Novorossiya close to the front lines mirror the popular consensus.

“Ray McGovern and Lawrence Wilkerson argue the U.S. should accept that no amount of U.S. funding will change Russia’s will and means to prevail in Ukraine.”

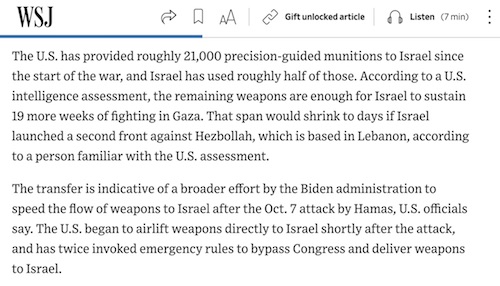

• Throwing Good Money After Bad in Ukraine? (CN)

On July 13, 2023, President Joe Biden announced Russian President Vladimir Putin “has already lost the war.” That was six days after C.I.A. Director William Burns, normally a sane voice, had called the war a “strategic failure” for Russia with its “military weaknesses laid bare.” Earlier, in December 2022, National Intelligence Director Avril Haines reported that the Russians were experiencing “shortages of ammunition” and were “not capable of indigenously producing what they are expending.” We advise caution, as these same people now say that Ukraine can prevail if the U.S. provides $60 billion more. Do they think they can change geography, overcome Russian industrial might, and persuade the Russians that Ukraine should not be a core interest of theirs? Recall President Barack Obama’s reasons for withholding lethal weapons from Ukraine.

In 2015, The New York Times reported on Obama’s reluctance: “In part, he has told aides and visitors that arming the Ukrainians would encourage the notion that they could actually defeat the far more powerful Russians, and so it would potentially draw a more forceful response from Moscow.” Senior State Department officials spelled out this rationale: “If you’re playing on the military terrain in Ukraine, you’re playing to Russia’s strength, because Russia is right next door. It has a huge amount of military equipment and military force right on the border. Anything we did as countries in terms of military support for Ukraine is likely to be matched and then doubled and tripled and quadrupled by Russia.” The above words were spoken by then-Deputy Secretary of State Antony Blinken on March 5, 2015 to an audience in Berlin. It turns out President Obama was right. It is hard to understand why Blinken (and Biden) chose the way of President Donald Trump, who gave lethal weapons to Ukraine, over the way of Obama.

So much for geography and relative strength. What about core interests? In 2016 President Obama told The Atlantic that Ukraine is a core interest of Russia but not of the U.S. He warned that Russia has escalatory dominance there: “We have to be very clear about what our core interests are and what we are willing to go to war for.” Earlier, when a saner William Burns was ambassador to Russia, he warned of Moscow’s “emotional and neuralgic reaction” to bringing Ukraine into NATO. Braced on the issue by Foreign Minister Sergei Lavrov in February 2008, Burns reported that Russia’s opposition was based on “strategic concerns about the impact on Russia’s interests in the region” and warned then that “Russia now feels itself able to respond more forcefully”. Burns added: “In Ukraine, these include fears that the issue could potentially split the country in two, leading to violence or even, some claim, civil war, which would force Russia to decide whether to intervene.”

The overthrow of Ukrainian President Viktor Yanukovych in February 2014 gave immediacy to Russia’s warnings on Ukraine and its fear that the West would try to effect “regime change” in Russia, as well. In a major commentary, “Russian Military Power”, published in December 2017, the U.S. Defense Intelligence Agency concluded: “The Kremlin is convinced the U.S. is laying the groundwork for regime change in Russia, a conviction further reinforced by the events in Ukraine. Moscow views the United States as the critical driver behind the crisis in Ukraine and the Arab Spring and believes that the overthrow of former Ukrainian President Yanukovych is the latest move in a long-established pattern of U.S.-orchestrated regime change efforts …”

Is Putin paranoid about “U.S. regime change efforts?” D.I.A. did not think him paranoid. And surely Putin has taken note of Defense Secretary Lloyd Austin’s remarks in April 2022: “One of the US’s goals in Ukraine is to see a weakened Russia. … The US is ready to move heaven and earth to help Ukraine win the war against Russia.” In sum: Russia has both the will and the means to prevail in Ukraine – no matter how many dollars and arms Ukraine gets. Obama was right; Russia sees an existential threat from the West in Ukraine. And nuclear powers do not tolerate existential threats on their border. Russia learned this the hard way in Cuba in 1962.

The Europeans are grown-up people. May they take care of their own fate..”

• Europe Is Losing Dignity By Obediently Submitting To US – Lavrov (TASS)

The United States is openly engaged in pumping resources out of European countries, while Europe in its obedient submission is losing strategic autonomy and the sense of dignity, Russian Foreign Minister Sergey Lavrov said at the plenary session of the forum of supporters for the fight against modern practices of neocolonialism For Freedom of Nations. “Against the backdrop of economic problems, the Americans have openly engaged in pumping resources out of Europe. They are cutting off promising markets and reliable energy sources. For the sake of this, they blew up the Nord Stream gas pipelines without hesitation and ordered Germany and the rest of Europe to swallow this humiliation. Europe quietly obeyed, forgetting about its former timid speculations about strategic autonomy and dignity,” Lavrov emphasized. He pointed out that now “the European industry is literally being forced to choose between transferring operations overseas and ruin.” “The Europeans are grown-up people. May they take care of their own fate,” Lavrov said.

“..von der Leyen’s antagonism toward Moscow “could prove to be a disadvantage in the long term..”

• Germany Blocked Von Der Leyens NATO Bid – Welt (RT)

German Chancellor Olaf Scholz intervened last year to prevent European Commission President Ursula von der Leyen from becoming NATO’s next secretary general, Germany’s Die Welt newspaper has said. Scholz reportedly felt that von der Leyen’s hardline anti-Russian stance would be a problem “in the long term.” NATO Secretary-General Jens Stoltenberg received a fourth extension to his term as head of the military bloc last July. While Stoltenberg may remain in office until October, the alliance’s leaders have already begun jockeying to replace him. At the end of last year, US Secretary of State Antony Blinken suggested von der Leyen to President Joe Biden as a potential replacement, Welt reported on Saturday. Biden approached Scholz with the idea, but was shot down, the report claimed, citing “several high-ranking EU officials and top diplomats.

“Scholz was categorically against von der Leyen becoming NATO chief,” one of these sources said. The German chancellor reportedly told Biden that the position of secretary-general is too important “to leave to a Christian Democrat from Germany,” and that von der Leyen’s antagonism toward Moscow “could prove to be a disadvantage in the long term,” in the newspaper’s words. There is no formal process by which NATO chooses its secretary-general. Instead, member states discuss candidates among themselves until a consensus is reached. NATO’s largest military power and de-facto controlling member, the US, is said to favor a woman for the role. Danish Prime Minister Mette Frederiksen was suspected to be a prime candidate last year, until she traveled to Washington in June and – according to Welt – failed to impress Biden or members of Congress. Stoltenberg’s term was extended a month later.

While Washington apparently wants a woman at the helm, Biden has already ruled out another leading female candidate, Estonian Prime Minister Kaja Kallas. According to Welt, the US president considers Kallas too critical of Moscow and incapable of building stable relations with the Kremlin when the conflict in Ukraine eventually ends. With von der Leyen, Frederiksen, and Kallas out of contention, the Netherlands’ caretaker prime minister, Mark Rutte, is now described in the media as a frontrunner for the job. Welt’s sources stated that “support for him is increasing,” and that leaders in 21 member states – including Biden and Scholz – are prepared to endorse his candidacy. While Biden may have favored a woman, Rutte is reportedly seen as someone who could work with either him or former President Donald Trump, should the latter defeat Biden in this November’s election. “The decision should, if possible, be made before the European elections in June,” a NATO diplomat told Welt. This weekend’s Munich Security Conference, the paper noted, will provide ample opportunity for Rutte to bring more supporters on board.

Ursula saw Germany’s move to block her coming. She’ll start her own NATO.

• EU To Get ‘Defense Commissioner’ – Von der Leyen (RT)

European Commission President Ursula von der Leyen will appoint a dedicated “defense commissioner” if she retains her post after EU elections in June, she said on Saturday. The precise duties of the role are unclear. “If I would be the president of the next European Commission, I would have a commissioner for defense,” von der Leyen said at the Munich Security Conference. Creating such a post would be a “reasonable” decision, she added. Von der Leyen and her 27 commissioners are not directly elected by European voters. Instead, a president of the commission is nominated by the European Council and approved or rejected by the European Parliament. If confirmed, the president then selects 27 commissioners, usually one from each member state.

The next commission will be formed while Hungary – whose prime minister has an antagonistic relationship with von der Leyen – holds the council’s rotating presidency. While right wing parties are projected to surge in June’s parliamentary elections, von der Leyen’s centrist European People’s Party (EPP) will likely remain the largest faction in the 720-seat legislature. The EPP has backed the appointment of a defense commissioner. In a draft manifesto seen by Euractiv last month, the party stated that whoever takes the post should be in charge of ensuring the EU spends 0.5% of its shared budget on defense and directs an equal share to overhauling the bloc’s ailing arms industry. Von der Leyen did not expand on these responsibilities, nor did she suggest whether a defense commissioner would have any input into the bloc’s overall military strategy, which was set out for the first time by the European Council in 2022.

The commission president said that it is an “open” question as to which nationality would get the post. However, she added that it is “important” for an Eastern European to receive a good portfolio, and “this is a good portfolio.” Earlier this week, an anonymous EU diplomat told Politico that Polish Foreign Minister Radoslaw Sikorski and Estonian Prime Minister Kaja Kallas are leading candidates for the position. Both are vocal backers of Ukraine, with German media reporting on Saturday that Kallas reportedly missed out on a chance to replace Jens Stoltenberg as NATO’s secretary general due to her overly hawkish stance on Russia.

“Today’s efforts to support Ukraine are nothing compared to those we would have to deploy against a Russia that feels victorious..”

• France Warns Of ‘Economic Shock’ From Russian Victory (RT)

A potential Russian victory in Ukraine could deal an economic blow to the West because Moscow would gain control of vast resources, French Foreign Minister Stephane Sejourne has said. In an opinion piece for the French daily Le Monde published on Saturday, the minister argued that Moscow wanted Paris to believe that it would be “more reasonable to abandon the Ukrainians to their tragic fate.” He protested against this point, saying that “the French are not fools” and that there were few things that “would be more contrary” to the country’s interests. Beyond the security risks, however, a Russian victory would also have powerful economic repercussions for the West, Sejourne said. “Allowing Russia to seize the Ukrainian black lands, which are among the most fertile in the world, would be to abdicate a part of food sovereignty, accept unbridled inflation, and provide Russia with unprecedented means of pressure and extortion,” he stated.

Recalling that Ukraine accounts for 30% of global wheat exports, the minister claimed that Moscow’s control over those resources would enable it to “attack our own farmers.” He also said that Europe would be at “an immense risk” if Russia were allowed to continue controlling the Zaporozhye nuclear power plant, the largest facility of its kind on the continent, without elaborating on why. “Europe and the world, the French people would suffer an unprecedented economic shock,” Sejourne stressed. Russian troops seized the power station in March 2022 shortly after the start of the Ukraine conflict. After four former Ukrainian regions, including Zaporozhye, voted to join Russia later the same year, the facility was transferred to state ownership.

Sejourne went on to urge the West to resist the “temptation of fatigue.” “Today’s efforts to support Ukraine are nothing compared to those we would have to deploy against a Russia that feels victorious,” he said, insisting that the current policies would allow Kiev’s backers to keep control over prices. Russia has repeatedly warned the West against supporting Ukraine with arms, warning that it will only prolong the conflict. The Russian military also said last month that it had eliminated several dozen mercenaries in Ukraine, saying that most of them were French-speaking. While Paris initially denied that there were any French mercenaries in Ukraine, it later admitted that a number of French nationals had indeed joined Kiev’s forces, although it insisted they had no links to the national government.

Just like Texas.

• Suicide Pact Threatens to Flood EU With 75 Million More Migrants (MN)

The EU has passed a migration pact dubbed “the suicide of Europe” which could lead to the continent being flooded with as many as 75 million new migrants. The European Parliament’s LIBE committee passed the act on Wednesday, which formalizes the distribution of migrants to member states and punishes those that refuse to take them. Because cultural enrichment and diversity is “our greatest strength,” countries that try to maintain their national identity without being subsumed by migrants will be hit with severe financial penalties. Marine Le Pen, the leader of National Rally’s parliamentary wing, previously said the pact would lead to “the suicide of Europe,” adding that it was a deal with the devil and represents an “organized plan of submersion of Europe and the nations which compose it.”

Member states will be forced to accept migrants or pay a massive financial penalty of €25,000 per migrant. This makes little sense given that we’re constantly reminded of how mass migration is such an economic boon and is both inevitable and vital to maintaining GDP levels. However, it makes total sense when you understand that such claims are completely fraudulent. “The next question is how many they will force on us. Now they are deciding that. So they are creating rules that give Brussels the right to say how many migrants they will distribute,” said Hungarian Prime Minister Viktor Orbán last year. “So, several countries have indicated that they do not agree. We do not want to implement it. In the end, we are facing a very unpleasant turn of events here.”

Orbán questioned why, if accepting migrants was so financially profitable, are western European nations trying to offload them onto Hungary. Róbert Gönczi, an analyst at Hungary’s Migration Research Institute, pointed out that migrants distributed to Hungary normally end up leaving for Sweden or Germany, where they receive far bigger welfare payments. “The redistribution system could also create intra-EU flows from the countries where these migrants have been relocated to the countries where they actually want to leave, as typically the destination countries have not changed,” said Gönczi.

“However, it would now be necessary for other EU countries to welcome these migrants, refugees and asylum seekers, he added. The real problem is that the reinforcement of the EU’s external borders would be less or not at all, which is what is really needed.” As we previously highlighted, there is no appetite whatsoever for the EU simply to impose proper border controls. The new leader of Frontex, the European Union agency tasked with securing borders, recently called for open borders and vowed to appease left-wing pro-mass migration activists. “Nothing can stop people from crossing a border, no wall, no fence, no sea, no river,” said Hans Leijtens, which was a bizarre statement given that’s his one job.

The Supreme Court said Biden could remove barbed wire. It said nothing about Texas putting up new wire.

• Texas To Build Military Base Camp On Mexico Border To House 1,800 Soldiers (ZH)

In the latest signal of his resolve to stem the flow of illegal immigrants into the United States, Texas Governor Greg Abbott on Friday announced that the Lone Star State will build a military base along the Rio Grand at the border city of Eagle Pass. Spanning 80-acres, “Forward Operating Base Eagle” will house upwards of 1,800 Texas National Guard soldiers supporting Operation Lone Star, and will be expandable to house 2,300. Texas Maj. Gen. Thomas Suelzer said the camp will have 300 beds by mid-April, and will add another 300 beds every month after that. “Before this effort here, they had been living in conditions that were atypical for military operations,” Abbott said at a press conference in Eagle Pass. “Because of the magnitude of what we’re doing, because of the need to sustain and actually expand our efforts of what we’re doing, it’s essential that we build this base camp for the soldiers.”

As it is, soldiers are housed all over the area, varyingly living in hotels, tents and even some private houses. Some bear long commutes. “Illegal crossings are down and, coincidentally, razor-wire barrier is up,” said Abbott. “We will continue to muster the efforts are needed to make sure that Texas does the job that the United States Congress has mandated. The United States Congress has mandated for barriers to be built on the border. Biden is not building those barriers.” Eagle Pass has been in the national spotlight in recent months, a flashpoint in the ongoing battle between Texas and the federal government over border security, including state authority to enforce immigration laws. Earlier this year, Texas seized control of a 47-acre park in the city, a park that has been a major avenue of illegal immigration.

The Texans also began barring US Border Patrol agents and watercraft from the property, which they’ve used as a staging area for processing migrants. The new base, located about 6 miles south of the park, will include a 700-seat dining facility, workout equipment, a recreation center and laundries, vehicle maintenance bays, weapons storage rooms and a helipad. Soldiers will have individual rooms. In January, the US Supreme Court ruled that the federal government could proceed with removing razor wire installed by Texas at the Eagle Pass border. However, a defiant Gov. Abbott not only slammed the order and barred federal agents from accessing the razor wire, he also added even more. On Friday, officials said they will add more barriers extending to the north and south of Shelby Park, the recreational site seized by the state in January, add three fan boats to the river-patrol capacity, and expand drone and radar capabilities.

Some 3,000 Texas troops are deployed along the 1,200-mile-long Mexican frontier. In December, Texas enacted a law allowing state law enforcement to arrest immigrants who’ve entered Texas without authorization. Biden’s Justice Department quickly sued, arguing that the Texas law encroaches on federal border-management authority. Gallup recently found that, among Americans who disapprove of President Biden’s job performance, immigration is their top reason for giving him a failing mark. In the January poll, only 41% approved of Biden — the worst-ever showing for an incumbent at that time in his term

By Irfan Galaria.

• American Doctor In Gaza: What I Saw Wasn’t War – It Was Annihilation (LAT)

In late January, I left my home in Virginia, where I work as a plastic and reconstructive surgeon and joined a group of physicians and nurses traveling to Egypt with the humanitarian aid group MedGlobal to volunteer in Gaza. I have worked in other war zones. But what I witnessed during the next 10 days in Gaza was not war — it was annihilation. At least 28,000 Palestinians have been killed in Israel’s bombardment of Gaza. From Cairo, Egypt’s capital, we drove 12 hours east to the Rafah border. We passed miles of parked humanitarian aid trucks because they weren’t allowed into Gaza. Aside from my team and other envoy members from the United Nations and World Health Organization, there were very few others there. Entering southern Gaza on Jan. 29, where many have fled from the north, felt like the first pages of a dystopian novel.

Our ears were numb with the constant humming of what I was told were the surveillance drones that circled constantly. Our noses were consumed with the stench of 1 million displaced humans living in close proximity without adequate sanitation. Our eyes got lost in the sea of tents. We stayed at a guest house in Rafah. Our first night was cold, and many of us couldn’t sleep. We stood on the balcony listening to the bombs, and seeing the smoke rise from Khan Yunis. As we approached the European Gaza Hospital the next day, there were rows of tents that lined and blocked the streets. Many Palestinians gravitated toward this and other hospitals hoping it would represent a sanctuary from the violence — they were wrong. People also spilled into the hospital: living in hallways, stairwell corridors and even storage closets.

The once-wide walkways designed by the European Union to accommodate the busy traffic of medical staff, stretchers and equipment were now reduced to a single-file passageway. On either side, blankets hung from the ceiling to cordon off small areas for entire families, offering a sliver of privacy. A hospital designed to accommodate about 300 patients was now struggling to care for more than 1,000 patients and hundreds more seeking refuge. There were a limited number of local surgeons available. We were told that many had been killed or arrested, their whereabouts or even their existence unknown. Others were trapped in occupied areas in the north or nearby places where it was too risky to travel to the hospital. There was only one local plastic surgeon left and he covered the hospital 24/7. His home had been destroyed, so he lived in the hospital, and was able to stuff all of his personal possessions into two small hand bags.

This narrative became all too common among the remaining staff at the hospital. This surgeon was lucky, because his wife and daughter were still alive, although almost everyone else working in the hospital was mourning the loss of their loved ones. I began work immediately, performing 10 to 12 surgeries a day, working 14 to 16 hours at a time. The operating room would often shake from the incessant bombings, sometimes as frequent as every 30 seconds. We operated in unsterile settings that would’ve been unthinkable in the United States. We had limited access to critical medical equipment: We performed amputations of arms and legs daily, using a Gigli saw, a Civil War-era tool, essentially a segment of barbed wire. Many amputations could’ve been avoided if we’d had access to standard medical equipment. It was a struggle trying to care for all the injured within the constructs of a healthcare system that has utterly collapsed.

I listened to my patients as they whispered their stories to me, as I wheeled them into the operating room for surgery. The majority had been sleeping in their homes, when they were bombed. I couldn’t help thinking that the lucky ones died instantaneously, either by the force of the explosion or being buried in the rubble. The survivors faced hours of surgery and multiple trips to the operating room, all while mourning the loss of their children and spouses. Their bodies were filled with shrapnel that had to be surgically pulled out of their flesh, one piece at a time.

“..The recycling process—from collection to sorting to processing to transport—requires more time, labor, and equipment to achieve a lower quality and less efficient output..”

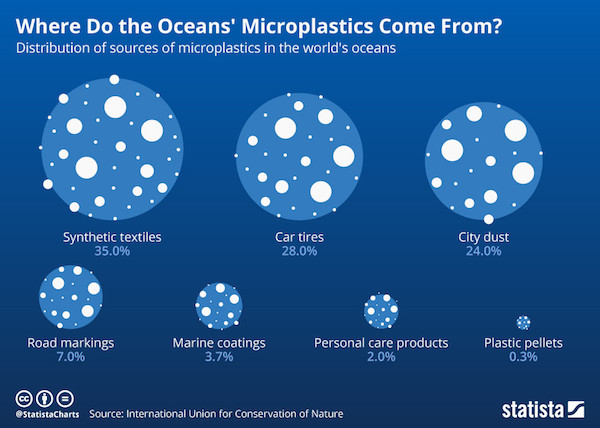

• Plastics Cannot Be Recycled and Producers Know This (Sp.)

The Center for Climate Integrity (CCI) released a report on Thursday which details how the plastics industry has evolved its marketing pitch in order to circumvent public backlash and potential regulation.= According to a report by the CCI, despite their knowledge that recycling plastics is not technically or economically practical, petrochemical companies have continued to push “fraudulent” marketing and public outreach campaigns to convince consumers otherwise. Doing so, the report says, has stalled legislative and regulatory action that could have addressed plastic waste and pollution long ago. “Fossil fuel and other petrochemical companies have used the false promise of plastic recycling to exponentially increase virgin plastic production over the last six decades, creating and perpetuating the global plastic waste crisis and imposing significant costs on communities that are left to pay for the consequences,” the CCI wrote.

More than 99% of plastics are produced from fossil fuels, the report continues. Though there are thousands of different types of plastic, the majority of these cannot be “recycled”. And despite efforts to convince consumers otherwise, the recycling rate in the US for plastics in 2021 was estimated to be only 5% to 6%. After a 10-year review on plastics, the Environmental Protection Agency (EPA) concluded that there are only two types of plastics that can be turned into high quality objects: PET and HDPE, which are both commonly used to make plastic containers and bottles. Meanwhile, any other form of plastic is incinerated or sent to landfills, because even though some plastics are recyclable in theory, they are not actually recycled in practice due to purity requirements that are not practical—for example, a green PET bottle cannot be recycled with a clear PET bottle. The quality of the plastic also degrades as it is recycled, which limits its use in its next life. And ultimately, recycled plastic materials will still end up in the landfill.

The toxicity of the plastics also creates issues during the recycling process. The chemical additives in plastics include stabilizers, plasticizers, coatings, catalysts, and flame retardants as well as possible contamination by whatever that plastic contained such as cleaning solvents or pesticides. This means a majority of plastics cannot be recycled into food-grade packaging, or other products that interact with food. The cost of recycling plastics is also much higher than what it costs to produce new plastic. “The recycling process—from collection to sorting to processing to transport—requires more time, labor, and equipment to achieve a lower quality and less efficient output than the process of making virgin resin from fossil fuels,” the report explains.

"If you want to end it, then quit using it."

Senator Markwayne Mullin utterly demolishes smug eco-zealot's ill-informed crusade against plastics, in one of the most epic, one-sided verbal beatdowns yet witnessed.

"You can choose to not use plastic… If you believe it, then… pic.twitter.com/b9nWm2QuWt

— Wide Awake Media (@wideawake_media) February 17, 2024

Tucker reacts to Julian Assange interview “It’s a total outrage”

— Sheri™ @FFT1776 (@FFT1776) February 17, 2024

Oliver Stone calls attention to protests in London and globally on February 20-21 as Julian Assange's final UK court hearing nears

"He's one of us, he's more than that – he is the collective us – if he goes down a part of each one of us goes down" #FreeAssange pic.twitter.com/LsTJHlqgOg

— WikiLeaks (@wikileaks) February 17, 2024

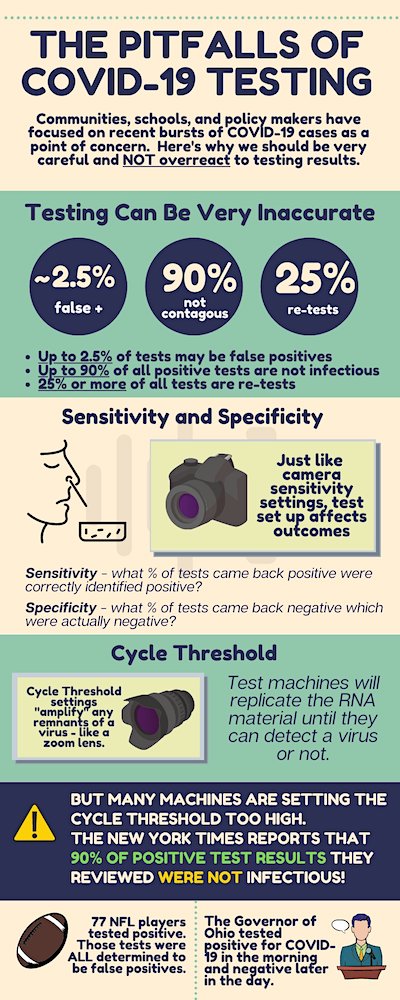

The Secret Files of the Corona Expert Council

The Secret Files of the Corona Expert Council

(Documentary, Germany 2024, English version)During the Corona years 2020-2022, for the first time in history, national policies of almost all countries have been „harmonized“ and brought into global lockstep. Whereas the overall… pic.twitter.com/TxJH6sLifg

— Aya Velázquez (@aya_velazquez) February 17, 2024

Bird feeder

A window bird feeder shaped to allow viewing of birds that visit

pic.twitter.com/3EyLi1amKh— Science girl (@gunsnrosesgirl3) February 17, 2024

https://twitter.com/i/status/1758928067311845875

Puppy nightmare

https://twitter.com/i/status/1758666573378994534

Billiard

Billiard balls collide with nearly perfect elasticity and kinetic energy in their motion is almost completely preserved: very little dissipates into heat.

This makes it a great sport to analyze mathematically and obtain amazing trick shots.pic.twitter.com/ia5T0KR7C9

— Massimo (@Rainmaker1973) February 17, 2024

The War on Children

Worth watching, especially for parents pic.twitter.com/k6gb2CMVqU

— Elon Musk (@elonmusk) February 18, 2024

Panama canal

https://twitter.com/i/status/1758845580640411653

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.