Walker Evans Vicksburg, Mississippi. “Vicksburg Negroes and shop front.” 1936

Bad news is good news again. No more uncertainty.

• Everyone’s a Winner in Brexit Aftermath as Doves Rescue Market (BBG)

One week after Brexit, the lesson investors are taking away is that there’s no problem central banks can’t fix. Just days after the U.K.’s vote to leave the European Union roiled financial markets around the world, stocks and bonds surged in tandem this week as policy makers once again rode to the rescue, dropping hints of further stimulus and suggesting they’ll keep interest rates lower for longer. Traditionally, what’s good for one asset class has not been good for the other, and stocks and bonds more often move in opposite directions on the same information. Yet with unprecedented monetary easing showing no signs of slowing, that relationship continues to break down.

With almost $12 trillion of government bonds globally paying less than zero, a rush into Treasuries Friday pushed yields to record lows, even as encouraging economic data helped propel U.S. stocks toward all-time highs. “This may be the new normal,” said Aaron Kohli, a fixed-income strategist in New York at BMO Capital Markets, one of 23 primary dealers that trade with Fed. “If you flood the markets with liquidity, and you have the anticipation that the central banks are going to be dovish — either adding to quantitative easing or becoming less hawkish, as the case may be for the U.S. Fed — any assets that aren’t impaired or encumbered are going to do very well.”

“This is 2016. They are still thinking 1950 economics..”

• The European Union Is ‘Doomed To Fail’ : Taleb (CNBC)

The European Union is doomed to fail, “Black Swan” author Nassim Nicholas Taleb said Thursday. He told CNBC’s “Power Lunch” the EU has become a “metastatic and rather incompetent bureaucracy” that is too intrusive. “The way they’ve been building it top down from Brussels is doomed to fail. This is 2016. They are still thinking 1950 economics,” said Taleb, who is also the author of “Antifragile” and is an advisor to Universa Investments. Taleb has warned about an EU breakup for some time, calling it a horrible, stupid project back in 2012. In fact, the U.K.’s vote to exit the EU last week didn’t turn out to be the catastrophe that was expected, he said. While Brexit fears initially rattled global markets, stocks have been climbing back up over the last few days.

While he’s against the current bureaucracy in place in the Europe, he still believes countries can work together, forming free trade agreements and joint military and economic policies. He envisions an Anglo-Saxon economic zone that encompasses the U.S., Ireland, Scotland and Britain. Taleb also doesn’t see Brexit as an isolated event. “People just realize that these elites don’t know what they’re talking about. It’s nice to have elites..you don’t want them to tell you what to do,” he said. “So they are tired of that and it’s a rebellion.” “You have waves and of course we have a wave and I think that .. it’s spreading.” That can be seen in the popularity of Donald Trump, he added. “He’s a brilliant salesperson. He knows how to sell you real estate.. He knows what people want. And he detected exactly that point. And he’s delivering but through trial and error.“

Note: On July 1, Slovakia took over from Holland as chair of the EU. Slovakia is very much opposed to the migrant quota plans.

And Orban is a dick, but he poses a basic question on sovereignty. Which the EU should not just try to sweep under the carpet, because it represents the very core of all the issues. It’s worrisome to me that the right seems to be the only side asking the right questions these days.

• Hungary’s Migrant Referendum Shows Europe’s Post-Brexit Challenge (R.)

Emboldened by Britain’s shock vote to quit the EU, Hungary’s leader Viktor Orban is forging ahead with his own referendum on migration, in what European diplomats see as a sign of battles to come with anti-Brussels populists across the continent. The 53-year-old Orban, in power since 2010, has clashed several times with the EU on issues ranging from independence of the courts and the central bank to his handling of the migrant crisis, which has included a fence on Hungary’s southern border. His next clash pits him against an EU Commission plan to resettle refugees across member states based on quotas, which Orban sees as an act of out-of-touch Brussels bureaucrats usurping national authority.

“We need to fight to prove to people that it is possible to form an EU migration policy that is in line with the Hungarian national interest,” Orban said days after the Brexit vote. “This is going to be a long struggle for which I will need a strong mandate, which cannot be ensured without a referendum,” said Orban, who is in favor of remaining in the EU but wants more powers for member states. Orban has enlisted allies, such as neighboring Slovakia, which also opposes the quotas and this week joined a chorus of eastern EU states calling for the powers of the EU Commission to be reined in after Britain’s vote to leave.

“We have a big problem with the proposed reform of the Dublin system,” Slovak Prime Minister Robert Fico said. “We think it’s stupid, because this is exactly what will keep dividing Europe if (countries) will be asked to pay €250,000 for each migrant they refuse to take.” [..] Orban has said the migration crisis could drive more countries out of the EU. His government will ask Hungarians: “Do you agree that the European Union should be able to prescribe the mandatory settlement of non-Hungarian citizens in Hungary without the consent of parliament?”

“..the largest macro imbalance in world history..” People who’ve been reading me for a while will know I fully agree with Bass. Except perhaps for his optimism about China as a buying opportunity. You must take into account, in my view, the inevitable massive losses for Chinese citizens, and their potential reaction to them.

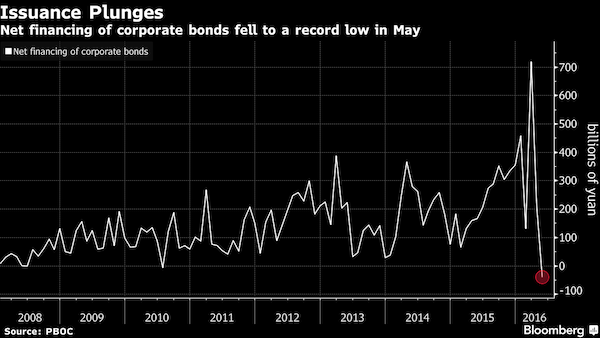

• Kyle Bass Says China’s Corporate Bond Market Is ‘Freezing Up’ (BBG)

Kyle Bass, the hedge-fund manager who’s wagering on a devaluation in China, said the country’s $3 trillion corporate bond market is “freezing up” amid rising defaults and canceled debt sales. “We’re starting to see the beginning of the Chinese machine literally break down,” Bass, the founder Hayman Capital Management, said in an interview on Real Vision. China’s corporate bond market contracted by a record in May as tepid economic growth and a raft of missed payments spooked investors. Seventeen publicly-traded Chinese bonds have defaulted so far this year, up from six in 2015, and at least 188 firms have scrapped or delayed debt sales since the end of March, according to data compiled by Bloomberg.

Bass, who rose to fame after prescient bets against U.S. subprime mortgages, has so far had less success with his China wagers, saying they’ve contributed to his “terrible” performance over the past two years. While his corporate bond warning follows signs of market stress, there’s no evidence yet of a collapse. Yields on junk-rated Chinese debt fell the most this year in June, while companies were able to sell 1.85 trillion yuan ($278 billion) of onshore notes in the second quarter. Defaults have ramifications beyond the corporate debt market, according to Bass. It also threatens to undermine the $3.5 trillion market for wealth management products, which raise money from Chinese individuals to invest in bonds, stocks and derivatives, he said.

The products receive less regulatory oversight than banks and often have mismatches between their maturities and underlying assets. Bass said in February that China’s lenders may suffer losses more than four times those at American banks during the 2008 credit crisis. He also predicted the yuan will fall in excess of 30%. In the Real Vision interview, Bass reiterated that China’s lending binge in recent years has created “the largest macro imbalance in world history.” He expects bank losses of $3 trillion to trigger a bailout, with the central bank slashing reserve requirements, cutting the deposit rate to zero and expanding its balance sheet – all of which will weigh on the yuan.

Great interview with Bass.

• QE Only Works When You’re The Only Country Doing It: Kyle Bass (ZH)

Grant : this idea of helicopter money, and the idea of banning cash, and all these things that, when you sit here in the cold like that, you can see exactly why they need to do these things. You watch the narrative unfold in the media, and then the trial balloons get floated. But you’re right, they have to go to helicopter money, they’re really not going to have a choice. And it seems to me that they are going to have to try to ban cash. Because, as you say, the U.S. savings rate has tripled since 2007, and that’s literally the last thing they want or need. So is there any way out for these guys? Because that’s the thesis that I keep checking. I can’t see a way out, absent cold fusion.

Kyle : Look, I had a fascinating out of body experience meeting with one of the world’s top central bankers in a private meeting about three years ago. And he said, “You know Kyle, quantitative easing only works when you’re the only country doing it.” He would never say that publicly. And I’ll protect his name, because it was a private meeting. But it was one of those moments where I…it was one of those epiphanies almost, where it’s something you and I knew, but hearing him say it, call it one of the four top central bankers in the world, it was a jarring experience for me, because when I look around the world today, everyone’s in the same boat. So we’re all trying…we’re attempting through our treasury and our Fed to get the rest of the world to not devalue against us, while we quietly attempt to devalue ourselves against them, and it’s all this…it is the race to the bottom, it is the beggar thy neighbor policies that we all talk about. And I believe that there is no way out.

Another economic miracle showing rot.

• Bad-Loan Ultimatum in India Sees Default Risk Climb Most in Asia (BBG)

Investors are starting to show nerves over the Reserve Bank of India’s ultimatum for state lenders to clean up their rising pile of bad loans this fiscal year. Bank of India’s credit-default swaps jumped 31 basis points in the past month, the most among Asian banks, after it was one of three lenders downgraded by S&P Global Ratings on May 30. Yield premiums on dollar bonds of the Mumbai-based company, Indian Overseas Bank and Syndicate Bank climbed to the highest in at least four months after the action. “It’s one of the most trying times for the public sector banks and how they handle this will be crucial for their future survival,” said Rajesh Mokashi at CARE Ratings. “I see a substantial jump in non-performing loans for most banks for the year to March 31, 2017.”

RBI Governor Raghuram Rajan, who will hand over the reins to an as-yet-undecided successor in September, has given lenders until March 31 to clean up stressed loans that surged to 11.5% of their assets last fiscal year. The rating downgrades will make it harder to raise capital for India’s state-owned commercial lenders, which issued no dollar bonds this year, versus $895 million in the first half of last year.

From AAA to stocks. It took only a few years. And there goes your pension.

• World Biggest Pension Fund Seen Losing $43 Billion Last Quarter (BBG)

Losses for the world’s biggest pension fund likely deepened in the quarter just ended, extending what may be its worst annual loss since the global financial crisis, brokerage estimates showed. Japan’s Government Pension Investment Fund will probably post a 4.4 trillion yen ($43 billion) loss in the April-June quarter, according to calculations by Yohei Iwao, executive director of the institutional equities division at Morgan Stanley MUFG Securities. That follows what he estimates was a 5 trillion yen decline in the fiscal year ended March 31, which would amount to the worst performance since fiscal 2009 when the fund lost 9.7 trillion yen.

The calculations come amid criticism the government has put the public’s pension money at risk after the fund known as the whale for the size of its assets increased its equity allocations in 2014. That’s prompted the main opposition party to pledge GPIF will move investments back into safer ones in its manifesto ahead of elections this month. “Looks like the scrutiny on GPIF will continue,” Morgan Stanley MUFG’s Iwao said. GPIF has been hurt after global stock routs in mid-2015 and early this year helped wipe about $7.4 trillion off world equities in the past 12 months. Japan’s Topix index has tumbled 19% in 2016 to be the second-worst performing developed stock market as the yen strengthened, reducing returns from overseas holdings.

No politician wants to touch this. Not in their timeframe.

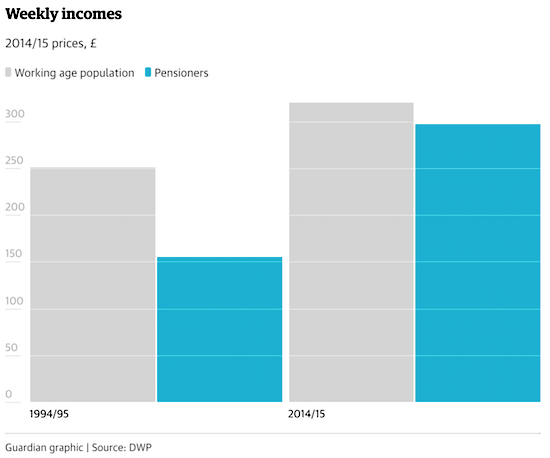

• We May Have Reached Peak Pensioner (G.)

Since 2004-05 the average income of all pensioners has jumped from £250 a week to £297. For pensioner couples the average income is £444, or £23,000 a year. During the same period, incomes for working people have stagnated or fallen; even today, average net disposable income is below where it was in 2007-08. Two factors have driven pensioner incomes up: first, the “triple lock” for state pensions, which has guaranteed that it rises every year by the highest of price inflation, earnings growth or 2.5%. During the global financial crash the triple lock meant pensioners received income rises even when pay for working people was falling. Income from welfare benefits has increased for pensioners since 1994-95, but fallen for working people.

[..] generous final salary pension schemes are in catastrophic decline, now confined almost entirely to the public sector. In the private sector their replacements will only pay a fraction of the amount enjoyed by the generation before them. While many previously picked up two-thirds of their final salary, today’s workers will be lucky to pick up 25%-30% of their former salary. Today’s well-off pensioners are, literally, a dying breed. This is not an argument to say that today’s pensioners should in any way be stripped of their incomes. There is huge inequality among pensioners themselves.

You know all those stories about pensioners saying their incomes have been destroyed by a decade of super-low interest rates? The truth is that the median weekly income from savings in retirement is just £6 a week. The average, though, is £64 a week. That tells you that a small number of pensioners have a large investment income, but the majority have almost nothing. There is a debate to be had about generational fairness. Britain, like all developed nations, is an ageing country. How do we arrange our national finances so that the elderly are protected, while at the same time the young are not overly burdened paying for it?

The problem is that the reforms suggested so far fall on today’s working generation. For example, the age at which you will qualify for the state pension is rising steeply. That’s an inevitable consequence of improved longevity, but one that will hit people in their late 50s, especially women, hard, not the existing retired. Another widely mooted reform is to slash pension tax relief, but the losers there are again the existing working population. Should better-off pensioners be expected to pay more as well? Maybe. But as we know from the referendum result, the old vote and the young don’t.

Breedlove is a nasty piece of work. So is NATO.

• Hacked Emails Reveal US NATO General Plotting Against Obama (Intercept)

Retired U.S. Air Force Gen. Philip Breedlove, until recently the supreme commander of NATO forces in Europe, plotted in private to overcome President Barack Obama’s reluctance to escalate military tensions with Russia over the war in Ukraine in 2014, according to apparently hacked emails from Breedlove’s Gmail account that were posted on a new website called DC Leaks. Obama defied political pressure from hawks in Congress and the military to provide lethal assistance to the Ukrainian government, fearing that doing so would increase the bloodshed and provide Russian President Vladimir Putin with the justification for deeper incursions into the country.

Breedlove, during briefings to Congress, notably contradicted the Obama administration regarding the situation in Ukraine, leading to news stories about conflict between the general and Obama. But the leaked emails provide an even more dramatic picture of the intense back-channel lobbying for the Obama administration to begin a proxy war with Russia in Ukraine. In a series of messages in 2014, Breedlove sought meetings with former Secretary of State Colin Powell, asking for advice on how to pressure the Obama administration to take a more aggressive posture towards Russia.

“I may be wrong, … but I do not see this WH really ‘engaged’ by working with Europe/NATO. Frankly I think we are a ‘worry,’ … ie a threat to get the nation drug into a conflict,” Breedlove wrote in an email to Powell, who responded by accepting an invitation to meet and discuss the dilemma. “I seek your counsel on two fronts,” Breedlove continued, “… how to frame this opportunity in a time where all eyes [sic] on ISIL all the time, … and two,… how to work this personally with the POTUS.”

Unbelievable. Australians themselves need to address their government’s despicable behavior.

• Australia Accused Of Torturing, Waterboarding Refugees (Ind.)

[..] in a devastating critique of Australia’s methods, medical ethicists have warned there is “increasing evidence that Australia is engaged in torturing asylum seekers” with refugees imprisoned for more than a year without trial. There are allegations of waterboarding, another method of torture called “zipping” in which people are tied to a bed that is then thrown into the air, sexual assault and exploitation, and child abuse. And the inmates of detention centres created outside of Australia to avoid its laws are held in conditions of secrecy that prevent scrutiny of their treatment while laws prevent doctors speaking out about mistreatment.

Last year, a United Nations report accused Australia of breaking the Convention Against Torture over its treatment of migrants. The then Prime Minister, Tony Abbott, responded that “Australians are sick of being lectured to by the United Nations”, saying their policies had stopped refugee boats from trying to make the perilous sea journey to Australia and “ended the deaths at sea”. In a paper in the Journal of Medical Ethics, the ethicists, Dr John-Paul Sanggaran, of the University of New South Wales, and Professor Deborah Zion, of Victoria University, wrote that there was “increasing evidence that Australia is engaged in torturing asylum seekers”.

“There are allegations of situations, circumstances and actions that also constitute cruel and unusual punishment throughout Australian immigration detention,” they wrote. They pointed to allegations by guards at a detention centre on the island of Nauru “of waterboarding, familiar to most as a torture technique that simulates drowning used by the CIA in places like Guantanamo bay”. “‘Zipping’ is also alleged. It is described as tying an individual to a metal bed frame with cable ties, the bed is then thrown into the air causing injury to the bound individual when the frame crashes to the ground,” they added.