Harris&Ewing “Slaves reunion DC. Lewis Martin, age 100; Martha Elizabeth Banks, age 104; Amy Ware, age 103; Rev. Simon P. Drew, born free.” c1916

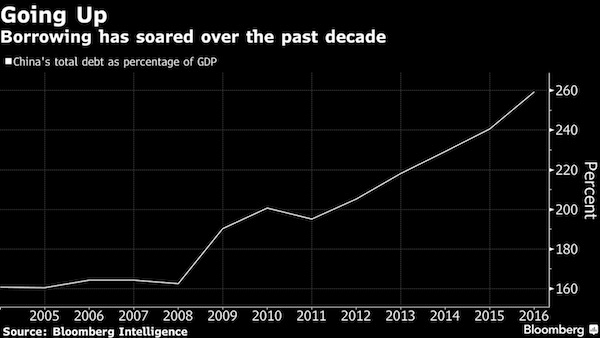

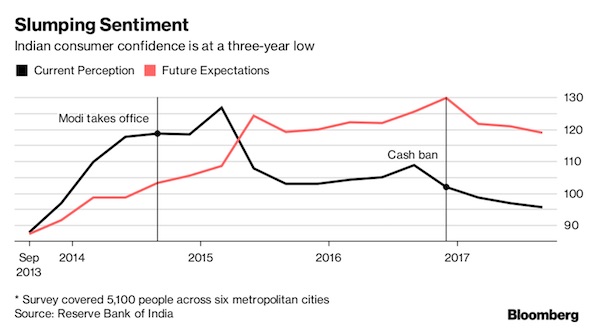

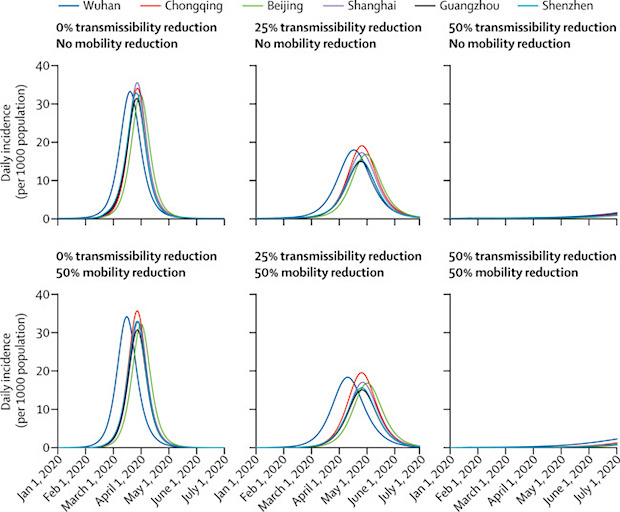

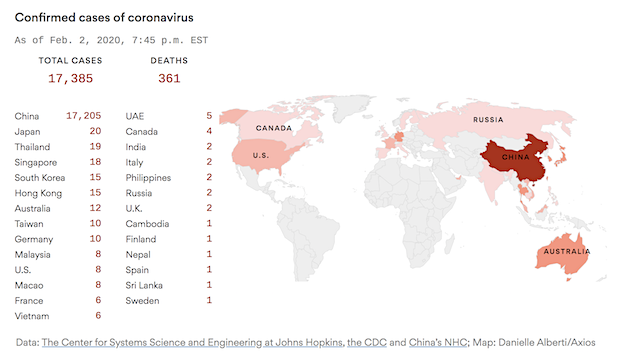

As the US and China accuse each other of, respectively, not accepting help and not offering it, numbers continue to rise. Just like doubts about the accuracy of the official numbers from Beijing do. Here are the official numbers:

• 17,480 cases (+2930 from yesterday’s 14,550)

• 362 deaths (+57 from yesterday’s 305)

• 11 U.S. confirmed infected

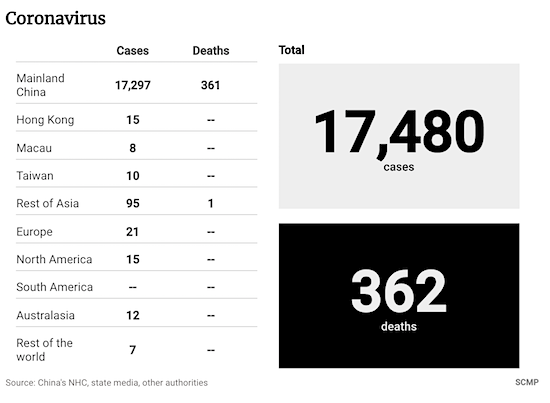

Also, the Lancet paper I’ve been citing a lot lately by Gabriel Leung and his team says “We estimated that if there was no reduction in transmissibility, the Wuhan epidemic would peak around April, 2020, and local epidemics across cities in mainland China would lag by 1–2 weeks.”

That would mean another 3 months. Mobility is a factor, mind you, as the graph shows, though a minor one. But imagine the Chinese economy being on lockdown for another 3 months. Where will OPEC sell their oil? Where will WalMart buy its supply? What will happen to the Chinese confined to their homes and/or cities? Will there be a global economy left?

Epidemic forecasts for Wuhan and five other Chinese cities under different scenarios of reduction in transmissibility and inter-city mobility

This is why I wrote yesterday’s The Party and the Virus. Question is when will the rest of the world increase pressure on China for real numbers? Will that first take multiple deaths in Europe or the US?

• China Censors Top Media Outlet That Says It Underreports Cases, Deaths (ZH)

Let’s be honest, do you think China is reporting the actual coronavirus cases and deaths? After all, Beijing has been the master of falsifying its economic growth figures for years, what makes you think they’ll change in the reporting of the deadly virus outbreak? Balaji S. Srinivasan, angel investor and entrepreneur, also former CTO of Coinbase, tweeted Saturday that a top news organization in China, Caijing, had one of their articles banned by Beijing after it noted Chinese officials were significantly underreporting coronavirus confirmed cases and deaths, especially among the elderly. Srinivasan said, “If half the claims in this article are true, #nCoV2019 seems to have completely overloaded Wuhan’s healthcare system. It appears particularly deadly for the elderly. But this 45-year-old had to be anesthetized and intubated in order to breathe.”

“In the past two days, he had seen a 45-year-old patient, a family of five, his parents had died of the new coronavirus pneumonia, and his son was infected. The patient’s condition was very serious. She used high-flow oxygen inhalation and non-invasive mask ventilation, but her blood oxygen saturation was only 50%. Finally, she had to be anesthetized and intubated with ECMO. “Before intubation and anesthesia, she watched us prepare, tears kept flowing down, and that fear made people feel very distressed,” said Shen Jun. There are still many cases like this, “Our doctors have made a decision Determined to do everything possible to treat all patients,” Caijing wrote.

Srinivasan points out that the Chinese newspaper found hospitals in Wuhan and elsewhere were intentionally recording coronavirus deaths as “general pneumonia” to keep the death count low. The article also notes test kits for the virus were in low supply, which allowed those who were infected, to continue their daily lives during a 7-10-day incubation period, enabling the virus to spread even more. The healthcare system was so overloaded in Wuhan, which forced hospital officials to send the dying home; hospitals didn’t have enough beds to house the sick. “Caijing understands that at least five suspected deaths at the hospital have not been diagnosed, so it does not count towards the confirmed deaths. This means that the number of confirmed and fatal cases that people can see at present does not fully reflect the full picture of the epidemic,” the article noted.

And then there’s this, from SixthTone’s David Paulk: “The 8 people detained in Wuhan for “spreading rumors” — who we wrote about in a Jan. 2 article that was censored — were doctors trying to raise the alarm about a new SARS-like virus.” We leave the last word to Zeng Guang, the chief scientist of epidemiology at China’s CDC, who, on Jan. 29 made a rare candid admission about why Chinese officials cannot tell people the truth in an interview with the state-run tabloid Global Times: “The officials need to think about the political angle and social stability in order to keep their positions,” which is all one needs to know about any “facts” coming out of China.

“More than 2,500 stocks fell by the daily limit of 10%.”

• Virus Worries Wipe $420 Billion Off China’s Stock Market (R.)

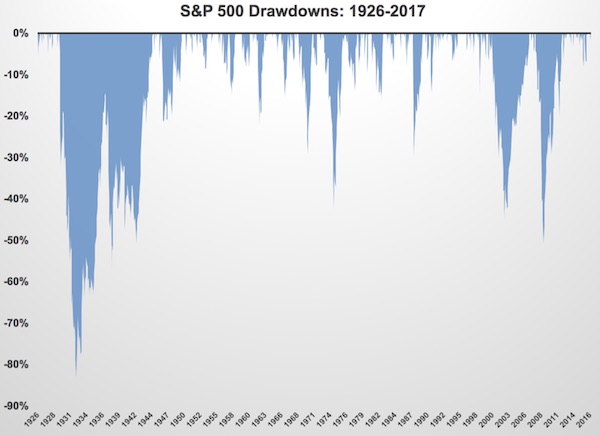

Investors erased $420 billion from China’s benchmark stock index on Monday, sold the yuan and dumped commodities as fears about the spreading coronavirus and its economic impact drove selling on the first day of trade in China since the Lunar New Year. The market slide came even as the central bank poured cash in to the financial system – a show of support for the economy -and despite apparent regulatory moves to curb selling. The total number of deaths in China from the coronavirus rose to 361 as of Sunday. It had stood at 17 when Chinese markets last traded on Jan. 23. By lunchtime, the benchmark Shanghai Composite index sat 8% lower near an almost one-year trough and poised to post its worst day in more than four years.

The yuan opened at its weakest level in 2020 and slid almost 1.2%, past the symbolic 7-per-dollar level CNY=, as the falls soured the mood in markets throughout Asia. Shanghai-traded oil, iron ore, copper and soft commodities contracts all posted sharp drops, catching up with sliding global prices. The new virus has created alarm because it is spreading quickly, much about it is unknown, and authorities’ drastic response is likely to drag on economic growth. “This will last for some time,” said Iris Pang, Greater China economist at ING. “It’s uncertain whether factory workers, or how many of them, will return to their factories,” she said. “We haven’t yet seen corporate earnings since the (spread of the) coronavirus. Restaurants and retailers may have very little sales.” More than 2,500 stocks fell by the daily limit of 10%.

Fluid, but 9% seems right.

Stock markets in China have seen the biggest daily fall for five years as traders rushed to sell amid continued fears about the impact on the global economy of the coronavirus epidemic. The benchmark Shanghai composite index fell 8.7% on Monday on a wave of negative sentiment that has built up for 10 days during the long market shutdown for the lunar new year. The Shenzhen composite was off 9.1% and dangerously close to the daily maximum permitted fall of 10% after which trading is suspended. The yuan fell through the seven-to-the-US-dollar mark for the first time since December. The losses were the worst on the Chinese markets since 2015 although they pared back slightly later in the day to 7.7%. [..]

Chinese authorities have reeled off a series of measures to tackle the market panic. On Sunday they announced they flood the financial system with 1.2 trillion yuan (US$170bn) in extra liquidity, a measure designed to buy up securities from investors seeking to sell. On Monday the People’s Bank of China – the country’s central bank – lowered the interest rate it charges banks for short-term funding upon which many banks rely to remain trading. Capital Economics said that while the move might take some pressure off the banks the rate cut was not enough to offset the drag on economic activity from the coronavirus outbreak and that more rate cuts were therefore on the way.

The growing fears about the Chinese economy also prompted the finance ministry to subsidies on interest payments for some companies hit by the coronavirus outbreak, state-run newspaper Guangming Daily said. [..] Many economists are predicting that the coronavirus will have a significant impact on the Chinese economy. Many businesses have been shut as part of the lockdown to contain the virus while most overseas airlines have suspended flights to the country and Chinese people are now banned from travelling overseas. Goldman Sachs has forecast that the virus could knock Chinese growth down to 5.5% for the year, from 6.1% in 2019, with knockon effects for the rest of the world economy. Economists at Citigroup said the steps taken by Chinese authorities were “unlikely” to be enough to prevent a sharp downturn in the first quarter.

Bloomberg claims Chinese oil demand is down 20%.

• China’s Sinopec Cuts Feb Daily Refinery Output By 12% As Virus Hits (R.)

China’s Sinopec Corp, Asia’s largest refiner, is cutting throughput this month by around 600,000 barrels per day (bpd) as the rapidly spreading coronavirus hits fuel demand, four people with knowledge of the matter said on Monday. The cut is equivalent to roughly 12% of the state refiner’s average daily throughput last year. Sinopec asked refineries last Friday to cut production and gave plants different reduction targets based on local fuel demand and logistics, the sources told Reuters. They declined to be named as they are not authorized to speak to media. Sinopec is closely monitoring the changing market situations and stands ready to ensure supplies, the refiner said in an email to Reuters.

“Company is closely monitoring the changing market situations, and will optimize operation rates and product mix based on market demand,” the company said, without commenting directly on the throughput cut rates. The four sources estimated cuts of about 2.5 million tonnes in total, equal to about 600,000 bpd on average, for February. One plant in eastern Jiangsu province is lowering runs by 10%, while a plant in Tianjin, near Beijing, is cutting throughput by 20%, two people with direct knowledge of the plants’ operations said. A plant manager with a central-China based Sinopec refinery said his plant has since Friday lowered processing rates to 60% of capacity. He said his plant was operating at near full rates before the cut.

Total lockdown, except for…

• Huawei, Chinese Chip Makers Keep Factories Humming Despite Coronavirus (R.)

Some Chinese technology firms are continuing to manufacture parts and products despite government calls across various cities and provinces for work to be halted as Being seeks to stop the spread of the coronavirus ravaging the country. Chinese telecom giant Huawei said on Monday it had resumed production of goods including consumer devices and carrier equipment, and operations are running normally. The company restarted manufacturing in line with a special exemption that allows certain critical industries to remain in operation, despite Beijing’s call to halt all work in some cities and provinces. The spokesman said most of the production was in Dongguan, a city in the southern Guangdong province.

Other companies have also kept production running, in some cases even through Chinese New Year, in a sign of the critical importance Beijing places on its domestic tech supply chain, a subject of friction with the United States Yangtze Memory Technologies, a state-backed maker of flash memory chips based in Wuhan – the city where the virus outbreak originated – confirmed on Monday that it has not yet ceased production. “At present, production and operations at YMTC are proceeding normally and in an orderly manner,” a company spokesman wrote in a statement on Monday. The spokesman added that no factory employees have been confirmed as infection cases, and that the company has enacted certain isolation measures and partitions to ensure the safety of employees. State media reported that the chip maker did not cease operations over the Lunar New Year holiday.

Are we going to argue that keeping borders open does not violate human rights?

• China’s Reaction To The Coronavirus Outbreak Violates Human Rights (G.)

When the World Health Organization declared the 2019nCoV coronavirus outbreak a global health emergency, it effusively praised China’s response to the outbreak. The WHO issued a statement welcoming the government’s “commitment to transparency”, and the WHO director general, Dr Tedros Adhanom Ghebreyesus, tweeted: “China is actually setting a new standard for outbreak response.” The WHO is ignoring Chinese government suppression of human rights regarding the outbreak, including severe restrictions on freedom of expression. In turn, Chinese state media are citing the WHO to defend its policies and try to silence criticism of its response to the outbreak, which has included rights violations that could make the situation worse.

China’s response to the outbreak included a month-long government cover-up in Wuhan, the centre of the outbreak, that led to the rapid spread of the coronavirus. Local authorities publicly announced that no new cases had been detected between 3-16 January in the lead up to a major Communist party meeting, likely to suppress “bad news”. Despite early evidence of human-to-human transmission when medical staff became infected, this information was not relayed to the public for weeks. Hardly a “commitment to transparency”. Chinese police punished frontline doctors for “spreading rumours” for trying to warn the public in late December. Police are still engaged in a campaign to detain Chinese netizens for spreading so-called “rumours”.

Rumours included reports of potential cases, including people turned away from hospitals or dying without ever being tested and quickly cremated, criticism of the government, the distribution of masks, or the criticism of the discrimination of people from Wuhan or others who may be infected. Activists have been threatened with jail if they share foreign news articles or post on social media about the coronavirus outbreak. That the Chinese government can lock millions of people into cities with almost no advance notice should not be considered anything other than terrifying. The residents of Wuhan had no time to buy food, medicine, or other essentials. Authorities hastily announced the lockdown in the middle of the night with an eight-hour gap before it went into effect, giving people time to flee and thus raising questions on the rationale for such extreme measures.

[..] The international community should support all efforts to end this outbreak, but human rights should not be a casualty to the coronavirus crisis. The WHO declares that core principles of human rights and health includes accountability, equality and non-discrimination and participation. It even acknowledges that “participation is important to accountability as it provides … checks and balances which do not allow unitary leadership to exercise power in an arbitrary manner”. The WHO’s admiration for the unitary actions of the Chinese dictator Xi Jinping exercising power in an arbitrary manner is a direct contradiction of its own human rights principles.

DNC and CNN are even regurgitating Mueller.

Twitter comment: “Brace yourself, the DNC is launching its troll army (branded as “troll fighters”) headed by a former Hillary staffer to counter “disinformation”. If you use the word “rigged”, they will come after you. Get ready to be called a Russian all over again.”

• The Democrats’ New Online Troll Fighters Make 2020 Debut In Iowa (CNN)

Days after the 2016 Iowa caucuses, the instructions were clear. “[U]se any opportunity to criticize Hillary and the rest (except Sanders and Trump — we support them),” they read. The guidance had been circulated among a group of Russians who were covertly running a vast network of social media accounts seeking to divide Democrats and push the candidacy of Donald Trump. (The instructions were later found during special counsel Robert Mueller’s investigation into Russian interference in the 2016 election.) Four years later, unhappy with Silicon Valley’s efforts to curb the manipulation of its platforms, the Democratic Party has developed capabilities of its own to monitor and tackle online disinformation.

The first-in-the-nation caucuses here Monday will be the Democrats’ first 2020 test of its new team on a day when voters have their say. The effort reflects Democrats’ growing discontent with Silicon Valley executives like Mark Zuckerberg and highlights concerns that viral disinformation could have an impact on this year’s election. “It’s like algorithmic wars here, it’s kind of crazy,” a Democratic National Committee staffer who works on the Democrats’ new counter disinformation team said on Saturday as preparations were underway in Des Moines. The staffer asked not to be identified due to the nature of their work and possibly being subjected to online harassment themselves.

“Both Republicans and foreign actors, like Russia, have an incentive to divide the American electorate and may try to use the Iowa Caucus to further that goal,” the DNC wrote in a “counter disinformation update” sent to campaigns on Thursday. Among the new weapons in the Democrats’ online arsenal is a monitoring tool called “Trendolizer.” When stories from websites known to peddle misinformation mention candidates and begin getting shares on social media, Trendolizer detects it and an alert is sent to the relevant campaigns. Another tool built in-house at the DNC monitors Twitter traffic. On Monday, it’ll watch for misinformation about how and where to caucus. Variations of the word “rigged” had been loaded into system when CNN was shown it Saturday — attempts to undermine legitimate vote results using disinformation is something Democrats are watching out for.

Today is closing argumants in the Senate “trial”. One more chance for Schiff to take revenge on the entire world, including Jerry Nadler, and repeat the same old points another 20 times. And announce a “surprise” subpoena for John Bolton in the House.

• Democrats Need to Break Their Cold War–Addled Impeachment Fever (Maté)

Sondland, according to Schiff’s account, told Yermak, “You ain’t getting the money until you do the investigations.” But both Sondland and Yermak offer a radically different account. According to Sondland, he told Yermak in “a very, very brief pull-aside conversation,” that he “didn’t know exactly why” the military funding was held up, and that its linkage to opening an investigation was only his “personal presumption” in the absence of an explanation from Trump. Yermak does not even recall the issue of the frozen aid being mentioned. To overcome that, Schiff has gone to the extraordinary step of arguing that it’s not just Sondland who is lying but the Ukrainians as well. “Like they’re going to admit they were being shaken down by the president of the United States,” Schiff told the proceedings.

Sure, that’s one possibility, but it is also wildly speculative. Ukrainian officials say they did not learn about the weapons freeze until it was publicly reported more than one month after the Trump-Zelensky call. And even after they did find out, and even voiced concerns to their US counterparts, there is no record of any complaints about the alleged linkage. As Democratic Senator Chris Murphy recalled of a meeting with Zelensky in early September—after the funding freeze became known—the Ukrainian president “did not make any connection between the aid that had been cut off and the requests that he was getting from [Trump attorney Rudy] Giuliani.”

House impeachment managers have not overcome this evidentiary flaw. They have tried to claim that the White House effectively admitted to their allegation in an October 2019 news conference by acting White House Chief of Staff Mick Mulvaney. But as I detailed back when Mulvaney’s comments initially caused a stir, Democrats and media outlets pundits rendered them as damning by isolating one fragment and ignoring the bulk of what Mulvaney said.

The absence of concrete evidence explains the last-minute excitement over compelling the potential testimony of another Trump administration official, former national security adviser John Bolton. A New York Times report about Bolton’s forthcoming memoir led to declarations that Bolton confirmed the quid pro quo allegation at the heart of the impeachment trial. As in other cases, that is based on a mistaken and maximalist interpretation of the available facts. The Times did not quote from Bolton’s manuscript. In its characterization of what Bolton wrote, the Times reports that Bolton said Trump “preferred sending no assistance to Ukraine until officials had turned over all materials they had about the Russia investigation that related to Mr. Biden and supporters of Mrs. Clinton in Ukraine”.

If this account is accurate, then Bolton is not confirming that Trump conditioned military assistance to Ukraine’s announcement of an investigation into Joe Biden and his son. Instead, Bolton is relaying that Trump “preferred” that Ukraine assist efforts to uncover the extent of Ukrainian meddling to hurt Trump’s campaign and help Democrats in 2016—meddling that did in fact happen. Recall that Trump is not on trial for preferring that Ukraine hand “over all materials they had about the Russia investigation,” but for pressuring Ukraine to announce an investigation of Trump’s political rival.

Dems’ new favorite boy.

It isn’t enough for the corporate media to praise John Bolton for his timely manuscript that confirms Donald Trump’s explicit linkage between military aid to Ukraine and investigations into his political foe Joe Biden. As a result, the media have made John Bolton a “man of principle,” according to the Washington Post, and a fearless infighter for the “sovereignty of the United States.” Writing in the Post, Kathleen Parker notes that Bolton isn’t motivated by the money he will earn from his book (in the neighborhood of $2 million), but that he is far more interested in “saving his legacy.” Perhaps this is a good time to examine that legacy. Bolton, who used student deferments and service in the Maryland National Guard to avoid serving in Vietnam, is a classic Chicken Hawk.

He supported the Vietnam War and continues to support the war in Iraq. Bolton endorsed preemptive military strikes in North Korea and Iran in recent years, and lobbied for regime change in Cuba, Iran, Libya, North Korea, Syria, Venezuela, and Yemen. When George W. Bush declared an “axis of evil” in 2002 consisting of Iran, Iraq, and North Korea, Bolton added an equally bizarre axis of Cuba, Libya, and Syria. When Bolton occupied official positions at the Department of State and the United Nations, he regularly ignored assessments of the intelligence community in order to make false arguments regarding weapons of mass destruction in the hands of Cuba and Syria in order to promote the use of force.

When serving as President Bush’s Undersecretary of State for Arms Control and Disarmament, Bolton ran his own intelligence program, issuing white papers on WMD that lacked support within the intelligence community. He used his own reports to testify to congressional committees in 2002 in effort to justify the use of military force against Iraq. Bolton presented misinformation to the Congress on a Cuban biological weapons program. When the CIA challenged the accuracy of Bolton’s information in 2003, he was forced to cancel a similar briefing on Syria. In a briefing to the Senate Foreign Relations Committee in 2005, the former chief of intelligence at the Department of State, Carl Ford, referred to Bolton as a “serial abuser” in his efforts to pressure intelligence analysts. Ford testified that he had “never seen anybody quite like Secretary Bolton…in terms of the way he abuses his power and authority with little people.”

Luckily there’s still important news going on.

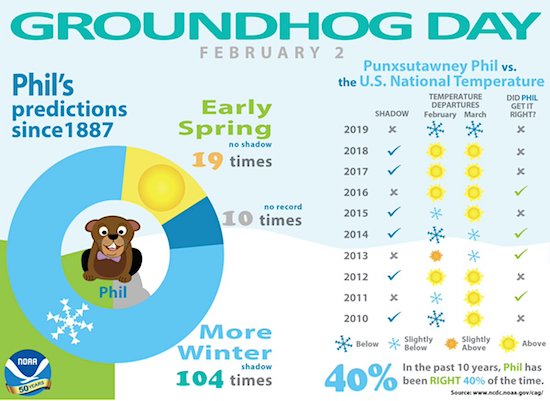

• Punxsutawney Phil Predicts Early Spring (Slate)

Across much of the United States, many have been enjoying a mild winter. And if the world’s most famous groundhog is to be believed, the trend will continue and there will be an early spring. In fact, on Sunday morning, Punxsutawney Phil declared that early spring “is a certainty.” Well, obviously the groundhog didn’t actually declare anything but that didn’t matter to the thousands of people who gathered at sunrise on Sunday to watch as Phil emerged from his den in Punxsutawney, Pa. The groundhog allegedly did not see his shadow, according to members of his “inner circle,” meaning there will be an early spring. According to legend, if he had seen his shadow it would have signified six more weeks of winter.

[..] Since Phil’s weather-predicting career began in 1887, he has seen his shadow 104 times and has failed to see it on a mere 20 instances (a few years are missing from the official record). That makes this year’s prediction relatively rare and marks the first time Phil hasn’t seen his shadow two years in a row. Phil’s forecast “seems fitting considering the lack of winter weather this winter so far,” notes the Washington Post. But truth be told, Phil doesn’t have the best track record. From 2010-2019, Phil predicted a longer winter seven times and an early spring three times. He was right only 40 percent of the time, according to the National Oceanic and Atmospheric Administration. He has been on a particularly poor streak lately as Phil got it wrong the past three years.

Support us on Paypal and Patreon.