Harris&Ewing Streamlined street car passing Washington Monument 1938

Must read. “Irrespective of the merits of fiscal consolidation and structural reforms, it is not the role of unelected central bankers to demand them — let alone dictate them.”

• The ECB Needs to Know Its Place (Philippe Legrain)

The rot began under Draghi’s predecessor, Jean-Claude Trichet. The former governor of the Banque de France fought tooth and nail to prevent a restructuring of an insolvent Greece’s debt in 2010, which would have imposed hefty losses on French banks. To give credence to the spurious claim that Greece was merely going through temporary funding difficulties, the ECB then started buying Greek government bonds. That gave Frankfurt a further reason to oppose the subsequent restructuring of Greece’s market-issued debt in 2012 — and the ECB’s threat to inflict chaos on the eurozone if it was disobeyed greatly limited the debt relief that Athens obtained, as I explain at length in my book European Spring. Both Trichet and Draghi have threatened, in effect, to force Greece out of the euro if it defaulted.

Now, the ECB’s ownership of Greek bonds is a further obstacle to the debt relief that Greece needs. Frankfurt is also squeezing Greek banks to pressure the government to comply with its eurozone creditors’ demands in a nakedly political manner. Trichet’s treatment of another crisis victim, Ireland, was equally outrageous. In November 2010, he threatened to cut off Irish banks’ access to ECB funding — which would have forced Ireland out of the euro — unless the government applied for an EU-IMF loan, bailed out the banks’ (often German) creditors, and implemented austerity and structural reforms. That abuse of power lumbered Irish taxpayers with some €64 billion in bank debt — €14,000 for every person in Ireland. Irrespective of the merits of fiscal consolidation and structural reforms, it is not the role of unelected central bankers to demand them — let alone dictate them.

Yet ECB officials routinely do. Trichet repeatedly espoused austerity, claiming (falsely) that it would be expansionary. Until he changed his tune in Jackson Hole last August, Draghi, too, demanded that eurozone governments tighten their belts. The president of Germany’s Bundesbank, Jens Weidmann, regularly lectures foreign governments, notably France’s, on what they ought to do. Yet were French officials to give the Bundesbank advice, Weidmann would scream bloody murder. It’s not just inappropriate jawboning. In the summer of 2011, Trichet and Draghi wrote to Italy’s then-prime minister, Silvio Berlusconi, demanding that he embark on austerity and reforms as a condition for the ECB buying Italian government bonds to limit the panic that threatened to force it to default.

When Berlusconi failed to comply, the ECB, in effect, forced the elected prime minister out of office, by letting it be known that it would only buy Italian bonds if he was replaced with a more pliable technocrat. In December 2011, when it seemed as if panic could cause the euro to collapse within weeks, Draghi demanded that eurozone governments agree to a “fiscal compact” that would entrench much tighter discipline, hinting that this might prompt the ECB to step in to quell the panic. Eurozone governments duly complied and are now locked into this new fiscal straitjacket through treaty obligations transposed into national constitutions. The ECB has also had a direct hand in setting fiscal policy and economy-wide reforms as part of the Troika (which also includes the IMF and the European Commission), which has run countries that have received EU-IMF loans — Greece, Ireland, Portugal, and Cyprus — as quasi-colonies.

Make that a ‘no’.

• Will Greece Run Out Of Cash? – No! – (Bruegel)

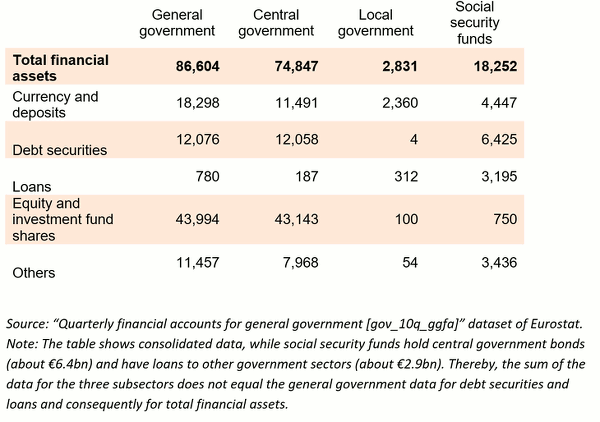

For many weeks now it has been regularly reported that Greece will run out of money if an agreement is not reached with the official lenders in the next few days. So far this has not happened. Given the huge stock of financial assets the Greek government has, I am always cautious about reports that it will soon run out of cash. At the end of September 2014, the Greek government had assets worth €86.6 billion. The data is unfortunately outdated, and assets have most likely been depleted significantly during the past six months. Some of the deposits are earmarked for banking issues. It may be difficult to sell some of the equity holdings, in particular bank shares.

Still, even if the €86.6 billion has declined by a dozen or two, and even if not all of the remaining assets could be easily used to pay for obligations, there is still a lot, and much more than the €30 billion assets the Greek general government had at the end of 1997. As a share of financial assets in GDP, Greece ranked seventh among the 28 EU countries in September 2014, so asset holdings were relatively high in a European comparison too. Greece has looming repayment deadlines: as Silvia Merler recently showed, Greece has to repay €6.7 billion to the ECB and €9.8 billion to the IMF in 2015. (There are also maturing treasury bills, but these are rolled over by the largely state-owned Greek banks).

Greece also has to pay some interest on its liabilities, though not that much, because interest payments on EFSF loans (the largest creditor of the country) are deferred (see my earlier post on Greek interest payments here). The question is therefore whether the primary budget surplus and the possible liquidation of some financial assets would be sufficient for the Greek government to carry on paying financial obligations until an agreement is reached with the creditors in the coming weeks or months. My guess is yes, at least perhaps till the summer, when large repayment will become due.

“..his eurozone peers insist only painful changes can lift Greece out of one of the deepest economic depressions in Europe since the 1950s.”

• Isolated In Debt Talks, Greek Finance Rebel Gets The Cold Shoulder (Reuters)

As the buses carrying European finance ministers left for a gala dinner in the Latvian capital on Friday night, one of the party hung back at the hotel and then wandered off alone into the dusk.Greece’s Yanis Varoufakis had other dinner plans, he said, after a bruising first day of meetings in Riga that underlined his isolation as he tries to avert national bankruptcy. While other ministers were feted by their entourages with food and warm clothing during the meeting in Riga, Varoufakis was seen alone at almost every turn, eschewing aides or any security detail. “He is completely isolated,” a senior euro zone official told Reuters on condition of anonymity. “He didn’t even come to the dinner to represent his country,” the official said of the event where ministers, serenaded by a Latvian choir, ate salmon and sea bass.

At breakfast before the meeting, Varoufakis and European Central Bank President Mario Draghi avoided eye contact as they picked up food at the buffet, Reuters reporters observed. The hardening of the mood against Varoufakis risks deepening the divide that Greece must bridge with its creditors if Athens is to avert default. After three months of largely fruitless negotiations, euro zone ministers warned him on Friday that the radical leftist Greek government will get no more aid until it agrees a complete economic reform plan, before the end of June. Some countries are so frustrated by what they see as Greece’s failure to compromise that one minister said it may be time to prepare for a Greek default.

Varoufakis, the only male minister at the meeting without a tie, said he was unfazed by the tone of Friday’s meeting – which Jeroen Dijsselbloem, the chairman of the euro zone finance ministers, described as “very critical” of Athens. In a sign of the coolness creeping in, Dijsselbloem referred to Varoufakis as “the Greek colleague” to reporters in Riga, although he addresses him by his first name in meetings. “I’m not surprised,” Varoufakis told reporters. “When you are approaching the end of negotiations, the stance hardens.”He denied reports that he had been insulted by ministers in Riga. “All these are false.”

While his economic demands have fallen on deaf ears, Varoufakis has become an improbable heartthrob in Germany. ZDF public television lampooned its own news anchor for enthusiastically comparing the minister with Hollywood tough guy Bruce Willis, while Stern magazine published a gushing article on Varoufakis’s “classical masculinity”. But some ministers say they resent being lectured by an academic who has studied in Britain, taught in Australia and the United States and challenged the theoretical basis of European policymaking.

While Varoufakis criticizes the spending cuts demanded by international creditors, his euro zone peers insist only painful changes can lift Greece out of one of the deepest economic depressions in Europe since the 1950s. According to people present in the room, several ministers rolled their eyes, closed their eyes or put their hands over their ears during Varoufakis’ interventions at Friday’s meeting. “Eurogroup ministers don’t like the fact that he is giving a small lecture when he is speaking to them,” one euro zone official said. “And for that reason (chairman) Dijsselbloem stopped him yesterday, saying: ‘Yanis, you don’t tell us what we want to hear.'”

”It’s true the infrastructure [to house the migrants elsewhere] does not exist, but it’s not the fault of those being held.”

• Migrant Influx Strains Greece As Economy Suffers (Reuters)

Shortly after taking power in January, Greece’s new government opened the gates of one of the main detention centers where thousands of undocumented migrants had been held against their will after arriving on the country’s Mediterranean shores. Many of the inmates, including refugees and children, were driven to Athens and released, in what Prime Minister Alexis Tsipras’s leftist government hailed as the beginning of the end of inhumane migrant policies of the past. Now the move has created other problems. With the influx of migrants from Africa and the Middle East rising this year, hundreds have ended up like 40-year-old Syrian Dia Qasem and her three sons: stuck in the Greek capital’s public squares with nowhere to sleep and little eat.

“The only help is from God,” sobbed Qasem, a neat hazel-eyed woman with chipped red nail varnish, one afternoon this week. Qasem and her sons fled Damascus last year and, after a dangerous voyage from Turkey, they landed on the island of Kos. They have enough money to stay in a hotel on occasion. But most nights Qasem settles down to sleep with her sons, other Syrians and migrants from other nationalities, under a tree in a central Athens’ square. Above her hung a billboard with a photo of the Acropolis and the slogan “Welcome to Greece!!!” The migrant crisis came into focus this week after the death of hundreds in a shipwreck off Libya. In Greece, the influx is testing the social and economic limits of a country already crippled by financial crisis.

Greek reaction to foreigners pouring into city centers, lining up at food banks and shelters already crowded with impoverished Greeks, is turning hostile. “Where are all these people going to stay? Where will all these people go? Where will they find a place to rest? asked Babis Karagianidis, an Athens resident. “With all the internal problems that we have? We can’t solve our own problems.” For Tsipras, an open-door policy on detention centers that was meant to help migrants is turning into a big political problem — largely because Greece doesn’t have the money to find alternative housing for the foreigners. According to a survey by the University of Macedonia, Greeks see the government’s response to the migrant crisis as barely passable. “Immigration is up there with finances as the government’s priorities,” said Theodore Couloumbis, an Athens political analyst. “And the government hasn’t got the luxury to add fronts to the problems it’s fighting.”

Greece is one of the main routes into the European Union for tens of thousands of Asian and African migrants fleeing war and poverty every year. The state of the country’s detention centers — seven in all still holding 2,000 people — received much international scrutiny. Greece was fined €1 million by the EU because of their poor conditions, which include intense crowding and no heating or hot water, says Tasia Christodoulopoulou, Greece’s minister for immigration.She says the government’s policy, and the emptying out of the Amygdaleza detention center near Athens, was a necessity. Other centers still house detainees and it is unclear what the government plans to do. “People that were there were living an indescribable barbarity,” she said in an interview. ”It’s true the infrastructure [to house the migrants elsewhere] does not exist, but it’s not the fault of those being held.”

“Anyone who can is taking their money abroad. Nothing is moving; the market is dead.”

• Greeks’ View Of Crisis: ‘What Lies Ahead Is Great, Great Hardship’ (Guardian)

Another week. Another crisis. Another make-or-break meeting that may, or may not, throw Greece into the unchartered waters of default, eurozone exit, destitution and despair. It is a sliding scale of drama, of high-octane intensity that Greeks have learned to watch with a mixture of shock, angst, bewilderment and dismay. Today dismay predominates. Five years on – Thursday was the fifth anniversary of the debt-stricken nation’s request for a bailout – there is an overriding sense of worse to come. “All I see is worried faces,” sighs Giorgos Pappas, who has a bird’s-eye view of central Athens from his appropriately named Cosmos café. “Anyone who can is taking their money abroad. Nothing is moving; the market is dead.”

Riding high on the promise of hope, Alexis Tsipras’s anti-austerity government initially enjoyed unparalleled support. But three months later, with a life-saving deal no nearer with its creditors – the EU, ECB and IMF – hope is ebbing. Greece desperately needs to find €7.2bn in funds under its €240bn bailout, but Athens’ inability to agree reforms in exchange for the money is pushing it to the brink of default. Last week, surveys showed the Syriza party-led coalition haemorrhaging the popular backing that has kept it buoyant. Support for the leftists and their hard-line stance in negotiations has dropped precipitously. Only 45.5 % told pollsters at the University of Macedonia that they endorsed the government’s stance, compared with 72% in February.

After an unusually long, wet winter, the sun has come out, which has helped lift the mood. Tourists are pouring in and with them comes the feelgood spirit of spring. But no amount of coping can hide the exhaustion of a nation with no idea of what tomorrow will bring. What everyone does know, thanks to regular newspaper headlines, is that time is running out. The endgame is here because cash reserves are perilously close to running dry. The light at the end of the tunnel remains cutbacks and reforms: that is to say more misery for a country that has seen its economy contract by a quarter since 2010.

On the street foreboding grows. The sight of the government now scrambling to find funds, which included ordering local authorities and state organisations to hand over cash reserves last week, has sparked panic that bank deposits could be next. Amid talk of a parallel currency being introduced and civil servants being paid in IOUs, anxious savers have rushed to clear out their accounts. “Everyone thinks their savings will be next,” said an official at the Bank of Greece.

“Any mention of a plan B is profoundly anti-European..”

• Euro Ministers Alarmed as Bloc Shuts Down Greece Plan B (Bloomberg)

Europe’s refusal to draw up contingency plans to prepare for the failure of negotiations with Greece is alarming some euro-area finance ministers. Slovenian finance chief Dusan Mramor led the calls at a meeting of the bloc’s 19 finance chiefs on Friday to consider a “plan B” to mitigate the fallout if negotiations with Greece fail. Several others raised similar concerns during official talks and in private conversations at a meeting in Riga, Latvia, on Friday, two people with knowledge of the discussions said. “What my discussion was about was what we will do if no new program will be achieved in time for Greece to be able to refinance itself or improve liquidity,” Mramor told reporters on Saturday. “A plan B can be anything.”

As Greece struggles to pay pensions and salaries, its government has failed to present a plan to revamp its economy that passes muster with euro-area officials who are withholding further aid. In February, finance ministers gave the Greek government until the end of June to complete the deal and said they expected a list of reforms by the end of April. Friday’s meeting, which European Union officials had for weeks identified as the moment when the list would be considered, instead descended into attacks on Greek Finance Minister Yanis Varoufakis for his failure to deliver. “Some countries have said, because of their concern on the lack of progress and the attitude on the Greek side, ‘if it continues like this, we will really get into trouble,’” Dutch Finance Minister Jeroen Dijsselbloem, who led Friday’s meeting, told reporters on Saturday. “In that context plan B has been mentioned.”

Still, ministers were left frustrated that European Economic Commissioner Pierre Moscovici clamped down on discussions of a backup plan. They went on to air their concerns without him, one of the people said. Finance chiefs aren’t saying in public that they’re contemplating alternative outcomes because that would send the message to markets that it’s game over, the person said “The central scenario is that in the Greece case we’re going to reach an agreement,” Spanish Economy Minister Luis de Guindos told reporters on Saturday. “That’s the only one that we’re considering.” Varoufakis joined Moscovici’s effort to prevent others in the group taking precautions in case the talks fail. “Any mention of a plan B is profoundly anti-European,” Varoufakis told Euronews on Friday. “My immediate response was to say there is no such plan B, there cannot be such plan B.”

“So you are not giving a solution to Greece, you press the Greek government? What can be the solution? Golden Dawn is coming. Nobody has an interest in that..”

• Greece Not Playing A Game Of Chicken On Debt (Reuters)

Greek Foreign Minister Nikos Kotzias said on Friday he respects Germany just not German politics, nor the way Berlin views Greece’s economy, which faces the prospect of running out of money if it cannot agree to new bailout terms with creditors. Kotzias is part of the leftist government that took over in January after an anti-austerity campaign promising to roll back reforms and cutbacks agreed by the prior government to improve Greece’s finances. Kotzias said Greece and its euro zone partners need to compromise on creating political policies that will foster growth and allow the country to pay its debts. Asked if he is simply asking the rest of Europe to trust Greece, he said: “No. To be pragmatic. Trust is a very important thing but they have to be pragmatic.”

“Do they want to support us to have growth… or do they decide to have Greece struggle, to punish Greece and to create an example of what happens to a country that has a left government,” Kotzias said at the end a four-day visit to Washington and New York. German Chancellor Angela Merkel said in Brussels on Thursday that everything must be done to prevent Greece from going into bankruptcy. However, Friday’s meeting of euro zone finance ministers in Riga brought a stark warning to Athens that its leftist government will get no more aid until a complete economic reform plan is agreed. Greece has scraped up enough cash to meet its obligations, but faces a big test on May 12 when it is due to pay a €750 million payment to the IMF. Now the question is how long could it last without fresh funds.

He further dismissed talk the 19-nation euro zone currency area could better handle a Greek default now versus the financial crisis that resulted in a Greek bailout of 240 billion euros. “It is like a game of chicken, but not the kind of game you know. What our friends are forgetting is that we don’t have gas to move… We like to come back to compromising and at the end we will do it,” said Kotzias, a fluent German speaker. “So you are not giving a solution to Greece, you press the Greek government? What can be the solution? Golden Dawn is coming. Nobody has an interest in that, so that is why they will find a solution,” said Kotzias, highlighting the far-right political party that is the third largest in parliament.

“Ms. Katseli was also upset that Greece’s lenders will have the right to seize the gold reserves in the Bank of Greece under the terms of the new deal.

• Is Greece About To “Lose” Its Gold Again? (Zero Hedge)

When it comes to the topic of Greece, most pundits focus on two items: i) when will Greece finally run out of confiscated cash, and ii) will Greece fold to the Troika (and agree to another bailout(s) with even more austerity) or to Russia (and agree to the passage of the Russian Turkish Stream pipeline, potentially exiting NATO and becoming the most important European satellite of the USSR 2.0) once that moment arrives. And yet what everyone appears to be forgetting is a nuanced clause buried deep in the term sheet of the second Greek bailout: a bailout whose terms will be ultimately reneged upon if and when Greece defaults on its debt to the Troika (either in or out of the Eurozone). Recall that as per our report from February 2012, in addition to losing its sovereignty years ago, Greece also lost something far more important. It’s gold: To wit:

Ms. Katseli, an economist who was labor minister in the government of George Papandreou until she left in a cabinet reshuffle last June, was also upset that Greece’s lenders will have the right to seize the gold reserves in the Bank of Greece under the terms of the new deal.

The “new deal” referred to is the Second Greek Bailout, which either will be extended and lead to a third (and fourth, and fifth bailout, each with every more draconian terms until finally Greece does default), or will collapse at which point the Troika will indeed have the right to seize the Greek gold reserves. What makes this case particularly curious, however, is that it won’t be the first time Greece will have “lost” its gold. In The Tower of Basel, citing the BIS archive from Febriary 9, 1931, Adam LeBor writes:

In February 1931, Gates McGarrah, the [BIS’s] American president, wrote to H. C. F. Finlayson, in Athens, asking about the Bank of Greece’s gold. Finlayson, a former British financial attaché in Berlin, was now an adviser to the Bank of Greece. Some of the Greek bank’s gold may have gone missing. Rather like nowadays, it seemed the accounting at the Bank of Greece left something to be desired. “What has ever happened to the gold of the Bank of Greece, some of which you thought might be left in our custody in Paris or elsewhere?” inquired McGarrah, who, as the president of the BIS might have been expected to know what it held and where. It might, McGarrah suggested, be a good time to find the Greek gold and place it with the BIS.

The BIS, wrote McGarrah, could give the Bank of Greece “all sorts of facilities, rather greater than those of a local Central Bank.” For example, if the Bank of Greece held gold at the Bank of France and wanted to buy another currency, it first had to buy francs from the Bank of France. The Bank of Greece then converted the francs to the second currency, with all the usual losses of exchange rates and commissions. However, if the Bank of Greece held gold at the Bank of France in the name of the BIS, the BIS could “give the Bank of Greece any currency it desires at any time and can fix an agreed rate without going through the actual exchange operation.” And, the BIS did not charge any commission.

After I published the article, I was thinking perhaps I should have called it “Europe, The Lost Continent”.

But then again, something tells me I may yet have time to use that title sometime soon.

They should take over the new ECB buiding in Frankfurt.

• The Migrants Who Took Over A Sicilian Palace (BBC)

As thousands of desperate African migrants arrive on Sicily’s shores, they must suddenly find their footing in a country in the grip of recession. They have something in common, though, with the island’s own homeless and unemployed – and in fact, working together with Sicilians, a group of migrants recently moved into a palace sitting empty in Palermo. When I visited, the elegant building appeared empty, its windows shuttered against the sun. I rang the buzzer and waited. Unsure if anyone had heard me, I banged on the heavy wooden door, but there was no answer. At last, a woman opened the door. Behind her, several of her housemates looked on nervously. They had been reluctant to come to the door, she explained, in case I was from the police. Some of the residents knew I was coming but my knocking had scared them.

We stood in a long, dimly lit corridor, lined with several ornately carved doors. The woman introduced herself. “My name is Wubelem Aklilu,” she told me. She had three rooms and shared the palace with 18 other people from Ethiopia and Eritrea, and one from Sicily. Wubelem means “Beauty” in Amharic, so that’s the English name the Italians have given her. Her housemates call her Mommy. Beauty agreed to show me around. One of the first rooms we entered was pitch black. When she hit the lights I found myself standing in front of an altar, below a vivid religious oil painting. This impressive mansion, which Italians call a palazzo, was built in the 19th Century by one of the most important families in Palermo – the Florios – whose name still adorns a brand of Marsala wine.

The Florios eventually gave the building to an order of nuns, the Daughters of St Joseph. After their numbers dwindled over the years, the nuns tried to sell it – but without success. For a decade the palace stood empty. It was also 10 years ago that Beauty left Ethiopia. She had been running a shop near the university in Addis Ababa. But as well as selling food she handed out pamphlets and sold T-shirts in support of a political party – a party in opposition to the government. It was a dangerous thing to do. One day, she saw police waiting for her as she approached the shop, so she turned round and walked quickly away.

Afraid for her life, she crossed over the border to Sudan, leaving behind her mother and children. She trekked across the Sahara to Libya, and eventually decided to attempt the sea crossing to Europe. The number of migrants making this perilous journey has rapidly increased since Libya descended into civil war. More than 1,727 have died on the route this year, and the death toll could be as high as 30,000 by the end of 2015, it’s estimated, if current trends continue. More than 85% of those making the journey come from sub-Saharan Africa.

“It was Mantega’s concern about inflation that led Petrobras to buy fuel abroad to sell to Brazilians at a loss..”

• Petrobras’s Next Steps May Be Tougher Than $17 Billion Loss (Bloomberg)

Petrobras’s massive writedowns this week answer the question about the cost of its corruption and pose a much bigger one: whether the state-run driller can restore its role as Brazil’s economic anchor and source of national pride. The problem is not just graft. The writedown for its executives’ transgressions represents less than one-eighth of Petrobras’s $17 billion in charges reported for 2014. The bulk of the impairment was due to mismanagement of two refinery projects. It was enough to give Petrobras its first annual operating loss since 1991. The former state bankers now running the world’s most indebted oil company averted disaster by getting long-delayed 2014 earnings audited, thus removing grounds for creditors to accelerate repayment of part of Petrobras’s $135 billion debt.

What remains to be seen is how well they can insulate the oil giant from decisions that make sense politically but turn out to be calamitous in a business context, while reducing debt and delivering projects on time and budget. “The biggest lesson to understand is that Petrobras’s management structure, built from political appointments, doesn’t work,” said Alvaro Marangoni at Quadrante Investimentos in Sao Paulo. The first sign of a new direction at Petroleo Brasileiro is the absence of government ministers on the new board of directors, said Joao Augusto de Castro Neves, Latin America director for Washington-based consultant Eurasia Group. The previous board was chaired by former Finance Minister Guido Mantega, and before him Dilma Rousseff, who was chief of staff to Brazilian President Luiz Inacio Lula da Silva at the time and is now the country’s president herself.

It was Mantega’s concern about inflation that led Petrobras to buy fuel abroad to sell to Brazilians at a loss, keeping prices low for consumers but running up Petrobras’s debt. Other instances of government meddling, from letting political allies appoint executives to investing in far-flung refineries that were never finished, were just as costly.

We saw the same in Vancouver a few years ago. Million dollar crackshacks.

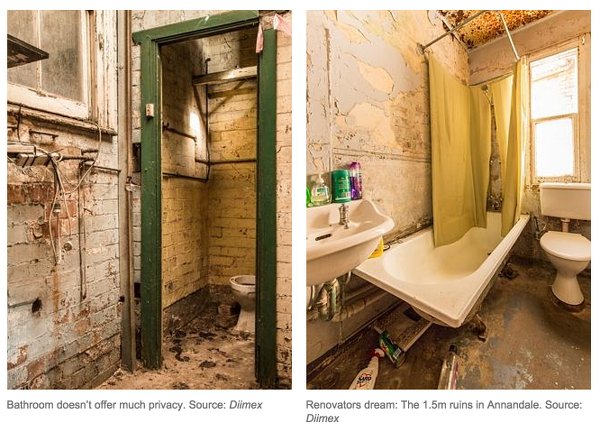

• What A $1.5 Million Home In Sydney Looks Like (News.com.au)

Would you pay 1.5 million dollars for a house you couldn’t live in? That is exactly what you would be expected to cough up for this dilapidated, mould-infested home in the inner Sydney suburb of Annandale. The house comes complete with holes in the floor, ceilings that are nearly rusted through, decaying walls and a backyard that requires more than a little TLC. It is the first time the house, located on Johnson street, has gone on the market since 1953 and the real estate agent in charge of the sale is under no illusions as to its run down state. “It needs so much work,” says James Bourke, from Callagher. With housing prices steadily growing in major cities, the “Australian dream” of owning your own house appears to be a distant reality for many young Australians.

Sydney has seen the highest rate of growth in housing prices leading some to speculate that the country’s biggest city is leading a nationwide housing bubble. Earlier in the month real estate group PRDnationwide tipped Sydney to be “minutes” away from its property price growth peak. But if you ever needed prooof that a million dollars doesn’t stretch as far as it used to, this is it. Despite its run-down state, the property has had a lot of interest since going on the market. Last Saturday, Mr Bourke had 31 groups “come through” to see the house and is frequently giving private viewings. However the reactions have been mixed. “A lot of people have come in and said this is well beyond what we can do,” Mr Bourke says.

But others are prepared for the challenge, which, given the level of work required, could take quite some time. “It might even take a year to get any changes through the council,” he said. The high price tag shouldn’t come as a surprise given the growing popularity of the inner west suburb. “There is a premium in this area because there’s so much demand. You don’t see bargains around here,” says Mr Bourke.

The very attempt to express the value of the oceans in monetary terms shows how deep we’ve sunk.

• 7th-Largest Economy At $24 Trillion? Our Oceans, Says WWF (CNBC)

If our oceans were considered a country, their worth would outshine the likes of Russia and Brazil’s economies, according to a new report. The world’s oceans are worth $24 trillion and generate $2.5 trillion in goods and services annually, making it technically the seventh-largest economy worldwide, according to the “Reviving the Ocean Economy” report, commissioned by the WWF, this week. This eye-watering asset value was determined by four components: direct output of resources ($6.9 trillion), productive coastline ($7.8 trillion), trade/transport ($5.2 trillion) and carbon absorption ($4.3 trillion). World Wide Fund for Nature (WWF) admits, however, that this trillion-dollar figure is an “underestimate,” as wind energy and offshore oil and gas drilling weren’t factored in, due to the difficulty in calculating their exact amounts.

So if the oceans are worth so much, this should be good, right? Wrong. With enviable value and precious assets come several threats, and the WWF suggest that with not enough being done it is becoming a “matter of global urgency” for governments to combat the man-made and natural factors impacting the oceans. In light of the report, WWF is calling upon governments and individuals worldwide with eight action proposals, asking those such as the U.K. government to progress the development of marine conservation zones and sustainable goals. Threats impacting the functioning of this system include pollution and destruction of marine habitats, yet one of the most destructive is climate change, which contributes to ocean acidity and impacts how marine animals live.

The Koch brothers team up against the Vatican.

• US Thinktank Seeks To Change Pope Francis’s Mind On Climate Change (Guardian)

A US activist group that has received funding from energy companies and the foundation controlled by conservative activist Charles Koch is trying to persuade the Vatican that “there is no global warming crisis” ahead of an environmental statement by Pope Francis this summer that is expected to call for strong action to combat climate change. The Heartland Institute, a Chicago-based conservative thinktank that seeks to discredit established science on climate change, said it was sending a team of climate scientists to Rome “to inform Pope Francis of the truth about climate science”. “Though Pope Francis’s heart is surely in the right place, he would do his flock and the world a disservice by putting his moral authority behind the United Nations’ unscientific agenda on the climate,” Joseph Bast, Heartland’s president, said.

Jim Lakely, a Heartland spokesman, said the thinktank was “working on” securing a meeting with the Vatican. “I think Catholics should examine the evidence for themselves, and understand that the Holy Father is an authority on spiritual matters, not scientific ones,” he said. A 2013 survey of thousands of peer-reviewed papers in scientific journals found that 97.1% agreed that climate change is caused by human activity. The lobbying push underlines the sensitivity surrounding Pope Francis’s highly anticipated encyclical on the environment, whose aim will be to frame the climate change issue as a moral imperative.

While it is not yet clear exactly what the encyclical will say, Pope Francis has been an outspoken advocate for action on the issue. In a speech in March, Cardinal Peter Turkson, who has played a key role in drafting the document, said Pope Francis was not attempting a “greening of the church”, but instead would emphasise that “for the Christian, to care for God’s ongoing work of creation is a duty, irrespective of the causes of climate change”.

“HFT is now reckoned to account for three-quarters of trading on US stock markets..”

• Trillion-Dollar Questions, The Flash Crash And The Hound Of Hounslow (Guardian)

High-frequency trading may sound like a minority, and rather frowned-upon, sport, but it’s not. HFT is now reckoned to account for three-quarters of trading on US stock markets, and regulators have done nothing to halt its rise. More trading in more places, runs their thinking, creates more activity, which leads to keener pricing that benefits everybody. So where does Sarao fit in? According to the allegations, he was illegally “spoofing” these constantly churning markets – trying to trick other investors’ computers into making false moves from which he could profit. He was trading contracts called e-minis, whose price rises and falls with movements in the S&P500 index, on the largest US futures market, the Chicago Mercantile Exchange.

The US department of Justice alleges that he used a system called “layering” – for example sending out a series of “sell” orders he intended to cancel but which created the illusion of downward pressure on the market. As other computers reacted to that artificial pressure, he would profit by buying at a lower price and then selling when prices returned. All faster than a blink of an eye. On the day of the flash crash, the DoJ alleges Sarao used layering “extensively and with particular intensity”, and made a net profit of $879,018 on that day alone. Overall, the DoJ claims Sarao fraudulently made $40m in five years. We’ll have to wait and see how the prosecutors make their case, if it goes to trial. But many have pointed out that the idea of Sarao helping cause the flash crash seems far-fetched.

First, Sarao was running his algorithm on several occasions from June 2009 and the market did not plunge. Second, he’d turned off his computer two minutes before the big fall started. Third, if he merely “contributed” to the crash, were others more to blame? If so, why single out Sarao? There’s another oddity, too. The Chicago Mercantile Board questioned Sarao about his suspicious trading before the flash crash. Indeed, on the very day, it wrote to him to say that all orders “are expected to be entered in good faith for the purpose of executing bona fide transactions”. He was hardly unknown to authorities, so why did they let him continue trading after May 2010, and wait almost five years to demand his extradition?

One school of thought has it that Sarao, whatever the legality of his techniques, should be hailed as a hero. Hedge fund manager John Hempton of Bronte Capital regards conventional HFT firms as the real villains because their goal is to “rip off” regular investors by “front running” their orders – using computers to spot trading patterns and getting in ahead. “I would prefer the front running computers to go away,” says Hempton. “And the way to make that happen is to allow spoofing. Spoofing makes the world unsafe for front-running high-frequency traders.” He calls the DoJ’s case “plain silly”.

“I’ve never seen anything like it, the terror that can haunt a human’s eyes: Babis Manias, fisherman”

• The Story Of The Greek Hero On The Beach (Guardian)

It was an image that came to symbolise desperation and valour: the desperation of those who will take on the sea – and the men who ferry human cargo across it – to flee the ills that cannot keep them in their own countries. And the valour of those on Europe’s southern shores who rush to save them when tragedy strikes. Last week on the island of Rhodes, war, repression, dictatorship in distant Eritrea were far from the mind of army sergeant Antonis Deligiorgis. The world inhabited by Wegasi Nebiat, a 24-year-old Eritrean in the cabin of a yacht sailing towards the isle, was still far away. At 8am on Monday there was nothing that indicated the two would meet. Stationed in Rhodes, the burly soldier accompanied his wife, Theodora, on the school run. “Then we thought we’d grab a coffee; We stopped by a cafe on the seafront.”

Deligiorgis had his back to the sea when the vessel carrying Nebiat struck the jagged rocks fishermen on Rhodes grow up learning to avoid. Within seconds the rickety boat packed with Syrians and Eritreans was listing. The odyssey that had originated six hours earlier at the Turkish port of Marmaris – where thousands of Europe-bound migrants are now said to be amassed – was about to end in the strong currents off Zefyros Beach. For Nebiat, whose journey to Europe began in early March – her parents paid $10,000 for a voyage that would see her walk, bus and fly her way to “freedom” – the reef was her first contact with the continent she had prayed to reach. Soon she was in the water clinging to a rubber buoy.

“The boat disintegrated in a matter of minutes,” the father-of-two recalled. “It was as if it was made of paper. By the time I left the café at 10 past 10, a lot of people had rushed to the scene. The coastguard was there, a Super Puma [helicopter] was in the air, the ambulance brigade had come, fishermen had gathered in their caiques. Without really giving it a second’s thought, I did what I had to do. By 10:15 I had taken off my shirt and was in the water.” Deligiorgis brought 20 of the 93 migrants to shore singlehandedly. “At first I wore my shoes but soon had to take them off,” he said, speaking by telephone from Rhodes. “The water was full of oil from the boat and was very bitter and the rocks were slippery and very sharp. I cut myself quite badly on my hands and feet, but all I could think of was saving those poor people.”

In the chaos of the rescue, the 34-year-old cannot remember if he saved three or four men, or three or four children, or five or six women: “What I do remember was seeing a man who was around 40 die. He was flailing about, he couldn’t breathe, he was choking, and though I tried was impossible to reach. Anyone who could was hanging on to the wreckage.” Deligiorgis says he was helped by the survival skills and techniques learned in the army: “But the waves were so big, so relentless. They kept coming and coming.” He had been in the water for about 20 minutes when he saw Nebiat gripping the buoy. “She was having great problems breathing,” he said. “There were some guys from the coastguard around me who had jumped in with all their clothes on. I was having trouble lifting her out of the sea. They helped and then, instinctively, I put her over my shoulder.”

Home › Forums › Debt Rattle April 26 2015