John M. Fox WCBS studios, 49 East 52nd Street, NYC 1948

I must admit I’m getting fed up with the stories and narratives. People may have short attention spans, but how is that a reason to just go and invent narratives about something as serious as a pandemic? The disgusting morally hollow Brits celebrating the recovery of Boris Johnson as he’s thanking the same NHS he actively helped defund, at the same time that he’s murdering Julian Assange, get a life.

From Dr. Fauci I don’t expect anything else anymore than putting the blame on anyone but himself. “We got the wrong infomation!” If you were an investor, that would be your fault, not someone else’s. See, the WHO will make the same argument: the Chinese gave us false info, don’t blame us. But if you’re in positions like that, it’s your own responsibility to get your info right. And if you fail at that, to be open and honest about it.

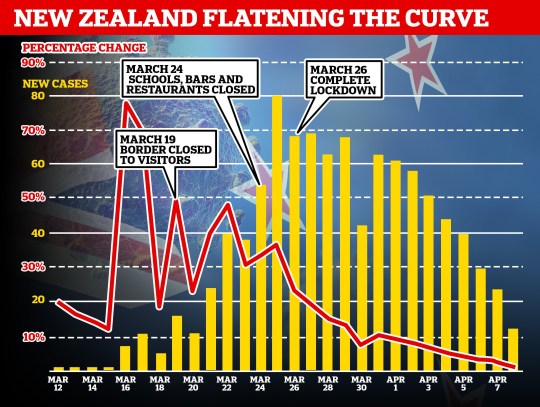

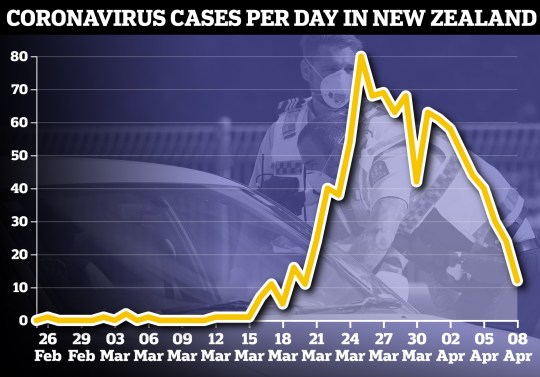

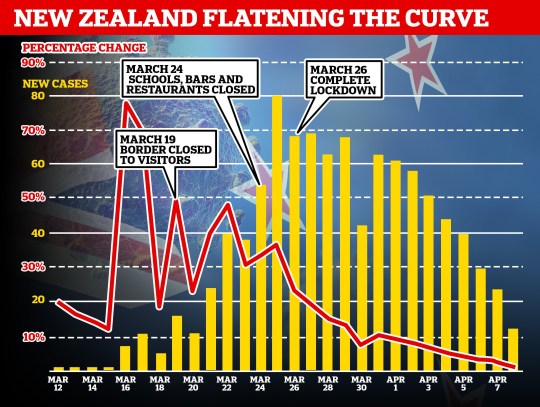

The pedestal upon which New Zealand PM Jacintha Ardern is placed -“a masterclass in crisis management!- while one look at a timeline shows that she, too, like all the rest, was way too late in her reaction. The WHO was criminally slow in declaring a pandemic, they finally did so on March 11, and STILL New Zealand didn’t lock down. Ardern closed the borders only on March 19 and locked down the country on the 26th. She’s just lucky New Zealand has the geographical advantages it has, far away from anyone else.

The next narrative has already started: what are we going to do after it’s all over. But how are you going to do the right thing today when all you think about is tomorrow? Moreover, the virus hasn’t even started for the next 5 billion people, who often live in the most vulnerable places. And we’re going to forget about that just because the West, China, Japan, can’t keep focused for more than 2 weeks?

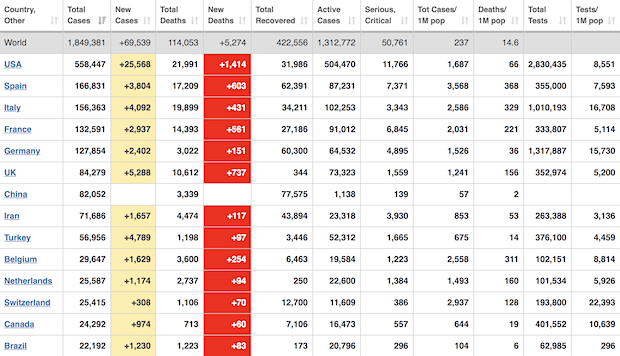

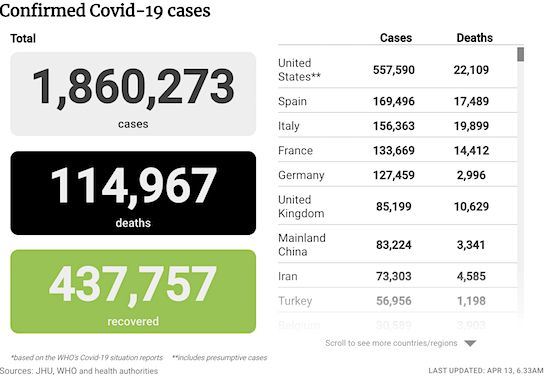

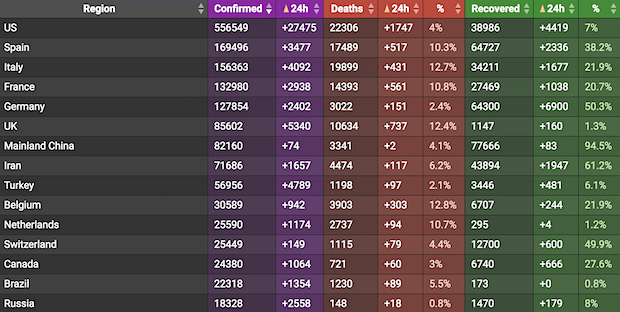

• Cases 1,862,584 (+ 72,011 from yesterday’s 1,790,573)

• Deaths 114,982 (+ 5,328 from yesterday’s 109,654)

From Worldometer yesterday evening -before their day’s close-

From Worldometer – NOTE: mortality rate for closed cases is at 21% !-

From SCMP:

From COVID2019Info.live:

If this is why the US gets hits so hard, watch out for Mexico. Chronic inflammation sounds like a credible factor.

• Obesity The Single Biggest Factor In New York COVID19 Hospitalizations (ZDN)

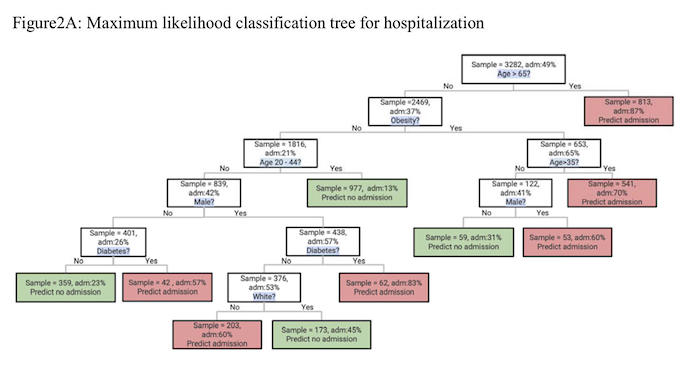

For months, scientists have been poring over data about cases and deaths to understand why it is that COVID-19 manifests itself in different ways around the world, with certain factors such as the age of the population repeatedly popping up as among the most significant determinants. Now, one of the largest studies conducted of COVID-19 infection in the United States has found that obesity of patients was the single biggest factor in whether those with COVID-19 had to be admitted to a hospital. “The chronic condition with the strongest association with critical illness was obesity, with a substantially higher odds ratio than any cardiovascular or pulmonary disease,” write lead author Christopher M. Petrilli of the NYU Grossman School and colleagues in a paper “Factors associated with hospitalization and critical illness among 4,103 patients with Covid-19 disease in New York City..”

Among other things, the presence of obesity in the study points to a potentially important role of heightened inflammation in patients, a phenomenon that has been a topic of much speculation in numerous studies of the disease. Petrilli and colleagues at the Grossman School, and doctors at the NYU Langone Health center, studied the electronic patient records of 4,103 individuals who tested positive for COVID-19 in the New York City healthcare system between March 1st and April 2nd. It is “the largest case series from the United States to date,” write Petrilli and colleagues. The motivation of the work, they write, was that “Understanding which patients are most at risk for hospitalization is crucial for many reasons,” such as how to triage patients and how to anticipate medical needs.

click to enlarge in new tab

Half of those patients were admitted to a hospital. What the researchers found is that “In the decision tree for admission, the most important features were age >65 and obesity.” Obesity, in this case, was measured as weight relative to a person’s height. The authors use a metric scale, so a body mass index of 30 kilograms of weight and higher is considered obese. The “decision tree” in this case refers to the statistical method they used to analyze the patient data. A decision tree is a way to group members of a sample based on their shared characteristics. “For a given population, the decision tree classification method splits the population into two groups using one feature at a time, starting with the feature that maximizes the split between groups relative to the outcome in question.” They keep splitting groups into smaller and smaller groups until they arrive at groups that “[have] similar characteristics and outcomes.”

https://twitter.com/StephanieKelton/status/1249465834029932545

Twitter: “Which is right? CDC officially says 6’ for #SocialDistancing . But a new CDC report, says #COVID19 can travel through the air at least 13 feet. Meanwhile, WHO says 3’ should be enough. And Dr Fauci rejects recent research, wherein virus could travel up to 27 feet.”

• Coronavirus Spreads At Least 13 Feet, Travels On Shoes: CDC (NYP)

The coronavirus can travel through the air at least 13 feet — more than twice as far as social distancing guidelines, according to a report from the Centers for Disease Control and Prevention. Research published in the federal agency’s Emerging Infectious Diseases journal shows the contagion spreading far further than previous official suggestions — and also getting spread on people’s shoes. “The aerosol distribution characteristics … indicate that the transmission distance of [COVID-19] might be 4 m,” the report says, translating as more than 13 feet. “Furthermore, half of the samples from the soles of the ICU medical staff shoes tested positive,” the researchers wrote of samples taken at Huoshenshan Hospital in Wuhan.

“Therefore, the soles of medical staff shoes might function as carriers.” The report, based on research by a team at the Academy of Military Medical Sciences in Beijing, appears to reaffirm fears that the current social distancing guidelines of 6 feet may not be enough. It also suggests people — especially medical staff on the frontlines — could inadvertently be spreading the bug away from its source, recommending stringent disinfecting measures.

High levels were also found on frequently touched surfaces like computer mice, trashcans and bed rails. The CDC recommends 6 feet for social distancing, while the World Health Organization claims just 3 feet should be enough, less than a quarter of the distance the current study suggests it spreads. Research last month said the virus could travel up to 27 feet. Dr. Anthony Fauci, the nation’s top infectious disease expert, however called that “terribly misleading,” saying it would require a “very, very robust, vigorous, achoo sneeze” to travel that far and the scenario was “not practical.”

First WHO warning was December 31.

• Fauci: US Given Wrong Information About Virus “Right From The Beginning” (JTN)

The U.S. was given inaccurate information about the coronavirus at the beginning of the crisis Director of the National Institute of Allergy and Infectious Diseases Dr. Anthony Fauci said on Saturday. When Fox News host Jesse Watters asked Fauci if he believes China or the World Health Organization “misled” him or if the WHO leader himself could have been “deceived,” Fauci noted that while he does not know the details behind the inaccurate information, it was disseminated from the start of the crisis. “You know I don’t know where the missteps went, the only thing I know what the end result was, that early on we did not get correct information,” Fauci said.

“And the incorrect information was propagated right from the beginning because you know when the first cases came out, that were identified I think on December 31st in China and we became aware of this, they said this was just animal to human period.” “Now we know retrospectively that there was ongoing transmission from human to human in China, probably at least a few weeks before then,” he said. Fauci said once the illness hit the U.S. it became evident “that was misinformation right from the beginning.” He added that “whosever fault that was, you know, we’re gonna go back and take a look at that when this is all over, but clearly it was not the right information that was given to us.”

She’s Greek, and those guys are all doing well. It’s the olive oil.

• 102-Year-Old NY Woman Beats COVID-19 With Hydroxychloroquine (CBS)

A 102-year-old woman who was diagnosed with the coronavirus defied the odds and is now recovering. At 102 years old, Sophie Avouris, of Yonkers, has seen a lot in her life, entering this world in 1918 at the start of the Spanish flu. “She survived it, thank goodness,” her daughter, Effie Strouthides, said. Strouthides says back in March, doctors at a Manhattan nursing home and rehab facility called to tell her Avouris, who was recovering at the facility from hip surgery, tested positive for COVID-19. “And we were thinking at 102 years old, at high risk, she might not make it,” Strouthides said. Because the facility was on lockdown, Strouthides called her mom to have a conversation that she thought would be the last.

“Once or twice I managed to let her know how much I loved her and she told me how much she loved me,” she said. According to the CDC, 8 out of 10 deaths reported in the U.S. have been adults who are 65 and older. Dr. Taimur Mirza oversaw Avouris’ care and says her prognosis initially was not good. “Her course in the beginning, it was a little bit rough. For a while there, she required some oxygen, then we started her on the combination of the hydroxychloroquine and the azithromycin,” Mirza said. After a week of treatment, Avouris started showing signs of improvement. By week three, she no longer had the virus. “She didn’t have the cough anymore, and, you know, it was just miraculous to see a woman of her age recover from this,” Mirza said.

Waaaay too late.

• New Zealand Preparing To End Lockdown (Metro)

New Zealand’s Prime Minister Jacinda Ardern says the country is ‘turning a corner’ in the battle against coronavirus after recording the lowest number of new cases in three weeks. She praised residents for mounting a ‘wall of defence’ which is ‘breaking the chain of transmission’ following the swift implementation of lockdown measures. The country has recorded 992 confirmed cases of Covid-19 with just one death so far. Health officials said there were 29 new cases on Thursday, the fourth successive daily drop since 89 were recorded on Sunday and the latest sign of a flattening of the curve. Ms Ardern suggested the four-week lockdown could be softened in just over a weeks’ time, allowing some to return to work if social distancing rules can be maintained.

The PM said New Zealanders’ strict adherence to the rules during the four-week lockdown had ‘saved lives’. She added: ‘At the halfway mark I have no hesitation in saying, that what New Zealanders have done over the last two weeks is huge. ‘In the face of the greatest threat to human health we have seen in over a century, Kiwis have quietly and collectively implemented a nationwide wall of defence. ‘You are breaking the chain of transmission. And you did it for each other.’ But she cautioned against taking a foot off the pedal, adding: ‘We have what we need to win this marathon. You have stayed calm, you’ve been strong, you’ve saved lives, and now we need to keep going.’ Ms Ardern said the government will decide on April 20 whether to relax or extend lockdown measures, which are currently due to expire on April 22.

But don’t worry about Kashkari, he’ll be fine. No matter how many trillions he wastes.

• America Should Be Ready For 18 Months Of Shutdowns – Fed’s Neel Kashkari (MW)

‘This could be a long, hard road that we have ahead of us until we get to either an effective therapy or a vaccine. It’s hard for me to see a V-shaped recovery under that scenario.’ That’s Neel Kashkari, the head of the Federal Reserve Bank of Minneapolis, painting a rather gloomy picture in a CBS interview on Sunday morning of what lies ahead for the U.S. economy as the country continues to battle the coronavirus outbreak. Kashkari, while acknowledging the downside of what a prolonged shutdown could mean for the economy, said the U.S., ‘barring some health-care miracle,’ is looking at an 18-month strategy of rolling shutdowns based on what has happened in other countries.

“We could have these waves of flareups, controls, flareups and controls until we actually get a therapy or a vaccine,” he said. “We need to find ways of getting the people who are healthy, who are at lower risk back to work and then providing the assistance to those who are most at risk, who are going to need to be quarantined or isolated for the foreseeable future.” Looking ahead, Kashkari doesn’t envision a quick rebound for the U.S. economy, which has already endured more than 16 million job losses in the past three weeks. “This could be a long, hard road that we have ahead of us until we get to either an effective therapy or a vaccine,” he said. “It’s hard for me to see a V-shaped recovery under that scenario.”

This started back in December.

• China Is Censoring Research On COVID-19 Origins (NW)

The Chinese government appears to be censoring research on the origins of the COVID-19 epidemic by requiring scientists to run their studies by the Ministry of Science and Technology, a since-deleted page on a university website shows. According to a cached version of that page from the China University of Geosciences in Wuhan that Newsweek reviewed, requirements were updated so that scientists would need to have their study approved by China’s Ministry of Science and Technology before publication: “1. Academic papers on the traceability of the new coronavirus must be reviewed by the academic committee of the school before publication, focusing on the authenticity of the paper and whether it is suitable for publication.

After the review is passed, the school reports to the Ministry of Science and Technology, which can only be published after the review by the Ministry of Science and Technology.” China has faced repeated internal and external accusations of censorship surrounding research into COVID-19, the disease caused by the coronavirus. Local Chinese officials in Wuhan also are known to have suppressed information about the initial outbreak, even detaining whistleblower doctor Li Wenliang. Wenliang later died from COVID-19, and Chinese authorities offered a “solemn apology” to the medical practitioner’s family for how he had been treated. Back in February, The New York Times shared videos of Chinese citizens warning that research into coronavirus was being censored and removed from the internet.

“My purpose is to make sure that all this information is not lost or deleted,” one of the unidentified Chinese nationals said with her face covered in the clip. “We don’t know what information and when the authorities will censor,” another unidentified person said. “So we are trying to be faster than the authorities.” U.S. government officials, and other international leaders, have criticized China for not being transparent about the coronavirus pandemic. Toronto-based cyber research group Citizen Lab reported in early March that Chinese social media had begun censoring keywords associated with the coronavirus as well as criticism of the government’s response to the crisis, according to Reuters.

Feb 5, from NYT:

‘Who Says It’s Not Safe to Travel to China?’ pic.twitter.com/5A7xr9cXDp

— BenTallmadge (@BenKTallmadge) April 5, 2020

Since there is such a link between pollution and literally everything else on the planet, feel free to consider this a piece of empty fluff.

• Experts See Worrisome Link Between Coronavirus, Pollution (Hill)

Advocates and Democratic lawmakers are raising concerns over new research that suggests air pollution, water access and other environmental conditions are exacerbating the effects of the coronavirus on low-income and minority communities. A recent Harvard study found that people who live in areas with more exposure to air pollution are more likely to die from the pandemic, while other research shows that black and Latino communities people are disproportionately affected by the disease. “In public health, it’s often said that your ZIP code is more indicative of your health outcomes than your genetic code,” Lubna Ahmed, the director of environmental health at WE ACT for Environmental Justice, told The Hill.

Polluting industries are frequently located near low-income and minority communities. One assessment published by the American Public Health Association in 2018 showed that nonwhite and low-income communities are harder hit by pollution. Authors of the more recent Harvard study on the coronavirus said their results “suggest that long-term exposure to air pollution increases vulnerability to experiencing the most severe COVID-19 outcomes.” That study added to a growing body of research on the overall health risks to communities exposed to high pollution levels, neighborhoods that are often occupied by people of color and low-income residents.

India is home to some of the world’s most polluted cities, but a strict nationwide coronavirus lockdown has cleared its skies. pic.twitter.com/01W42VbYkX

— DW News (@dwnews) April 12, 2020

“But first they need to actually work.”

• After The Lockdown, Europe Debates Exit Strategies (AFR)

Across Europe there are signs that observance of stringent social distancing measures by the vast majority of the public – better compliance than many experts had expected – has led to a big decline in viral transmission. The key figure is the “reproduction number” R, measuring the average number of new cases generated by an infected individual. If R is above 1, an outbreak spreads; if it is below 1, it contracts. For COVID-19, R was between 2.5 and 3 in most places before any measures were introduced. According to a leading scientist in the UK’s fight against the disease, the latest evidence shows a steep fall in the R rate to around 0.6 now, which would quickly suppress the pandemic. However, deaths are still rising fast because of the delay between infection and when serious symptoms develop.

[..] If the UK can achieve its target of carrying out 100,000 tests a day by the end of April and ramp up capacity further over the following months, it will be possible to test individuals in the community who report COVID-19 symptoms. In theory, this would then be followed by the tracing, testing and isolating of people who have been in contact with them if they are infected. This type of contact tracing, which involves questioning patients directly, took place when the first UK cases were reported but soon stopped when the pandemic swamped the country’s extremely limited testing capacity. “Evidence suggests that countries that are able to do very high levels of testing have many more options to allow people greater social mobility,” says Steven Riley at Imperial College London. “Some really innovative solutions will play a part. Contact tracing based on a mobile phone app is being looked at.”

[..] For many scientists, the key to ending the lockdowns is mass testing for COVID-19 infection, which detects the presence of the virus. Paul Romer, the Nobel Prize-winning economist, has outlined a plan for mass testing in the US that he believes would allow for much of the economy to reopen. However, this requires each person being tested every 14 days – or 22 million tests a day – a mammoth undertaking in terms of labs, chemicals, health workers and data analysis, even if such tests are constitutionally acceptable. In the UK, the epidemiologist Julian Peto has made a similar proposal – weekly tests, running to 10 million a day. Large-scale antibody testing, to show whether individuals have been infected in the past and still have some immunity, is a more tantalising prospect because they would only need to be conducted occasionally and could potentially be bought at a pharmacy.

But first they need to actually work. Specialised labs are carrying out studies to determine antibody levels in samples of the population but no one has yet developed an antibody kit reliable enough for widespread use in homes. Kits evaluated by the UK government have failure rates of 30 to 50 per cent. Eventually antibody tests could give individuals “immunity passports” to show that they are safe from infection, Professor Riley says, “but there’s some very important science to do first”. The key questions that have still to be answered are how different antibody levels relate to resistance to infection and how long any immune protection is likely to last.

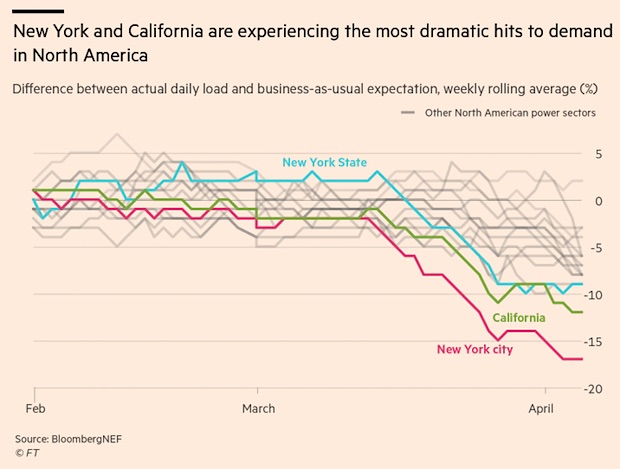

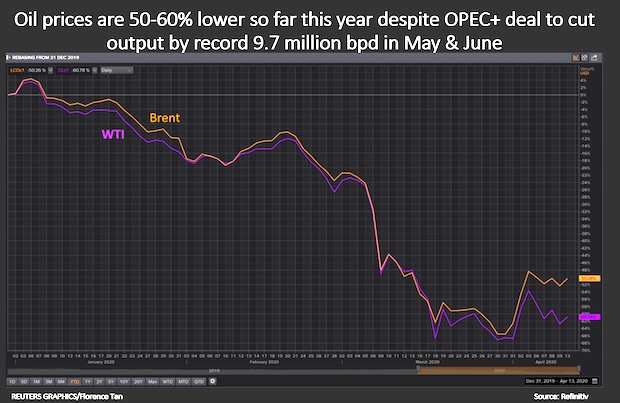

Demand is down 20%, production maybe 10%. You do the math.

• Giant Oil Output Cuts Make Ripple, Not Big Waves (R.)

Muted oil price gains on Monday show record output cuts by giant producers will still leave them with a mountain to climb to restore market balance, industry watchers said, with the coronavirus pandemic decimating demand just as stocks swell. The morning after OPEC and allies led by Russia agreed to reduce output by 9.7 million barrels per day (bpd) in May and June – equal to nearly 10% of global supply – prices gained less than 5% and are still 50-60% down for the year so far. That headline cut by the grouping known as OPEC+ may be more than four times deeper than the previous record set in 2008, and may provide a floor for prices according to some analysts, but the reduction still dwarfed by the near 30 million bpd drop in demand in April already anticipated by forecasters like Goldman Sachs.

What’s more, governments in countries around the globe are considering extending travel and social lockdown measures that have sapped fuel use in order to prevent the coronavirus from spreading. “Even if these cuts provide a floor to prices they will not be able to boost prices given the scale of inventory builds we are still staring at,” Energy Aspects analyst Virendra Chauhan said, referring to storage tanks and ships around the world the are filling up fast amid the slide in demand from end-users. “The absence of hard commitments from the United States or other G20 members is (a) shortcoming of the deal.” G20 nations have been urged to help reduce the supply glut, but there was little detail on the outcome of Friday talks between energy ministers from the group and Saudi Arabia.

Meanwhile analysts said that while the core number in the deal suggests a near 10 million bpd cut, Middle East producers like Saudi Arabia, the United Arab Emirates and Kuwait will likely have to reduce by more than the 23% cut to which they signed up, as they had begun to ramp up output in April amid a price war before the agreement was struck. “This 9.7 million b/d ‘headline’ deal represents a 12.4 million bpd cut from claimed April OPEC+ production (given the Saudi, UAE, Kuwait ongoing surge) but an only 7.2 million bpd cut from 1Q20 average production levels,” Goldman Sachs analysts said in a note.

It’s not just Texas where various religious sects feel exempt from society at large. Remember the one that started the epidemic in South Korea? Nice thing in Greece is the government actually pays the salaries of the priests.

• Greek Government To Go After Priests Flouting Quarantine (K.)

The government has asked for a prosecutor to press charges against two priests who provided communion to the faithful Sunday despite a ban on church attendance. One of the priests, in the Athens neighborhood of Koukaki, was photographed from a nearby building secretly giving communion to people through the back door. The other incident happened in St. Spyridon Church in the city of Corfu. “What happened today in churches in Koukaki and Corfu is a violation of the law and of the Holy Synod’s orders and put the lives of citizens and public health in great danger. I contacted the Minister of Justice so that he can ask the prosecuting authorities to intervene,” said Nikos Hardalias, Deputy Minister of Civil Protection.

Authorities’ main concern remains attempts to flout strict quarantine measures during the week up to Orthodox Easter, which is celebrated next Sunday, by attending church and engage in the customary exodus from the cities to the countryside. From 6 am to 3 pm Sunday, 38 people were stopped trying to leave cities and fined 300 euros each.

The mortally lost British nation cheer their PM’s health as he’s slow-murdering Julian Assange and letting people starve.

• Lockdown: Not Novels And Family Time But Food Parcels And Hardship (G.)

Last week, I spoke to Anna Rogers, a Polish-born Londoner who lives in Brixton. She works for a charity called Money A+E, which operates across the south of the capital. It offers advice about debt, benefits and other financial issues to people who are often facing extreme hardship. It is a small set-up, with only four dedicated advisers. Since the coronavirus crisis began, the number of people getting in touch has tripled and is rising all the time. Rogers spoke matter-of-factly about the defining feature of many who now need her help. “They are people without any income,” she said. Many are migrant workers who have been sacked by small businesses or had cash-in-hand work – in, say, the building trade – suddenly withdrawn. In desperation, some say they would like to return to their countries of origin to be with their families, but that option is cut off right now.

A lot of them have no experience of the British benefits system, and few of the language skills and insider knowledge needed to navigate it. “The universal credit system never worked terribly well,” Rogers said. “But now people are saying that the system crashes, or they can’t upload documents.” Not everyone has internet access, and the sudden closure of public libraries has meant that even fewer people can get online. Even if they manage to do so, there is now an ominous sense that with the system under such pressure, the standard five-week wait for universal credit is bound to increase.

So, for now, Rogers and her colleagues have to introduce people to the most basic kinds of help. One fairly reliable source of food assistance, she said, was the array of new mutual aid groups that have sprung up at the most local level: “Fingers crossed, they can get people some food parcels.” When she spoke about the details of her work, her words had a palpable sense not just of sadness, but of urgency and a clear sense that things were only going to get worse, and quickly. The fact that we now rarely leave our homes means few people are aware of what is actually going on all over the country. Our field of vision is replete with statistics, and broad-brush warnings about the near future: from the daily death toll to the warnings from big banks of $5.5 trillion in lost global output, to the million or so people said to have newly applied for benefits in the UK. A very human crisis caused by Covid-19 is already here, beyond the illness itself, and it demands our attention.

It must be possible to run the Automatic Earth on people’s kind donations. These are no longer the times when ads pay for all you read, your donations have become an integral part of the process.

Thanks everyone for your generous donations.

Support the Automatic Earth. It’s good for your mental health.