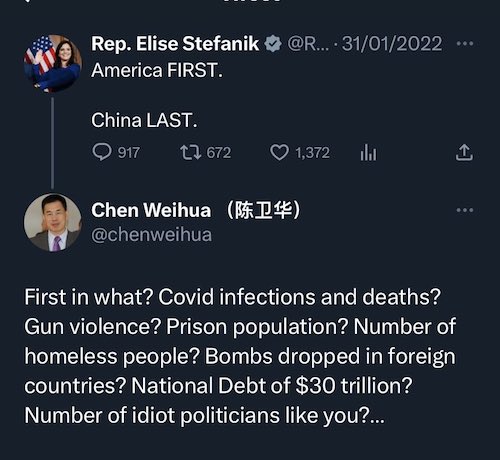

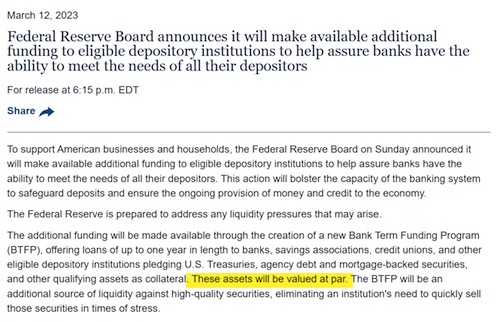

Andy Warhol Sigmund Freud 1980

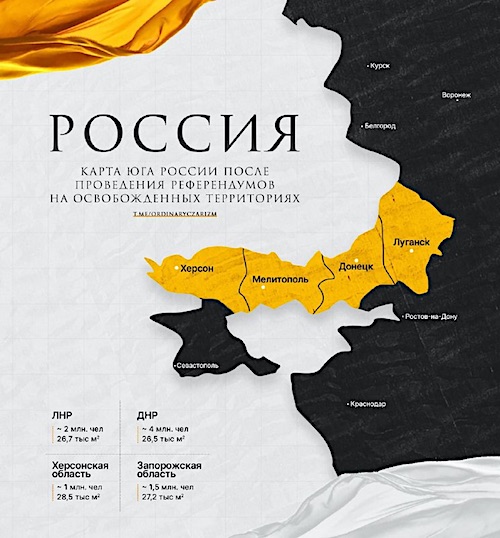

Putin

Vladimir #Putin about #Russia:

"You can be friends with Russia – it's kind. You can cooperate with Russia – it's honest. You can ask Russia – it's generous. Russia can be deceived – it's trusting. But you can't fight Russia – it's invincible!" pic.twitter.com/qtkplD3TNy

— StellaMoscow (@SgforgoodStella) July 16, 2023

Fascinating interview given the gaps in our knowledge currently. Starts with the Grain Deal & ends with Wagner.

Subtitles roughly accurate. As some may recall, I have long argued that the grain deal was very much against Russia's interest, more so if the few commitments to pic.twitter.com/Nn8iMQuHbp

— Erik Zimerman (@ZimermanErik) July 14, 2023

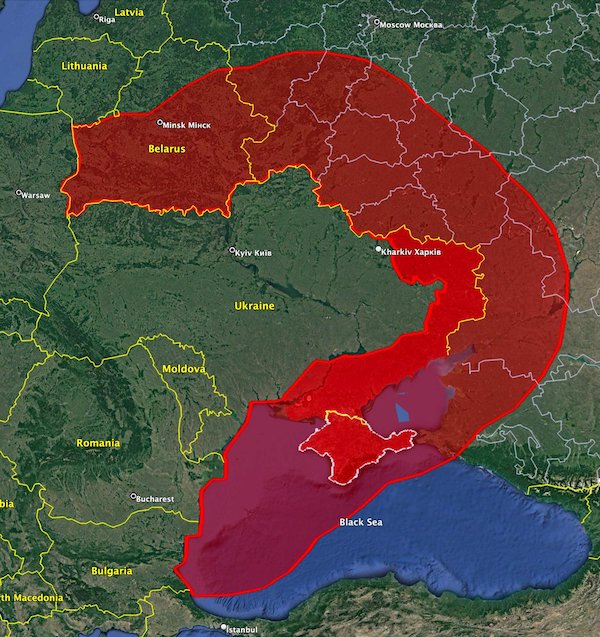

Macgregor

“They know they lost. Their troops are falling apart. Today, Defense Minister Shoigu announced an offensive in the Liman direction. And this is clearly aimed, as far as I can tell, at Kharkov. So the Russians are now on the offensive in the northeast of the defensive lines.… pic.twitter.com/7BhLOANVWZ

— Mats Nilsson (@mazzenilsson) July 17, 2023

https://twitter.com/i/status/1680884654172258305

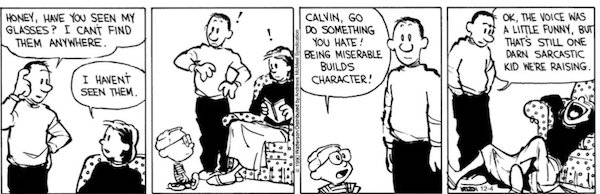

Ukr pre2014

This was how the media covered Ukraine before rehabilitating it as a thriving liberal democracy. pic.twitter.com/4J3ieybfHv

— Ian Miles Cheong (@stillgray) July 17, 2023

RFK Event 201

Bitches don't know about Event 201 pic.twitter.com/KHGXCFgDOf

— illuminatibot (@iluminatibot) July 18, 2023

“Sullivan said that accepting Ukraine into the alliance now would mean a direct confrontation between the bloc and Russia.”

• US Not Ready For War With Russia – White House (RT)

US National Security Advisor Jake Sullivan has stated that Ukraine’s future lies in NATO, but said certain conditions must be met before it can join the alliance, which includes ending its conflict with Russia. In an interview with CBS on Sunday, Sullivan insisted that NATO is committed to accepting Kiev into its ranks despite the lack of a formal invitation or timeline for membership during last week’s NATO summit in Vilnius, Lithuania. “Ukraine’s future is in NATO. We meant it. That’s not up for negotiation,” Sullivan said. “That’s something that now all 31 allies have committed to,” he added, referring to the final statement released at the end of the summit, in which all members of the alliance pledged to eventually accept Ukraine into the bloc, once a number of conditions are met. Speaking to ABC, Sullivan said that accepting Ukraine into the alliance now would mean a direct confrontation between the bloc and Russia.

“Having Ukraine come into NATO while the war is going on would mean that NATO was at war with Russia, it would mean the United States was at war with Russia. And neither NATO nor the United States were prepared to do that,”he said. Kiev insists that it has already met all of the requirements to join the US-led bloc and has expressed confusion over what more it has to do to qualify for membership. “When will those conditions be met? What are those conditions? Who should formulate them? What are they?” Ukrainian Foreign Minister Dmitry Kuleba said in an interview with Radio Free Europe last week. Ukrainian President Vladimir Zelensky lashed out at NATO for failing to meet Kiev’s membership demands and called the lack of a roadmap towards accession “unprecedented and absurd,”saying NATO’s indecisiveness is a sign of weakness.

Ru soldier

The Russian soldier that went viral with his epic rant, is continuing on Russian TV. pic.twitter.com/b5S7AToSyb

— Lord Bebo (@MyLordBebo) July 17, 2023

“The worst day in Afghanistan or Iraq is a great day in Ukraine.”

• US Soldiers Don’t Belong in Ukraine (Ottenberg)

So how many American soldiers fight in Ukraine? The Biden bunch is careful not to reveal or refer to their presence, mercenary or otherwise, but the question keeps coming to mind. It popped up again June 27, when Russia bombed what the Ukraine press called simply a restaurant in Kramatorsk. However, this supposedly innocuous restaurant was part of a hotel complex that apparently attracted lots of western men of fighting age, specifically American soldiers and others from NATO countries. We know this because eyewitnesses heard them speaking American English and saw their U.S. military tattoos (3rd Ranger Battalion) and the American flags on their helmets. Also, American mercenaries were reported dead in twitter accounts. We also know that this missile attack killed 50 Ukrainian officers and two generals and at least 20 of the westerners, including Americans, proving yet again that one American soldier in Ukraine is one too many.

The problem is that we don’t know how many U.S. soldiers – to say nothing of American mercenaries – are in Ukraine. The Russian ministry of defense estimates that there have been over 900 American mercenaries in Ukraine. Meanwhile Washington remains mum, closely guarding its knowledge of this secret for the obvious reason that not doing so might provoke an open confrontation with Moscow. And since they don’t want a nuclear World War III, the white house and pentagon nurture an intense interest in concealing facts about the U.S. military footprint in Ukraine and their possible encouragement of it. Even if large numbers of American NATO officers were killed there, we, back in the so-called homeland, would doubtless be kept in the dark.

The scraps of news we do get indicate that the fighting goes poorly for U.S. troops. “This is my third war I’ve fought in, and this is by far the worst one,” Troy Offenbecker told the Daily Beast July 1. “You’re getting fucking smashed with artillery, tanks. Last week I had a plane drop a bomb next to us, like 300 meters away. It’s horrifying shit.” The Daily Beast quotes another U.S. soldier, David Bramlette: “The worst day in Afghanistan or Iraq is a great day in Ukraine.” Regarding reconnaissance missions, he said, “if two of them get injured…there’s no helicopter coming to get you…shit can go south really, really frickin’ quickly.” In other words, this is a different enemy, a very competent one, and U.S. soldiers in Ukraine sub rosa could die in large numbers that people back home never hear about.

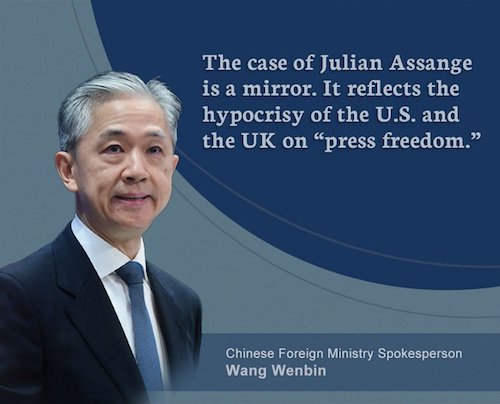

“..the official said the Ukraine crisis erupted last year thanks to “expanding military blocs..”

• No Military Solution To Ukraine Crisis – China (RT)

Only a political settlement can resolve the conflict in Ukraine, China’s deputy UN envoy has said, urging the international community to seek a peaceful end to the crisis after Beijing advanced its own plan to halt the fighting. Speaking at an open meeting on Ukraine at the United Nations Security Council (UNSC) on Monday, Beijing’s deputy permanent UN representative, Geng Shuang, proposed a four-point framework for future peace efforts, saying the global body should “work together to prevent the situation from getting out of control.” “The evolution of the battlefield situation shows that military means cannot resolve the Ukrainian crisis, and the continuation of the conflict will only bring more suffering to civilians, and may even lead to unpredictable and irreparable situations,” he said.

“No matter how long the crisis lasts, it will eventually be resolved through political means.” The Chinese framework calls for talks between Moscow and Kiev, limiting the potential “spillover effects of the crisis,” addressing humanitarian issues, and guaranteeing “nuclear safety and security” – in particular at the Zaporozhye Nuclear Power Plant. The deputy UN envoy went on to argue that any solution to the conflict must “uphold a common, comprehensive, cooperative, and sustainable security concept.” Though he did not cite the NATO alliance by name, the official said the Ukraine crisis erupted last year thanks to “expanding military blocs,” which “can only bring turmoil and unrest to Europe and the entire world.”

Early this year, China unveiled a 12-point roadmap designed to end the fighting, calling for the resumption of talks and arguing that the sovereignty and territorial integrity of all nations should be upheld. The Chinese government has previously slammed the unilateral sanctions on Moscow, and argued that NATO expansion in Europe is the root of the conflict in Ukraine. The initiative received a positive reception in Moscow, with senior officials in the Kremlin signaling willingness to discuss it further. However, the proposal was soon rejected by Kiev and some of its Western backers, who accused Beijing of supporting Russia’s interests.

The grain deal met the same fate as Minsk, April 2022: the west doesn’t make good on its part of the deal.

• No More Security Guarantees For Black Sea Navigation – Russian FM (RT)

Russia will no longer provide security guarantees for civilian vessels traversing the formerly exempted corridor in the Black Sea, the country’s foreign ministry has announced. Earlier on Monday, the Kremlin stated that it would not extend the Black Sea grain agreement since its own food and fertilizer exports are still being blocked. In a statement released on Monday, the Foreign Ministry said that this latest decision “means the recall of maritime navigation security guarantees, the discontinuation of the maritime humanitarian corridor [and] the reinstatement of the ‘temporarily dangerous area’ regime in the north-western Black Sea.” Russian diplomats went on to accuse Ukraine of using the humanitarian corridor to carry out attacks on Russian targets.

As for the Ukrainian grain shipments that were facilitated by the deal, the ministry claimed that the vast majority of those ended up in Europe, with several countries there allegedly lining their pockets. The statement pointed out that the whole mechanism, which was launched last summer, had ostensibly been designed to help avert famine in poorer nations. According to Moscow, key points in the Russia-UN memorandum, which was signed in lockstep with the Black Sea Initiative, have remained unfulfilled to date. As a result, the ministry explained, Russian bank transactions, insurance and logistics were effectively paralyzed, meaning that Moscow could not sell its own produce and fertilizers on the international market. In one case cited in the statement, a shipment of Russian fertilizers donated free of charge to several African countries was blocked in the EU.

The foreign ministry concluded that in light of all these issues, the agreement no longer makes sense. Moscow has suggested European nations should allow Ukraine to transfer its grain via their territory and potentially face the wrath of local farmers, or take action and address Russia’s grievances. Should this happen, Moscow would be ready to return to the implementation of the agreement, the statement noted. Earlier on Monday, Kremlin spokesperson Dmitry Peskov announced the termination of the deal. He also reiterated Russia’s readiness to return to the mechanism; however, he added that this would only happen if its interests were respected. Last week, Russian President Vladimir Putin warned that Moscow would “suspend participation in this deal,” describing the arrangement as a “one-sided game all along.”

Grain deal

https://twitter.com/i/status/1680936741430018049

Erdogan didn’t keep his word to Putin about the Azov commanders.

• Erdogan To Talk Black Sea Grain Deal Resumption With Putin (RT)

Türkiye believes that Russia is interested in continuing the Black Sea grain deal despite Moscow announcing on Monday that it was ending its involvement in the agreement, President Recep Tayyip Erdogan has claimed. The arrangement “went down in history as a diplomatic success,” the Turkish leader said during a press conference on Monday. Erdogan insisted that his Russian counterpart, Vladimir Putin, wanted the deal to survive, and that the two would soon talk on the phone about a possible way forward. Earlier in the day, Kremlin spokesman Dmitry Peskov said the scheme “effectively ceased to be in effect today.” Russia has accused the UN of failing to deliver on its part of the bargain, which included lifting Western economic sanctions hampering Russian exports of foodstuffs and fertilizers.

Unless that changes, Moscow will no longer keep up its end of the deal either, Peskov said. The Russian Foreign Ministry confirmed that the UN and Türkiye had been formally notified that Moscow had opted against renewing the grain deal again, resulting in its expiration on Monday. Formally known as the Black Sea Grain Initiative, the agreement between Moscow and Kiev was mediated by the UN and Türkiye last summer. It allowed Ukrainian grain to be shipped by sea, with merchant ships being inspected to prevent misuse of the arrangement. The deal was touted as a way to alleviate a food price hike in the world’s poorest nations. However, Moscow said that contrary to the deal’s stated goal, European nations were the primary recipients of the shipments.

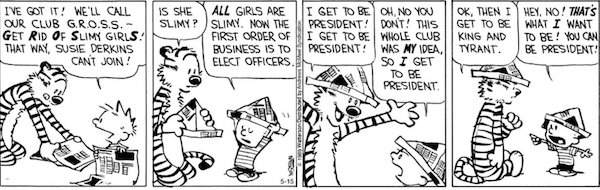

Latin American heads of state are not wild about Zelensky.

• EU Snubs Zelensky Over Summit – Spanish Daily (RT)

The European Union ignored Ukrainian President Vladimir Zelensky’s requests to be invited to the bloc’s summit with Latin American heads of state and government, Barcelona’s La Vanguardia has reported. Last week, NATO refused to accommodate Kiev’s demands for a clear NATO membership timeline, let alone immediate accession to the US-led military alliance. In its article on Monday, the paper cited anonymous European diplomats as claiming that the European Council’s President, Charles Michel, had decided it would be “better not to invite” the Ukrainian head of state to the meeting of European Union and Community of Latin American and Caribbean States (CELAC) leaders in Brussels.

However, “Ukraine will occupy a prominent place during the leaders’ discussions,” unnamed sources told the Spanish daily ahead of the event, which kicked off on Monday. The unnamed diplomats listed food security as one item that would likely be high on the agenda. According to the outlet, the EU has been pressing for the inclusion of condemnation of Russia’s military campaign against Ukraine in the summit’s final document. However, it is not clear whether this will be the case as there is reportedly no consensus on the issue among Latin American nations. La Vanguardia pointed out that the previous EU-CELAC summit took place back in 2015, with Brussels now busy doubling down on its efforts to woo the Global South.

Last week, NATO fell short of Ukraine’s expectations after the US-led military bloc decided that Kiev would be granted membership at some unspecified point in the future, “when allies agree and conditions are met.” President Zelensky took to social media last Tuesday, slamming the alliance’s “indecisiveness” and “weakness.” “It’s unprecedented and absurd when [a] time frame is not set neither for the invitation nor for Ukraine’s membership,” the Ukrainian head of state insisted. Later on, however, Zelensky softened his stance somewhat after the US delegation reportedly became “furious” at his criticisms.

“Outside this event, war in Ukraine has also taken the glitter off of western weapons and the military industrial complex. For a very high price, it produces inadequate quantities of shoddy goods..”

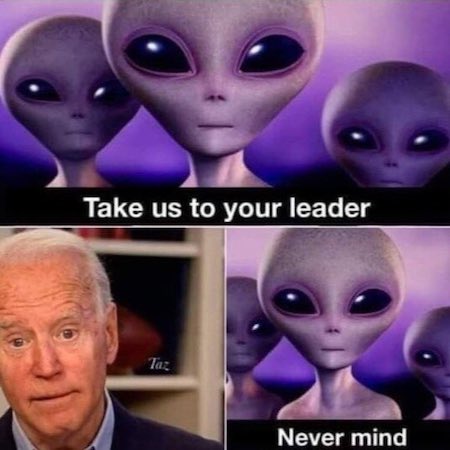

• US Bid to Prolong Ukraine Proxy War Risks Another Quagmire (Sp.)

The Biden administration appears content to prolong the proxy conflict in Ukraine in an effort to weaken Russia, while serving the interests of certain stakeholders in the American establishment, despite the risk of the confrontation turning into another Vietnam or Afghan-style quagmire, experts told Sputnik. At the NATO summit in Vilnius earlier this week, the US and its allies made long-term security commitments to Ukraine while easing alliance admission requirements. However, Kiev was disappointed in not getting an invitation to join NATO as soon as possible, with US President Joe Biden even saying membership is off the table for Ukraine while the conflict with Russia lasts.

“NATO summit proved what was known anyway. The collective West under US leadership wants to destroy Russia without going to war directly but by using Ukrainians as cannon fodder,” American University in Moscow President Edward Lozansky told Sputnik. “Thus we are witnessing a crime that supersedes the atrocities in Vietnam and the Middle East.” However, in previous proxy fights, he added, the US could at least use countering communism or terror as a pretext. “Here we see a policy of provoking, funding, and prolonging the war between the two Christian nations that lived together for over three centuries and who were bounded by close historical, religious, economic, cultural, and family ties under the false flag of preserving a non-existing democracy in the most corrupted state to preserve the geopolitical advantage of the hegemon and its willing vassals,” Lozansky said.

University of Louvain Professor of Political Philosophy Jean Bricmont believes by only pledging more security assistance, NATO allies have made it obvious they do not want to spark a direct war with Russia, which is not good news for Ukrainian President Volodymyr Zelensky. “The mere sending of weapons does not seem to tilt the balance in his favor,” Bricmont suggested. Meanwhile, Bricmont added, developments on the ground in Ukraine and inside Russia have not gone according to plan for the United States, especially as the hoped-for collapse of the Russian economy has not happened and Ukraine’s counteroffensive is failing. “The whole thing has become a very cynical game: using Ukrainians as much and as long as possible in that war, but without any real plan of success,” Bricmont told Sputnik.

“This is likely to end like Vietnam or Afghanistan, but the Americans cannot admit it and cut their losses. So, Ukrainians and Russians will continue to die needlessly.” Lozansky suggested there were other motives driving the White House’s Ukraine policy besides simply trying to counter Russia. “Of course, there was an additional incentive to make money for the military-industrial complex, and, as it turns out, to enrich the Biden family,” Lozansky said. Krainer Analytics Founder Alex Krainer, a Europe-based financial analyst, said while the war may have filled the US defense industry’s pockets, it also undermined many perceptions of its strengths and American’s military prowess. “Outside this event, war in Ukraine has also taken the glitter off of western weapons and the military industrial complex. For a very high price, it produces inadequate quantities of shoddy goods,” Krainer said. “The whole thing has been outed as a con and a paper tiger.”

Shrooms.

• Yellen Says Ukraine Aid Is the Best Boost for Global Economy (NM)

Redoubling support for war-stricken Ukraine is the “single best” way to aid the global economy, Treasury Secretary Janet Yellen said Sunday, along with boosting emerging economies and tackling debt distress. Yellen also said on the sidelines of a G20 finance ministers’ summit in India she would “push back” on criticism there was a tradeoff between aid to Ukraine and developing nations. “Ending this war is first and foremost a moral imperative,” she told reporters in Gandhinagar. “But it’s also the single best thing we can do for the global economy.” Yellen also pointed to efforts to tackle debt distress faced by struggling economies, bank reform and a global tax deal, and warned it was “premature” to talk of lifting tariffs on China.

Russia’s invasion of Ukraine, both global breadbaskets that together exported almost a quarter of the world’s wheat supply, triggered shockwaves in economies worldwide by sending prices for food and fuel shooting up. Japan’s Finance Minister Shunichi Suzuki, speaking after a G7 meeting of ministers, “reconfirmed the G7’s unshakeable support” to Ukraine. “We confirmed that Russia-owned assets that are under the G7’s supervision would not be transferred until Russia pays damages to Ukraine,” Suzuki said, adding that Moscow should also “pay long-term reconstruction costs”. Any discussion on Ukraine is awkward for G20 host India, which has not condemned Russia’s invasion but is also part of the Quad grouping alongside Australia, the United States and Japan.

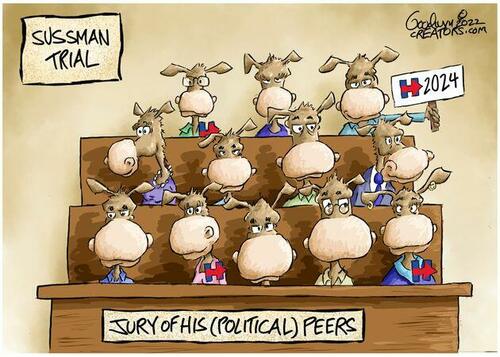

High time SCOTUS gets involved.

• Jan. 6 Defendant Appeals To Supreme Court (JTN)

Jan. 6 defendant Edward Jacob Lang is asking the Supreme Court to hear his challenge against one of the 11 charges he was indicted on – obstruction of an official proceeding – in a case that could upend legal proceedings against hundreds of other defendants indicted on charges related to the Jan. 6, 2021, U.S. Capitol riot. The obstruction charge could be levied against “anyone who attends at a public demonstration gone awry,” attorneys for Lang wrote in an appeal to the Supreme Court last week. The proceeding for which the charge was brought refers to the event where Congress certifies the Electoral College votes to confirm the president.

The charge “is nothing less than the weaponization of the penal code to stifle dissent; it sets a terrifying precedent unworthy of this nation’s history,” Lang’s attorneys also wrote. Lang had filed a motion to dismiss the obstruction charge, which carries a 20-year sentence, before his trial, and the D.C. District court granted this motion. However, an appeals court reversed the lower court’s decision and a motion for a rehearing was denied. Lang’s attorney Norman Pattis told Newsweek that he thinks the Supreme Court could upend the cases of “hundreds of defendants.” “The government misuse and abuse of the federal penal code in the [January 6] cases is shocking,” Pattis also said. His client expects to hear this fall whether the Supreme Court will take up the case.

Lang has been incarcerated for more than 900 days without a trial. He told The Epoch Times that he thinks his appeal could impact the Justice Department’s separate effort to potentially charge former President Donald Trump with obstruction. “I think the timing of this filing is astronomical,” Lang said. “Donald Trump is the political frontrunner for the Republican Party, and while the other bogus charges might easily go away through a plea deal, the obstruction of Congress charge carries prison time. This one would land him in serious hot water with a conviction.”

How about Bolton, Pompeo?

• Trump Opens Up About Mistakes Made During First Term (ET)

President Donald Trump acknowledged that he made mistakes during his first term in office, saying that most issues arose from the people he chose to fill various roles in office. In an interview that aired July 16, Mr. Trump sat down with Fox News’ Maria Bartiromo to discuss an array of issues, including whether he thought he made any mistakes during his term. Ms. Bartiromo asked, “If there’s anything that you could look back on in [2016] that you think maybe you want to do differently this time around?” Mr. Trump replied, “The mistake would be people. I mean, I wouldn’t have put a guy like Bill Barr in—he was weak and pathetic,” a reference to his former attorney general, who has spoken out against Mr. Trump since leaving office and has expressed opposition to a second term for the former president.

“I wouldn’t have put Jeff Sessions in,” Mr. Trump said, a reference to another former attorney general with whom Mr. Trump clashed. “There are some people that I wouldn’t have put in. You know, most people were good. But I had some people—we had [former Secretary of Defense Mark] Esper. I didn’t like him. He was incompetent. I thought we had other people I didn’t like.” Ms. Bartiromo replied, “Why did you put them in the job then?” “Because every—look, every president, you put somebody in, you think they’re good,” Mr. Trump said. “But one thing that has happened and I find it very interesting, and this is the way life goes, I put people in—I was there 17 times in Washington, D.C. my whole life. I never stayed overnight. The press actually reported 70 I don’t know if it’s right, but it’s probably pretty right.

“I never stayed overnight. Ever. And then all of a sudden, I’m the President of the United States and it’s like a different society. I was New York and you know, it was a different thing. So I didn’t know people, I became President,” Mr. Trump said, adding later, “I never was involved in that.” “So you didn’t know what to expect?” Ms. Bartiromo asked. “No, no,” Mr. Trump cut in. “I didn’t know the people. I know the people now better than anybody has ever known the people. I know the good ones, the bad ones, the dumb ones, the smart ones.” Mr. Trump was also pressed on whether he had “drained the swamp,” a reference to Mr. Trump’s 2016 campaign pledge to root out D.C. bureaucrats and other entrenched establishment figures in the capital city. “You didn’t drain the swamp like you said you would, you didn’t drain the swamp,” Ms. Bartiromo said, a common criticism of the former president by conservative elements in the party who feel he failed to live up to his 2016 campaign promises.

It’s not the FBI, but people working there. Who?

• FBI Tipped Off Biden Team, Secret Service About Plan To Interview Hunter (JTN)

A recently retired FBI supervisory agent told Congress behind closed doors Monday that the bureau tipped off Joe Biden’s team and the Secret Service in late 2020 about a plan to interview Hunter Biden in his criminal tax probe, corroborating allegations from two IRS whistleblowers. The FBI agent, who worked alongside the IRS whistleblowers on the Hunter Biden case when he was assigned to the Wilmington field office, gave his account in a transcribed interview before the House Oversight and Accountability Committee, providing fresh evidence of alleged political interference in the treatment of Joe Biden’s son. He corroborated several aspects of the account IRS whistleblower Gary Shapley and a second agent gave Congress last month, including that law enforcement’s plan to conduct a surprise interview in early December 2020 with Hunter Biden about alleged tax crimes was foiled by the tipoff.

The agent, whose name wasn’t immediately made public, said the bureau told both Joe Biden’s transition office and the Secret Service, creating a tipoff that thwarted the planned interview. “The night before the interview of Hunter Biden, both Secret Service headquarters and the Biden transition team were tipped off about the planned interview,” Committee Chairman James Comer, R-Ky. said. “On the day of the Hunter Biden interview, federal agents were told to stand by and could not approach Hunter Biden—they had to wait for his call. As a result of the change in plans, IRS and FBI criminal investigators never got to interview Hunter Biden as part of the investigation. “The Justice Department’s efforts to cover up for the Bidens reveals a two-tiered system of justice that sickens the American people,” he added.

In his testimony to the House Ways and Means Committee back in May, Shapley described how the tipoff around Dec. 7-8, 2020, was a major set back for the investigation, and one of several instances in which political favoritism and interference occurred. “I was informed that FBI headquarters had notified Secret Service headquarters and the transition team about the planned actions the following day,” Shapley testified. He said the alert afforded Hunter Biden and his team “an opportunity to obstruct” the investigation. Shapley and his IRS colleague are slated to testify in public for the first time as early as Wednesday before Comer’s panel, and officials told Just the News they hope to release a transcript of the FBI agent’s corroborating testimony in the next few days.

IRS

https://twitter.com/i/status/1681036655178686469

“..a pharmaceutical industry metastasizing on money the way an aggressive cancer feeds on sugar..”

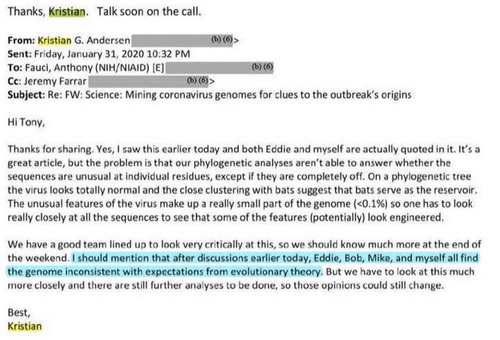

• Situational Awareness (Jim Kunstler)

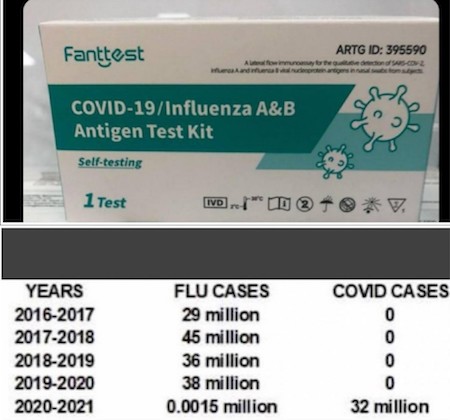

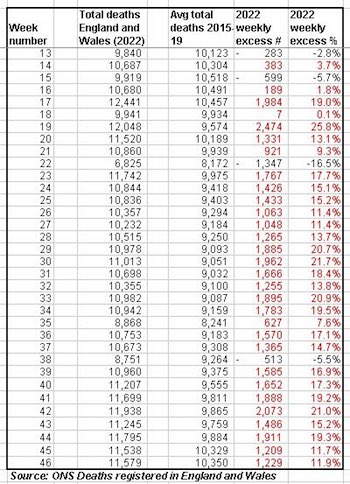

What if Dr. Geert Vanden Bossche is correct? The [Belgian] virologist said at the outset of the Covid-19 episode in 2020 that vaccinating the world in the midst of an epidemic was insane because it would train the virus to evolve more dangerously while disabling human immune systems. Last week he issued a warning that the world was within weeks of just such a new and deadly immune escape variant outbreak that would bring on a shocking wave of sickness and death among people who received multiple Covid-19 vaccinations. This would happen on top of an already accelerating rise in latent vaccine adverse reactions manifesting as aggressive cancers, blood disorders, cardiac injury, neurological disease, and much, much more.

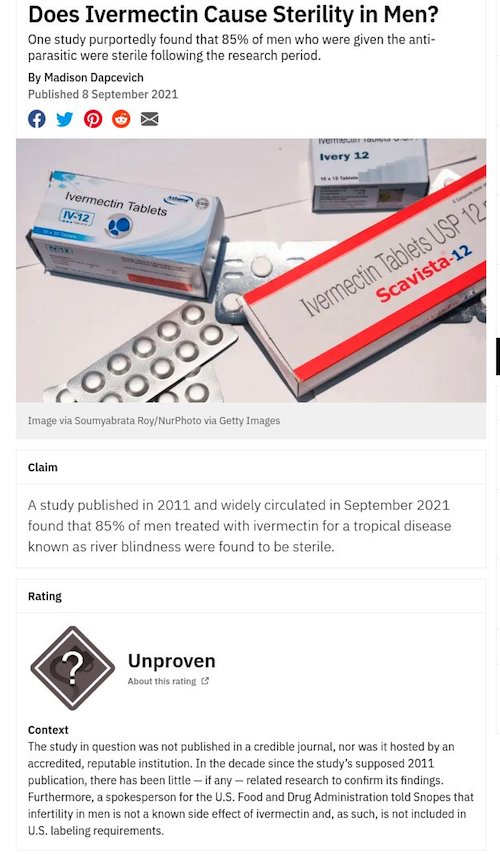

To this point in the Covid-19 story, Western Civ in general, and the USA in particular, have descended into an epic group psychosis as a result of the managed mind-fuckery induced by their own governments in collusion with a pharmaceutical industry metastasizing on money the way an aggressive cancer feeds on sugar in a human body. Fearful citizens swallowed all manner of unreality foisted on them by means of propaganda and censorship.We still don’t know for sure how, who, and why, exactly, Covid-19 was set loose on the world, and the public health agencies don’t want you to know. Perhaps the worst and most baldly dishonest act was the official suppression of effective treatments with common, safe, anti-virals that could have saved millions of lives. And all just to preserve the vaccine companies’ liability shield from the Emergency Use Authorization. In fact, governments are still militating against the sale and use of ivermectin and hydroxychloroquine, which could be taken prophylactically in anticipation of a new outbreak.

So, if these populations were driven crazy by authorities ginning up their fear and preying on it, what will happen if that fear turns to anger instead? Because that’s exactly what will happen when Americans, and perhaps even Europeans, realize they’ve been subject to history’s biggest homicidal fraud. That anger is going to seek targets, and they are going to find them very easily in their own government officials and also — get this — in the medical establishment that has betrayed its patients so unconscionably. It’s just impossible to say exactly how that will play out on-the-ground. Governments are already falling — Spain, the Netherlands — but these were parliamentary downfalls according to regular political procedure. Our country has no such procedures for changing authority in a time of crisis. Instead, we have a president up to his neck in bribery scandal and executive agency thuggery, and political parties sunk in corruption, and no way to get rid of them except elections many months away — elections which at least half the people don’t believe are honest.

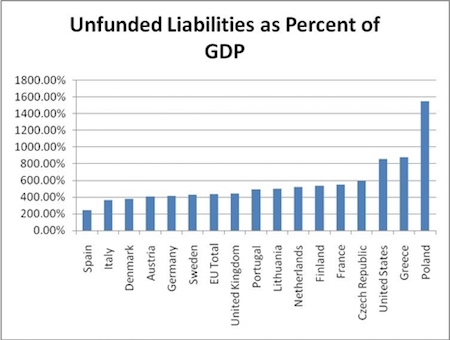

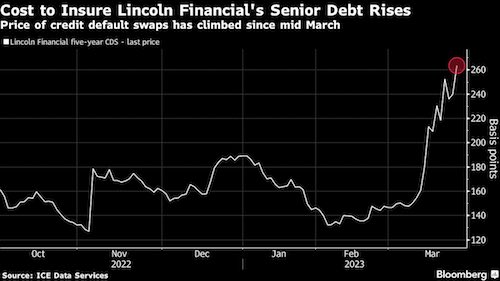

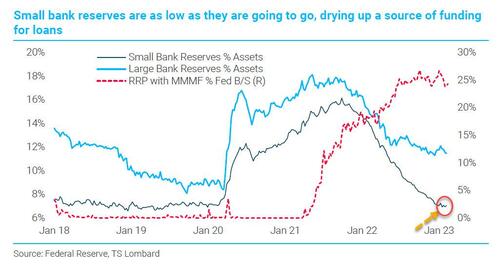

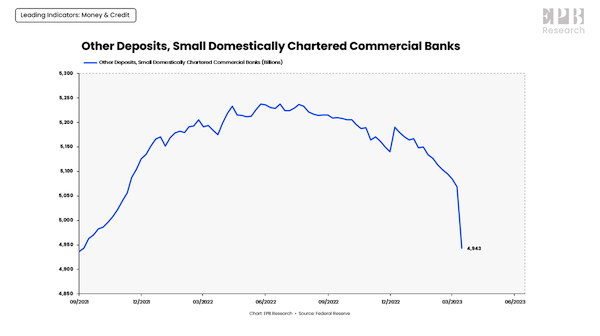

This crisis of bad faith and sickness is happening at the same time that Western Civ enters an equally vicious crisis of economy and finance. America and Europe are broke. All are playing games with their conjoined banking systems and their currencies. All are de-industrializing economies strictly based on industrial production of goods no longer being produced, and pretending to replace them with economies of computer vapor-ware. That can’t work and can only end badly in collapsing standards of living. The past few years, an apparent coalition of global elites, functioning in orgs such as the WEF, the WHO, the EU, the IMF, the central banks, and countless NGOs, along with shadowy intel units and what remains of the old news media, have promoted ever more desperate top-down control programs to prevent a breakdown into wholesale economic and political disorder. Their efforts increasingly tilt into pretense.

“..this fake news accusation went around the world faster than Churchill’s famous line about the truth and the time it takes to put on your pants.”

• Abominable RFK Jr. Anti-Semitism Accusation a Harbinger of Things to Come (ET)

To claim that COVID-19 is the product of a cabal of Chinese and Jews is so ridiculous that it only speaks to what the author wants to believe or, more accurately, wants us to believe Kennedy meant. Which Chinese and which Jews? It’s hard to imagine since Israel was locked down to such a degree it made California look like Florida. Also, Israeli scientists were working around the clock to invent a successful vaccine but got nowhere. If they had been in on the original design, you would think they would have been able to do something, or at least have a leg up. The internet being what it is, this fake news accusation went around the world faster than Churchill’s famous line about the truth and the time it takes to put on your pants.

The lie appeared almost immediately in numerous publications from the Daily Mail to the Daily Beast as if it had to be true that RFK Jr. was anti-Semitic. But Kennedy doesn’t need me to defend him. He’s doing a fine job himself, including demanding a retraction from the Post and an apology from Levine, in his Twitter feed. So what’s actually going on here? This isn’t, in the end, really about anti-Semitism, real or imagined. It was just low-hanging fruit, as the “canary in the coal mine” often is, the first of many—a harbinger of many dastardly smears of the candidate to come.

If there’s one thing the military-industrial complex (endless wars from Iraq to Ukraine) and the health care-industrial complex (Big Pharma, Centers for Disease Control and Prevention, et al.) do not want, it’s a Robert F. Kennedy Jr. presidency. Big Tech probably isn’t very keen on it, either. It would cost them all incalculable amounts of money, much of it courtesy of the U.S. taxpayer and a complaisant government. Most of all, the current leadership of the Democratic Party—bent on exploiting every so-called progressive policy, no matter how looney, for maximum gain and power—don’t want anyone bringing their party back to sanity, under the leadership of Mr. Kennedy or anyone else. Notable is that Rep. Alexandria Ocasio-Cortez (D-N.Y.) is backing Joe Biden for reelection, not RFK Jr.

And then there’s the CIA, whose antipathy for RFK Jr. should be obvious to all those with even a passing knowledge of the lives and deaths of his father and uncle who wanted that organization splintered in a thousand pieces and cast to the winds. In all, it’s no surprise then that the corporate media, in which we now must include the N.Y. Post of the increasingly untrustworthy Murdoch empire, is now the mouthpiece of anti-RFK Jr. propaganda. More and most probably worse will come. What we are looking at is what we might call the coming ‘The Plot Against Kennedy” after Lee Smith’s best-selling “The Plot Against the President,” which detailed the subversion of Donald J. Trump before and after his presidency by many of the same parties. The similarity between the treatment of Trump by corporate media that was always dishonest and is now, if anything, worse, and the beginnings of the treatment of RFK Jr. is all too obvious.

RFK Townhall

.@RobertKennedyJr: "We need to stop listening to these comic book depictions.

We need to realize there's nuance, there's complexity in our relationships, and we need to be able to put ourselves in the shoes of our adversaries – if we want to have true peace in the world. Which… pic.twitter.com/hUgtm8UCLn— The People’s Party (@PeoplesParty_US) July 17, 2023

Zero society.

• The Human Cost of Net Zero (Spiked)

Canadian political scientist Vaclav Smil lists cement, steel, plastics and ammonia as the four ingredients that make the modern world possible. For example, modern healthcare systems need enormous amounts of plastic (for everything from flexible tubes to sterile packing), making it yet another crucial ingredient in the wellbeing of humanity. And without steel and cement, nothing could be built – no roads, no houses, no harbours, no airports. Plastics, steel and cement also require fossil fuels for their production. The same goes for modern agriculture. It depends on synthetic fertilisers, which massively increase yields and allow farmers to use smaller areas of arable land. Without these fertilisers, half the current global population would go unfed.

The production of these fertilisers depends on something called the Haber-Bosch process, a method of producing ammonia from nitrogen and hydrogen, which was invented in the early 20th century. Given its contribution to feeding the world, Smil has justifiably called it the ‘most momentous technical advance in history’. The problem for those demanding the phasing out of fossil fuels is that the hydrogen required for the production of ammonia, and therefore synthetic fertilisers, is almost entirely derived from fossil fuels. So all of Smil’s building blocks for the modern world are dependent on the very materials that Western elites say they want to keep in the ground. It’s not just fertilisers that require fossil fuels, either. 75% of all farm equipment in the US runs on diesel. It dominates the entire farming supply chain, from planting to harvesting to bringing food to market.

A green optimist might suggest simply replacing all these diesel-powered machines with industrial EVs. Yet to build the batteries for all these EVs would require a massive expansion of energy-intensive mining for metallic minerals, such as cobalt, lithium, manganese and nickel. EVs would also require clean electricity sources to charge them. In fact, every step of the proposed energy transition is itself dependent on fossil fuels. You cannot build a wind turbine without lubricants from oil, a concrete foundation and copious amounts of steel. Just as you cannot make solar panels without polysilicon, a component that is immensely energy intensive to produce because it requires temperatures beyond 1,150 degrees Celsius.

The expansion of mining activities needed to build EVs and wind turbines is particularly problematic for the clean-tech crusaders. According to the International Energy Agency: ‘A typical electric car requires six times the mineral inputs of a conventional car and an onshore wind plant requires nine times more mineral resources than a gas-fired plant. Since 2010, the average amount of minerals needed for a new unit of power generation capacity has increased by 50 per cent as the share of renewables in new investment has risen.’ The mineral-mining sector is also energy intensive, producing a huge amount of carbon emissions. It is already responsible for 38 per cent of total global industrial energy use. This means that even if the electrification of all vehicles were possible, it wouldn’t eliminate carbon emissions. It would just raise them at other points in the supply chain.

Orson

So here’s ORSON WELLES in 1970 talking with Dick Cavett about making ‘Citizen KANE’ and the sorts of filthy shenanigans old Kane himself – W.R. Hearst – got up to trying destroy Welles & the movie.

Entirely fascinating stuff.— Michael Warburton (@MichaelWarbur17) July 17, 2023

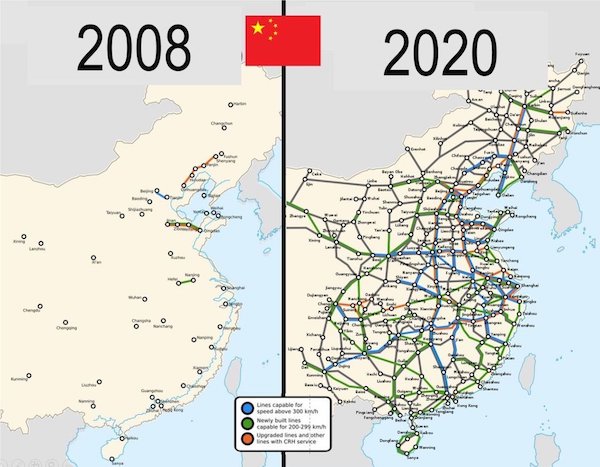

Chinsa high speed rail

Magnet

They failed to get the #mRNA shot into enough people. Now they are putting it into the food supply. Beware of what you are eating. Get a magnet!!!#WEF2030Agenda #GlobalResistance #Outlaws pic.twitter.com/4usXP6ldZd

— Jim Ferguson (@JimFergusonUK) July 17, 2023

Birdies

https://twitter.com/i/status/1680905456389361671

Bobi

https://twitter.com/i/status/1680910054910730240

Jonathan was born in 1832 in the Seychelles. He has been living in Saint Helena since 1882 and just celebrated his 190th birthday.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.