Ivan Aivazovsky Creation of the World 1864

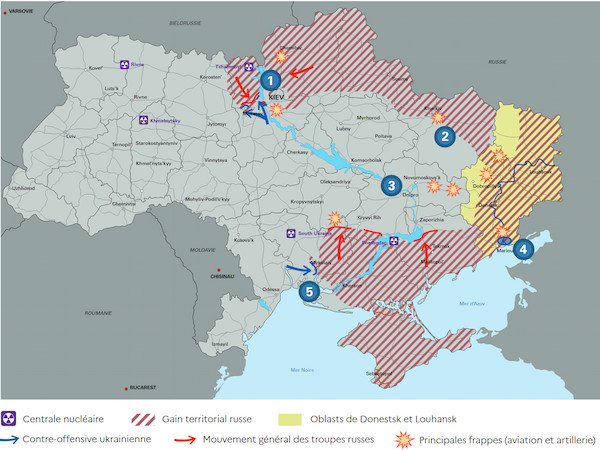

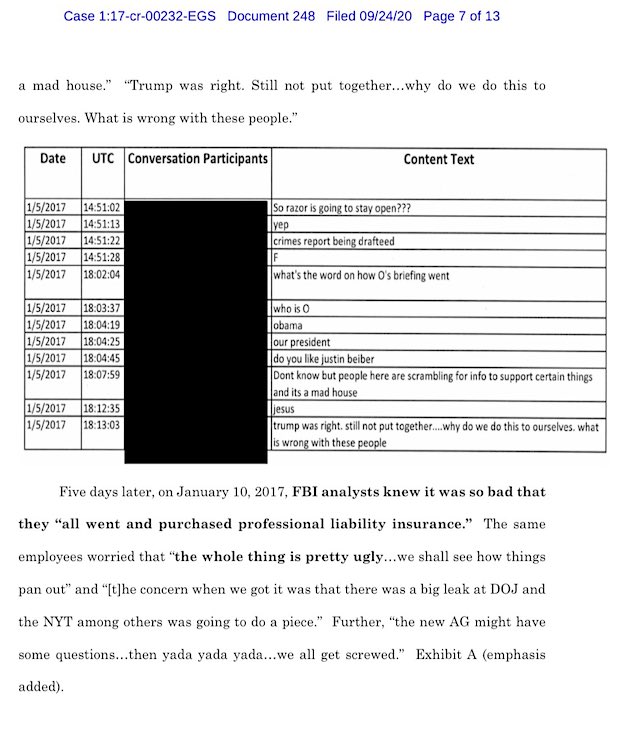

RFK Ukraine

https://twitter.com/i/status/1673710581977686016

Scott Ritter

https://twitter.com/i/status/1673489886970535936

Tucker

https://twitter.com/i/status/1673866669628727298

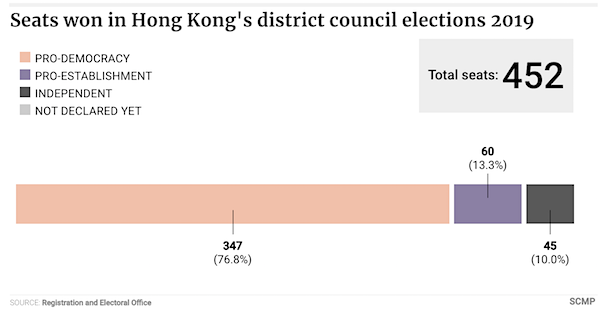

Ep. 7 Irony Alert: the war for democracy enables dictatorship. pic.twitter.com/tk7aOZ4H6n

— Tucker Carlson (@TuckerCarlson) June 28, 2023

“..in the end the “coup” could turn out to be the Greatest Russian Trolling of the West Ever..”

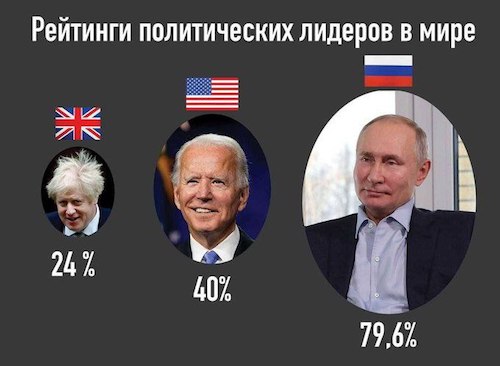

• Putin Wins – on All Counts (Pepe Escobar)

After the extraordinary events in Russia during The Longest Day, President Putin wins on all counts. Among other feats, he has made an absolute, inter-galactic ass of the whole collective West MSM – all over again. He rallied virtually every Russian to end the Special Military Operation (SMO) – or “almost war” (according to some business circles) quicker. He – and the FSB – amassed a formidable list of traitors and 5th and 6th columnists, which will be properly dealt with. And he now enjoys unlimited freedom to deploy de facto Counter-Terrorist Operation (CTO) martial law powers. As much as Putin helped perennial Lukashenko in August 2020, preventing regime change in Belarus, good ol’ Luka prevented Russia from sliding into civil war in June 2023.

A complex wide-ranging counter-terror op is now in effect in Moscow and beyond, while assorted Western sub-zoology specimens are stunned, dazed and confused: wasn’t that supposed to be Putin meeting his Czar Nicholas II moment? A first glance at the chessboard tells us that all the pieces seem to be falling in their right places. Prighozin gets a golden parachute in Belarus. Shoigu may be about to be sacked, perhaps even Gerasimov (yes, there are deeply dysfunctional layers inside the Ministry of Defense). The Wagner musicians will be incorporated as a regular Army Corps. They may keep doing business in Africa: demand is huge. So what really happened after The Longest Day? Hefty CIA funds may have changed hands. But in the end the “coup” could turn out to be the Greatest Russian Trolling of the West Ever.

Once again, facts on the ground prove Putin is the undisputed champion of Russia. After keeping a strategic silence for a few hours, his intervention gathered full support from the civilian population, the FSB, the Chechens, the Army, the Communists, everyone. The exact terms of the deal between Luka and Prighozin, with help from the governor of the Tula region, Alexey Dyumin, are still unclear. Prighozin said he was satisfied with the terms. Peskov confirmed on the record that a criminal case against Prigozhin would be dropped. A key Prighozin demand was the twin resignation of Defense Minister Shoigu and Chief of Staff Gerasimov. That may – or may not – happen in the immediate future.

And that brings us to the still fascinating possibility this was the Mother of All Maskirovkas. Prigozhin sets up all this circus just to get a meeting in Moscow with Shoigu and Gerasimov. Talk about an overkill just to go out on a date. The Mother of All Maskirovkas scenario also implies a move worthy of 5D chess. On Saturday, Wagner was 200 km away from Moscow. Yet on Sunday, Wagner was 100 km away from Kiev. Next level Sun Tzu Art of War, anyone?

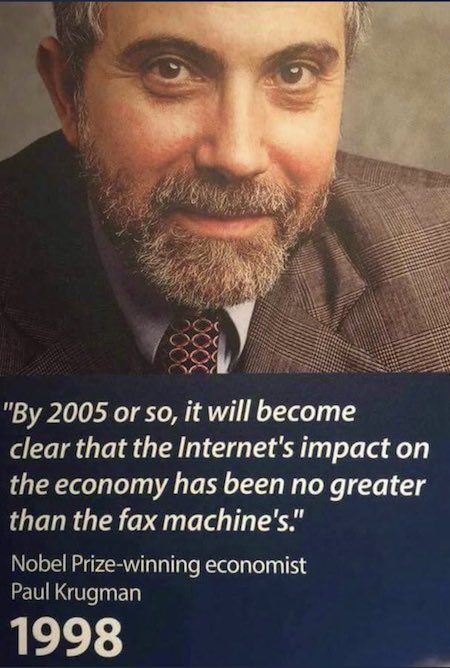

The level of misinformation coming from the experts is something else.

• The Real Casualties Of Russia’s ‘Civil War’: The Beltway Expert Class (GZ)

When Wagner Group leader Yevgeny Prigozhin launched a supposed revolt against Russian President Vladimir Putin on June 23, sending his forces on a march toward Moscow following a series of tirades against the country’s defense establishment, Washington’s expert class overflowed with an orgy of regime change fantasies. For just over 12 hours, everyone from former US ambassador to Russia and noted Hitler apologist Michael McFaul to Ukrainian President Volodymyr Zelensky to neocon pundit Anne Applebaum exploded with seemingly libidinal excitement about a supposed “civil war” that was certain to feature “Russians…killing Russians,” along with “lots of casualties” and Putin “probably hiding somewhere.”

It was as though the Soviet Union was collapsing all over again, and Prigozhin, a character named on the FBI’s most wanted list whom the US government has sanctioned for leading what it described as a “transnational criminal organization,” was suddenly a white knight storming into Moscow to liberate Russia from “the Putin regime” on the back of a tank. Move over, Juan Guaido. Expecting a bloodbath and seismic political upheaval, corporate networks like CNN had budgeted wall-to-wall coverage of the coup that wasn’t, filling cable news green rooms with rent-a-generals, K Street think tankers, and war-hungry former diplomatic corps hacks. On the afternoon of June 24, however, news broke across the US that Prigozhin had struck a deal with Belarusian President Alexander Lukashenko to end his protest and go into exile.

Thus ended a largely bloodless affair that ultimately saw fewer documented deaths than the January 6 Capitol Riot. Though the supposed revolt in Russia burned out faster than a Leopard tank on the way to Zaporizhzhia, we now know that a number of serious casualties were incurred inside the DC Beltway. The Grayzone obtained an exclusive look at the massacre some of America’s top Russia experts carried out against their own credibility. Ever since he was unceremoniously ejected from Moscow for apparently attempting to organize a color revolution in 2012, Ambassador Michael McFaul has waged a personal jihad against the country’s government. His hatred of the Russian leadership grew so impassioned that he once declared that Putin was morally inferior to Adolf Hitler, embracing a fringe view associated with Holocaust deniers that asserts the Nazi dictator “didn’t kill German-speaking people.”

When the events of June 23 kicked off, McFaul could hardly contain himself. The disgraced diplomat immediately took to Twitter to insist without a shred of evidence to claim that Putin “has ordered his army and others to destroy Wagner & Prigozhin.” “So there’s going to be a big fight,” he promised. As for the Russian President, McFaul confidently declared: “I am sure that he is no longer in Moscow.” Just after noon on June 24, he seemed to believe the Russian president’s demise was imminent. “Rats are jumping” from Putin’s ship, he effused, referring to oligarch Arkady Rotenberg taking a flight to Azerbaijan. “This is now a civil war,” the self-styled expert confidently declared.

But around 1:30 PM on June 24, the unwelcome news had made its way to Washington: Putin and Prigozhin had reached an agreement. There was to be no civil war in Russia, after all. McFaul was suddenly forced to reckon with the reality that his predictions of a coup were premature, and that virtually everything he had said hours before was completely wrong. “Can anyone remember a mutiny or coup attempt that lasted 24 hours and no one really fought or was killed?,” pondered the retired diplomat, seemingly coming to grips with the obvious. Then, like an alcoholic in denial after yet another blackout, McFaul whimpered, “I was wrong about this. Eager to learn why.”

But the opposite is happening.

• ‘Whole Logic of West’: US, EU Want to Weaken Russia ‘Through Ukraine’ (Sp.)

Western countries continue to do their utmost to damage Russia by various means, Professor Stevan Gajic, a research associate at the Institute of European Studies in Belgrade, told Sputnik. Discussions on the expansion of military and financial aid to Ukraine topped the agenda of a recent meeting of EU member states’ foreign affairs ministers held on June 26 in Luxembourg. The US recently also expressed its readiness to announce a new $500 million military package to Ukraine, which is expected to include Bradley combat vehicles and Stryker armored personnel carriers. “The whole logic of the West and of these statements” pertains to the drive by the US and its allies to continue damaging Russia, not least by fuelling the conflict in Ukraine, Gajic said.

He insisted that “The United States wants to pull Russia into a series of internal conflicts and to inflict as much damage as they can through Ukraine.” He suggested that Western countries “eventually want a partition of Russia and [its] occupation through creating many invented puppet states similar to those that we’ve seen in the B or C category Hollywood movies.” He was echoed by US author and lawyer Dan Kovalik, who told Sputnik that the White House is interested in the continuation of the Ukraine conflict because they want to use it “to weaken Russia.” Touching upon Wagner’s aborted mutiny, Kovalik said that Western countries “smell blood in the water and therefore they want to speed up the process of, in their minds, destabilizing Russia.”

“So all of this is leading them to increase aid to Ukraine at a time when people in Europe, I think, are getting cold feet about this,” he added. The same tone was struck by Michael Shannon, a political commentator and Newsmax columnist, who told Sputnik about a possible “two reasons” regarding Washington’s drive to go ahead with providing Kiev with hefty military packages. “One, the long-awaited spring offensive hasn’t really gone very far. It doesn’t look much different from the winter stalemate. So, the vehicles are to replace what has been lost in the fighting so far. Two, they may believe the Wagner mutiny has weakened the Russian position in Ukraine — either physically or in morale — and they want to follow up as soon as possible,” Shannon said.

No conscience. And they represent us.

• US Congress Urges Biden To Send Cluster Bombs To Kiev (RT)

Washington should supply Kiev with artillery-delivered cluster bombs, a group of US Congress representatives told President Joe Biden in a letter last week, Foreign Policy reported on Monday. The lawmakers urged the White House to put what they called America’s “vast arsenal” of the highly controversial munitions to its “intended use.” Cluster bombs carry smaller explosive submunitions that are released in flight and scattered across a target area, typically used against personnel and lightly armored vehicles. According to Foreign Policy, the US-designed bombs, also known as dual-purpose improved conventional munitions (DPICMs), can penetrate four to eight inches (10 to 20 centimeters) of armor. The munitions also have a tendency to leave behind undetonated ‘duds’ that can remain in former conflict zones for decades.

This fact prompted more than 110 nations, including many NATO members, to ban cluster bombs under a UN convention back in 2008. The US did not join the convention but banned exports of cluster bombs with a ‘dud’ rate of more than 1% in 2009. The ban covered most of its existing stockpile. Now, the lawmakers, who are all members of the Congress Helsinki Commission, which monitors human rights in 57 OSCE nations, push for their transfer to Ukraine to be used in a conflict zone. “During the Cold War, DPICMs were developed and fielded specifically to counter Russia’s numerical and material superiority,” the group, including the Helinski Commission head, Joe Wilson, wrote in the letter. “Now they can be put to their intended use in Ukraine’s defense,” they said, adding that it would serve US national security as well.

“Let us use this untapped, vast arsenal in service of Ukrainian victory, and reclaiming Europe’s peace,” the letter said. Kiev’s troops already received DPICMs, which can be launched through the NATO-supplied 155mm artillery pieces, from other nations. Türkiye sent such munitions to Ukraine in January 2023. The Pentagon has also recently spoken in favor of such deliveries. “Our military analysts have confirmed that DPICMs would be useful, especially against dug-in Russian positions on the battlefield,” Laura Cooper, the Deputy Assistant Defense Secretary for Russia, Ukraine and Eurasia, said last week amid the ongoing Ukrainian offensive that had largely stalled without gaining much ground.

Moscow previously warned Washington against sending cluster bombs to Ukraine. Such actions would have consequences both for NATO’s own security and the normalization of bilateral relations between Russia and the US, Russian Deputy Foreign Minister Sergey Ryabkov said in March. Kiev has repeatedly asked the US for various cluster munitions. The Ukrainian troops wanted to get MK-20 cluster bombs, which they sought to drop on Russian forces from drones. The artillery cluster shells were also on its wish list. So far, US officials have said they are not “actively considering” sending cluster bombs to Kiev. Yet, Biden can potentially waive the export restriction at any time.

They’re waiting for a guaranteed passage to Belarus. Where first camps have to be built etc.

• Wagner Troops Are Still Inside Ukraine, Pentagon Says (Az.)

Wagner troops are still inside Ukraine after the weekend mutiny, according to the US Defense Department, Report informs referring to CNN. “But in terms of their specific disposition and whether they may or may not move be moving, I’m not going to speculate on that,” said Pentagon press secretary Brig. Gen. Patrick Ryder at a press briefing. Ryder added that the US did not make any changes to US force posture in response to the events in Russia.

“The Wagner Group currently has many of the same weapons as regular troops, including tanks, anti-aircraft systems and attack aircraft..”

• Wagner To Hand Over Heavy Weapons – Russian MOD (RT)

The Russian Defense Ministry has announced preparations for the handover of heavy weapons from the Wagner private military company to units of the national Armed Forces. A brief statement posted by the ministry on social media on Tuesday offered no further details on the arms transfer. The Wagner Group currently has many of the same weapons as regular troops, including tanks, anti-aircraft systems and attack aircraft. Some of them were used by the contractors during their short-lived mutiny last weekend. Last Friday, Wagner chief Evgeny Prigozhin accused senior Russian military figures of treason and sent his troops towards major cities in Russia, including the capital, with the stated goal of having the officials removed from service.

The mutiny ended the following day, when the businessman accepted a Belarus-mediated deal with Moscow, including immunity from prosecution for him and Wagner personnel. The insurrection was not bloodless, as Wagner soldiers shot down several Russian military aircraft, while their convoy rolled down the M4 highway. Details on those losses remain murky, but President Vladimir Putin acknowledged the deaths of military pilots during in his address to the nation on Monday. There have been unconfirmed claims that Prigozhin has offered to pay compensation to families of the slain service members. Putin has offered Wagner troops the choice of joining the Russian military or law enforcement agencies, retiring from active duty, or following Prigozhin to Belarus, which has agreed to host them.

“Talking about lagging behind in certain aspects is the best way to increase defense spending..”

• EU Attempt to Get Anti-Hypersonic Weapon in 3 Years Unlikely to Succeed (Sp.)

While European missile manufacturer MBDA recently announced its intent to “lead a consortium” for developing an interceptor capable of defending against “hypersonic threats” called the Aquila project, it remains unclear exactly how fruitful this venture is going to be. Military expert with independent Russian military affairs think tank Center for Military-Political Journalism, Boris Rozhin, told Sputnik that it seems unlikely that some MBDA prototype interceptor would be adopted in the next three years or so. As Rozhin pointed out, even the United States is currently experiencing serious problems with the development of an air defense system capable of dealing with hypersonic weapons, and Europe currently lags behind the US in that sphere.

“Some additional funds will definitely be allocated, additional research and development teams will be assigned,” he pondered. “But I don’t think that Europe will be able to acquire within the next two-three years more variants of air defense system that could effectively combat modern hypersonic missiles.” Rozhin noted that four countries – Russia, China, Iran and North Korea – currently have working models of hypersonic missiles, and that the United States may acquire a working hypersonic missile of their own within two or three years, but so far, no air defense system capable of effectively countering such a threat exist.

“Talking about lagging behind in certain aspects is the best way to increase defense spending,” Rozhin added. “That is, we say that we are lagging behind [our rivals] and so we need more money to develop something in order not to lag behind.” However, it is hard to say at this point, i.e. during the development stage, how efficiently this funding is going to be used, he remarked. Rozhin also observed that Russia currently surpasses the US and Europe in terms of hypersonic weapons development, and while he did admit that Moscow may be working on anti-hypersonic defense systems, the expert argued that any such research would be highly classified and not advertised to the public.

They have similar files about Russia, no doubt.

• UN Documents Rampant Torture of Civilians by Ukrainian Security Forces (Sp.)

The United Nations has recorded a significant increase in law violations by Ukrainian security forces since start of Russia’s special military operation, the UN Human Rights Office (OHCHR) said in a report on Tuesday. “Since 24 February 2022, OHCHR has documented a significant increase in violations of the right to liberty and security of person by Ukrainian security forces. Out of the overall number of such cases, OHCHR documented 75 cases 92 of arbitrary detention of civilians (17 women, 57 men and 1 boy), some of which also amounted to enforced disappearances, mostly perpetrated by law enforcement authorities or the Armed Forces of Ukraine,” the report read. “Of further concern, OHCHR has documented the arrests of several civilians involved in distribution of humanitarian aid in territory ‘occupied’ by the Russian Federation,” the report read.

On May 30, a Russian law enforcement source told Sputnik that the Security Service of Ukraine (SBU) has opened torture chambers to get testimony from people who had cooperated with the Russian authorities while the city was under Russia’s control between March and November 2022 The source said the torture rooms were created at two district police departments, Dneprovsky and Komsomolsky. While mostly Ukrainians work at the Dneprovsky department, locals are not allowed into the second one, as only foreign mercenaries speaking English, Polish and Georgian work there, the source said.

Vladimir Malina, a former business assistant who decided to stay in Kherson after the withdrawal of the Russian troops, died in the torture chamber of the Dneprovsky police department. “[He] was kept in the torture chamber of the Dneprovsky district department, [he was] brutally beaten, the next day, he died in the cell. In order to hide his death, for three days, two [former] employees of the Russian humanitarian center [in Kherson], Roman Gavrilyuk and Igor Gurov, who were detained with him, were tortured and forced to write an explanation that Vladimir Malina was released together with them,” the source said. Several people were tortured to death in these chambers, including a nurse and an investigator, the source said, adding that all of them are recognized as missing.

“.. there is currently no limit to how much Washington can send to Kiev..”

• All Aboard The Gravy Train: An Independent Audit Of US Funding For Ukraine (GZ)

During a recent discussion with New York Times columnist Nicholas Kristof, Administrator of the United States Agency for International Development (USAID), Samantha Power, touted her organization’s push to guarantee transparency for US taxpayer funds sent to Ukraine. “We are involved in funding efforts at ensuring judicial integrity, which is intrinsically important to building Ukraine’s democracy and its integration plans to get into Europe,” Power declared, adding USAID’s work in Ukraine was “also really important in terms of assuring the taxpayer, the American taxpayer, that they’re resources are well spent.” While innocuous on the surface, Power’s comments revealed a great deception the US government is currently waging against the American public.

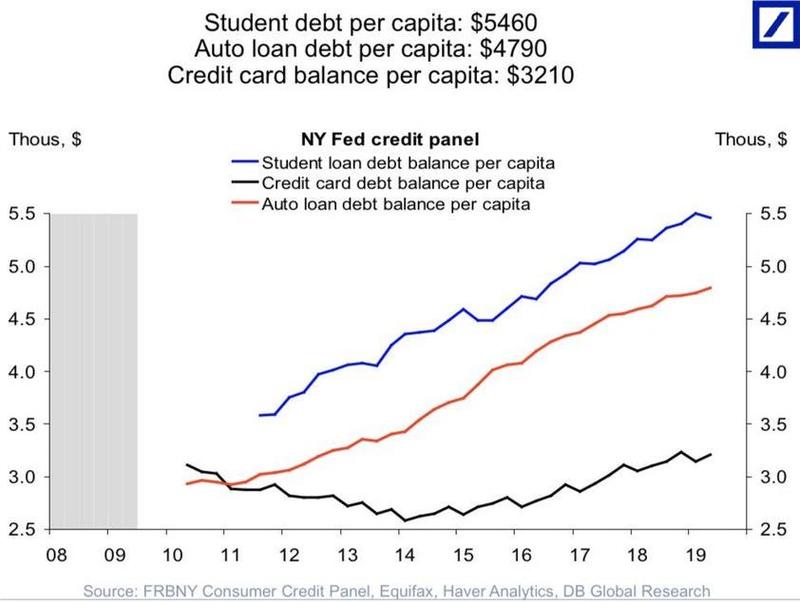

In the roughly 16 months since Russia’s February 2022 escalation of the Ukraine conflict, the US government has approved several multi-billion dollar spending packages to sustain the Kiev military’s fight against Moscow. Though many Americans likely believe that US dollars allocated for Ukraine are spent directly on supplies for the war effort, the lead author of this report, Heather Kaiser, conducted a thorough review of Washington’s budget for the 2022 and 2023 fiscal year and discovered that is far from the case. US taxpayers may be shocked to learn that as their families grappled with fears of Social Security’s looming insolvency, the Social Security Administration in Washington sent $4.48 million to the Kiev government in 2022 and 2023 alone.

In another example of bizarre spending, USAID paid off $4.5 billion worth of Ukraine’s sovereign debt through payments made to the World Bank — all while Congress went to loggerheads over America’s ballooning national debt. (Western financial interests including BlackRock Inc. are among the largest holders of Ukrainian government bonds.) Though it is nearly impossible to calculate the total sum of US tax dollars sent to Kiev, Kaiser was able to perform an independent audit of Washington’s proxy war in Ukraine through a careful search of open source data available on the US government’s official spending tracker. Kaiser reviewed all the funding allocations in which Ukraine was listed as the “Place of Performance” for fiscal years 2022 and 2023.

Additionally, she discovered supplementary funds were sent to Kiev by listing Ukraine as the “justification” for spending, rather than the location where the money was physically sent. Calculating the total dollar amount that the US has given to Ukraine is incredibly challenging for multitude of reasons: there is a lag in reporting expenditures; covert money given by the CIA (Title 50 Covert Action) won’t be publicly disclosed; and direct military assistance in the form of military equipment is not calculated in the same manner as raw cash. The Pentagon recently admitted to an accounting error revised up to 6.2 billion dollars. Despite this, Kaiser submitted a request to the Department of Treasury asking them to disclose the total dollar amount of US taxpayer support for Ukraine. Treasury has not responded at the time of publication.

Though Kaiser was able to search through pages of reported spending, the US government has yet to conduct an official audit of its funding for Ukraine. What’s more, there is currently no limit to how much Washington can send to Kiev.

“He resisted the pressure from advisors who wanted to start a war with Iran, but he refused. He refused to go along with them. And that’s I think that’s really part of the anger directed at him as well.”s

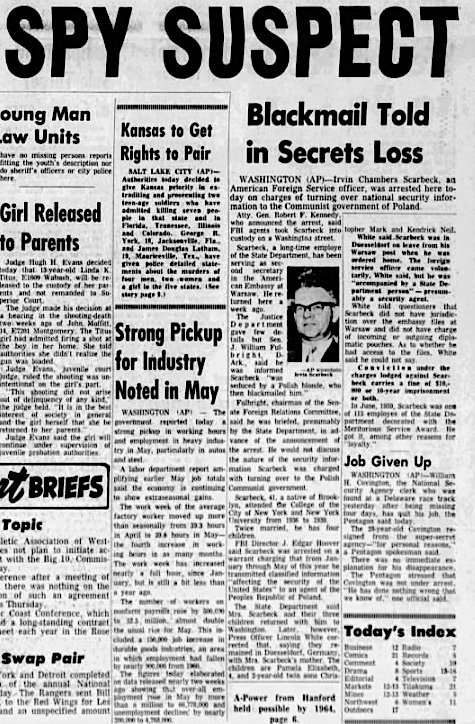

• Audio Shows Trump Refused Decades-Long Push to Attack Iran (Sp.)

A veteran of the US state apparatus told Sputnik that the most significant part of the story about former US President Donald Trump holding onto still-classified plans for war with Iran after he left office is that Trump refused to give in to pressure to launch such a conflict, which Washington has sought for decades. US media has obtained the audio of an alleged conversation between Trump and his aides in which prosecutors said he described showing them files he knew were still classified. The conversation, which allegedly occurred in the summer of 2021, was previously reported based on a partial transcript cited in a criminal complaint against Trump that was filed in a federal court earlier this month.

In the two-minute-long audio clip, Trump can seemingly be heard referencing top secret plans regarding an attack against Iran that he says were prepared by Gen. Mark A. Milley, the chairman of the Joint Chiefs of Staff, who has become a sharp critic of Trump after the former president’s term ended. “These are the papers,” Trump is heard saying. “This was done by the military and given to me.” “See as president I could have declassified it,” Trump continues as others in the room laugh, adding: “Now I can’t, you know, but this is still a secret.” Trump faces 37 charges related to the classified files, which the FBI seized in a raid last August at his Mar-a-Lago estate in Florida. Many of the charges each carry a potential 20-year prison sentence, if Trump were to be convicted.

Larry Johnson, a retired CIA intelligence officer and US State Department official, told Sputnik that Trump’s administration was by no means the first to consider a war against Iran, and that the focus on the war plans conceals a greater truth: that Trump didn’t want to launch such an attack. “The war plans against Iran have existed since 1980, since the mullahs took power. And those plans exist and have been revised and updated over time. So I wouldn’t read too much into his discussing one plan.” “I think the key point is that Trump did not act on these plans,” Johnson asserted. “He resisted the pressure from advisors who wanted to start a war with Iran, but he refused. He refused to go along with them. And that’s I think that’s really part of the anger directed at him as well.”

However, Johnson said there was actually a greater chance of war with Iran under Trump’s predecessor, Barack Obama. “During the presidency of Barack Obama, the United States was more actively engaged in supporting intelligence operations that were leading to the assassination of Iranian scientists. They were backing this terrorist group, the MEK, the Mujahedin-e-Khalq. So, Trump is really sort of a problem for the defense establishment in Washington, DC, who were eager for that conflict. Trump tried to avoid conflict. He was always looking to cut a deal as opposed to go to war.” Johnson predicted that if Trump manages to dodge the charges against him and win the 2024 US election, for which he has already declared his candidacy, that Trump would “cut a deal” with Tehran.

“He would find a way to de-escalate the tensions. But unfortunately, you’ve got a war party. There’s not just one political party. It’s bipartisan. We’ve got Republicans and Democrats alike who are promoting conflict, insisting on conflict. [US President Joe] Biden is not keen upon actually getting a real agreement with these guys. Trump was. I think Trump genuinely believed in and tried to promote those kinds of agreements,” the former CIA officer said.

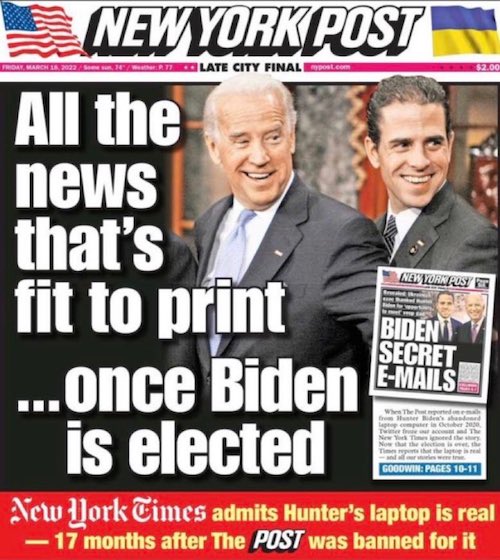

“Will this take Joe Biden off the ballot?” Wong pondered. “I’m not sure it will, but certainly it’s another thing he has to address and he can’t hide from this one.”

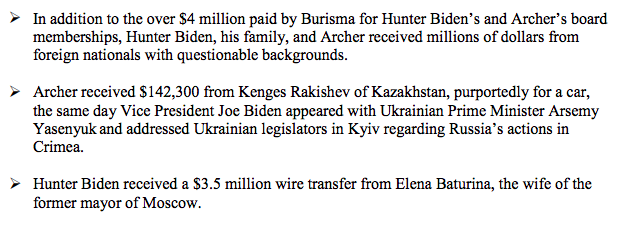

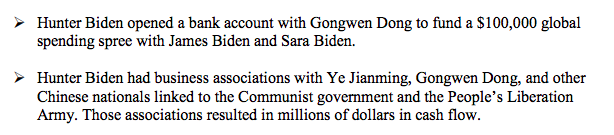

• Biden Family ‘Lawyered-Up’ for Legal Battle After Incriminating Leak (Tweedie)

US President Joe Biden and his family are preparing for legal trouble after the latest revelation about his son Hunter’s shady foreign dealings, journalist Angie Wong has said. Last week it emerged that Internal Revenue Service (IRS) agent Gary Shapley blew the whistle on a WhatsApp exchange between Hunter Biden and Chinese businessman Henry Zhao in July 2017, in which Hunter demanded to know why their “orders” had not been carried out. “I am sitting here with my father and we would like to understand why the commitment made has not been fulfilled,” Hunter Biden wrote. The message has contradicted the president’s previous claims he had no knowledge of his son’s dealings with foreign millionaires, including payments he received allegedly in return for political influence.

Just days earlier, Biden’s son had avoided doing jail time for corruption and influence-peddling with a plea bargain for misdemeanor charges of tax evasion and illegal possession of a handgun. Angie Wong, who also serves as the president of the Legacy PAC, told Sputnik that Biden and son were “lawyered-up” and ready for battle. “They can’t keep trying to disguise what’s actually right there in front of everybody’s faces. And now they have to address it,” Wong said. “We’re going to expect some major legal moves coming up, I would imagine in days.” “When Hunter Biden got a slap on the wrist last week for a gun charge and for tax fraud, that really just fueled the sentiment that was going on in Washington and certainly in American homes,” she noted.

“It’s not that we want to necessarily get them. It’s just that it’s just so unfair. I think it’s prompted what’s happening right now, which is the release of this text message,” Wong stressed. “If you and I even lied to our government. That would be a felony. But when our government lies to us, well, that’s just politics.” The journalist said Biden was “finally worried” that his son’s dodgy dealings would come back to haunt his presidency, and “now needs to address it” because “these are real voter issues and this is an election season.” “Will this take Joe Biden off the ballot?” Wong pondered. “I’m not sure it will, but certainly it’s another thing he has to address and he can’t hide from this one.”

Radicals? Like free radicals?

• GOP Leaders Block Radicals From Impeaching Biden for Foreign Graft (Tweedie)

Republican Congress leaders are stymying attempts to impeach US President Joe Biden even as proof of of his shady dealings with foreign businessmen came out. Biden’s wayward son Hunter wriggled out of a jail sentence last week with a plea bargain that got him a slap on the wrist for tax evasion and illegal possession of a firearm. But Internal Revenue Service whistleblower Gary Shapley testified to a WhatsApp message exchange the president’s son had with Chinese businessman Henry Zhao in July 2017, in which he demanded to know why their “orders” had not been carried out. “I am sitting here with my father and we would like to understand why the commitment made has not been fulfilled,” Hunter Biden wrote — belying the president’s previous claims he had no knowledge of his son’s dealings with foreign millionaires, including payments he received allegedly in return for political influence.

Hunter’s attorney Chris Clark made a statement on Friday in which he blamed his client’s addiction to crack cocaine for the wording of the messages. Former Colorado state senator Ted Harvey told Sputnik that while the latest revelations of misconduct by the Biden family were “astonishing,” the Republican Party was playing its hands close to its chest on a possible presidential impeachment. “The leadership of the Republican Party is doing everything they possibly can to avoid any impeachment discussion, to make sure that they do not fall into the trap that every political party does when they have the ability to impeach a president and their party wants to go in that direction,” Harvey said. Republican in the House of Representatives Speaker Kevin McCarthy and others “are doing everything they can” to stop Georgia representative Marjorie Taylor Greene or Colorado’s Lauren Boebert getting the ball rolling.

“But when you have this kind of stuff coming out, this is what the impeachment process is there for,” Harvey stressed. “But now that it’s getting to the point that Republicans are going to be have to throw their hand in.” Not only are the White House, Democrats and GOP trying to downplay talk of impeaching Biden, but the media are attacking the dissident Republicans who refuse to let go of the issue. “The reason why the press is being as direct and aggressive as they are is because they realize this rises to the level of criminal activity,” Harvey said. “But it also gets to the point of compromising our national security” since the Chinese government “can hold this over him” when disputes and conflicts arise “whether it be Taiwan or anything else,” he argued “Our national security is now compromised because the president of the United States.”

“It’s dangerous in the military to have legal orders disobeyed,” he said. “It’s a very slippery slope.”

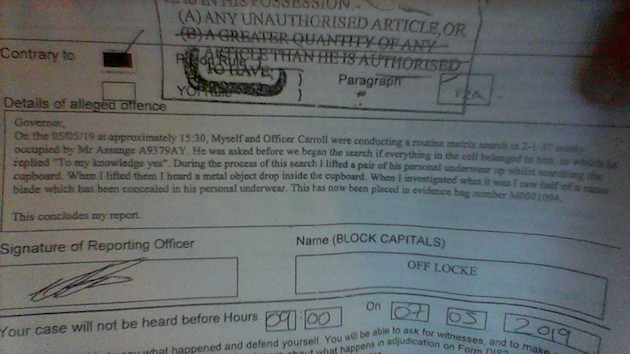

• Canadian Military Members File $500 Million Lawsuit Over Vaccine Mandates (LSN)

Hundreds of members of the Canadian Armed Forces (CAF) last week signed onto a $500 million class action lawsuit against military leaders over the imposition of “unlawful” COVID jab mandates. According to the legal challenge, the mandates “caused the Plaintiffs harm and constitute[d] a breach of the public trust.” A victory in the case could set an important precedent for all Canadians who have been pressured to get the experimental shots against their will. In the 137-page statement of claim filed with the Federal Court on June 21 and viewed by LifeSiteNews, 329 individuals who have served in the CAF argued that Canada’s Chief of the Defence Staff General Wayne Eyre “issued an unlawful order on October 25, 2021, in violation of established law and constitutional rights” by requiring members of the armed forces to get the experimental COVID-19 shot or face removal from the service.

On October 8, 2021, the CAF handed down a military-wide COVID jab mandate requiring all service members to become “fully vaccinated” against the coronavirus or be discharged from service. Hundreds of unvaccinated service members were subsequently discharged. The mandate was finally partially rolled back last year, though troops supporting operational readiness are still required to get the injections. Last year, military leadership said they would still discharge soldiers who chose to remain unvaccinated. In an interview with the Canadian Press in October 2022, General Eyre suggested that the refusal by service members to get vaccinated “raises questions about your suitability to serve in uniform.”

“It’s dangerous in the military to have legal orders disobeyed,” he said. “It’s a very slippery slope.” However, the June 21 statement of claim — which also names Vice Chief of the Defence Staff Lieutenant-General Frances Allen and Minister of National Defence Anita Anand, among others, as defendants — contends that the Canadian military “shirked its own purpose and rushed an untested product onto its members.” The plaintiffs claim that top members of the military “mislabeled this experimental gene therapy a “vaccine,” knowingly made false statements of safety and efficacy, and facilitated its mandate with no option to refuse except for mandatory permanent removal from service.”

The lawsuit is seeking monetary damages of roughly $1,000,000 per plaintiff and well over $1,000,000 more in other damages, coming to around $500,000,000 total. “This is not about COVID-19,” Catherine Christensen, an attorney with Valour Law who filed the class action suit on behalf of the plaintiffs, said in an email statement to LifeSiteNews. “This is about a corrupt Chain of Command that thinks they are untouchable and above the law.”“The Canada I want to live in has [the] Rule of Law and no person is above being answerable to the Court for malicious and unlawful act,” she said.

Limitless stupidity.

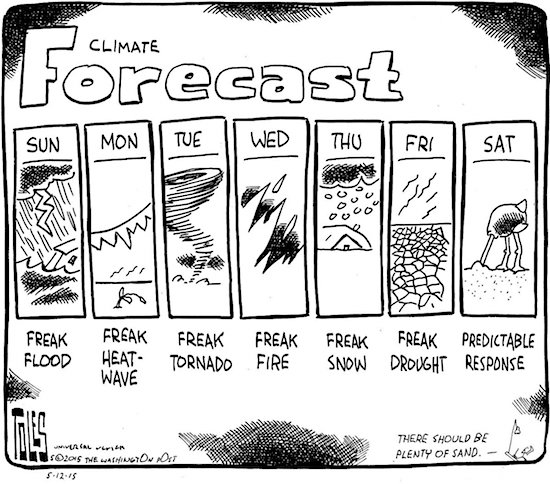

• EU To Consider Blocking Out Sun – Bloomberg (RT)

The European Union is looking into technologies involving large-scale interventions into natural phenomena like sun rays or the atmosphere, as part of its new strategy for tackling climate change, Bloomberg reported on Monday, citing a draft document that might be made public later this week. The paper Brussels is reportedly about to release is aimed at assessing the consequences of rapid global warming such as water or food scarcity, and the risks of them triggering new conflicts or mass migration waves, the outlet said. It will also feature an assessment of the potential for studying atmospheric re-engineering technologies and the dangers associated with them.

Such projects might range from deflecting the Sun’s rays or blocking them from reaching the Earth’s surface to changing the weather patterns, Bloomberg noted. The EU would like to invite international discussions on the matter as well as on potentially creating rules in this field. “The EU will support international efforts to assess comprehensively the risks and uncertainties of climate interventions, including solar radiation modification,” says the document, which is still subject to change, according to Bloomberg.

The paper also admits that such technologies “introduce new risks to people and ecosystems, while they could also increase power imbalances between nations, spark conflicts, and raise a myriad of ethical, legal, governance and political issues.” The geo-engineering option is considered amid fears that the international community might miss its target of limiting global warming to 1.5C (2.7F), Bloomberg noted, adding that the EU might turn to more radical options like spraying stratospheric aerosol to reduce the amount of sunlight reaching earth. Bloomberg also noted that critics of geo-engineering have warned that such methods might involve unforeseen side effects like changes in rain patterns, without naming any names.

Net zero

https://twitter.com/i/status/1673683916195086337

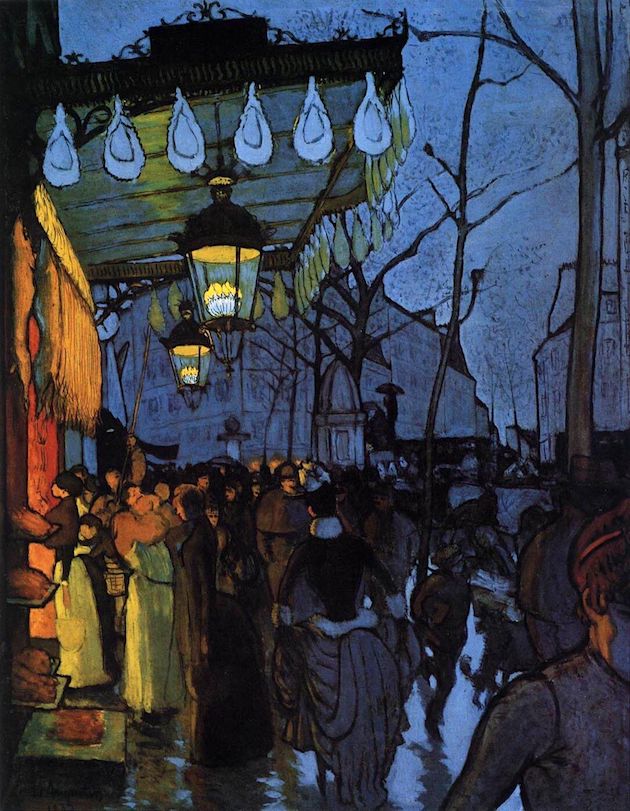

Bald art

woow amazing art pic.twitter.com/lu7Y1L2uwt

— Enezator (@Enezator) June 27, 2023

Roseanne

Here is the full clip of Roseanne Barr obviously using sarcasm and satire. She is a mensch and one of the funniest people i've ever met. pic.twitter.com/p0K6pWEqr8

— Theo Von (@TheoVon) June 27, 2023

ChatGPT

I have been researching The Dead Internet Theory since 2006.

By 2016, security firm Imperva in a report and found that bots were 52% of web traffic, the first time it surpassed human traffic.

Today I use a AI systems to prove the case.

My Denis SuperPrompt asking ChatGPT-3. pic.twitter.com/fRLhsq9ABB

— Brian Roemmele (@BrianRoemmele) June 27, 2023

Unleash

"At my signal, unleash hell" pic.twitter.com/unZyiwUxhF

— Paul Bronks (@SlenderSherbet) June 27, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.