Francisco Goya Witches’ Sabbath 1798

Both Mattis and Pompeo, a coordinated effort. 30 days seems ambitious, but MbS doesn‘t have much leverage left.

• US Calls For Yemen Ceasefire, Peace Talks ‘In The Next 30 Days’ (AFP)

The United States called Tuesday for a ceasefire and peace talks in Yemen, as the Saudi-led military coalition sent more than 10,000 new troops toward a vital rebel-held port city ahead of a new assault. Pentagon chief Jim Mattis said the US had been watching the conflict “for long enough,” adding that Saudi Arabia and the United Arab Emirates, which are in a US-backed coalition fighting Shiite Huthi rebels, are ready for talks. “We have got to move toward a peace effort here, and we can’t say we are going to do it some time in the future,” Mattis said at the US Institute of Peace in Washington. “We need to be doing this in the next 30 days.”

He said the US is calling for all warring parties to meet with United Nations special envoy Martin Griffiths in Sweden in November and “come to a solution.” US-Saudi ties have cooled in recent weeks after the murder of journalist Jamal Khashoggi, a prominent critic of the conservative kingdom, that has also tarnished the image of Crown Prince Mohammed bin Salman. Saudi Arabia and its allies intervened in the conflict between embattled Yemeni President Abedrabbo Mansour Hadi, whose government is recognized by the United Nations, and the Huthis in 2015. Nearly 10,000 people have since been killed and the country now stands at the brink of famine, with more than 22 million Yemenis — three quarters of the population — in need of humanitarian assistance.

[..] US Secretary of State Mike Pompeo called for an end to all coalition air strikes in Yemen’s populated areas. “The time is now for the cessation of hostilities, including missile and UAV (drone) strikes from Huthi-controlled areas into the Kingdom of Saudi Arabia and the United Arab Emirates,” Pompeo said in a statement. “Subsequently, coalition air strikes must cease in all populated areas in Yemen.”

Body still not found.

• Erdogan Urges Saudi Prosecutor To Find Out Who Ordered Khashoggi Hit (AFP)

Turkish President Recep Tayyip Erdogan on Tuesday called on Saudi Arabia’s chief prosecutor to find out who ordered the murder of journalist Jamal Khashoggi, and not spare “certain people” in his investigation. “Who sent these 15 people? As Saudi public prosecutor, you have to ask that question, so you can reveal it,” Erdogan said, referring to the 15-man team suspected of being behind the hit. “Now we have to solve this case. No need to prevaricate, it makes no sense to try to save certain people,” he told reporters in Ankara. Khashoggi was killed after entering the Saudi consulate in Istanbul on October 2 to obtain paperwork ahead of his upcoming wedding. His body has not yet been found.

[..] Erdogan said that during the talks Fidan requested the 18 suspects be sent to Turkey for trial, as the killing took place in Istanbul. The Istanbul prosecutor’s office last week prepared a written request for the extradition of the 18 suspects “involved in the premeditated murder”, the justice ministry said, but Riyadh rejected Ankara’s request. Erdogan also urged Saudi Foreign Minister Adel al-Jubeir to explain who the “local co-conspirators” were that were reportedly given Khashoggi’s body after his death. “Again either the Saudi foreign minister or the 18 suspects must explain who the local co-conspirators are. Let’s know who this co-conspirator is, we can shed further light. We cannot let this subject end mid-way.”

Only this time it’s global.

• Housing Market Now ‘Reminds Me Of 2006′ – Robert Shiller (MW)

Famed housing-watcher Robert Shiller said Tuesday that the weakening housing market reminded him of the last market top, just before the subprime housing bubble burst, slashing prices by nearly a third and costing millions of Americans their homes. Home price gains moderated again in the most recent version of the closely-watched housing index that bears his name, which was released Tuesday, and Shiller, a Nobel Prize-winning economist, told Yahoo Finance that such data shows “a sign of weakness.” Housing pivots take more time than those in the stock market, Shiller said. Still, “the housing market does have a momentum component and we’re seeing a clipping of momentum at this time.”

When a startled reporter reminded Shiller that 2006 predated the greatest financial crisis in a lifetime, the Yale economist acknowledged that any correction would likely be far less severe. “The drop in home prices in the financial crisis was the most severe drop in the U.S. market since my data begin in 1890,” Shiller said. “It could be that we’re primed to repeat it because it’s in our memory and we’re thinking about it but still I wouldn’t expect something as severe as the Great Financial Crisis coming on right now. There could be a significant correction or bear market, but I’m waiting and seeing now.”

Foreign reserves runnning out.

• China Debt Bomb Ready to Explode (Rickards)

The great Chinese growth slowdown has been proceeding in stages for the past two years. The reason is simple. Much of China’s “growth” (about 25% of the total) has consisted of wasted infrastructure investment in ghost cities and white elephant transportation infrastructure. That investment was financed with debt that now cannot be repaid. This was fine for creating short-term jobs and providing business to cement, glass and steel vendors, but it was not a sustainable model since the infrastructure either was not used at all or did not generate sufficient revenue. China’s future success depends on high-value-added technology and increased consumption. But shifting to intellectual property and the consumer means slowing down on infrastructure, which will slow the economy.

In turn, that means exposing the bad debt for what it is, which risks a financial and liquidity crisis. China started to do this last year but quickly turned tail when the economy slowed. Now the economy has slowed so much that markets are collapsing. But doesn’t China have over $1 trillion of reserves to prop up its financial system? On paper, that’s true. But in reality, China is “short” U.S. dollars. The Chinese may have $1.4 trillion of U.S. Treasury securities in its reserve position, but they need those assets possibly to bail out their banking system or defend the yuan. Meanwhile, the Chinese banking sector, which in many ways is an extension of the state, owes $318 billion in U.S. dollar-denominated deposits of commercial paper.

From a bank’s perspective, borrowing in dollars is going short dollars because you need dollar assets to back up those liabilities if the original lenders want their money back. For the most part, the banks don’t have those assets because they converted the dollar to yuan to prop up local real estate Ponzis and local corporations. There’s not much left over to bail out the corporate, individual and real estate sectors. This is all part of a global “dollar shortage” attributable to Fed tightening, both in the forms of higher rates but also a reduction in base money. A dollar shortage seems implausible in a world where the Fed printed $4.4 trillion. But while the Fed was printing, the world borrowed over $70 trillion (on top of prior loans), so the dollar shortage is real. The math is inescapable.

Everyone’s going to call on Beijing to come to the rescue.

• China Factory Growth Weakest In Over 2 Years, Export Orders Slump Deepens (R.)

China’s manufacturing sector in October expanded at its weakest pace in over two years, hurt by slowing domestic and external demand, in a sign of deepening cracks in the economy from an intensifying trade war with the United States. Anxiety about China’s cooling growth and its likely drag on the global economy have vexed financial markets recently, and Wednesday’s official Purchasing Managers’ Index (PMI) indicates more stress for investors through coming months. The official PMI – which gives global investors their first look at business conditions in China at the start of the last quarter of the year – fell to 50.2 in October, the lowest since July 2016 and down from 50.8 in September.

It was a touch above the 50-point mark that separates growth from contraction for a 27th straight month, but undershot the 50.6 forecast in a Reuters poll. The latest reading suggests a further loss of momentum in the world’s second-biggest economy, and the deteriorating environment for businesses could prompt more policy support from Beijing on top of a raft of recent initiatives. “All the numbers from China’s PMI release today confirm a broad-based decline in economic activity,” said Raymond Yeung, chief economist for China at ANZ in a client note, adding that conditions for the private sector is “much worse” than headline data suggested. “Besides an expected reserve requirement ratio (RRR) cut next January, we expect future supportive policy actions to be measured. The government’s priority is to avoid a financial blow-up.”

Not hard to be better than The Oracle, Bernanke and Yellen. But where was Volcker when these three went off the rails?

• Ray Dalio Hails Paul Volcker As ‘The Greatest Man’ He Knows (MW)

Those weighty words of praise were tweeted out Tuesday by Ray Dalio, founder of hedge-fund behemoth Bridgewater Associates. Dalio’s social-media nod to the former Fed chair coincides with the release of Volcker’s memoir, “Keeping at It: The Quest for Sound Money and Good Government.”

In his new book, Volcker says he’s worried about the impact of money in politics and argues that the U.S. is devolving into a plutocracy. “We face a huge challenge in this country to restore a sense of public purpose and of trust in government,” he wrote in the book. “It will require critically needed reforms in our political processes and leaders who can restore and preserve a consensus upon which our great democracy can depend.” Volcker, 91, served as Fed chair from 1979 until 1987, and he’s widely credited for stopping runaway inflation during that time. He was also chairman of the Economic Recovery Advisory Board under Obama from 2009 to 2011.

Dalio wasn’t the only one to give Volcker some love in light of his memoir. Martin Wolf of the Financial Times is also a big fan, saying that he’s “the greatest man I have known,” because “he is endowed to the highest degree with what the Romans called virtus (virtue): moral courage, integrity, sagacity, prudence and devotion to the service of country.” Wolf said “the pinnacle of Volcker’s career” was when he achieved something many thought impossible: he slew inflation. “Great credit is due to Jimmy Carter, who appointed him, and Ronald Reagan, who supported him. But Volcker did it, despite great criticism,” Wolf explained. “The costs were huge. But he was right: it had to be done.”

“And if it happens that the Dems don’t prevail, and don’t manage to get their hands on the machinery of congress — then what?”

The Democratic Party war on white people and their dastardly privilege has been the theme all year long, with its flanking movement against white men especially and super-especially the hetero-normative white male villains who rape and oppress everybody else. Anyway, that’s the strategy du jour. I’m not persuaded that it’s going to work so well in the coming election. The party could not have issued a clearer message than “white men not welcome here.” Very well, then, they’ll vote somewhere else for somebody else. And if it happens that the Dems don’t prevail, and don’t manage to get their hands on the machinery of congress — then what?

For one thing, a lot of people get indicted, especially former top officers from various glades of the Intel swamp. It shouldn’t be a surprise, given the numbers of them already called before grand juries and fingered by inspectors general. But it may be shocking how high up the indictments go, and how serious the charges may be: sedition… treason…? These midterm election may bring the moment when the Democratic Party finally blows up, at least enough to sweep away the current coterie of desperate idiots running it. It’s time to shove the crybabies offstage and allow a few clear-eyed adults to take the room, including men, yes even white men. And let all the shrieking, clamoring, marginal freaks return to the margins, where they belong.

That recession is now certain, deal or not. Even in case of a deal, 1000s of documents must be signed. A deal will not mean a return to BAU.

• No-Deal Brexit Would Trigger Lengthy UK Recession – S&P (G.)

Britain’s economy will suffer rising unemployment and falling household incomes that would trigger a recession should Theresa May fail to secure a deal to prevent the UK crashing out of the European Union next year, according to analysis by the global rating agency Standard & Poor’s. Property prices would slump and inflation would spike to more than 5% in a scenario that S&P said had become more likely in recent months following deadlock with Brussels over a post-Brexit deal. In a warning that included a possible downgrade to the UK’s credit rating, which would bring with it an increase in the Treasury’s borrowing costs, S&P said it still expected both sides in the Brexit talks to come to an agreement before next March, when the UK is scheduled to leave the European Union.

But it warned that the chance of a “no-deal” Brexit had risen in recent months to such an extent that it needed to warn international investors about the potential challenges ahead. [..] S&P Global Ratings credit analyst Paul Watters, said: “Our base-case scenario is that the UK and the EU will agree and ratify a Brexit deal, leading to a transition phase lasting through 2020, followed by a free trade agreement. “But we believe the risk of no deal has increased sufficiently to become a relevant rating consideration. This reflects the inability thus far of the UK and EU to reach agreement on the Northern Irish border issue, the critical outstanding component of the proposed withdrawal treaty.”

Coming only a day after the chancellor said the failure to secure a deal would force him to hold an emergency budget, S&P’s analysis joins a welter of independent reports that forecast that a split from the EU without a deal will deal a serious blow to the prospects of the UK economy. Last month rival agency Moody’s said the risks to the British economy had “risen materially” in recent months.

If you think Trump’s scary, this guy’s in a league of his own.

• Welcome to the Jungle (Escobar)

It’s darkness at the break of (tropical) high noon. Jean Baudrillard once defined Brazil as “the chlorophyll of our planet”. And yet a land vastly associated worldwide with the soft power of creative joie de vivre has elected a fascist for president. Brazil is a land torn apart. Former paratrooper Jair Bolsonaro was elected with 55.63 percent of votes. Yet a record 31 million votes were ruled absent or null and void. No less than 46 million Brazilians voted for the Workers’ Party’s candidate, Fernando Haddad; a professor and former mayor of Sao Paulo, one of the crucial megalopolises of the Global South. The key startling fact is that over 76 million Brazilians did not vote for Bolsonaro. His first speech as president exuded the feeling of a trashy jihad by a fundamentalist sect laced with omnipresent vulgarity and the exhortation of a God-given dictatorship as the path towards a new Brazilian Golden Age.

French-Brazilian sociologist Michael Lowy has described the Bolsonaro phenomenon as “pathological politics on a large scale”. His ascension was facilitated by an unprecedented conjunction of toxic factors such as the massive social impact of crime in Brazil, leading to a widespread belief in violent repression as the only solution; the concerted rejection of the Workers’ Party, catalyzed by financial capital, rentiers, agribusiness and oligarchic interests; an evangelical tsunami; a “justice” system historically favoring the upper classes and embedded in State Department-funded “training” of judges and prosecutors, including the notorious Sergio Moro, whose single-minded goal during the alleged anti-corruption Car Wash investigation was to send Lula to prison; and the absolute aversion to democracy by vast sectors of the Brazilian ruling classes.

That is about to coalesce into a radically anti-popular, God-given, rolling neoliberal shock; paraphrasing Lenin, a case of fascism as the highest stage of neoliberalism. After all, when a fascist sells a “free market” agenda, all his sins are forgiven.

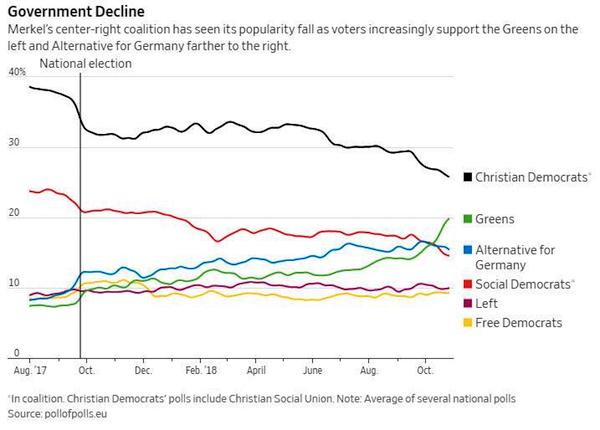

My old buddy John Rubino is right, but the story’s bigger than this. Merkel’s been given far too much power.

• After Germany’s Merkel Comes Chaos (John Rubino)

After a long, initially-successful run promoting European integration and mass immigration, German Chancellor Angela Merkel saw the bottom fall out of her political fortunes this year. This week she stepped down as leader of the formerly-dominant Christian Democrat party and promised not run again when her term as Chancellor ends in 2021. What happens next is almost certain to be chaotic, as the following chart (courtesy of this morning’s Wall Street Journal) makes clear. Note that in August of 2017 the two least popular parties were the far right Alternative for Germany (blue line) and the far left Greens (green line). In the ensuing 14 or so months AfG’s support rose from single digits to around 17% while the Greens rocketed from the bottom of the pack to 20%.

If you didn’t know what these two parties stood for you might think, “Fine, they’re new and interesting, so let them form a coalition and govern for a while.” Unfortunately they’re more likely to kill each other in street fights than work together, since the former want closed borders and free markets while the latter want increased regulation and unlimited immigration. The alternative to an AfG/Green coalition then becomes some combination of the remaining, more centrist (by European standards at least) parties. But the biggest of those parties – Merkel’s Christian Democrats and their coalition partner Social Democrats – are in freefall, precisely because of what they’ve done while in power. So there appears to be no way to put these puzzle pieces together to produce a stable government.

And – here’s where things get truly scary – a stable Germany under Merkel’s bland but firm hand has been the only thing holding the European Union and eurozone together. If Germany descends into internal turmoil without a coherent government to push the Italys and Hungarys around, European populists/nationalists will fill the resulting vacuum. Borders will be re-imposed within and without the EU, national government budgets – already above EU deficit limits in many cases – will explode. Already-debilitating debts will keep rising, and the ECB will be forced to bail out Italy for sure and probably several other member states after that.

Intro to an elaborate series of reports by Reuters, kudos for the effort. Fish have moved north and deeper, leaving entire communities without their proteins.

To stand at the edge of an ocean is to face an eternity of waves and water, a shroud covering seven-tenths of the Earth. Hidden below are mountain ranges and canyons that rival anything on land. There you will find the Earth’s largest habitat, home to billions of plants and animals – the vast majority of the living things on the planet. In this little-seen world, swirling super-highway currents move warm water thousands of miles north and south from the tropics to cooler latitudes, while cold water pumps from the poles to warmer climes. It is a system that we take for granted as much as we do the circulation of our own blood. It substantially regulates the Earth’s temperature, and it has been mitigating the recent spike in atmospheric temperatures, soaking up much of human-generated heat and carbon dioxide.

Without these ocean gyres to moderate temperatures, the Earth would be uninhabitable. In the last few decades, however, the oceans have undergone unprecedented warming. Currents have shifted. These changes are for the most part invisible from land, but this hidden climate change has had a disturbing impact on marine life – in effect, creating an epic underwater refugee crisis. Reuters has discovered that from the waters off the East Coast of the United States to the coasts of West Africa, marine creatures are fleeing for their lives, and the communities that depend on them are facing disruption as a result. As waters warm, fish and other sea life are migrating poleward, seeking to maintain the even temperatures they need to thrive and breed.

The number of creatures involved in this massive diaspora may well dwarf any climate impacts yet seen on land. In the U.S. North Atlantic, for example, fisheries data show that in recent years, at least 85 percent of the nearly 70 federally tracked species have shifted north or deeper, or both, when compared to the norm over the past half-century. And the most dramatic of species shifts have occurred in the last 10 or 15 years. Fish have always followed changing conditions, sometimes with devastating effects for people, as the starvation that beset Norwegian fishing villages in past centuries when the herring failed to appear one season will attest. But what is happening today is different: The accelerating rise in sea temperatures, which scientists primarily attribute to the burning of fossil fuels, is causing a lasting shift in fisheries.