DPC Maumee River waterfront, Toledo, OH 1910

It’s still just the start. If you’re a mom and pop investor in China, the only way to go is out.

• China Stocks Suffer Biggest One-Day Loss In Eight Years (Reuters)

Chinese shares tumbled more than 8% on Monday amid renewed fears about the outlook for the world’s No. 2 economy, reviving the specter of a full-blown market crash that prompted unprecedented government intervention earlier this month. Major indexes suffered their largest one-day drop since 2007, shattering a period of relative calm in China’s volatile stock markets since Beijing unleashed a barrage of support measures to arrest a slump that began in mid-June. The CSI300 index .CSI300 of the largest listed companies in Shanghai and Shenzhen plunged 8.6%, to 3,818.73, while the Shanghai Composite Index .SSEC lost 8.5%, to 3,725.56 points. While the falls followed lackluster data on profit at Chinese industrial firms on Monday and a disappointing private factory sector survey on Friday, there was little to explain the scale of the sell-off.

Some analysts said fears that China may hold off from further loosening of monetary policy had contributed to souring investor sentiment. “The recent rebound had been swift and strong, so there’s need for a technical correction,” said Yang Hai, strategist at Kaiyuan Securities. He said the trigger was “a sluggish U.S. market amid stronger expectations of a Fed rate rise in the fourth quarter. That, coupled with China’s rising pork prices, fuels concerns that China would refrain from loosening monetary policies further.” In late June and early July, Chinese authorities cut interest rates, suspended initial public offerings, relaxed margin-lending and collateral rules and enlisted brokerages to buy stocks, backed by central bank cash, to support share prices.

The battery of stabilization measures followed a peak-to-trough slump of more than 30% in China’s benchmark indexes, which had more than doubled over the preceding year. Chinese share markets had recovered around 15% since then, before Monday’s renewed sell-off. Stocks fell across the board on Monday, with 2,247 companies falling, leaving only 77 gainers.

Blood. Bath.

• China Stocks Post Biggest Plunge Since 2007 (Bloomberg)

The biggest slump in Chinese shares in eight years led equities lower worldwide and selling spread to the dollar as the turmoil bolstered the case for keeping U.S. interest rates lower for longer. Stocks fell in Europe for a fifth day after the Shanghai Composite Index tumbled 8.5% as Chinese industrial company profits decreased in June. The dollar weakened 0.8% to $1.1069 per euro at 10:22 a.m. in London while Italian and Spanish bonds pared losses. Gold futures rose the most in a month as the drop in equities spurred haven demand and investors speculated that recent losses have been overdone. “Today’s rout in China poured cold water on investor sentiment,” said Mari Oshidari at Okasan Securities. “This also revealed the market is still too fragile without government support.”

The profit decline is the latest evidence of a deteriorating economic outlook for China, while the slump in stocks will be a blow to policy makers who enacted unprecedented measures to stem a $4 trillion rout. A gauge of Chinese stocks in Hong Kong slumped 3.8% Monday, while the city’s benchmark Hang Seng Index slid 3.1%. The report on industrial profits from the statistics bureau followed data Friday showing a private manufacturing gauge unexpectedly declined in July to a 15-month low. Chinese officials allowed more than 1,400 companies to halt trading, banned major shareholders from selling stakes, restricted short selling and suspended initial public offerings, spurring a 16% rebound on the Shanghai measure through last week from a low on July 8.

The IMF has urged the nation to eventually unwind the support measures, according to a person familiar with the matter.

“I have a strong suspicion that there will be no deal on August 20..”

• Varoufakis Reveals Cloak And Dagger Greece ‘Plan B’, Awaits Treason Charges (AEP)

A secret cell at the Greek finance ministry hacked into the government computers and drew up elaborate plans for a system of parallel payments that could be switched from euros to the drachma at the “flick of a button” . The revelations have caused a political storm in Greece and confirm just how close the country came to drastic measures before premier Alexis Tsipras gave in to demands from Europe’s creditor powers, acknowledging that his own cabinet would not support such a dangerous confrontation.

Yanis Varoufakis, the former finance minister, told a group of investors in London that a five-man team under his control had been working for months on a contingency plan to create euro liquidity if the ECB cut off emergency funding to the Greek financial system, as it in fact did after talks broke down and Syriza called a referendum. The transcripts were leaked to the Greek newspaper Kathimerini. The telephone call took place a week after he stepped down as finance minister. “The prime minister, before we won the election in January, had given me the green light to come up with a Plan B. And I assembled a very able team, a small team as it had to be because that had to be kept completely under wraps for obvious reasons,” he said.

“The context of all this is that they want to present me as a rogue finance minister, and have me indicted for treason. It is all part of an attempt to annul the first five months of this government and put it in the dustbin of history,” he said. “It totally distorts my purpose for wanting parallel liquidity. I have always been completely against dismantling the euro because we never know what dark forces that might unleash in Europe,” he said. The goal of the computer hacking was to enable the finance ministry to make digital transfers at “the touch of a button”. The payments would be ‘IOUs’ based on an experiment by California after the Lehman crisis. A parallel banking system of this kind would allow the government to create euro liquidity and circumvent what Syriza called “financial strangulation” by the ECB.

“This was very well developed. Very soon we could have extended it, using apps on smartphones, and it could become a functioning parallel system. Of course this would be euro denominated but at the drop of a hat it could be converted to a new drachma,” he said. Mr Varoufakis claimed the cloak and dagger methods were necessary since the Troika had taken charge of the public revenue office within the finance ministry. “It’s like the Inland Revenue in the UK being controlled by Brussels. I am sure as you are hearing these words your hair is standing on end,” he said in the leaked transcripts. Mr Varoufakis said any request for permission would have tipped off the Troika immediately that he was planning a counter-attack.

Mr Varoufakis said that Mr Schauble has made up his mind that Greece must be ejected from the euro, and is merely biding his time, knowing that the latest bail-out plan is doomed to failure. “Everybody knows the IMF does not want to take part in a new programme but Schauble is insisting that it does as a condition for new loans. I have a strong suspicion that there will be no deal on August 20,” he said. He said the EU authorities may have to dip further into the European Commission’s stabilisation fund (EFSM), drawing Britain deeper into the controversy since it is a contributor. By the end of the year it will be clear that tax revenues are falling badly short of targets – he said – and the Greek public ratio will be shooting up towards 210pc of GDP. “Schauble will then say it is yet another failure. He is just stringing us along. he has not given up his plan to push Greece out of the euro,” he said.

Lafazanis is part of the picture too.

• Tsipras Under Pressure Over Covert Syriza Drachma Plan Reports (Reuters)

Some members of Greece’s leftist government wanted to raid central bank reserves and hack taxpayer accounts to prepare a return to the drachma, according to reports on Sunday that highlighted the chaos in the ruling Syriza party. It is not clear how seriously the plans, attributed to former Energy Minister Panagiotis Lafazanis and former Finance Minister Yanis Varoufakis, were considered by the government and both ministers were sacked earlier this month. However the reports have been seized on by opposition parties who have demanded an explanation. The reports came at the end of a week of fevered speculation over what Syriza hardliners had in mind as an alternative to the tough bailout terms that Tsipras reluctantly accepted to keep Greece in the euro.

Around a quarter of the party’s 149 lawmakers rebelled over the plan to pass sweeping austerity measures in exchange for up to €86 billion euros in fresh loans and Tsipras has struggled to hold the divided party together In an interview with Sunday’s edition of the RealNews daily, Panagiotis Lafazanis, the hardline former energy minister who lost his job after rebelling over the bailout plans, said he had urged the government to tap the reserves of the Bank of Greece in defiance of the ECB. Lafazanis, leader of a hardline faction in the ruling Syriza party that has argued for a return to the drachma, said the move would have allowed pensions and public sector wages to be paid if Greece were forced out of the euro.

“The main reason for that was for the Greek economy and Greek people to survive, which is the utmost duty every government has under the constitution,” he said. However he denied a report in the Financial Times that he wanted Bank of Greece Governor Yannis Stouranaras to be arrested if he had opposed a move to empty the central bank vaults. In comments to the semi-official Athens News Agency, he called the report a mixture of “lies, fantasy, fear-mongering, speculation and old-fashioned anti-communism”.

The Guardian seems to be sitting on the fence. Has any western press eevr before referred to Kathimerini as a “conservative newspaper”?

• Greece Rocked By Alleged Secret Plan To Raid Banks For Drachma Return (Guardian)

Some members of Greece’s leftist-led government wanted to raid central bank reserves and hack taxpayer accounts to prepare a return to the drachma, according to reports that highlighted the chaos in the ruling Syriza party. It is not clear how seriously the government considered the plans, attributed to former energy minister Panagiotis Lafazanis and ex-finance minister Yanis Varoufakis. Both ministers were sacked earlier this month, however, the revelations have been seized on by opposition parties who are demanding an explanation. The reports on Sunday came at the end of a week of fevered speculation over what Syriza hardliners had in mind as an alternative to the tough bailout terms Tsipras has reluctantly accepted to keep Greece in the eurozone.

About a quarter of the party’s 149 lawmakers rebelled over proposals to pass sweeping austerity measures in exchange for up to €86bn in fresh loans. Tsipras has been struggling to hold the party together. In an interview with Sunday’s edition of the RealNews daily, Lafazanis said he had urged the government to tap the reserves of the Bank of Greece in defiance of the ECB. Lafazanis, the leader of a hardline Syriza faction that has argued for a return to the drachma, said the move would have allowed pensions and public sector wages to be paid if Greece were forced out of the euro. “The main reason for that was for the Greek economy and Greek people to survive, which is the utmost duty every government has under the constitution,” he said.

In a separate report in the conservative Kathimerini newspaper, Varoufakis was quoted as saying that a small team in Syriza had prepared plans to secretly copy online tax codes. It said the “plan b” was devised to allow the government to introduce a parallel payment system if the banks were closed down. In remarks the newspaper said were made at an investors’ conference on 16 July, Varoufakis said passwords used by Greeks to access their online tax accounts were to have been duplicated secretly and used to issue new PIN numbers for every taxpayer to be used in transactions with the state. “This would have created a parallel banking system, which would have given us some breathing space, while the banks would have been shut due to the ECB’s aggressive policy,” Varoufakis was quoted as saying.

A woman to watch.

• The Politics of Coercion in Greece (Zoe Konstantopoulou)

This is a transcript of Speaker Zoe Konstantopoulou’s important July 22nd speech in the Hellenic Parliament.

I confess that the consciously, politically and personally painful moments which we are being called on to experience in parliament during this parliamentary term are multiplying. From my capacity as Speaker of the House, I have just sent a letter to the President, Mr. Prokopis Pavlopoulos and to Prime Minister Alexis Tsipras noting that it is my institutional responsibility to emphasize and underline that the conditions this bill is being introduced under allow no guarantees of compliance with the constitution, no protection of the democratic process or the exercise of legislative power of parliament, nor a conscience vote by members of parliament, under conditions of blatant blackmail, which is aimed by foreign government of EU member States at this government and the members of parliament and which is in fact introduced without any possibility of amendment by the parliament as was confessed by the Minister, whom I honor and respect deeply, as he knows, a statute through which a major intervention in the functioning of justice and the exercise of the fundamental rights of the citizens is being attempted, in a manner that tears down both the functioning of Greek democracy as a social state under the rule of law and in which there is a separation of powers according to the constitution, as well as the preservation of the principle of fair trial.

Ministers are being coerced to introduce a legislation whose content they do not agree with, and the statement made by the Justice Minister was characteristic, but who are directly opposed to it and members of parliament are being coerced to vote for it who are also opposed to its content, and the statements made by members of parliament in the two parliamentary groups, which make up the parliamentary majority were also characteristic, every one of them. All this is happening under the direct threat of a disorderly default and reveal that, in truth, this bill which foreign governments and not the Greek government have chosen as a prerequisite, is an attempt at the completion of a dissolution. Because this bill contains a major intervention into the third independent function, which is justice. This bill attempts to undermine the functioning of justice and is lifting basic guarantees to a fair trial and basic and fundamental rights of citizens.

Münchau wakes up: “If so many important people say it, then surely it must be true, mustn’t it? Actually, as it turns out, there is no such rule.”

• The Make Believe World Of Eurozone Rules (Wolfgang Münchau)

Whenever you are in a room with European officials and discuss the euro, there is usually somebody who raises his finger and says: “This is all well and good, but it is ‘against the rules’.” It then gets very quiet. “Against the rules” is a big thing in Europe. Most people do not really know what the rules are. But they do know that rules have to be followed. The situation reminds me of a short story by Franz Kafka, Before the Law, where a man tries to seek entrance to a courthouse. A door keeper tells him that this is possible in principle, but not at the moment. The man spends his entire life in front of the court waiting to be admitted. At the end of his life he was told that he could have gone through the door at any time. That man followed the wrong set of rules — rules of the mind, not of the law.

Rules of the mind is what we are dealing with in the European debate about the single currency. Many of these rules either do not exist, or they constitute some rather far-fetched interpretation of existing rules. During the recent Greek crisis, I came across a completely new rule. I first heard it from Wolfgang Schäuble, the German finance minister. It says that countries are not allowed to default inside the eurozone. But a default was perfectly fine once they leave the euro, on the other hand. I later read that Otmar Issing, the former chief economist of the European Central Bank, used almost exactly the same phrase as Mr Schäuble in an Italian newspaper interview. If so many important people say it, then surely it must be true, mustn’t it? Actually, as it turns out, there is no such rule.

There is only Article 125 of the European Treaty on the Functioning of the European Union. Article 125 says that countries should not take on the debt of other countries. This is also known as the “no-bailout” clause — though that, as it turns out, is a rather loaded interpretation. In its landmark Pringle ruling — relating to an Irish case in 2012 — the European Court of Justice said bailouts are fine, even under Article 125, as long as the purpose of the bailout is to render the fiscal position of the recipient country sustainable in the long run. In another landmark ruling, from June this year, the ECJ supported Mario Draghi’s promise to do whatever it takes to help a country subject to a speculative attack.

The ECB president’s pledge had previously been challenged by the German constitutional court. In both cases, the ECJ did not support the predominant German legal interpretation. So what then can we infer from the previous ECJ rulings in the absence of an explicit ruling from the court on debt relief? An interesting article by three authors from Bruegel, a European think-tank, concludes that debt relief is almost certainly consistent with current law. The argument goes as follows: in the Pringle case, the court gave the go-ahead for bailouts in principle as long as they are intended to stabilise public finances. In the ruling on the ECB’s backstop, the court accepted the principle that the ECB could incur a loss on its asset purchases, as long as the bank follows its own mandate.

What is really happening is that Germany does not want to grant Greece debt relief for political reasons, and is using European law as a pretext. Likewise, when Mr Schäuble proposes a Greek exit from the euro, ask yourself what rule that is consistent with. The fact is they are making up the rules as they go along to suit their own political purposes.

View from the left.

• Capitalism, Engineered Dependencies and the Eurozone (Urie)

Near-term technological considerations aside, the question that the Greeks and other peoples of the West may wish to ask is why banks and bankers whose livelihoods derive from the public grant to create and allocate money should be allowed to use it to rule the world? The quote from economist Joan Robinson that ‘The only thing worse than being exploited by capitalism is not being exploited by capitalism’ refers to precisely this type of engineered dependency, not to a natural state of the world. Was the intent of the European Union a partnership of equals then Syriza would have been granted a distinctive voice. With its mandate to remain within the union it is but another set of bodies warming the chairs at ‘negotiation’ tables listening to the dictates of the Troika.

The pragmatic difficulties of following the democratic mandate from the July 5th referendum derive from complexities that were sold as simplifications. Instead of multiple currencies the EMU would have only one— a simplification. However, any exit from the currency union will require the rapid constitution / reconstitution of a monetary infrastructure now rendered infinitely more complex through the broader project of joining finance capital’s ways of conducting business. A long-term exit plan assumes that Syriza can either stay in, or regain, power when political control has already been acceded to the Troika through economic control. An unplanned exit that allows the engineered complexity of monetary integration to quickly destroy the Greek economy would most likely find desperation leading to restoration of a compliant Greek government in dramatically worsened economic conditions.

What isn’t being put forward in the present, as best I can determine, is a left vision of possible economic organization either after a well-planned exit from the monetary union has been accomplished or after the broader EMU project has imploded from its own capitalist / banker-friendly design. The Western criticism that the European periphery is destined for permanent second-class status grants primacy to the wholly unsustainable political economy of the Western ‘center’ and to ‘first-world’ capitalism as a habitable form of social organization. Economic complexity is being used as a tool of social repression leaving either simplification or complexity that serves a social purpose as alternatives.

Real relief in any form is not on the agenda.

• Debt Conundrum To Keep Greek Banks In Months-Long Freeze (Reuters)

Greek banks are set to keep broad cash controls in place for months, until fresh money arrives from Europe and with it a sweeping restructuring, officials believe. Rehabilitating the country’s banks poses a difficult question. Should the euro zone take a stake in the lenders, first requiring bondholders and even big depositors to shoulder a loss, or should the bill for fixing the banks instead be added to Greece’s debt mountain? Answering this could hold up agreement on a third bailout deal for Greece that negotiators want to conclude within weeks. The longer it takes, the more critical the banks’ condition becomes as a €420 weekly limit on cash withdrawals chokes the economy and borrowers’ ability to repay loans.

“The banks are in deep freeze but the economy is getting weaker,” said one official, pointing to a steady rise in loans that are not being repaid. This cash ‘freeze’ is unlikely to thaw soon, although capital controls may be slightly softened, such as the loosening on Friday of restrictions on foreign transfers by businesses. “Ultimately, you can only lift the capital controls when the banks are sufficiently capitalized,” said Jens Weidmann, the head of Germany’s Bundesbank, which pushed the ECB to pare back bank funding, leading to their three-week closure. The debate is interlinked with a wrangle over reforms, about Greek sovereignty in the face of European controls and whether the country can recover with ever rising debts that have topped €300 billion, far bigger than its economy.

Were another €25 billion to be piled on top – the amount foreseen for the recapitalization of Greek lenders – it would add to debts that the IMF has argued are excessive. Greek officials, alarmed by a downward spiral in the economy, want an urgent release of funds for their banks. Four big banks dominate Greece. Of those, National Bank of Greece, Eurobank and Piraeus fell short in an ECB health check last year, when their restructuring plans were not taken into account. The situation is now dramatically worse. “We want, if possible, an initial amount to be ready for the first needs of the banks,” said one official at the Greek finance ministry, who spoke on condition of anonymity. “That should be about €10 billion.”

Others, including Germany, however, are lukewarm and could push for losses for large depositors with more than 100,000 euros on their accounts, or bondholders. There are more than €20 billion of such deposits in Greece’s four main banks, dwarfing the roughly €3 billion of bonds the banks have issued. Imposing a loss, something the Greek government has repeatedly denied any planning for, would be controversial, not least because much of this money is held by small Greek companies rather than wealthy individuals. “This is not like Cyprus where you can say these are just Russian oligarchs,” said an insolvency lawyer familiar with Greece. “It’s the very community everyone is hoping will resuscitate Greece, namely the corporates. You’ll end up depriving them of their cash.”

Eichengreen proves incapable of solving the issues. Writedowns are inevitable. A poorly structured workaround won’t do the trick.

• Escaping the Greek Debt Trap (Eichengreen et al)

Greece’s debt is unsustainable. The IMF has said so, and it’s hard to find anyone who disagrees. The Greek government sees structural reform without debt reduction as politically and economically toxic. The main governing party, Syriza, has made debt reduction a central plank of its electoral platform and will find it hard to hold on to power – much less implement painful structural measures – absent this achievement. Moreover, tax increases and spending cuts by themselves will only deepen the Greek slump. Other measures are needed to attract the investment required to jump-start growth. Reducing the debt and its implicit claim on future incomes is an obvious first step. But Wolfgang Schaeuble and Chancellor Angela Merkel refuse to consider any cut in the nominal stock of Greece’s debt to the EU.

They refuse to agree to debt-service reductions without prior structural reforms. In their view, lower interest rates, grace periods and more generous amortization terms should be a reward for prior action on the structural front. If they are offered now, Greece will only be let off the hook. There’s an obvious way of squaring this circle: Greece and the EU should contractually link changes in the terms of the country’s EU loans to milestones in structural reform. Think of the result as structural-reform-indexed (SRI) loans, akin to former Greek Finance Minister Yanis Varoufakis’s gross-domestic- product-indexed bonds. Under the new loan terms, if Greece implements more reforms, future interest payments would be permanently lower and principal payments would be extended indefinitely.

Full implementation of the specified reforms would turn Greece’s debt into the equivalent of zero-coupon, infinitely lived bonds that drain little if anything from the public purse. Greece should welcome this arrangement, because it would receive a guarantee of debt reduction, not just vague reassurances. The German government and other creditors should welcome it as well, because debt reduction would only be conferred if Greece follows through with structural reform. Both sides would appreciate that Greece’s incentive to push ahead with reforms would be heightened insofar as successful reform conferred an additional reward. Even better, Euro-group members could convert their bilateral loans and European Financial Stability Facility/European Stability Mechanism funding for Greece into SRI bonds.

Pundits don’t understand how Greece works. Tsipras’ popularity is actually growing, but that’s too much for them to report. They go instead for ‘enduring’.

• Tsipras’s Paradox Is Six Months of Pain and Enduring Popularity (Bloomberg)

His party is split, government undermined and the economy lies in tatters. Yet in the rubble of Greece, Prime Minister Alexis Tsipras reigns supreme. In the six months since he became prime minister, Tsipras breezed past challengers at home, new and old, as he followed an election victory with backing for his anti-bailout message in a referendum. After yielding to his European peers, next month he may be signing a third financial rescue that he opposed, while capital controls keeping money in Greece remain. The paradox reflects how punch-drunk Greece has become after years of spending cuts and tax increases by successive governments allied to the euro region’s austerity hawks.

For all his doomed brinkmanship, Tsipras’s popularity is unblemished as Greeks blame Europe for their financial punishment, or others in his Coalition of the Radical Left. “His rhetoric of defiance, resistance and regaining sovereignty flies well with Greek public opinion,” said Wolfango Piccoli, of consulting company Teneo Intelligence “He is by far the most popular politician across the whole spectrum.” A poll by Kapa Research published on July 14 showed 51.5% of Greeks backed the new terms Tsipras agreed to in return for staying in the euro. The blame for the pension cuts and higher taxes rested with the Europeans, 49% said, while 68% said Tsipras should lead the country. For now, he has to deal with the party that he brought to power.

Tsipras, who turns 41 this week, purged his government of dissenters after bringing home the deal that promised the exact opposite of what he pledged to voters in January. Even as he clawed back some supporters in last week’s parliament vote, Syriza officials publicly worried about the chasm growing between dissident leftists and the more pragmatic group Tsipras leads, fearing a breakup of the party. “The question is whether Tsipras will remain the leader of Syriza or he will form his own party with those who support him in Syriza,” said George Tzogopoulos at the Athens-based Hellenic Foundation. “It is probably easier for him to purge Syriza.” For now, the focus is on filling in the outlines of the deal agreed with creditors on July 13. Tsipras could then move to consolidate his position by holding elections. [..]

Yanis Varoufakis, the former finance minister and face of successive failures to reach an accord with the euro region, garnered the most votes of any party candidate in the Jan. 25 election. He now has a popularity rating of 28%, compared with 59% for Tsipras in the Kapa poll. Comrades causing Tsipras headaches, such as former Energy Minister Panagiotis Lafanzanis and Speaker of Parliament Zoe Konstantopoulou, both polled lower than Varoufakis. “It is more and more a Tsipras government and party,” said Piccoli. “His U-turn has been justified with a narrative that argues that there was no other option.”

Long portrait.

• The Greek Warrior: “Molon Labe” (New Yorker)

After months at the center of a global political spectacle, Varoufakis still carried himself as an outsider: informal, ironic, somehow alone on the stage. This demeanor had sometimes given his tenure the air of a five-month-long TED talk. At the restaurant, Varoufakis’s commentary on the recent tumult, and on the likely catastrophic events to come, sometimes seemed amused almost to the point of blitheness. He asked after Galbraith’s children, then noted that, a few hours earlier, a member of Germany’s parliament had visited his apartment, confessing, “I don’t believe in what we’re doing to you.” The legislator was a Christian Democrat—the party led by Angela Merkel, the German Chancellor, who had it in her power to ease Greece’s crisis. On departing, the legislator said, “I know you’re an atheist, but I’m going to pray for you.”

Varoufakis made a call. Speaking Greek, he greeted Euclid Tsakalotos, a colleague and friend, as “comrade,” then speculated about Tsipras’s behavior in the event of a “yes” vote: “The wise guys in Maximos”—the Prime Minister’s residence—“have become nicely settled in their seats of power, and they don’t want to leave them.” Varoufakis seemed to be suggesting that Tsipras would not resign after losing the referendum. There would be a “strategic restructuring,” Varoufakis said, and then elections. As for himself, he said, “After tomorrow, I’m going to be riding into the sunset.” He spoke the last four words in English. A Roma boy came to the table, selling roses. “Varoufakis!” he said, amazed. “I saw you on the news.”

Varoufakis allowed himself to be teased for his habit of carrying a backpack, which, he was told, made him look like a schoolboy. He laughed and paid five euros for a rose, which he gave to Stratou. As the boy left, he shouted “Varoufakis! Varoufakis!” at a vender’s volume, and, a few tables away, the minister’s plainclothes security detail—two chic young men who bore a resemblance to George Michael at the time of “Faith”—turned around. Galbraith told Varoufakis that his instinct was wrong about the referendum results. “No” would prevail, despite the bank closures. Many Greeks had nothing left to lose, and many others had hedged their financial assets, perhaps by buying a car. “Maybe,” Varoufakis said.

Stratou glanced at her phone. “Jamie, you might be right,” she said. She showed Varoufakis her screen. A survey was showing “no” with a lead. “Don’t underestimate your countrymen—the most utterly fearless group of people,” Galbraith said. Although a “no” victory would complicate Varoufakis’s immediate political future, he allowed himself to marvel at the Greek electorate’s willingness to accept immediate economic hardship. Syriza had given Greeks no palpable relief since taking power, yet the party’s positions still had popular support. “What the hell is going on?” Varoufakis asked. The waiter brought a metal jug of wine. Galbraith raised his glass and, freighting an old shared joke with new emotion, quoted Che Guevara: “Hasta la victoria siempre?!?” (“Ever onward to victory!”) Varoufakis laughed.

Think they are capable of discussing actual economics?

• Troika Technical Teams Return To Athens, New Prior Actions On Agenda (Kath.)

Technical teams representing Greece’s lenders began arriving in Athens on Sunday, with the aim of talks with the government beginning on Tuesday. The mission heads are not expected in Athens until Wednesday or Thursday. The visiting officials have asked to have access to ministries, ministers and general secretaries. So far, the Greek side has only agreed for the meetings to take place in a hotel and for the visitors to be allowed access to the General State Accounting Office. One of the potential stumbling blocks is that the lenders are expecting the government to draft another bill with prior actions so it can be passed through Parliament in the next two or three weeks, despite already adopting two pieces of legislation with new measures in the past two weeks.

And still Europe hasn’t acted. Repugnant.

• Migrants Left Looking For Shelter As Greece Struggles In Crisis (Reuters)

Aid workers called for emergency accommodation for hundreds of migrants who are camped out in the streets of the Greek capital as it struggles back from the brink of financial collapse. Hundreds of refugees from Afghanistan and Syria have set up temporary camps in central Athens while waiting to move on to what they hope will be a more permanent home in Europe. There are two chemical toilets in the park for the migrants and they wash themselves by using a garden hose attachment at the park’s taps. Stagnant water and human waste attract mosquitoes, and some of the children who walk barefoot in the park are covered in insect bites. Strewn with old clothes, garbage and waste and with summer temperatures reaching as high as 38 degrees Celsius (100.4°F), the sites are unfit for habitation but remain because there is no alternative.

“We need a campus because more and more people are coming so they cannot live like this in the center of the city,” said Nikitas Kanakis, president of the Greek section of medical charity Doctors of the World. “It’s not good for them, it’s not safe for them, and it’s not good for the city,” he said. [..] “It’s a huge problem because there are families with young children in a really bad situation with no water, with no food,” Kanakis said, adding that his organisation tried to provide basic medical care but more was needed. “We need a place, a center where they can stay,” he said. Along with Italy, which has faced a massive influx of African migrants arriving by boat from Libya, Greece is at the front lines of a crisis that has threatened to overwhelm public services already worn down by years of recession.

According to figures from the United Nations High Commissioner for Refugees, migrant arrivals in Greece have leapt almost tenfold in the first six months of the year, jumping from 3,452 in the first six months of 2014 to 31,037 this year. A coordinated response from Europe has been slow in coming however, caught up by wrangling over how to distribute the arrivals among countries where anti-immigration parties have seen a steady rise in support. “This is an emergency for Europe not to tell that they will help, to help. Otherwise, the situation will become worse and worse and we will see in the middle of Athens pictures that the humanitarian doctors have seen back in the east or back in Africa,” Kanakis said.

TTIP, anyone?

• French Farmers Block Spanish and German Borders In Foreign Food Protest (AFP)

French farmers blocked roads from Spain and Germany on Sunday to stop foreign products entering the country, the latest protest against a fall in food prices that has brought them to the brink of bankruptcy. Farmers in the north-eastern Alsace region used tractors to obstruct six routes from Germany in a bid to stop trucks crossing the Rhine carrying agricultural goods, in a blockage that is expected to last until at least Monday afternoon. “We let the cars and everything that comes from France pass,” Franck Sander, president of the local branch of the powerful FDSEA union said, adding that more than a thousand agricultural workers were taking part in the roadblocks. A dozen trucks have been forced to turn back at the border since the blockage started at about 10pm on Sunday night.

Meanwhile, about 100 farmers ransacked dozens of trucks from Spain on a highway in the south-western Haute-Garonne region, threatening to unload any meat or fruit destined for the French market. They used 10 tractors to block the A645 motorway, not far from the Spanish border, causing traffic jams that stretched up to four kilometres, Guillaume Darrouy, secretary general of the Young Farmers of Haute-Garonne, told AFP. The action comes after a week that has seen farmers block cities, roads and tourist sites across France in protest at falling food prices, which they blame on foreign competition, as well as supermarkets and distributors. Farmers have dumped manure in cities, blocked access roads and motorways and hindered tourists from reaching Mont St-Michel in northern France, one of the country’s most visited sites.

Fearful of France’s powerful agricultural lobby, the government on Wednesday unveiled an emergency package worth €600m in tax relief and loan guarantees, but the aid has done little to stop the unrest. “The measures announced by the government … none of them deal with the distortion of competition” with farmers from other countries, said Sander, saying French farmers face higher labour costs and quality standards. A combination of factors, including changing dietary habits, slowing Chinese demand and a Russian embargo on western products over Ukraine, has pushed down prices for staples like beef, pork and milk. Paris has estimated that about 10% of farms in France – approximately 22,000 operations – are on the brink of bankruptcy with a combined debt of €1bn.

“The problem is that without work you stop living, you can’t start a family, you can’t have kids..”

• The Italian Job Market Is So Bad That Workers Are Giving Up in Droves

Seven years of economic setbacks can break one’s spirit. At least that seems to be the case in Italy, where many unemployed are losing hope of finding a job The International Labour Organization gives unemployment status only to people who made at least one job-seeking effort in the last 30 days. According to the European Union’s statistics agency, almost 4.5 million Italians who are willing to work failed to make such an effort in the first quarter. That’s the most since the series started in 1998. For every 100 working Italians there are 15 persons seeking a job and another 20 willing to work but not actively searching, the highest level among the 28 EU countries, according to statistics agency Eurostat.

Driven by survival necessity, Greeks are much more active compared to Italians, with a willing-to-work-but-not-seeking aggregate totaling only 3.1 percent of the extended labor force. That compares with 15 percent of Italians, as shown in the following chart, which covers the first three months of 2015. The main reason pushing up the Italian number seems to be discouragement: after seeking and not finding work, many Italians lose hope of securing a decent occupation and retreat toward family tasks or activities in the informal economy. Italy surpasses formerly communist Bulgaria in this discouragement tendency while Danes are the least discouraged based on numbers for 2014, the most recent figures available for this category.

Spain is getting set to boil.

• Spain Mayors Spin Tale of Two Cities With Anti-Austerity Stance (Bloomberg)

Ruling Madrid and Barcelona is a tale of two cities as their new mayors forge their own styles of government even though both emerged from the same anti-austerity movement as Podemos. In Barcelona, Ada Colau has frozen hotel openings in a bid to prevent the city from becoming overrun by hordes that afflict tourist hot spots like Venice. In Madrid, Manuela Carmena has ruled out a plan put forward by her own finance chief to levy a charge on visitors to the city and has said she welcomes investment in tourism.

Colau and Carmena swept to power in Spain’s two biggest cities in local elections held in May as voters gave their verdict on three years of austerity imposed by the pro-business People’s Party of Prime Minister Mariano Rajoy.The way they run their cities will help investors parse the political climate in Spain, with polls showing that Podemos, an ally of Greece’s Syriza, may have a chance to shape national policy after general elections due by the end of the year. “A leader needs to be an example to follow to all,” Ismael Clemente, CEO of Merlin Properties, Spain’s largest real estate trust, said in Madrid. “We met with some of Carmena’s team and they were open minded, ready to listen and reasonable.” Colau, 41, who rose to prominence in Spain leading protests against evictions, won power as head of the Barcelona en Comu movement which includes Podemos. Podemos also backed the Ahora Madrid campaign of Carmena, a 71-year-old labor-rights lawyer, who ended 24 years of rule by Rajoy’s PP in the capital.

With the general election set to redraw Spain’s political map and Greece ravaged by Syriza’s failed attempt to overturn European austerity demands, the paths taken by Madrid and Barcelona may have ramifications for the rest of Europe. Both cities are under scrutiny from voters as the nation prepares to go to the polls, Antonio Barroso at Teneo Intelligence, said by phone. Colau’s decree freezing new investment threatens projects including the conversion for hotel use of the Agbar Tower operated by Hyatt Hotels and Deutsche Bank’s headquarters in the upscale Passeig de Gracia avenue. She said in a June 1 interview with El Pais that she wanted to put a moratorium on new hotels and tourist apartments to stop mass tourism getting out of control.

Not his job.

• Draghi Sets Sights On Reviving Economy With Greece On Back Seat (Bloomberg)

Mario Draghi can take a break from being a full-time Greek crisis firefighter and get back to the job of fostering economic recovery across the euro area. Although the 19-nation currency bloc has avoided losing a member and the market upheaval that might have entailed, reports this week will probably show the economy is hardly firing on all cylinders. Three years after Draghi promised to do “whatever it takes” to keep the union together, the ECB has its work cut out to speed up the pace of growth and inflation. A weaker euro and the ECB’s quantitative-easing program are helping the economy find its feet, with the second quarter forecast to show a ninth quarter of expansion. Consumer-price growth remains too low, however, and unemployment, particularly in southern European states, is stubbornly high.

“The Greek issue moves from page 1 to 2 or 3 in the minds of traders and economists,” said Holger Sandte, chief European analyst at Nordea in Copenhagen. “Now attention turns to more classic macro style things.” The euro-area jobless rate was little changed at 11% in June, while inflation held at 0.2% in July, according to surveys of economists before data this week. Economic confidence probably dipped this month, as did Germany’s Ifo business climate index. Due at 10 a.m. Frankfurt time, economists predict it fell to a five-month low of 107.2 from 107.4. The euro-area economy maintained its growth at the start of the third quarter, weathering strains on confidence from the crisis in Greece, judging by a closely watched manufacturing and services index.

Still, that barometer also showed German factory growth weakened, with exports falling for the first time in six months. In France, manufacturing has shrunk in all but one of the last 15 months. “It’s better but not good — we are improving from an extremely low level and have awful lot of catch-up to do,” especially on investment spending, said David Milleker, chief economist at Union Investment Privatfonds GmbH in Frankfurt. The ECB sees the economy growing 1.5% this year, picking up to 1.9% in 2016. Price growth will be almost non-existent this year, at 0.3%, though the ECB expects its bond buying to help push that to 1.5% in 2016.

Commodity currencies.

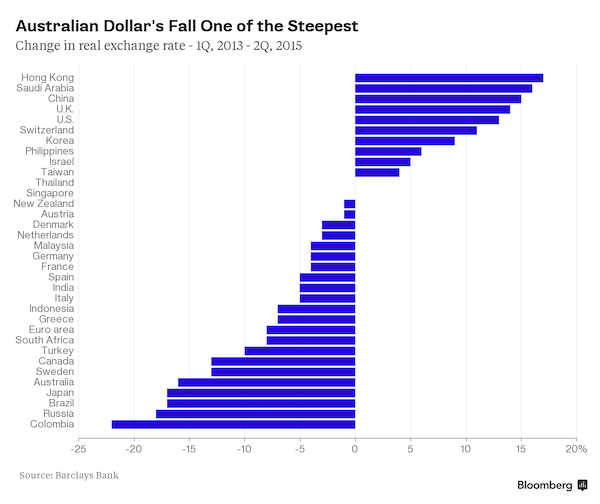

• What Does Australia Have in Common With Colombia and Russia? (Bloomberg)

Australia’s currency has had one of the most rapid depreciations of its real exchange rate, only beaten by a ragged bunch of troubled economies. Kieran Davies of Barclays Plc estimates that the Aussie’s 16% fall from 2013 to the end of the second quarter is the fastest after Colombia — where growth has halved; Russia, which is in recession; Brazil, which is also in a slump, and Japan. All these economies bar Japan are struggling with plunging oil and commodity prices as China’s economy slows. “Excluding the brief fall at the worst point of the global financial crisis, this is the lowest level since 2007” for the Australian dollar, said Davies, chief economist at Barclays in Australia, who reckons the real exchange rate has fallen a further 3% so far this quarter.

The depreciation should add half a %age point to growth this year and next, he said. Still, Davies, using the Reserve Bank of Australia’s fair value model, estimates the real exchange rate remains 6% overvalued this quarter given the larger fall in commodity prices over the period. The central bank’s own commodity price index has dropped 37% since the start of 2013 in U.S. dollar terms. As a result, he thinks the RBA is unlikely to alter its negative language on the currency. “I think they’d be comfortable with it still going lower,” said Davies, a former Treasury official. “Sometimes the RBA has dropped the reference to the currency drop being necessary and the market’s read too much into it and the RBA has then had to backtrack.”

TEXT

• Oil Groups Have Shelved $200 Billion In New Projects As Low Prices Bite (FT)

The world’s big energy groups have shelved $200bn of spending on new projects in an urgent round of cost-cutting aimed at protecting investors’ dividends as the oil price slumps for a second time this year. The sell-off in oil has been matched by a broader slump in copper, gold and other raw materials, pushing the Bloomberg commodities index to a six-year low over concerns of weaker Chinese growth and rising supplies across the board. The plunge in crude prices since last summer has resulted in the deferral of 46 big oil and gas projects with 20bn barrels of oil equivalent in reserves — more than Mexico’s entire proven holdings — according to consultancy Wood Mackenzie.

Among companies postponing big production plans while they wait for costs to come down are UK-listed BP, Anglo-Dutch Royal Dutch Shell, US-based Chevron, Norway’s Statoil, and Australia’s Woodside Petroleum. Research from Rystad Energy, a Norwegian consultancy, found in May that $118bn of projects had been put on hold, but the Wood Mackenzie study shows the toll is now much greater. The decline in Brent crude, which has more than halved in the past year, was triggered by Opec’s decision not to cut output in the face of a US supply glut and weaker than expected demand. After stabilising in March, oil prices have faced renewed pressure, with Brent falling below $55 a barrel this month — a 20% decline from a five-month high reached in early May.

More than half the reserves put on hold lie thousands of feet under the sea, including in the Gulf of Mexico and off west Africa, where the technical demands of extracting crude and earlier inflation have pushed up the cost of projects. Deepwater drilling rigs cost hundreds of thousands of dollars a day to hire and these projects could yet proceed if contractors’ costs fall far enough. Canada is the biggest single region affected, with the development of some 5.6bn barrels of reserves, almost all oil sands, having been deferred.

Home › Forums › Debt Rattle July 27 2015