Christopher Helin Federal truck, City Ice Delivery Co. 1934

“..the real problem will come in U.S. dollar China corporates.”

• China: A Debt Balloon With Nowhere to Go But Down (Bloomberg)

Chinese skyscrapers apparently aren’t scaring bond investors, but they probably should. Debt buyers have brushed off concerns about China’s overvalued real estate and slowing growth this year. They have been snapping up speculative-grade bonds of Chinese companies, even those sold in the U.S., where the appetite for risk is waning in general. Consider, for example, a $41.5 billion pool of dollar-denominated bonds sold in large part by deeply indebted Chinese property companies. The debt has gained 9.2% this year, which is equal to $3.8 billion of market gains, according to Bank of America Merrill Lynch index data. These hefty returns are pretty amazing when juxtaposed with losses on U.S. high-yield bonds, which have suffered amid plunging commodity prices and waning economic momentum, especially in China.

Frederic Neumann, HSBC’s co-head of Asian economics research, put it more bluntly. “In many ways, the market is divorced from reality,” he said Monday at a conference in New York. While local-currency Chinese debt may hold its value, “the real problem will come in U.S. dollar China corporates.” Chinese debt markets have benefited from tumult in the nation’s equities, which has pushed local investors into the safety of bonds. A lot of this money is sticky, with institutions wanting to keep their money close to home. But some of these investors have made their way to the U.S., where they’re buying up bonds of Chinese companies. That’s propping up this slice of the dollar-denominated market at an unlikely time.

Shanghai closed own 3% -after a late surge-, Shenzhen dropped almost 6%.

• China Stocks Down Over 4% In Choppy Trade (CNBC)

Asian stocks mostly advanced on Wednesday, but share markets in China were hit by a sudden bout of selling in the afternoon session. Major U.S. averages slipped overnight, with the Dow Jones Industrial Average snapping a three-day winning streak, amid a decline in healthcare and biotech names. The blue-chip Dow and S&P 500 shed 0.1% each, while the Nasdaq Composite closed down 0.5%. Volatility returned to China’s share markets on Wednesday, with the Shanghai Composite index skidding over 4% after weaving in and out of positive territory since the market open. Earlier in the session, the key index touched 3,444 points – its highest level in two months.

“For the Shanghai Composite, the 3,500 level remains the key barrier to break. I expect stiff resistance above this handle as those who bought when the market was above this level, expecting state buying to prop up prices, will be keen to get rid of their stock holdings,” IG’s market strategist Bernard Aw wrote in a note. Shares of Huaneng Power leaped 2% after the listed unit of China’s biggest power generator delivering a 11.2% rise in third-quarter net profit on Tuesday, marking its weakest pace in three quarters amid slowing growth in the mainland. Among other indexes, the CSI300 erased early gains to slide 2.3%. Small-caps underperformed; the Shenzhen Composite tumbled 4% and the start-up ChiNext board plummeted 4.4%, a day after jumping 2%. Hong Kong markets are closed for the Chung Yeung Festival.

“Repurchase transactions allowing investors to use existing note holdings as collateral to borrow money for one day doubled in the past year..”

• China’s Overheated Bond Market Showing Strain for Local Bankers (Bloomberg)

Chinese bankers say a debt-driven bond market rally is starting to show the same signs of overheating that preceded a collapse in equities. Repurchase transactions allowing investors to use existing note holdings as collateral to borrow money for one day doubled in the past year to a record 2.1 trillion yuan ($331 billion) on Tuesday. The cost of such funding in the interbank market has risen to 1.87% from a five-year low of 1% in May and has swung violently before, reaching 11.74% in June 2013. A similar contract on the Shanghai stock exchange climbed to 2.21% as equities rallied. Credit spreads near the narrowest in six years are being questioned after a state-owned steel trader missed a bond payment. “There are signs of an overheating market, and certainly the rally can’t last for long,” said Wei Taiyuan at China Merchants Bank in Shanghai.

“Leverage in the bond market is much higher than at any time in history. If equities continue to perform well, or initial public offerings resume, the liquidity-fueled rally may come to an end.” Among possible triggers for a correction is Sinosteel Co.’s failure to pay interest due Tuesday on 2 billion yuan of bonds maturing in 2017, a default that’s fanned concern about the government’s willingness to meet the obligations of state-owned companies. Competition for funds is increasing as the best weekly rally in stocks since June has led to the biggest growth in margin debt for buying equities in half a year, which risks diverting money away from money markets. The yield premium of five-year AAA rated corporate bonds over similar-maturity Chinese government debt fell to 84 basis points on Sept. 7, the least since 2009. The spread widened to 100 basis points on Tuesday, compared with an average of 144 over the past five years.

Think UK steel is bad?

• China Bond Defaults Seen Rising After Sinosteel Misses Payment (Bloomberg)

China bond defaults are forecast to climb after a state-owned steelmaker missed an interest payment, raising questions about the government’s commitment to stand behind such firms. Sinosteel failed to pay interest due Tuesday on 2 billion yuan ($315 million) of 5.3% notes maturing in 2017 after saying it will extend the deadline as it plans to add a unit’s stock as collateral. That came after the National Development and Reform Commission planned to meet noteholders and ask them not to exercise a redemption option on Tuesday to force full repayment, people familiar with the matter said last week. Chinese authorities are weeding out weak state firms that Premier Li Keqiang called zombies. Australia & New Zealand Bank. warned that rising debt in the sector may drag economic growth down to as low as 3%.

Two state-owned companies, Baoding Tianwei and China National Erzhong reneged on obligations earlier this year, according to China International Capital and China Bond Rating Co. “Sinosteel’s default means we will see more and more real bond defaults, in which investors may not get full repayment, in China,” said Ivan Chung at Moody’s in Hong Kong. “The government may want to reduce its intervention in default cases and let market forces play a bigger role.” Sinosteel’s failure to pay interest on time constitutes a default, according to Industrial Securities, Haitong Securities and China Merchants Securities.

China Bond Rating Co. said in a report Wednesday if Sinosteel bond investors had agreed to the delay of interest payment, it didn’t constitute a default, whereas if they hadn’t, it did. Sinosteel hasn’t said in its statements whether it got permission from investors, and two calls to the company Wednesday went unanswered. Flagging authorities’ balancing act as they try to liberalize markets while preventing turbulence, Li said last week the government will prevent systemic risks and banks should not cut or withdraw lending to companies which are in “temporary” difficulties.

“How do you define a global recession? For individual countries, the rule of thumb is two consecutive quarters of falling output. That convention is difficult to apply to the world economy, which rarely contracts.”

• Just How Bad Was the 2009 Global Recession? Really, Really Bad (Bloomberg)

The global recession that followed the financial crisis was the most severe in half a century, an unusually synchronized shock that paralyzed trade and left 23 million more people out of work. Yet the response by policy makers hasn’t been up to the task, with central banks bearing too much of the burden. And the world may be on the edge of another recession, even though it hasn’t recovered from the last one. Those are the conclusions of a new book on business cycles released Tuesday by the IMF. “The 2009 episode was the most severe of the four global recessions of the past half century and the only one during which world output contracted outright – truly deserving of the ‘Great Recession’ label,” write Ayhan Kose, director of the World Bank’s Development Prospects Group, and Marco Terrones, deputy division chief at the IMF’s research department.

“The possibility of another global recession lingers in light of the persistently weak recovery, even though damage from the previous one has yet to be fully repaired.” The 272-page book, “Collapse and Revival: Understanding Global Recessions and Recoveries,” underscores the challenges policy makers face as they try to jumpstart a sputtering recovery more than six years after the global financial crisis. A slowdown in emerging markets driven by weak commodity prices forced the IMF this month to cut its outlook for global growth in 2015 to 3.1%, which would be the weakest rate since 2009, from a July forecast of 3.3%. Kose and Terrones try to answer a question that has become more pressing as nations become more integrated: How do you define a global recession? For individual countries, the rule of thumb is two consecutive quarters of falling output. That convention is difficult to apply to the world economy, which rarely contracts.

In predicting a global recession next year, Citigroup Chief Economist Willem Buiter recently forecast that world growth would slow to “well below” 2% in 2016. Kose and Terrones define a recession as a contraction in inflation-adjusted output per capita accompanied by a broad, synchronized decline in various measures, such as industrial production, unemployment, trade and capital flows, and energy consumption. By that standard, there have been four world recessions since 1960, starting in 1975, 1982, 1991 and 2009. In only the last case did the global economy shrink. The 2009 downturn was “by far” the deepest, Kose and Terrones found. It was also the broadest, with almost all advanced economies and a large number of emerging and developing countries contracting. About 65% of countries fell into recession, the highest among the four slumps.

Iron ore is like oil: everyone produces full-tard just to stay alive for another day.

• Why Miners May Want To Rethink Record High Output (CNBC)

The world’s top three iron-ore producers continue to consistently churn out record volumes of output, worsening an already dire supply glut, but investors are now wondering just how long that strategy can last. On Wednesday, BHP Billiton—the world’s largest miner by market capitalization—reported a 7% annual rise in September quarter output to 61 million tons, adding to a 6% gain in the June quarter, and maintaining its full-year guidance of 247 million tons. Report cards over the past week confirms other miners are also in high-output mode. Rio Tinto reported a 12% annual rise in third-quarter production to 86 million tons, building on a 9% gain in the previous quarter.

The world’s second largest miner also announced it was on track to meet a full-year target of 340 million tons. Meanwhile, Brazilian giant Vale logged a record performance, with output up 2.9% on year to 88.2 million tons and more increases to come. A low cost of production has been the secret to miners’ profitability despite iron ore prices crashing to $52 a ton from nearly $200 four years ago. Rio Tinto’s unit cash production cost at its Pilbara operation fell to $16.20 a ton during the first half of this year, from $20.40 per ton during the same period last year, while Vale plans to reduce its current unit cost from $15.80 per ton to less than $13 by 2018, according to the companies.

But if miners continue ramping up production at high levels, it could become counterproductive. “So far, miners have been able to withstand commodity price declines but if they keep pushing prices down, and testing the low cost producer-price relationship, margins and cash flow will eventually decline and they’ll get to a point where they can’t escape by cutting costs further,” explained David Lennox, resources analyst at market research firm Fat Prophets.

Consumer deposits to be owned by investment bankers…

• Barclays Plots Bombshell Ring-Fencing Plan (Sky)

Barclays is heading for a showdown with the Bank of England over a secret plan to place its high street operations under the temporary ownership of its investment banking arm. Sky News can reveal that Barclays is preparing to warn regulators that the credit rating of its investment bank could be slashed unless it is allowed to restructure its operations in this way. The development threatens to drop a bombshell into the heart of the debate about banking reform just days after City regulators outlined new measures designed to protect taxpayers in the event of a future banking crisis. John McFarlane, Barclays’ executive chairman, is understood to have briefed more than 100 of the bank’s top executives on the plans at a meeting at a west London hotel this month.

Mr McFarlane, who will revert to a non-executive role after a new chief executive is in place, is said to have acknowledged to colleagues the likely difficulty of securing regulators’ approval for the proposals. But an insider familiar with the meeting said he expressed a belief that the idea was consistent with the blueprint drawn up by the Independent Commission on Banking in 2011 for separating banks’ high street and investment banking operations. One source speculated that a rejection of Barclays’ proposals by the PRA could oblige it to sell large parts of its investment bank or seek to raise many billions of pounds in new capital from investors. Like other lenders – although to a greater degree owing to the size of its investment bank – Barclays’ credit rating derives a diversification benefit from its current structure.

All big banks are in deep.

• Credit Suisse to Launch $6.3 Billion Capital Increase (WSJ)

ZURICH— Credit Suisse nnounced plans on Wednesday to raise roughly 6 billion francs ($6.3 billion) in fresh capital and slash costs, as the Swiss bank delivered a disappointing set of quarterly results. Incoming Credit Suisse Chief Executive Tidjane Thiam took over the top job in July, and has been widely expected to raise capital and reduce what has been a relatively expensive, and relatively high-risk investment banking unit. On Wednesday, Credit Suisse said it would restructure its investment bank and significantly cut the amount of capital allocated to the business. That will be coupled by a proposed rights offering of about 4.7 billion francs to raise capital, and a private placing of roughly 1.35 billion francs, Credit Suisse said.

In addition, Credit Suisse said it plans a partial initial public offering for its Swiss bank unit. Its plans also include cutting 3.5 billion francs in costs by the end of 2018. [..] Credit Suisse has long operated a larger investment bank than that of its Swiss peer, UBS. That has provided Credit Suisse with needed profit during good quarters, but also with a relatively expensive set of businesses that are increasingly impractical due to stricter capital rules. Regulators in Switzerland are expected to unveil new rules for the big banks later this year, including a requirement to maintain a bigger cushion of capital relative to the loans and investments being made.

On Wednesday, Credit Suisse said it would reduce the amount of risk-weighted assets allocated to its investment banking businesses such as foreign exchange and rates by 72%, while the allocation to its so-called “prime” business providing services for hedge funds will be cut by half. On Wednesday, Credit Suisse reported a pretax loss of 125 million francs for its investment bank in the third quarter, compared with a profit of 516 million francs in the period last year. The bank cited challenging market conditions and “reduced client activity.” Overall, Credit Suisse posted a 24% decline in net profit for the third quarter, and an 8% decline in net revenues.

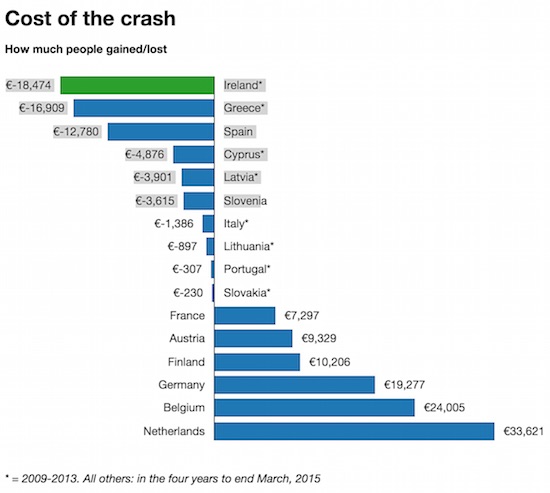

Germany, Holland came out big winners from the crash. if that doesn’t tell you the EU is a failure, what does?

• Irish Biggest Losers From Financial Crash: ECB (Reuters)

The Irish lost more of their personal wealth than any other euro zone country in the aftermath of the financial crash while Germany and the Netherlands gained the most, fresh data from the ECB shows. In an analysis of the years between 2009 and 2013, ECB experts discovered that Ireland lost more than €18,000 per person, while Spaniards saw wealth dwindle by almost €13,000 as property in both nations plummeted. Greeks saw their notional wealth decline by almost €17,000 for the same reason. In the Netherlands and Germany, by contrast, the wealth per capita grew by roughly €33,000 and €19,000 respectively, due in part to a boost to financial investments over that time. The data, which takes a snapshot before the recent economic upswing in Spain and Ireland, illustrates the stark differences between countries in the 19-country euro zone that extends from cities such as Helsinki in the north to Athens in the south.

By presenting the data in this manner, the ECB acknowledges the divergence, although there is little the central bank can do to remedy it. Its money-printing scheme known as quantitative easing is spread out according to euro zone member countries’ relative size and not determined by their economic needs. To fix imbalances between strong industrial nations such as Germany and countries such as Spain, experts have long pushed for a system of financial transfers or payments from rich to poor states. Germany, which fears that this would lumber it with unmanageable costs and believes that handouts would discourage spendthrift countries from reforming, has flatly rejected the suggestion.

A pumped-up success story.

• Why There’s No Easy Way Out Of Spain’s Insurmountable Economic Mess (Telegraph)

Spain is the current superstar economy of the eurozone. The former bail-out country, which became embroiled in one of the worst banking and house price collapses in the euro just four years ago, is now proudly held up as the European Union’s model economic pupil. Spain is set to be the fastest growing economy of the “Big Four” euro economies – Germany, France, Italy and Spain – over the next two years, expanding by 3.2pc and 2.5pc respectively, according to the IMF. This compares to just 1.5pc and 1.6pc in Germany, and a paltry 1.2pc and 1.5pc in France. Madrid’s growth rate will also surpass the eurozone average of 2pc and 2.2pc over 2015-16, as it races ahead of the rest. The secret of this success lies in the implementation of belt-tightening measures and structural reforms, as demanded by Brussels, so the story goes.

But the economic turnaround has attracted high-profile critics. The recently-departed chief economist of the IMF has rubbished any talk of a growth “miracle” in Spain. In a new report, Simon Tilford at the Centre for European Reform also pours cold water over the dominant narrative of the Spanish recovery. “There is no evidence that [growth numbers] are the result of austerity, and not much evidence that they are the product of structural reforms,” writes Mr Tilford. Instead, he paints a picture of a fragile economy that has benefited from a number of headwinds, but remains acutely vulnerable to another global downturn. Here are some of the insurmountable challenges that are set to condemn Spain to more economic pain.

Spain’s export performance has been held up as the backbone of its stellar growth performance since 2013. Bouyed by a cheap euro, exports have boomed over the past two years. Key to this growth has been Spain’s “remarkable cost adjustment process” – where it has managed to slash wage costs – helping to “transform the export sector into a lean and mean machine, able to compete at a high level”, notes Angel Talavera at Oxford Economics. But buoyant exports have also been accompanied by falling imports, as suffering Spaniards have endured lower living standards and high unemployment, notes Mr Tilford. The composition of the exports is also a cause for concern. More than half of the growth has come from “low-value” goods such as food and fuel.

That’s all that’ll be left. Best case.

• From European Union to Just a Common Market (Roberto Savio)

Seventy years ago Europe came out from a terrible war, exhausted and destroyed. That produced a generation of statesman, who went about creating a European integration, in order to avoid the repetition of the internal conflicts that had created the two world wars. Today a war between France and Germany is unthinkable, and Europe is an island of peace for the first time in its history. This is the mantra we hear all the time. What is forgotten is that in fact a good part of Europe did not want integration. In 1960, the United Kingdom led the creation of an alternative institution, dedicated only to commercial exchange: the European Free Trade Association (EFTA), formed by the United Kingdom, Austria, Denmark, Norway, Portugal, Sweden, Switzerland, then later Finland and Iceland.

It was only in 1972 that, bowing to the success of European integration, the UK and Denmark asked to join the EU. Later, Portugal and Austria left EFTA to join the European Union. The UK was never interested in the European project and always felt committed to “a special relation” with United States. Union would mean also solidarity and integration, as the various EU treaties kept declaring. The UK was only interested in the market side of the process. Since 1972, the gloss of European integration has lost much of its shine. Younger generations have no memory of the last war. The EU is perceived far from its citizens, run by unelected officials who make decisions without a participatory process, and unable to respond to challenges. Where is the external policy of the EU? When does it take decisions that are not an echo of Washington?

Since the financial crisis of 1999, xenophobic, nationalistic and right wing parties have sprouted all over Europe. In Hungary, one of them is in power and openly claims that democracy is not the most efficient system. The Greek crisis has made clear that there is a north-south divide, while Germany and the others do not consider solidarity a criterion for financial issues. And the refugee crisis is now the last division in European integration. The UK has openly declared that it will take only a token number of 10,000 refugees, while a new west-east divide has become evident, with the strong opposition of Eastern Europe to take any refugee. The idea of solidarity is again out of the equation.

Germany moved because of its demographic reality. It had 800,000 vacant jobs, and it needs at least 500,000 immigrants per year to remain competitive and keep its pension system alive. But that mentality is even more clear with the East European countries, which experience increasing demographic decline. At the end of communism in 1989, Bulgaria had a population of 9 million. Now it is at 7.2 million. It is estimated that it will lose an additional 7% by 2030, and 28.5% by 2050. Romania will lose 22% by 2050, followed by Ukraine (20%), Moldova (20%), Bosnia and Herzegovina (19.5%), Latvia (19%), Lithuania (17.5%), Serbia (17%), Croatia (16%), and Hungary (16%). Yet, all Eastern Europe countries have followed the British rebellion, and take a strong stance on refusing to accept refugees.

Fear.

• Lessons for Draghi From a Land of Sub-Zero Interest Rates (Bloomberg)

Until not so long ago, the idea of sub-zero interest rates was about as far-fetched as the prospect of a brash real estate tycoon running for U.S. president. These days, the discussion is whether a deposit rate below minus 0.20% is a good trump card to play when dealing with Europe’s sclerotic economy. The ECB meets on Thursday for yet another discussion on how to stimulate growth. Rate cuts are improbable – ECB board member Benoit Coeure recently described the current level as “the effective lower bound.” Should ECB President Mario Draghi and his colleagues nevertheless opt to discuss the matter, they might consider taking this lesson from Denmark: negative rates don’t provide a quick fix. The Danish central bank, whose sole mandate is to guard the krone’s peg to the euro, first cut rates below zero in mid-2012, when investors were looking for havens at the height of Europe’s debt crisis.

The key deposit rate, now minus 0.75%, has been mostly negative since then. Economists recently surveyed by Bloomberg see negative rates continuing into 2017. That’s not necessarily because they expect rates to rise after that, but because their models just don’t go any further. One of the key lessons from Denmark is that banks are reluctant to charge customers for holding their money. While some have raised fees, “real rates for real people were actually never negative,” says Jesper Rangvid, a professor of finance at the Copenhagen Business School. For that reason, Danes haven’t been hoarding cash. According to Rangvid, rates would have to drop as low as minus 10% before people start “building their own vaults.” Experiences in Switzerland and Sweden tell a similar story. Economic theory says interest rates are inversely related to investment.

People are also supposed to spend less when rates are high and spend more when they’re low. Because interest rates determine the value of cash today, they have been described as “a tax on holding money” and “the price of impatience.” And yet, Danes have actually been squirreling away. According to central bank data, Danish households’ have added 28 billion kroner ($4.3 billion) to bank deposits since rates shrank to their record low on Feb. 5. Danish businesses, meanwhile, have barely increased their investments, adding less than 6% in the 12 quarters since Denmark’s policy rate turned negative for the first time. At a growth rate of 5% over the period, private consumption has been similarly muted. Why is that? Simply put, a weak economy makes interest rates a less powerful tool than central bankers would like.

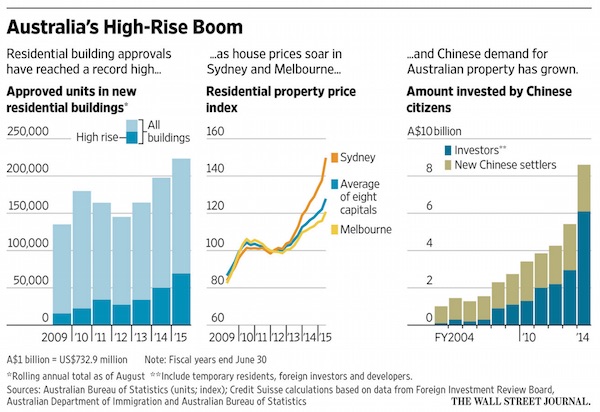

“People underestimate how much residential construction has been propping up the economy..”

• Developers in Australia Roll Out Red Carpet for Wealthy Chinese (WSJ)

Cranes dominate skylines above Sydney and Melbourne, which are popular with Asian migrants. Current rules generally only allow foreign investors to buy real estate before construction, typically in apartment developments. Cracks are emerging in the market, however. On Friday, the country’s central bank warned that risks to residential property developers had risen over the past six months, with inner-city Melbourne and Brisbane particularly exposed to a supply glut of apartments. The central bank has previously warned that any sudden collapse in home prices risks destabilizing the nation’s banks and the economy, which grew by just 0.2% in the second quarter from the first, the slowest pace in four years.

“People underestimate how much residential construction has been propping up the economy,” said Warren Hogan, chief economist at Australia & New Zealand Banking Group. Approvals to build new dwellings hit an all-time high in the year through August, as did the number of permits given to build high-rise apartments, which now account for 31% of the total, up from 11% six years ago, according to government data. China has become the largest source of foreign money flowing into Australian real estate, with Chinese investment in residential property up by more than 60% to A$8.7 billion in the year through June 2014, a Credit Suisse analysis of government data shows.

“Why is war more palatable than more refugees? Why is the destruction of lives you can’t see easier to live with than someone on your bus making a phone call in a language you don’t understand?”

• Britain Addicted To Bombing With The Weary Rationale Of A Junkie (Frankie Boyle)

In every addiction, a part of us is addicted to the process. Laying out the cigarette papers to build the joint; heating the spoon and flicking the syringe; dealing with our emails before our DMs; cueing up Netflix for when the kids go to sleep; methodically polishing the keys to our own prisons. Britain seems to be going through the preliminaries associated with one of its most cherished addictions: bombing. Bombing Syria has probably only been postponed by Russia’s intervention. It was, of course, amusing to see the western press suddenly preoccupied about whether bombs were hitting their intended targets. Perhaps Putin should have avoided such rigorous international scrutiny by bombing only hospitals.

The recent immolation of a Médecins Sans Frontières hospital in Afghanistan presented us with the internal contradiction of our media’s presentation of bombing: that we have technology so precise our weapons can hear their victims begging for a trial, and that we sometimes blow up stuff “accidentally”. It has been suggested that non-white people caught up in our foreign wars are “unpersons reported”. More accurately, they are treated as subpersons. A handful of Afghans dying could make the front pages, but only if they were strangled one by one by Beyoncé as the half-time entertainment at the Super Bowl. Historically, Syria has existed as a place where outsiders come to fight, a bit like Wetherspoon’s.

No one likes Assad: he has the surprised appearance of a man who has just swallowed his own chin, and a bizarre, faint, fluffy moustache, as if he pulled on a cashmere turtleneck just after eating a toffee apple. He has created a hell for his own people that British teenagers seem eager to go to and fight in, just to give you some idea of how shit Leeds is. But if their desire to go to Syria is deluded, how is our government’s any less so? A government that doesn’t believe it should have any responsibility for regulating our banks or even delivering our post thinks it needs to be a key player in, of all things, the Syrian civil war. Somehow, the plight of this strategically significant state has touched their hearts. Britain is so concerned about refugees that it will do anything – except take in refugees – to try to kill its way to a peaceful solution.

Is that why the Chinese are coming?

• Number Of London’s ‘Working Poor’ Surges 70% In 10 Years (Guardian)

More than a million Londoners who are defined as living in poverty are members of households in which at least one adult has a job, according to a new analysis. The figures include 450,000 children who live in such households, and research estimates that cuts in working tax credits to families next April could make 640,000 children worse off. The analysis is contained in the fifth London Poverty Profile, which is compiled by the New Policy Institute thinktank for the charity Trust for London. It indicates that the total number of Londoners in poverty now stands at 2.25 million. Of these, slightly more than half – 1.2 million – qualify as “in-work poor”, representing an increase of 70% in the past 10 years.

The study found that, although the numbers of unemployed adults and the proportion of people in workless households has fallen in the capital, the city’s overall poverty rate is 27%, much as it has been for the past decade. The rate for the rest of England is 20%. The report also illuminates how the poverty picture is changing in some parts of the Greater London area, with two east London boroughs, Newham and Tower Hamlets, seeing significant falls in the numbers and%ages of benefit claimants there, while Brent and Ealing in the west now stand out for their high levels of low pay and unemployment. Just over one fifth of people in London in all types of working households are in poverty, compared with 15% a decade ago.

This is despite the present number of unemployed adults, just over 300,000, being the lowest since 2008, at a time of rapid increases in the capital’s population, and with the proportion of workless households being at a 20-year low of 10%. The poverty threshold is defined as households with incomes of less than 60% of the national median after housing costs are included, consistent with standards used across the EU. The report says: “The increase in the number of people in poverty in London has been almost entirely among those in working families.” It points to low pay, limited working hours and the capital’s notoriously high housing costs as key reasons. The poverty rate among working families where an adult is self-employed, not all adults work or they work only part-time is 35% and among those where all adults work full time or one works full time and one part time is 9%.

Britain’s only growth industry.

• Food Banks Have Become A Lifeline For Many, But Where Is The Way Out? (Guardian)

In a large steel container outside St Philip’s church in north Nottingham, Nigel Webster is taking stock: not just of the thousands of neatly stacked tins of food arrayed there, but of his experience as a food bank volunteer. When we started out three years ago, he reflects, we thought we’d be gone by now. For Webster, the manager of Bestwood and Bulwell food bank, part of the Trussell Trust network, the pressing existential question is not just: “Why food banks?” but: “Food banks for how long?”. The growth of the food bank has been an astonishing achievement, but he regards its continued presence as a kind of social disgrace. It is the search for a food bank exit strategy, as much day-to-day operational problems, that keeps him awake at night.

“We will always seek to help people in need,” he says. His Christian faith means he could not do otherwise. But there must be limits, he says. Food banks cannot simply let the state withdraw from its responsibilities. It is important, he says, to keep in mind the idea that the food bank, essentially, is an “outrage”. “We do not want our food banks to exist. We look forward to a time when they disappear. We do not want to get too comfortable. We must resist the temptation to expand. I do not think having a food bank on every street corner is a way for our society to go. Foodbanks must do their best to remain ‘unusual’”.

If anything, food banks are in danger of becoming mainstream. A series of reports and studies have linked cuts in the social security system to the rise in charity food. Scores of evidence submissions to a Commons work and pensions committee inquiry, opening on 21 October, testify that thousands of vulnerable citizens are forced to rely on food banks as a result of avoidable delays to benefits being paid. Food banks are gearing up for a surge in demand for charity food parcels over the next few months, as proposed cuts to working tax credits and housing benefit, the continuing rollout of universal credit, and the shrinking of local welfare support schemes take effect.

Slavery 21st century style.

• Buying Begets Buying: Stuff Has Consumed The Average American’s Life (Guardian)

The personal storage industry rakes in $22bn each year, and it’s only getting bigger. Why? I’ll give you a hint: it’s not because vast nations of hoarders have finally decided to get their acts together and clean out the hall closet. It’s also not because we’re short on space. In 1950 the average size of a home in the US was 983 square feet. Compare that to 2011, when American houses ballooned to an average size of 2,480 square feet – almost triple the size. And finally, it’s not because of our growing families. This will no doubt come as a great relief to our helpful commenters who each week kindly suggest that for maximum environmental impact we simply stop procreating altogether: family sizes in the western world are steadily shrinking, from an average of 3.37 people in 1950 to just 2.6 today.

So, if our houses have tripled in size while the number of people living in them has shrunk, what, exactly, are we doing with all of this extra space? And why the billions of dollars tossed to an industry that was virtually nonexistent a generation or two ago? Well, friends, it’s because of our stuff. What kind of stuff? Who cares! Whatever fits! Furniture, clothing, children’s toys (for those not fans of deprivation, that is), games, kitchen gadgets and darling tchotchkes that don’t do anything but take up space and look pretty for a season or two before being replaced by other, newer things – equally pretty and equally useless. The simple truth is this: you can read all the books and buy all the cute cubbies and baskets and chalkboard labels, even master the life-changing magic of cleaning up – but if you have more stuff than you do space to easily store it, your life will be spent a slave to your possessions.

We shop because we’re bored, anxious, depressed or angry, and we make the mistake of buying material goods and thinking they are treats which will fill the hole, soothe the wound, make us feel better. The problem is, they’re not treats, they’re responsibilities and what we own very quickly begins to own us. The second you open your wallet to buy something, it costs you – and in more ways than you might think. Yes, of course there’s the price tag and the corresponding amount of time it took you to earn that amount of money, but possessions also cost you space in your home and time spent cleaning and maintaining them. And as the token environmentalist in the room, I’d be remiss if I didn’t remind you that when you buy something, you’re also taking on the task of disposing of it (responsibly or not) when you’re done with it. Our addiction to consumption is a vicious one, and it’s stressing us out.

Weather getting worse fast. Balkans can get nasty in winter.

• Slovenia Deploys Troops to Border as Migrant Exodus Swells (AP)

Led by riot police on horseback, thousands of weary migrants marched across western Balkans borderlands as far as the eye could see Tuesday as authorities cautiously lowered barriers and intensified efforts to cope with a human tide unseen in Europe since World War II. Leaders of Slovenia deployed military units to support police on their overwhelmed southern border with Croatia, which delivered more than 6,000 asylum seekers by train and bus to the frontier in bitterly disputed circumstances between the former Yugoslav rivals. With far too few buses available in Slovenia to cope, most people walked 15 kilometers on rural lanes past cornfields and pastures to reach a refugee camp, a challenge eased by sunny weather after days of torrential rain, fog and frigid winds.

On Slovenia’s frontiers with Croatia and Austria, aid workers toiled to erect enough tents and other emergency accommodation to shelter up to 14,000 travelers, more than five times the tiny nation’s previous official limit. Interior Secretary of State Bostjan Sefic told reporters in the Slovene capital, Ljubljana, that the pressure on border security with Croatia had grown “very difficult with an enormous number of people.” He said Slovenia, an Alpine land of barely 2 million, needed much more help immediately from bigger EU partners to cope or the country might have to adopt border-toughening measures. “If this continues we will have extreme problems. Slovenia is already in dire straits, an impossible situation,” Sefic said as lawmakers debated whether to increase the military’s powers to manage border security.

In Brussels, Slovenian President Borut Pahor met European Union leaders and said he expected his country to apply for emergency financial aid and border patrol reinforcements from EU partners. Hungary, long the most popular eastern gateway for people fleeing conflict and poverty in the Middle East, Asia and Africa, has padlocked its borders for migrants progressively over the past month, forcing the tide west through Croatia and Slovenia. All three nations have expressed fears of ending up stuck accommodating tens of thousands of asylum-seekers indefinitely if other EU nations farther north close their borders too.

Save them the Aegean trip and the drowning babaies.

• Resettling Migrants From Middle East Camps Could Ease Crisis: Greece (Reuters)

Greece said on Tuesday that resettling migrants from camps in the Middle Eastern countries such as Turkey, Jordan and Lebanon, where they first arrive, could ease Europe’s refugee crisis. Greece is struggling to control the influx of more than half a million migrants through its islands bordering Turkey, with arrivals spiking over the past two days in a rush to beat the onset of winter. Some 10,000 people arrived on the island of Lesvos on Sunday and Monday alone, officials said. Reuters witnesses said there had also been a rush on Tuesday of mainly Syrians and Afghans.

“We have a huge problem in not being able to control the flow of arrivals,” migration minister Yannis Mouzalas told Skai TV. The International Organisation for Migration said of an estimated 650,500 arrivals to European Union states this year, almost 508,000 went through Greece, while the United Nations put that figure at 502,000 on Tuesday. “That (resettling) would mean we, and countries like Italy and Hungary, would not be dealing with uncontrolled flows of people, save these people from smugglers and from the prospect of drowning trying to get here,” Mouzalas said.

“Asked whether the refugees would be able to claim asylum in Britain, the MoD official said: “That’s not our understanding.”

• Refugee Boats Wash Up At UK Military Base In Cyprus (Guardian)

Three overloaded boats carrying more than 100 refugees from Syria have washed up at Britain’s military base in Cyprus, potentially opening up a new front line in the migration crisis. The refugees, believed to include women and children, have been transferred to a temporary reception area at the sovereign base at Akrotiri on southern coast of the Mediterranean island. A spokesman for the Ministry of Defence confirmed that three boats had arrived at the base, which has been used to launch airstrikes against Islamic State militants in Iraq and Syria. The MoD is still gathering details about the incident, including the number of refugees involved. “I believe it is more than a hundred, but there is no confirmation of the exact number at the moment,” the spokesman said.

He said it was unclear where the refugees had travelled from but a police official told local media that refugees “appear” to have come from Syria. He added: “At the moment the first priority is to make sure everyone is safe and well before decisions are taken on what’s going to happen to them. We don’t know full numbers. It is happening as we speak so details are still coming in.” Asked whether the refugees would be able to claim asylum in Britain, the MoD official said: “That’s not our understanding.” The base is one of two sovereign territories retained by Britain on Cyprus, a colony until 1960.

Cyprus has received hundreds of refugees from Syria, but if confirmed this would be the first time any have arrived at the Akrotiri base, which is about 150 miles from the Syrian port of Tartus. The news site In-Cyprus quoted George Kiteos, the head of police at the sovereign base area, as saying: “The number of persons has been counted and recorded. The boats were carrying over 100 persons.” He added: “They have received first aid and they all appear to be in good health. We have already alerted all the other necessary services. They appear to have come from nearby Syria.” The site said two small boats had been spotted off the coast of Akrotiri at about 6.30am and were shepherded back to the shore by the Cyprus coastguard.

Home › Forums › Debt Rattle October 21 2015