Harris & Ewing Gettysburg 50th reunion: Grand Army of the Republic and the United Confederate Veterans 1913

And we’re off to the races again. With the renewed attention for the FBI and DOJ shenanigans in the cases past and present of Roger Stone, Michael Flynn and even Andrew McCabe, it’s easy to get too many articles for an effective aggregator.

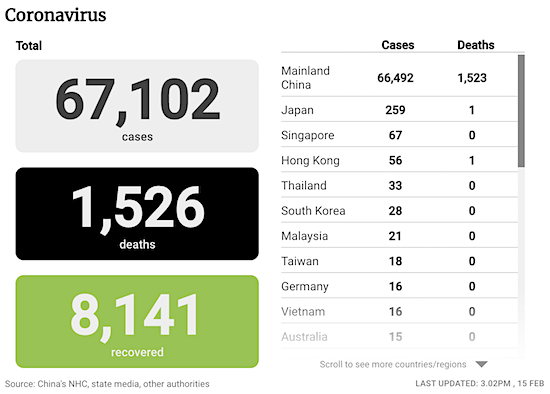

• Cases 67,102, up 2,661 from yesterday. 11,053 – 18% of cases listed as severe.

• Deaths 1,526, up 143 from yesterday

• First death in Europe, a Chinese tourist in France. Close the borders!

• 2,420 new cases (total 54,406) and 139 new deaths in Hubei province

• Chinese experts expect surge in confirmed cases inn coming days.

• 4 more cases in Japan, 3 more cases in Hong Kong

• Infected passengers and crew aboard ‘the Diamond Princess’ climbs to 218

• Lockdown in Beijing

• 217 medical teams sent to provinces, including 25,033 medical professionals to Hubei, in addition to 181 teams of army doctors in Wuhan and 36 army medical teams across Hubei

They’re even sanitizing coins and bank notes with UV light.

• Massive Medical Response As China Death Toll Reaches 1,526 (SCMP)

China reported 2,641 new confirmed cases and 849 new severe cases on Saturday. A total of 143 more people have died, bringing the total number of deaths in the country to 1,526. There are 2,277 suspected new cases. The total number of confirmed cases across the country stands at 66,492, of which 11,053 – 18 per cent – are severe. In Hubei province – epicentre of the coronavirus outbreak – 2,420 new confirmed cases were reported with 1,923 of those in provincial capital Wuhan. The city also accounted for 107 of the 139 new deaths reported in Hubei on Saturday. National Health Commission deputy director Wang Hesheng said nine medical shelters had been opened to accommodate patients with mild symptoms, as well as people with suspected infections.

It was Wang’s first press conference since his arrival in Wuhan – provincial capital of Hubei where the novel coronavirus emerged – about a week ago. Wang and Chen Yixin, secretary general of the Central Political and Legal Affairs Commission, the Communist Party’s top law enforcement body, were sent to Wuhan in response to public uproar about the death of ophthalmologist Li Wenliang, widely regarded as a whistle-blower about the new virus. Wang said China had sent 217 medical teams across provinces, including a total of 25,033 medical professionals to Hubei. These were in addition to the 181 teams of army doctors in Wuhan and a further 36 military medical teams in other cities in the province.

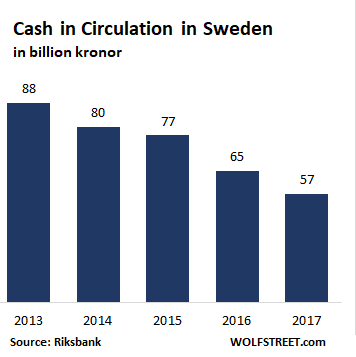

[..] Fan Yifei, vice-governor of the People’s Bank of China, said money supply in the country would be ensured, with 4 billion yuan (US$572 million) in new bank notes already allocated to Hubei before the Spring Festival holiday. Fan said the central bank would temporarily store bank notes from major government institutes or state enterprises in warehouses to prevent the disease spreading through the handling of cash. Banks have also been told to sanitise notes before giving them to enterprises. Fan said cash from hospitals and wet markets were being stored and bank notes and coins sanitised with UV light before they were released back into circulation.

Imagine this in Paris, London, New York.

• Beijing To Quarantine All Arrivals As Economic Life Struggles To Pick Up (R.)

The Chinese capital Beijing on Friday imposed a 14-day self-quarantine on people returning to the city from holidays to prevent the spread of the new coronavirus, and threatened to punish those who failed to comply. It was not immediately clear how the restriction, relayed by the official Beijing Daily newspaper, would be enforced, or whether it would apply to non-residents of Beijing or foreigners arriving from abroad. [..] Wuhan, the city of 11 million people where the outbreak began, has the most acute problem. With all public transport, taxis and ride-hailing services shut down in the city, volunteer drivers are responding to requests on ad hoc messaging groups to ferry medical staff and others in vital jobs to and from work, risking their own health.

Others work round the clock to find accommodation for medical workers in hotels that have volunteered rooms. Many of the drivers keep their identities secret to avoid objections from family and friends. “Everyone in our group has such a strong sense of mission,” said 53-year-old Chen Hui, who runs one of the ad hoc ride services. [..] “From now on, all those who have returned to Beijing should stay at home or submit to group observation for 14 days after arriving,” read the notice from Beijing’s virus prevention working group cited by the Beijing Daily. “Those who refuse to accept home or centralised observation and other prevention and control measures will be held accountable under law.”

He’s starting to acknowledge he can’t do both. How to save face?

• Xi Puts On Brave Face, Vows To Deliver Economic Goals Amid Coronavirus (SCMP)

Shrouded in utmost secrecy, the Politburo Standing Committee is the inner circle of China’s power structure. The seven-member body, which is the core of the 25 member Politburo cabinet with general secretary Xi Jinping as its head, rarely publishes meeting schedules or agendas before or even after meetings. The details of only four standing committee meetings have been published in the two and half years since Xi consolidated his power in late 2017, even though the group is believed to have met on a weekly basis. Two of the meetings were to listen to work reports from China’s government, parliament and the top court, one was a discussion about a grand plan to build an entirely new city in Xiongan, Hebei province, and the fourth concerned a low-quality vaccine scandal.

This all changed last month with the outbreak of the coronavirus, which causes the disease now officially known as Covid-19. The conclusions of three standing committee meetings in three consecutive weeks have since been published, an attempt to make it clear that China’s leadership, in particular Xi himself, has a strong message to send to the country’s ruling apparatus and the general public. During Wednesday’s meeting, Xi said control of the coronavirus had entered a critical stage despite “positive developments” in containing the outbreak, the official Xinhua News Agency reported. However, Xi emphasised that the outbreak of coronavirus should not stop China from achieving its social and economic goals, while also continuing the country’s long-term rise.

“This year is the last year to complete the goal of building up a comprehensively well-off society” said Xi, with all levels of the government expected to ensure economic stability and social harmony to achieve set goals despite the coronavirus. The meeting came just a day after Xi told his Indonesian counterpart, Joko Widodo, that China “has the capability, confidence and certainty to score an outright victory over the epidemic”. “We must see that the long-term sound fundamentals of our economy haven’t changed. The impact of the outbreak will only be short-term and [China] won’t be intimidated by the current problems and difficulties,” Xi said according to Xinhua.

Africa is an ideal breeding ground for a virus like this. But who’s going to do the testing, and with what? A hospital in Cairo may do it, but what about the Congo for instance? There are at least a millionn Chinese working in Africa. Come to think of it, what will COVID19 mean for Belt and Road?

• Egypt Confirms Coronavirus Case, The First In Africa (AlJ)

Egypt has confirmed its first case of a deadly coronavirus that emerged in central China at the end of last year and has since spread to more than two dozen countries around the world. Health Ministry spokesman Khaled Mugahed said in a statement on Friday that the affected person was a “foreigner” who did not show any serious symptoms. Officials were able to confirm the case through a follow-up programme implemented by the government for travellers arriving from countries where the virus has spread. The ministry statement said the person was hospitalised and in isolation. It did not specify the person’s nationality or their point of entry. The development made Egypt the first country in the African continent to report a confirmed case, and the second in the Middle East region, after the United Arab Emirates late last month diagnosed its first cases.

China must ask for mass assistance.

• Chinese Medical Staff Pay ‘Too High A Price’ In Battle To Curb Virus (SCMP)

More than a thousand health care workers have been infected with Covid-19, many of whom contracted the virus that causes the disease in the early weeks of the outbreak when there was a shortage of protective equipment and the authorities said there had been few cases of human-to-human transmission. One specialist warned that frontline medical workers were paying “too high a price” in the battle to contain the disease and warned that the high number of infected health care staff increased the risk of cross-infection in hospitals. On Friday the government said a total 1,716 health care workers had been infected with the disease. The number is far higher than that recorded during the 2003 severe acute respiratory syndrome (Sars) epidemic, although there have been 12 times more confirmed cases of Covid-19.

[..] Cai Haodong, a communicable diseases specialist from Beijing’s Ditan Hospital, said the absolute number of health care worker infections was far higher than during the Sars epidemic because there were many patients who had not initially shown any symptoms. “The enemy (coronavirus) is in the dark. The awareness of doctors of non-communicable disease was not strong. They may have lowered their guard when the patient did not show any symptoms.” Health care workers were also forced to go to the frontline without proper protective clothing and masks, she added. “The doctors in Wuhan don’t have sufficient protective gear and they are forced to go to the frontline. The price is just too high,” she said.

The large number of health care worker infections increases the risks of cross-infection in hospitals. “When doctors are infected, they may infect patients and cause cross-infections. That is why the United States requires doctors to have influenza vaccines so that they won’t pass it on to patients,” Cao said.

How much did the industry pay for this commercial?

“We had free internet and free wine. We had three-course meals. There was so much choice..”

• Wandering Ship Becomes ‘Best Cruise Ever (R.)

After nearly two weeks cast away in search of a port that would take them, passengers aboard the MS Westerdam cruise ship spoke of an ordeal that was anything but harrowing. “Everyone says ‘poor you’. But there was no poor you. We had free internet and free wine. We had three-course meals. There was so much choice,” said Zahra Jennings, a retired staff nurse from Britain. How was it? “Lovely,” she said. The 1,544 passengers and 802 crew had never expected a port stop in Hong Kong to metastasize into full-blown fear that some of the ship’s passengers carried the novel coronavirus that emerged in Wuhan, China, late last year and has killed more than 1,500 people.

Turned away by Japan, Taiwan, Guam, the Philippines and Thailand, it was Cambodia that finally let the lost ship dock – and it was discovered there that none of the passengers was infected. The only complaint aboard? “They ran out of hash browns a couple of days ago, and tomato sauce,” said Robert Sayers, a 60-year-old chemical company employee from New Zealand. “But that was it. It was fine, really.” Cruise ships around Asia face widespread fears they may be spreading the virus since it was found aboard the Diamond Princess that is now at anchor in Yokohama and where 218 of the passengers have been diagnosed with the virus.

Vietnam turned back two ships on Friday. It was Valentine’s Day when the first passengers disembarked from the Westerdam. The prime minister, Hun Sen, flew in from the capital, shaking hands with passengers and handing out roses. Government officials draped “Welcome to Cambodia” banners on buses. All passengers were given free visas. Hun Sen, an authoritarian ruler condemned by Western countries for human rights abuses said: “Our current disease around the world is fear and discrimination,” he said. “If Cambodia didn’t allow this ship to dock, where should these 2,000 passengers go?”

Holland America sent letters to all passengers saying it would reimburse the cost of the cruise, give them another free 14-day cruise, and charter them flights home. The company, it said, would do its best to match the class of flight they had originally booked. The cruise had been scheduled to end in Shanghai on Saturday. In Shanghai it was 14 Celsius, overcast and raining. In Sihanoukville, it was 27C and sunny.

He was led to believe that he wasn’t being investigated, so he didn’t need a lawyer, and now we’re off to the races.

• Sidney Powell: One Atrocity After The Other In Michael Flynn Case (SAC)

Sidney Powell, the attorney for former National Security Adviser Michael Flynn told Sean Hannity on Friday that there has been “one atrocity after another” in the proceedings. “So not only was [Michael Flynn] not warned of his rights, he didn’t even know that he was being investigated,” Powell told host Sean Hannity. “In fact, he was led to believe that he wasn’t being investigated.” Powell added that Michael Flynn’s case was the first instance she had heard of in which a defendant accused of making false statements to the FBI was not warned of his rights or informed that he was under investigation. “They say they can’t find [it], he can’t produce it [the 302 form],” she said of Michael Flynn prosecutor Brandon Van Grack. who she claimed has a separate conflict of interest in the case. “There is one atrocity after the other in this case.”

Would this have happened if Powell hadn’t taken over? I don’t believe it for a second.

• Barr Assigns Outside Prosecutor To Review Case Against Flynn (ZH)

A week of two-tiered legal shenanigans was capped off on Friday with a New York Times report that Attorney General William Barr has assigned an outside prosecutor to scrutinize the government’s case against former Trump national security adviser Michael Flynn, which the Times suggested was “highly unusual and could trigger more accusations of political interference by top Justice Department officials into the work of career prosecutors.” Notably, the FBI excluded crucial information from a ‘302’ form documenting an interview with Flynn in January, 2017. While Flynn eventually pleaded guilty to misleading agents over his contacts with the former Russian ambassador regarding the Trump administration’s efforts to oppose a UN resolution related to Israel, the original draft of Flynn’s 203 reveals that agents thought he was being honest with them – evidence which Flynn’s prior attorneys never pursued.

His new attorney, Sidney Powell, took over Flynn’s defense in June 2019 – while Flynn withdrew his guilty plea in January, accusing the government of “bad faith, vindictiveness, and breach of the plea agreement.” In addition to a review of the Flynn case, Barr has hired a handful of outside prosecutors to broadly review several other politically sensitive national-security cases in the US attorney’s office in Washington, according to the Times sources. Of particular interest will be cases overseen by now-unemployed former US attorney for DC, Jessie Liu, which includes actions against Stone, Flynn, the Awan brothers, James Wolfe and others. Notably, Wolfe was only sentenced to leaking a classified FISA warrant application to journalist and side-piece Ali Watkins of the New York Times – while prosecutors out of Liu’s office threw the book at former Trump adviser Roger Stone – recommending 7-9 years in prison for process crimes.

[..] New York Times: “The moves amounted to imposing a secondary layer of monitoring and control over what career prosecutors have been doing in the Washington office. They are part of a broader turmoil in that office coinciding with Mr. Barr’s recent installation of a close aide, Timothy Shea, as interim United States attorney in the District of Columbia, after Mr. Barr maneuvered out the Senate-confirmed former top prosecutor in the office, Jessie K. Liu. Mr. Flynn’s case was first brought by the special counsel’s office, who agreed to a plea deal on a charge of lying to investigators in exchange for his cooperation, before the Washington office took over the case when the special counsel shut down after concluding its investigation into Russia’s election interference”.

But that’s not the end of the line for McCabe, says Jason Chaffetz. Stay tuned.

• DOJ Drops Investigation Of Former FBI Deputy Andrew McCabe (UPI)

The Justice Department has dropped its investigation into former FBI Deputy Director Andrew McCabe over accusations he leaked information to news media, his attorneys said Friday. A letter to McCabe’s lawyers said the Justice Department declined to pursue criminal charges. “Based on the totality of the circumstances and all of the information known to the government at this time, we consider the matter closed,” said the letter, signed by J.P. Cooney and Molly Gaston of the Fraud & Public Corruption Section of the Justice Department. Former Attorney General Jeff Sessions fired McCabe from the FBI in March 2018 after the Justice Department’s inspector general determined he’d authorized FBI officials to reveal sensitive information to media about an investigation related to former Secretary of State Hillary Clinton.

The IG report accused McCabe of subsequently misleading investigators about his role in the matter. McCabe had stepped down from his role as deputy director of the FBI months earlier. McCabe’s lawyers, Michael Bromwich and David Schertler, said the U.S. Attorney’s Office of Washington, D.C., notified them the case was closed.

#Horowitz discovered @FBI agents shared Classified info with #Steele https://t.co/VvuIGZkZtV

— Sara A. Carter (@SaraCarterDC) February 15, 2020

How can the request be refused? Hard to see.

• Roger Stone Asks For New Trial (Hill)

Attorneys for Roger Stone on Friday requested a new trial, a day after saying they were looking into potential bias by a juror who voted to convict the longtime Trump associate of lying to Congress and witness tampering. The request also comes after President Trump accused the juror of harboring “significant bias” following reports that her social media activity contained posts that were critical of Trump. “Now it looks like the fore person in the jury, in the Roger Stone case, had significant bias. Add that to everything else, and this is not looking good for the “Justice” Department. @foxandfriends @FoxNews,” Trump tweeted Thursday.

Stone’s attorneys would not reveal the contents of the motion, which was filed under seal to protect sensitive information, saying only that an un-redacted version will be submitted later for public filing. However, a day earlier they indicated they were looking into the newly surfaced social media activity of jury foreperson Tomeka Hart. “Mr. Stone and his defense team are diligently reviewing the newly reported information to determine any appropriate next steps,” said attorney Grant Smith, who did not refer to the juror by name. Hart’s role as the jury foreperson became publicly known Wednesday when she confirmed to CNN that she had written a Facebook post defending the prosecutors in Stone’s case.

The four-person prosecution team quit Tuesday after their recommended sentence of seven to nine years in prison was overruled by top Justice Department officials, sparking questions about whether the White House had put undue political pressure on the department to seek a lighter sentence for Trump’s longtime associate. Stone, a 67-year-old right-wing provocateur, was found guilty in November of lying to Congress and witness tampering related to his efforts to provide the Trump campaign inside information about WikiLeaks in 2016. [..] It was unclear if the request for a new trial — Stone’s second attempt after the first was denied — would delay his scheduled Feb. 20 sentencing.

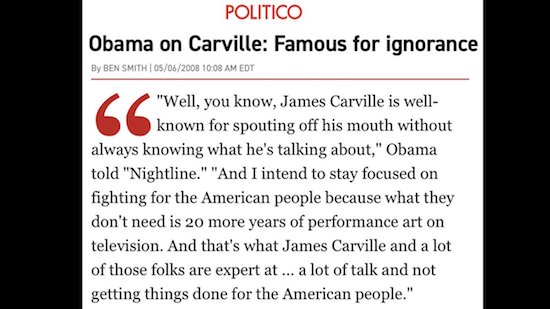

Carville is THE symbol of the demise of the Democratic Party in the past 30 years. He’s a sleaze like Roger Stone, only he’s free.

• Carville Slams Sanders For ‘Hack’ Slam: ‘At Least I’m Not A Communist’ (Hill)

James Carville fired back at Sen. Bernie Sanders (I-Vt.) for calling him “a political hack,” calling the self-described democratic socialist “a communist.” The back and forth follows a week in which Carville has repeatedly sounded the alarm about a potential Sanders match-up against President Trump in November, calling the scenario “the end of days” for the Democratic Party while referring to Sanders supporters as “a cult.” Sanders returned fire on Wednesday night during an interview with CNN’s Anderson Cooper, arguing that “political hack” Carville represents the establishment his campaign is running against.

“James, in all due respect, is a political hack,” Sanders said. “We are taking on Trump, the Republican establishment, Carville and the Democratic establishment. But at the end of the day, the grassroots movement that we are putting together — of young people, of working people, of people of color — want real change.” Carville, who worked as a campaign strategist for former President Clinton, escalated the feud Thursday on Snapchat with former CNN reporter Peter Hamby. “Last night on CNN, Bernie Sanders called me a political hack,” Carville said. “That’s exactly who the f— I am! I am a political hack! I am not an ideologue. I am not a purist. He thinks it’s a pejorative. I kind of like it! At least I’m not a communist.”

Trump also recently referred to Sanders as a communist. “I think he’s a communist. I mean, you know, look, I think of communism when I think of Bernie,” Trump said in an interview with Fox News host Sean Hannity before the Super Bowl. Sanders dismissed Trump’s comment a week later in an interview with Chris Wallace on “Fox News Sunday.” “Obviously I am not a communist,” Sanders said, adding that maybe Trump “doesn’t know the difference.”

Does anyone think the 737 MAX will fly again this year? How about ever?

• United Airlines Pulls Boeing 737 MAX From Schedule Until September 4 (R.)

United Airlines said on Friday it is extending the cancellation of Boeing 737 MAX flights until Sept. 4, a fresh delay that comes as sources told Reuters that the timing of a key certification flight may not happen until at least April. U.S. airlines that operate Boeing’s737 MAX, which was grounded worldwide last March after two fatal crashes, had last pulled the jet from their flight schedules until early June. On Thursday, Southwest Airlines extended its MAX cancellations until Aug. 10.

“..it is a peculiar feature of our times that a lot of things have an appearance that doesn’t sync with reality..”

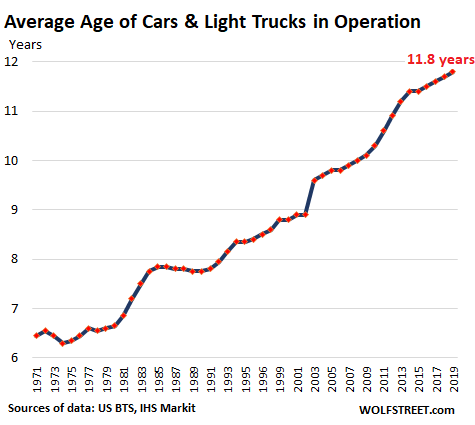

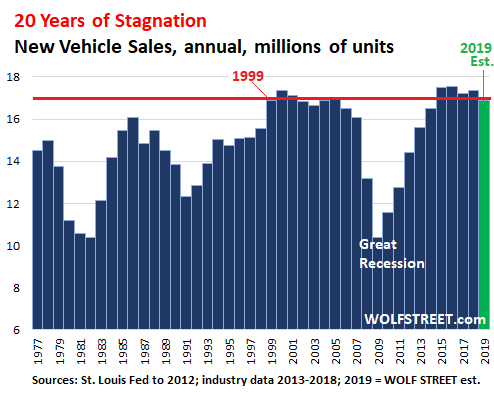

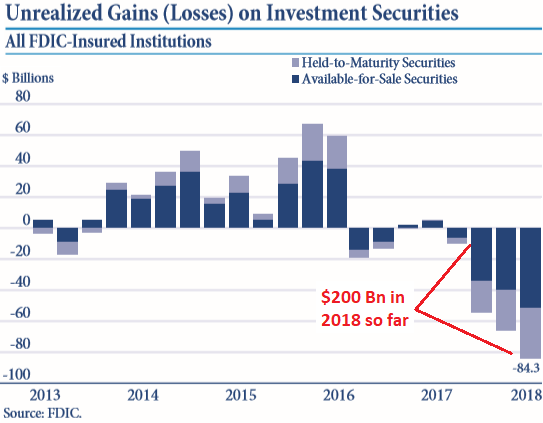

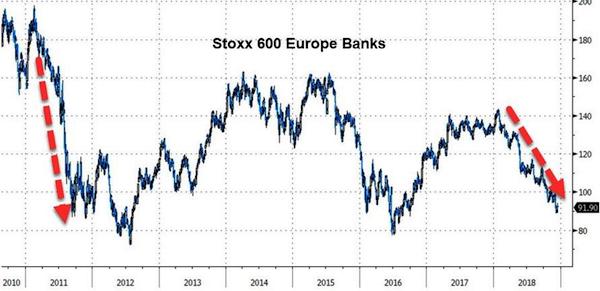

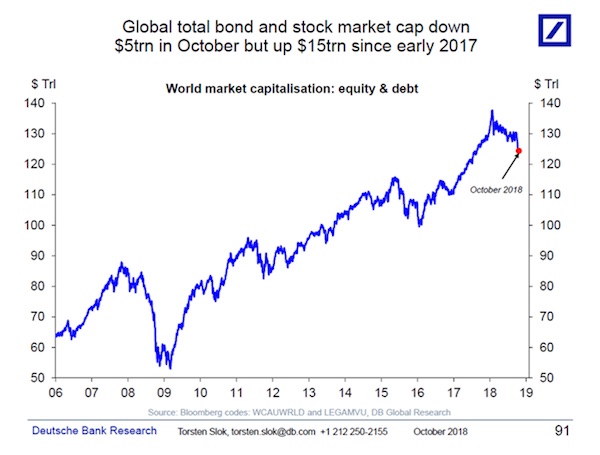

..companies doing business need a revenue stream to service their revolving debts. They have to make stuff, and move stuff, and get paid for it. What happens when there is no revenue stream? The workings of this hyper-complex financial system depend utterly on the velocity of these revenue streams. They can’t just… stop! Everybody who follows these things understands that China’s banking system is 1) a hot mess of confabulated public and private lending relationships, 2) completely opaque as regards the true workings of its operations, and 3) shot through with fraud, swindling, and Ponzis. Did China’s ruling party just put its banking system in an induced coma while Corona virus plays out? How can that possibly not affect the rest of global finance, which is plenty janky, too?

The USA gets everything from car parts to pharmaceuticals from China. How long will it take for the manufacturing lock-down to show up in American daily life? What if it continues for some months going forward? You can easily draw your own conclusions. Here’s another interesting angle on that: Corona virus might give President Donald Trump an easy out from being the bag-holder for a stock market crash and banking train wreck. The signal weakness of Mr. Trump’s term-in-office was his taking ownership of a magical mystery stock market that climbs ever-higher day after day, defying all known rules of physics as applied to money.

This longest “expansion” in US history (if that’s what it was, and I’m not so sure about it) seems to have hit a speed bump last September when something broke in the short-term “re-po” lending markets, at which time (and ever since), Jay Powell’s Federal Reserve began jamming hundreds of billions of dollars into them to smash down zooming interest rates and prevent a heart attack in the system. That creation of “liquidity” — money from thin air — appears to have stabilized the situation. But then, it is a peculiar feature of our times that a lot of things have an appearance that doesn’t sync with reality.

Time to go before things get out of hand.

• US Soldiers in Deathly Scuffle With Syrian Civilians (Whitney Webb)

As resistance to U.S. troop presence in both Iraq and Syria gains steam, a rare scuffle between Syrian civilians and U.S. forces broke out on Wednesday resulting in the death of one Syrian, believed to be a civilian, and the wounding of another. A U.S. soldier was also reportedly injured in the scuffle. The event is likely to escalate tensions, particularly in the Northeastern region where the incident took place, as Syria, Iraq and Iran have pushed for an end to the U.S. troop presence in the region following the killing of Iranian General Qassem Soleimani.

The clash between U.S. forces and Syrian locals took place near the town of Qamishli where the U.S. forces were conducting a patrol that, for reasons that are still unclear, entered into territory controlled by the Syrian government instead of territory occupied by the U.S. and its regional proxy, the Syrian Democratic Forces (SDF). At a Syrian military checkpoint, the U.S. patrol was met by Syrian civilians of a nearby village who gathered at the checkpoint and began throwing rocks at the U.S. convoy. Then, one Syrian took a U.S. flag off of one of the military vehicles. Reports from activists on the ground and Syrian media then claim that U.S. troops opened fire using live ammunition and fired smoke bombs at the angry residents, killing one and wounding another.

A U.S. soldier was said to have received a superficial wound, though the nature of the wound was not specified. After the scuffle, the protests grew larger, preventing more U.S. troops from arriving at the scene. In one video of the protests, a local was seen ripping a U.S. flag as he approached an American soldier. The obstruction of the road prevented the U.S. patrol from advancing and two military vehicles had to be towed after becoming stuck in the grass after an apparent attempt to circumvent the roadblock created by the Syrian military checkpoint and supportive Syrian civilians.

US forces come under stones attack by local villagers while patrol in #Qamishli #Syria pic.twitter.com/RPtlM8kzf9

— Eyad Alhosain (@Eyad_Alhosain) February 12, 2020

After the Greek House speaker refused to accept the recordings, Varoufakis -through DiEM25- said this:

“No one has the right to keep a sovereign Parliament, nor citizens, in the dark. This is why by the end of February we will release all recordings, so that all European citizens finally get to see the hypocrisy of the Establishment and the despicable way in which governments behave, in their name, behind closed doors.”

• Varoufakis Submits Recordings Of Eurogroup Talks To Greek Parliament (K.)

The head of Mera25 party and former finance minister Yanis Varoufakis on Friday submitted to Parliament an envelope allegedly containing his secret audio recordings from the Eurogroup meetings while he was negotiating for Greece’s SYRIZA-led government in the first half of 2015. Varoufakis said he expected House speaker Kostas Tasoulas to forward the content to Greek lawmakers. Tasoulas, however, said he had no intention of sharing the recordings. “Parliament will not shoulder [Varoufakis’] responsibilities,” he said. The exchange took place during a debate on labor issues.

Tasoulas’ reaction was welcomed by Prime Minister Kyriakos Mitsotakis. In a statement, Mera25 said that Tasoulas’ refusal to accept the transcripts “confirms that Eurogroup’s wall of intransparency suited and still suits many people, while truth and transparency terrifies [them].” “All European citizens have a right to directly access the statements, the dialogues and the decisions that shape their future,” it said. Eurogroup rules do not explicitly prohibit participants from recording talks as long as the contents are kept confidential.

Intruiging. But no answer.

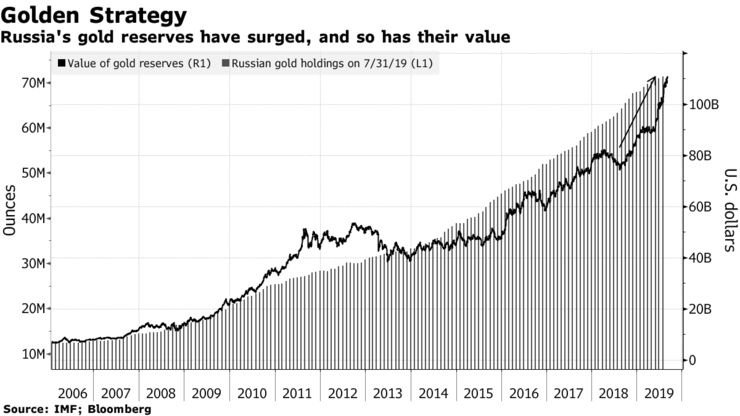

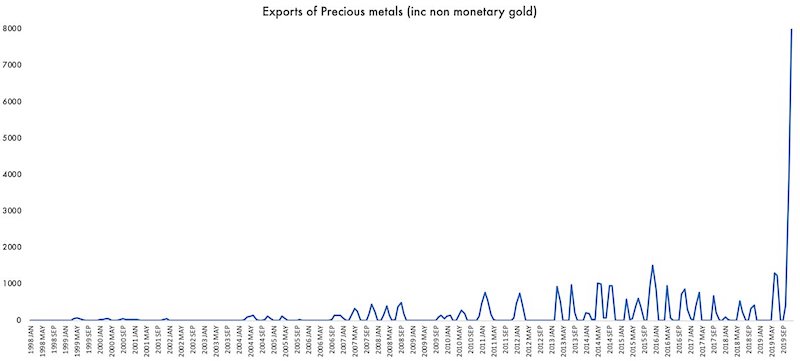

• Multibillion Mystery Of The Great British Gold Sale (Conway)

Every so often you encounter a chart that takes your breath away. This week I saw just such a graph and I’m still struggling to get my head round it. It depicts something which on the face of it sounds mundane — exports of gold from the UK — and it looks like a hockey stick. You’ve probably seen a hockey-stick chart before. There’s the one Al Gore put up on the big screen in An Inconvenient Truth showing temperatures hovering at about the same level for century after century before shooting up in recent decades. Or the one of GDP going back to the dark ages: for most of history we subsisted on meagre earnings until the industrial revolution came along and catapulted GDP into the stratosphere.

The one this week has much the same shape. Not much of anything for month after month from 1998 when it begins until October 2019. Sure, there were occasional months when the amount of gold leaving British hands would hit a few hundred million pounds. Once or twice it ticks over a billion. But nothing like what occurs in November and December last year: in those months it skyrockets at a rate that doesn’t make any sense. Until then, the monthly average of gold exports was £126 million. Then in November they leapt to £4 billion. In December they doubled to £8 billion. [..] Britain does not mine any significant quantity of gold yet we are the world’s hub for the trade in physical bullion.

This is something of an accident of history, in much the same way as we are also the world’s centre for the trade in fine wine, despite the fact that we produce very little of the stuff ourselves. Yet gold bullion is so valuable that every time it changes hands it massively distorts the trade figures. Consider: Britain has not achieved a goods trade surplus, which is where we export more goods than we import, in any single month since comparable records began more than two decades ago. Yet in December that astonishing leap in gold exports meant that the headline figures published this week showed Britain achieving its first goods trade surplus in modern times. That this was almost entirely down to a mysterious movement of gold bars was seemingly lost on Liz Truss, the international trade secretary, who promptly issued a press release hailing a “record-breaking year for UK exports”.

[..] why did gold exports soar at the end of last year? Was it down to Brexit, with traders switching out of gold in the run-up to Brexit day? Was it to do with the election? Was it central banks repatriating gold or investment banks shifting their portfolios from UK-domiciled funds to EU ones? We still don’t know. I have spoken to statisticians, to gold analysts and economists, to traders and industry experts. None of them have the foggiest idea what is going on. One analyst took a look at the chart and spluttered a four-letter word. “That’s crazy,” he said. “Must be a mistake.” Another person pointed to the fact that Poland flew back about £4 billion worth of gold from the UK last year, before remembering that this happened before December and, oh, these kinds of things don’t count as official exports anyway.

The most plausible explanation I’ve heard is that this was simply an accounting change: one of London’s leading gold custodians, an American investment bank, shifted some of the gold from one column of its accounts to another. The gold didn’t leave the country; someone simply fiddled with a spreadsheet. Even so, that raises further questions: is that bank in trouble? Why do it now? Who ordered it: the bank holding the gold or the gold’s owners? If the latter, then who owns so much gold that they could single-handedly distort this country’s trade figures and surface in Britain’s national accounts?

Valentine’s.

The Automatic Earth will not survive without your Paypal and Patreon donations. Please support us.