L.S. Lowry The mill, Pendlebury 1943

Blood-brain barrier

German Pathologist Presents Autopsy Results of "Sudden Adult Death" Patients Post-Vaccination

"Blood brain barrier is crossed by the vaccine…These Brain Cells are Supposed to be Helping us to think Rather than Making Spike Protein" – Prof. Arne Burkhardt pic.twitter.com/z9lrdr7SBy

— Asher Press (@AsherPress) December 25, 2022

Tom Renz

https://twitter.com/i/status/1607224317099798530

Mozart

After months in Ukraine training soldiers, Ret Col Andrew Milburn of @TheMozartGroup mercenary firm gets sauced on camera & spills the beans:

Ukraine is a "corrupt, fucked-up society" run by "fucked-up people"

Ukrainian soldiers "kill dudes who surrendered," commit "atrocities" pic.twitter.com/MhKljQwQpq

— Max Blumenthal (@MaxBlumenthal) December 26, 2022

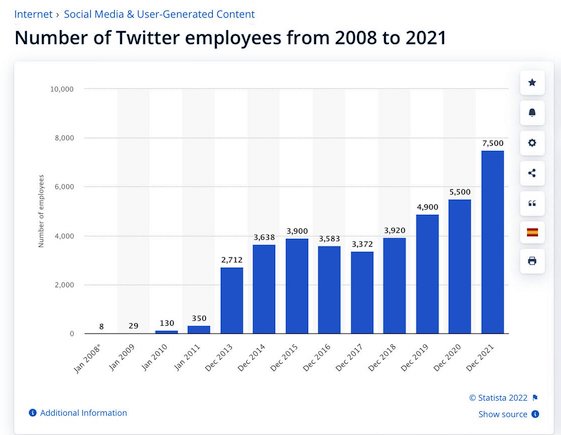

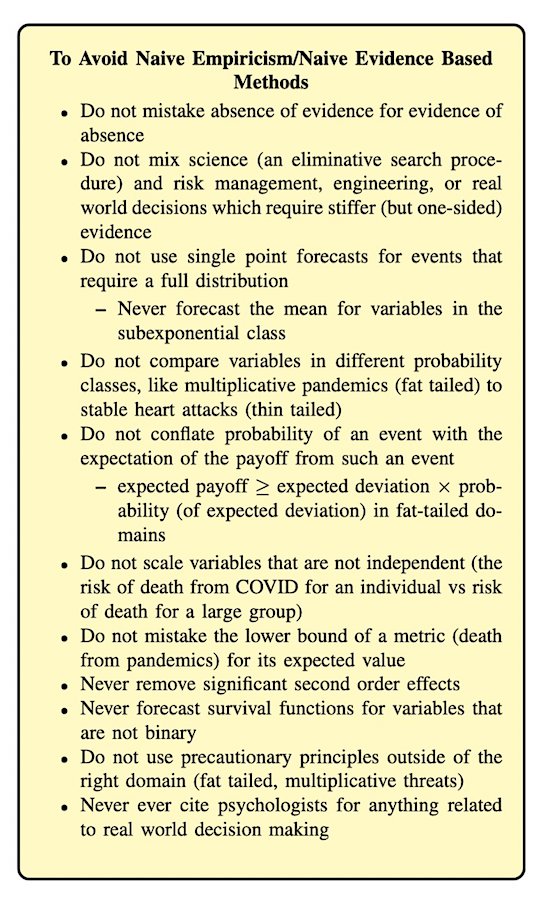

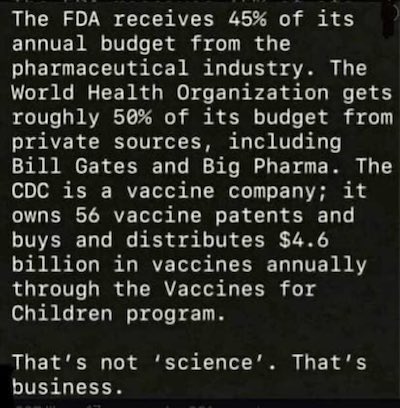

More Twitter files, this time on Covid response.

Elon Musk @elonmusk: “Much more to The Twitter Files: Covid Editon than this introductory thread. Follow-up piece to come next week, featuring leading doctors & researchers from Harvard, Stanford & other institutions. (Many of whom were, of course, actively suppressed on Twitter).”

Author David Zweig also has a longer article here . I’ll start off with his Twitter thread.

• The Twitter Files: How Twitter Rigged The Covid Debate (Zweig)

– By censoring info that was true but inconvenient to U.S. govt. policy

– By discrediting doctors and other experts who disagreed

– By suppressing ordinary users, including some sharing the CDC’s *own data*

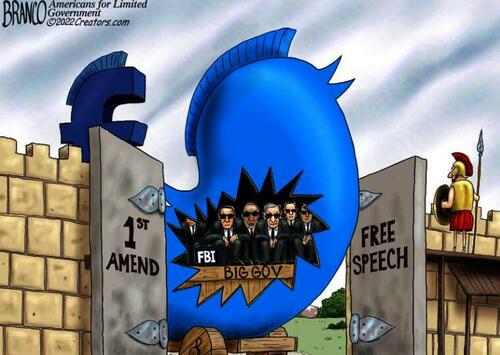

2. So far the Twitter Files have focused on evidence of Twitter’s secret blacklists; how the company functioned as a kind of subsidiary of the FBI; and how execs rewrote the platform’s rules to accommodate their own political desires.

3. What we have yet to cover is Covid. This reporting, for The Free Press, @thefp, is one piece of that important story.

4. The United States government pressured Twitter and other social media platforms to elevate certain content and suppress other content about Covid-19.

5. Internal files at Twitter that I viewed while on assignment for @thefp showed that both the Trump and Biden administrations directly pressed Twitter executives to moderate the platform’s pandemic content according to their wishes.

6. At the onset of the pandemic, according to meeting notes, the Trump admin was especially concerned about panic buying. They came looking for “help from the tech companies to combat misinformation” about “runs on grocery stores.” But . . . there were runs on grocery stores.

7. It wasn’t just Twitter. The meetings with the Trump White House were also attended by Google, Facebook, Microsoft and others.

8. When the Biden admin took over, one of their first meeting requests with Twitter executives was on Covid. The focus was on “anti-vaxxer accounts.” Especially Alex Berenson.

9. In the summer of 2021, president Biden said social media companies were “killing people” for allowing vaccine misinformation. Berenson was suspended hours after Biden’s comments, and kicked off the platform the following month.

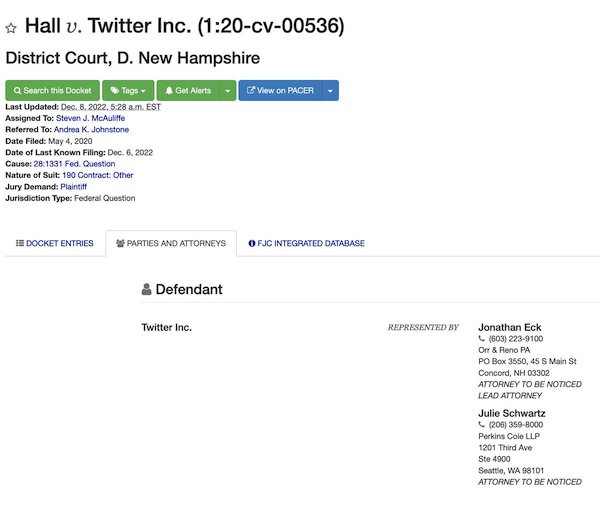

10. Berenson sued (and then settled with) Twitter. In the legal process Twitter was compelled to release certain internal communications, which showed direct White House pressure on the company to take action on Berenson.

“We are asking them to step up,” Murthy said. “We can’t wait longer for them to take aggressive action.”

• How Twitter Rigged the Covid Debate (ZH)

Today’s edition, dropped by journalist David Zweig, focuses on ‘how Twitter rigged the Covid debate’ by taking direction from both the Trump and Biden administrations (while at the same time trying to censor the former president). What’s somewhat notable is how aggressive government (and ex-government) officials were in trying to stifle free speech, while Twitter’s non-government-linked employees would often push back (and then totally fold) – a theme we’ve observed in previous drops. In one such instance, former head of Twitter’s Trust & Safety team Yoel Roth tells former FBI lawyer and then-Twitter Deputy General Counsel Jim Baker to calm his tits over a Trump tweet. Of course, in the end the government typically got its way, as you will read below.

Zweig, who was granted access to internal files while on assignment for The Free Press, notes that “both the Trump and Biden administrations directly pressed Twitter executives to moderate the platform’s pandemic content according to their wishes.” What’s more, the censorship effort extended to Google, Facebook, Microsoft and others. In July 2021, then-U.S. Surgeon General Vivek Murthy released a 22-page advisory concerning what the World Health Organization referred to as an “infodemic,” and called on social media platforms to do more to shut down “misformation.” “We are asking them to step up,” Murthy said. “We can’t wait longer for them to take aggressive action.”

That’s the message the White House had already taken directly to Twitter executives in private channels. One of the Biden administration’s first meeting requests was about Covid, with a focus on “anti-vaxxer accounts,” according to a meeting summary by Lauren Culbertson, Twitter’s Head of U.S. Public Policy. They were especially concerned about Alex Berenson, a journalist skeptical of lockdowns and mRNA vaccines, who had hundreds of thousands of followers on the platform: By the summer of 2021, the day after Murthy’s memo, Biden announced publicly that social media companies were “killing people” by allowing misinformation about vaccines. Just hours later, Twitter locked Berenson out of his account, and then permanently suspended him the next month.

Berenson sued Twitter. He ultimately settled with the company, and is now back on the platform. As part of the lawsuit, Twitter was compelled to provide certain internal communications. They revealed that the White House had directly met with Twitter employees and pressured them to take action on Berenson. The summary of meetings by Culbertson, emailed to colleagues in December 2022, adds new evidence of the White House’s pressure campaign, and illustrates how it tried to directly influence what content was allowed on Twitter. Culbertson wrote that the Biden team was “very angry” that Twitter had not been more aggressive in deplatforming multiple accounts. They wanted Twitter to do more.

Yeah, we could use some summaries. Authors so far: Matt Taibbi, Bari Weiss, Michael Shellenberger, Lee Fang, David Zweig, Leighton Woodhouse, Abigail Shrier. And perhaps others?! I hadn’t even noticed the last two.

• You Need to Start Paying Attention to the ‘Twitter Files’ (PJM)

The “Twitter Files” have now officially had more sequels than Planet of the Apes and can be difficult to absorb. Thus, I don’t think they’re getting the attention they deserve. For those of you not following the “Twitter Files” drops, let me catch you up on what I believe are some of the most important parts:

• The FBI paid Twitter $3.5 million to censor conservatives.

• The FBI pressured Twitter to give them information that would legally require warrants, though they did not have warrants.

• Leading up to the 2020 election, the FBI would eventually hold weekly meetings with Twitter and tell them whose tweets to squelch and which accounts they wanted to be suspended. Almost all were those of conservatives.

• The FBI knew the Hunter Biden laptop story was real, they knew it was coming out — weeks before the 2020 election — and they told Big Tech to expect a “Russian disinformation” drop and squelch the story. That means the FBI corrupted the election to help Joe “totally showered with his daughter, Ashley” Biden.

• There are so many former FBI employees at Twitter that they have their own Slack channel.

In response to the “Twitter Files” detailing how the FBI-Twitter circle jerk was real, the bureau called the allegations “conspiracy theories” but never actually denied its relationship with Twitter. Elon Musk provided the world with an early Christmas present on Saturday with Twitter Files Pt. IX. I’ll sum it up so you can avoid the Twitter mess and get to the relevant facts:

• The FBI was a portal, specifically the San Francisco office, for other government agencies to get to Twitter to surveil and censor Americans.

• Hiding under the title of Foreign Influence Task Force (FITF), actors from local police departments to the Department of Defense (DOD) and the CIA were watching and censoring Americans — not foreigners.

• Twitter wasn’t the only Big Tech firm hip-deep in spooks. The feds had their fingers in Verizon, Reddit, Facebook, Microsoft, and, for some reason, Pinterest.

• As the 2020 election neared, the FBI-FITF assailed Twitter with hundreds of requests to censor Twitter accounts and tweets. There were so many requests that Twitter execs had to come up with a system to prioritize them.

• FBI employees were tasked with doing word searches on Twitter, looking for violations of Twitter policies — instead of chasing actual criminals.

• The FBI had roughly 80 agents working with Big Tech companies. It is unclear how many members of the DOD, CIA, etc. were involved

“Criticizing the FBI is now ‘disinformation’”

• It’s Time to Reform the Bureau (Turley)

The “Twitter Files” released by Twitter’s new owner, Elon Musk, show as many as 80 agents targeting social-media posters for censorship on the site. This included alleged briefings that Twitter officials said was the reason they spiked the New York Post’s Hunter Biden laptop story before the 2020 election. The FBI sent 150 messages on back channels to just one Twitter official to flag accounts. One Twitter executive expressed unease over the FBI’s pressure, declaring: “They are probing & pushing everywhere they can (including by whispering to congressional staff).” We also have learned that Twitter hired a number of retired FBI agents, including former FBI general counsel James Baker, who was a critical and controversial figure in past bureau scandals over political bias.

It is not clear what is more chilling — the menacing role played by the FBI in Twitter’s censorship program, or its mendacious response to the disclosure of that role. The FBI has issued a series of “nothing-to-see-here” statements regarding the Twitter Files. In its latest statement, the FBI insists it did not command Twitter to take any specific action when flagging accounts to be censored. Of course, it didn’t have to threaten the company — because we now have an effective state media by consent rather than coercion. Moreover, an FBI warning tends to concentrate the minds of most people without the need for a specific threat. Finally, the files show that the FBI paid Twitter millions as part of this censorship system — a windfall favorably reported to Baker before he was fired from Twitter by Musk.

Criticizing the FBI is now ‘disinformation’. Responding to the disclosures and criticism, an FBI spokesperson declared: “The men and women of the FBI work every day to protect the American public. It is unfortunate that conspiracy theorists and others are feeding the American public misinformation with the sole purpose of attempting to discredit the agency.” Arguably, “working every day to protect the American public” need not include censoring the public to protect it from errant or misleading ideas. However, it is the attack on its critics that is most striking. While the FBI denounced critics of an earlier era as communists and “fellow travelers,” it now uses the same attack narrative to label its critics as “conspiracy theorists.”

After Watergate, there was bipartisan support for reforming the FBI and intelligence agencies. Today, that cacophony of voices has been replaced by crickets, as much of the media imposes another effective blackout on coverage of the Twitter Files. This media silence suggests that the FBI found the “sweet spot” on censorship, supporting the views of the political and media establishment. As for the rest of us, the FBI now declares us to be part of a disinformation danger which it is committed to stamping out — “conspiracy theorists” misleading the public simply by criticizing the bureau. Clearly, this is the time for a new Church Committee — and time to reform the FBI.

“Consider the last four directors, the public faces of the FBI for the last 22 years.”

• What Will the FBI *Not* Do? (Hanson)

The FBI is now, tragically, in freefall. The public is at the point, first, of asking what improper or illegal behavior will the bureau not pursue, and what, if anything, must be done to reform or save a once great but now discredited agency. Consider the last four directors, the public faces of the FBI for the last 22 years. Ex-director Robert Mueller testified before Congress that he simply would not or could not talk about the fraudulent Steele dossier. He claimed that it was not the catalyst for his special counsel investigation of Donald Trump’s alleged ties with the Russians when, of course, it was. Mueller also testified that he was “not familiar” with Fusion GPS, although Glenn Simpson’s opposition research firm subsidized the dossier through various cutouts that led back to Hillary Clinton’s 2016 presidential campaign. And the skullduggery in the FBI-subsidized dossier helped force the appointment of Mueller himself.

While under congressional oath, Mueller’s successor James Comey on some 245 occasions claimed that he “could not remember,” “could not recall,” or “did not know” when asked simple questions fundamental to his own involvement with the Russian collusion hoax. Comey, remember, memorialized a confidential conversation with President Trump on an FBI device and then used a third party to leak it to the New York Times. In his own words, the purpose was to force a special counsel appointment. The gambit worked, and his friend and predecessor Robert Mueller got the job. Twenty months and $40 million later, Mueller’s investigation tore the country apart but could find no evidence that Trump, as Steele alleged, colluded with the Russians to throw the 2016 election.

Comey also seems to have reassured the president that he was not the target of an ongoing FBI investigation, when in fact, Trump was. Comey was never indicted for either misleading or lying to a congressional committee or leaking a document variously considered either confidential or classified. While under oath, his interim successor, Andrew McCabe, on a number of occasions flat-out lied to federal investigators. Or as the office of the inspector general put it: “As detailed in this report, the OIG found that then-Deputy Director Andrew McCabe lacked candor, including under oath, on multiple occasions in connection with describing his role in connection with a disclosure to the WSJ, and that this conduct violated FBI Offense Codes 2.5 and 2.6. The OIG also concluded that McCabe’s disclosure of the existence of an ongoing investigation in the manner described in this report violated the FBI’s and the Department’s media policy and constituted misconduct.”

McCabe purportedly believed Trump was working with the Russians as a veritable spy—a false accusation based entirely on the FBI’s paid, incoherent prevaricator Christopher Steele. And so, McCabe discussed with Deputy Attorney General Rod Rosenstein methods to have the president’s conversations wiretapped via a Rosenstein-worn stealthy recording device, presumably without a warrant. Note the FBI ruined the lives of General Michael Flynn and Carter Page with false allegations of criminal conduct or untruthful testimonies. Under current director Christopher Wray, the FBI has surveilled parents at school boards meetings—on the prompt of the National School Boards Association, whose president wrote Attorney General Merrick Garland alleging that bothersome parents upset over critical race indoctrination groups were supposedly violence-prone and veritable terrorists. Under Wray, the FBI staged the psychodramatic Mar-a-Lago raid on an ex-president’s home. The FBI likely leaked the post facto myths that the seized documents contained “nuclear codes” or “nuclear secrets.”

What could go wrong?

• Pandemic Response Gets A Permanent New Home At The White House (STAT)

The era of the rotating cast of public health czars at the White House may finally be over. Presidents for decades have brought fresh faces to the White House to coordinate federal responses to threats such as Covid-19, mpox, Ebola, AIDS, and the bird flu. Now, Congress aims to give pandemic response a permanent home at the White House.Next year’s government funding package includes a brand-new White House Office of Pandemic Preparedness and Response Policy that would have a director appointed by the president and up to 25 staff members. “They’re not simply going to retire the role that [White House Covid-19 response coordinator Ashish Jha] plays when the emergency declaration ends,” said J. Stephen Morrison, a senior vice president at the Center for Strategic and International Studies and the director of its Global Health Policy Center.

“You can’t just keep piling on coordinators, disease by disease.” The new director’s main responsibilities would be to advise the president on preparing for pandemics and other biological threats, to coordinate response activities across the federal government — including research into new countermeasures and distribution of medical supplies — and to evaluate the government’s readiness. The director would also be a member of the Domestic Policy Council and the National Security Council. “The functions outlined are exactly what is needed at the White House, and what I’ve been calling for for years, to avoid having any single agency take the lead on something that overlaps most departments in the U.S. government,” said Ken Bernard, who worked in biodefense policy in both the Clinton and George W. Bush White Houses.

Start off with impossible conditions. And then say: hey, we tried!

• Ukraine Calls For UN-Brokered ‘Peace Summit’ In February (RT)

Kiev has proposed holding a so-called “peace summit” by the end of February to mark the one-year anniversary since Russia launched its military operation against Ukraine. The initiative was announced by that country’s Foreign Minister Dmitry Kuleba, who also set out conditions for inviting Moscow to the event. In an interview with AP published on Monday, Kuleba stated that Ukraine will do whatever it can to win its ongoing military conflict with Russia in 2023, but admitted that diplomacy always plays an important role. “Every war ends in a diplomatic way,” Kuleba said, adding that “every war ends as a result of the actions taken on the battlefield and at the negotiating table.”

The minister noted that the UN was “the best venue for holding this summit, because it is not about making a favor to a certain country” and suggested that UN Secretary General Antonio Guterres could act as mediator for the event. “He has proven himself to be an efficient mediator and an efficient negotiator, and most importantly, as a man of principle and integrity. So we would welcome his active participation,” Kuleba said about Guterres. Asked about the matter of inviting Russia to this “peace summit,” Kuleba insisted Moscow must first face an “international court” and be prosecuted for supposed war crimes. He also dismissed Putin’s recent calls for negotiations, stating that everything Russia does on the battlefield “proves” that Moscow does not want to talk.

Earlier this month, Ukrainian President Vladimir Zelensky’s addressed G20 leaders in Indonesia and laid out a ten-point “peace formula,” which includes the restoration of Ukraine’s territorial integrity, the withdrawal of Russian troops, an “all for all” prisoner swap, and a tribunal for those Kiev accuses of aggression. Russia, meanwhile, has insisted that Kiev must “recognize the reality on the ground” as a prerequisite for any peace negotiations, including the new status of Donetsk, Lugansk, Kherson and Zaporozhye as parts of Russia.

Sleeper cells.

• Report: The CIA Is Directing Sabotage Attacks Inside Russia (Antiwar)

The CIA has been using a European NATO country’s intelligence services to conduct sabotage attacks inside Russia since the February invasion of Ukraine, investigative journalist Jack Murphy reported on Saturday, citing unnamed former US intelligence and military officials. The report said that no US personnel are on the ground in Russia but that the operations are being directed by the CIA. The US is using an ally’s intelligence services to add an extra layer of plausible deniability, and a former US special operations official told Murphy that layer was a major factor in President Biden signing off on the attacks. Murphy said he didn’t name the NATO country whose intelligence services were being used in the report because “doing so might endanger the operational security of cells that are still operational inside of Russia.”

The report appeared on Murphy’s personal website, and in a note at the end of the piece, he explained why it wasn’t published by a media outlet. “While working with editors at mainstream publications I was asked to do things that were illegal and unethical in one instance, and in another instance I felt that a senior CIA official was able to edit my article by making off the record statements, before he leaked a story to The New York Times to undermine this piece,” he wrote. According to the report, the covert campaign inside Russia has been years in the making. Two former military officials said that the NATO country’s spy services had hidden a cache of explosives and equipment in Russia more than a decade ago, and some of the gear has been used recently.

A former US special operations official and US person briefed on the campaign said that the CIA didn’t get involved with the NATO country’s operations inside Russia until 2014. The first time sleeper cells entered Russia that were directed by both the CIA and the NATO ally’s spy service was in 2016, and more entered the country in the following years. The NATO ally provided the undercover operatives with stories to explain their presence in Russia and documents to back them up. The report said that around the time Russia invaded Ukraine on February 24, the NATO ally’s spy service activated its sleeper cells inside Russia using covert communication, and they were ready for orders on what targets to strike.

Medvedev becomes more visible. He’s still close to Putin, or so it seems. If anything happens to Putin, he appears to be the go-to guy.

• Medvedev Gives Timeline For Reconciliation With The West (RT)

Former Russian president Dmitry Medvedev has accused Western powers of lying, causing a rift that will remain for decades to come, and convincing Moscow that there is no sense in trying to reach an agreement with them. Medevedev, who serves as deputy chair of the national Security Council, wrote in a keynote article on Sunday that the year 2022 has shattered illusions about the West, proving that its promises and principles cannot taken at face value. “Alas, there is nobody in the West we could deal with about anything for any reason,” he wrote. Medvedev went on to say that nations that claim global leadership deceived Russia when they claimed NATO expansion in Europe posed no threat to it.

They again lied when they backed a peace roadmap for Ukraine, which in reality was meant to give Kiev time to prepare for an eventual armed conflict with Russia, he added. The conflict in Ukraine is a war against Russia by a proxy, which was long in the making, Medvedev claimed. The behavior of Washington and others this year “is the last warning to all nations: there can be no business with the Anglo-Saxon world [because] it is a thief, a swindler, a card-sharp that could do anything.” For Russia, there will be no restoration of normal relations with the West for years or even decades to come, Medvedev predicted. “From now on we will do without them until a new generation of sensible politicians comes to power there. We will be careful and alert. We will develop relations with the rest of the world,” he wrote.

However, Medvedev argued that the loss of Western leadership could be a net positive, considering what he called the moral bankruptcy of the US-led neo-colonial order. Elites that caused the financial meltdown of 2008 and the ongoing global crisis are unable to claim global leadership, he wrote. “The West is incapable of offering to the world any new ideas, which would take humanity forward, solve global problems, or provide collective security,” the former president insisted. Medvedev expects that several regional blocs will emerge in the near future, each with its own values and rules, and that Russia will have its place in the new order.

A very strange Twitter thread from Medvedev. Elon Musk reacted: “Those are definitely the most absurd predictions I’ve ever heard, while also showing astonishing lack of awareness of the progress of artificial intelligence and sustainable energy..”

• What Can Happen In 2023 (Dmitry Medvedev)

On the New Year’s Eve, everybody’s into making predictions Many come up with futuristic hypotheses, as if competing to single out the wildest, and even the most absurd ones. Here’s our humble contribution.

1. Oil price will rise to $150 a barrel, and gas price will top $5.000 per 1.000 cubic meters

2. The UK will rejoin the EU

3. The EU will collapse after the UK’s return; Euro will drop out of use as the former EU currency

4. Poland and Hungary will occupy western regions of the formerly existing Ukraine

5. The Fourth Reich will be created, encompassing the territory of Germany and its satellites, i.e., Poland, the Baltic states, Czechia, Slovakia, the Kiev Republic, and other outcasts

6. War will break out between France and the Fourth Reich. Europe will be divided, Poland repartitioned in the process

7. Northern Ireland will separate from the UK and join the Republic of Ireland

8. Civil war will break out in the US, California. and Texas becoming independent states as a result. Texas and Mexico will form an allied state. Elon Musk’ll win the presidential election in a number of states which, after the new Civil War’s end, will have been given to the GOP

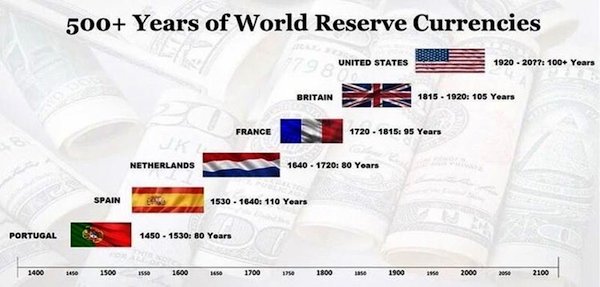

9. All the largest stock markets and financial activity will leave the US and Europe and move to Asia

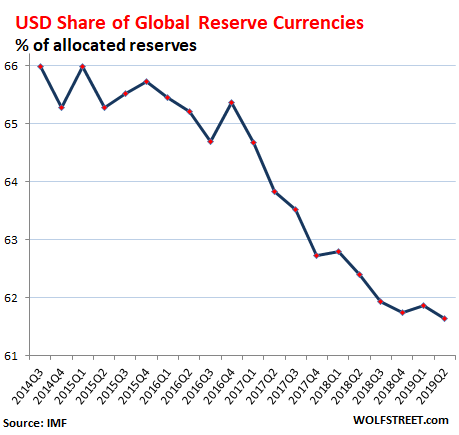

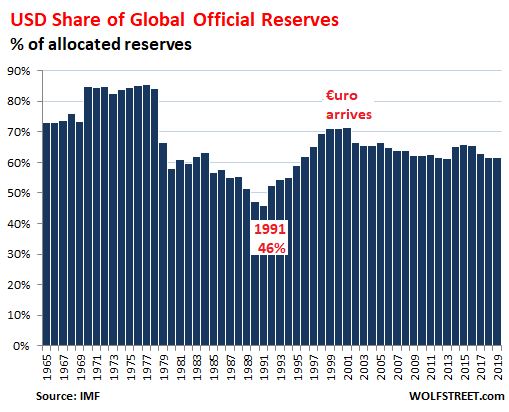

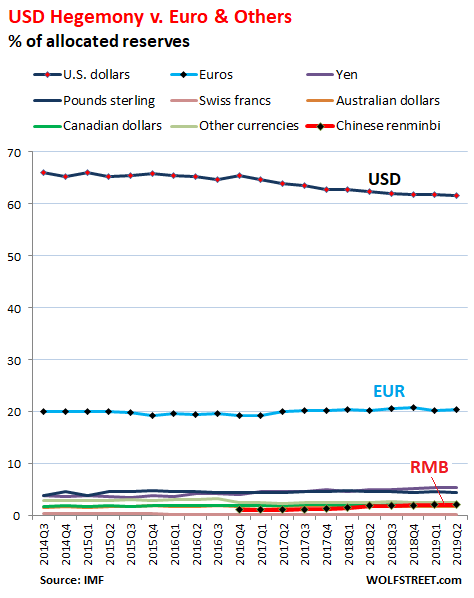

10. The Bretton Woods system of monetary management will collapse, leading to the IMF and World Bank crash. Euro and Dollar will stop circulating as the global reserve currencies. Digital fiat currencies will be actively used instead

Season greetings to you all, Anglo-Saxon friends, and their happily oinking piglets!

“..a delicate balancing act between fighting inflation and exacerbating the slowdown..”

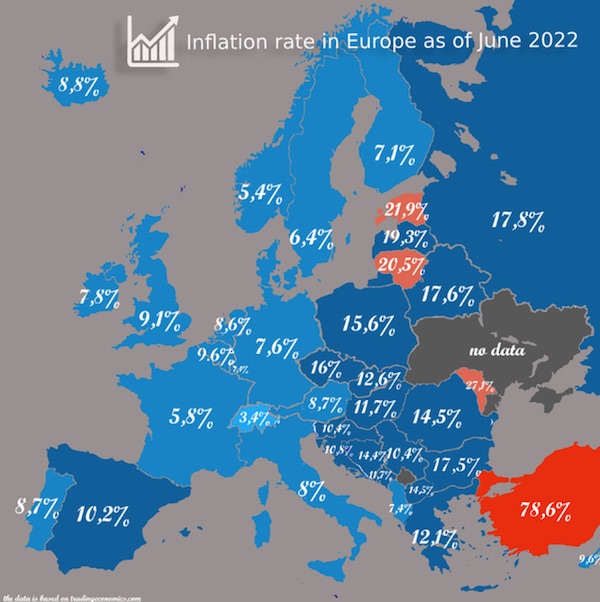

• ECB Governing Council Says Growth Of Key Rate In 2023 Possible (Az.)

A veteran member of the European Central Bank’s rate-setting council believes it has only just passed the halfway point of its tightening cycle and needs to be “in there for the long game” to tame high inflation, Report informs referring to Financial Times. After more than a decade of aggressive easing, 2022 was the year when many leading central banks began to raise rates in response to soaring prices. The ECB increased borrowing costs by 2.5 percentage points, capping the year with its fourth rise in a row to leave its benchmark deposit rate at 2 percent.

Klaas Knot, head of the Dutch central bank and one of the governing council’s more hawkish rate-setters, told the Financial Times that, with five policy meetings between now and July 2023, the ECB would achieve “quite a decent pace of tightening” through half percentage point rises in the months ahead before borrowing costs eventually peaked by the summer. In the eurozone, consumer price inflation hit a record high of 10.6 percent in the year to October – more than five times the ECB’s 2 percent target. In the Netherlands, inflation has been higher still, peaking at 17.1 percent in September. However, growth in the bloc is grinding to a halt, leaving central bankers facing a delicate balancing act between fighting inflation and exacerbating the slowdown.

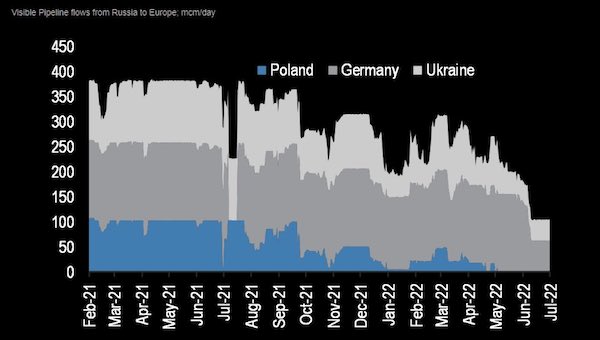

“The Polish leg of the route is currently being used to pump stored gas from Germany.”

• Russia Ready To Resume Gas Supplies To EU – Official (RT)

Moscow is ready to restart supplies of natural gas to the EU via the Yamal-Europe Pipeline, Russian Deputy Prime Minister Aleksandr Novak said on Monday. He noted that shipments through the route were halted for political reasons. According to the official, the EU remains a relevant market for Russia, which is able to resume supplies to a region suffering from a gas shortage. “For example, the Yamal-Europe Pipeline, which was shut down for political reasons, remains unused,” Novak said. Gas supplies via the pipeline, which usually flow westward, have been mostly reversed since Poland terminated a supply contract with Russia ahead of its end-2022 expiry date, after rejecting Moscow’s demand for ruble payments. The Polish leg of the route is currently being used to pump stored gas from Germany.

In response to Warsaw’s move, Russian state-run energy giant Gazprom cut off supplies, saying it could no longer send gas via Poland, while Moscow imposed sanctions against the firm that owns the Polish section of the Yamal-Europe pipeline. Although Russian gas deliveries to the EU via the Nord Stream and Yamal-Europe pipelines have been halted, Russian gas is still being supplied to certain European buyers via a transit line through Ukraine and the TurkStream pipeline through Türkiye. Despite the persisting problems, Novak says he still sees the EU as a viable market for Russia. “Today we can confidently say that there is a stable demand for our gas. Therefore, we continue to consider Europe as a potential market for our products. It is clear that a large-scale campaign was launched against us, which ended with acts of sabotage against the Nord Stream pipelines,” he said. The market for LNG also remains open, according to Novak, who noted that Russian LNG supplies to the EU are expected to grow to 21 billion cubic meters by the end of the year.

“We don’t want gas and oil supplies from Russia any more, at the same time our ‘green’ friends are restarting coal-fired power plants..”

• Germany Becoming ‘Dysfunctional’ State – MP (RT)

Germany faces a serious risk of going bankrupt due to the government’s inability to find a viable solution to the current energy crisis, the Vice President of the Bundestag, Wolfgang Kubicki, said in an interview published in the national Sunday newspaper Bild am Sonntag. According to the official, Germans now have the impression that their country is on the way to becoming a “dysfunctional state.” “Infrastructure, energy prices and the inability of the Bundeswehr [the country’s armed forces] to protect us are challenges that require immediate action from the German authorities, otherwise things will go wrong,” he said.

Kubicki blasted Economy Minister Robert Habeck over purchases of liquefied natural gas (LNG) from Qatar, the United Arab Emirates and the US for “a lot of money” while at the same time refusing to mine cheaper shale gas in Germany “for purely ideological reasons.” He added that the German authorities should revise their approach to nuclear power plants, which should continue operating while the country is facing an energy crisis. “We don’t want gas and oil supplies from Russia any more, at the same time our ‘green’ friends are restarting coal-fired power plants, while preventing a reasonable extension of the life of nuclear power plants,” Kubicki said, commenting on Habeck’s latest decisions.

The MP called for a change in the government’s strategy and the rejection of excessive financial assistance in the face of the energy crisis. “If we continue to pursue the policies of paying out money for years as part of the fight against the energy crisis, then we are at risk of national bankruptcy if not state socialism,” Kubicki warned. According to the Vice Speaker, the funds that Berlin is planning to spend on additional purchases of energy resources amid the crunch were originally destined for investments in other areas. “This money cannot be printed or covered by taxpayers. We cannot exist in a state of financial crisis for a long time due to the risk of shortage of funds to support other areas,” he said.

Poland seeks more power.

• Return Europe To A Union Of Homelands (RMX)

Polish Prime Minister Mateusz Morawiecki said that “he and Italy’s Prime Minister Giorgia Meloni will change Europe.” In an interview for the Italian newspaper La Stampa, Morawiecki explained that Europe and power should return to stronger nation states. “We do not believe in a superstate of 27 EU member states. We want a return of a union of homelands,” underlined the Polish prime minister. Morawiecki pointed out that Europe has to choose between an authentic solidarity of equal states, or a model of a single superstate in which “decisions will be made in a couple of the largest capitals, disregarding other countries.” Referring to Russian aggression in Ukraine, Morawiecki pointed out that the Ukraine war will end only with the defeat of Vladimir Putin.

“We have warned that Russia’s colonial ambitions are a threat to eastern European countries and the entire EU,” said Morawiecki, adding that Europe must do everything to aid Ukraine, as the fall of Kyiv would open the way for Russia to conquer Europe. “Together with [Italian] Prime Minister Meloni, we stand to defend Ukraine. We realistically assess the threat posed by the Russian Federation,” the Polish leader added. According to Morawiecki, some European nations are more acutely aware of the Russian threat due to their past experiences. “That is why we all think about armaments and protecting against the threat from the East,” he explained Meloni often refers to policies pursued by Poland’s Law and Justice (PiS) government, using them as a model and an example. She often mentions that European conservative parties need to cooperate, previously saying: “We will transform ideas into a government policy, just as our friends from the Czech and Polish republics have done.”

It’s one big party.

• Republican Senators Turn On Leader Mitch McConnell Over $1.7t Omnibus (DM)

Donald Trump tore into his Republican rival, Senate GOP Leader Mitch McConnell, on Monday over his role in helping pass a bipartisan $1.7 trillion ‘omnibus’ spending bill to keep federal government agencies and the military funded through September 2023. The former president dusted off an old favorite monicker of his for McConnell, calling him an ‘Old Crow,’ while also claiming that Democrats ‘must have something’ on the Kentucky legislator after he was one of 18 Senate Republicans to vote in favor of the bill. He had stopped using the nickname for a time after McConnell said ‘Old Crow’ was his favorite brand of Kentucky bourbon, and even once gifted bottles in a veiled dismissal of Trump’s taunts. Trump made his thoughts on the spending bill clear, deriding it as ‘ominous’ and claiming it would not have been passed under his administration.

He also hurled a racist insult he previously lodged at McConnell’s wife, his own former Transportation Secretary Elaine Chao. ‘The Marxist Democrats must have something really big on Mitch McConnell in order to get him and some of his friendly “Republican” Senators to pass the horrendous “All Democrat, All the Way” OMINOUS Bill,’ Trump wrote on his Truth Social app. ‘It gives Border Security to other countries, but ZERO $’s to the U.S., it fully funds the corrupt “Justice” Department, FBI (which RIGGED the Presidential Election!), and even the Trump Hating Special “Prosecutor.” It is also a massive giveaway & capitulation to CHINA, making COCO CHOW so happy!’ He wrote in a follow-up post, ‘If the Old Crow waited just 10 days, the Republican Majority in the House could have made the “Ominous” Bill MUCH, MUCH, MUCH BETTER.’

‘Just another win for the Democrats, Mitch, that wouldn’t have happened if “Trump” were President!’ Trump concluded. A pair of Republican senators loudly denounced McConnell on Sunday over his shepherding through the $1.7 trillion bill. The funding package includes fiscal victories for both parties. Many on the right who voted for it made clear that it was not the fiscal agenda they preferred but believed it was necessary to keep the military and other critical aspects of the government running smoothly. But federal spending priority talks have divided the GOP. Many on the right having opposed working with Democrats on where the government spends dollars next year.

“..it still doesn’t explain how these outfits became the enemies of truth itself, and by extension, enemies of reality.”

• What It’s Really About (Kunstler)

Not so many years ago, the force counter-balancing criminal misconduct in the government was the news media, even if the reporters and editors claimed to be on the political Left. Or, shall we say, especially if they were on the Left, because the Left in those days fervently championed free speech. Reporters of that long-ago day (Seymour Hersh, John Sack, and Michael Herr) would be out digging up the true facts of a big event — say, the US Military’s deadly blunders and scams in Vietnam — and editors would plaster screaming headlines about it on the front page: GENERAL SAYS “WE HAD TO DESTROY THE VILLAGE TO SAVE IT!” When the venerable news-spieler Walter Cronkite of CBS began to hint that the war was a fiasco, public opinion across the country shifted decisively against it.

Of course, those crimes and sins were committed against people in distant lands. Now, the administrative weight of the US is rolling over its own citizens, and over the Constitution — and the news media is uniformly and enthusiastically in favor of suppressing the news about it. How that happened is one of several cosmic mysteries of our time, along with who exactly runs “Joe Biden,” and how did the many nations of Western Civ adopt in lock-step Covid-19 policies aimed at harming their own people? No reporter even of the alt.news division even tried to get inside the head of New York Times executive editor Dean Baquet during the years of RussiaGate. Did he believe all that crap his paper was putting out? Now, you realize, it’s established fact (in the federal court record) that the Steele Dossier and everything spun off of it was a flim-flam confected by Hillary Clinton’s campaign.

But even at the time, say 2017 to 2019, independent journalists were reporting the truth about it — for example, the FBI’s long-running fraud in the FISA Court — while The New York Times ardently inveighed against any emerging fact-pattern that broke through its wall of propaganda. The Times was showered with awards for that, including the Pulitzer Prize for its completely fallacious RussiaGate coverage. One easy answer is that The Times and many of its “legacy” cohorts — The WashPo, CBS, NBC, and ABC — have volunteered to be the public relations office of the Democratic Party, covering-up anything and everything the Party does against the public interest. And while that appears to be the case, it still doesn’t explain how these outfits became the enemies of truth itself, and by extension, enemies of reality.

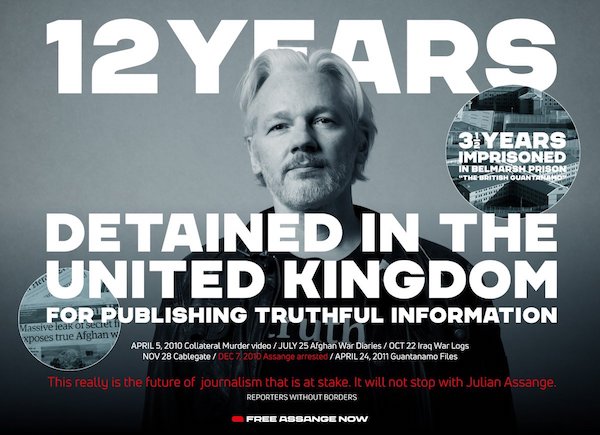

Julian Claus

“You’re the light that the world’s demanding.”

This Christmas, Julian Assange should have been home celebrating with his wife @Stella_Assange and children. Let’s #BringHimHome. #FreeAssange pic.twitter.com/sv3AoT0Omf

— Siuan the Amyrlin (@SiuantheAmyrlin) December 26, 2022

Montreal 2010

Canada was preparing for tyranny back in 2010….

Source: https://t.co/hgRO17uEZk pic.twitter.com/xJMuIuQqmF— Wittgenstein (@backtolife_2023) December 26, 2022

Cobalt

Joe Rogan guest exposes the “heart-wrenching” reality of the battery mining industry.

— The Post Millennial (@TPostMillennial) December 26, 2022

Piano stairs

Great idea! pic.twitter.com/udcL0nxbc3

— Buitengebieden (@buitengebieden) December 26, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.