Hans Behm Windy City tourists at Monroe Street near State 1908

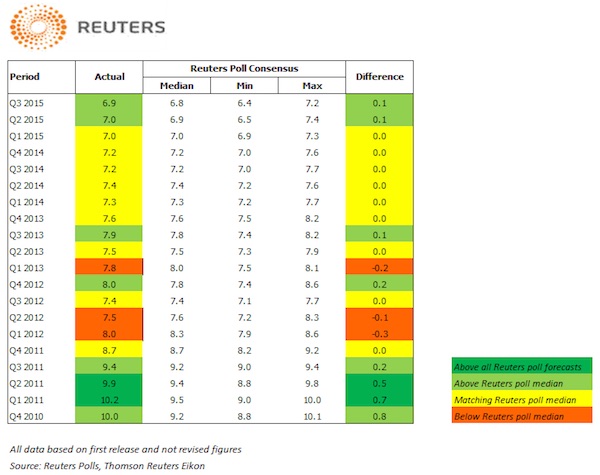

Maybe Beijing is just very good at predicting.

• Another Quarter Of Remarkably Precise China GDP Growth Data (Reuters)

China GDP releases are starting to look like near-perfect landings each and every time, in all kinds of weather conditions and visibility. Yet another quarter has just gone by – literally less than three weeks ago – and already statisticians have reported that growth slowed a tiny sliver from Beijing’s 2015 target of 7% recorded for the first half of the year. Now it’s 6.9%, slightly above the Reuters consensus forecast from 50 economists of 6.8%. It is difficult to understate just how precise such figures are in the grand scheme of economic data reporting. It is also difficult to ignore just how remarkable this stability is considering the Chinese authorities are trying to rebalance the entire economy away from reliance on exporting manufacturing goods toward domestic consumer spending.

And that worry about a Chinese growth slowdown was one of the main reasons cited by the U.S. Federal Reserve for holding off last month on its first rate rise in nearly a decade. That’s also not to mention that China growth concerns dominated the International Monetary Fund and World Bank’s latest meetings in Lima, Peru. In the past three years, Chinese GDP data as reported have only missed the Reuters Polls consensus three times, and on each occasion it was because the reported growth figure beat by just 0.1 percentage point. For the periods of Q4 2013 through to Q1 of this year, the reported figure was exactly on forecast.

Other large and important global economies are nowhere near as accurate. U.S. growth data have taken even the most pessimistic forecaster completely off guard on several occasions since the financial crisis, most recently in the first quarter of last year. The initial report for Q1 GDP this year also matched the lowest forecast. Initial U.S. growth data have only actually been reported exactly in line with expectations three times in the last half decade. It seems implausible that economists, who are often widely panned as a group for failing to predict economic turning points, are uncannily able to nail Chinese GDP within a few tiny slivers of a percentage point each and every time.

Not much use trying to analyze something so obvious.

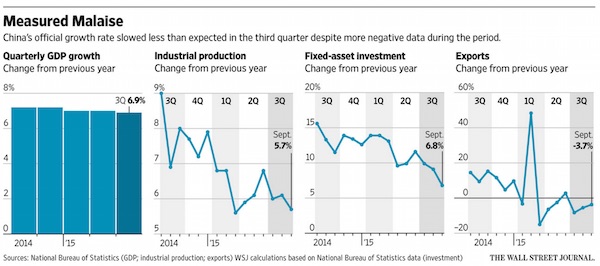

• China’s Better-Than-Expected GDP Prompts Skepticism From Economists (WSJ)

Within minutes of China’s publishing its rosier-than-expected numbers, a wave of skepticism emanated from economists over the accuracy of the official 6.9% third-quarter growth figure. Economists’ doubts centered in part on the apparent disconnect between the headline figure and the underlying data. Both exports and imports declined during the third quarter, and industrial production was weaker than expected. Factories have seen 43 consecutive months of falling prices and—despite a flood of government infrastructure spending—fixed-asset investment decelerated in September. While retail sales and services have held up, and new lending data in September point to a pickup in demand, these factors haven’t been enough to offset the parade of negative data, economists said.

“When you look at the numbers, it’s not entirely easy to see how GDP growth held up so well,” said Société Générale CIB economist Klaus Baader. The weak reports leading up to Monday’s GDP release had strengthened the impression that China is increasingly under siege to reach its 2015 growth target of about 7%, which already would be its slowest pace in a quarter century. Economists say the world’s second-largest economy is far from collapsing, though a number of them say they believe actual growth is one or two percentage points below the official figure. China’s official growth statistics have long been viewed with skepticism. Although the methodology has improved exponentially since the days of the 1958-61 Great Leap Forward, when cadres were encouraged to inflate production statistics to please Chairman Mao, many say there is still a focus on reaching a predetermined number, even when underlying conditions change.

Much better index, and Pettis explaining how China is both much worse and not all that bad (I disagree).

• Chinese Economists Have No Faith In 7% Growth ‘Target’ (Zero Hedge)

Earlier today in “The Truth Behind China’s GDP Mirage: Economic Growth Slows To 1999 Levels”, we pointed out that Beijing may be habitually understating inflation for domestic output, which has the effect of making “real” GDP less “real” than nominal GDP. This is what we’ve called the “deficient deflator math” problem and it raises questions about whether China is netting out import prices when they calculate the deflator. If they’re not, then the NBS is likely overstating GDP during periods of rapidly declining commodities prices. If Beijing is indeed understating the deflator it’s not entirely clear that it’s their fault, as robust statistical systems take time to implement, especially across an economy the size of China’s.

That said, there are plenty of commentators who believe that the practice of overstating GDP is policy and exists with or without an understated deflator. Put simply: quite a few people think China is simply lying about its economic output. To be sure, there’s ample evidence to suggest that Beijing’s critics are right. After all, the Li Keqiang index doesn’t appear to be consistent with the numbers coming out of the NBS and the degree to which the data tracks the Communist party’s “target” is rather suspicious (and that’s putting it nicely).

In effect, everyone is perpetually in an awkward scenario when it comes to Chinese GDP data. Economists are forced to “predict” a number that they know is gamed and while that’s pretty much always the case across economies (just see “double adjusted” US GDP data for evidence), with China it’s arguably more blatant than it is anywhere else, and one could run up a pretty impressive track record simply by betting with Beijing’s “target.” It’s with all of this in mind that we bring you the following clip from University of Peking economist Michael Pettis, whose outlook is apparently far more dour than his compatriots:

I can’t see how or why this would stop.

• China’s Capital Outflows Top $500 Billion (FT)

Capital outflows from China topped $500bn in the first eight months of this year, according to new calculations by the US Treasury that highlight the shifting fortunes in the global economy. The outflows, which peaked at about $200bn during the market turmoil in August according to the estimates released on Monday, have also contributed to a shift by Washington in its assessment of the valuation of China’s currency, the renminbi. In its latest semi-annual report to Congress on the global economy, the US Treasury dropped its previous assessment that the renminbi was “significantly undervalued”. Instead, the Treasury said the Chinese currency was “below its appropriate medium-term valuation”. “Given economic uncertainties, volatile capital flows and prospects for slower growth in China, the near-term trajectory of the RMB is difficult to assess,” Treasury economists wrote.

“However, our judgment is that the RMB remains below its appropriate medium-term valuation.” The new language reflects the cautious welcome that the Obama administration has given to Beijing’s efforts in recent months to prop up the renminbi since China announced on August 11 that it would allow a greater role for the market in setting the currency’s exchange rate. It is also a sign of the recognition in Washington that even as it believes China’s currency should strengthen in the longer term, in the short term the renminbi is facing downward pressures because of several factors including what amount to historic outflows from China and other emerging economies. “Market factors are exerting downward pressure on the RMB at present, but these are likely to be transitory,” the Treasury said. Among those factors, Treasury economists wrote, was the unwinding of carry trades betting on the appreciation of the renminbi.

Q: what will happen to prices when Chinese storage has filled up its teapots?

• China Heads For Record Crude Buying Year (Reuters)

As China closes in on the US as the world’s biggest crude oil importer, demand from private refiners and stockpiling of cheap oil is expected to keep imports at record levels after a wobble in the third quarter. Despite slower growth in recent months – crude imports rose just 1.3% in September on a year earlier – buying for October-November delivery has picked up strongly, traders and analysts say. The purchases will ease concerns of a sharp slowdown in Chinese buying and support prices in coming months, analysts said. The increased buying has shown up in tanker movements and freight rates, said Energy Aspects analyst Virendra Chauhan, and analysts are upgrading earlier forecasts for second half growth. “Despite a slowing Chinese economy, crude imports remain robust on the back of accelerated stockpiling activities into operating and commercial storage,” said Wendy Yong, analyst at oil consultancy FGE.

Since July, China has also granted nearly 700,000 barrels per day (bpd) of crude import quotas to small refiners, known as “teapots”, or roughly 10% of China’s current total imports, as part of efforts to boost competition and attract private investment, creating a new source of demand. “The teapots are super-active,” said one oil trader, with many racing to fill their new quotas. And state-owned refiners are restocking after a third-quarter lull. Unipec, the trading arm of Asia’s top refiner Sinopec, bought 6 million barrels of North Sea Forties crude and 2.9 million barrels of Russian ESPO for loading this month, and it has also stepped up Angolan crude purchases for November. To accommodate the oil, new storage tanks on southern Hainan island have either been put to use or are due to be filled with crude from end-2015.

Something to do with licking certain body parts.

• Britain’s Love Affair With China Comes At A Price (AEP)

It is a sobering experience to travel through eastern China with a British passport. Again and again you run into historic sites that were burned, shelled or sacked by British forces in the 19th century. The incidents are described in unflattering detail on Mandarin placards for millions of Chinese national pilgrims, spiced with emotional accounts of the Opium Wars. The crown jewel of this destructive march was the Summer Palace of the Chinese emperors outside Beijing, looted of its Qing Dynasty treasures by Lord Elgin in 1860, and burned to ground. It was a reprisal for the murder of 18 envoys by the Chinese court, but the exact “casus belli” hardly matters anymore. The defilement lives on in the collective Chinese mind as a high crime against the nation, the ultimate symbol of humiliation by the West.

The Communist Party has carefully nurtured the grievance under its “patriotic education” drive. David Marsh, from the Official Monetary and Financial Institutions Forum, says Britain’s leaders are implicitly atoning for a colonial past by rolling out the red carpet this week for Chinese President Xi Jinping, and biting their tongue on human rights. They are acknowledging that British officialdom is in no fit position to lecture anybody in Beijing. The exact line between good manners and kowtowing is hard to define, but George Osborne came close to crossing it on his trade mission to China last month, earning plaudits from the state media for his “pragmatism” and deference. But as the Chancellor retorted, you have to take risks in foreign policy. Moral infantilism is for the backbenches. “China is what it is,” he said.

The proper question for David Cameron and Mr Osborne is whether they have accurately judged the diplomatic and commercial trade-off in breaking ranks with other Western allies and throwing open the most sensitive areas of the British economy to Chinese expansion, and whether they will reap much in return. The US Treasury was deeply irritated when the Chancellor defied Washington and signed up to the Asian Infrastructure Investment Bank (AIIB), China’s attempt to create an Asian rival to the Bretton Woods institutions controlled by the West. Mr Osborne was correct on the substance. Congress acted foolishly in trying to smother the AIIB in its infancy and stem the rise of China as a financial superpower. It was tantamount to treating the country as an enemy, an approach that soon becomes self-fulfilling.

The AIIB is exactly what is needed to recycle China’s trade surpluses back into the world economy, just as the US Marshall Plan recycled American surpluses in the 1950s. The problem is that Britain carelessly undercut a close ally, putting immediate mercantilist interests ahead of a core strategic relationship. Anglo-American ties are now at their lowest ebb for years, a risky state of affairs at a time when the UK faces a showdown with the European Union.

Overinvestment.

• The Perfect Storm That Brought Britain’s Steel Industry To Its Knees (Telegraph)

Britain’s steel industry is caught in a “perfect storm”, ravaged by global economics and politics, reducing an industry that once led the world to a mere bit player on the global stage. Just 12m tonnes of the metal that is a basic raw material for the modern world were produced in the UK in 2013, according to the World Steel Association, out of a global total of 1.65bn. In 1983 this figure was 15m tonnes out of a total 663bn. However, the number of people employed making the metal in Britain has dropped from 38,000 in 1994 to less than 18,000 today. While productivity improvements account for some of the decline, with worldwide demand more doubling than in a generation, there are other factors that are inflicting a much heavier toll on the industry. Globalisation is the main one, according to Chris Houlden at commodities analyst CRU.

“The issue facing UK steel has been developing since the financial crisis,” he says. “Demand for steel in Britain and the EU has fallen and not recovered and there’s persistent global overcapacity.” While things weren’t all sunshine and roses ahead of the crash – the sector faced the universal pressures to find efficiencies and savings – Britain’s steel industry could function successfully with the growing global economy gobbling up available output, led by China’s burgeoning growth. Today things are different. Beijing is pencilling in annual growth of about 7pc, half the rate seen in heady pre-crisis times as its economy industrialised, placing huge demand on the country’s steel mills to turn out the beams and sheets needed for machines and construction.

Thanks to heavy investment in its steel industry, China is now responsible for half of the world’s steel output – up from 10pc a decade ago – and is reluctant to let it go to waste. As a result, China’s mills are dumping excess output abroad, and the country’s overcapacity is estimated to be 250m tonnes a year. “China’s production is not abating,” says Peter Brennan, European editor at steel industry data provider Platts. “You might have thought they would cut capacity but in a country where industry is effectively government controlled, it’s not happened. In what’s arguably a more unstable society, the government has no intention of cutting masses of jobs.”

The sentiment is echoed by the International Steel Statistics Bureau. “It would take a major reversal of the slowdown in the Chinese economy to prevent them pushing steel abroad,” says ISSB commercial manager Steve Andrews. “That’s why they are looking externally. There’s not the political will to remove capacity. They have taken some of the old and highly polluting plants out as they look at improving air quality but a lot of their stuff is big and modern.” The result is cheap steel coming on to the market, pushing prices down. But it’s not just China that is dumping output. “China is not unique,” says Houlden. “There’s low to no growth in a lot of other major steel producers such as Brazil and Russia, so they are doing it, too. Japan, the world’s second largest producer, is also looking to export more steel.”

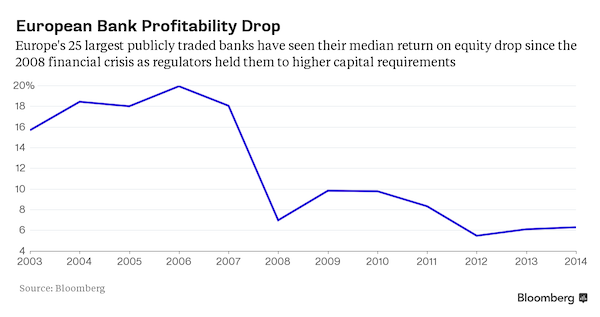

All banks are in deep shit.

• Deutsche Bank, Credit Suisse Set to Scale Back Global Ambitions (Bloomberg)

Europe’s last global banks are caving in to pressure from regulators and preparing to tell investors just how much their aspirations will shrink. “The European banks were too long holding onto the past and not realizing that this change is for good – it’s permanent,” said Oswald Gruebel, a former chief executive officer of both UBS and Credit Suisse. “The main reason for reducing global investment banking is that with the capital requirements which the regulators put on these banks, you cannot make any decent return.” Deutsche Bank announced sweeping management changes on Sunday, less than two weeks before co-CEO John Cryan will present his plans to scale back the trading empire built by his predecessor.

On Wednesday, Tidjane Thiam will probably reveal a strategy to prune Credit Suisse’s investment bank in favor of wealth management. Barclays, BNP Paribas and Standard Chartered are also trimming operations. Europe’s global lenders are struggling to adapt to rising capital requirements, record-low interest rates and shrinking opportunities for growth. Their retrenchment risks further squeezing lending to economies in the region and handing more business to U.S. competitors, which were quicker to raise capital levels and are benefiting from growth at home. “Everything that’s being done should have been done years ago,” said Barrington Pitt Miller at Janus Capital in Denver. “The European muddle-through scenario has been proven not to be a terribly good one.”

Very predictable, and very blind too: “..Wal-Mart believes it can grow sales by 3 to 4% a year over the next three years..”

• Wal-Mart Puts The Squeeze On Suppliers To Share Its Pain (Reuters)

Suppliers of everything from groceries to sports equipment are already being squeezed for price cuts and cost sharing by Wal-Mart. Now they are bracing for the pressure to ratchet up even more after a shock earnings warning from the retailer last week. The discount store behemoth has always had a reputation for demanding lower prices from vendors but Reuters has learned from interviews with suppliers and consultants, as well as reviewing some contracts, that even by its standards Wal-Mart has been turning up the heat on them this year. “The ground is shaking here,” said Cameron Smith, head of Cameron Smith & Associates, a major recruiting firm for suppliers located close to Wal-Mart’s headquarters in Bentonville, Arkansas. “Suppliers are going to have to help Wal-Mart get back on track.”

For the vendors, dealing with Wal-Mart has always been tough because of its size – despite recent troubles it still generates more than $340 billion of annual sales in the U.S. That accounts for more than 10% of the American retail market, excluding auto and restaurant sales, and the company increasingly sells a lot overseas too. To risk having brands kicked off Wal-Mart’s shelves because of a dispute over pricing can badly hurt a supplier. On Wednesday, Wal-Mart stunned Wall Street by forecasting that its earnings would decline by as much as 12% in its next fiscal year to January 2017 as it struggles to offset rising costs from increases in the wages of its hourly-paid staff, improvements in its stores, and investments to grow online sales.

This at a time when it faces relentless price competition from Amazon.com, dollar stores and regional supermarket chains. Keeping the prices it pays suppliers as low as it can is essential if it is to start to claw back some of this cost hit to its margins. Helped by investments to spruce up stores and boost worker pay, Wal-Mart believes it can grow sales by 3 to 4% a year over the next three years, or by as much as $60 billion, offering suppliers new opportunities to boost their own revenues.

Here’s hoping.

• Brazil’s Corruption Crackdown Can’t Be Stopped (Bloomberg)

In a continent of peacocks, Brazilian federal judge Sergio Moro makes an unlikely celebrity. Laconic and poker-faced, he has little time for the spotlight, and yet his name is emblazoned on t-shirts and protest banners, and splashed across social media. Why the fuss? Check out the 13th federal district court, where Moro has presided over the largest corruption investigation in the country’s history, sent muckety-mucks to jail and helped restore civic pride in a land where too often justice has been honored in the breach. So after the Brazilian Supreme Court ruled last month to take a high-profile defendant named by witnesses in the landmark Petrobras case away from the 13th district, worried citizens hit the streets. Is the so-called Operation Carwash investigation into looting at the state oil company in danger of getting derailed, as some claim?

Brazil’s white-collar crooks should be so lucky. True, the scope of the scam at Latin America’s biggest corporation might never have come to light had it not been for the 43-year-old judge, who specializes in money-laundering cases, and a dedicated cadre of prosecutors. From their base in Curitiba, a city in southern Brazil, investigators exposed what Prosecutor General Rodrigo Janot called a “complex criminal organization” bent on skimming money from padded supply contracts with Petrobras into political coffers. But getting to Curitiba took the collaboration of the best minds in public service, from the federal police to the Finance Ministry’s financial intelligence unit. That web of sleuths and wonks is the best assurance that the effort to shut down Brazil’s most brazen political crime ring will carry on, no matter who holds the gavel.

The probe began when federal police watching a gas station and one-time car wash (hence the name) in the nation’s capital uncovered a money-changing scheme to spirit gains overseas. The public prosecutor’s office took up the chase and, tapping into finance ministry data, followed the money trail to Petrobras. Janot took the investigation across the Atlantic, where Swiss prosecutors found evidence pointing to the head of Brazil’s lower house, as well as to corporate leaders. Some of Brazil’s biggest oil and construction executives are behind bars, and dozens of politicians are under investigation, including the head of the senate. And despite recently ruling to spin off parts of the investigation, the Supreme Court has consistently buttressed Moro’s authority in the past.

“One in four borrowers is either delinquent or in default on his or her student loans.”

• US Supreme Court May Weigh In on a Student Debt Battle (Bloomberg)

Mark Tetzlaff is a 57-year-old recovering alcoholic who has been convicted of victim intimidation and domestic abuse. He may also be the person with the best shot at upending the way U.S. courts treat student debt for bankrupt borrowers. Tetzlaff has spent three years battling lawyers for the Department of Education over the right to have his student loans canceled in bankruptcy. On Thursday, he appealed his case to the Supreme Court. If the nation’s highest court takes the case on, it will be one of the rare occasions when it has addressed the $1.3 trillion pile of student debt held by 41 million Americans. Tezlaff also got a new attorney after representing himself for most of his case. The lawyer, Douglas Hallward-Driemeier, successfully argued part of the landmark June case that made same-sex marriage a legal right in all 50 states.

Hallward-Driemeier and his team have asked the court to clarify 1970s-era rules that prevent borrowers from getting rid of education debt in bankruptcy, except in cases in which repaying it would constitute an “undue hardship.” Lawmakers never fully defined “undue hardship,” leaving it to the courts to define these special, and rare, circumstances in individual cases. Tetzlaff has said that the standard being applied to his case is unconstitutional. The Supreme Court may be tempted to consider the case partly because it would be able to resolve a split between federal courts in their interpretation of the law, according to court documents. Courts disagree mainly on which of two tests should be used to determine whether someone can erase his or her debt in bankruptcy.

The so-called Brunner test is used in most federal courts and was applied in Tetzlaff’s case. It is the strictest version of the standard because it requires debtors to prove that they have diligently tried to repay their loans, that making any payments would deprive them of a “minimal” standard of living, and that the hardship affecting them today will persist long into the future. Over the past two decades, lawyers arguing on behalf of the government have further pushed courts to take the most stringent view of each one of those components. Tezlaff’s legal team has said the Supreme Court should instead apply a less harsh alternative to the Brunner test, known as the “totality of the circumstances” test, which has been gaining ground in courts across the country.

[..] It would be hard to overstate the significance of this case for people struggling with student debt. Student loans are the largest source of consumer debt aside from mortgages. The total amount of outstanding student debt is expected to double to $2.5 trillion in the next decade. One in four borrowers is either delinquent or in default on his or her student loans.

Surprisingly nice write-up of Trudeau for Bloomberg. I wish Justin well, but Canada’s in for very hard times.

• New Canada PM Justin Trudeau: Out of Father’s Shadow and Into Power (Bloomberg)

As a young man, Justin Trudeau continually sought respite from his father’s long shadow. He debated in university as Jason Tremblay, boxed as Justin St. Clair and eventually settled on Canada’s west coast – as far in Canada as he could get from being Pierre Trudeau’s eldest and still be close to great skiing. Now 43, he has come full circle, reviving a moribund Liberal Party to a solid majority amid a new wave of the Trudeaumania that swept his father to power in 1968. In ousting Stephen Harper Monday, he becomes the country’s first inter-generational prime minister and gets to move back into his childhood home. Trudeau campaigned on a brand of optimism, transparency and youthful energy – while promising government activism to stimulate a weak economy and address middle class anxiety over income inequality and retirement security.

In contrast to the departing Harper, he will run deficits willingly, reduce Canada’s combat role against the Islamic State and get behind the Iran nuclear deal. He’ll also rule out the purchase of F-35 fighters in favor of more spending on the navy and join President Barrack Obama in Paris in pushing for aggressive action on climate change. He is, in many ways, the happy faced anti-Harper. Trudeau’s political role model is not so much his beloved “papa,” whose public persona over 15 years as prime minister mixed charisma and aloofness, but his maternal grandfather, Jimmy Sinclair, a consummate glad-handing, baby-kissing Scottish immigrant to Canada and Rhodes scholar.

It was no accident that Trudeau held his final campaign event Sunday night in the Vancouver constituency his grandfather represented from 1940 to 1958. “I’m not sure if love of campaigning has any kind of genetic component, but if it does, I can trace my passion for it straight back to grandpa,” he told an enthusiastic crowd on what was the birthday of both his father and his eldest son, eight-year-old Xavier James, named for Sinclair. “He loved knocking on doors, getting out, meeting with people, taking the time to really listen to what they had to say. It’s his style that I’ve adopted as my own.”

“Both of them had a penchant for using precisely the same words to describe the country’s future as an “Energy Superpower”.

• Farewell Fossil Fools – Harper And Abbott Both Dispatched (CS)

The prospects for the forthcoming global climate conference to be held in Paris later this year have received a significant diplomatic boost. The two developed world leaders most intent on undermining the conference – Australia’s Tony Abbott and Canada’s Stephen Harper – have been dispatched to the political wilderness. Based on early Canadian election vote counting Monday night, Harper’s Conservative Party look set to lose office, with the centrist Liberals having been declared the winner of 173 seats at the time of writing and projected to win 184 of the 338 lower house seats (according to Canada’s Globe and Mail), giving them the ability to rule in their own right. The Conservatives have suffered big losses, with latest counting giving them 92 seats with a projection of 102 seats.

Back in June 2014 when Abbott visited Harper in Canada, the two put on an act of professing concern for climate change while describing a policy that would actually limit carbon emissions as something that would “clobber the economy” in Abbott’s words while being “job killing” in Harper’s words. As Climate Spectator noted in Harper and Abbott: Two fossils fooling no one, what was plainly obvious was that both Harper and Abbott had confused the interests of the coal mining industry (in Abbott’s case) and tar sands (Harper) with the interests of their respective country as a whole.

A year on it appears the two of them had far too narrowly focussed and deeply flawed economic strategies. [..] Harper and Tony Abbott have followed eerily similar strategies. Both of them had a penchant for using precisely the same words to describe the country’s future as an “Energy Superpower”. Unfortunately for them the plummeting price of a barrel of oil and a tonne of coal left them both floundering without a coherent economic narrative for how to drive their respective nations’ future prosperity. They then both resorted in desperation to the bottom of the barrel trying to using fears of terrorism in an attempt to restore their popularity.

“Resistance will be local. It will be militant. It will defy the rules imposed by the corporate state. It will turn its back on state and NGO environmental organizations. And it will not stop until corporate power is destroyed or we are destroyed.”

• Death by Fracking (Chris Hedges)

The maniacal drive by the human species to extinguish itself includes a variety of lethal pursuits. One of the most efficient is fracking. One day, courtesy of corporations such as Halliburton, BP and ExxonMobil, a gallon of water will cost more than a gallon of gasoline. Fracking, which involves putting chemicals into potable water and then injecting millions of gallons of the solution into the earth at high pressure to extract oil and gas, has become one of the primary engines, along with the animal agriculture industry, for accelerating global warming and climate change. The Wall Street bankers and hedge fund managers who are profiting from this cycle of destruction will—once clean water is scarce and crop yields decline, once temperatures soar and cities disappear under the sea, once droughts and famines ripple across the globe, once mass migrations begin—surely profit from the next round of destruction.

Collective suicide is a good business, at least until it is complete. It is a pity most of us will not be around to see the power elite go down. [..] The activists are waging a war against a corporate state that is deaf and blind to the rights of its citizens and the imperative to protect the ecosystem. The corporate state, largely to pacify citizens being frog-marched to their own execution, passes environmental laws and regulations that, at best, slow the ongoing environmental destruction. Corporations, which routinely ignore even these tepid restrictions, largely write the laws and legislation designed to regulate their activity. They rewrite them or overturn them as the focus of their exploitation changes. They turn public hearings on local environmental issues into choreographed charades or shut them down if activists succeed in muscling their way into the room to demand a voice.

They dominate the national message through a pliable and bankrupt corporate media and slick public relations. Elected officials are little more than corporate employees, dependent on industry money to stay in office and, when they retire from “public service,” salivating for jobs in the industry. Environmental reform has become a joke on the public. And the Big Green environmental groups are complicit because they rely on donors, at times from the fossil fuel and animal agriculture industries; they are silent about the reality of corporate power, largely ineffectual, and part of the fiction of the democratic process. Resistance will be local. It will be militant. It will defy the rules imposed by the corporate state. It will turn its back on state and NGO environmental organizations. And it will not stop until corporate power is destroyed or we are destroyed.

John Helmer has written a deep-digging and extensive series on the Dutch MH17 report (h/t Yves Smith). I’ve left the topic alone, because Holland was never in a position to write a neutral analysis. From the get-go it was made clear that Russia and the rebels were responsible, proof be damned, because that fitted the overall anti-Russia mood whipped up by US and EU. What’s perhaps most galling is that the question of intent has been taken off the table altogether: whoever shot down the plane, did they do it on purpose? In ignoring that question, the answer is implied, and analysis makes way for propaganda. Victims’ families be damned.

• Is There A War Crime In What The Dutch Safety Board Is Broadcasting? (Helmer)

Tjibbe Joustra, chairman of the Dutch Safety Board, wants it to be very clear that Russia is criminally responsible for the destruction of Malaysian Airlines Flight MH17 on July 17, 2014; that a Russian-supplied ground-to-air missile, fired on Russian orders from territory under Russian control, exploded lethally to break up the MH17 aircraft in the air, killing everyone on board; and that Russian objections to these conclusions are no more than cover-up and dissimulation for the guilty. Joustra also wants to make sure that no direct evidence for what he says can be tested, not in the report which his agency issued last week; nor in the three Dutch government organs which prepared and analysed the evidence of the victims’ bodies, the aircraft remains, and the missile parts on contract to the Dutch Safety Board (DSB) – the Dutch National Aerospace Laboratory (NLR), the Netherlands Organization for Applied Scientific Research (TNO), and the Netherlands Forensic Institute (NFI).

So Joustra began broadcasting his version of what he says happened before the release of the DSB report. He then continued in an anteroom of the Gilze-Rijen airbase, where the DSB report was presented to the press; in a Dutch television studio; and on the pages of the Dutch newspapers. But when he and his spokesman were asked today for the evidence for what Joustra has been broadcasting, they insisted that if the evidence isn’t to be found in the DSB report, Joustra’s evidence cannot be released. So, if the evidence for Joustra’s claims cannot be found in the NLR, TMO and NFI reports either, what exactly is Joustra doing – is he telling the truth? Is he broadcasting propaganda? Is he lying? Is he covering up for a crime?

In the absence of the evidence required to substantiate what the DSB chairman is broadcasting, is the likelihood that Joustra is concealing who perpetrated the crime equal to the probability that he is telling the truth? And if there is such a chance that Joustra is concealing or covering up, is this evidence that Joustra may be committing a crime himself? In English law, that may be the crime of perverting the course of justice. In US law, it might be the crime of obstruction of justice. In German law, it might be the crime of Vortäuschung einer Straftat. By the standard of World War II, Joustra’s crime might be propagandizing for the losing side, that’s to say the enemy of the winning side.

When William Joyce, an Anglo-American broadcaster on German radio during the war and known as Lord Haw-Haw, was prosecuted in London in 1945, he was convicted of treason and hanged. The treason indictment said he “did aid and assist the enemies of the King by broadcasting to the King’s subjects propaganda on behalf of the King’s enemies.” The legality of this indictment and the conviction was upheld by the Court of Appeal and the House of Lords.

They’re going to die like flies.

• Stranded in Cold Rain, a Logjam of Refugees in the Balkans (NY Times)

After weeks of warnings about the dangers involved in Europe’s migrant influx, and fears about winter’s arrival, the worries of public officials and humanitarian groups were realized on Monday when thousands of asylum seekers, many of them families with small children, began to back up at crossings and were stranded in a chilly rain. The backups came just two days after Hungary closed its border with Croatia, and occurred as countries on the north end of the Balkan route tightened border controls while states to its south quarreled over how to manage the unabated human flow into Europe.

The logjam followed a month of relative stability across the Balkans and Central Europe, as countries unofficially worked together to create a safe and relatively quick route north and west by transporting asylum seekers by bus or train from one border to the next, where they could exit on their way toward Germany, Sweden and other desired destinations. The arrangement filled the void left by the European Union, which has talked, bickered and failed to come up with a common solution to the problem of accommodating hundreds of thousands of new arrivals, many fleeing war in Syria, Iraq and Afghanistan, or repression in places like Eritrea in northern Africa.

A recent effort to stem the flow of migrants by keeping them in Turkey, and preventing them from entering the European Union through Greece, faltered over the weekend, when little progress was reported in talks between Chancellor Angela Merkel of Germany and Turkish leaders. No other plans appear to be on the table, and the safety of the migrants has depended upon the cooperation of the countries along the route, many of them dubious about the migration from the start and resentful that Germany has encouraged it by agreeing to accommodate asylum seekers. That policy by the government of Ms. Merkel has created tensions in Germany, as well, where the weekend stabbing of the politician in charge of refugee affairs in Cologne heightened the polemics surrounding the influx.

“I could get there and back for just €30. That’s because I’m British. I am not Syrian, Afghan, Palestinian, Iraqi, Somali or Eritrean.”

• Without Safe Access To Asylum, Refugees Will Keep Risking Their Lives (Crawley)

I stood in the corner of a dusty cemetery on the Greek island of Lesvos and watched a mother bury her child. As the tiny body of a baby boy wrapped in a white sheet was lifted from the boot of a car, she fell to her knees and howled with pain. The child had slipped from her arms into the cold waters of the Aegean as she made the journey from Turkey to join her husband, who had already travelled to Germany to seek protection from the war that is ravaging their home country, Syria. Her baby should not have died. The journey from Turkey to Lesvos is short and safe. If I wanted to take a ferry trip from the port of Mytiline to Ayvalik on the Turkish coast, the trip would take around an hour. I could get there and back for just €30. That’s because I’m British. I am not Syrian, Afghan, Palestinian, Iraqi, Somali or Eritrean.

I am not required to put my life at risk by paying a smuggler hundreds or even thousands of euros to sit in the bottom of a motorised dingy with 30 or 40 other people to take the exact same journey. I do not need to close my eyes and pray that my children and I will make it to the other side without drowning. After a long summer of protracted negotiations about how to respond to the crisis in the Mediterranean region, this is what European asylum policy still looks like in practice. Although (most) EU member states have reluctantly agreed to redistribute 160,000 of those who have already arrived, there is still no legal route for refugees to enter Europe. And with no hope of a better life at home, thousands of people continue to make the illegal, expensive and potentially dangerous journey across the sea. They know the risks, but the water seems like a better option than the alternatives.

Although Turkey offers temporary protection to Syrian refugees, it is not a signatory to the 1967 Protocol which extends the protection available under the 1951 Refugee Convention to those coming from outside Europe. That means no guaranteed access to employment, education or even basic health care. Conditions for Syrian refugees in Turkey are well documented and known to be deteriorating. There is no prospect that things will improve, no hope for a better future. Those who are not from Syria get nothing. And so they come to Europe. Since the beginning of 2015, more than a quarter of a million people have arrived on Lesvos by sea, and still more are coming. More than 70,000 people arrived in September alone and, according to the International Organisation for Migration (IOM), the numbers are set to be even higher for October.

Cattle trade.

• Merkel In Turkey: Trade-Offs And Refugees (Boukalas)

The gilded thrones may have been the perfect expression of Turkish President Recep Tayyip Erdogan’s sultanic ambitions but they appeared to make his guest, Angela Merkel, somewhat uncomfortable judging by the customary photographs. Maybe the German chancellor was thinking that such a lavish setting was not appropriate for discussing the fate of thousands of people whose only surviving assets are their bodies, their children and whatever dollars or euros they have managed to save up to pay their traffickers. Maybe Merkel, as she sat in the kind of showy opulence that usually reveals something deeper, was thinking that she was being used by the Turkish president as a propaganda tool, that her presence in Istanbul just a few days before elections in Turkey was giving Erdogan a powerful boost.

Particularly at a time when the Turkish government is facing so many accusations: of waging war against the Kurds and brushing off every proposal for a peace settlement in a bid to appeal to those who want authoritarian rule; of racism and intolerance; of persecuting its political rivals; and of quashing free speech by cracking down on “unorthodox” journalists who don’t propagate the Erdogan narrative. Merkel cannot be unaware of all this, and even if her own advisers failed to brief her 100 Turkish university professors did in an open letter. Let us accept that on a mission during which she was not just representing Germany but the EU as a whole, Merkel decided to strike a concessionary tone for the sake of the issue at hand: the protection of the refugees, or, rather, the stemming of the flow of refugees.

The idea is that the refugee influx will abate not as a result of peace in Syria but by convincing Turkey to be more vigilant of its borders, to accept the creation of camps on its territory where refugees can be identified and documented and to grant passage to Europe to those who are deemed eligible for refugee status. It is a technical solution to a political problem; ergo, no solution at all. Turkey, naturally, did not just demand financial remuneration for its cooperation. It asked that its own people be given easier to access to Europe. And it got it. It asked that its European accession be speeded up even though it has fulfilled only a handful of the 40 criteria. And it was promised this would happen by the most powerful voice in Europe: the German one.

And what about the refugees? If only they had been the main topic of discussion at that meeting. Instead, they will keep drowning. And if the complex war in Syria continues unabated, even the winter will not prevent them from trying to get across.

Most shocking: nobody’s shocked by dead babies anymore.

• Greek Coast Guard Rescues 2,561 Migrants Over The Weekend (AP)

Greece’s coast guard says it has rescued 2,561 people in dozens of incidents in the eastern Aegean over the weekend as Europe’s refugee crisis continues unabated. The coast guard said Monday the rescues occurred in 69 operations from Friday morning until Monday morning near eight Aegean islands. The number doesn’t include those who make it ashore themselves from the nearby Turkish coast, often in overcrowded and unseaworthy vessels. On Sunday, the bodies of two women, a baby and a teenager were recovered near the remote island of KastelLorizo after their vessel overturned, while 12 others were rescued by a passing sailing boat. The deaths came a day after a 7-year-old boy died after falling into the water from a boat carrying 80 people who reached the island of Farmakonisi.

Home › Forums › Debt Rattle October 20 2015