Jack Delano Eastbound freight on Atchison, Topeka & Santa Fe near Ash Fork, AZ March 1943

I know, I know, you’re probably thinking: why all the attention for Portugal, and for Esperito Santo (Holy Spirit), its second biggest but still smallish bank – it’s just 0.3% of eurozone assets -, especially now that European markets have already shaken off yesterday’s scare and are happily bubbling away all over again as if nothing happened.

Well, I’m sorry, but we got to do this, and I think you’ll see why: it’s because there are a bunch of underlying issues that would otherwise go mainly undetected. That is, until they blow up the next victim. Let’s start with a Bloomberg piece from earlier today, about how only after yesterday’s blow-up, the bank revealed a number of missing pieces. I suggest you read this properly, don’t just look it over. First, we set the stage:

Espirito Santo Discloses €1.2 Billion Exposure to GES

Banco Espirito Santo SA, Portugal’s second-biggest bank by market value, said it has exposure of €1.18 billion ($1.6 billion) to companies of Grupo Espirito Santo and is waiting for the release of that group’s restructuring plan to assess any potential losses. “Banco Espirito Santo’s executive committee believes that the potential losses resulting from the exposure to Grupo Espirito Santo do not compromise the compliance with the regulatory capital requirements,” the Lisbon-based bank said in a regulatory filing. “Banco Espirito Santo is committed not to increase its total exposure to Espirito Santo Group.”

The bank said that it has a capital buffer of €2.1 billion above the regulatory minimum of 8% for the common equity Tier 1 ratio as of March 31, taking into account a capital increase completed in June. The figure for exposure includes loans, securities and other items as of June 30. The Portuguese lender provided the update after a parent company, Espirito Santo International, said it missed payments on commercial paper to “a few clients”. While the nation’s central bank sought to reassure markets that Banco Espirito is protected, the lack of transparency in the corporate structure has disturbed investors in Portugal and abroad.

Banco Espirito Santo’s stock dropped more than 17% yesterday before being suspended from trading by the securities regulator, and the bank’s bonds fell to record lows. The regulator last night said short selling of Banco Espirito Santo shares is banned during today.

Ok, stage set, here comes the corporate structure. Pay attention:

Espirito Santo Financial Group SA, which owns 25% of Banco Espirito Santo, yesterday said it decided to suspend its shares and listed bonds on the Luxembourg and Euronext exchanges due to “ongoing material difficulties” at Espirito Santo International SA, its biggest shareholder. Espirito Santo Financial said it’s assessing the financial impact of its exposure to Espirito Santo International. Espirito Santo Financial is 49% owned by Espirito Santo Irmaos SGPS SA, which in turn is fully owned by Rioforte Investments SA, which is fully owned by Espirito Santo International.

[Swiss ‘affiliate’] Banque Privee Espirito Santo SA, which is fully owned by Espirito Santo Financial, on July 8 said there was a delay in payments of some of the latest maturities of short-term debt securities issued by Espirito Santo International. The delays affect “only a few clients,” Banque Privee said.

If you got all that after just one read-through, you’re probably on pills of one kind or the other. Me, I have no such talent. This sort of thing always makes me think back of that famous Groucho quote:

Well, art is art, isn’t it? Still, on the other hand, water is water! And east is east and west is west and if you take cranberries and stew them like applesauce they taste much more like prunes than rhubarb does. Now you tell me what you know.

The ‘tidbits’ revealed by Banco Espirito Santo SA clarify some of what hides behind the veil, but it also adds to the confusion:

Banco Espirito Santo said in the statement released late yesterday that its retail clients hold €255 million of commercial paper issued by Espirito Santo International, €342 million of commercial paper issued by Rioforte, €44 million of commercial paper issued by Rioforte subsidiaries and €212 million of commercial paper and bonds issued by Espirito Santo Financial and its subsidiaries. Espirito Santo Financial Group has issued a €700 million guarantee to cover debt instruments issued by Espirito Santo Group companies and distributed to Banco Espirito Santo retail clients, the statement said.

I have no doubt that some if not all of this is considered mightily smart in the world of finance, and it pays an entire flock of lawyers and accountants hefty salaries, but I’m afraid I don’t share that admiration.

Moreover, there are other parties involved who either didn’t get it either or are hiding what they found and/or lying about it. Another Bloomberg contribution explains:

Espirito Santo Turmoil Shows ECB Systemic Risk Challenge

“This shows that even a bank in a peripheral country can have systemic reach,” said Jerome Forneris at Banque Martin Maurel in Marseille. “A solution must be found, but it must be found quickly.” Banco Espirito Santo SA [..] has assets equal to less than 0.3% of the euro-area’s total banking assets.

Its ability to roil markets shows the task confronting the European Central Bank as it works toward a banking union with the creation of a supervisory body for the bloc’s lenders. The ECB has been charged with overseeing the euro-area’s banks to prevent a repeat of the taxpayer-funded bailouts during the financial crisis. Lenders are currently being subjected to an unprecedented, yearlong review of their assets, the results of which will be released in October. Lenders from Italy’s Banca Monte dei Paschi to Banco Espirito Santo bolstered capital as the ECB reviewed their balance sheets.

European banks and insurers sold $55 billion of stock this year, already exceeding the $49.3 billion raised in all of 2013, data compiled by Bloomberg show. “The implication of what’s happening are huge,” Inigo Lecubarri, who helps manage the $800 million Abaco Financials Fund in London. “Investors are finding out new information just weeks after the regulators and the underwriters scrutinized the bank before its rights offer. This is a blow to confidence in regulators and supervisors and it puts the risk premium up.” The Portuguese central bank’s assurances that Banco Espirito Santo’s solvency is solid failed to ease investor concern.

The ECB regulators had already told Banco Espirito Santo to bolster its capital, so clearly they went through the books, but they still somehow failed to see the problems that emerged yesterday? And then a few weeks later the whole thing falls apart? Are these ECB guys, who undoubtedly also get paid well, so much less competent than the ones who set up the structure? If that were so, they should be classified as useless. Or is it more likely that they did see what was going on and decided not to reveal what they saw, hoping it would all blow over and go unnoticed?

In both options, ECB regulation enforcement falls short of its mandate by a mile and several halves. That raises serious questions about the health of all of Europe’s banking system, and especially southern Europe’s. If the ECB has in its infinite wisdom determined that it’s ‘better’ not to reveal the flaws it finds, or worse still, it simply doesn’t find them, confidence and trust will soon be going going gone out the window of one those high speed trains.

Using that same infinite wisdom, that same ECB has decided that hiding essential details about the problems it finds in Europe’s banks will now become official policy. Bloomberg reports on a draft document:

ECB Plans to Limit Stress-Test Inputs in Bank Checks

The European Central Bank plans to limit the amount of data it carries over from its asset review into a subsequent stress test as it tries to manage the burden from an unprecedented health check of euro-area lenders. Instead of entering all loan values obtained in the Asset Quality Review that ends this month into its stress test, officials will apply a “materiality threshold” to ensure only significant results are incorporated, according to a draft ECB document seen by Bloomberg News. Regulators have yet to sign off on the methodology, including a definition for that term. ECB officials have vaunted the credibility of the stress test that it is conducting with the European Banking Authority compared with previous exercises, citing the use of scrubbed data from 160,000 credit files to enhance its reliability.

The document, scheduled for publication on July 17, shows the degree of pragmatism the ECB is applying as it tries to square a desire for methodological rigor with a schedule to start supervising around 120 banks in November. “The ECB plans to publish the manual for the join-up of the AQR and the stress test in August, and it will include the definition of the materiality threshold,” the ECB said in a statement. The stress test pits bank balance sheets against a range of negative, hypothetical economic events to gauge their robustness, and are designed to help the ECB take over supervision with a clear picture of the banking system’s health.

[..] By late October, the ECB will release results that show a detailed picture of bank capital levels and provisioning, as well as a level of harmonized data on non-performing loans that has never before been available.

I can’t help but admire the choice of words in phrases like “the degree of pragmatism the ECB is applying”, “materiality threshold”, “scrubbed data” and “harmonized data”. Those phrases sound good and healthy, and completely paper over the impression that the ECB is either absolutely overwhelmed (“it tries to square a desire for methodological rigor with a schedule to start supervising“), or it’s working with the banks to keep daylight out of their vaults.

And I must admit I’m confused by “Regulators have yet to sign off on the methodology, including a definition for that term.” What does that even mean?

What I think is happening is that the ECB grossly underestimates the role and importance of confidence in financial markets. The central bank’s idea seems to have become that confidence is something it can control at will, a notion that was built and reaffirmed by Mario Draghi’s “whatever it takes” bazooka speech. I also think that playing these kinds of games will always, and necessarily, end in failure. Investors have taken notice of the recently announced German plan to use Cyprus style bail-ins for failing financial institutions, and its aversion to QE style measures. They’ve seen Esperito Santo and it labyrinthian structure. These things hurt confidence, and having Draghi flash yet another bazooka out of his hip pocket may not be enough to restore it, certainly if and when another “small” issue like Esperito Santo occurs.

It’s not just the ECB either. Regulators globally are tasked more with hiding problems than they are with solving them, it comes with the notion of systemic (aka too big to fail) banks. No matter how bad the situation certain banks find themselves in, if they can’t fail, what’s a regulator to do but lie about its findings? Systemic banks must of necessity lead to systemic lies about systemic risks.

The IMF does it too (no surprise), as Simon Black notes:

IMF Pronounces Bulgaria’s Banks Safe Just Two Weeks Before Bank Run

Earlier this summer, IMF bureaucrats went to Sofia, Bulgaria to study the country’s economic progress. And roughly a month ago, they released an official report which stated, among other things, that Bulgarian banks are “stable and liquid.” Talk about epic timing. Because less than two weeks later, Bulgaria’s banking system was in the throes of a full-blown crisis. There was a run on two of the nation’s largest banks – several hundred million dollars had been withdrawn in a matter of hours. And the Bulgarian central bank had to step in and take over both of them or risk a collapse in the entire system.[..]

In the case of Bulgaria, the EU Commission soothingly announced that “the Bulgarian banking system is well-capitalized and has high levels of liquidity compared to its peers in other member states.” Whoa whoa wait a minute. Are these geniuses really saying that the country experiencing a bank run due to its LACK of liquidity is MORE liquid than the rest of Europe?? Yes, that is exactly what they’re saying. So it begs the question – if Bulgarian banks with their “high levels of liquidity” can suffer such shocks, what can happen to other European banks which are worse off?

When a central bank labels a commercial and/or investment bank too big to fail aka systemic, it doesn’t actually bolster confidence – other than perhaps temporarily -, it destroys confidence. Inside any systemic bank, everyone knows it’s labeled that, there may be gigantic hidden losses. By treating even those banks that are not systemic the same way, which is what the ECB is -stealthily – announcing it plans to do, more confidence will be lost. As long as problems are not properly dealt with, they’re only getting bigger. It’s just a matter of time until investors demand to be compensated for the actual risk they are taking, not the illusional one Draghi and Yellen are attempting to portray. That compensation will come in the shape of higher interest rates. But no – formerly – rich economy today can afford those.

Eh, could you say that one more time, please?

“Espirito Santo Financial Group SA, which owns 25% of Banco Espirito Santo, yesterday said it decided to suspend its shares and listed bonds due to “ongoing material difficulties” at Espirito Santo International SA, its biggest shareholder.” “Espirito Santo Financial is 49% owned by Espirito Santo Irmaos SGPS SA, which in turn is fully owned by Rioforte Investments SA, which is fully owned by Espirito Santo International. Banque Privee Espirito Santo SA, which is fully owned by Espirito Santo Financial … ”

• Espirito Santo Discloses €1.2 Billion Exposure to Parent Company (Bloomberg)

Banco Espirito Santo SA, Portugal’s second-biggest bank by market value, said it has exposure of €1.18 billion ($1.6 billion) to companies of Grupo Espirito Santo and is waiting for the release of that group’s restructuring plan to assess any potential losses. “Banco Espirito Santo’s executive committee believes that the potential losses resulting from the exposure to Grupo Espirito Santo do not compromise the compliance with the regulatory capital requirements,” the Lisbon-based bank said in a regulatory filing. “Banco Espirito Santo is committed not to increase its total exposure to Espirito Santo Group.”

The bank said that it has a capital buffer of €2.1 billion above the regulatory minimum of 8% for the common equity Tier 1 ratio as of March 31, taking into account a capital increase completed in June. The figure for exposure includes loans, securities and other items as of June 30. The Portuguese lender provided the update after a parent company, Espirito Santo International, said it missed payments on commercial paper to “a few clients”. While the nation’s central bank sought to reassure markets that Banco Espirito is protected, the lack of transparency in the corporate structure has disturbed investors in Portugal and abroad. European stocks and Portuguese bonds tumbled yesterday, while U.S. Treasuries and gold rallied.

Banco Espirito Santo’s stock dropped more than 17% yesterday before being suspended from trading by the securities regulator, and the bank’s bonds fell to record lows. The regulator last night said short selling of Banco Espirito Santo shares is banned during today.

Espirito Santo Financial Group SA, which owns 25% of Banco Espirito Santo, yesterday said it decided to suspend its shares and listed bonds on the Luxembourg and Euronext exchanges due to “ongoing material difficulties” at Espirito Santo International SA, its biggest shareholder. Espirito Santo Financial said it’s assessing the financial impact of its exposure to Espirito Santo International. Espirito Santo Financial is 49% owned by Espirito Santo Irmaos SGPS SA, which in turn is fully owned by Rioforte Investments SA, which is fully owned by Espirito Santo International.

Banque Privee Espirito Santo SA, which is fully owned by Espirito Santo Financial, on July 8 said there was a delay in payments of some of the latest maturities of short-term debt securities issued by Espirito Santo International. The delays affect “only a few clients,” Banque Privee said.

Banco Espirito Santo said in the statement released late yesterday that its retail clients hold €255 million of commercial paper issued by Espirito Santo International, €342 million of commercial paper issued by Rioforte, €44 million of commercial paper issued by Rioforte subsidiaries and €212 million of commercial paper and bonds issued by Espirito Santo Financial and its subsidiaries. Espirito Santo Financial Group has issued a €700 million guarantee to cover debt instruments issued by Espirito Santo Group companies and distributed to Banco Espirito Santo retail clients, the statement said.

“Investors are finding out new information just weeks after the regulators and the underwriters scrutinized the bank before its rights offer.”

• Espirito Santo Turmoil Shows ECB Systemic Risk Challenge (Bloomberg)

The Espirito Santo saga is giving believers in the end of the euro-area crisis cause for pause. Although a return to the panic days of the crisis may be unlikely, the case, involving the inability of a parent company of a bank in Portugal to make some short-term debt payments, has sent government bonds of Europe’s most-indebted nations and the stocks of lenders tumbling, showing how fragile investor confidence in the region’s banking recovery is. “This shows that even a bank in a peripheral country can have systemic reach,” said Jerome Forneris, who helps manage $9 billion at Banque Martin Maurel in Marseille. “A solution must be found, but it must be found quickly.” Banco Espirito Santo SA, the bank at the heart of the turmoil, is Portugal’s second-largest lender by market value and has assets equal to less than 0.3% of the euro-area’s total banking assets.

Its ability to roil markets shows the task confronting the European Central Bank as it works toward a banking union with the creation of a supervisory body for the bloc’s lenders. The ECB has been charged with overseeing the euro-area’s banks to prevent a repeat of the taxpayer-funded bailouts during the financial crisis. Lenders are currently being subjected to an unprecedented, yearlong review of their assets, the results of which will be released in October. Lenders from Italy’s Banca Monte dei Paschi di Siena SpA to Banco Espirito Santo bolstered capital as the ECB reviewed their balance sheets.

European banks and insurers sold $55 billion of stock this year, already exceeding the $49.3 billion raised in all of 2013, data compiled by Bloomberg show. “The implication of what’s happening are huge,” Inigo Lecubarri, who helps manage the $800 million Abaco Financials Fund in London. “Investors are finding out new information just weeks after the regulators and the underwriters scrutinized the bank before its rights offer. This is a blow to confidence in regulators and supervisors and it puts the risk premium up.” The Portuguese central bank’s assurances that Banco Espirito Santo’s solvency is solid failed to ease investor concern. Its shares were suspended yesterday after tumbling 17% as its bonds dropped to record lows. Portuguese government debt fell along with securities from other European nations, while banks dragged stock indexes in the region down more than 1%.

• Hang On, Portugal, Europe’s Crisis Isn’t Over (Bloomberg)

Europe has come a long way since the darkest days of 2012, when the common currency at the center of its union seemed on the verge of falling apart. But it hasn’t come far enough. This week’s turmoil surrounding a Portuguese bank shows how fragile the euro area’s financial system still is. At issue is the condition of Espirito Santo International SA, the ultimate parent of Portugal’s second-largest lender by market value, Banco Espirito Santo SA. The parent missed some debt payments amid concerns about its accounting. A frenzy of speculation sent the bank’s shares plummeting until trading was halted today. Espirito Santo is small by global standards, about a 20th the size of Germany’s Deutsche Bank by assets. Even so, Portugal can’t easily afford to support the bank, should support be needed. Its government has to run a big budget surplus to get its debts below European Union-directed limits. That has already put fiscal policy under an enormous strain.

Recognizing Portugal’s vulnerability, investors have pushed the yield on its government bonds up sharply, further worsening its finances. It’s akin to the vicious circle that drove several euro-area nations close to financial collapse in 2012. Europe’s recent reforms were supposed to have severed the link between the finances of banks and sovereigns. In a new banking union, euro-area nations said they would assume joint responsibility for oversight and recapitalization. Unfortunately, as Portugal’s latest travails demonstrate, their efforts have fallen short. The risk-sharing that’s needed isn’t yet in place. By failing to provide deposit insurance throughout the euro area, and by creating an underfunded and overly complex mechanism for rescuing banks, Europe has told investors, in effect, that struggling governments are still largely on their own.

• Here’s What’s Happening In Portugal (CNBC)

After several months of rumbling, Portuguese conglomerate Espírito Santo International this week delayed payments to some of the holders of its short-term debt securities. Its Swiss banking arm Banque Privee Espirito Santo is at the center of the concerns after it failed to pay some of its clients earlier this week. The Portuguese media reported the company blamed the issue on an IT mistake, while at the same time making sure that the investors with this exposure were being protected. However by, Wednesday, investors holding the commercial paper issued by Espírito Santo International were being asked to swap their debt securities for shares. And by Thursday, the country’s Economico news publication reported that it was seeking judicial protection against its creditors.This comes against the backdrop of reorganization at the conglomerate with investors waiting eagerly for details of a restructuring plan.

A general meeting is touted for July 29. Back in May, an audit by the country’s central bank showed there were “irregularities” in the accounts of Espírito Santo International with doubts surrounding its financial condition. All this sparked concerns over another part of the conglomerate – and Portugal’s leading bank – Banco Espirito Santo, with investors speculating that it could be ready to default on its debt. Shares in Banco Espirito Santo were down 19 percent before being suspended by market regulators and Espirito Santo Financial Group dropped 8% before also being suspended. These concerns rolled over into the wider European equity markets, triggering a sell-off across the rest of Europe. In the debt markets, Banco Espirito Santo bonds continue to underperform, with the knock-on effect on Portuguese government bonds, with the yield on its 10-year sovereign debt moving higher throughout Thursday.

Still shuddering at the memory of the euro zone financial crisis, investors sent the yields for other euro zone “peripheral” countries – Greece, Italy and Spain – higher during the morning session. Claus Vistesen, the chief euro zone economist at Pantheon Macroeconomics believes that credit market stress quickly feeds into the sovereign bond markets. Thus, this reinforces the idea that banks and governments are too closely knit in the region, in what many have called a “doom loop” which could place more additional stress in the case of any potential crisis. Portugal’s banking problems could further hit debt markets and make it costlier for its government to borrow. This would make it harder for its economy to recover from the sovereign debt crisis of 2011. However, Jim Iuorio, managing director at TJM Institutional Services, told CNBC that the current problems may be hitting so-called peripheral Europe but wouldn’t be a full-blown fear for the greater region until core countries like France were being affected. “One thing we can almost all agree on is that there probably is some sort of bubble in European peripherals and it could have a destabilizing effect,” he said.

The euro zone’s periphery had enjoyed a significant bounce-back over the past few months with the yields on some Spanish and Portuguese bonds beating those of even the U.S. Are Portuguese and Greek bonds mispriced?” asked Iuorio, “Of course they are, and it’s just a function of every central bank throwing tons of money into this system.” He added that the situation was “worth watching” with the real trigger point in asset markets being when French government bonds begin to sell off. Analysts Gildas Surry and Geoffroy de Pellegars at French bank BNP Paribas said there was potentially three outcomes for Banco Espirito Santo. These were either an orderly resolution at the bank, a going concern or even a forced liquidation. Any resolution, they said, could involve the intervention of cash-rich investors – such as sovereign wealth funds from Angola or Venezuela – which would solve the funding crisis for the parent company, Espírito Santo International .

• Portugal Banking Turmoil Revives Darkest Nightmares About Europe (MarketWatch)

Just what Europe needed: another banking crisis. Thursday’s turmoil in Portuguese financial conglomerate Espirito Santo International has sent stock markets tumbling, driven bond yields skyward and re-awoken niggling fears about the robustness of Europe’s banking system. Sound familiar? Well, there are striking similarities to daily headlines from the crisis two years ago, when European Central Bank President Mario Draghi was forced to calm panicky bond markets with his famous “do whatever it takes” speech. And as Peter Garnry, head of equity strategy at Saxo Bank, put it in a note on Thursday: “The event has hit European financials like a torpedo and has revived investors’ darkest nightmares about Europe.” If your definition of that nightmare is a selloff, his description is pretty much spot-on. Portuguese government bonds are tanking, sending the benchmark 10-year yield to levels not seen since before the June ECB meeting, when the central bank launched an aggressive package of liquidity measures.

The 10-year borrowing costs for government paper were up 21 basis points on Thursday, to 3.97%, according to electronic trading platform Tradeweb. That’s on top of the 13 basis-point rise on Wednesday. At the same time, the PSI 20, Portugal’s benchmark stock index, slumped 4.2% to 6,105.24, its biggest drop since July last year and the lowest closing level since October. Why? All due to troubles at Portuguese multi-industry conglomerate Espírito Santo, the general consensus says. Earlier this week, ESI missed a payment on some short-term debt. This triggered massive nervousness over the health of Portugal’s financial sector and sent shares of its subsidiaries Espirito Santo Financial Group and Banco Espirito Santo deep into the red. Trading in both subsidiaries was suspended on Thursday , when their losses amounted to 9% and 17%, respectively.

• ECB Plans to Limit Stress-Test Inputs in Bank Checks (Bloomberg)

The European Central Bank plans to limit the amount of data it carries over from its asset review into a subsequent stress test as it tries to manage the burden from an unprecedented health check of euro-area lenders. Instead of entering all loan values obtained in the Asset Quality Review that ends this month into its stress test, officials will apply a “materiality threshold” to ensure only significant results are incorporated, according to a draft ECB document seen by Bloomberg News. Regulators have yet to sign off on the methodology, including a definition for that term. ECB officials have vaunted the credibility of the stress test that it is conducting with the European Banking Authority compared with previous exercises, citing the use of scrubbed data from 160,000 credit files to enhance its reliability.

The document, scheduled for publication on July 17, shows the degree of pragmatism the ECB is applying as it tries to square a desire for methodological rigor with a schedule to start supervising around 120 banks in November. “The ECB plans to publish the manual for the join-up of the AQR and the stress test in August, and it will include the definition of the materiality threshold,” the ECB said in a statement provided by a spokeswoman. The stress test pits bank balance sheets against a range of negative, hypothetical economic events to gauge their robustness, and are designed to help the ECB take over supervision with a clear picture of the banking system’s health.

The ECB’s supervisory board is due to meet next week to sign off on the methodology for joining up the AQR and the stress test, the two parts of its so-called Comprehensive Assessment. Banks, which have submitted templates on how they assume the negative scenarios will affect balance sheets, will be required to adjust their numbers after a review by the ECB. “The quality assurance process of the bottom-up stress-test results of the banks has started and will continue until early September,” the document shows. “Thereafter, the AQR findings and the stress-test results will be joined up, and only then meaningful results of the comprehensive assessment can be determined.” Lenders across the euro area’s 18 countries are taking part in the exercise, which started last November. By late October, the ECB will release results that show a detailed picture of bank capital levels and provisioning, as well as a level of harmonized data on non-performing loans that has never before been available.

Fun and tragedy in one.

• Some Recent Euphoric Comments About Portugal (Zero Hedge)

May 30: PORTUGAL’S BANKS MORE CAPITALIZED, MORE TRANSPARENT NOW: COSTA

May 18: PORTUGAL HAS SUCCESSFULLY EXITED EFSF PROGRAM, REGLING SAYS

“FISCAL MEASURES AND STRUCTURAL ADJUSTMENT HAVE ENABLED PORTUGAL TO IMPROVE COMPETITIVENESS” REGLING SAYSMay 14: PORTUGAL WILL EXIT ITS AID PROGRAM, MERKEL SAYS

May 9: PORTUGAL RAISES TO Ba2 BY MOODY’S, MAY BE RAISED FURTHER

PORTUGAL OUTLOOK REVISED TO STABLE AT S&PMay 4: IMF’S LAGARDE: PORTUGAL IN `STRONG POSITION’ TO DEEPEN REFORMS

PORTUGAL BAILOUT EXIT IS IMPRESSIVE, GERMANY’S SCHAEUBLE SAYSApril 23: PORTUGAL IS NOW ABLE TO FINANCE ITSELF IN THE MARKET: COELHO

April 14: PORTUGAL TO OUTPERFORM ITALIAN BONDS ON MACRO OUTLOOK, MS SAYS

April 11: BARROSO SAYS FOREIGN INVESTOR CONFIDENCE IN PORTUGAL INCREASING

Strange comparison, but not entirely untrue.

• Does Asia Face Portugal-Style Debt Risks? (CNBC)

Rising corporate debt levels in Asia could make investors nervous after missed debt payments by one of Portugal’s conglomerates spurred renewed fears over debt defaults. “It’s not so much the [debt] level of individual companies that raises concern,” Wilfried Verstraete, CEO of Euler Hermes, the trade-finance insurance arm of Allianz, said in an interview. “What might be more of a concern is the balance sheets of banks themselves.” If regional banks restrict lending because of excessive bad loans or because of monetary tightening, as is currently the case in China, it can tighten the noose on some companies, he said. “Never forget that the definition of a bankruptcy is when you don’t have the liquidity to pay your debts,” he said. “If the banks suddenly no longer provide the necessary liquidity, you’re in trouble.”

The inability of Portuguese conglomerate Espirito Santo International to make some of its short-term debt payments has fueled concerns one of its units, Portugal’s leading bank, Banco Espirito Santo, might default on its debt. The region’s banks and governments are considered too closely knit, so that had a knock-on effect on Portuguese government bonds, and with memories of the European credit crisis still fresh, spurred fears of “doom loop” around the continent. Within Asia, corporate borrowing picked up in recent years. Data from the Bank for International Settlements show international corporate bond issuance from 2010 to the first half of 2013 was up over 133% by China companies, while India and Korea saw around 39% and 21% increases respectively, with the rest of Asia seeing a more than 54% increase.

While many analysts believe contagion from Portugal is unlikely, Asia’s companies may face knock-on effects from a credit issue closer to home: China’s Qingdao port is investigating whether cargos of metal were used and re-used as collateral to obtain financing from different banks and trading houses, possibly leaving banks and firms around the region holding the bag. In these types of cases, the main risk isn’t the payment default by the company abusing collateral, it’s the domino effect on subcontractors and suppliers, which will also not be paid, Verstraete said.

• IMF Pronounces Bulgaria’s Banks Safe Just Two Weeks Before Bank Run (Black)

Earlier this summer, IMF bureaucrats went to Sofia, Bulgaria to study the country’s economic progress. And roughly a month ago, they released an official report which stated, among other things, that Bulgarian banks are “stable and liquid.” Talk about epic timing. Because less than two weeks later, Bulgaria’s banking system was in the throes of a full-blown crisis. There was a run on two of the nation’s largest banks – several hundred million dollars had been withdrawn in a matter of hours. And the Bulgarian central bank had to step in and take over both of them or risk a collapse in the entire system. This is the modern miracle of fractional reserve banking. When you make a deposit, your bank only holds a tiny percentage of that cash.

The rest of it gets loaned out or invested in securities that pay a much higher rate of return than the pitiful amount you receive in interest. Needless to say, the less money banks hold in reserve, the more money they’re able to invest… and the more profit they make. This puts their incentives and our incentives at odds. Because as depositors, it’s better for us if the bank holds most (if not all) of our funds. In typical form, though, governments stepped in to settle this dispute. And a century ago, they sided with the banks. Because of this, it’s perfectly legal for banks to hold a tiny percentage of customer deposits. So now, anytime there’s the slightest spook (as happened in Bulgaria), it creates a panic. Naturally that’s when politicians step in to calm nerves.

In the case of Bulgaria, the EU Commission soothingly announced that “the Bulgarian banking system is well-capitalized and has high levels of liquidity compared to its peers in other member states.” Whoa whoa wait a minute. Are these geniuses really saying that the country experiencing a bank run due to its LACK of liquidity is MORE liquid than the rest of Europe?? Yes, that is exactly what they’re saying. So it begs the question – if Bulgarian banks with their “high levels of liquidity” can suffer such shocks, what can happen to other European banks which are worse off? I think the lesson here is clear: The people in charge of regulating the system and making these proclamations about bank safety are totally CLUELESS. Of course they’re going to say that the banks are safe. Of course they’re going to compliment the system’s liquidity and solvency.

Or the end of Japan as we know it.

• The End of ‘Made in Japan’? (Bloomberg)

Historical comparisons can admittedly be facile. But given the bleak turn Japanese economic data has taken, I can’t help but be reminded of the downturn in 1997, the last time Tokyo raised sales taxes. A huge drop in machinery orders – the biggest on record – is yet another reminder Japanese executives remain reluctant to invest their massive cash reserves or raise wages. Even more ominously, M2 money supply growth is now in negative territory. Such measures should be surging 14 months after the Bank of Japan unleashed history’s biggest monetary bonanza. Instead the tepid 3% rise in M2 last month put Japan’s money supply in the red in real terms, a clear sign BOJ Governor Haruhiko Kuroda’s bond-buying spree has lost potency. “The reality is this: so far, the spending retrenchment in April-May tracks fairly closely the retrenchment seen in 1997,” says Richard Katz, publisher of the New York-based Oriental Economist Report.

Economists are clamoring for another jolt of monetary audacity after Prime Minister Shinzo Abe’s ill-advised sales tax increase in April. Clearly, the sugar high from the BOJ’s April 2013 move to double bond purchases has worn off. Yet the BOJ is expected to keep policy unchanged at its July 14-15 meeting. “The BOJ’s inaction risks turning the quantitative-easing program from a qualified success into a failure,” says Adam Slater, senior economist at Oxford Economics in London. “Now, the danger is increasing that this will instead be a tardy response to a significant deterioration in economic conditions.” All along, the hope was that Kuroda’s yen-printing spree would get corporate Japan to deploy its $2.3 trillion cash stockpile in ways that would quicken growth and spur inflation. The 19.5% plunge in machinery orders in May from April underscores the degree to which that’s not happening.

Boom! Bang!

• China Stimulus Magnifies Housing Risk (CNBC)

Chinese authorities’ use of targeted stimulus measures deepened risks in the housing market, according to Societe Generale. Analysts have grown increasingly concerned about the impact of declining house prices on China’s economy, especially as property represents 30% of the overall economy. “Such a selective policy approach is hardly good news to the housing sector,” said Societe Generale in a note published on Thursday, referring to the government’s mini stimulus moves. “There is no room for complacency when it comes to housing sector risk,” they added. So far stimulus has targeted weaker areas of the economy – a stark contrast to the far-reaching policies of 2008-2009, which critics argue contributed to excessive credit growth.

However, because recent measures were smaller and more selective, they stabilized credit growth rather than boosting it and the housing market is suffering as a result, SocGen said. “The housing sector downturn, as suggested by very recent price data, is deepening further and very likely to be protracted, in the absence of another credit boom,” the analysts said. Earlier this week, an independent survey by private data provider Soufun showed house prices in 100 major Chinese cities fell 0.5% on month in June, the second consecutive month of declines.

The survey also showed that new apartments offered deeper discounts, as developers are eager to boost sales in order to liquidate inventories – a worrying sign for future housing construction and investment. SocGen acknowledged that the stimulus moves boosted growth prospects, however, especially infrastructure spending. It now sees the economy growing 7.5% in the second quarter, up from its previous forecast of 7.1%, and in line with the government’s annual target. But the bank warned that higher infrastructure spending is not entirely positive as it detracts cash from the housing market, exacerbating risks there. “This lift in short-term growth does not mean lower risk going forward. Surging infrastructure investment growth with steady total credit growth means that the funding for other sectors, especially housing, continues to dwindle,” they added.

Beijing still thinks it’s in control.

• China’s Structured Product Offerings Drop on Shadow Bank Curbs (Bloomberg)

Chinese structured product offerings dropped by the most in six months in June after the government put in place measures to curb the shadow-banking industry, restricting issuers’ ability to sell the investments. The number of securities fell 14% to 197, compared with average growth of 8.4% in the first five months, according to Cnbenefit, a consulting firm that focuses on wealth management. The company collected the data from publicly available information and also through agreements with some banks. Premier Li Keqiang has sought to stem expansion of trust companies, wealth management products and other forms of shadow banking, which Barclays Plc estimates was worth 38.8 trillion yuan ($6.3 trillion) as of the end of last year.

The central bank introduced steps in May that included ordering lenders to curb interbank borrowing. The banking regulatory tightened regulation of new trust products in April. “The Chinese central bank’s move to curb interbank borrowing may dry up liquidity and affect funding for wealth management products,” said Francis Chan, who follows the financial sector in Asia for Bloomberg Industries. “Together with a clampdown on trust-related wealth management products, that may have caused sales of structured products to fall.” The data from Cnbenefit, based in the southwest Chinese city of Chengdu, include structured notes offered through the qualified domestic individual investor program, which allows Chinese investors to buy certain overseas securities.

They also cover structured deposits and other wealth-management products that combine a fixed-income security with derivatives, Cnbenefit said. The People’s Bank of China’s measures in May closed off routes for banks to offer wealth products with attractive yields, according to Xiaoning Meng, a portfolio manager at CSOP Asset Management Ltd. “For banks to offer higher yields than deposit rates on the products, they have to go through non-loan channels,” Hong Kong-based Meng said. “The central-bank move sealed off a lot of these channels and now, banks won’t have a method to support the higher yields of the structured products.”

This is how the Chinese buy up the US.

• China State Banks Offer ‘Money Laundering’ Services (SCMP)

A day after Bank of China (BOC) was accused by the state broadcaster of breaking foreign exchange rules by helping people take money out of the country, it has emerged a second state bank has also been offering the service. Industry sources told the South China Morning Post yesterday that China Citic Bank – controlled by the Citic Group, which in turn is directly controlled by the State Council, China’s cabinet – also facilitated the movement of currency overseas, including Hong Knog. “It is definitely not an illegal business,” said one source. “Both BOC and Citic Bank have been able to do this business only after they got approval from the Guangzhou branch of the People’s Bank of China. So the PBOC definitely knows what the business is about,” said the source, who declined to be named as he was not authorised to speak to the media.

“If there is any problem, it should not be a problem about whether this business is legal or illegal but more about how exactly the business is done, especially about internal risk controls and customer background checks at those banks.” Another source said Hong Kong regulators were unlikely to get involved because the issue did not violate local laws against money laundering. “The case is not about money laundering but more about whether the mainland banks have got the authorisation to transfer money out of the country,” the source said. A Hong Kong Monetary Authority spokeswoman said: “The mainland authorities and banks should be responsible for verifying whether the transactions undertaken are in compliance with the relevant rules and requirements on the mainland.”

Before it costs someone an election?

• US Student Loan Forgiveness May Be Coming (CNBC)

For many members of the class of 2014 who borrowed money to attend college, the clock is ticking on what is likely to be their biggest expense after graduation. They’ll have to start paying back their federal student loans in November or December—as the six-month grace period that lenders give new grads comes to an end. But depending on their income—or lack of income, if they’re still looking for work—some borrowers may be eligible for much lower payments than they’d anticipated. And eventually they could have their federal loans forgiven altogether. “If total student debt exceeds one’s annual income, then you will likely qualify for some sort of payment plan and receive a financial benefit from participation” in an income-driven repayment plan, said Mark Kantrowitz, senior vice president and publisher of Edvisors.com, a website that provides information, advice and tools for helping families plan and pay for college.

The Consumer Financial Protection Bureau estimates that 1 out of 4 American workers may be eligible for public service loan-forgiveness programs, but many graduates still are not aware of their options. The “Pay As You Earn” plan introduced by Obama caps a federal student loan borrower’s payments at 10% of their income, and the balance will be forgiven after 20 years of on-time payments. Borrowers who opt for careers in the nonprofit or public sector could have loans forgiven in 10 years. However, this payment plan is only available to borrowers whose loans were disbursed on or after Oct. 1, 2007. Borrowers with older loans may be eligible for an income-based repayment plan, which caps monthly payments at 15% of your income. Payments change as your income changes, but may be forgiven after 25 years. Or they may qualify for income-contingent repayment plans, where payments are calculated each year based on your adjusted gross income, family size and the total amount of your federal loans.

• Selloff Masks Real Concern For Stocks (CNBC)

Stocks sold off on concerns about the global economy, but the real worry for the market is the second-quarter earnings season. The selloff was sparked by worries about insolvency at a Portugese bank and global growth concerns after a stream of negative data. This comes after the Federal Reserve announced an end date of October for its bond buying program, formalizing what markets had expected The Dow opened sharply lower, with an 180 point or 1% decline, but recovered more than half its losses to close down 70 at 16,915. That was the biggest reversal for the Dow since June, 2013. The S&P 500 was off 8 at 1964, and the Nasdaq finished 22 lower at 4396. The Russell 2000 was the worst performer, down 1% to 1161. “I don’t think people are too enthused to commit new money up here. I also don’t think they want to sell,” said Jones Trading chief market strategist Michael O’Rourke.

“We’ve gone up 10% since mid-April and today was the biggest pullback we had in the last couple of months and we can’t even stay down 1%. There definitely was some dip buying. It’s not like we hit any point where there was panic selling.” O’Rourke said trading volume was about normal. “Usually, on a big down day, volume is 20% higher than the average,” he said. Overnight, weaker-than-expected Chinese exports and a stunning 19.5% drop in May Japanese machine orders stoked concerns that growth is not picking up as expected. Surprising declines in industrial production in France and Italy added to the unease, and French inflation fell to its lowest level since the recession. Investors flocked to the safety of gold, U.S. Treasurys and German bunds, while tossing stocks and peripheral European debt, including Portugese, Italian, Spanish and Greek bonds.

“Not all Germans believe in God, but they all believe in the Bundesbank.” -Jacques Delors

• History Lesson: Why Merkel Loves Her Central Bank (MarketWatch)

In his definitive Financial Times series on the euro currency crisis, Peter Spiegel tells the story of a tearful German Chancellor Angela Merkel rejecting a U.S.-French proposal to use central bank reserves to backstop the beleaguered common currency. The drama took place in November 2011 on the sidelines of the Group of 20 summit hosted by then-French President Nicholas Sarkozy. According to Spiegel — unknown to the Germans — Sarkozy and Barack Obama had hatched a plan in which the Germans and other European Union members would apportion some of their reserves for a contingency fund to be used if the euro came under speculative attack. Spiegel writes that at a late-night gathering of the German, French and American leaders at the Cannes summit Merkel broke into tears, saying she would not “commit political suicide” by agreeing to an action vigorously opposed by the Bundesbank, the independent German central bank.

Regaining composure, Merkel reminded her interlocutors that it was the Western powers themselves — France and America — who mandated Bundesbank independence, writing it into the constitution they approved for war-ravaged Germany in 1949. Merkel has her history correct. As Stalin’s iron curtain descended across Europe, the Americans responded to the imposition of Communist regimes in the East with Marshall Plan economic assistance to forestall similar takeovers in the West. In 1948 America and Britain countered Stalin’s blockade of the German capital with the Berlin airlift and merged their occupation zones into what became the German Federal Republic. A common currency — the deutsche mark — was established with a central bank to manage it placed in Frankfurt, the headquarters of the American military and the Marshall Plan.

The man most responsible for the decentralized structure of an independent Bundesbank was Joe Dodge, a respected Detroit banker who served as financial advisor to American military governor Gen. Lucius Clay. Dodge insisted that the new German central bank be modeled on the Federal Reserve with powers dispersed to regional central banks. The Americans were equally opposed to the universal banking model in which Germany’s biggest financial institutions had dominated industry. Dodge collaborated with like-minded Germans such as Ludwig Erhard, who became economics minister and later chancellor, and former Reichsbank deputy Wilhelm Vocke, who had vehemently opposed Hitler’s suspension of central bank autonomy in the 1930s. In 1947 Vocke became the head the Bank of the German States, the precursor of the Bundesbank. West Germany’s 1949 constitution specifically declared that the central bank was not subject to instructions from political authorities.

Lacy Hunt is no fool.

• Far From Wall Street, An Inflation Dove Flies (The Tell)

Lacy Hunt’s outpost in Austin, Texas, is half a continent away from the soaring investment bank headquarters in Manhattan. His outlook on the U.S. economy reflects a similar distance from many of those firms. Hunt, an economist at Hoisington Investment Management, has long maintained a view that inflation is poised to fall on weak economic growth. As Wall Street firms raise their inflation forecasts along with upgrades to their outlooks, Hunt believes as strongly as ever in his contrarian mantra. There’s a lot hinging on the outcome: The Wasatch-Hoisington US Treasury fund rode that lowflation bet to returns of over 15% so far this year by buying long-term Treasury bonds, whose yields surprised most analysts by falling. MarketWatch mentioned Hunt as one of the few who wasn’t fooled by the bond market so far this year.

But if inflation and economic growth pick up, long-term bonds yields could rise, sending prices on those bonds lower. As yields rose sharply in 2013, the fund lost nearly 17%, though the fund still has trailing total returns of over 10% during the past three years, according to Morningstar. The latest reading of the consumer price index data showed a 2.1% rise in the cost of goods over the past year ending in May, the highest inflation reading since late 2012. That’s been welcome news to inflation hawks. But Hunt says such a phenomenon is temporary, and inflation is likely to fall under the weight of slow growth and a lack of real household earnings. “When you have episodic inflation and wages are not accelerating because GDP is too weak, you get a deceleration in real wage income,” Hunt said, referring to a drop in inflation-adjusted earnings.

In other words, if the costs of goods are rising for consumers, but the earnings that consumers use to buy those goods aren’t, they won’t be able to afford the higher costs, which which will eventually have to fall. In the meantime, rising costs are merely a headache for most people — not a sign of rebound. “The episodic price increases actually serve as a tax on the broad middle-income earners in the economy,” Hunt said. Wage growth won’t accelerate because economic growth remains weak, he asserts. Over the long haul, he posits that the economy will remain constrained by, among other things, a large U.S. debt load.

Wow.

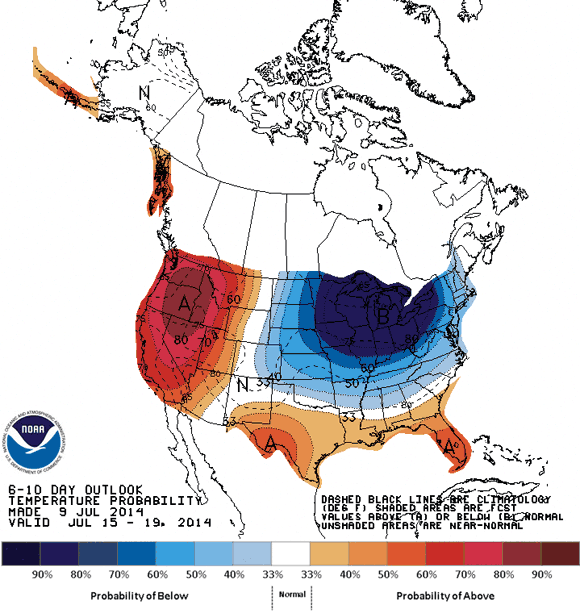

• Poor Man’s Polar Vortex To Make Shock Return To Eastern US Next Week (WaPo)

Call it the ghost of the polar vortex, the polar vortex sequel, or the polar vortex’s revenge. Meteorological purists may tell you it’s not a polar vortex at all. However you choose to refer to the looming weather pattern, unseasonably chilly air is headed for parts of the northern and northeastern U.S at the height of summer early next week. Bearing a haunting resemblance to January’s brutally cold weather pattern, a deep pool of cool air from the Gulf of Alaska will plunge into the Great Lakes early next week and then ooze towards the East Coast. Of course, this is July, not January, so temperatures forecast to be roughly 10 to as much as 30 degrees below average won’t have quite the same effect. But make no mistake, in parts of the Great Lakes and Upper Midwest getting dealt the chilliest air, hoodies and jeans will be required. Highs in this region could well get stuck in the 50s and 60s – especially where there is considerable cloud cover.

Or Scottish?

• Falling North Sea Oil Revenue ‘To Hit UK Government Finances’ (BBC)

Dwindling revenue from North Sea oil will increase the pressure on government finances over the coming decades, according to the Office for Budget Responsibility (OBR). The OBR has cut its estimate of tax income from the North Sea between 2020 and 2041 by a quarter, to £40bn. The fall is down to lower production forecasts over the next few years. But its assessment was dismissed as “stuff and nonsense” by Scottish First Minister Alex Salmond. The Scottish government has argued that the OBR figures are based on a “very low estimate of future total production”, which resulted in them being more pessimistic than other estimates, including those produced by industry body Oil and Gas UK.

The OBR was created by George Osborne in 2010 in one of his first acts as chancellor to provide independent economic forecasts and analysis of the UK’s public finances. Its latest fiscal sustainability report predicted that UK government debt will peak in 2015-16, a year earlier than expected, at 78.7% of GDP. This is 6.9% lower than previously forecast. The latest figures also showed total debt at £1.273bn, or 76.1% of GDP. This is the equivalent of £48,200 per household. The OBR warned that governments will have to raise taxes or implement further spending cuts in the coming decades, mainly because, as life expectancy grows, the cost of health, social care and the state pension will increase. Lower revenue from taxes on North Sea oil producers will exacerbate the problem, along with falling income from road taxes as cars become more efficient, it added.