Harris&Ewing National Emergency War Garden Commission display, Wash. DC 1918

December is Yellen’s final chance to restore credibility.

• Fed Keeps Interest Rates Unchanged But Hints At December Rise (Guardian)

The Federal Reserve on Wednesday kept interest rates unchanged at their record low of near-zero, but raised the likelihood of a rate hike in December by dropping previous warnings about the fragility of the global economy. Following a two-day meeting in Washington, Fed policymakers voted to leave rates at 0-0.25% – where they have been for the seven years since the financial crisis. However, the bank’s Federal Open Market Committee (FOMC), which sets the rate, significantly raised the prospect of a historic rate rise at its next meeting in December by removing cautious statements about unstable international markets could adversely effect the US economy.

In September, following concerns about the health of the Chinese economy, the committee said: “Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term.” This was modified on Wednesday to: “The committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced but is monitoring global economic and financial developments.” The committee specifically pointed towards the possibility of raising rates at its December meeting – the last of 2015.

“In determining whether it will be appropriate to raise [rates] at its next meeting, the committee will assess progress – both realized and expected – toward its objectives of maximum employment and 2% inflation,” it said in the statement. Nine out of 10 FOMC members voted to keep rates unchanged. That is the same proportion as in September with Jeffrey Lacker, the president of the Federal Reserve Bank of Richmond, being the only member to push for a 25 basis points increase.

Does having a mouthpiece at the WSJ give the Fed more credibility?

• Fed Keeps December Rate Hike in Play (Hilsenrath)

Federal Reserve officials explicitly said they might raise short-term interest rates in December, pushing back against investors who have bet that the central bank wouldn’t move this year. The message appeared to have the desired effect. Before the Fed released its policy statement Wednesday, traders in futures markets put about a 1-in-3 probability on a Fed rate increase this year; after the release, that probability rose to almost 1-in-2. While the Fed kept rates steady after its two-day meeting this week, investors appeared to welcome a vote of confidence in the economy from the central bank. Top Fed officials have been saying for months they believed the economy was nearly strong enough to tolerate an increase in the benchmark short-term rate from near zero, where it has been since December 2008. But they have hesitated to move.

The last instance was in September, when the Fed pointed to worries about turbulence in financial markets and uncertainties about growth overseas—particularly in China—as reasons to stay put. “They are trying to tell us that December is still their base case,” said Roberto Perli, an analyst at Cornerstone Macro, a research firm that advises investors. Market and international developments have turned in the Fed’s favor in recent weeks. The People’s Bank of China last week cut short-term lending rates in an effort to boost growth in the world’s second-largest economy. ECB President Mario Draghi suggested he might extend a bond-purchase program in an effort to stimulate his region’s economic growth rate. The moves sparked a global stock-market rally and could support world-wide growth.

The Dow is up 6% since the Fed met last month, a sign financial-market stress has dissipated. The Fed responded Wednesday by playing down its earlier-stated concerns. Officials struck from their policy statement a sentence introduced in September that pointed to market turbulence and global developments as potential restraints on U.S. economic activity. As those concerns recede, the Fed has fewer impediments standing in the way of a rate increase. Though not mentioned in their statement, officials likely took note in their meeting of the recent progress toward an agreement between Congress and the White House on a federal budget and raising the government’s borrowing limit.

If enacted, the budget and debt-limit resolution would reduce uncertainty about the fiscal outlook and boost government spending and short-term economic growth. Officials pointed specifically in the policy statement to their Dec. 15-16 meeting as a moment when they might act on rates. Individual officials have signaled before that they expected to move before year-end, but the Fed’s policy-making committee hadn’t previously pointed so explicitly in an official statement to the potential timing of a rate increase.

Do keep this in mind: “..when the world is offering ‘money’ for free, one can only surmise its worth is also close to zero…”

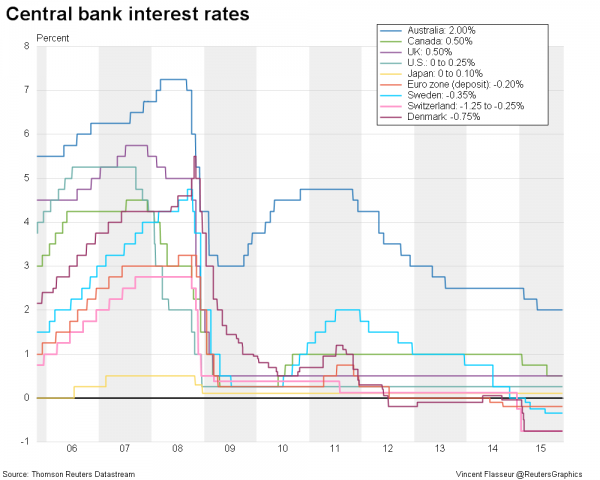

• The Death Of Monetary Policy In 1 Dismal Chart (Zero Hedge)

Perhaps “The Japanification of Monetary Policy” would have been a more appropriate title… “well it didn’t work for them, so we should all try more of it” appears to be the repost of policy-makers worldwide which, inevitably, will lead to the total collpase of their credibility (and th every ‘faith’ of the world’s investors shattered). As the old adage goes “you get what you pay for” and when the world is offering ‘money’ for free, one can only surmise its worth is also close to zero…

TBTF banks like the Fed clueless.

• Inflation Fixated Central Banks Have Lost Their Way (Stephen Roach)

Fixated on inflation targeting in a world without inflation, central banks have lost their way. With benchmark interest rates stuck at the dreaded zero bound, monetary policy has been transformed from an agent of price stability into an engine of financial instability. A new approach is desperately needed. The US Federal Reserve exemplifies this policy dilemma. After the Federal Open Market Committee decided in September to defer yet again the start of its long-awaited normalization of monetary policy, its inflation doves are openly campaigning for another delay. For the inflation-targeting purists, the argument seems impeccable. The headline consumer-price index (CPI) is near zero, and “core” or underlying inflation – the Fed’s favorite indicator – remains significantly below the seemingly sacrosanct 2% target.

With a long-anemic recovery looking shaky again, the doves contend that there is no reason to rush ahead with interest-rate hikes. Of course, there is more to it than that. Because monetary policy operates with lags, central banks must avoid fixating on the here and now, and instead use imperfect forecasts to anticipate the future effects of their decisions. In the Fed’s case, the presumption that the US will soon approach full employment has caused the so-called dual mandate to collapse into one target: getting inflation back to 2%. Here, the Fed is making a fatal mistake, as it relies heavily on a timeworn inflation-forecasting methodology that filters out the “special factors” driving the often volatile prices of goods like food and energy. The logic is that the price fluctuations will eventually subside, and headline price indicators will converge on the core rate of inflation.

This approach failed spectacularly when it was adopted in the 1970s, causing the Fed to underestimate virulent inflation. And it is failing today, leading the Fed consistently to overestimate underlying inflation. Indeed, with oil prices having plunged by 50% over the past year, the Fed stubbornly maintains that faster price growth – and the precious inflation rate of 2% – is just around the corner. Missing from this logic is an appreciation of the new and powerful global forces that are bearing down on inflation. According to the International Monetary Fund’s latest outlook, the price deflator for all advanced economies should increase by just 1.5% annually, on average, from now to 2020 – not much higher than the crisis-depressed 1.1% pace of the last six years.

Steve vs Krugman redux.

• The Unnatural Rate Of Interest -Ultra Wonkish- (Steve Keen)

Paul Krugman’s latest column—“Check Out Our Low, Low (Natural) Rates” (which he didn’t flag as “Wonkish”, even though it is so in spades)—noted that the “natural real rate of interest” was falling, and that this justified the low interest rate set by the Federal Reserve. And this made me think about Karl Marx. Why? Because the “natural real rate of interest” is an unobservable entity—in that it’s not a rate you’ll find charged by any bank, but a rate that has to be statistically derived. But more importantly, it is a fantasy: there is no such thing. However it is required as part of a theory in which the economy returns to equilibrium after it is hit by an “exogenous shock”. So Neoclassical economists—meaning both “New Classicals” and “New Keynesians”, as the two fractious clans in this economic tribe call themselves—have to go in search of this phantom.

Marx had an equally important unobservable fantasy at the heart of his attempt to produce a mathematical version of his own economics: the “Labor Theory of Value”. This is the proposition that all value—and hence all profit—emanates solely from labor. Machinery, Marx asserted, simply passed on the value that had been transferred to it by the labor expended in making it. It is mathematically impossible to reconcile this proposition with the Marxist belief that profit rates in different industries converge (for competitive reasons), when you acknowledge that different industries have different ratios of capital to labor. But Marxist economists have tied themselves up in logical (and illogical) knots over this fantasy for well over a century. However Marxists have something over Neoclassicals in this regard: at least they’re aware that there is an issue.

Even though they continue to cling to this belief, they don’t shy away from acknowledging the conundrum. Neoclassicals, on the other hand, don’t even realize that they might have a problem. Some Marxists attempted to circumvent their conundrum on statistical grounds, while making the dubious assumption that the actual wage corresponded to an important concept in Marxian economics, the “value of labor power” (which strictly speaking is a subsistence wage). The great British scholar Ronald Meek rightly derided this fudge, stating that he was “unconvinced by … redefining `the value of labour-power’ so that it becomes equivalent … to any wage which the workers happen to be getting” The real problem for Marxists was that their model of how the economy operated was simply wrong. Statistical work on this chimera wasn’t going to rescue them from that problem.

Watch video at the link.

• Britain Is Heading For Another 2008 Crash: Here’s Why (David Graeber)

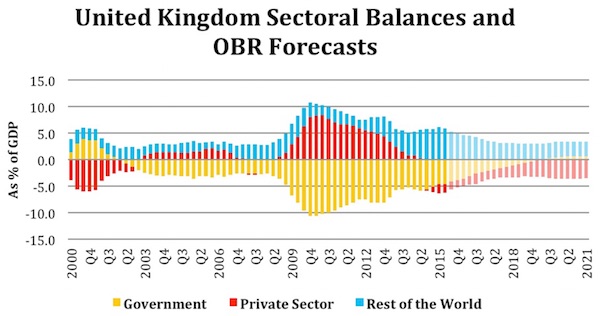

British public life has always been riddled with taboos, and nowhere is this more true than in the realm of economics. You can say anything you like about sex nowadays, but the moment the topic turns to fiscal policy, there are endless things that everyone knows, that are even written up in textbooks and scholarly articles, but no one is supposed to talk about in public. It’s a real problem. Because of these taboos, it’s impossible to talk about the real reasons for the 2008 crash, and this makes it almost certain something like it will happen again. I’d like to talk today about the greatest taboo of all. Let’s call it the Peter-Paul principle: the less the government is in debt, the more everybody else is. I call it this because it’s based on very simple mathematics. Say there are 40 poker chips. Peter holds half, Paul the other. Obviously if Peter gets 10 more, Paul has 10 less. Now look at this: it’s a diagram of the balance between the public and private sectors in our economy:

Notice how the pattern is symmetrical? The top is an exact mirror of the bottom. This is what’s called an “accounting identity”. One goes up, the other must, necessarily, go down. What this means is that if the government declares “we must act responsibly and pay back the national debt” and runs a budget surplus, then it (the public sector) is taking more money in taxes out of the private sector than it’s paying back in. That money has to come from somewhere. So if the government runs a surplus, the private sector goes into deficit. If the government reduces its debt, everyone else has to go into debt in exactly that proportion in order to balance their own budgets. The chips are redistributed. This is not a theory. Just simple maths.

Now, obviously, the “private sector” includes everything from households and corner shops to giant corporations. If overall private debt goes up, that doesn’t hit everyone equally. But who gets hit has very little to do with fiscal responsibility. It’s mostly about power. The wealthy have a million ways to wriggle out of their debts, and as a result, when government debt is transferred to the private sector, that debt always gets passed down on to those least able to pay it: into middle-class mortgages, payday loans, and so on. The people running the government know this. But they’ve learned if you just keep repeating, “We’re just trying to behave responsibly! Families have to balance their books. Well, so do we,” people will just assume that the government running a surplus will somehow make it easier for all of us to do so too. But in fact the reality is precisely the opposite: if the government manages to balance its books, that means you can’t balance yours.

Ambrose is techno-happy incorporated. ‘Save the world for profit!’ But we won’t have the money to do it even if we wanted to.

• Paris Climate Deal To Ignite A $90 Trillion Energy Revolution (AEP)

The fossil fuel industry has taken a very cavalier bet that China, India and the developing world will continue to block any serious effort to curb greenhouse emissions, and that there is, in any case, no viable alternative to oil, gas or coal for decades to come. Both assumptions were still credible six years ago when the Copenhagen climate summit ended in acrimony, poisoned by a North-South split over CO2 legacy guilt and the allegedly prohibitive costs of green virtue. At that point the International Energy Agency (IEA) was still predicting that solar power would struggle to reach 20 gigawatts by now. Few could have foretold that it would in fact explode to 180 gigawatts – over three times Britain’s total power output – as costs plummeted, and that almost half of all new electricity installed in the US in 2013 and 2014 would come from solar.

Any suggestion that a quantum leap in the technology of energy storage might soon conquer the curse of wind and solar intermittency was dismissed as wishful thinking, if not fantasy. Six years later there can be no such excuses. As The Telegraph reported yesterday, 155 countries have submitted plans so far for the COP21 climate summit to be held by the United Nations in Paris this December. These already cover 88pc of global CO2 emissions and include the submissions of China and India. Taken together, they commit the world to a reduction in fossil fuel demand by 30pc to 40pc over the next 20 years, and this is just the start of a revolutionary shift to net zero emissions by 2080 or thereabouts. “It is unstoppable. No amount of lobbying at this point is going to change the direction,” said Christiana Figueres, the UN’s top climate official.

Yet the energy industry is still banking on ever-rising demand for its products as if nothing has changed. BP is projecting a 43pc increase in fossil fuel use by 2035, Exxon expects 35pc by 2040, Shell 43pc and Opec is clinging valiantly to 55pc. These are pure fiction.

The Intergovernmental Panel on Climate Change (IPCC) may or may not be correct in arguing that we cannot safely burn more than 800bn tonnes of carbon (two-thirds has been used already) if we are to stop global temperatures rising two degrees above pre-industrial levels by 2100. I take no view on the science. But this is the goal accepted by world leaders. It is solemnly enshrined in international accords, and while it might once have been possible for energy companies to dismiss these utterings as empty pieties, to persist now is to trifle with fate.“This is a world apart from where we were going into Copenhagen. The centre of gravity has fundamentally and irreversibly shifted,” said Mark Kenber, head of the Climate Group. China switched sides several years ago, not least because it faces a middle class insurrection that has shaken the Communist Party to its core. An estimated 100m people viewed the anti-pollution video “Under the Dome” in just 24 hours before it was shut down by horrified officials in February. The IEA says China invested $80bn in renewable energy last year, as much as the US and the EU combined. It is blanketing chunks of the Gobi Desert with solar panels, necessary to absorb the massive surplus production of its own solar companies. The party’s Energy Research Institute has floated the idea of raising the renewable share of electricity to 86pc by 2050.

What’s that going to do with prices? Deflation equals demand crash.

• China Running Out Of Strategic Oil Reserve Space (Reuters)

About 4 million barrels of crude oil bought by a Chinese state trader for the country’s strategic reserves have been stranded in two tankers off an eastern port for nearly two months due to a lack of storage, two trade sources said. The delays will cost millions of dollars and indicate how China is struggling to import record amounts of crude if storage and port capacity at Qingdao, its largest oil import terminal, are unable to keep pace. Ocean Lily and Plata Glory, two very large crude carriers (VLCCs) carrying oil for Sinochem Corp, arrived at Huangdao, Qingdao’s main oil terminal, in early September, and both were still at anchor this week, waiting to unload. “They are both for SPR (strategic petroleum reserve), but no tank space is available to take that oil in,” said a senior trader familiar with Sinochem’s oil trading.

China’s crude oil imports rose nearly 9% in the first nine months of the year over a year earlier to 6.65 million bpd, driven partly by reserve building. China said late last year the first phase of the government’s emergency stockpile is storing about 90 million barrels of crude oil, with the construction of a second phase due by 2020, partly through private investment. Huangdao is the site of one of China’s first SPR tanks, with space for 20 million barrels of oil and also has plans for a second phase of similar size. A recent move to increase competition for oil imports by granting quotas to independent refineries has added to congestion at Huangdao, where operations were already hampered following a pipeline accident two years ago. “Storage and berths were not ready for such a quick market opening,” the trader said.

“..for all of us that believe in democracy and want to see it reimplemented, the British referendum offers a golden opportunity.”

• Nigel Farage Rages At EU’s Modern Day “Brezhnev Doctrine” (Zero Hedge)

Nigel Farage unleashes another of his must-watch rage-fests aimed at the collapse of democracy in Europe. Amid the stunning “democracy crisis” in Portugal, where, as we detailed here, the government has lost its majority but the anti-EU opposition is being prevented from attempting to form a coalition, Farage fumes “this is the modern day implementation of the Brezhnev Doctrine. This is exactly what happened to states living inside the USSR.” One of his best…

“This is the modern day implementation of the Brezhnev Doctrine. This is exactly what happened to states living inside the USSR . What is being made clear here with Greece and indeed with Portugal is that a country only has democratic rights if it’s in favour of the [European] project. If not, those rights are taken away. And perhaps none of this should surprises us as Mr. Juncker has told us before: there can be no democratic choice against the European treaties. And the German Finance Minister, Mr. Schäuble, has said: elections change nothing – there are rules.

I think for anyone that believes in democracy, Portugal should be the final straw. It should be the warning that this project, [in order to] to protect itself and all its failings, will destroy the individual rights of peoples and of nations. My country has always believed in parliamentary democracy so strongly that twice in the last century it risked everything to fight for parliamentary democracy, not just for Britain but for the rest of Europe too. And I actually believe that for all of us that believe in democracy and want to see it reimplemented, the British referendum offers a golden opportunity.”

The opposition in Portugal might be socialists, but the country is effectively suspending democracy to prevent Eurosceptics with a massive electoral mandate from taking power. As we concluded previously, note what’s happened here. The will of the people is now being characterized as a “false signal” to “financial institutions, investors, and markets.”

Break it up! Break it down!

• British Bookmaker Doubles Probability of Exit From EU (Bloomberg)

The chances of the U.K. leaving the EU have almost doubled in just three months, if the odds from Betfair’s gambling exchange are any indication of sentiment. The probability of a majority vote for leaving the EU has jumped to 36%, from 18.5% at the end of July, based on the odds given to bettors on the outcome of the referendum. While bettors are following the momentum of the polls, it would require a huge swing for so-called Brexit to become the favorite outcome. “A vote in favor of staying in the EU is still the firm favorite at 1.56 (4/7 or a 64% chance), in much the same way as the Scottish Referendum market was predicting a No to independence from very early on,” Betfair spokeswoman Naomi Totten said. “The price for a vote in favor of leaving the EU is the shortest it has been since June, currently trading at 2.76 (7/4 or a 36% chance), but in the context of the market it is still very much assumed that Britain will vote to remain within the EU.”

The West cannot win this.

• Putin Tests English Debt Law as Ukraine Feud Heads to London Court (Bloomberg)

Russia and Ukraine are about to test the boundaries of sovereign-debt litigation in a dispute that could have far-reaching implications for government bailouts the world over. The neighbors are vowing to fight each other in a London court over a $3 billion bond Vladimir Putin bought to reward his Ukrainian ally, Viktor Yanukovych, for rejecting closer trade ties with the European Union two years ago. That move fueled the protests in Kiev that led to Yanukovych’s ouster, Putin’s annexation of Crimea and an insurgency that’s killed 8,000 people. Ukraine’s government, on life support from the IMF, says Russia has until Oct. 29 to agree to the same writedown and extension that Franklin Templeton, which manages the largest U.S. overseas bond fund, and most other creditors accepted this month.

Russia’s Finance Ministry says it won’t negotiate and is shopping for a law firm to file suit as soon as Ukraine makes good on its threat to default when the bond comes due Dec. 20. “This issue will go to court, there’s no other way around it,” said Christopher Granville, a former U.K. diplomat in Moscow who runs Trusted Sources research group in London. “There’s no way Russia will remain under financial sanctions from the U.S. government and accept the same terms as Franklin Templeton.” The bond is unusual for a state-to-state loan. It was drafted as a commercial instrument under English law, meaning any dispute will be settled by a judge in the U.K. It also contains a clause designed to prevent Ukraine from offsetting its debt due to damages inflicted by Russia, such as the annexation of Crimea, which President Petro Poroshenko plans to seek compensation for.

Ukraine’s government, which accuses Yanukovych and his allies of stealing tens of billions of dollars before fleeing to Russia, says the bond should be considered commercial and treated the same as debt held by private investors. “This $3 billion was in reality a bribe from Russia, so that President Viktor Yanukovych would stop the association agreement with the EU,” Prime Minister Arseniy Yatsenyuk told German newspaper Handelsblatt this week. Russia maintains the loan is official, a designation that would, if Ukraine doesn’t pay, force the IMF to either end its $17.5 billion bailout or alter its policy of not lending to any country that’s in arrears to another. The crisis lender has said it will only decide on the classification if Ukraine defaults.

Either way, the showdown is shaping up to be one of the most unique cases in memory, one followed closely by governments and scholars around the world, including Mitu Gulati, a law professor at Duke University who specializes in sovereign debt. “This kind of court case has never really happened before,” Gulati said. “To see the argument play out as to what Russia owes Ukraine because of its involvement in Crimea, to have that be in court in London would be fabulous.”

“.. the European Commission proposed the draft law in April in a bid to give opponents of GMOs fewer grounds to hold up EU approvals urged by supporters of the technology.”

• European Parliament Opposes National Bans on GMO-Food Imports (Bloomberg)

The European Parliament rejected a draft law that would give individual countries in Europe scope to ban imports of genetically modified food and animal feed, potentially killing an initiative that was greeted with widespread criticism. The EU assembly voted against granting EU governments a right to opt out of rules making the 28-nation bloc a single market for gene-altered food and feed. With Europe split over the safety of gene-modified organisms, the European Commission, the EU’s regulatory arm, proposed the draft law in April in a bid to give opponents of GMOs fewer grounds to hold up EU approvals urged by supporters of the technology.

The commission proposal was modeled on European legislation approved three months earlier – following more than four years of deliberations – that lets national governments go their own way on the cultivation of gene-modified crops. The EU Parliament’s rejection on Wednesday in Strasbourg, France, of the food and feed measure reflects concerns it would have been a step too far in denting a free-trade tenet of the bloc. “Member states should shoulder their responsibilities and take a decision together at EU level, instead of introducing national bans,” said Giovanni La Via, an Italian who chairs the 751-seat assembly’s environment committee, which earlier this month recommended throwing out the draft legislation on GMO food and feed. The commission said it would pursue talks on the proposal with EU governments, which also have a say on the matter.

The moment it was unveiled six months ago, the commission proposal drew rebukes from anti- and pro-GMO groups as well as from the U.S. government. Environmental organization Greenpeace called the initiative “a farce,” saying the opt-out option wouldn’t stand up in court against EU free-market rules. The European Association for Bioindustries, whose members include GMO manufacturers, said the proposal would limit choice for livestock farmers, weaken the EU economy and rattle innovative companies’ confidence in the bloc’s approval procedures. The U.S. government said the draft legislation would enable EU nations to ignore “science-based safety and environmental determinations,” would fragment the European market and was inconsistent with current trans-Atlantic talks on a free-trade agreement.

Not bad.

• Germany To Oblige Banks To Offer Accounts To Refugees (Reuters)

Germany’s cabinet signed off on a draft law on Wednesday which will make it easier for hundreds of thousands of asylum seekers in the country to set up bank accounts. Under the new rules, everyone will have the right to access basic banking services, including the homeless and people who fall under the protection of the Geneva Convention on Refugees. This means that migrants will be able to open accounts at any bank, enabling them to deposit and withdraw cash, carry out bank transfers, set up direct debits and make payments with cards. Germany expects between 800,000 to one million people, many fleeing war zones in the Middle East and Africa, to arrive this year, although not all of them will be given asylum.

Giving refugees access to current accounts is seen as a vital first step to help them integrate them into society. “Those who don’t have a bank account, don’t have good prospects on the labour market. Hunting for a flat is also a problem for many people without an account,” said Justice Minister Heiko Maas. In Germany, the number of people without a bank account is in the high six figures, according to estimates by the European Commission, and that figure is expected to rise due to the influx of refugees. Until now, only a few saving banks, which are publicly owned or controlled, have accepted refugees as customers. Asylum seekers were often turned away by other banks since they had no fixed address or lacked the necessary documents.

Under the draft law, which must be approved by parliament to go into effect, all banks that offer current accounts would be obliged to do so for a wider group of consumers. Last month, Germany’s financial watchdog Bafin said it was going to allow banks to accept a broader spectrum of documents, such as papers provided by Germany’s immigration authorities. The draft law also obliges banks to become more transparent about their charges and make it easier for customers to change bank accounts.

Brought to you by Brussels.

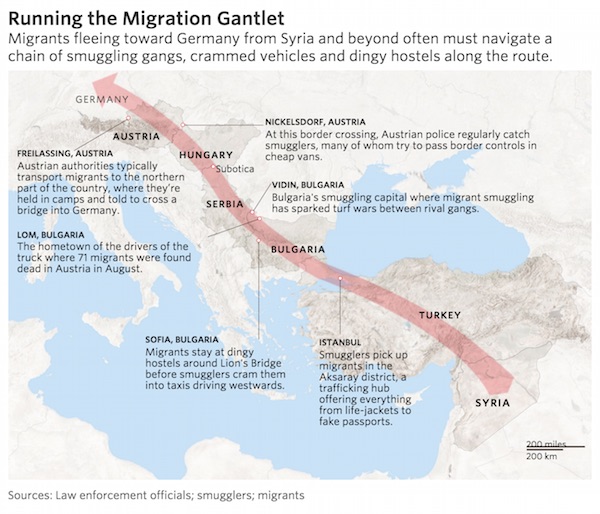

• Inside Europe’s Migrant-Smuggling Rings (WSJ)

The entry of established crime syndicates operating between the Middle East and Europe has brought a new level of organization and brutality to the people-smuggling game. In Sofia, many taxis from Lion’s Bridge drive northwest to Vidin, Bulgaria’s smuggling capital, where gangs move up to 500 migrants nightly across the Timok river into Serbia, Bulgarian officials say. On the town outskirts, smugglers store transiting refugees in pig farms and disused airport hangars. The money at stake has sparked a turf war between rival gangs. One public official seeking to crack down was attacked with a Molotov cocktail. Five hundred miles west, Bulgarian crime gangs have played a central role as industrial-scale migrant-smuggling expands into the heart of Europe.

In the case of 71 migrants found asphyxiated in a van in Austria in August, five of six men arrested, including the truck’s owner, are Bulgarian, Austrian police say, adding that five were arrested in Hungary and one in Bulgaria. The Hungarian prosecutor says it won’t release additional information until the men are charged and that the men aren’t reachable for interviews. Bulgaria’s prosecutor’s office says it has initiated criminal proceedings, declining to provide more information. “Our main focus now is the Balkans,” says Col. Gerald Tatzgern, Austria’s vice squad chief, who estimates the illicit transport generates more money in Europe than drug-running or weapons-trafficking. The mushrooming smuggling trade, he says, “has forced us to rethink everything we knew about the industry.”

Smugglers are positioned for another windfall: Hungary’s border-wall construction and increased checks on Austria and Germany’s normally open borders have the unintended effect of handing business to groups that skirt migrants across frontiers, says Wil van Gemert, Europol’s deputy director of operations. Closing borders “opens up new opportunities for criminals to benefit from smuggling,” he says. Smuggling “is becoming a big business in Balkan countries as they are sitting on the main migrant routes.”

“..turning into a constant operation of locating and collecting drowned refugees..”

• Three Migrants Drown Off Lesvos, Coastguard Rescues 242 As Boat Sinks (Reuters)

The Greek coastguard rescued 242 migrants when their wooden boat sank north of the island of Lesbos on Wednesday, but at least three drowned, including two small boys, authorities said. “We do not have a picture of how many people may be missing yet,” a coastguard spokeswoman said. A man and the two boys were found drowned and an extensive search was under way in the area after what was thought to be the largest maritime disaster off Greece in terms of numbers involved since a massive refugee influx began this year. More than 500,000 refugees and migrants have entered Greece through its outlying islands since January, transiting on to central and northern Europe in what has become the biggest humanitarian crisis on the continent in decades.

Inflows have increased recently as refugees are trying to beat the onset of winter, crossing the narrow sea passages between Turkey and Greece on overcrowded small boats. “These praiseworthy attempts of the coastguard to save refugees at sea is at risk of now turning into a constant operation of locating and collecting drowned refugees,” Greek shipping minister Thodoris Dritsas said.

11 confirmed drowned today so far, 39 missing, little hope of survivors

• At Least Five Refugees, Including Four Children, Drown In Aegean (AP)

Greek authorities say at least five people, including four children, have drowned as thousands of refugees and economic migrants continued to head to the Aegean Sea islands in frail boats from Turkey, in worsening weather. The coast guard said Wednesday that two children and a man died off the coast of Samos, while 51 people from the same small boat were rescued. A 5-year-old girl also drowned in a separate incident off Samos. A 7-year-old boy died off Lesbos, where most migrants land, while a 12-month-old girl was in critical condition in hospital from the same boat accident.

The ultimate disgrace that is the EU. Someone should send an army to start saving these people.

• Dozens Of Refugees Missing After Boat Sinks Off Lesvos (AP)

Authorities on the Greek island of Lesvos say 38 people are believed still missing after a wooden boat carrying migrants sank. Three people are known to have died. At first light Thursday, a helicopter from the European border protection agency Frontex joined the search by Greek coast guard vessels off the northern coast of the island, hours after the dramatic rescue of 242 people. At least 11 people – mostly children – died in five separate incidents in the eastern Aegean Sea on Wednesday, as thousands of people continued to head to the Greek islands from Turkey in frail boats and stormy weather.

Lesvos has borne the brunt of the refugee crisis in Greece, with more than 300,000 reaching the island this year – and the number of daily arrivals recently peaking at 7,500. In a dramatic scene late Wednesday, dozens of paramedics and volunteers helped in the effort to assist the survivors, wrapping them in foil blankets and prioritizing ambulance transport. Eighteen children were hospitalized, three in serious condition, local authorities said.

Home › Forums › Debt Rattle October 29 2015