El Greco St. Paul and St. Peter 1595

Macgregor

Those who today are arguing for globalism are very similar to the people who wanted to go to Vietnam.

What they were interested in doing, particularly today's group is erasing national identities.pic.twitter.com/aICD6pUlSr

— Douglas Macgregor (@DougAMacgregor) August 6, 2023

Full German Nazism, complete with Untermenschen etc. This is what you fund.

• Asians Are Less ‘Humane’ – Ukrainian Security Chief (RT)

Russians are “Asians” and, therefore, lack the “humanity” that Ukrainians purportedly possess, Aleksey Danilov, the head of Ukraine’s National Security and Defense Council, has claimed. The top official made the remark as he spoke live on Ukrainian TV, which has been heavily censored and turned into a state-approved “broadcasting marathon” amid the ongoing conflict. “I’m fine with Asians, but Russians are Asians. They have a completely different culture, vision. Our key difference from them is humanity,” Danilov stated. The security chief, as well as other top Ukrainian officials, have repeatedly made hateful remarks about Russians during – and even well before – the ongoing hostilities between the two countries broke out back in February 2022.

Danilov has repeatedly promised to “kill” Russians anywhere across the globe, with similar extreme statements consistently made by Mikhail Podoliak, the top aide to Ukrainian President Vladimir Zelensky. Podoliak has repeatedly claimed that all Ukrainians universally “hate Russians,” as well as voiced calls to “kill Russians” on a daily basis. Similarly radical remarks have been repeatedly made by the Ukrainian military spy chief, Kirill Budanov, who also expressed the same urge. Threats by the latter have been addressed by Russia’s permanent envoy to the UN, Vassily Nebenzia, who branded them a “blatant example of hateful remarks, Russophobia and incitement of violence based on nationality.”

“.. the fetid stench of rotting corpses, abandoned by their comrades who fled for their lives.”

• Who is Responsible for Ukraine’s Failed Counteroffensive? (Scott Ritter)

On a normal summer’s day, the road to Rabotino would be empty, save for the odd combine tractor and the vehicles driven by farmers and their families as they tend to the fields of crops they had planted in spring. The summer’s heat would reflect off the horizon, creating glimmering mirages, while the still air would echo with the chirping of birds and the buzzing of insects. On a normal summer’s day, the road to Rabotino would resemble paradise. Today, the road to Rabotino can best be described as a highway to hell: the serene landscape scarred with craters made by artillery shells, bombs, and mines. Fields that once grew crops intended to feed the world now seem to produce another crop—the torn, burned-out hulks of Ukrainian tanks, infantry fighting vehicles, and other military vehicles of all shapes and sizes.

The air buzzes not with bees, but bullets, and the sky above is torn by the sound of shells passing overhead, on their way to their intended target, often consisting of a new crop of military metal waiting to be consumed by fire. The smell of fresh soil, young crops, and flowers of the field has been replaced by the fetid stench of rotting corpses, abandoned by their comrades who fled for their lives. The Russian Ministry of Defense has assessed that, since the Ukrainian counteroffensive began in early June, the Ukrainian Army has suffered some 43,000 casualties, with more than 4,900 pieces of equipment, including 1,831 tanks and infantry fighting vehicles (among which are included 25 German-made Leopard tanks and 21 US-made M-2 Bradley Infantry Fighting Vehicles) having been destroyed.

Russian casualties, while unspecified, have been alluded to by President Putin, who stated that the kill ratio was 10:1 in Russia’s favor. That equates to 4,300 casualties: the brutal blade of war cuts both ways. The casualties suffered by Ukraine roughly align with the casualties suffered by German forces during their offensive operations against the Soviet Army in the battle of Kursk, fought in the month of July and August 1943. The Kursk battle was one of the largest during the Second World War.This should give one an idea of the scope and scale of the violence which has transpired in and around the village of Rabotino, and elsewhere in the Zaporozhye and Donetsk regions where Ukraine and Russian forces are confronting one another.

When an army suffers a defeat of the scope and scale of that suffered by Ukraine near Rabotino, and in other fields and villages across the line of contact with Russia, it is normally incumbent upon the leadership of the defeated forces to ascertain the reasons why the defeat occurred, and then to undertake remedial action to correct the problems identified.It came weeks after being on the receiving end of criticism from their erstwhile allies and partners in NATO, who provided Ukraine with both the material used to equip the Ukrainian Army, and training on how this equipment was to be used in battle against the Russians.

Where’s China?

• What Should Russia Expect From Saudi Arabia’s Ukraine ‘Peace Summit’? (RT)

Political expert Andrey Dubnov:

The goal of the conference is not to formulate “agreements acceptable to all parties.” Russia has not been invited to this event, and this makes sense, because otherwise the meeting would have been doomed to failure. It is obvious that Moscow’s position has been articulated; the last time it was expressed was at the Russia-Africa summit. Moscow’s main position is essentially an arrangement that can be called a ceasefire, based on Russia’s retention of the Ukrainian territories now organized as four Russian regions. It is difficult to imagine that Moscow is prepared to abandon this as its main negotiating position. On the other hand, Kiev’s stance on peace is articulated as being possible only if Russia withdraws its troops to the 1991 borders. With such positions of the parties, a general meeting would be pointless.

What is the purpose of the summit in Saudi Arabia? Since this initiative comes mainly from Kiev and is backed by the US, it is now about consolidating the whole wider world – not just the West, but the big South, including the BRICS member countries (India, Brazil and South Africa). It is an attempt to find a consolidated expression of support for the Ukrainian peace plan. Within this “formula of support” there are some limits regarding the flexibility of Kiev’s negotiating position: under what conditions it is ready to give up its categorical demand to return to the 1991 borders and to compromise with Russia? Clarifying this kind of flexibility may be one of the ulterior goals of this conference. But practice shows that such diplomatic conferences look first and foremost like big, big PR. Diplomacy needs silence and confidentiality. The Saudi initiative does not yet provide for this silence and confidentiality, so it is still more of a political meeting than a search for a diplomatic solution to the problem.

President Vladimir Zelensky’s peace plan will be at the center of the Saudi initiative. Within this framework, an attempt will be made to somehow find acceptable windows in which Kiev, I repeat, will be prepared to make further compromises with Moscow. But at the end of the day, everything will depend on the outcome of the military operations on the ground, which are being actively pursued. No peace plan for Ukraine can become a reality without China’s participation. The meeting in Saudi Arabia could be a precursor to a financial and economic assistance plan to rebuild Ukraine. This is how the plan to help Afghanistan began at the Bonn conference many years ago.

Remarkable how similar his story is to Trump’s. One man vs the establishment.

• Ex-Pakistani PM Imran Khan Jailed For Three Years (RT)

Former Pakistani prime minister Imran Khan was issued with a three-year jail sentence by an Islamabad court on Saturday after he was found guilty on corruption charges. The verdict means that Khan, who claims the prosecution was politically motivated, will not be able to contest elections later this year. In a pre-recorded statement released on X (formerly Twitter), Khan told his supporters: “I have only one appeal, don’t sit at home silently.” Judge Humayun Dilawar declared in court that Khan, 70, had “deliberately submitted fake details” after he was accused of illegally profiting from the sale of gifts he received while serving as Pakistan’s head of state between 2018 and 2022. After issuing the three-year custodial term, the judge also ordered Khan to be banned from politics for a period of five years.

Following the verdict, Khan, who was not in court, was arrested at his home in Lahore and taken into police custody. The claims against the former prime minister are a case of “political victimization,” according to his lawyer Intezar Hussain Panjutha. “Khan was not given an opportunity to defend himself and say his side of the story,” he said after the verdict. “We wanted to provide witnesses in his favor but he was not allowed this opportunity. Khan was not given a fair trial.” Khan’s barrister, Gohar Khan, added in comments to The Dawn newspaper that the court’s verdict had been a “murder of justice.” However, opponents of the former politician appeared to celebrate the court’s judgment outside the building, with some chanting: “Imran Khan is a thief.” More than 150 cases have been brought against Khan, the former sports star turned populist political figure, since he was ousted from office last April following a no-confidence vote. He has denied all wrongdoing.

Barring a successful appeal, Khan’s conviction means he will be prohibited from standing in Pakistan’s general elections, which are expected to take place in October or November. Khan, who had unsuccessfully called for early elections to take place, has previously stated his belief that Pakistan’s military authorities have attempted to obstruct his Tehreek-e-Insaf party from regaining political power. It’s the second time in recent months that Khan has been arrested. Around 100 paramilitary troops were involved in his detention last May in connection with one of the numerous cases against him. Khan has alleged that Pakistan’s military is responsible for attempts to subdue his political influence. He has also claimed that the United States has conspired with Pakistan’s government to prevent him from returning to political power.

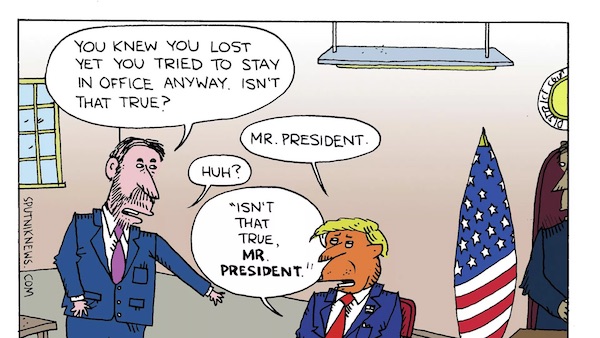

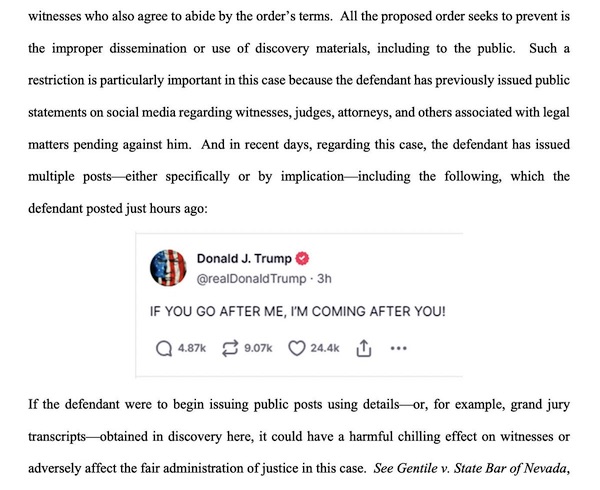

“IF YOU GO AFTER ME, I’M COMING AFTER YOU!”

• DOJ Seeks Protective Order in Election Case (ET)

Justice Department special counsel Jack Smith on Aug. 4 requested the federal judge overseeing former President Donald Trump’s case to issue a “protective order” in light of a social media post made by the former president. The Aug. 4 Truth Social post by Mr. Trump said, “IF YOU GO AFTER ME, I’M COMING AFTER YOU!” Following this, Mr. Smith urged U.S. District Court Judge Tanya Chutkan to “enter a protective order governing or restricting discovery or inspection” of case details, to restrict what Mr. Trump can share publicly about the case and evidence. “Such a restriction is particularly important in this case because the defendant has previously issued public statements on social media regarding witnesses, judges, attorneys, and others associated with legal matters pending against him,” argued Mr. Smith in a filing, citing the Truth Social post.

“If the defendant were to begin issuing public posts using details—or, for example, grand jury transcripts—obtained in discovery here, it could have a harmful chilling effect on witnesses or adversely affect the fair administration of justice in this case,” Mr. Smith said, adding that such posts may influence jurors.A spokesperson for Mr. Trump responded immediately to the filing implying that the post was not a retaliation against Mr. Smith’s charges. “The Truth post cited is the definition of political speech, and was in response to the RINO, China-loving, dishonest special interest groups and Super PACs, like the ones funded by the Koch brothers and the Club for No Growth,” said the brief statement.

“I don’t care about a link… I have a much better link,” and “I have a lot of friends in Detroit… Detroit is totally corrupt.”

• A Successful Prosecution Would Fold Space And Time (Taibbi)

Special Counsel Jack Smith’s indictment is a case within a case, a prosecutorial enchilada filled with things for people of all political persuasions to hate. The outside is a shell of a conventional conspiracy prosecution, and these parts are genuinely damaging for Donald Trump. Inside, it’s a deranged authoritarian fantasy, at times reading more like a 45-page Louise Mensch tweet than an indictment. This radical core is somehow scarier than the allegations against Trump and co-conspirators like Rudy Giuliani, John Eastment, Sidney Powell, Jeffrey Clark, and Kenneth Cheeseboro. Despite early criticism describing the case as entirely about protected speech, Special Prosecutor Jack Smith’s case does focus on some overt acts, and these sections are buttressed by witnesses who could be convincing across the spectrum.

Former Arizona Speaker of the House and onetime Trump supporter Rusty Bowers will describe being asked not to certify the results by, among others, Trump and Giuliani. Ronna McDaniel, chair of the RNC, will say she was told votes by so-called “fraudulent electors” would only be deployed if election litigation was successful. Former Vice President Mike Pence, who is rumored to be running for president and took instant advantage of indictment news Tuesday, will testify Trump told him, “You’re too honest,” in response to prods to refuse to certify the outcome.

If Smith simply focused on those damaging episodes in states like Arizona, Michigan, and Georgia, or on Trump’s interactions with Pence, this prosecution would be an easier sell to the general population. Instead, Smith has tried to pen a Unified Field Theory of insurrection that would massively expand the meaning of concepts like incitement to include false statements, tweets, and other forms of protected speech, down to classic Trumpisms like “I don’t care about a link… I have a much better link,” and “I have a lot of friends in Detroit… Detroit is totally corrupt.”

In fact, if rumors are true and the four counts filed by Smith this week are later complemented by a superseding indictment, this document may end up expanding the definition of “seditious conspiracy” to include those things as well. As Adam Kinzinger said this week, he hoped additional counts will hold Trump “accountable” for all the actions of January 6th. It’s not hard to read this and see the framework of an argument that Trump’s ideas, tweets and “knowingly false statements” were elements of the same conspiracy to “violently disrupt” the election for which people like Oath Keepers Elmer Stewart Rhodes and Kelly Meggs have already been convicted and sentenced to 18 and 12 years in prison, respectively. A successful prosecution would fold space and time to make legal speech felony violence.

Flammable.

• Niger Junta Turns To Wagner For Help – Media (RT)

One of the leaders of last week’s coup in Niger has reportedly sought the assistance of Russian defense contractor Wagner Group PMC as the junta nears a deadline to either return the country’s ousted president to power or face a possible military intervention by neighboring nations. General Salifou Moody allegedly made the request during a visit to neighboring Mali, where he met with a Wagner representative, the Associated Press reported on Saturday, citing French journalist Wassim Nasr, a senior research fellow at the Soufan Center. The meeting was first reported by France 24, and Nasr said he had confirmed the talks with a French diplomat and three people familiar with the matter in Mali.

“They need (Wagner) because they will become their guarantee to hold onto power,” Nasr told the AP, claiming that Wagner is considering the request. Neither Wagner nor Russian government officials have commented on the junta’s alleged request for help from the contractor. The Kremlin said on Friday that any interference in Niger from powers outside the region wouldn’t likely improve the situation. “We continue to favor a swift return to constitutional normality without endangering human lives,” Kremlin spokesman Dmitry Peskov told reporters. Wagner chief Yevgeny Prigozhin has called the coup a “justified rebellion of the people against Western exploitation.”

The Economic Community of West African States (ECOWAS) has threatened to send troops into Niger if the coup leaders don’t return President Mohamed Bazoum to power by Sunday. Bazoum has been under house arrest since his ouster and has asked the US “and the entire international community” to restore his government. The militaries of several ECOWAS members, including Nigeria, have agreed on a plan for their intervention in Niger. Wagner has become a major player in the African security landscape, though it’s unclear how its influence on the continent stands after its failed mutiny against Moscow in June. Russian Foreign Minister Sergey Lavrov has said that the future of the contracts Wagner signed with various African countries is a matter for those client governments to decide. The firm’s troops have reportedly operated in such countries as Mali, Burkina Faso, Sudan, Mozambique and the Central African Republic.

Mali and Burkina Faso are among the ECOWAS member states that have sided with the Niger junta following the coup. Bazoum accused the two neighbors of employing “criminal Russian mercenaries.” African Freedom Institute President Franklin Nyamsi warned in an RT interview on Thursday that if ECOWAS carried out its threat to send troops into Niger, it would be seen as a declaration of war on the junta’s allies, including Mali and Burkina Faso. Such a conflict could escalate dramatically as the warring factions seek help from the world’s military superpowers, he said, adding, “We are now at the door of a world African war.”

Wonder how the idea would work out in practice.

• X to Fund Legal Bills of People ‘Unfairly Treated’ for Posts, Likes on X (Sp.)

US billionaire entrepreneur Elon Musk pledged on Saturday that his social media platform, X (formerly known as Twitter), will pay legal bills of those people who were “unfairly treated” at workplaces by their employers for posts and likes on the platform. He added that there would be “no limit” to funding the bills and called on people to inform the platform of such cases. “If you were unfairly treated by your employer due to posting or liking something on this platform, we will fund your legal bill,” Musk said on X. In late October 2022, Musk finalized the $44 billion acquisition of Twitter, a US company founded in 2006 and headquartered in San Francisco, California. Twitter Corporation ceased to exist as a separate company as a result of its merger with X Corp. founded by Musk in 2006. In late July, Twitter’s logo was changed from a blue bird to a black-and-white X logo. Musk specified that the new logo symbolized “the imperfections in us all that make us unique.”

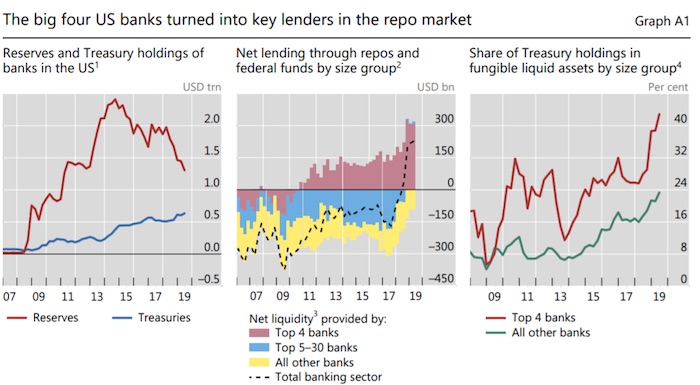

“..the right to cash was worthless if “there won’t be a single ATM left in Austria..”

• Austrian PM Proposes Constitutional ‘Right to Cash’ (Sp.)

As cashless payment methods proliferate across Europe, Austrian Prime Minister Karl Nehammer has moved to legally preserve paying in the old-fashioned way, with banknotes and coins. Speaking on Friday, the conservative Austrian leader proposed a “constitutional protection of cash as a means of payment,” saying he would direct Finance Minister Magnus Brunner and the country’s central bank to come up with a plan in the coming months to ensure a “basic supply” of cash remains in the economy. “Everyone should have the opportunity to decide freely how and with what he wants to pay,” he said. “That can be by card, by transfer, perhaps in future also with the digital euro, but also with cash. This freedom to choose must and will remain.”

“More and more people are worried that cash could be restricted as a means of payment in Austria,” Nehammer said, adding that people have a “right to cash.” Nehammer noted that his comments are in response to claims circulating on social media that the country could soon do away with cash payments, forcing customers to use bank cards or payment apps. According to the Austrian leader, €47 billion is withdrawn from ATMs every year in Austria and the average Austrian carries €102 in cash. Further, two-thirds of payments under €20 are made in cash, he said. Roughly 9.1 million people live in the Central European country, which is part of the European Union and the Eurozone.

The debate isn’t new to Austria, and Nehammer’s proposal was criticized by both left and right politicos. Philip Kucher, an MP from the Social Democratic Party, said the right to cash was worthless if “there won’t be a single ATM left in Austria,” while the right-wing Freedom Party accused the prime minister of stealing their idea. While the Eurozone nations have been increasing options for cashless payment, the European Central Bank has also committed itself to preserving cash as a payment form. The Eurosystem Cash 2030 strategy was launched in 2020. A study published by the ECB in March found that within the Eurozone, cash is still the most frequent payment method, accounting for 59% of transactions. However, 55% of consumers said they preferred cashless payments. They also found that the value of card payments had exceeded the value of cash payments for the first time, rising to 46% of transactions.

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.