Johannes Vermeer The lacemaker 1669-71

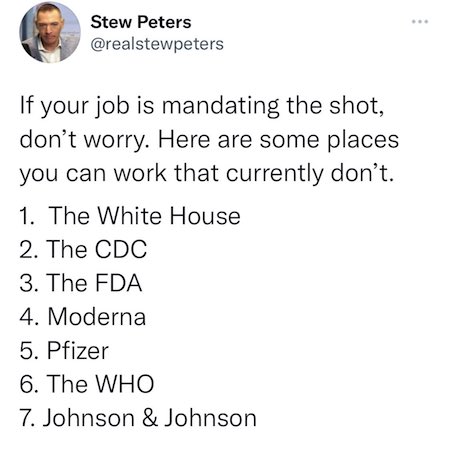

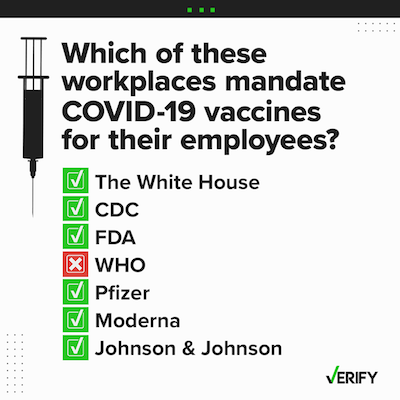

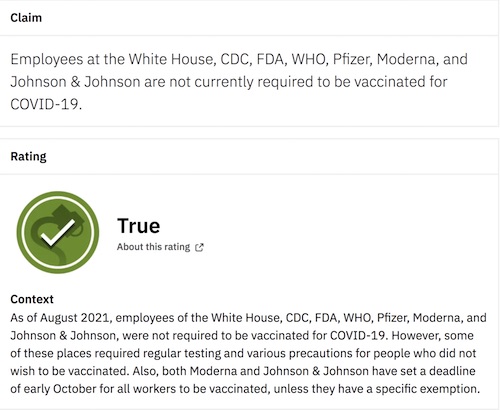

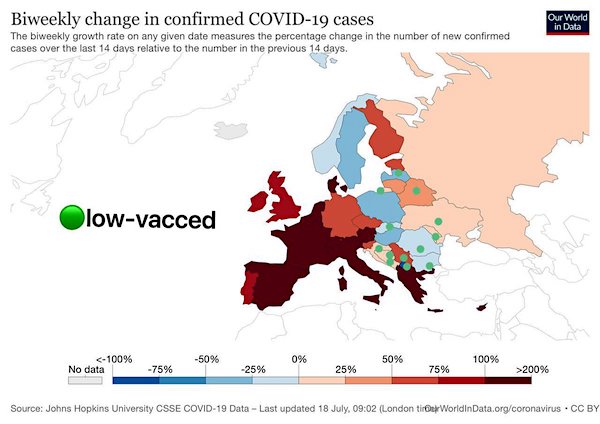

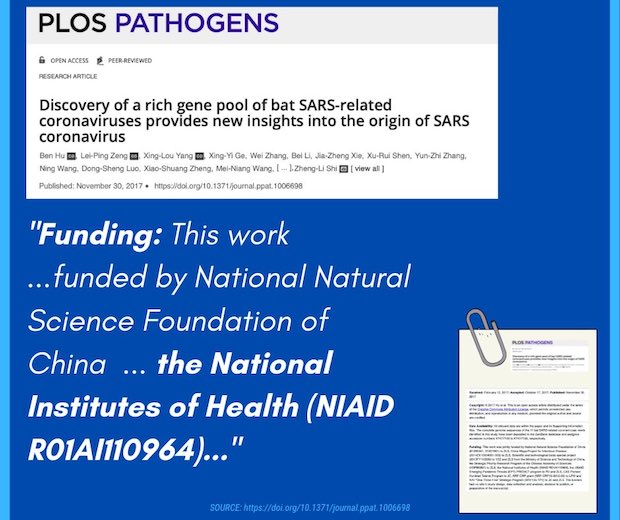

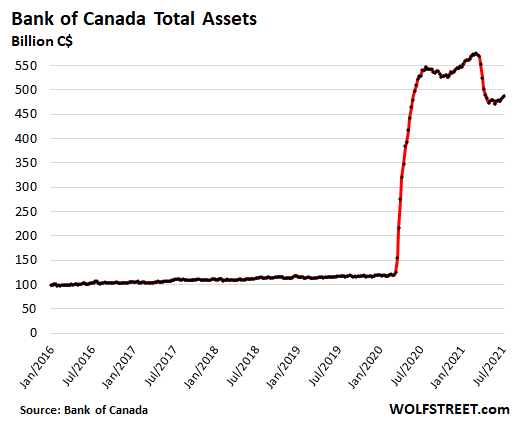

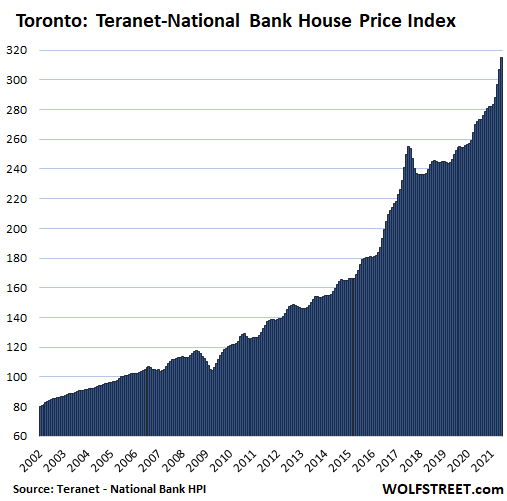

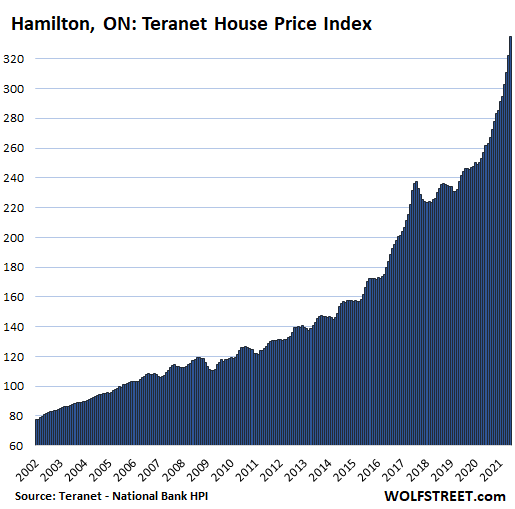

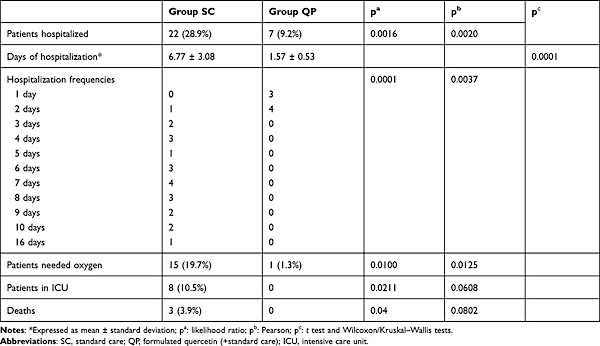

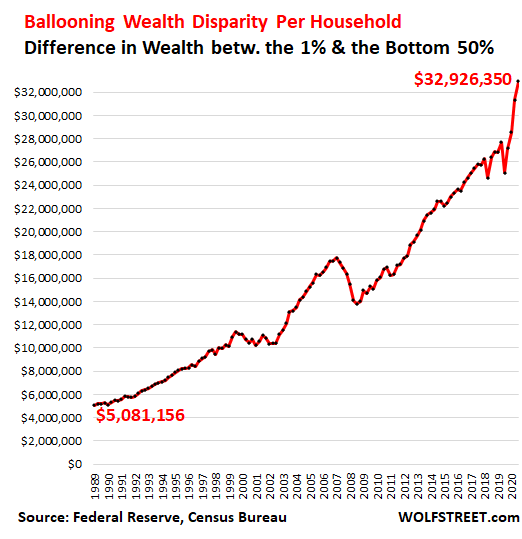

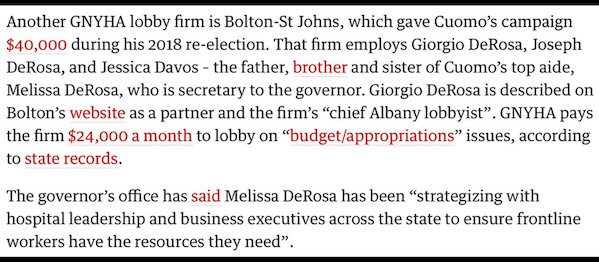

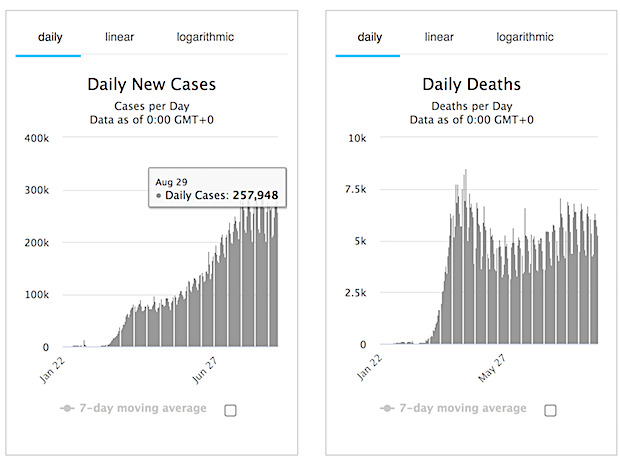

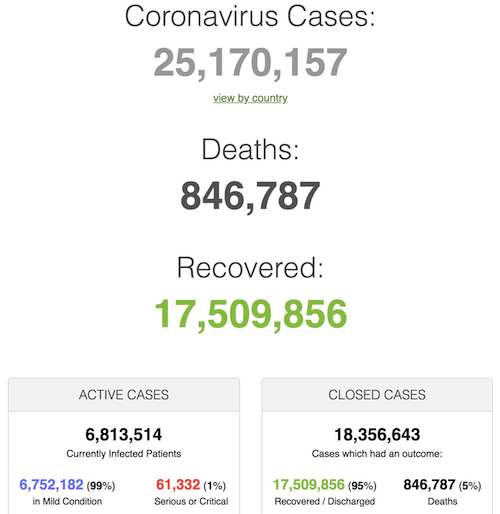

Covid profits

Profiting from COVID shots… pic.twitter.com/X9a5KbPUHM

— Wittgenstein (@backtolife_2022) January 17, 2022

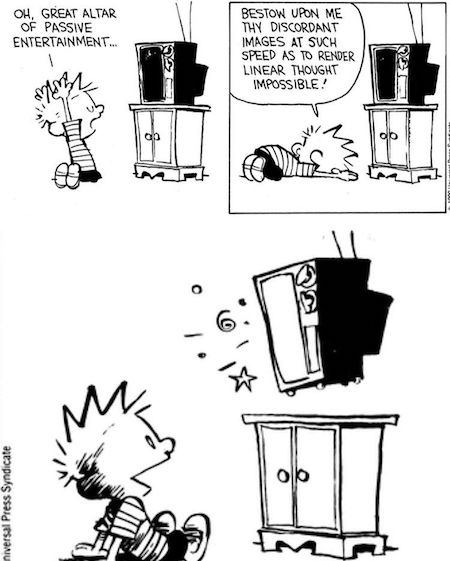

“..a culture of junk food, junk work, junk art, junk environments, junk government, junk economics, and, lately, junk science..”

• No Time for Crybabies (Jim Kunstler)

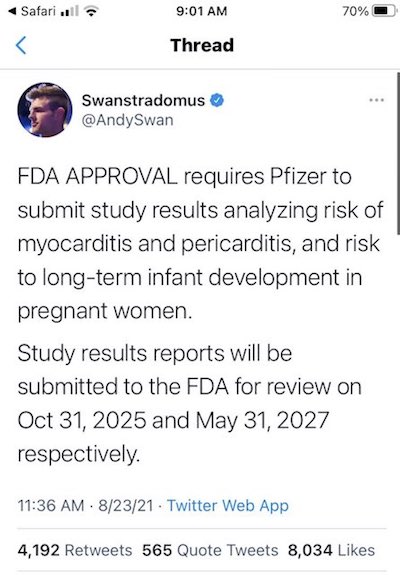

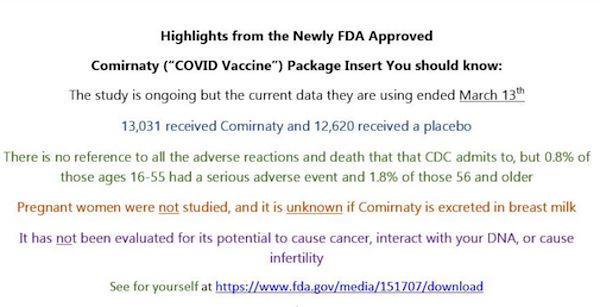

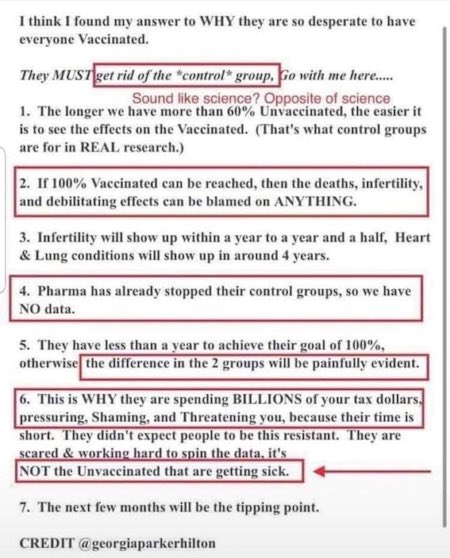

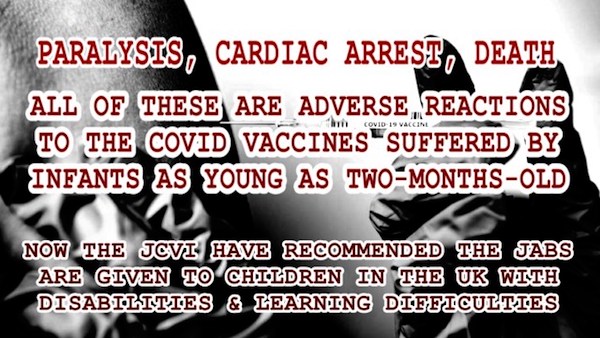

[..] it’s obvious now, after a year on-the-scene, that the vaxxes work poorly at best to protect against infection or control the spread, and, at worst, induce terrible long-term damage to organs, blood vessels, and the immune system. The vaxxes can kill you or gravely disable you. The statistics in the CDC’s VAERS registry show this in no uncertain terms: 1,003,992 Covid vaxx adverse event reports including 21,745 deaths linked to them through January 7 — and these figures are said to be deeply understated due to the poor design and difficulty using the VAERS website with its clunky, out-dated code that the CDC refuses to fix.

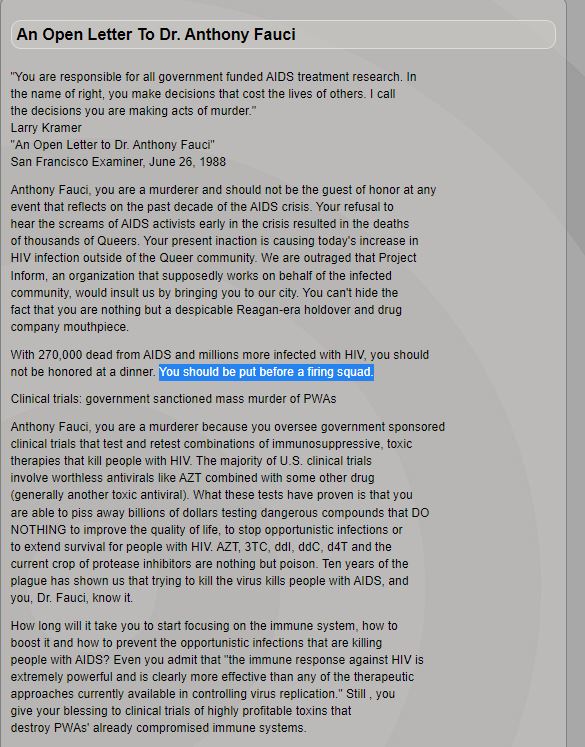

Dr. Fauci has avoided addressing these adverse reactions and the negative efficacy of the “vaccines.” He simply states that the vaxxes are “safe and effective.” That so many Americans believe him, despite all the evidence, and go along with the crusade to vaxx-up everybody, is proof that they are insane. But now that the whole story is unravelling, they are ever more determined to stick to the script. Covid-19 has been their security blanket for two years. As long as it was in the picture, raging and killing as an invisible demon, it could be the focus of all their free-floating terror.

Terror of what, you might ask? Of the meaninglessness, alienation, and debility induced by the managerial class in its own sick institutions and corporations… in short, the 21st-century America that the managers evolved in and supported — a culture of junk food, junk work, junk art, junk environments, junk government, junk economics, and, lately, junk science… a sickening panorama of systems out-of-control and entering failure mode. Confronting the disaster of its own incapacity to sustain a healthy culture and an economy with a future, the managerial class went nuts. Its insane actions now are killing people while seeking to punish those who refuse to walk sheepishly into America’s version of the gas chamber, the Anthony Fauci “vaccines.”

5,6,7….

• Israel Finds 4 Covid Vaccine Jabs ‘Not Good Enough’ Against Omicron (RT)

A fourth dose of coronavirus vaccine showed dwindling effectiveness against the Omicron variant, according to a trial conducted in Israel, with one its lead researchers saying the immunization is simply “not good enough.” A study involving 154 medical staffers at Sheba Medical Center near Tel Aviv found that a fourth shot of the Pfizer vaccine gave only marginal protection against the Omicron strain compared to previous mutations. A separate group of 120 volunteers were also given a fourth dose of Moderna’s inoculation following three rounds with Pfizer, but their immune response was similar. “We see an increase in antibodies, higher than after the third dose. However, we see many infected with Omicron who received the fourth dose,” said Gili Regev-Yochay, one of the head researchers on the trial, adding that while “the vaccine is excellent against the Alpha and Delta [variants],” for Omicron “it’s not good enough.”

Despite the new findings, Israeli health officials already moved ahead with fourth doses for the elderly, the immunocompromised and medical workers beginning earlier this month, with some 500,000 receiving a second booster on top of an initial two-dose regimen as of Sunday. Though the trial is still in an early phase and the hospital did not offer specific figures, Regev-Yochay said she made its preliminary conclusions public as boosters are a matter of “high public interest,” according to the Times of Israel. She noted that giving fourth doses to high-risk residents is “probably” still the best approach, but suggested the booster campaign should be limited to an even older age group than the current over-60 guideline.

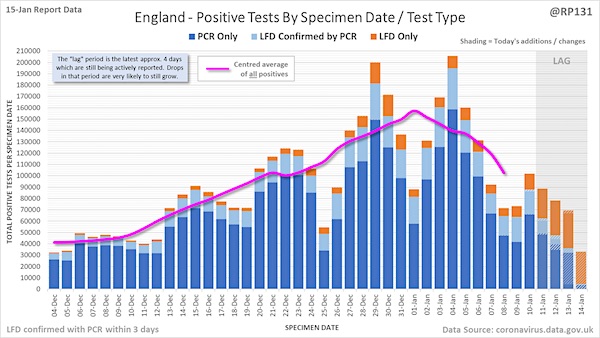

Good overview.

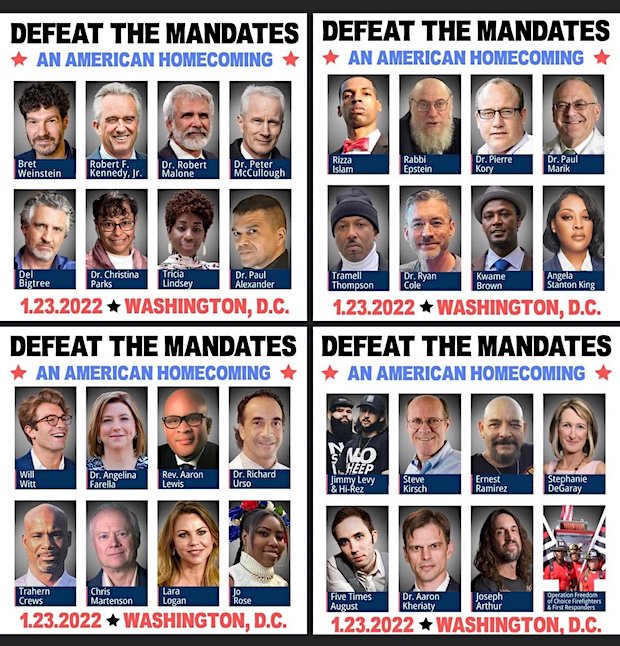

• The War on Treatment Is Fiercer Now Than Even Covid Itself (Pfeiffer)

Omicron is tearing through the country, with Covid cases quadrupling and quintupling in thirty-five states from last winter’s peak.That’s the bad news, but only sort of.The good news: For the first time in twenty-two months, experts are uttering words we haven’t heard in answer to the central question: Are we nearing the pandemic’s end? “I think we are,” said Dr. Pierre Kory, a pulmonary and critical care specialist and president of the Front Line COVID-19 Critical Care Alliance.“I am optimistic for this,” said Dr. Harvey Risch, a Yale epidemiologist and treatment advocate. “The more Omicron cases the better until the peak starts to turn downward.”

These two early treatment pioneers echo the sentiments of other experts, some guarded but mostly hopeful, that the highly transmissible, less-virulent Omicron may end covid as we know it. “I’m so happy that Omicron is milder, that Omicron is winding up the pandemic,” said Dr. Mobeen Syed, known to a half-million subscribers of Drbeen Medical Lectures on YouTube.From France, treatment advocate Dr. Christian Perronne, author of the aptly titled, Is There A Mistake They Didn’t Make?, told me, “It could be the end of the pandemic soon.” By all indications, the U.S. and Europe—where a “west-to-east tidal wave” is unfolding—will follow the South Africa–United Kingdom model.

There, Omicron rose and fell fast, obliterating the more fearsome Delta, and leading to far lower rates of hospitalization and death. Experts are anxiously waiting for that to happen in exploding Omicron hot spots like the United States. But one certainty remains. The U.S. and first-world governments still do not want doctors to treat covid early and are doing all it can to stop them. This article covers that ongoing problem, how to adapt to a veritable blockade on safe effective generics, and how I got around those obstacles when I got sick.

Steve risks overkill.

• Incriminating Evidence (Steve Kirsch)

For many people, the most convincing argument is not the scientific data presented here, but seeing what happened to a formerly perfectly healthy friend or family member (or famous public figure) after they took the vaccine. In my case, I lost confidence in the COVID vaccines when a friend told me that three of her relatives died shortly after being vaccinated (and they were all perfectly healthy before the shot). A week later, another friend had a heart attack 2 minutes after getting the vaccine and his wife developed Parkinson’s symptoms after she got her vaccine. Today, my wife just told me that one of her friends recently got boosted and now her four kids don’t have a mother anymore. It’s tragic, but for most people, it takes many events like this before people wake up and realize they’ve been lied to.

In most cases, the victims remain silent because they don’t want to be ostracized or receive death threats. So you rarely hear of the incidents. Also, the press will never cover the reactions because the media cannot prove the vaccine was the cause of the event. [..] Tragically, when all these events happen, the news reports never mention that the person was recently vaccinated. Many never realize it was due to the vaccine because the vaccine is supposed to be completely safe. For example, Celine Dion’s career ended shortly after she got vaccinated. Did anyone ever notice that the singer never announced the cause of her sudden uncontrolled muscle spasms? Did her agent ever tell the public why the vaccine was ruled out as a possible cause? Nope.

Uncontrolled muscle spasms post-vaccination is a very common side effect of the vaccine, especially in women. Is it possible that her injury was just bad luck? Of course, but statistically, it is far more likely that her injury was caused by the COVID vaccines. If she isn’t being treated by a specialist in vaccine injury, she may never return to the stage.

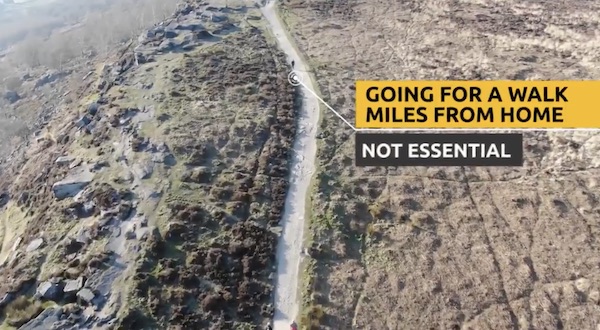

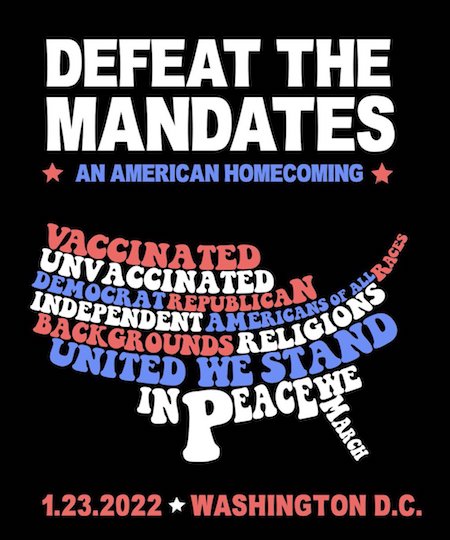

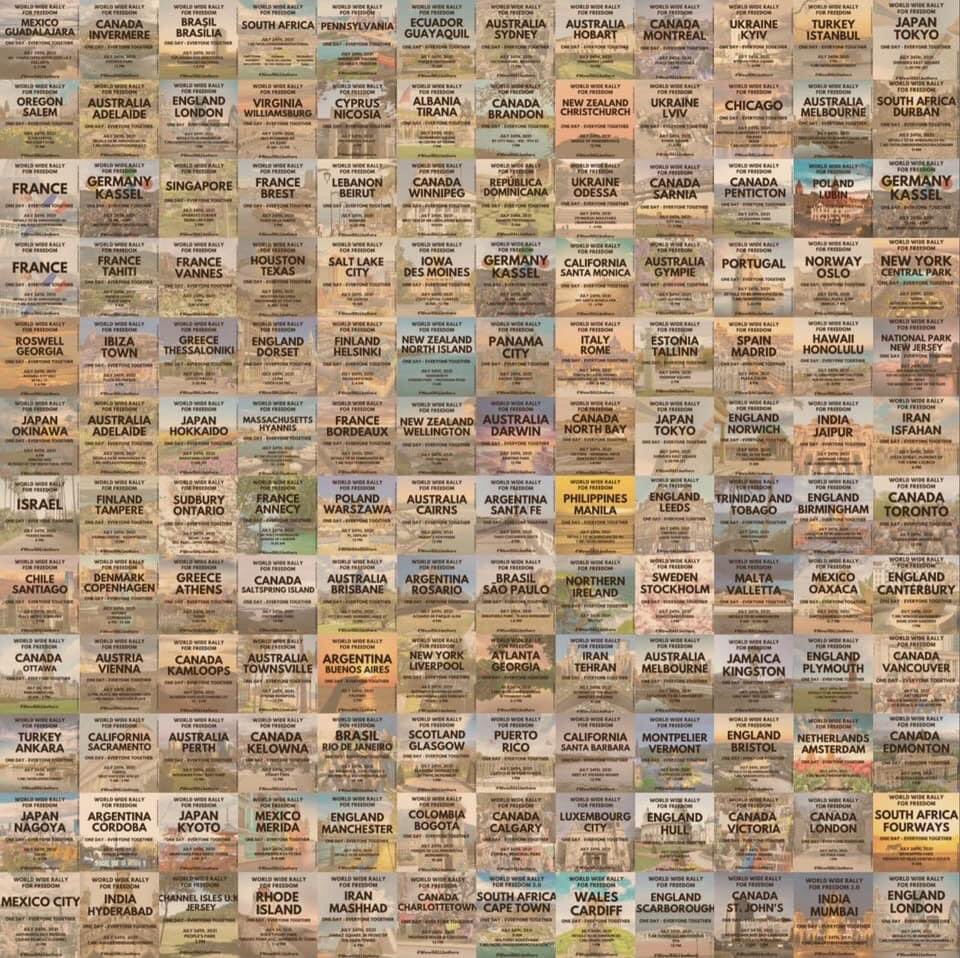

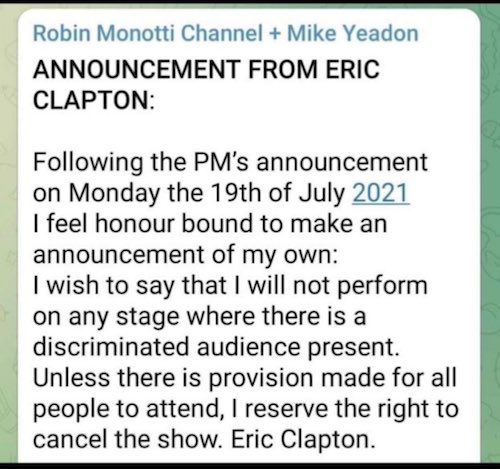

Freedom.

• Returning Travellers To Hand Over Phones, Passcodes At Australian Border (G.)

A man who was forced to hand over his phone and passcode to Australian Border Force after returning to Sydney from holiday has labelled the tactic “an absolute gross violation of privacy”, as tech advocates call for transparency and stronger privacy protections for people’s devices as they enter the country. Software developer James and his partner returned from a 10-day holiday in Fiji earlier this month and were stopped by border force officials at Sydney airport. They were taken aside, and after emptying their suitcases, an official asked them to write their phone passcodes on a piece of paper, before taking their phones into another room. It was half an hour before their phones were returned, and they were allowed to leave. James initially posted about his ordeal on Reddit.

“We weren’t informed why they wanted to look at the phones. We were told nothing,” he told Guardian Australia. “Who knows what they’re taking out of it? With your phone and your passcode they have everything, access to your entire email history, saved passwords, banking, Medicare, myGov. There’s just so much scope.” James said he has no idea what officials looked at, whether a copy of any of the data was made, where it would be stored and who would have access to it. “It’s an absolute gross violation of privacy.” Under the Customs Act, ABF officers can force people to hand over their passcodes to allow a phone search, as part of their powers to examine people’s belongings at the border, including documents and photos on mobile phones.

“..these politicians think that Australian residents will only become vaccine hesitant if Djokovic is physically present in Australia..”

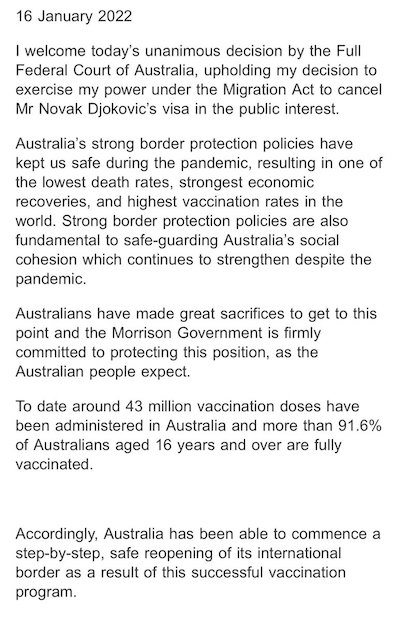

• Australia’s Government Is From the Dark Ages (Simon Black)

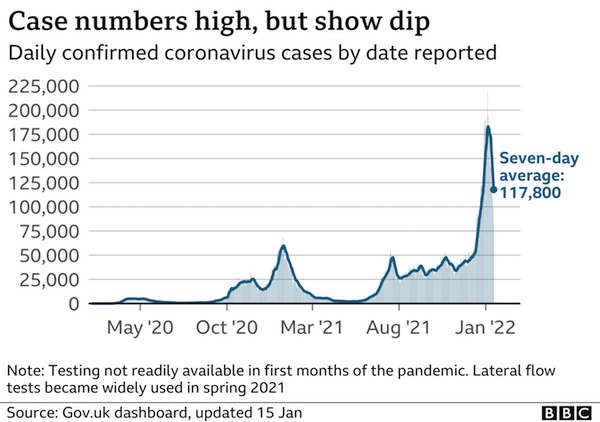

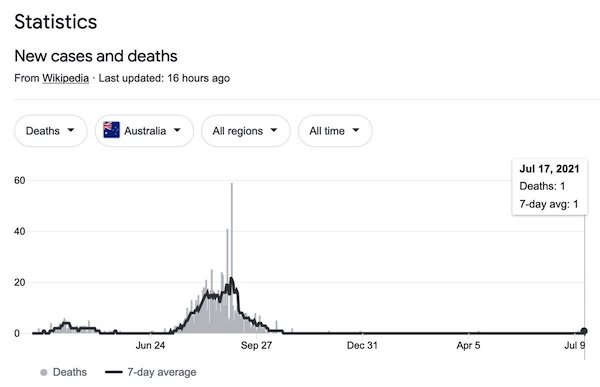

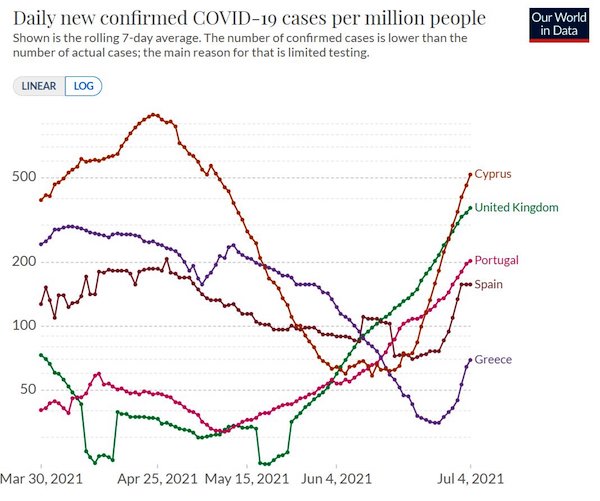

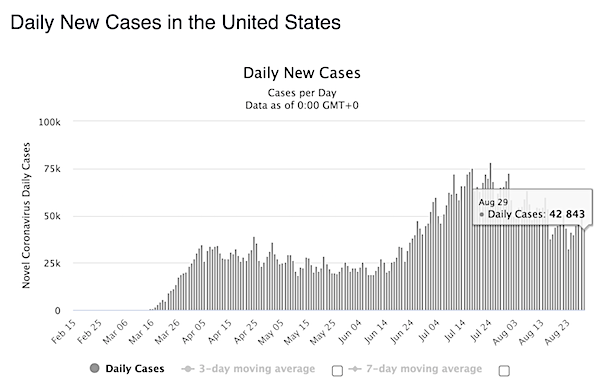

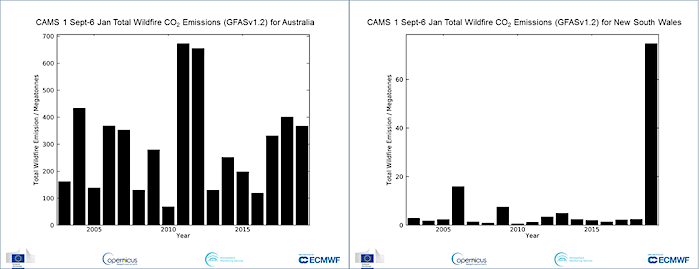

Vaccination rates in Australia are among the highest in the world, and they’re feverishly (no pun intended) administering booster shots to the population. Yet despite this adherence to public health authorities, cases are surging to record highs. In the last 24 hours there were 55,232 new Covid cases in Australia. By comparison, Australia had 10 (yes, ten) new daily cases a year ago in January 2021, just prior to the vaccine rollout.But now that 92.6% of eligible Australians have been vaccinated, the infection rate has increased more than 5,000x from a year ago. Obviously vaccinated people are transmitting the virus to other vaccinated people.Yet the government seems to be asserting that only unvaccinated people like Djokovic can spread Omicron… which is a very flat-earth, anti-science view.

But the Australian government’s dumbest reason to expel Djokovic was that his presence in the country may increase vaccine or booster hesitancy. This one is really extraordinary.Let’s we assume for a moment that their point is true, i.e. Djokovic could infect Australian people with his dangerous ideology.Even so, the Australian government apparently believes that ideas only spread through physical contact.In other words, these politicians think that Australian residents will only become vaccine hesitant if Djokovic is physically present in Australia, as if he’s going to sneeze and his ideas will spread like Omicron droplets.But as long as they keep him out of the country, then Australians will be sufficiently socially distanced from his ideas and no one will be exposed to his heresy.

Just like the rest of their arguments, this notion is completely absurd. And yet it was their ‘rational’ basis for punishing someone whose only transgression was exercising independent thought.Back in the 1600s (and prior), anyone who disagreed with the civil or religious authorities was branded a heretic. And their censorship was especially brutal; people were expelled, imprisoned, tortured, and even put to death for questioning authority and expressing a different view.We have once again returned to medieval intolerance for ideological differences.

Australia’s government is a sad example of this Dark Ages-era mentality– that they (and they alone) dictate truth. And anyone who questions their supreme wisdom must be banished.Back then people faced Inquisition, witch hunts, and public beheadings. Today it’s the Twitter mob, cancel culture, and expulsion.It’s not quite as bloody, but still ruinous.

“..because their risk of infection is higher, a vaccinated person will need to have substantial post-infection protection to have an overall lower risk of serious outcomes.”

• Watch Australia Closely (Berenson)

Australia now averages more than 100,000 new Covid cases per day – equal to about 1.5 million in the United States. One fine day last week, it reported 175,000, the equivalent of about 2.5 million, maybe the highest per-capita total any country has ever reported.Not even six months ago, Australia was still chasing zero Covid and patting itself on the back for “Doughnut Days” – with no new Covid infections. (Because a doughnut is shaped like a zero, see?) By the way, Australia is among the world’s most Covid vaccinated counties. Its policy of open coercion and discrimination against the unvaccinated has “succeeded” – more than 95 percent of Australians 16 and over have received at least one vaccine dose, and 93 percent two doses. Those figures effectively represent full vaccination – many of the people left are probably simply too frail to tolerate Covid vaccines.

Deaths are still relatively low by American standards. But they have risen sixfold in the last two weeks and are now at their highest level ever, equal to almost 700 deaths in the United States a day. The trend adds to other worrisome signs about Omicron in highly vaccinated countries. At this point two facts about Omicron are near-certain: 1: Vaccinated people are at HIGHER risk of being infected with Omicron than the unvaccinated (and whatever protection boosters offer does not last). In Scotland, another highly vaccinated country, vaccinated people are more than twice as likely to be infected as the unvaccinated – and people who have received a booster are 30 percent more likely. 2: Omicron is less dangerous than earlier variants.

But how much less dangerous is not entirely clear, because infections have risen so fast that hospitalizations and deaths are still catching up. In South Africa, the first country to see an Omicron spike, deaths from Omicron didn’t peak until Jan. 11 – almost four weeks after infections peaked. In Britain, infections peaked 10 days ago, but deaths are still soaring; they have tripled since late December. Unfortunately, at this point we still do not know how those two facts interact. In other words, if you are vaccinated and infected with Omicron, will your risk of being hospitalized or dying the same, higher, or lower than someone who is infected but unvaccinated? Remember, because their risk of infection is higher, a vaccinated person will need to have substantial post-infection protection to have an overall lower risk of serious outcomes.

In other words, vaccinations will only help and not hurt against hospitalization or death from Omicron if they somehow substantially reduce the risk of getting very sick even though they substantially increase the risk of infection. Is that tightrope even biologically possible? Sure, it’s possible. The vaccine advocates have lately been writing stories about T-cell protection. But possible doesn’t mean plausible. In reality the vaccines do little to drive broad B- or T-cell responses – and that fact was known before Omicron.

That only took 48 hours.

• Djokovic Facing Fresh Grand Slam Blow (RT)

After his deportation from Australia, Novak Djokovic could be forced to miss another Grand Slam after French Sports Minister Roxana Maracineanu signaled a vaccination pass will be mandatory for international athletes. World number one Djokovic was deprived of the chance to defend his title in Melbourne after a federal court backed the decision by Immigration Minister Alex Hawke to cancel the unvaccinated tennis star’s visa. Djokovic is due to arrive back in Serbia on Monday, but could now find himself barred from the second Grand Slam of the season after the French National Assembly approved the introduction of a controversial new vaccine pass which will exclude anyone who is not fully jabbed from restaurants, sports arenas and other venues.

The legislation is set to come into force in the coming days, and was backed by Sports Minister Maracineanu. “The vaccination pass has been adopted. As soon as the law is promulgated, it will become mandatory to enter public buildings already subject to the health pass (stadium, theater or lounge) for all spectators, practitioners, French or foreign professionals,” she tweeted. “Thank you to the sports movement for the work of conviction with the last rare unvaccinated. We will work together to preserve the competitions and to be the ambassadors of these measures at the international level.” Sunday’s parliamentary vote in France means Sports Minister Maracineanu appears to have been forced to backtrack on previous comments which suggested Djokovic’s vaccination status would not be an issue for his participation at the French Open.

“He would not follow the same organizational arrangements as those who are vaccinated,” Maracineanu told the FranceInfo radio station earlier this month. “But he will nonetheless be able to compete [at Roland Garros] because the protocols, the health bubble, allows it.” That position now appears to be in doubt after the more stringent rules are due to be imposed.

“It’s hard to sell fear — and jabs — to those who have already been infected if you tell them the truth..”

• Oh Look, MORE BS! (Denninger)

Not only do the shots not work they have negative efficacy — that is, they make it more likely for you to not only get it but get seriously ill with it. Of course that’s exactly the opposite of what the medical “profession” has claimed, isn’t it? When you make pronouncements without evidence that has a way of happening. Let’s not forget you’ve been bull****ting people for quite some time in public, haven’t you?”Not only that, but multiple studies have shown that the Omicron variant itself affects the upper airways far more than the lungs, even as it’s much more transmissible than any other variant. This is exactly what happened in the later stages of 1918 Spanish flu pandemic, according to John M. Barry, author of “The Great Influenza: The Epic Story of the Deadliest Plague in History,” who spoke to me about it on SiriusXM’s Doctor Radio this week.”

I thought *****-19 was the deadliest plague in history? Oh, you mean it isn’t? In fact its not even close, as you’re well-aware, but scaring people is hard when you admit that there have been many pandemics through history that have been worse, isn’t it? Indeed. And yes, this very same pattern did happen in 1918. It has also happened in every other respiratory pandemic, including the one in the late 1800s that we think was caused by a beta coronavirus that is known as OC43 and circulates today. We can’t prove that one because we have no preserved samples to test, but genetic sequencing and back-fitting does appear to line up with a pandemic that caused disease very similar to what we saw this time around — and both are beta coronaviruses. In fact there is not one respiratory pandemic where this pattern has not been true.

How do I know this is a fact? You and I are both on this planet along with many billions of other humans, that’s how. Were this not true the human race would have ceased to exist long ago — well before anything known as “modern medicine” showed up.Of course admitting that blows up all the screaming and fear-mongering too, doesn’t it, including that nice fear-mongering OpEd you got published in August? Yeah, it does. Especially for those who already had it, they’re ok, and thus no longer have a reason, statistically-speaking, to fear it in any way. It’s hard to sell fear — and jabs — to those who have already been infected if you tell them the truth about how every respiratory pandemic in history has played out isn’t it? Never mind it being rather tough to convince such people they should wear a mask too eh?

Going to have to take a closer look at this.

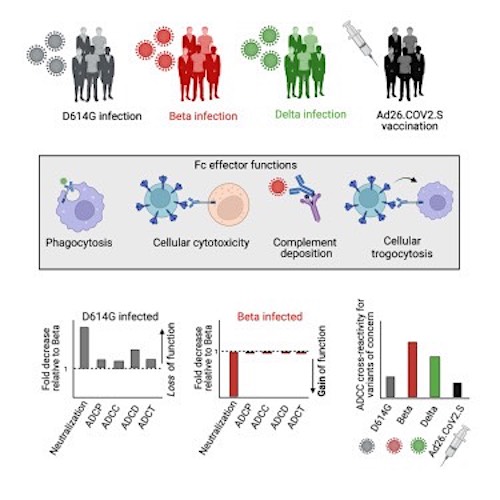

• Beta and Delta Variants Trigger Fc Effector Function (Cell)

SARS-CoV-2 variants of concern (VOCs) exhibit escape from neutralizing antibodies, causing concern about vaccine effectiveness. However, while non-neutralizing cytotoxic functions of antibodies are associated with improved disease outcome and vaccine protection, Fc effector function escape from VOCs is poorly defined. Furthermore, whether VOCs trigger Fc functions with altered specificity, as has been reported for neutralization, is unknown. Here, we demonstrate that the Beta VOC partially evades Fc effector activity in individuals infected with the original (D614G) variant.

However, not all functions are equivalently affected, suggesting differential targeting by antibodies mediating distinct Fc functions. Furthermore, Beta and Delta infection trigger responses with significantly improved Fc cross-reactivity against global VOCs compared to D614G-infected or Ad26.COV2.S vaccinated individuals. This suggests that, as for neutralization, the infecting spike sequence impacts Fc effector function. These data have important implications for vaccine strategies that incorporate VOCs, suggesting these may induce broader Fc effector responses.

Trumped by Nordstream 2 posturing.

• Poor UK Households May Have To Spend Half Their Income On Energy (G.)

Soaring energy bills could eat up more than half of some UK households’ incomes, a leading poverty charity has said, amid warnings that vulnerable people will be left unable to eat regularly or could even be at risk of death from the cold. The Joseph Rowntree Foundation (JRF) said that while households across the board faced bill increases of 40% to 47% from April, there would be huge variations in the ability of families to cope. Energy bills would amount to 6% of the average income of a middle-income family but 18% for a low-income family. This would rise to 25% for lone parents and couples without children, while single-adult households on low incomes could be forced to spend 54% of their income on gas and electricity when the new energy price cap comes in on 1 April, the JRF found.

“Rising energy prices will affect us all but our analysis shows they have the potential to devastate the budgets of families on the lowest incomes. The government cannot stand by and allow the rising cost of living to knock people off their feet,” said Katie Schmuecker, the deputy director of policy and partnerships at the JRF. The warning came as one of the UK’s most respected financial advisers, Martin Lewis, said ministers must intervene urgently to help vulnerable people whose lives could be at risk. Lewis, the founder of the consumer advice website MoneySavingExpert, said the government must provide billions of pounds in support to millions of poorer households who faced major financial stress and “heat or eat” decisions.

“We absolutely know we need a substantial increase in the billions of pounds funding to vulnerable people, and people on low incomes, or it is not an exaggeration to say some will have to choose between heating or eating, and that is not appropriate in one of the world’s richest economies and a civilised nation,” he told BBC Radio 4’s Today programme. “What we can’t get away from is we are going to need to put money into the system or we are going to have an absolute, not a relative, an absolute poverty crisis in this country, with people really being unable to eat or dying because of the cold.”

Rollout is tomorrow.

“The ripple effects across both passenger and cargo operations, our workforce and the broader economy are simply incalculable… To be blunt, the nation’s commerce will grind to a halt.”

• Airlines Say 5G Will Create ‘Economic Calamity’ (RT)

Some of the US’ largest commercial and cargo airlines have sounded the alarm about the potentially “devastating” effects of 5G service around airports, saying the technology could effectively grind travel and shipping to a halt. Airlines for America – a lobbying group that represents JetBlue, American Airlines, Southwest, United, Delta, UPS, and FedEx, among others – issued a letter on Monday warning that the new 5G C-Band service could have a massive impact on aircraft operations around the country and create a “completely avoidable economic calamity.” “Unless our major hubs are cleared to fly, the vast majority of the traveling and shipping public will essentially be grounded,” it said, adding that up to 1,100 flights and 100,000 passengers could experience delays and cancelations per day.

While the Federal Aviation Administration (FAA) has acknowledged the new cell network could interfere with key aircraft systems – namely radio altimeters, which help pilots land in low visibility – as of Sunday, the agency said it had cleared less than half of the US fleet to operate alongside C-Band towers. The latest update came just days ahead of a planned rollout set for January 19, which itself followed several delays due to the ongoing safety concerns. However, the airlines stressed that the interference goes beyond one system, as altimeters “provide critical information to other safety and navigation systems in modern airplanes,” which could mean that “huge swaths of the operating fleet” are “indefinitely grounded” until the issues are resolved.

MORE valid.

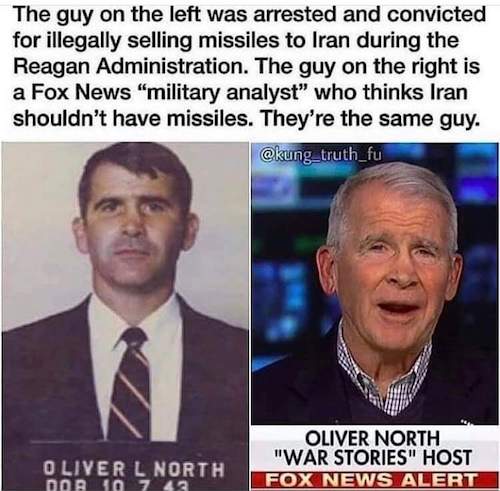

• Eisenhower’s Warning About The Military-industrial Complex Is Still Valid (CST)

President Dwight Eisenhower’s farewell address of Jan. 17, 1961, is just as relevant today as back then. Ike warned American citizens of the “military-industrial complex” and the dangers it presented to our nation and the world. Eisenhower was rightly wary of the armaments industry, which at that time was relatively new. Ike knew that such a massive arms industry could dominate the nation. Eisenhower said in his speech, “This conjunction of an immense military establishment and a large arms industry is new in the American experience. The total influence — economic, political, even spiritual — is felt in every city, every state house, every office of the federal government. We recognize the imperative need for this development. Yet we must not fail to comprehend its grave implications. Our toil, resources and livelihood are all involved; so is the very structure of our society.”

Resources for this arms industry would come from the American people. And if the arms industry is large, that burden becomes substantial. The more you finance the military, the less money you have for other priorities. With people profiting from armaments and their development, there will inevitably be the push for more weapons. Any arms buildup will encourage other nations to build up their weapons. Arms races remain a continuing danger. Eisenhower further warned, “In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military industrial complex. The potential for the disastrous rise of misplaced power exists and will persist.”

Ike believed the American people needed to be politically active when it came to regulating the arms industry. He said, “Only an alert and knowledgeable citizenry can compel the proper meshing of the huge industrial and military machinery of defense with our peaceful methods and goals, so that security and liberty may prosper together.” We need to question military spending, especially when it comes at the expense of social programs. For example, the Build Back Better legislation is being rejected by many senators complaining about its costs. This means important social programs, such as the Child Tax Credit, free school meals and summer feeding for impoverished children won’t get passed because they claim they’re too expensive.

Yet those same senators are not questioning a nearly $2 trillion program of nuclear weapons modernization. Spending on nuclear weapons simply encourages arms races with Russia and China. Eisenhower warned against such reckless military spending that comes at the expense of the American people. Ike said, “As we peer into society’s future, we — you and I, and our government — must avoid the impulse to live only for today, plundering, for our own ease and convenience, the precious resources of tomorrow.” Eisenhower emphasized in his speech the need for diplomacy and peacemaking. He said, “Disarmament, with mutual honor and confidence, is a continuing imperative. Together we must learn how to compose differences, not with arms, but with intellect and decent purpose.”

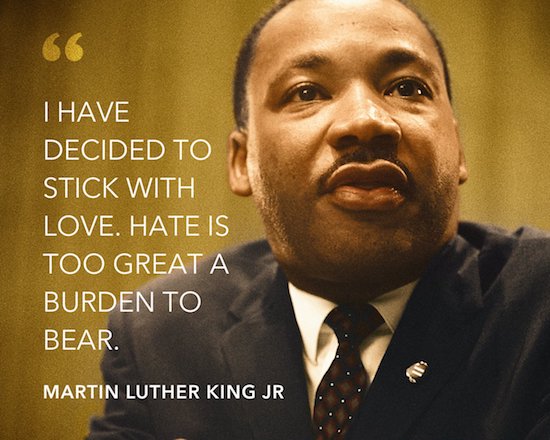

MLK

Share this clip of my father. We must study him beyond the end of ‘I Have a Dream.’ (and that’s taken out of context, too) #MLK #MLKDay pic.twitter.com/bRYlVE1vlU

— Be A King (@BerniceKing) January 18, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.