Pablo Picasso Guernica [Study] III 1937

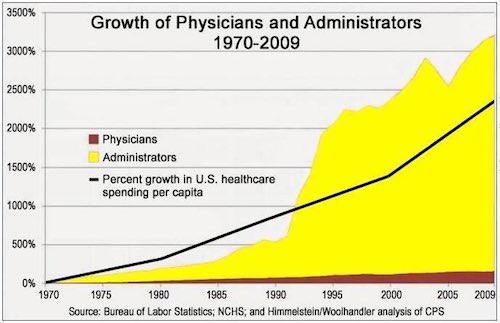

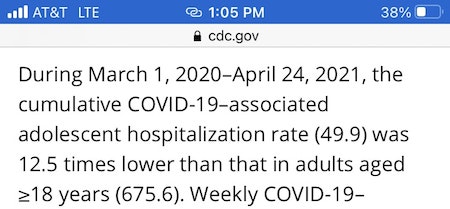

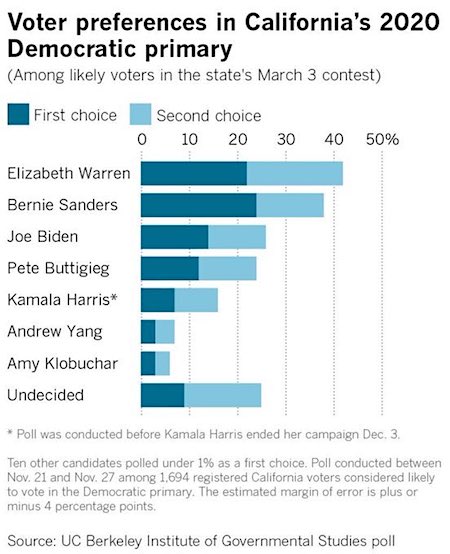

Health care

An American experiences universal health care pic.twitter.com/xTuFPQ8BR4

— Dr. Glaucomflecken (@DGlaucomflecken) July 14, 2022

“Syria, which refused to get the message too, asked the Russians for help. The Russians helped Syria, and now nobody is afraid of the US any more. Meanwhile, the US became spoiled by all this free money, grew fat, lazy, degenerate and weak and amassed the hugest pile of “debt”…”

• Old Way, New Way (Dmitry Orlov)

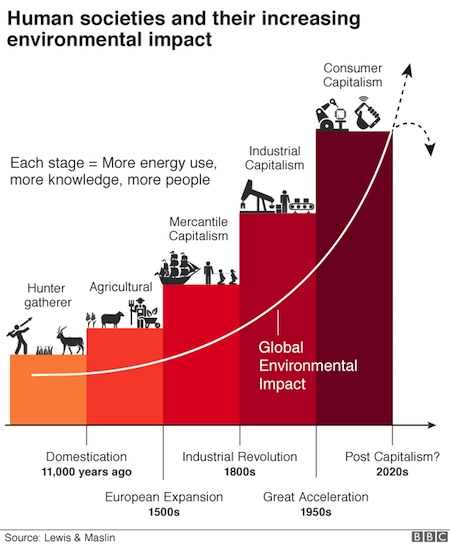

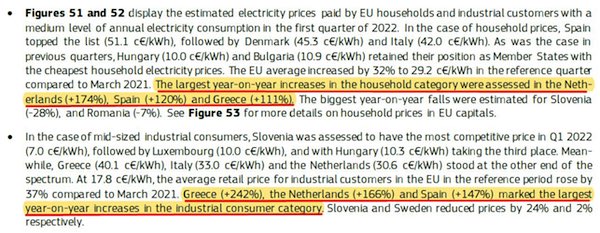

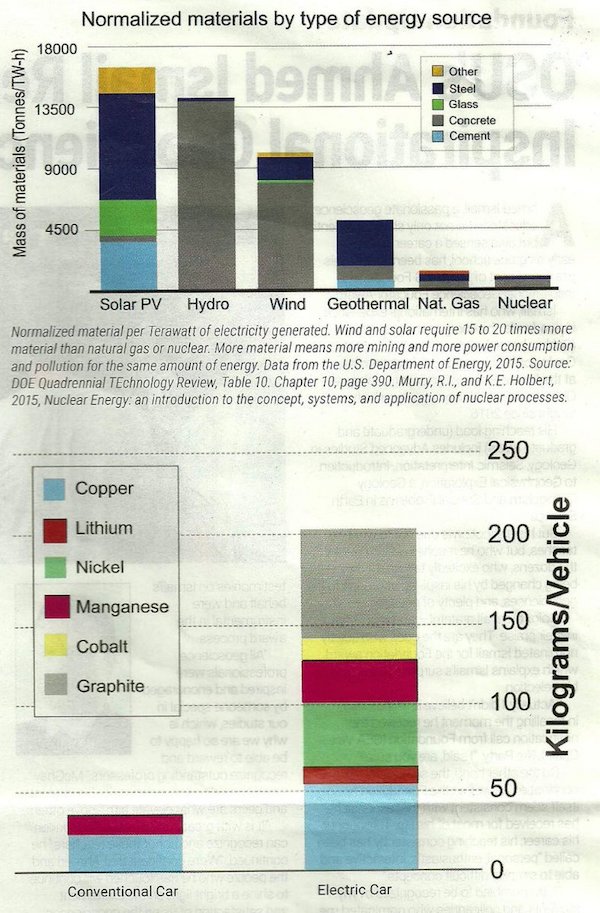

The hardest part of living through a time of wrenching change is that nobody particularly bothers to inform you that the times have changed and that nothing will be the same again. Certainly not the talking heads on TV, who are often the last to know. You have to figure it out for yourself if you can. But I am here to help. It all has to do with energy. Not with technology—that’s incidental; not with military superiority—that’s fleeting and largely imaginary; certainly not with any sort of political or cultural self-righteousness—that’s delusional. There is no substitute for energy. If you run low, you can’t switch to running your industrial economy on fiddlesticks. It just shuts down. What’s worse, energy sources are not even particularly substitutable for each other. If you run low on gas, you can’t just switch to coal or to dried dung, even if you are up to your neck in it.

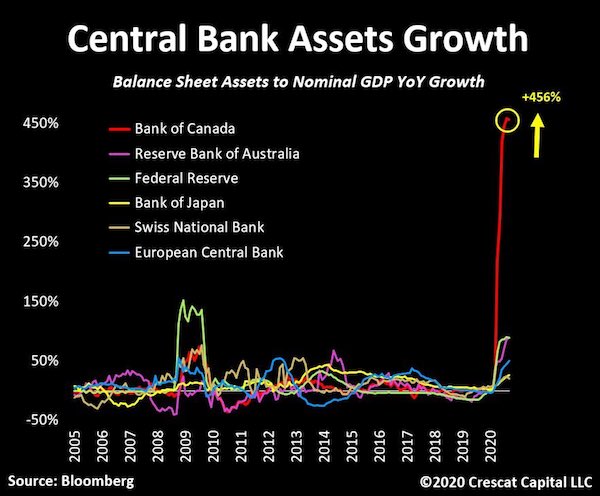

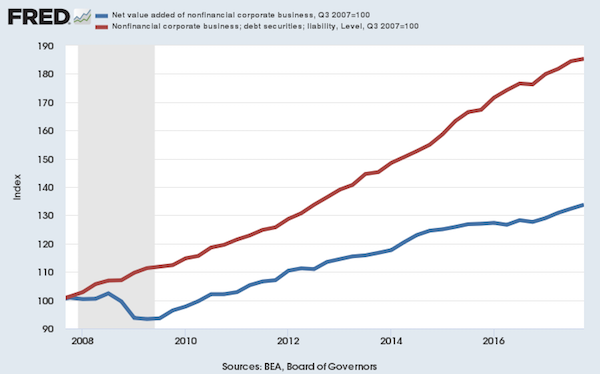

Modern industry runs on oil, natural gas, and coal, in that order, and they can be substituted for each other in very limited ways. Furthermore, energy has to be very cheap. Oil has to be about the cheapest liquid you can buy—cheaper than milk; cheaper even than bottled water. If energy isn’t cheap enough, then all the energy-hungry industry that runs on it becomes unprofitable and shuts down. That’s the stage at which we are now in much of the world. So, what happened? Once upon a time the US produced most of the oil in the world. But then the prolific wells in West Texas ran out and Saudi Arabia took over as the biggest oil producer. But the US wasn’t about to take that sitting down and hatched an ingenuous plan: Saudi Arabia will sell its oil for printed US dollars, then take most of those dollars and give them back to the US by “investing” it in US “debt”.

Everybody else who needed oil had to figure out a way to earn US dollars to buy it, and any US dollars they had left over after buying oil also had to be used to buy up US debt just because: “Nice economy you have there! Now we wouldn’t want anything bad to happen to it, would we?” Indeed, a few people didn’t get the message (Saddam of Iraq, Qaddafi of Libya) and got their countries bombed. And a whole lot of other defenseless countries got bombed just to keep the others scared. But then Syria, which refused to get the message too, asked the Russians for help. The Russians helped Syria, and now nobody is afraid of the US any more. Meanwhile, the US became spoiled by all this free money, grew fat, lazy, degenerate and weak and amassed the hugest pile of “debt” (in quotes because there is no question of ever repaying it) in all of human history.

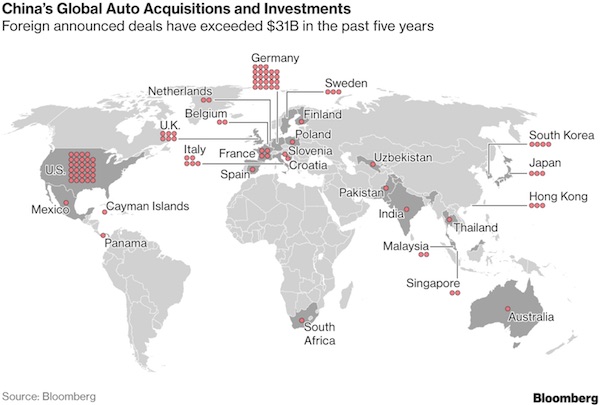

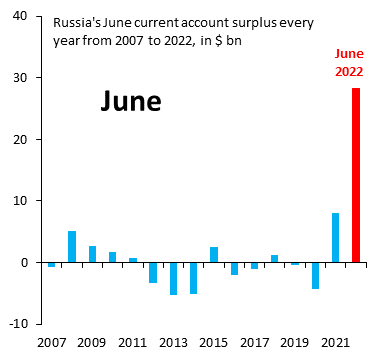

In the meantime Russia, being the largest energy-producing country in the world, decided that it has had enough. Under the old scheme, Russia exported its resources cheaply, spend 1/3 of the revenue on imports and allowed 2/3 to leak out of the country, quite a lot of it also used to buy US “debt”. It couldn’t do anything about this right away, and so it spent the last decade developing its military to a point where now the US/NATO are afraid to go near it and its economy to a point where it doesn’t need much of the imports, at least not for a few years. And then a silly thing happened: the US confiscated Russia’s holdings of US “debt,” making everyone in the world take notice and start dumping it—even the Japanese!—sending the entire financial scheme into a tailspin.

Meanwhile, Russia has started to switch from selling its energy exports for dollars and euros, which then leave the country, where they can be confiscated, to selling them for rubles, which stay inside the country. Do you want to buy some Russian energy? Well, figure out how to earn some rubles! And if your own anti-Russian sanctions prevent you from doing so—well, la-di-da, whose fault is that? Also, given that there is now a worldwide energy shortage, the Russians asked themselves: Why sell lots of oil and gas for a little money when you can sell less of them for more money?

As Dmitry writes: “Do you want to buy some Russian energy? Well, figure out how to earn some rubles!”

• Russia Continues To Earn More By Exporting Less Oil (ZH)

Russian export revenues in June rose by $700m to the $20 billion mark, despite that oil exports fell by 250k b/d m/m to 7.4m b/d, the lowest since August 2021, Bloomberg’s Sherry Su reports citing the IEA’s latest Oil Market Report. Compared to a post-war peak level in April, total Russian oil exports in June were down 530k b/d, Or 7%, but export revenues were up by $2.3 billion, or 13%. Crude oil exports were down by 250k b/d in June to just above 5m b/d, still slightly higher than the pre-war average level according to Su. Shipments to the EU fell below 3m b/d for the first time since November 2020, bringing the EU share of Russian oil exports to 40%, compared to 49% in January-February.

Crude oil loadings to EU destinations fell 190k b/d m/m to 1.8m b/d, partly because of lower offtake on the Druzhba pipeline due to maintenance at a Hungarian refinery in June. Meanwhile, product loadings to the European Union fell by 135k b/d to 1.13m b/d, the IEA said. The fall in crude oil volumes came mostly from lower loadings on the Black Sea, as Rosneft’s 240k b/d Tuapse refinery reportedly came back online in June after a three-month shutdown. Total product exports out of Russia were relatively unchanged in June. Diesel exports increased slightly m/m to 825k b/d, 300k b/d lower than the pre-war average. Diesel Loadings to EU countries ticked up to 650 kb/d, returning to January-February average levels.

Assisted suicide.

• Germany To Halt Russian Coal Imports Next Month (ZH)

Germany will stop importing Russian coal from August 1 and crude oil from December 31, the country’s deputy finance minister, Joerg Kukies said today, as quoted by Reuters. “We will be off Russian coal in a few weeks,” Kukies said at the Sydney Energy Forum, which is taking place this week. “Anyone who knows the history of the Druzhba pipeline, which was already a tool of the Soviet empire over eastern Europe, ridding yourself of that dependence is not a trivial matter, but it is one that we will achieve in a few months,” he added. Kukies admitted, however, that replacing Russian hydrocarbons, not only in Germany, will be no easy task, citing the fact that together, the United States and Qatar could only supply some 30 billion cu m of natural gas equivalent to Europe, which imports more than 150 billion cu m of Russian gas annually.

Despite the challenge, Germany is in a rush to build LNG import terminals so it can replace at least part of Russian gas imports with liquefied gas from abroad. The problem here is, however, tightening supplies, with Freeport LNG in the U.S. offline until at least September, and Shell’s Prelude in Australia shut down amid industrial action. Demand for gas in Germany and Europe as a whole remains strong as governments seek to fill up their gas storage caverns ahead of the next heating season. Germany, specifically, is also on edge after Gazprom stopped the flow of gas via the Nord Stream 1 pipeline this week for regularly scheduled maintenance. Fears are that it will not turn the taps back on once the maintenance is done.

The suspension of coal and oil purchases from Russia is a result of sanctions the EU placed on Moscow earlier this year, providing buyers of the commodities with a temporal cushion of six months for each, so they could stock up on coal and oil before the respective embargos kicked in.

The European Commission has a tail between its legs.

• Lithuania To Allow Rail Transit Of Russian Goods To Kaliningrad (ZH)

It seems that saner minds are prevailing after ratcheting rhetoric coming from Moscow threateningly elevated Lithuania’s effective blockade of all overland trade and goods to an ‘act of war’ by the West… as the European Union is now refusing to back the full extent of Lithuania’s sanctions enforcement measures. The European Commission issued its legal guidance on the standoff Wednesday, which had over the past month resulted in some one million Russian citizens in the exclave remaining cut off from products brought by rail and road. “The transit of sanctioned goods by road with Russian operators is not allowed under the EU measures. No such similar prohibition exists for rail transport,” the European Union executive said, specifying that Russian goods should continue to be allowed by train.

“The Commission underlines the importance of monitoring the two-way trade flows between Russia and Kaliningrad … to ensure that sanctioned goods cannot enter the EU customs territory,” it added, emphasizing further that the rail exception doesn’t apply to weapons or munitions. The ban on transit still exits for freight brought by road, however. The EU said further this should be done through “targeted, proportionate and effective controls and other appropriate measures.” There was the additional caveat to the ruling that EU trade sanctions would not apply as long as Russia’s transport volumes do not exceed averages of the last three years, according to the “the real demand for essential goods at the destination.” It remains that food and humanitarian goods were reportedly never subject to the sanctions, nor was travel of citizens back-and-forth.

Lithuania’s government soon after the EU legal advice was issued said that it would adhere to it, albeit perhaps grudgingly: “Lithuanian Foreign Ministry said on Wednesday the previous trade rules, which blocked many sanctioned cargos from transport between mainland Russia and Kaliningrad, were “more acceptable”. “Kaliningrad transit rules may create an unjustified impression that the transatlantic community is softening its position and sanctions policy towards Russia”, the statement said. On Monday Russian President Vladimir Putin and his Belarusian counterpart Alexander Lukashenko during a phone call agreed to a “possible joint response” to the blockade of transit to Kaliningrad by Lithuania. Without elaborating on details, but sounding ominous given threat of near future action, a Kremlin statement said of the call, “Emphasis was placed on the situation relating to the illegal restrictions imposed by Lithuania on the transit of goods to the Kaliningrad Region. In this context, some possible joint steps were discussed.”

As western governments fail and fall, “the other side” unites.

Iran, Argentina, Saudi Arabia, Turkey, and Egypt add another 350 million people to the 3.2 billion already in BRICS.

• Three More Countries Set To Join BRICS (RT)

Saudi Arabia, Turkey, and Egypt plan to join BRICS, and their potential membership bids could be discussed and answered at next year’s summit in South Africa, Purnima Anand, the president of the organization, told Russian media on Thursday. “All these countries have shown their interest in joining [BRICS] and are preparing to apply for membership. I believe this is a good step, because expansion is always looked upon favorably; it will definitely bolster BRICS’ global influence,” she told Russian newspaper Izvestia. The BRICS nations (Brazil, Russia, India, China, and South Africa) account for over 40% of the global population and nearly a quarter of the world’s GDP. The bloc’s stated purposes include promoting peace, security, development, and cooperation globally, and contributing to the development of humanity.

Anand said the issue of expansion was raised during this year’s BRICS summit, which took place in late June in Beijing. The BRICS Forum president said she hopes the accession of Saudi Arabia, Turkey, and Egypt will not take much time, given that they “are already engaged in the process,” though doubts that all three will join the alliance at the same time. “I hope that these countries will join the BRICS quite shortly, as all the representatives of core members are interested in expansion. So it will come very soon,” Anand added. The news of the three nations’ plans to join BRICS comes after Iran and Argentina officially applied for membership in late June, with Iranian Foreign Ministry spokesman Saeed Khatibzadeh touting the bloc as a “very creative mechanism with broad aspects.”

Italian president has refused Draghi’s resignation. Here’s why:

“President Sergio Mattarella cannot accept the prime minister’s resignation without himself departing. Mattarella only agreed to remain so long as the Draghi coalition would stand….”

British Prime Minister Boris Johnson resigned. Days later, former Japanese Prime Minister Shinzo Abe was assassinated. A few days passed and both the President and Prime Minister of Sri Lanka, resigned and fled the country. Today, with their ruling governments in a state of turmoil, Estonian Prime Minister Kaja Kallas and Italian Prime Minister Mario Draghi have both tendered their resignations. The collapse of each of these national leaders is not necessarily connected; however, the global political system is reverberating with tremors directly connected to the post-pandemic economic turmoil. It would be naïve not to see these governing issues as consequences. The legitimacy of the governing class is slipping; perhaps it would be fair to say, some have ‘lost’ their legitimacy altogether.

Estonia is part of the EU and a member of NATO. Italy is a member of the G7, a part of the EU and a member of NATO. The parliamentary coalitions are fracturing. New alliances are being formed. One recent example that stunned everyone in the EU was the far-right and far-left in the French parliament joining forces to defeat the coalition government of Emmanuel Macron as he tried, and failed, to extend emergency COVID rules. The COVID rules in France are set to expire on July 31st. The first parliamentary goal for President Macron was to extend the COVID emergency and keep his powers. However, the legislative effort was rejected by 219 votes to 195, destroying the goals of Macron. Both populist groups joined forces to defeat the Macron coalition.

Yes, amid all of the economic damage created by western leaders and their Build Back Better efforts, the geopolitical world is having spasms as the rulers are being rejected by the ruled. In the parliamentary systems, the voices of the angry people are rising up. Those shouts are entering the halls of government through the direct representatives closest to the people. The ruling coalitions are no longer able to hold together as the people demand change. That is the connective tissue behind these resignations and departures. Western government leaders like Joe Biden, Justin Trudeau, Emmanuel Macron, Boris Johnson and Jacinda Ardern have the audacity to stand atop a two-year mountain of unilateral fiats, rules, regulations and mandates and then decry “autocracy” and threats to the “global order.” All of them have destroyed their own legitimacy by pretending to represent western democracy while carrying out two years of totalitarian power.

Little man just got a little littler..

• Macron’s Minority Government Defeated on Vaccine Passports (SN)

French President Emmanuel Macron suffered a humiliating setback in parliament after his vaccine passport scheme was defeated. Macron’s minority government wanted to extend the policy whereby anyone entering France has to show proof of vaccination or a negative Covid test. However, the right-wing populist National Rally (RN), the hard-left La France Insoumise (LFI) and the right-wing Republicains (LR) all united to vote against the policy. Macron’s government lost the vote by a margin of 219 votes to 195. “The bill’s defeat was met with wild cheering and a standing ovation from opposition lawmakers, in footage that was widely circulated on social media,” reports the Telegraph. The bill was one of the first put to parliament by the new minority government, highlighting how Macron will find it incredibly difficult to get new laws passed in the country.

Elisabeth Borne, the French Prime Minister, condemned the vote. “The situation is serious. By joining together to vote against the measures to protect the French against Covid, LFI, LR and RN prevent any border control against the virus. After the disbelief on this vote, I will fight so that the spirit of responsibility wins in the Senate,” she tweeted. As we previously highlighted, the French Minister of Health admitted that vaccine passports are a “disguised” form of mandatory vaccines, despite President Macron claiming vaccine mandates “will not be compulsory.” On the first day the new program was in place, police in Paris were visibly patrolling bars and cafes demanding customers show proof they’ve had the jab. It later emerged that many businesses were refusing to enforce the scheme.

He’s calling it out over himself.

• Don Lemon: Republicans Must Be Treated As Danger To Society By Media (Fox)

Appearing on CNN’s New Day Thursday morning, Don Lemon once again urged the media to hold Republicans to a different standard than Democrats in their media coverage. The primetime host tied the GOP to the threat of “growing extremism” on the right. He warned journalists to not give a “false equivalence” to both sides, and instead acknowledge Republicans were endangering America. “We sit around and we talk about these things and we want to give this false equivalence to Democrats and Republicans. That is not where we are right now. Republicans are doing something that is very dangerous to our society and we have to acknowledge that. We have to acknowledge that as Americans, we must acknowledge that as journalists because if we don’t, we are not doing our jobs,” Lemon declared.

A Pew survey of nearly 12,000 journalists found that a majority of journalists, 55%, reject the idea that both sides “always deserve equal coverage.” Lemon was referring to Republicans who continue to support former President Trump after the January 6, 2021 riot at the Capitol, as well as the recent Supreme Court ruling to overturn Roe v. Wade. “They have to answer for those questions if they come here on CNN, they must answer for that. If they go on MSNBC, they must answer for that. If they go on ABC, they must answer for that. And they cannot expect to be coddled when they go on to a news organization or if they step in front of a crowd of supporters or voters or Americans.” He made a similar plea in June, saying, “we cannot pretend as journalists” that both sides are “equal.”

Lemon referred to an interview he did with a former spokesperson for the Oath Keepers saying Republicans had become associated with “extremists.” He rejected any Republican opposition to that belief. “You have the inmates running the asylum basically. You have the extremists because I know there are Republicans sitting out there going, ‘Don Lemon that’s not what we are.’ Maybe it’s not what you are but it’s what party has become and what you have allowed to happen,” he lectured.

Excuse me?! “..the House Select Committee on January 6 (whose hearings are the runaway TV-ratings hit of the summer)..”

The runaway TV-ratings hit that nobody watches…

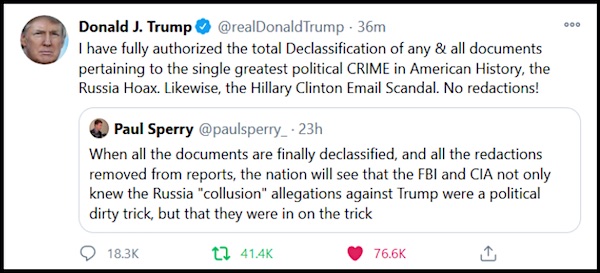

• Donald Trump on 2024: ‘I’ve Already Made That Decision’ (NYMag)

Donald Trump was impeached twice, lost the 2020 election by 7,052,770 votes, is entangled in investigations by federal prosecutors (over the Capitol insurrection and over the mishandling of classified White House documents and over election interference) and the District of Columbia attorney general (over financial fraud at the Presidential Inaugural Committee) and the Manhattan district attorney (over financial fraud at the Trump Organization) and the New York State attorney general (over financial fraud at the Trump Organization) and the Westchester County district attorney (over financial fraud at the Trump Organization) and the Fulton County, Georgia, district attorney (over criminal election interference in Georgia) and the Securities and Exchange Commission (over rules violations in plans to take his social-media company public through a SPAC) and the House Select Committee on January 6 (whose hearings are the runaway TV-ratings hit of the summer), yet on Monday, July 11, he was in a fantastic mood.

It was a beautiful day in Bedminster, New Jersey, where the former president maintains a golf club and private estate to which he decamps when the Palm Beach humidity and the habits of snowbirds shut down Mar-a-Lago for the Mother’s Day–to–Labor Day summer season, and it had been a beautiful weekend, too, one he said affirmed the choice he had made about his own future, the future of the Republican Party, and — whether he wins this time or if he loses as sorely as before — the future of the American experiment. At a rally in Alaska on Saturday, he told me by phone, his fans were adoring. “More love,” in his words, “than I’ve ever had before.” His voice was humming with excitement. He was still in awe.

After all of this time, after so many rallies, so many crowds, so many winding speeches and chants of “Lock her up” and “USA” and “Build the wall” and the familiar sounds of “Tiny Dancer” and “Memory” (from Cats) and “You Can’t Always Get What You Want” and “YMCA” and that goofy little dance and the delusion and the fervor so great that it built up to an attack on the Capitol and the democratic process at the center of the Republic itself, the novelty of this had not faded. As a technical matter, the Anchorage event was on behalf of Sarah Palin and Kelly Tshibaka, Trump-endorsed candidates for the U.S. House and U.S. Senate, respectively, but like all such endeavors, it was for its star a means of discerning through a vibe check what traditional polls could not so reliably or completely tell him.

And what it told him this time, he said, is that his voters — a portion of the electorate that he insists amounts to a majority of the country, though it does not — want to, and will, bring him back to power. “Look,” Trump said, “I feel very confident that, if I decide to run, I’ll win.”

The Chinese didn’t buy real estate as an investment, but as an insurance. Xi must beware.

• “Disgruntled” Chinese Homebuyers Refuse To Pay Their Mortgages (ZH)

While US snowflakes are all too happy to talk the talk (which remains free, even despite Biden’s hyperinflation), Chinese residents are increasingly walking the walk. First, it was the violent outcry against mandatory covid vaccines that put an end to Beijing’s desire to forcibly innoculate all Beijing residents in just 48 hours – a feat not all of America’s armed militias have been able to achieve, and now it’s a grassroots push for what appears to be a debt jubillee as millions of homeowners suddenly stop paying their mortgages, a shocking move that has sent shockwaves across China’s capital markets and has sparked panic within China’s political leadership circles.

As Bloomberg reports overnight, a rapidly increasing number of “disgruntled Chinese homebuyers” are refusing to pay mortgages for unfinished construction projects, exacerbating the country’s real estate woes and stoking fears that the crisis will spread to the wider financial system as countless mortgages default. According to researcher China Real Estate Information, homebuyers have stopped mortgage payments on at least 100 projects in more than 50 cities as of Wednesday, up from 58 projects on Tuesday and only 28 on Monday, according to Jefferies Financial Group Inc. analysts including Shujin Chen. “The names on the list doubled every day in the past three days,” Chen wrote in a note published Thursday.

“The incident would dampen buyer sentiment, especially for presold products offered by private developers given the higher risk on delivery, and weigh on the gradual sales recovery.” What’s behind this grassroot movement to halt mortgage payments altogether? Negative equity: “Analysts believe that a drop in home values may be another driver for the refusal to meet mortgage payments. “Investors are concerned about the spread of mortgage payment snubs to buyers, simply due to lower property prices, and the impact on property sales,” Chen wrote. According to Citi analysts, average selling prices of properties in nearby projects in 2022 were on average 15% lower than purchase costs in the past three years. Meanwhile, it’s only getting worse as China’s home prices fell for a ninth month in May, with June figures set for release Friday.

Here comes Sri Lanka.

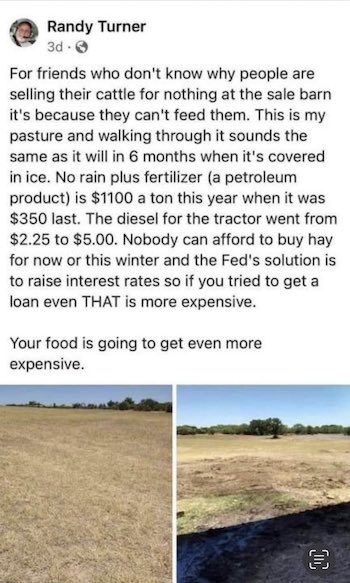

• High Inflation Figure Masks Even Higher Cost Hikes Of Necessities (ET)

The June inflation figure of 9.1 percent, up half a percentage point from May and the highest since 1981, doesn’t tell half the story of how expensive life has become for Americans. The overall figure hides the fact that not all prices have risen uniformly and that products that have become especially expensive also happen to be the ones people usually can’t do without, such as food, fuel, and energy, according to Consumer Price Index data published by the Bureau of Labor Statistics (BLS). Among foodstuffs, margarine and egg prices hiked the most over the 12 months ending in June, up more than 34 and 33 percent, respectively. Trailing behind were butter (up more than 21 percent), flour (up more than 19 percent), and chicken (up more than 18 percent). Milk and coffee were up about 16 percent.

Regular gasoline hiked more than 60 percent, diesel about 76 percent, and fuel oil, which many Americans use to heat their homes, nearly doubled in price. Natural gas went up more than 38 percent and electricity nearly 14 percent. The White House, through President Joe Biden’s Twitter account, on July 13 called the inflation figures “not acceptable” but “outdated,” noting that the average gasoline price had declined about 40 cents per gallon (about 8 percent) over the past 30 days. The products with the most prominent price hikes tend to also suffer supply issues. Gasoline production is constrained by the policies of the Biden administration and the financial elites more generally as part of their efforts to curb carbon emissions.

Egg production has been constrained by the avian flu outbreak that cut the number of laying hens by about 8 percent in recent months. Grain production has been hit with sky-high fertilizer prices and herbicide shortages. Higher grain prices, in turn, show up not only in bakery goods and flour, but also in the cost of animal feed, which then hits meat and milk prices, too. Normally, consumers respond to higher prices by tightening their belts—consuming less—which in turn leads prices down. But because of the lavish federal spending packages during the COVID-19 pandemic, consumer demand has been artificially boosted. Prices will have to go up relatively steeply for another year or two before the productivity of the economy catches up with all the newly printed money, some economists have predicted.

Some prices, it appears, have already peaked. Beef steaks, for instance, hiked by more than 30 percent between October 2019 and October 2021 but are down about 5 percent since then. Similarly, car and truck rental prices went up more than 70 percent from July 2020 to July 2021 but have since dropped by about 11 percent.

Those lines will get much longer.

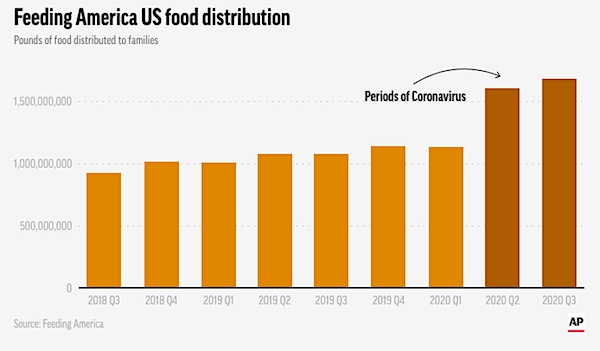

• Long Lines Are Back At US Food Banks (AP)

Long lines are back at food banks around the U.S. as working Americans overwhelmed by inflation turn to handouts to help feed their families. With gas prices soaring along with grocery costs, many people are seeking charitable food for the first time, and more are arriving on foot. Inflation in the U.S. is at a 40-year high and gas prices have been surging since April 2020, with the average cost nationwide briefly hitting $5 a gallon in June. Rapidly rising rents and an end to federal COVID-19 relief have also taken a financial toll. The food banks, which had started to see some relief as people returned to work after pandemic shutdowns, are struggling to meet the latest need even as federal programs provide less food to distribute, grocery store donations wane and cash gifts don’t go nearly as far.

[..] The Phoenix food bank’s main distribution center doled out food packages to 4,271 families during the third week in June, a 78% increase over the 2,396 families served during the same week last year, said St. Mary’s spokesman Jerry Brown. More than 900 families line up at the distribution center every weekday for an emergency government food box stuffed with goods such as canned beans, peanut butter and rice, said Brown. St. Mary’s adds products purchased with cash donations, as well as food provided by local supermarkets like bread, carrots and pork chops for a combined package worth about $75.

Distribution by the Alameda County Community Food Bank in Northern California has ticked up since hitting a pandemic low at the beginning of this year, increasing from 890 households served on the third Friday in January to 1,410 households on the third Friday in June, said marketing director Michael Altfest. At the Houston Food Bank, the largest food bank in the U.S. where food distribution levels earlier in the pandemic briefly peaked at a staggering 1 million pounds a day, an average of 610,000 pounds is now being given out daily. That’s up from about 500,000 pounds a day before the pandemic, said spokeswoman Paula Murphy said.

Murphy said cash donations have not eased, but inflation ensures they don’t go as far. Food bank executives said the sudden surge in demand caught them off guard. “Last year, we had expected a decrease in demand for 2022 because the economy had been doing so well,” said Michael Flood, CEO for the Los Angeles Regional Food Bank. “This issue with inflation came on pretty suddenly.” “A lot of these are people who are working and did OK during the pandemic and maybe even saw their wages go up,” said Flood. “But they have also seen food prices go up beyond their budgets.”

Well, Rutte says in the Davos video at the bottom that he wants to buy the press.. Sorry the other video is mostly in Dutch.

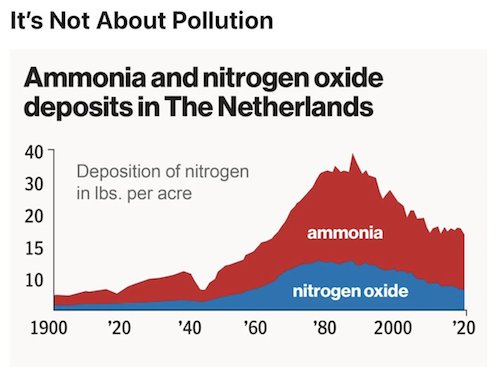

• Dutch State Broadcasters Attack Coverage Of The Dutch Uprising (TCS)

In a video entitled “The Great Reset: the recurring fabrications,” Nieuwsuur, a program produced by government broadcasters, claims that Bexte travelled to the Netherlands to perpetuate supposed conspiracy theories, saying that the WEF has “absolutely nothing” to do with the “nitrogen crisis” — by which they mean the nitrogen policy to cut emissions by 50% and destroy farmers’ livelihoods. “These bloggers from far-right websites have travelled to the Netherlands especially to see that image confirmed,” the host says before playing a clip of Bexte talking about the WEF’s support for the career-destroying nitrogen policy being protested. “But the WEF has absolutely nothing to do with the nitrogen crisis,” he continues. “It was the highest judge who ordered the Netherlands to comply with the nitrogen standards of the European Union.”

Yes, but where did the “nitrogen standards” of the European Union come from? The nitrogen policy that was introduced is just one of many policies being brought forth by the EU to better align with the UN’s radical Sustainable Development Goals to cut all emissions, which is itself part of the UN’s Agenda 2030. According to the European Commission’s website, “Sustainable development is a core principle of the Treaty on European Union and a priority objective for the Union’s internal and external policies. The United Nations 2030 Agenda includes 17 Sustainable Development Goals (SDGs) intended to apply universally to all countries.” Moreover, in an EU briefing entitled “European policies on climate and energy towards 2020, 2030 and 2050,” the European Parliament states the UN’s Sustainable Development Goals will impact European policy, specifically regarding climate policy:

“Within the framework of the commitments laid down in the Paris Agreement, in November 2018, the European Commission published a new long-term strategy which confirms Europe’s commitment to lead on global climate action and to achieving net-zero GHG emissions by 2050, through a socially fair transition in a cost-efficient manner… The strategy does not intend to launch new policies, nor does the European Commission intend to revise the 2030 targets. It is rather meant to set the direction of transition of EU climate and energy policy, and to frame what the EU considers as its long-term contribution to achieving the Paris Agreement temperature objectives, in line with the UN Sustainable Development Goals, which will further affect a wider set of EU policies.”

Now, who has been a core contributor in shaping the UN’s Sustainable Development Goals? Why, the World Economic Forum, of course. In 2019, the WEF and UN signed a strategic partnership “to accelerate the implementation of the 2030 Agenda for Sustainable Development.” “The new Strategic Partnership Framework between the United Nations and the World Economic Forum has great potential to advance our efforts on key global challenges and opportunities, from climate change, health and education to gender equality, digital cooperation and financing for sustainable development,” said UN Secretary-General António Guterres at the time.

So, yes. If the Netherlands is abiding by the EU’s climate policies, and the EU’s climate policies are based on the UN’s Sustainable Development Goals, and the WEF signed a partnership with the UN to control what these goals are, I think it’s safe to say that the WEF absolutely has something to do with the nitrogen policy being protested right now.

Mark Rutte, Prime Minister of the Netherlands in 2020 at the World Economic Forum suggests paying for the salaries of journalists to inform the Dutch on issues like Climate Change.

Where is the Dutch media during the farmer protests? pic.twitter.com/KrNK9FNqFr

— K2 (@kiansimone44) July 6, 2022

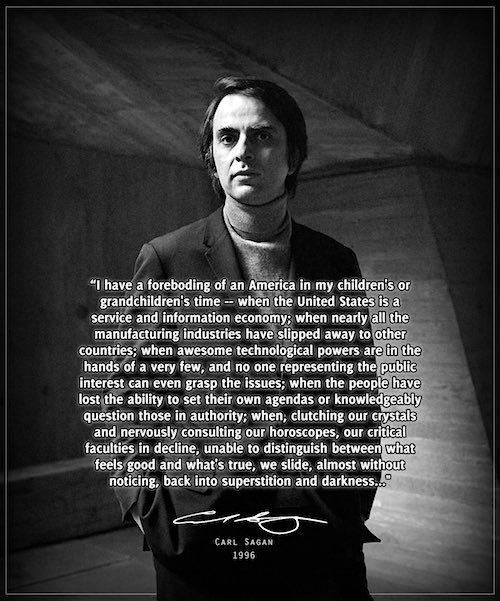

People observe and interpret. Be careful with that.

• It’s About Globalism, Stupid (Maajid Nawaz)

1) Framing is Everything – i) It is No Longer About Brexit – Contrary to what you will read, the UK leadership race is no longer about Brexit. Brexit is done. It will not be undone. Even Labour leader Sir Keir Starmer has told his party that Brexit will not be reversed. This is not to say that Brexit is no longer relevant. It is relevant. It is to say instead that Brexit is not the main impetus for the domestic palace coup that has just unfolded against outgoing PM Boris Johnson.

ii) It is No Longer About Covid – This leadership challenge is also no longer about Covid. The Covid control mechanisms of emergency legislation, supply-chain disruption and the weaponisation of Big Pharma have already served their purpose. As with Brexit, the UK is unlikely to go backwards on Covid policy. Any intervention now from the authorities about Covid will again only serve to keep opponents stuck fighting our last battle, just as the state launches its next psychological war against its own population. This is not to say that Covid policy is no longer relevant. It is relevant. Rather, it is to say again that Covid is not the main impetus for the domestic palace coup that has just unfolded against outgoing PM Boris Johnson.

iii) It is No Longer About War in Ukraine – The UK leadership contest is also not about the war in Ukraine. A keen observer will already notice corporatist media spin turning against deeper involvement, as well as the establishment-liberal US outlets turning sour on Biden. The Ukraine war has served its purpose. Billions have been laundered. Global food and gas shortages have been precipitated. This is not to say that Russia and Ukraine are no longer relevant. They are relevant. This is to say instead that war in Ukraine is not the main impetus for the domestic palace coup that has just unfolded against outgoing PM Boris Johnson. And so what exactly is going on in Britain? Arriving at an answer is only possible if the globalist playbook is understood first.

2) The Global Uprising: Centralisation vs Decentralisation: – Division has been sown after Brexit. Civil norms has been crushed after Covid. The ‘means of production’ have been disrupted after war in Ukraine. What comes next is the purpose they all served: the Great Reset. Combined, these cumulative crises of monumental fiscal suicide, unprecedented supply chain disruption and food and energy shortages are in danger of causing the collapse of the global financial system, sparking truly unprecedented global uprisings. In fact, we are already witnessing this.

[..] The collapse of the global financial system now appears inevitable. It actually collapsed in 2008. What has proceeded since then is merely the execution of a carefully planned, if not vicious, controlled demolition. The demolition is orchestrated by WEF establishment globalists so that their own controlled opposition may steer this global reset towards further centralised tyranny, as opposed to allowing it to enable decentralised democracy. Popular resistance will now be used as a pretext to clamp down and suspend liberty by rolling out militarised forces to subjugate the very conveniently rebelling citizens. [..] This is how the global financial establishment seeks to ride the current global revolution in order to retain their power. We are at the end of a natural generational cycle: a historic turning. We are witnessing the ‘reset’ part of Klaus Schwab’s Great Reset. They have told us what they plan to do. After the reset they will seek to ‘Build Back Better’ in order to create their New World Order.

Marty Makary M.D., M.P.H. and Tracy Beth Høeg M.D., Ph.D.

“I can’t tell you how many people at the FDA have told me, ‘I don’t like any of this, but I just need to make it to my retirement.’”

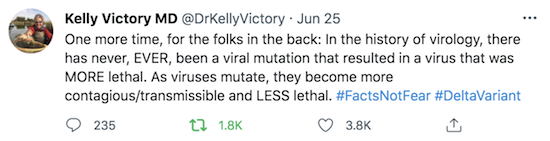

• US Public Health Agencies Aren’t ‘Following the Science,’ Officials Say (CS)

The calls and text messages are relentless. On the other end are doctors and scientists at the top levels of the NIH, FDA and CDC. They are variously frustrated, exasperated and alarmed about the direction of the agencies to which they have devoted their careers. “It’s like a horror movie I’m being forced to watch and I can’t close my eyes,” one senior FDA official lamented. “People are getting bad advice and we can’t say anything.” That particular FDA doctor was referring to two recent developments inside the agency. First, how, with no solid clinical data, the agency authorized Covid vaccines for infants and toddlers, including those who already had Covid. And second, the fact that just months before, the FDA bypassed their external experts to authorize booster shots for young children.

That doctor is hardly alone. At the NIH, doctors and scientists complain to us about low morale and lower staffing: The NIH’s Vaccine Research Center has had many of its senior scientists leave over the last year, including the director, deputy director and chief medical officer. “They have no leadership right now. Suddenly there’s an enormous number of jobs opening up at the highest level positions,” one NIH scientist told us. (The people who spoke to us would only agree to be quoted anonymously, citing fear of professional repercussions.) The CDC has experienced a similar exodus. “There’s been a large amount of turnover. Morale is low,” one high level official at the CDC told us. “Things have become so political, so what are we there for?” Another CDC scientist told us: “I used to be proud to tell people I work at the CDC. Now I’m embarrassed.”

Why are they embarrassed? In short, bad science. The longer answer: that the heads of their agencies are using weak or flawed data to make critically important public health decisions. That such decisions are being driven by what’s politically palatable to people in Washington or to the Biden administration. And that they have a myopic focus on one virus instead of overall health. Nowhere has this problem been clearer—or the stakes higher—than on official public health policy regarding children and Covid. First, they demanded that young children be masked in schools. On this score, the agencies were wrong. Compelling studies later found schools that masked children had no different rates of transmission. And for social and linguistic development, children need to see the faces of others.

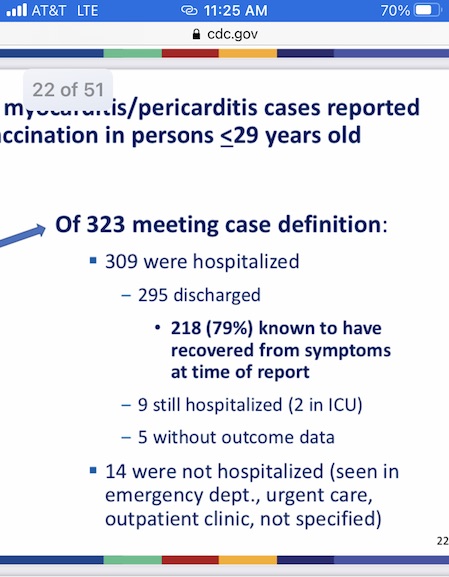

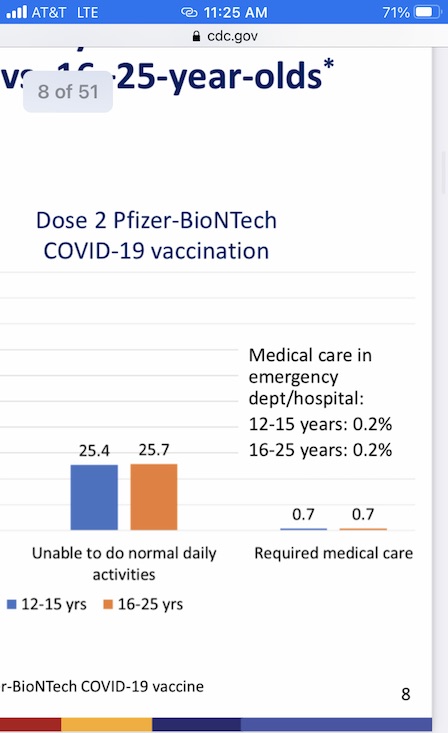

Next came school closures. The agencies were wrong—and catastrophically so. Poor and minority children suffered learning loss with an 11-point drop in math scores alone and a 20% drop in math pass rates. There are dozens of statistics of this kind. Then they ignored natural immunity. Wrong again. The vast majority of children have already had Covid, but this has made no difference in the blanket mandates for childhood vaccines. And now, by mandating vaccines and boosters for young healthy people, with no strong supporting data, these agencies are only further eroding public trust. One CDC scientist told us about her shame and frustration about what happened to American children during the pandemic: “CDC failed to balance the risks of Covid with other risks that come from closing schools,” she said. “Learning loss, mental health exacerbations were obvious early on and those worsened as the guidance insisted on keeping schools virtual. CDC guidance worsened racial equity for generations to come. It failed this generation of children.” An official at the FDA put it this way: “I can’t tell you how many people at the FDA have told me, ‘I don’t like any of this, but I just need to make it to my retirement.’”

Johns Hopkins' Dr. Marty Makary to Tucker Carlson on medical professionals who buck the Covid narrative:

"… they really can't say anything … they know that their jobs are at risk …"

"They feel like they're watching a horror show and they can't close their eyes." pic.twitter.com/C4Fb4O444M

— Scott Morefield (@SKMorefield) July 15, 2022

Morales

https://twitter.com/i/status/1547604089705353218

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.