Caravaggio I musici 1595-96

Elon Musk speaks after his SpaceX Dragon spacecraft returned two stranded astronauts, Butch Wilmore and Suni Williams, to Earth after spending over 9 months at the International Space Station. pic.twitter.com/emSgFDlKwq

— America (@america) March 19, 2025

https://twitter.com/AutismCapital/status/1902175105305981196

https://twitter.com/VigilantFox/status/1902173370579337700

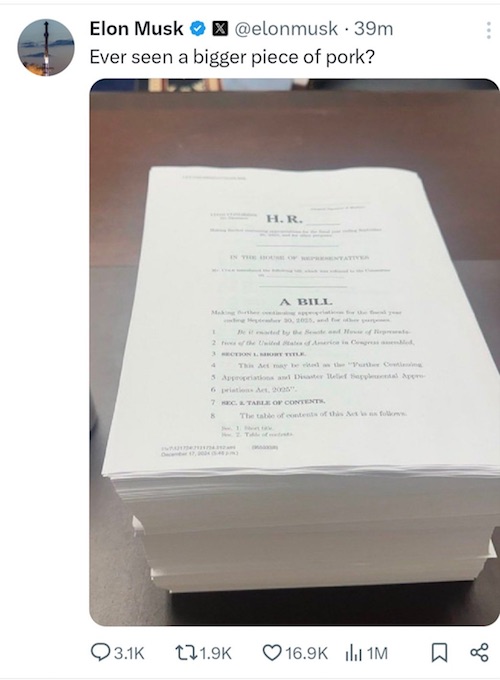

ELON ON FOX NEWS: FULL INTERVIEW

Here's the full interview of Elon Musk by Sean Hannity on Fox News earlier today about returning astronauts from the space station and facing hatred and violence.

0:24 Successful astronauts return

0:51 SpaceX's beginnings

3:19 Dangers of… pic.twitter.com/o0ihiittRP— ELON CLIPS (@ElonClipsX) March 19, 2025

Rogan Musk

Joe Rogan and Elon Musk talk about how Democrats were qualifying illegal migrants for Social Security and Disability FOR LIFE

Joe Rogan “It was using social security money — She was in charge of turning illegal immigrants into clients. That's what they would call them. She would… pic.twitter.com/rpiC0nPbzA

— Wall Street Apes (@WallStreetApes) March 18, 2025

Sachs

"Netanyahu is our greatest, disastrous president of the 21st century, he ran American foreign policy for 20 years, and cost us trillions of dollars.

Israel is using the U.S. as if our military is in their hands, and in effect it is."

– Jeffrey Sachs

pic.twitter.com/0n7Vd4PNax— ADAM (@AdameMedia) March 18, 2025

Bessent

NEW: Hunter Biden IRS whistleblowers Gary Shapley and Joe Ziegler have been promoted to leadership positions at the Treasury Department.@SecScottBessent: "I decided I would bring them into Treasury, give them a year to investigate the wrongdoing that is going on at the IRS."… pic.twitter.com/WWsuLBPm2z

— KanekoaTheGreat (@KanekoaTheGreat) March 18, 2025

American Academy

https://twitter.com/i/status/1902100705969594607

“According to Witkoff, more progress was made on March 18 than in the “last three and a half years,..

• Ukraine Ceasefire ‘Within Weeks’ – Steve Witkoff (RT)

A complete ceasefire in the Ukraine conflict will likely be implemented within “a couple of weeks,” US President Donald Trump’s special envoy, Steve Witkoff, has stated. He also said that sanctions imposed by Washington on Moscow could be relaxed once they reach such an agreement. Commenting on the phone call on Tuesday between Trump and his Russian counterpart, Vladimir Putin, Witkoff hailed the conversation as “epic” and “transformational.” “President Trump and President Putin were in sync with one another, the call was outcome-oriented,” the official said. He confirmed that the two leaders agreed on a “cessation of attacks on energy infrastructure, from both [Russia and Ukraine], and civilian infrastructure for that matter.” Trump and Putin also undertook to work “toward a Black Sea moratorium on hits on naval vessels and freighters carrying grain and things of that sort.”

Witkoff expressed hope that these initial steps would “evolve into a full-on ceasefire, which is a bit more complicated because there is a 2,000-kilometer border, there’s [Russia’s] Kursk [Region], and there’s a lot of details that go into that.” Commenting on the Russian Defense Ministry’s report that its air defenses had shot down their own drones headed for Ukrainian energy infrastructure after receiving an order to halt such attacks overnight, Trump’s special envoy told Bloomberg TV, “I tend to believe that President Putin is operating in good faith.” According to Witkoff, more progress was made on March 18 than in the “last three and a half years,” with important “trust-building” steps being taken now. President Trump and President Putin “went into how you would put the finishing touches on a full-on ceasefire,” with technical teams expected to meet in Saudi Arabia beginning next Monday or Tuesday, the White House envoy revealed.

“I actually think in a couple of weeks, we’re gonna get to [a ceasefire],” Witkoff told the outlet. When asked about a possible in-person Trump-Putin meeting in Saudi Arabia, the US official said that “my best bet would be that it’s likely to happen.” He reiterated that the two heads of state have a “great rapport,” dating back to Trump’s first term in office, which was “on display yesterday.” While the two leaders “did not discuss specifically sanctions yesterday… everybody is open” to such a conversation down the road, Witkoff added. Once a ceasefire in Ukraine takes hold, “everything else will be a detail: sanction relief and all the other things that go with a full-on peace treaty,” he predicted.

“Following Putin’s order the Russian military had to shoot down seven of its own kamikaze drones launched at Ukrainian energy facilities..”

• Zelensky Makes New Victory Promise (RT)

Ukraine’s Vladimir Zelensky on Wednesday reiterated his pledge to achieve a victory over Russia, as he touted an upcoming phone call with US President Donald Trump. Zelensky made the remarks during a press conference alongside Finnish President Alexander Stubb, during which he expressed hope that Trump will brief him on Tuesday’s talks with Russian President Vladimir Putin. “Today I will have contact with President Trump. We will discuss the details with him today. I am thinking about the details of the next steps. Well, and I think I will hear from him the details of his conversation with Putin,” Zelensky stated, reiterating his determination to achieve a victory. “And we live, we defend ourselves, we survive, we fight for our sovereignty and our independence. And we will definitely win this war,” he said.

The conversation between Putin and Trump lasted for 2.5 hours, during which the presidents focusing on the Ukrainian crisis and ways to resolve it. Putin backed Trump’s proposal of a mutual 30-day suspension of strikes on energy infrastructure facilities and repeatedly “immediately” ordered a halt to such strikes, according to the Russian defense ministry. Zelensky publicly backed the idea shortly after the Trump-Putin talks concluded. However, he expressed concerns about how exactly the pause could be implemented. “If Russia stops striking our targets, we will definitely stop hitting targets in Russia. But Putin’s promises alone are not enough; there must be control. The main subject of this control must be the US,” he said during the press conference.

Following Putin’s order the Russian military had to shoot down seven of its own kamikaze drones launched at Ukrainian energy facilities. A few hours after the Putin-Trump talks concluded, Kiev attacked a Russian oil pumping station with three fixed-wing kamikaze drones. The attack sparked a massive fire at the facility, the military noted, describing the incident as “yet another provocation deliberately staged by the Kiev regime to derail the peace initiatives coming from the US president.”

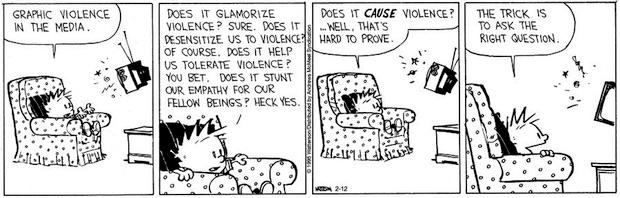

“..the acute onset of paranoia in otherwise normal persons that is in reaction to the policies and presidencies of President Donald J. Trump.”

• Trump Derangement Syndrome Could Be Recognized As A Mental Illness (RT)

Republican lawmakers in Minnesota have introduced a bill seeking to amend state law to classify ‘Trump Derangement Syndrome’ (TDS) as a mental disorder. The proposal defines TDS as a condition affecting individuals who react irrationally to US President Donald Trump’s policies and presidency. The term ‘Trump Derangement Syndrome’ has been widely used by Trump supporters and conservative commentators to describe strongly negative reactions to the Republican leader. The Minnesota bill was introduced on Monday by five GOP lawmakers who proposed adding TDS to the state’s official list of mental disorders, defining it as “the acute onset of paranoia in otherwise normal persons that is in reaction to the policies and presidencies of President Donald J. Trump.”

The text of the bill claims that TDS can manifest in behaviors such as “verbal hostility or acts of aggression against those with differing political opinions.” The proposal further suggests that individuals with TDS struggle to differentiate between political disagreements and psychological conditions. Senator Glenn Gruenhagen, one of the bill’s authors, defended the proposal, arguing that the “irrational behaviour” exhibited by some Trump critics indicates a “deeper psychological problem” and that the bill seeks to address this issue, “not mere political disagreements.” “We should be able to have civil debates without demonstrating violent and unreasonable reactions such as burning down Tesla dealerships, threatening people who wear Trump hats or committing road rage at the sight of a Trump bumper sticker on a person’s car,” the senator wrote in a Facebook post.

At the same time, Gruenhagen has acknowledged that despite its introduction, the bill is unlikely to pass the Minnesota Senate where Democrats hold a narrow majority. “Of course, we all know that the Democrats and Governor Walz will never allow this bill to pass anyway, so take a deep breath and calm down,” he wrote, referring to the outrage stirred by the bill in the Minnesota Capitol. Critics of the term TDS have argued that it is a rhetorical tool used to dismiss legitimate criticism of Trump’s policies and behavior. Some have also pointed out that the label could apply to Trump supporters who react aggressively to opposition against him.

Nothing could trigger Trump Derangement Syndrome more than merely mentioning this:

• Trump Will Run Again In 2028 – Steve Bannon (RT)

President Donald Trump will find a way to bypass America’s constitutional two-term limit and run again in 2028, former White House strategist Steve Bannon has said. The 22nd Amendment to the US Constitution states that “no person shall be elected to the office of the President more than twice.” Bannon, however, who led Trump’s 2016 election campaign, has argued that Trump would be able to secure a third term. “I’m a firm believer that President Trump will run again in 2028. I’ve already endorsed President Trump,” Bannon told NewsNation’s Chris Cuomo on Wednesday. “A man like this comes along once every century if we’re lucky. We’ve got him now. He’s on fire, and I’m a huge supporter. I want to see him again in 2028,” he added. When asked how Trump would bypass the constitutional ban on a third term, Bannon replied, “We’re working on it.”

“I think we’ll have a couple of alternatives, let’s say that. We’ll see what the definition of term limit is,” the former Breitbart News chairman said. “We’ve had greater longshots than Trump 2028. We’ve got a lot of stuff we’re working on. We’re not prepared to talk about it publicly.” When asked if he was implying a violent revolution or an insurrection, Bannon said, “No. We are big believers in democracy.” The strategist said that the Trump supporters intend to mobilize their voting base, including low-propensity and low-information voters. Trump has repeatedly joked about the possibility that he could serve more than two terms. In January, he told a crowd of supporters in Nevada, “It will be the greatest honor of my life to serve, not once but twice or three times or four times.”

Earlier this year, Republican Congressman Andy Ogles proposed to amend the Constitution to allow presidents who did not serve two consecutive terms to serve three terms in total. “It is imperative that we provide President Trump with every resource necessary to correct the disastrous course set by the Biden administration,” Ogles said in January. Trump was first elected in 2016, defeating former Secretary of State Hillary Clinton. He ran for reelection in 2020 but lost to former Vice President Joe Biden. Trump won his second term last year, defeating Biden’s hand-picked successor, Kamala Harris. The two-term restriction was included in the US Constitution in response to Franklin D. Roosevelt serving an unprecedented four terms in office. Before him, presidents had only served one or two terms.

“Russia is willing to incur significant losses and take substantial risks in order to defend its fundamental security interests. It is not willing to back away,..”

• Here’s Why Trump Is Talking Peace With Putin (Timofeev)

Tuesday’s talks between Russian President Vladimir Putin and US President Donald Trump have marked a shift towards the resolution of the Ukraine conflict. However, given the number of unresolved issues, the results are still unclear and a setback could occur at any moment. The flaws in the European security system will continue to jeopardize prospects for normalization for a long time. Nonetheless, the window of opportunity for achieving peace is still open. The motivation to leverage these circumstances is shaped by the results that Russia has achieved in its military operation so far, as well as the potential scenarios that could unfold for both sides if the conflict continues.

Among the key results, we may note Russia’s readiness to use force to defend its interests in Europe. For three decades following the conclusion of the Cold War, Moscow’s ability to protect its interests using force was often dismissed. The military operation in Ukraine put an end to this misconception. It has demonstrated that security relations with the West had become so complicated that, from Russia’s perspective, there appeared to be no other option. It became clear that the use of force and a large-scale conflict in Europe were real possibilities, so Moscow’s demands and concerns couldn’t be brushed aside with vague reassurances. Russia is willing to incur significant losses and take substantial risks in order to defend its fundamental security interests. It is not willing to back away, even if it can save face by doing so.

In the field of diplomacy, it’s notable that the non-Western countries have not formed any major anti-Russia coalitions. The Western bloc, united against Russia, has failed to pull in additional players. China, India, Brazil, South Africa – and others – have distanced themselves from sanctions policies. While businesses in these nations are wary of the secondary sanctions that could be imposed by the US and are not always eager to engage with our country, their governments have avoided imposing anti-Russia measures.

Trade with many nations in the Global South has surged. These countries have neither adopted a pro-Russian stance, nor formed a unified anti-Western front. However, discussions about diversifying global finance, trade, and political institutions have gained considerable traction. Ultimately, the resilience of the Western coalition has begun to falter. The new US administration seems to have recognized that the conflict has reached a dead end and has taken preemptive steps to end it.

Among the diplomatic outcomes, we may note Moscow’s ability to contain the escalation of military support for Ukraine. For an extended period of time, Russia’s ‘red lines’ were often crossed, as it struggled to halt increasing weapons supplies to Ukraine. These deliveries increased, with weapons systems becoming more long-range and lethal. Changes in Russia’s nuclear doctrine and the deployment of a new medium-range missile with a non-nuclear configuration have provided a crucial deterrent signal against the potential mass use of Western cruise missiles and other weapons systems by Ukraine.

Another significant outcome has been the ability to engage in a large-scale conflict with an opponent that has received substantial Western support in the form of weapons, intelligence, and funding. Russia’s defense industry has managed to maintain a high pace and scale of operations, quickly adapting to the new challenges posed by advancements in military technology, including the production and use of drones. At the same time, Moscow has essentially maintained an expeditionary approach in its military actions, avoiding extensive mobilization and instead relying on military volunteers and contract soldiers. The ability to conduct a large-scale and sustained military operation with a professional, rather than conscripted army has been a key interim achievement.

In Europe, that is.

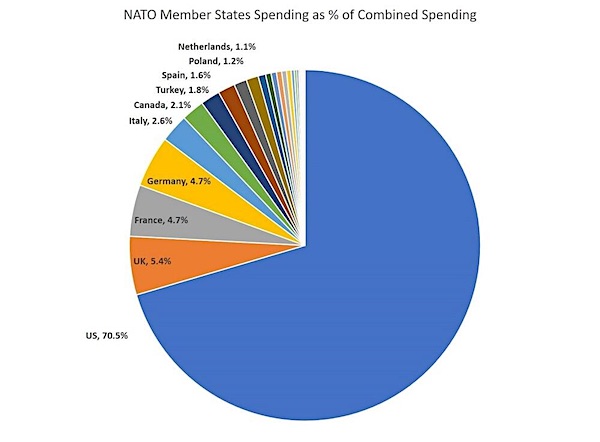

• Trump Looking To Give Up US Command of NATO – NBC (RT)

US President Donald Trump is reportedly considering giving up Washington’s exclusive role in leading NATO’s military command, NBC News has claimed, citing defense officials. The outlet said Trump is exploring the possibility of relinquishing control of the office of Supreme Allied Commander Europe (SACEUR), which has been held by a US four-star general since the bloc’s founding in 1949. The SACEUR is tasked with overseeing NATO military operations in Europe. The position is currently held by Gen. Christopher G. Cavoli, who has also been in charge of NATO’s coordination of military assistance to Kiev throughout the Ukraine conflict.

If the US does give up ownership of the role, it would likely be filled by one of NATO’s European member states. According to NBC, Trump weighing the move is part of a broader effort to restructure US military commands and reduce defense expenditures. The report states that his administration has been looking into cutting costs within the Department of Defense. Over the years, Trump has repeatedly criticized NATO. Following his inauguration in January, he urged European bloc members to increase their defense spending and warned that the US would not be responsible for defending NATO countries that do not meet their financial obligations.

Trump has also claimed that NATO’s expansion and its outreach to Ukraine under former US President Joe Biden were among the factors that led to the current conflict. Russia has consistently condemned NATO expansion towards its borders, describing the bloc as a threat to its national security. Russian officials, including President Vladimir Putin, have also repeatedly stressed that NATO’s push to include Ukraine was one of the root causes behind the escalation of the conflict in 2022. The NBC report did not specify whether Trump has made a final decision on relinquishing the SACEUR position, and the extent to which the proposal is under consideration remains unclear. The US Defense Department has also not commented.

“American ownership of those plants would be the best protection for that infrastructure..”

• Trump Wants US Ownership Of Ukraine’s Energy Facilities – White House (RT)

US President Donald Trump has proposed an American takeover of Ukrainian power plants, suggesting it would be the best way to protect the infrastructure, the White House has revealed. The idea was floated by Trump during a phone conversation with Ukraine’s Vladimir Zelensky on Wednesday, described by the US president as a “very good” call. “President Trump also discussed Ukraine’s electrical supply and nuclear power plants. He said that the United States could be very helpful in running those plants with its electricity and utility expertise. American ownership of those plants would be the best protection for that infrastructure and support for Ukrainian energy infrastructure,” according to a statement by US Secretary of State Marco Rubio and National Security Adviser Mike Waltz released shortly after the call.

The Trump-Zelensky phone call comes a day after the US president held a conversation with his Russian counterpart Vladimir Putin. They discussed the Ukraine crisis, with Trump floating the idea for Moscow and Kiev to halt long-range strikes on energy infrastructure. Putin backed the proposal and ordered a halt to such strikes immediately. The Russian military said it had to shoot down seven kamikaze drones en route to Ukrainian energy facilities when the order was issued. Ukraine’s leader has publicly backed the idea as well, albeit expressing concerns about how exactly the truce would be implemented and monitored. Following the phone talk with Trump, Zelensky appeared to offer a broader definition of targets that should be avoided during the period, including unspecified “civilian infrastructure.”

“One of the first steps toward fully ending the war could be ending strikes on energy and other civilian infrastructure. I supported this step, and Ukraine confirmed that we are ready to implement it,” Zelensky said in a statement. Overnight, Kiev attacked an oil pumping facility in Russia’s south with three fixed-wing drones. The strike sparked a massive blaze at the site, the Russian military said. The attack was “yet another provocation deliberately staged by the Kiev regime to derail the peace initiatives coming from the US president,” the Russian Defense Ministry said.

“..Lavrov said earlier this month that the Trump administration is “guided by common sense. They say outright that they want to end all wars, they want peace. And who demands a continuation of the banquet in the form of a war? It is [Western] Europe.”

• Italy and Spain Reject EU’s Ukraine Spending Hike – Reuters (RT)

The EU’s third and fourth largest economies – Italy and Spain – are skeptical about the bloc’s idea of doubling military aid to Ukraine, Reuters has reported. Proposed by renowned Russia hawk and EU foreign policy chief Kaja Kallas, the plan would increase the bloc’s cashflow to Kiev from €20 billion ($20,9 billion) last year to €40 billion ($43,7 billion) in 2025. Following a meeting of EU foreign ministers on Monday, Kallas acknowledged that her proposal had “broad,” but not unilateral, support among the 27 member states. She has been pushing for more EU aid to Kiev amid concerns in Brussels that US President Donald Trump could stop the flow of American arms to the government of Vladimir Zelensky.

Earlier this year, Kallas, along with NATO chief Mark Rutte urged EU members against prioritizing social welfare over military spending, arguing that billions already invested in healthcare, education and other areas would be “at risk” if the bloc is unable to defend itself from a supposed “Russian threat.” The idea of ramping up EU military aid to Ukraine has “strong backing” from northern and eastern European countries, the agency said in an article on Monday, citing diplomatic sources. However, some southern European capitals, further away from the Russian border, have been “more reticent,” it noted. Speaking before the meeting in Brussels, the foreign ministers from Italy and Spain made it clear that it was too early to take a definitive stance on Kallas’ proposal, Reuters said.

Italian FM Antonio Tajani said that the decision on doubling aid to Kiev should be made taking into account the progress in the talks between Moscow and Washington. He also noted that Rome needed money to increase its own defense spending. Spain’s top diplomat Jose Manuel Albares reminded that Madrid did not wait for Kallas to make her proposal and had already committed to providing 1 billion euros (around $1.1 billion) in military aid to Ukraine this year. Even France, which has been one of the strongest backers of Ukraine during the conflict with Russia, has questions about Kallas’ plan, according to the diplomats.

During the ministers’ discussions, Hungary and Slovakia, who have long been critical of EU military assistance to Kiev, said that they will not participate in the initiative, Reuters said. EU officials have assured Reuters that Budapest and Bratislava would not be able to block Kallas’ proposal as increased contributions to Ukraine would be voluntary. Russian Foreign Minister Sergey Lavrov said earlier this month that the Trump administration is “guided by common sense. They say outright that they want to end all wars, they want peace. And who demands a continuation of the banquet in the form of a war? It is [Western] Europe.”

“Howell predicted the end of the Democrat Party, which he said will meet its demise “defending terrorists, transgenders, and autopens.“

• Biden Autopen Actions ‘Non-Delegable’ and ‘Invalid,’ Legal Analysis Finds (DS)

The pardon authority is the president’s alone and cannot be delegated, according to a legal analysis by The Heritage Foundation’s Oversight Project. The watchdog group—which first conducted an analysis of former President Joe Biden’s White House use of autopen—released a memo late Monday night on the matter, bringing the numerous acts of clemency into question. “Every leftist who shrieked, whined, and moaned about defending democracy is a complete hypocrite if they are not outraged by the antidemocratic action on the scale of presidential actions enacted by people who were never elected to anything,” Oversight Project Executive Director Mike Howell told The Daily Signal Tuesday. Howell added, “The pardons are as valid as a $3 bill.”

The legal analysis came after President Donald Trump, based on the Oversight Project’s investigative work, said he would nullify the pardons. Pardons included members of Biden’s family, members of the House Jan. 6 committee, former National Institute of Allergy and Infectious Diseases Director Dr. Anthony Fauci, and former Chairman of the Joint Chiefs Gen. Mark Milley. “If President Biden’s non-delegable official actions were not his own, then they are invalid,” the analysis says. “Start with the Constitution. Multiple Constitutional provisions, like the pardon power, vest those powers solely in the president. In those cases, the president affixing his signature is his execution of the acts as president.” The use of the autopens occurred amid broad speculation about whether Biden had enough cognitive capacity to carry out the job of president.

An early 2024 Justice Department report by special counsel Robert Hur—regarding Biden’s handling of classified information—found Biden had “diminished faculties” during the counsel’s interview. Biden’s own Democrat Party eventually forced him off the 2024 ticket during last year’s election. Howell predicted the end of the Democrat Party, which he said will meet its demise “defending terrorists, transgenders, and autopens.” “If we have autopen, we don’t really need them anyway,” Howell said. The use of autopen is not new for presidents and staffers, but has traditionally been for minor or routine proclamations. Howell stressed that after the John F. Kennedy assassination, the 25th Amendment was enacted to ensure a process is in place if an incapacitated president is not able to serve. In this case, the autopen was misapplied, Howell said.

“This was a device used as a workaround of the 25th Amendment,” Howell said. Based on a 2005 Justice Department Office of Legal Counsel finding, it’s permissible to use autopen signatures for legislation. The Oversight Project contends the DOJ was wrong in its conclusion. Nevertheless, the DOJ’s Office of Legal Counsel 2005 opinion states, “we are not suggesting that the president may delegate the decision to approve and sign a bill, only that, having made this decision, he may direct a subordinate to affix the president’s signature to the bill.” The Oversight Project analysis adds, “Thus, the Biden administration’s use of the autopen may well have been contrary even to the most permissive interpretation of the law.”

“The USPS has been bleeding money for a long time, including a whopping $9.5 billion in the last fiscal year..”

• USPS Calls on DOGE for Help, but Is It Too Little Too Late? (PJM)

In D.C., DOGE is the talk of the town. Whether it’s conservatives applauding every move Elon Musk’s governmental organization makes or bureaucrats crying about having to account for their time at work, everybody can’t stop talking about DOGE. This includes the United States Postal Service (USPS), which has authorized DOGE to swoop in and save the day.“The U.S. Postal Service has authorized Elon Musk’s Department of Government Efficiency to help eliminate red tape hurting financial and operational performance in a move Democrats decried but some postal workers say could be beneficial,” reports FreightWaves.“It also gave concrete figures on previously announced force reductions, saying it expects to eliminate 10,000 jobs through a voluntary early retirement program,” the report continues. “Meanwhile, postal workers and community activists this week plan to protest Trump administration expressions of interest in selling the Postal Service to private sector owners.”

The USPS has been bleeding money for a long time, including a whopping $9.5 billion in the last fiscal year. Yet shipping prices keep going up while service has been dissatisfactory for millions of Americans. Postmaster General Louis DeJoy, who is leaving his office once the Trump administration identifies a successor, has been trying to turn things around for about three years. He set out to make the USPS profitable by the end of this decade, although it sounds like a fool’s errand of the highest order. DeJoy told lawmakers last week that he signed an agreement with DOGE and the General Services Administrations to identify inefficiencies and, as FreightWaves reports, “tackle big challenges related to retirement benefit calculations and investments, which have been a drag on Postal Service finances, and reform the Postal Regulatory Commission.”

“The Postal Service once faced the immediate threat of insolvency, which would have required a taxpayer bailout…” DeJoy wrote to congressional leaders. “Our efforts have provided a lifeline to our organization and [a pathway that is] financially sustainable. I ask that you please engage with the Postal Service, our DOGE representatives, and the federal agencies that need… to correct for the deficiencies of the past.” DeJoy believes that fixing accounting errors and revamping pension and worker’s compensation programs will help the USPS become more solvent, which is why he’s seeking DOGE’s help. He also believes that cutting burdensome regulations can save money. But, naturally, Democrats and left-wing media outlets are up in arms.

“As you explain in the letter, this agreement authorizes DOGE to ‘assist’ the Postal Service, presumably in making drastic cuts to Americans’ mail service and firing thousands of postal employees,” Rep Gerry Connolly (D-Va.) carped in a press release disguised as a “letter” to DeJoy. “The actions of employees operating under the ‘DOGE’ moniker have thus far been shielded from transparency and accountability, but this cannot continue.” “This backroom agreement between the billionaire-led DOGE and Postmaster DeJoy sets off alarm bells about this administration’s plans for the Postal Service’s role as a cornerstone public institution,” complained a bunch of Democrats in another letter. (These folks love them some letters.) And the Daily Beast rushed out with the breathlessly melodramatic headline, “USPS Chief Calls in DOGE to Slash Your Local Post Office.”

I looked it up. There are 677 district judges in the US.

• The Judiciary Is Attempting to Seize Executive Power (Paul Craig Roberts)

Biden judge Tanya Chutkan orders EPA not to obey a presidential order to terminate waste, fraud, and abuse. Chutkan was admonished by the US Supreme Court last June for ignoring presidential immunity and rushing a politically motivated case against Trump just prior to election season. Biden judge Ana Reyes ordered the Defense Department not to enforce a presidential directive to ban transgender people from serving in the military. No Democrat judge blocked the Biden Defense Department’s order to put promotions of white heterosexuals on hold while transgendered, homosexual, and blacks were promoted in their place.

Obama judge James Boasberg ordered planes in flight deporting dangerous immigrant-invader gang members to return the illegal aliens to the US. President Trump called for the lunatic judge’s impeachment, and Republican Supreme Court justice Roberts (no relation) upbraided Trump. Boasberg’s order is especially egregious as is Justice Roberts upbraiding of Trump. It seems neither Boasberg nor Roberts are sufficiently competent to know that the US Supreme Court has previously ruled that deportations under the Alien Enemy Act are not subject to judicial review.

I predicted that the judiciary would be the main obstacle to American renewal. So many incompetent and unqualified people have been put on the bench that the judiciary is an obstacle to governance. So many judges have been put on the bench because of where they stand on liberal causes such as abortion and who use judicial rulings to legislate their personal preferences that the institution of the judiciary is a dangerous threat to the United States. The only solution is to ignore the corrupt judiciary, or perhaps they should all be removed and we start over. The US judicial system is so cumbersome that an appeal of a ruling against a president can take longer than a presidential term. This makes it so easy for ideological judges to prevent governance.

Bring the lawfare!

• Trump to Sign Order to Eliminate Department of Education (ET)

President Donald Trump is expected to sign an executive order on March 20 that will facilitate the dismantling of the U.S. Department of Education, taking a step toward fulfilling a campaign pledge. The order, which has been under preparation for weeks, will be signed at a White House event with several Republican governors and state education commissioners in attendance, as confirmed by the White House. The plan was first reported by USA Today. Trump will direct his recently confirmed Education Secretary Linda McMahon to take all required steps to prepare for the closure of the Education Department and transfer its authority to the states, according to a White House fact sheet obtained by NTD TV, sister media of The Epoch Times.

According to the fact sheet, the order also aims to ensure that, throughout the process, there is no disruption in the delivery of services, programs, and benefits that Americans rely on. The order also instructs that any programs or activities receiving remaining Department of Education funds will not promote diversity, equity and inclusion (DEI) or gender ideology. The Department of Education did not immediately respond to a request for comment. McMahon, confirmed by the Senate on March 3, said in her first message to employees—titled “Our Department’s Final Mission”—that her “vision is aligned with the president’s: to send education back to the states.”

She added, “Our job is to respect the will of the American people and the President they elected, who has tasked us with accomplishing the elimination of bureaucratic bloat here at the Department of Education—a momentous final mission—quickly and responsibly.” The Department of Education employed about 4,200 workers before its recent termination of around 1,300, and the buyout of another 600. The agency’s current form stems from a 1979 law that made it independent by splitting it from the Department of Health, Education, and Welfare. The federal government’s role in education, according to the White House, has failed students, parents, and teachers.

National Assessment of Educational Progress (NAEP) scores demonstrate that student achievement has not improved, despite more than $3 trillion invested since the Department of Education’s inception in 1979, according to the fact sheet. Trump promised on the campaign trail to abolish the Department of Education, alleging it is responsible for indoctrinating America’s youth. On Feb. 4, Trump cited global rankings that have the United States behind many other countries, despite spending the most per student. He suggested at the time that he could work with Congress and teachers’ unions to abolish the agency but also did not rule out issuing an executive order.

It’s Judge Tanya Chutkan again!

• Judge Temporarily Blocks EPA From Canceling Climate Grants (ZH)

A federal judge on March 18 blocked the Environmental Protection Agency (EPA) from terminating grants that were part of a $20 billion climate funding program created by the previous administration. In a 23-page ruling, U.S. District Judge Tanya Chutkan issued a temporary restraining order to prevent the EPA from terminating grants awarded to three environmental groups—Climate United, Coalition for Green Capital, and Power Forward Communities—and block Citibank from transferring the funds back to the government. According to the court ruling, the EPA explained that it was terminating the grants because of multiple ongoing investigations into “programmatic waste, fraud, and abuse and conflict of interest.” Chutkan said the evidence was insufficient, as the agency failed to provide specific information about the investigations, factual support for the decision, or an individualized explanation for each plaintiff.

“Based on the record before the court, and under the relevant statutes and various agreements, it does not appear that EPA Defendants took the legally required steps necessary to terminate these grants, such that its actions were arbitrary and capricious,” the judge wrote. Chutkan said the plaintiffs would face imminent harm if Citibank were to transfer the funds—which they use to pay staff, rent, and fund projects—out of their accounts, as the money would be unrecoverable by then. The judge stated that the plaintiffs have no cash or reserves available to cover their operating expenses and have no other committed sources of funding that could replace the grants. Climate United was awarded $6.97 billion, the Coalition for Green Capital received $5 billion, and Power Forward Communities received $2 billion last year through the Greenhouse Gas Reduction Fund, which was created under the Inflation Reduction Act.

Their grants, held by Citibank, were part of the $20 billion in funding the Biden administration awarded to eight entities for projects aimed at curbing pollution. The three nonprofits filed the lawsuit on March 8 after Citibank withheld their funding and their grants were terminated. The plaintiffs alleged that the EPA’s decision to terminate their grants was unlawful. Climate United CEO Beth Bafford said in a statement that the preliminary injunction was “a strong step in the right direction” for their legal challenge against the EPA. “In the coming weeks, we will continue working towards a long-term solution that will allow us to invest in projects that deliver energy savings, create jobs, and boost American manufacturing in communities across the country,” Bafford stated.

Commenting on the ruling, EPA administrator Lee Zeldin said the former Biden administration awarded the grants to “politically connected” nonprofit organizations “in a manner that deliberately reduced the ability of EPA to conduct proper oversight.” Zeldin vowed to claw back the funding and ensure that “every penny EPA spends” is directed toward its core mission of protecting human health and the environment. “I will not rest until these hard-earned taxpayer dollars are returned to the U.S. Treasury,” the EPA head said in a statement. Zeldin said last month that the EPA had decided to rescind the grants for climate and clean-energy projects because of concerns over lack of oversight and transparency.

“We are still commissioners. We’re suing to make that clear for everyone..”

• Trump Fires Democrat FTC Commissioners (ZH)

President Trump has fired the two Democrats sitting on the Federal Trade Commission. Rebecca Slaughter – a former legal advisor to Sen. Chuck Schumer (D-NY), and Alvaro Bedoya – a former Georgetown official, were informed by the White House that the president was terminating their positions at the FTC, which enforces consumer protection and antitrust laws. The Commission typically has five members, with the president’s party holding three seats and the opposing party two. Slaughter and Bedoya say they plan to challenge their dismissals in court. “Today the president illegally fired me from my position as a federal trade commissioner, violating the plain language of a statute and clear Supreme Court precedent,” said Slaughter, who Trump nominated to the FTC during his first term in 2018. “Why? Because I have a voice. And he is afraid of what I’ll tell the American people.”

Former FTC Commissioners Rebecca Kelly Slaughter (L) and Alvaro Bedoya (R) say they plan to sue President Trump’s administration over their firings. Bedoya wrote on social media, “I’m a commissioner at the Federal Trade Commission. The president just illegally fired me,” adding that Trump wants the FTC to be “a lapdog for his golfing buddies.” “We are still commissioners. We’re suing to make that clear for everyone,” Bedoya said in a follow-up statement reported by Fox News. FTC Chairman Andrew Ferguson, a Republican first appointed by President Biden and recently made chairman by Trump, said he sees no issues with the firings. “President Donald J. Trump is the head of the executive branch and is vested with all of the executive power in our government,” Ferguson wrote. “I have no doubts about his constitutional authority to remove commissioners, which is necessary to ensure democratic accountability for our government.”

“I wish Commissioners Slaughter and Bedoya well, and I thank them for their service,” he added.The FTC firings are set to become yet another test to the limits of Trump’s executive authority, as Democrats who don’t get their way can simply go venue shopping for an activist judge who will halt, even if temporarily, various decisions by the executive branch. Last week, US District Court Judge James Boasberg issued a 14-day restraining order to immediately halt several planes full of Tren de Aragua gang members under the Alien Enemies Act of 1798 – which the Trump administration ignored since the planes were over international waters at the time.

“..what matters is off the record. And that might as well have been Iran.”

• A Hard Rain’s a-Gonna Fall – From The West Down To The East (Pepe Escobar)

Let’s start with that phone call. The is quite sober – but it does reveal a few nuggets. There is no comprehensive deal – yet – between Moscow and Washington. Far from it: we are just in the initial tentative stage of talking and talking about several interconnected dossiers. President Putin gave absolutely nothing away. The agreed-upon pause on attacks on energy infrastructure – not energy and (italics mine) infrastructure – spells out as Putin imposing a stop on dangerous Ukrainian hits on the Zaporizhzhia nuclear plant. That may be lost among all the Western hysteria; but there are two absolute conditions expressed by Moscow for anything in this riddle to start complying with objective reality – and not muddle along as a reality show narrative trainwreck:

1.“The settlement in Ukraine must take into account the unconditional need to eliminate the root causes of the crisis, Russia’s legitimate security interests.”

2.“The key condition for preventing the escalation of the conflict should be a complete cessation of foreign military aid and the provision of intelligence information to Kiev.”U.S. special envoy Witkoff is spinning that ceasefire “details” will be ironed out on Sunday in Saudi Arabia. No matter the amount of shrieking, Kiev will have to accept it. Putin-Trump did not spend over 2 hours just talking hockey, hazy Black Sea navigation prospects and a quite limited energy infrastructure missile strike one-month pause. In this incandescent juncture, what matters is off the record. And that might as well have been Iran. And the prospect of serious Hard Rain fallin’.

I’ve stepped in the middle of seven sad forests

I’ve been out in front of a dozen dead oceans

I’ve been ten thousand miles in the mouth of a graveyardA certain psychopathological entity in West Asia is obsessed to ram all its opponents through the mouth of a graveyard. Putin must have had the chance to explain to Trump that Russia respects the UN Charter and abides by international law. Russia and Iran – top BRICS members – signed a comprehensive strategic partnership last January in Moscow. Russia provides detailed ISR/air defense/EW intel to Tehran. A proverbially hysterical narrative now imprints the notion that Tel Aviv – courting Trump 2.0 backing – is ready to inflict airstrikes on Iran to “prevent it from going nuclear”. Tehran, as detailed by Ayatollah Khamenei, has no interest whatsoever in building a nuclear weapon. There’s no way Russia will allow Israel – with crucial American backing – to wreak havoc on Iran. Even as Tehran is already capable to react to any attack, with devastating consequences. Without nuclear weapons – and even without Russian direct help.

Operation True Promise 2 – True Promise 3 is still on hold – had already demonstrated that Israel is absolutely defenseless against wave after wave of sophisticated Iranian missiles. Were the U.S. under Trump 2.0 to be involved in a direct attack, all U.S. military bases in West Asia would be incinerated, plus severe punishment to vassals hosting these bases. End result: oil prices skyrocketing, massive global economic crisis.

I saw a newborn baby with wild wolves all around it

I saw a room full of men with their hammers a-bleedin’

I saw ten thousand talkers whose tongues were all brokenWhile the self-proclaimed peacemaker was on the phone polishing the newest iteration of his Art of the Deal, genocidal psychopathological Zionists with hammers a-bleedin’ were unleashing wild wolves on displaced newborn babies – huddling in tents ablaze in Khan Yunis. And ten thousand EUrotrash talkers with their tongues all broken were mute on genocide but ready to erupt in shrieking delight pledging loyalty – and billions in funds – to the envoy of the former self-proclaimed Emir of Al-Nusra, a moderate head-chopper turned Hugo Boss-clad President. sAll yelled a Eurovision-tinged Sieg Heil to the protégé’s mercenary “army”, duly backed by Qatari, British and European masters: ISIS-clad Salafi-jihadis, al-Qaeda remnants, assorted takfiris, Chechens, Uzbeks, Uighurs, a movable Terror Inc. on tour slashing Alawites, Christians, Shi’ites and even moderate Sunnis, facilitating the evisceration of Syria and the “donation” of large swathes of Syrian sovereign territory to Tel Aviv.

The Zionist SS Brussels Medusa von den Lugen gleefully showered the moderate head-chopper gangs – al-Qaeda R Us – with 2.5 billion euros. It was Qatar that pressured the European Commission (EC) to invite Jolani’s henchman turned Foreign Minister, Asaad al-Shaibani to the 9th Brussels Conference for Donors on Syria – even as at least 7,000 Alawites and Christians were being “slaughtered” by his goons, according to a Greek Member of the European Parliament, Nikolas Farantouris, who visited Damascus on March 8-9 and met, among others, with the Patriarch of the Greek Orthodox Church of Antioch and the Near East.

In parallel the Exceptionalist “peace through strength” circus ringmaster – dubbed across vast swathes of the Arab street as “The Marmalade Moron” – brutally started bombing Ansarallah in Yemen, to force unbowed warriors to ditch their unwavering support for Palestine and wallow in submission. Additionally, “Bomb, bomb, bomb – bomb bomb Iran” was back as the crypto-Beach Boys theme song, because in the end Tehran must by all means be turned into Syria, Jordan, Qatar, UAE, Saudi Arabia, South Yemen: a pitiful Quisling Zionist regime.

The destabilized but not broken Axis of Resistance is fighting titanic, simultaneous battles against the Axis of Genocidal Zion on several fronts: the psycho-killers in Tel Aviv; the Jolani mercenary army in Syria, de facto ground troops of Israel, simultaneously supported, ideologically, by Zionist Arab regimes and assorted Salafi/takfiri Islamic outfits blessing the massacre against Palestinians; the Eurotrash liberal totalitarians, who are financing Jolani; and Washington/Pentagon-bombed Ansarallah in Yemen.

Abdul-Malik al-Houthi, leader of Ansarallah, made it all very clear in his March 16 speech: “Our decision to support the Palestinian people, including our move to block Israeli maritime navigation, that clearly targets the Israeli enemy and no one else, is aimed solely at pressuring Israel to open the crossings, allow the entry of humanitarian aid, and put an end to the starvation of Gaza.”

Deep state.

• The Kingdom of Judea vs. The State of Israel (Alastair Crooke)

Israel is deeply fractured. The schism has become bitter and heated as both sides see themselves to be in an existential war for the future of Israel. The language used has become so venomous (particularly in reserved channels in Hebrew) that calls for a coup and for civil war are far from uncommon. Israel is nearing the precipice and the seemingly irreconcilable differences may soon erupt into civil unrest – as Uri Misgav writes this week, the “Israeli spring” is on its way. The point here is that President Trump’s utilitarian and determinedly transactional style may work effectively in the secular western hemisphere, but with Israel (or Iran) Trump may find little or no traction amongst those with an alternative weltanschauung that expresses a fundamental different concept of morality, philosophy and epistemology, to the classic western deterrence paradigm of material ‘carrots and sticks’.

Indeed, the very attempt to impose deterrence – and to threaten ‘all hell breaking out’ if his injunctions are not followed – may produce the opposite to that which he seeks: i.e. it may trigger new conflicts and wars. An angry plurality in Israel (led for now, by Netanyahu) have taken the reins of power after a long march through the institutions of Israeli society, and now have their sights focussed on dismantling the ‘Deep State’ within Israel. Equally, there is a furious push-back to this perceived take-over. What exacerbates this societal fracture are two things: Firstly, it is ethno-cultural; and second it is ideological. The third component is the most explosive – Eschatology. At the last national election in Israel, the ‘underclass’ finally broke the glass ceiling to win election and to take office. The Mizrahi (Jews from the Middle East and North Africa) have been long treated as the poorer, lower order in society.

The Ashkenazi (European, largely liberal-secular Jews) form much of the urban professional (and until recently) the security class. These are the élites whom the coalition of National Religious and Settler Movement displaced at the last election. This present phase to a long struggle to power perhaps can be put at 2015. As Gadi Taub has recorded, “It was then, Israel’s Supreme Court judges removed sovereignty itself—that is, the power of final decision over the whole realm of law and politics—from the elected branches of government and transferred it to themselves. One unelected branch of government officially holds power, against which there are neither checks, nor balances, by any counterforce”. In the optic of the Right, the self-awarded power of Judicial Review, gave to the Court power, Taub writes, “to prescribe the rules of the political game – and not just its concrete results”.

“Law enforcement then became the huge investigative arm of the press. As was true of the “Russiagate” hoax, The Israel Police and State Attorney were not so much collecting evidence for a criminal trial as they were producing political dirt for leaks to the press”. The ‘Deep State’ in Israel is a consuming point of contention for Netanyahu and his cabinet: In a speech at the Knesset this month – as one example – Netanyahu savaged the media, accusing news outlets of “full cooperation with the deep state” and of creating “scandals”. “The cooperation between the bureaucracy in the deep state and the media didn’t work in the United States, and it won’t work here”, he said.

“In a real “America first” foreign policy we would be following the Russian and Chinese lead and staying out of the conflict..”

• President Trump: Stop Bombing Yemen and Exit the Middle East! (Ron Paul)

Over the weekend President Trump ordered a massive military operation against the small country of Yemen. Was Yemen in the process of attacking the United States? No. Did the President in that case go to Congress and seek a declaration of war against the country? No. The fact is, Yemen hadn’t even threatened the United States before the bombs started falling. Last year, candidate Trump strongly criticized the Biden Administration’s obsession with foreign interventionism to the detriment of our problems at home. In an interview at the Libertarian National Convention, he criticized Biden’s warmongering to podcaster Tim Pool, saying, “You can solve problems over a telephone. Instead they start dropping bombs. Recently, they’re dropping bombs all over Yemen. You don’t have to do that.”

Yet once in office, Trump turned to military force as his first option. Since the Israel/Hamas ceasefire plan negotiated by President Trump’s special envoy Steve Witkoff, Yemen has left Red Sea shipping alone. However, after Israel implemented a total blockade of humanitarian relief to citizens of Gaza last week, Houthi leaders threatened to again begin blocking Israel’s Red Sea shipping activities. That was enough for President Trump to drop bombs and launch missiles for hours, killing several dozen Yemeni civilians – including women and children – in the process. After the attack, Trump not only threatened much more force to be used against Yemen, but he also threatened Iran. His National Security Advisor Mike Waltz added that the US may start bombing Iranian ships in the area, a move that would certainly lead to a major Middle East war.

Like recent Presidents Bush and Obama, candidate Trump promised peace after four years of Joe Biden’s warmongering and World War III brinkmanship. There is little doubt that with our war-weary population this proved the margin of his victory. Unfortunately, as with Bush and Obama, now that he is President, he appears to be heading down a different path.The Republican Party is gradually becoming a pro-peace, America first party, but the warmongers and neocons of the old line in the Party are not going to let go so easily. Unfortunately many of these dead-enders have found their way to senior positions in Trump’s Administration, with voices of restraint and non-intervention nearly nowhere in sight among his top tier of advisors.

To solve the Yemen problem we must understand it: Russian and Chinese ships, for example, are not being threatened because they are not enabling the Israeli demolition of Gaza. The slaughter there has been facilitated with US money and US weapons. It is the US doing Israel’s bidding both in Gaza and in the Red Sea that is painting a target on us and unnecessarily putting our troops at risk of retaliation.The US government, starting with Biden and continuing now with Trump, seems eager to make this our war even though, as Rep. Thomas Massie pointed out over the weekend, Red Sea shipping is of minor importance to the US economy. In a real “America first” foreign policy we would be following the Russian and Chinese lead and staying out of the conflict. It’s not our war. End US military involvement in the Middle East and our troubles disappear. It really is that simple.

Olmert

https://twitter.com/AdameMedia/status/1901998480756793838

They will lead to tariffs.

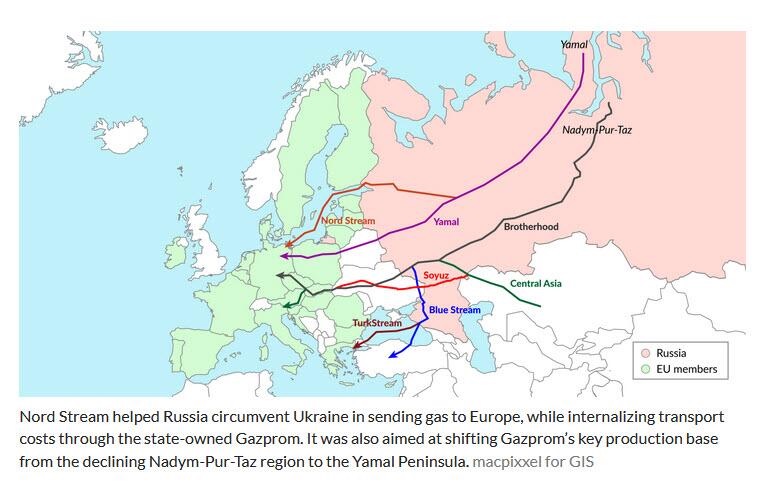

• What Will US Trade Wars With Canada, Mexico And Europe Lead To? (Pacini)

The recent trade wars waged by the United States against Canada, Mexico and Europe have had a significant impact on the international economic system. These protectionist measures, characterized by the imposition of significant tariffs on a wide range of imported products, have raised concerns about the possible consequences for global trade dynamics and economic relations between the world’s major powers. In particular, the question arises as to whether these tensions can favor greater commercial, economic and investment cooperation between the United States and Russia. The main questions that arise are: what will be the consequences of these trade wars on global trade and on the economies involved? Could these conflicts favor an economic rapprochement between the United States and Russia?

Trade tensions between the United States and its main economic partners are not a new phenomenon, but they have intensified in the last decade with a return to protectionist policies. With regard to Canada and Mexico, the United States has imposed tariffs of 25% on steel imports and 10% on aluminum imports from Canada and Mexico, provoking negative reactions from both countries. North American trade relations, traditionally based on a free trade agreement (USMCA, formerly NAFTA), have been seriously damaged by these measures. In Europe, on the other hand, we have the EU, which has been hit by tariffs on imports of cars and other luxury goods, in response to European duties on U.S. agri-food products. Tensions between the United States and Europe have led to a worsening of transatlantic relations, compromising the economic stability of both parties.

Trade wars inevitably lead to an increase in production costs, which translates into higher inflation and a reduction in the competitiveness of companies. The imposition of tariffs makes imported goods more expensive, with repercussions on various economic sectors: industries that depend on imported components, such as the automotive and technology industries, are strongly affected by the price increase; Producers in the U.S. of soy, meat and dairy products have suffered significant losses due to trade retaliation from Canada, Mexico and the EU; transatlantic tourism and transportation have been affected by economic tensions, reducing growth in the sector. The interruption of global supply chains is one of the most serious consequences of trade wars (and, let’s remember, it’s a consequence that also has an impact on many other countries that apparently don’t seem directly involved, but that in reality depend on the trend of that market).

Modern industry depends on a complex network of international suppliers, and customs tariffs increase production costs, making global trade less efficient. Trade wars are not just an economic issue, they have profound geopolitical implications. It is now well known and widely acknowledged that sanctions policies have been a tool for the planned weakening of Europe. The data shows that the EU has a significant trade surplus with the USA in the goods sector, equal to 157 billion euros in 2023. However, in the services sector, the EU has a deficit of 109 billion. The economic ties between the two areas are therefore not as unbalanced as is often claimed. European companies export many goods to the United States, but on the other hand Europe buys many services, particularly digital services, from the U.S. American tariffs on European goods could damage the sectors most dependent on the U.S. market, with different impacts depending on the countries and the types of goods affected (such as cars).

There may be an intention to exploit this disparity to divide EU member states and push them to negotiate separately, while trade policy should remain the exclusive competence of the Union. Some are already putting forward the idea of negotiating favorable conditions to the detriment of others, but it is clear that the EU should maintain a unified approach to exert greater influence in the negotiations. The European single market is the largest in the world, with around 450 million people representing 20% of global GDP. It is clear that Europe will have to adopt a strategy that combines both pressure and incentives in order to remain in the international game.

1991

William Cooper exposes the assassination of JFK on LIVE TV

MAY 15th, 1991 RARE

William Cooper tried to tell us and it was aired on Live TV in your living room. The government murdered him for telling truth. There is no better day to post this than today pic.twitter.com/kMHHBXfeGE

— Redpill Drifter (@RedpillDrifter) March 18, 2025

BBee

Civil War Veteran Slams Elon Musk For Taking Away His Social Security pic.twitter.com/BIa47eCsuI

— The Babylon Bee (@TheBabylonBee) March 18, 2025

Fractals

Fractal spirographs generated by circles circling around each other.

— Science girl (@gunsnrosesgirl3) March 19, 2025

Smart bird

https://twitter.com/buitengebieden/status/1902042650527600713

Shower

https://twitter.com/Rainmaker1973/status/1902364436062728572

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.