Pablo Picasso Vue de Notre-Dame de Paris 1945

“If Greece continues to participate in the EU, democracy is doomed”

Claire Connelly’s damning version of the events. Please read the whole thing.

• Why Greece Took The Fall For A European Banking Crisis (Ren.)

The Greek financial crisis was actually a French and German banking crisis for which Greece took the fall, the result of decades of irresponsible spending and lending. When Greece joined the Euro it went on a spending spree, building roads, airports, new subway systems, infrastructure and a state-of-the-art military arsenal all built and provided by German companies. Companies which, incidentally, have been accused of bribing Greek politicians to secure military and civilian government contracts. Siemens allegedly paid €100 million to Greek officials to secure a contract to upgrade Athens’s telecommunications infrastructure for the 2004 Olympic Games. The Euro was designed to limit competition between the industries of member nations while shifting deficits and surpluses around the continent. Greece’s deficits are Germany’s surplus, and so on.

Had Greece still been using the Drachma, it had a chance of keeping its deficits in check, because it could decide on its own how to set interest rates and tax currency, but when replaced with the Euro, French and German loans caused its deficits to explode and it had no option but to accept the terms of its creditors, even though they knew the debt had no chance of being repaid. Banks – having been bankrupted by the 2008 Global Financial Crisis – stopped lending, and Greece, unable to rollover its debt, became insolvent. As a result, the three French banks which had issued loans to its European nations faced peripheral losses twice the size of its economy. More to the point, the French and German banks didn’t want the debts to be repaid. But they also didn’t want countries like Italy, Spain, Portugal and Ireland to default.

France’s top three banks had loaned €627 billion to Italy, Spain and Portugal and €102 billion to Greece and were staring down a 30 to 1 leverage ratio, meaning that if it lost only 3.33% of its loans to defaults, its capital would be wiped out and banking regulators would be forced to shut the banks down. And if Greece defaulted on its debt, the banks were concerned Spain, Italy, Portugal and Ireland would follow, resulting in a 19% loss of French debt assets, far and above the 3% that would lead to its insolvency. The three French banks needed a €562 billion bailout, but unlike the US which can shift its losses to its central bank, the Federal Reserve, France a) had no such central bank to shift its losses to, having dismantled it in favour of the European Central Bank, and b) the ECB was prohibited upon its formation to shift bad debts onto its books.

Likewise, Germany’s banks also went bust and required a €406 billion bailout – which it received – but it was barely enough to cover its US-based toxic derivative trades which led to the crisis in the first place, let alone what they had leant to their European neighbours. The banks came back begging, mere months after being cut a €406 billion cheque by the German government. “Greece’s bankruptcy would force the French state to borrow six time its total annual tax revenues just to hand it over to three idiotic banks,” former Greek finance minister, Yanis Varoufakis wrote in his expose of the ‘bailout’ negotiations, Adults In The Room. Had the markets found out this secret, interest rates would have skyrocketed and €1.29 trillion of French government debt would have gone bad and the country bankrupted, and the EU with it.

Edwards likes Kevin Warsh, frontrunner for Fed chief….

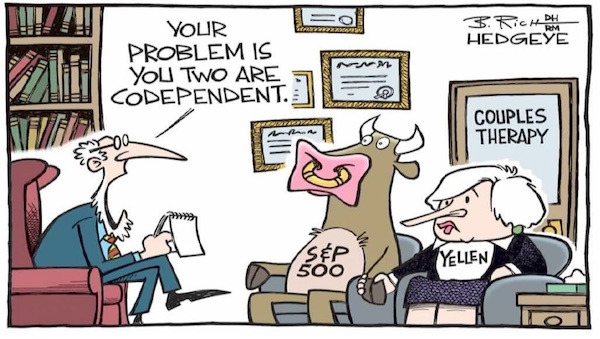

• The Fed is a Slave to the S&P 500 (Albert Edwards)

I was the first speaker and afterward I enjoyed listening to every other speaker at the two-day event. Most notable of the outside economics speakers were Paul Volcker, Larry Summers, and most significantly for me, ex Fed-Governor Kevin Warsh. Much to my own regret, I had never familiarised myself with the views of Governor Warsh, who was at the Fed from 2006-11, and played a key role in navigating the Fed through the crisis. He got a rousing reception from the BCA audience as he talked a lot of sense – in particular on how the Yellen Fed has lost its way and current policy is deeply flawed. He explained that the Fed has been “captured” by a groupthink of academics led by the ‘Secular Stagnation’ ideas of his friend, Larry Summers.

Rather than admitting they are wrong, this group, who failed to predict the current economic malaise, have constructed this theory to explain why ever more stimulus is required. In particular, Warsh warned that the Fed had become the slave of the S&P. Summers’ relaxed view on the debt build-up, particularly visible in the corporate sector, is in sharp contrast with our own view that this looks set to wreck the US economy. The problem with Summers’ analysis in my view is that it is the higher debt that is being used to push up asset values (via share buybacks), just as it did during the housing bubble in 2005-7. And by pushing asset values well beyond fundamentals you build debt structures on false asset values, which only become apparent when the asset bubble bursts. And am I in any way reassured that the Fed sees no bubbles? No, I am not. These dudes will never identify an asset bubble – at least before the event!

… bur Warsh might endanger easy money policies, and make the dollar stronger.

• Trump Gets Final List Of Fed Candidates, Yellen Gets The Cold Shoulder (ZH)

[..] we can cross out economist Glenn Hubbard and U.S. Bancorp Chairman Richard Davis, both of whom have been floated as possible candidates, although Trump has no intention of interviewing them. A potential wildcard is Stanford economist John Taylor, a favorite of fiscal conservatives, who is also said to be under consideration. It has also been previously reported that Trump has spoken to Yellen, Cohn, Warsh and Powell about the Fed post, although there is no frontrunner at the moment. According to Bloomberg, “the latest developments show that Trump is closer to making a final selection than previously known.” Last Friday, Trump said that he is “two or three weeks away from announcing his nominee” for the post overseeing the nation’s central bank.

Meanwhile, speaking at the Vanity Fair New Establishment Summit on Tuesday in Los Angeles, Jeffrey Gundlach – who accurately predicted Trump’s presidency – predicted that Neel Kashkari would be picked as next Fed chair. “I actually have a very non-consensus point of view. I think it’s going to be Neel Kashkari… He happens to be the most easy money guy that’s in the Federal Reserve system today and that’s why he may win.” The Bond King said that Trump needs someone who will keep rates low in order to keep his populist reputation and help his base voters and that’s why he’ll pick Kashkari. “A stronger dollar is not good for achieving that agenda,” he said. Gundlach also is confident that Yellen would not get reappointed: “I think there is no chance that she wants to be chairwoman, nor do I think the president wants her to be,” said the manager of $109 billion.

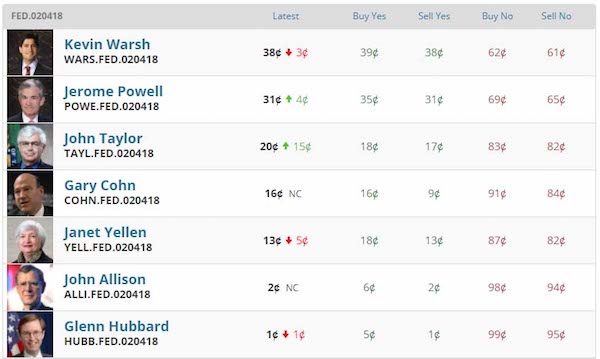

Judging by the latest PredictIt odds, if Gundlach is right, and if he is willing to bet some money on it, he could make a killing, as Kashkari does not even have a contract. As to the current ranking, Warsh remains in top spot with 38% odds, although following today’s Politico news, Powell surged to second place with 31% odds, and now following the Bloomberg report, John Taylor finds himself in third spot with 20% odds, above both Gary Cohn in 4th and Janet Yellen who has tumbled to 5th with just 13% odds of being reappointed.

“I don’t know if it’s Goldman Sachs but whoever it is, you can wave good-bye to that.” Wonder how it would be done. And what does it mean for Texas, Florida debt?

• Trump Says Puerto Rico’s Debt Will Have To Be Wiped Out (BBG)

President Donald Trump suggested that the government debt accumulated by bankrupt Puerto Rico would need to be wiped clean to help the island recover from the devastation caused by Hurricane Maria. “We are going to work something out. We have to look at their whole debt structure,” Trump said during an interview on Fox News Tuesday. “You know they owe a lot of money to your friends on Wall Street. We’re gonna have to wipe that out. That’s gonna have to be – you know, you can say goodbye to that. I don’t know if it’s Goldman Sachs but whoever it is, you can wave good-bye to that.” Puerto Rico is dealing with an immediate humanitarian disaster made worse by the long-term debt crisis that led it to declare a form of bankruptcy this year.

The island’s government for decades had been plagued by budget deficits caused by wasteful spending, and borrowed $74 billion. Much of that went to operations. The commonwealth’s budget is under the control of a federally appointed oversight board, a panel that the U.S. Congress created to wield broad sway over the territory’s finances. The panel approves the island’s budget and is meant to help make unpalatable decisions such as closing schools and cracking down on tax evasion. Trump paid a four-and-a-half-hour visit to the island earlier Tuesday, greeting local officials and offering consolation to residents who have been without power and, in many cases, drinking water since the storm struck on Sept. 20. Some in Puerto Rico’s government already are estimating reconstruction costs will be as high as $60 billion.

Prices of the U.S. territory’s bonds have plunged to record lows, signaling investors expect that there will be even less money available to repay its $74 billion of debt. Puerto Rico has little financial ability to navigate the disaster on its own, leaving the recovery heavily dependent on how much aid comes from Washington. It began defaulting on its debts two years ago, seeking to avoid draconian budget cuts officials said would deal another blow to an already shrinking economy. With nearly half of its 3.4 million residents living in poverty, the government filed for bankruptcy protection in May.

Are they going to fight over this?

• White House To Request $29 Billion For Hurricane Relief (R.)

The White House is preparing a $29 billion disaster aid request to send to the U.S. Congress after hurricanes hit Puerto Rico, Texas and Florida, a White House official said on Tuesday. The request is expected to come on Wednesday. It will combine nearly $13 billion in new relief for hurricane victims with $16 billion for the government-backed flood insurance program, the White House official told Reuters. The White House wants Congress to forgive $16 billion of the debt that the National Flood Insurance Program, which insures about 5 million homes and businesses, has racked up.

The request comes as the program is close to running out of money, congressional aides said. The program had racked up nearly $25 billion in debt before this season’s major hurricanes. The Trump administration is also proposing more than a dozen reforms including new means testing and an extreme-loss repetition provision, aides said. Some homes insured under the program have gotten payments repeatedly from the program after multiple storms. The flood insurance money is aimed primarily for areas impacted by Hurricanes Harvey and Irma, which struck Texas and Florida, aides said.

Don’t think the GOP will like this.

• White House: A Tax Plan That Doesn’t Add To The Deficit Won’t Spur Growth (BBG)

The White House is showing “softness” on ending a $1.3 trillion federal tax deduction filers get for their state and local taxes, Senator Bob Corker said Monday, warning that it raises questions about the GOP’s “intestinal fortitude” and could imperil a tax overhaul. The framework that President Donald Trump and Republican leaders released Wednesday calls for deep rate cuts and would abolish existing tax breaks to help pay for them. Without such “pay-fors,” Congress might have to settle for only temporary tax cuts. Corker, who insists he won’t vote for a tax bill that adds a penny to the deficit, said in an interview that he’s concerned about the early signals from the White House. On Friday – two days after the tax framework was rolled out – National Economic Council Director Gary Cohn said that ending the state and local tax break was negotiable.

“That’s the easiest one,” said Corker, a Tennessee Republican. “Some of the others are actually more offensive and produce lesser amounts of money.” The budget rules that Senate leaders plan to use to pass the legislation require that any changes that boost the federal deficit would have to expire in time. But the nine-page framework released Wednesday provided few details on revenue raisers. It calls for eliminating deductions, but doesn’t specify them. By showing its willingness to negotiate on one such deduction, the White House appears to be charting a rocky path. “As a general matter in tax reform you have to acknowledge that you cannot negotiate with everybody’s single pay-for,” said Doug Holtz-Eakin, who runs the American Action Forum, a conservative group that’s working with GOP leaders on taxes. “If you do that for everything, you don’t get tax reform.”

Ending the state and local deduction, which Trump’s aides proposed in April, faces resistance from Republican lawmakers in high-tax states like New York and New Jersey. The same day Cohn commented on the state tax break, tax-writing chiefs Senator Orrin Hatch and Representative Kevin Brady dismissed a study that found ending personal exemptions, another one of the few offsets set forth, could raise taxes for some middle-class families. Their response: The committees haven’t made decisions about which tax breaks to end. Asked if the state tax break and personal exemptions were negotiable, Brady reiterated Monday the bill is a work-in-progress. “We’re continuing to work on the final design of the tax reform plan that we’ll have ready after the budget is completed,” he said.

White House Budget Director Mick Mulvaney is signaling similar flexibility, saying on CNN Sunday that decisions about deductions remain up in the air as “the bill is not finished yet.” He took it a step further on Fox News Sunday, by adding that a tax plan that doesn’t add to the deficit won’t spur growth. “I’ve been very candid about this. We need to have new deficits because of that. We need to have the growth,” Mulvaney said. “If we simply look at this as being deficit-neutral, you’re never going to get the type of tax reform and tax reductions that you need to get to sustain 3% economic growth.”

Just-in-time politics.

• IMF Warns That Using Consumer Debt To Fuel Growth Risks Crisis (G.)

The IMF has issued a warning to governments that rely on debt-fuelled consumer spending to boost economic growth, telling them they run the risk of another major financial collapse. In a report before the IMF’s annual meeting in Washington next week, it said analysis of consumer spending and levels of household debt showed that economies benefited in the first two to three years when households raised their levels of borrowing, but then risks began to mount. Once growth becomes dependent on household debt, it can be a matter of two to three years before a financial crash, the IMF said in its annual report on the global financial system. The study follows a series of warnings about rising levels of household debt in the UK from financial regulators and debt charities.

In a blogpost accompanying the report, one of the authors, Nico Valckx, warned: “Debt greases the wheels of the economy. It allows individuals to make big investments today – like buying a house or going to college – by pledging some of their future earnings. That’s all fine in theory. But as the global financial crisis showed, rapid growth in household debt – especially mortgages – can be dangerous.” He added: “Higher debt is associated with significantly higher unemployment up to four years ahead. And a one percentage point increase in debt raises the odds of a future banking crisis by about one percentage point. That’s a significant increase, when you consider that the probability of a crisis is 3.5%, even without any increase in debt.”

Earlier this year the IMF cut its forecast for the UK’s GDP growth in 2017 by 0.3 percentage points to 1.7% and it is expected to reduce its prediction further next week when its global outlook is published. The uncertainty created by the Brexit vote and negotiations to leave are likely to be blamed, along with a reliance on consumer spending, which has slowed this year. The Bank of England, which regulates the banking sector, said last month that the UK’s banks could incur £30bn of losses on their lending on credit cards, personal loans and for car finance if interest rates and unemployment rose sharply. The debt charity Stepchange has warned that 6.5 million people have used credit to pay for basic items such as food after a change in their circumstances. And MPs have called for an independent commission to examine the effects of rising household debt levels in the UK.

Same IMF report, specifically for Australia.

• IMF Warns That Australia’s Household Debt Hangover Will Hurt (Aus.)

Rapid growth in household debt works as a short-term sugar hit to the economy but leaves a long hangover with reduced growth, higher unemployment and the risk of a banking crisis, the International Monetary Fund has warned. The fund identifies Australia as one of the countries most exposed, with household debts rising to more than 100% of GDP compared with an advanced- country average of 63%. “In the short term, an increase in the household debt-to-GDP ratio is typically associated with higher economic growth and lower unemployment, but the effects are reversed in three to five years, the IMF says in its latest review of global financial stability. Moreover, higher growth in household debt is associated with a greater probability of banking crises.

Reserve Bank governor Philip Lowe yesterday repeated his concern that housing debt has been outpacing the slow growth in household incomes and is now limiting growth in household spending. “Slow growth in real wages and high levels of household debt are likely to constrain growth in household spending,” he said. Announcing that the bank was keeping its benchmark cash rate at the record low of 1.5%, where it has now been sitting since August 2016, he said risks in the housing market were being contained by banking regulator the Australian Prudential Regulation Authority, which had tightened supervision of real estate lending.

The IMF’s research shows that on average, a 5 percentage point rise in household debt to GDP over a three-year period foreshadows weaker growth in GDP, which would be 1.25 percentage points lower in three years’ time. Reserve Bank statistics on household balance sheets show that total debts have risen from 123% of GDP to 137% over the past five years, or a 14 percentage point increase.

And Das has some more on the land of Oz.

• A Debt Bomb Is Growing Down Under (Satyajit Das)

Australia’s record of 26 years without a recession flatters to deceive. The gaudy numbers mask serious flaws in the country’s economic model. First and most obviously, the Australian economy is still far too dependent on “houses and holes.” During part of the typical business cycle, national income and prosperity are driven by exports of commodities – primarily iron ore, liquefied natural gas and coal – that come out of holes in the ground. At other times, low interest rates and easy credit boost house prices, propping up economic activity. These two forces have combined with one of the highest population growth rates in the developed world (around 1.5% annually, driven mostly by immigration) to prop up headline growth. Yet a significant portion of housing activity is speculative. Going by measures such as price-to-rent or price-to-disposable income, Australia’s property market looks substantially overvalued.

Meanwhile, GDP per capita has been largely stagnant since 2008. Australia’s manufacturing industry, once a significant employer and an important part of the economy, has increasingly been hollowed out. The country’s cost structure is high. Improvements in productivity have, as elsewhere, been lackluster. Infrastructure is aging and unable to cope with the demands of a rising population, especially in major cities. Australia stands at 21st place in the 2017 Global Competitiveness Report. It ranks 15th in the World Bank’s ease of doing business list. Attempts to diversify the economy have had mixed results. Tourism and service exports, mainly of education and health services, have expanded significantly. But they’re nowhere near replacing the revenues brought in by mineral exports.

Second, a debt bomb is growing Down Under. Australia’s total non-financial debt is over 250% of GDP, up around 50% since 2010. Household debt is currently over 120% of GDP, among the highest proportions in the world. The ratio of household debt to income has nearly quintupled since the 1980s, reaching an all-time high of 194%. Stagnant real incomes have contributed to the problem, as have high home prices and the associated mortgage debt. Despite record-low interest rates, around 12% of income is now devoted to servicing all this debt. That’s a third more than in 1989-90, when interest rates neared 20%.

“..a motley collection of imbeciles, con artists, thieves, opportunists and warmongering generals. And to be clear, I am speaking about Democrats, too.”

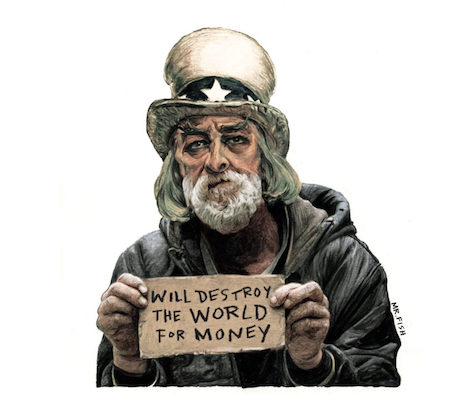

• The End of Empire (Chris Hedges)

The American empire is coming to an end. The U.S. economy is being drained by wars in the Middle East and vast military expansion around the globe. It is burdened by growing deficits, along with the devastating effects of deindustrialization and global trade agreements. Our democracy has been captured and destroyed by corporations that steadily demand more tax cuts, more deregulation and impunity from prosecution for massive acts of financial fraud, all the while looting trillions from the U.S. treasury in the form of bailouts. The nation has lost the power and respect needed to induce allies in Europe, Latin America, Asia and Africa to do its bidding. Add to this the mounting destruction caused by climate change and you have a recipe for an emerging dystopia.

Overseeing this descent at the highest levels of the federal and state governments is a motley collection of imbeciles, con artists, thieves, opportunists and warmongering generals. And to be clear, I am speaking about Democrats, too. The empire will limp along, steadily losing influence until the dollar is dropped as the world’s reserve currency, plunging the United States into a crippling depression and instantly forcing a massive contraction of its military machine. Short of a sudden and widespread popular revolt, which does not seem likely, the death spiral appears unstoppable, meaning the United States as we know it will no longer exist within a decade or, at most, two.

The global vacuum we leave behind will be filled by China, already establishing itself as an economic and military juggernaut, or perhaps there will be a multipolar world carved up among Russia, China, India, Brazil, Turkey, South Africa and a few other states. Or maybe the void will be filled, as the historian Alfred W. McCoy writes in his book “In the Shadows of the American Century: The Rise and Decline of US Global Power,” by “a coalition of transnational corporations, multilateral military forces like NATO, and an international financial leadership self-selected at Davos and Bilderberg” that will “forge a supranational nexus to supersede any nation or empire.”

“We serve one out of every three Americans, we have 270,000 team members,” Sloan began, before Schatz cut him off. “So you’re too big?” Schatz asked.

• ‘What In God’s Name Were You Thinking?’ Senators Grill Wells Fargo CEO (MW)

The chief executive of Wells Fargo & Co. on Tuesday faced senators unimpressed with the bank’s claims of progress in rectifying a massive scandal that lasted years and ensnared millions of customers. “My task is to make sure nothing like this happens again at Wells,” CEO Tim Sloan, a former CFO who was elevated after the ouster of John Stumpf last fall, told the Senate Banking Committee. Sloan outlined steps Wells had taken to address the management structure that incentivized opening accounts for customers fraudulently, and to make affected customers whole. But most legislators said those actions – and Sloan’s testimony – fell far short. The hearing marked one year since regulators settled with Wells over the opening of 2 million phony accounts – and since then, additional wrongdoing has emerged.

In July, the New York Times broke the news that Wells had charged hundreds of thousands of customers for auto insurance they didn’t request or require – a practice that in many cases resulted in overdrawn accounts, fees, and car repossessions. Just days later, the bank told regulators that the number of unauthorized accounts should be revised much higher, to 3.5 million. On Tuesday, Sloan was asked whether the actual count of fraudulent accounts could be even higher than that. He told legislators that he was confident 3.5 million would be the final tally—and more than one noted that Stumpf had said the same thing, a year before. But many senators, it seemed, hadn’t even made peace with the revelations already reported.

“What in God’s name were you thinking?” said Senator John Kennedy, a Louisiana Republican. “I’m not against large, I’m against dumb. I’m against a business practice which has Wells Fargo first and customers second,” he added. Senator Elizabeth Warren, the populist Massachusetts Democrat, was even more blunt. “At best you were incompetent, at worst you were complicit. And either way you should be fired,” she told Sloan. Warren has previously called for removal of the entire board of directors, and urged Federal Reserve Chairwoman Janet Yellen to oust the board in her capacity as a regulator, if Wells doesn’t do it voluntarily. Yellen has said that the bank’s actions were “egregious and unacceptable” and has hinted at further penalties or enforcement actions.

“Why shouldn’t the OCC (Office of the Comptroller of the Currency) simply revoke your charter?” Brian Schatz, a Hawaii Democrat, asked Sloan. “We serve one out of every three Americans, we have 270,000 team members,” Sloan began, before Schatz cut him off. “So you’re too big?” Schatz asked.

The King represents the old Franco interests. He’s being used to turn Spaniards against Catalans.

• King Felipe: Catalonia Authorities Have ‘Scorned’ All Spaniards (G.)

King Felipe of Spain has accused the Catalan authorities of attempting to break “the unity of Spain” and warned that their push for independence could risk the country’s social and economic stability. In a rare and strongly worded television address on Tuesday evening, he said the Catalan government’s behaviour had “eroded the harmony and co-existence within Catalan society itself, managing, unfortunately, to divide it”. Speaking two days after the regional government’s unilateral independence referendum, in which 90% of participants opted to secede from Spain, he described Catalan society as “fractured” but said Spain would remain united. The king made no mention of the violence that marred the referendum when Spanish police officers raided polling stations, beat would-be voters and fired rubber bullets at crowds.

Instead, he focused on the actions of the government of the Catalan president, Carles Puigdemont. “These authorities have scorned the attachments and feelings of solidarity that have united and will unite all Spaniards,” he said. “Their irresponsible conduct could even jeopardise the economic and social stability of Catalonia and all of Spain. He described the regional government actions as “an unacceptable attempt” to take over Catalan institutions, adding that they had placed themselves outside both democracy and the law. “They have tried to break the unity of Spain and its national sovereignty, which is the right of all Spaniards to democratically decide their lives together,” he said.

“Given all that – and faced with this extremely grave situation, which requires the firm commitment of all to the common interest – it is the responsibility of the legitimate state powers to ensure constitutional order and the normal functioning of the institution, the validity of the rule of law and the self-government of Catalonia, based on the constitution and its statute of autonomy.”

The EU is making mistakes that will threaten its existence.

• Spain Rules Out Mediator In Catalan Crisis (Pol.)

The Spanish government Tuesday dismissed calls to bring in a mediator between Madrid and the government of Catalonia in the wake of Sunday’s controversial independence vote. Spanish European Affairs Minister Jorge Toledo told POLITICO that no third-party mediator would be acceptable to Madrid, and that any dialogue must be bilateral. “You can change the law, you can oppose it, but you cannot disobey it,” Toledo said. The comments are a further sign of Madrid’s opposition to providing any sort of encouragement or reward to Catalan separatists as a result of Sunday’s violent clashes, which they blame on the Catalan government.

The European Commission Monday called for “all relevant players to now move very swiftly from confrontation to dialogue.” European Council President Donald Tusk on Monday “appealed for finding ways to avoid further escalation and use of force.” Ahead of Sunday’s vote Amadeu Altafaj, Catalonia’s representative in Brussels, told POLITICO’s EU Confidential podcast that he welcomed the idea of a third-party mediator and that “ideally it would have happened some time ago.”

It’s World Animal Day.

• Goodbye – And Good Riddance – To Livestock Farming (G.)

What will future generations, looking back on our age, see as its monstrosities? We think of slavery, the subjugation of women, judicial torture, the murder of heretics, imperial conquest and genocide, the first world war and the rise of fascism, and ask ourselves how people could have failed to see the horror of what they did. What madness of our times will revolt our descendants? There are plenty to choose from. But one of them, I believe, will be the mass incarceration of animals, to enable us to eat their flesh or eggs or drink their milk. While we call ourselves animal lovers, and lavish kindness on our dogs and cats, we inflict brutal deprivations on billions of animals that are just as capable of suffering. The hypocrisy is so rank that future generations will marvel at how we could have failed to see it.

The shift will occur with the advent of cheap artificial meat. Technological change has often helped to catalyse ethical change. The $300m deal China signed last month to buy lab-grown meat marks the beginning of the end of livestock farming. But it won’t happen quickly: the great suffering is likely to continue for many years. The answer, we are told by celebrity chefs and food writers, is to keep livestock outdoors: eat free-range beef or lamb, not battery pork. But all this does is to swap one disaster – mass cruelty – for another: mass destruction. Almost all forms of animal farming cause environmental damage, but none more so than keeping them outdoors. The reason is inefficiency. Grazing is not just slightly inefficient, it is stupendously wasteful. Roughly twice as much of the world’s surface is used for grazing as for growing crops, yet animals fed entirely on pasture produce just one gram out of the 81g of protein consumed per person per day.

A paper in Science of the Total Environment reports that “livestock production is the single largest driver of habitat loss”. Grazing livestock are a fully automated system for ecological destruction: you need only release them on to the land and they do the rest, browsing out tree seedlings, simplifying complex ecosystems. Their keepers augment this assault by slaughtering large predators. In the UK, for example, sheep supply around 1% of our diet in terms of calories. Yet they occupy around 4m hectares of the uplands. This is more or less equivalent to all the land under crops in this country, and more than twice the area of the built environment (1.7m hectares). The rich mosaic of rainforest and other habitats that once covered our hills has been erased, the wildlife reduced to a handful of hardy species. The damage caused is out of all proportion to the meat produced.