Lewis Wickes Hine Newsies Gus Hodges, 11, and brother Julius, 5, Norfolk VA 1911

Deflation in the US…

• Weak US Business Spending Plans Point To Slower Economic Growth (Reuters)

A gauge of U.S. business investment plans fell for a second straight month in September, pointing to a sharp slowdown in economic growth and casting more doubts on whether the Federal Reserve will raise interest rates this year. Other data on Tuesday showed consumer confidence slipped this month amid worries over a recent moderation in job growth and its potential impact on income. Housing, however, remains the bright spot, with home prices accelerating in August. That should boost household wealth, supporting consumer spending and the broader economy, which has been buffeted by a strong dollar, weak global demand, spending cuts in the energy sector and efforts by businesses to reduce an inventory glut.

The continued weakness in business spending, together with the slowdown in hiring, could make it difficult for the Fed to lift its short-term interest rate from near zero in December, as most economists expect. The U.S. central bank’s policy-setting committee started a two-day meeting on Tuesday. “The drift of data suggests that the first time the Fed will raise rates will be in the spring,” said Steve Blitz, chief economist at ITG Investment Research in New York. Non-defense capital goods orders excluding aircraft, a closely watched proxy for business spending plans, slipped 0.3% last month after a downwardly revised 1.6% decline in August, the Commerce Department said. These so-called core capital goods were previously reported to have dropped 0.8% in August.

The data was the latest dour news for manufacturing, which has borne the brunt of dollar strength, energy sector investment cuts and the inventory correction. Manufacturing accounts for 12% of the economy. In a separate report, the Conference Board said its consumer sentiment index fell to 97.6 this month from a reading of 102.6 in September. Consumers were less optimistic about the labor market, with the share of those anticipating more jobs in the months ahead slipping. There was a drop in the proportion of consumers expecting their incomes to increase and more expected a drop in their income. The downbeat assessment of the labor market follows a step down in job growth in August and September.

…and in China…

• Chinese Consumer Sentiment Indicator Slumps In October (CNBC)

Consumer sentiment in China plunged in October, as the outlook for business conditions plummeted and household finances weakened, a survey showed Wednesday. The Westpac MNI China Consumer Sentiment Indicator fell to 109.7 in October from 118.2 in September, marking the lowest reading since the survey began in 2007. Business outlook over the coming year was the hardest hit, with Business Conditions in One Year registering a 10.3% decline, while the Business Conditions in Five Years component fell 8.2%. Current and expected measures for household finances were also weaker, down 5.3% and 7.3% respectively. The survey is taken from consumers across 30 Chinese cities ranging from tier 1 to tier 3.

Respondents said that they were planning on reducing their shopping and entertainment activities in the near term. “This result openly questions the resilience of the Chinese consumer to the discouraging state of the real economy,” said Huw McKay, senior international economist at Westpac. The survey follows China’s gross domestic product release last week, which showed the world’s second largest economy grew by 6.9% in the three months through September, the slowest pace since 2009. Concerns over the health of the Chinese economy have spilled from Chile to Korea, sparking a sharp sell-off in the price of commodities that Chinese factories traditionally consume in hefty amounts, as well as the currencies of the countries that benefit from selling raw materials to China.

[..] The drop in confidence was most acute among in the 35-to-54-year-old group, with sentiment plunging 11.2% between September and October. In contrast, confidence among the youngest and oldest age cohorts (18-34 and 55-64) declined more moderately by 3.3% and 3.2% respectively, Wesptac said in a statement.

…and in Japan too..

• Japan’s Retail Sales Fall Piles Pressure On Bank of Japan (CNBC)

Japan’s retail sales unexpectedly fell on-year in September, official data showed on Wednesday, suggesting that consumer spending does not the momentum to make up for weak exports and factory output. The retail sales news could add to pressure on the Bank of Japan under to expand monetary stimulus, possibly as soon as its rate review meeting on Friday, when it is also expected to slash its rosy economic and price projections, analysts say. Retail sales fell 0.2% in September from a year earlier, compared with economists’ median estimate for a 0.4% rise, the Ministry of Economy, Trade and Industry said on Wednesday.

The decline, which followed five straight months of gains, was largely due to sluggish demand for cars and fuel, according to the data. On a seasonally adjusted basis, retail sales rose 0.7% in September from the previous month. Japan’s economy shrank in April-June and may suffer another contraction in July-September on weak exports and consumption. Analysts say any rebound in the current quarter will be modest as companies feel the pinch from soft demand in China and other emerging Asian markets.

…and it’s not just consumers, it’s spending across the board.

• China Steel Head Says Demand Slumping at Unprecedented Speed (Bloomberg)

If anyone doubted the magnitude of the crisis facing the world’s largest steel industry, listening to Zhu Jimin would put them right, fast. Demand is collapsing along with prices, banks are tightening lending and losses are stacking up, the deputy head of the China Iron & Steel Association said on Wednesday. “Production cuts are slower than the contraction in demand, therefore oversupply is worsening,” said Zhu at a quarterly briefing in Beijing by the main producers’ group. “Although China has cut interest rates many times recently, steel mills said their funding costs have actually gone up.” China’s mills – which produce about half of worldwide output – are battling against oversupply and sinking prices as local consumption shrinks for the first time in a generation amid a property-led slowdown.

The fallout from the steelmakers’ struggles is hurting iron ore prices and boosting trade tensions as mills seek to sell their surplus overseas. Shanghai Baosteel Group forecast last week that China’s steel production may eventually shrink 20%, matching the experience seen in the U.S. and elsewhere. “China’s steel demand evaporated at unprecedented speed as the nation’s economic growth slowed,” Zhu said. “As demand quickly contracted, steel mills are lowering prices in competition to get contracts.” Medium- and large-sized mills incurred losses of 28.1 billion yuan ($4.4 billion) in the first nine months of this year, according to a statement from CISA. Steel demand in China shrank 8.7% in September on-year, it said.

Signs of corporate difficulties are mounting. Producer Angang Steel warned this month it expects to swing to a loss in the third quarter on lower product prices and foreign-exchange losses. The company’s Hong Kong stock has lost more than half its value this year. Last week, Sinosteel, a state-owned steel trader, failed to pay interest due on bonds maturing in 2017. Crude steel output in the country fell 2.1% to 608.9 million tons in the first nine months of this year, while exports jumped 27% to 83.1 million tons, official data show. Steel rebar futures in Shanghai sank to a record on Wednesday as local iron ore prices fell to a three-month low.

Because there’s a huge global steel oversupply?

• Why Don’t We Save Our Steelworkers The Way We Saved Bankers? (Chakrabortty)

Every so often a society decides which of its citizens really matter. Which ones get the star treatment and the big cash handouts – and which get shoved to the bottom of the pile and penalised. These are the big, rough choices post-crash Britain is making right now. A new hierarchy is being set in place by David Cameron in budget after austerity budget. Wealthy pensioners: winners. Young would-be homeowners: losers. Millionaires see their taxes cut to 45%, while the working poor pay a marginal tax rate of 80%. Big business gets to write its own tax code; benefit claimants face harsh sanctions. When the contours of this new social order are easy to spot, they can cause public uproar – as with the cuts to tax credits. Elsewhere, they’re harder to pick out, though still central. It is into this category that the crisis in the British steel industry falls.

It would be easy to tune out the past few weeks’ headlines about plant closures and job losses as just another story of business disaster. But what’s happening to our steelworkers, and what we do to protect them, goes to the heart of the debate about which people – and which places – count in Britain’s political economy. If Westminster lets the UK’s steel industry die, it’s in effect declaring that certain regions and the people who live and work in them are surplus to requirements. That it really doesn’t matter if Britain makes things. That the phrase “skilled working-class jobs” is now little more than an oxymoron. That’s the criteria against which to judge MPs, as they continue to take evidence today on the crisis and then debate options.

What does this crisis look like? Imagine coming to work on a September morning – only to find that you and one in six other employees in your entire industry face redundancy before Christmas. That’s the prospect facing British steelworkers. Motherwell, Middlesbrough, Scunthorpe: some of the most kicked-about places in de-industrialised Britain now face more punishment. Mothball the SSI plant in Redcar and it’s not just 2,200 workers that you send to the dole office and whose families you shove on the breadline. An entire local economy goes on life support: the suppliers of parts, the outside engineers who used to do the servicing, the port workers and hauliers, the cafes and shops. Within days of SSI’s closure, one of Teeside’s biggest employment agencies went into liquidation.

[..] Britain is entering the early stages of yet another industrial catastrophe. It could finally sink a sector, steel, that actually helps reduce the country’s gaping trade deficit. With that will go another pocket of well-paid blue-collar jobs. Chuck in employer contributions to pensions and national insurance, and the total remuneration per SSI staffer is £40,000 a year. Just try getting such pay in a call centre or distribution warehouse, even as a manager. Imagine what would happen if manufacturing were centred around the capital, and its executives had Downing Street on speed dial. Actually, you needn’t imagine – merely remember the meltdown of 2008. Then Gordon Brown was so desperate to save the City that the IMF estimates he propped it up with £1.2 trillion of public money. That’s the equivalent of nearly £20,000 from every man, woman and child in the country doled out to bankers in direct cash, loans and taxpayer guarantees.

Try ten times that: “..central-bank officials who attempt to say that underground banks handle about 800 billion yuan ($125 billion) annually..”

• In China’s Alleyways, Underground Banks Move Money (WSJ)

In a warren of tiny shops beneath grimy residential towers, a white-haired man selling Snickers bars and fizzy drinks from a kiosk no larger than a cashier’s booth is figuring out a way to move $100,000 out of China. That is twice what Chinese are allowed to send out of the country in a year. Licensed banks won’t do it. But middlemen like Mr. Chen, perched in his mini-mart at the front lines of a vast underground currency-exchange and offshore-remittance network, can and often will. “There’s never a certainty that these things can be done,” said Mr. Chen, who declined to give his full name. “But, usually, when things get stricter, the fee will just be a bit higher.” Facing a turbulent stock market and a weakening economy, many Chinese are trying to move money offshore.

That spells business for operations that can end-run capital controls. No official data track the underground transfers, but central-bank officials who attempt to say that underground banks handle about 800 billion yuan ($125 billion) annually, and more than usual this year. One sign of unusually high activity in underground banks is a drop in China’s foreign-exchange reserves, an indicator of demand for hard currency. Reserves fell by a record $93.9 billion in August and $43 billion more in September, though part of the reason was central-bank selling to support the yuan. Often hidden behind the façades of convenience stores and tea shops, they cater to a clientele ranging from corrupt officials hiding gains to middle-class Chinese trying to buy overseas property.

All believe their money is safer abroad or can bring a higher return, a sentiment that has deepened since this summer’s stock-market plunge. New York real-estate agent Jiang Jinjin said she has handled nearly 2,000 residential-property purchases this year for Chinese families with children at Columbia University. “I didn’t sleep much this summer. Too many kids looking for apartments,” she said. Some customers rely on relatives and friends to carry cash over on repeated trips, she said, and some set up U.S. companies. Such firms can be used to overpay for imports, experts on underground banking say. Ms. Jiang said her company checks the provenance of money used to buy real estate.

The outflows have put underground bankers in China in the cross hairs of financial regulators. China’s capital controls were set up to keep funds onshore when the country was starved for investment. Officials consider them still necessary, to prevent sharp outflows of the kind that shocked developing economies in the 1997 Asian financial crisis. Also, too much cash going out could complicate efforts to stimulate growth through interest-rate cuts.

Early understanding.

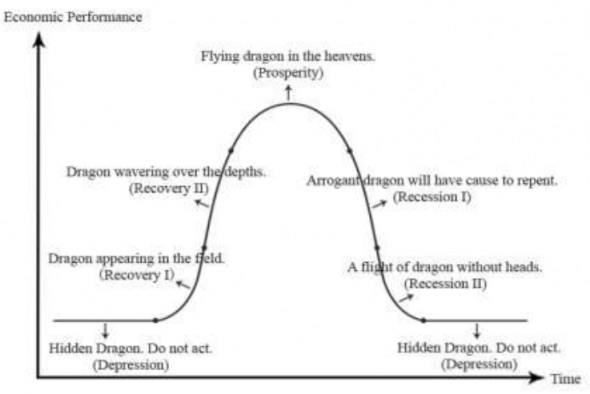

• Where Are My (Business Cycle) Dragons? (FT)

The Qian Diagram implies a complete circulation with characteristics of contraction and expansion as well as phases of prosperity, recession, depression and recovery. The corresponding economic cycles are as follows: “Hidden Dragon. Do not act” refers to the economy that in a slump or depressed state in which it is hard to do anything; “Dragon appearing in the field” implies an economic recovery, in which successful people can take the opportunity to succeed; “The energetic gentlemen work hard all day” means keeping vigorous through the whole recovery phase, and no one can relax at any time. Being certain about the target and achieving it with effort and prudence, there will be no great harm even if in the face of risks; “Dragon wavering over the depths” refers to the phase from depression to recovery.

During this rising period, the average social profit rate is high and almost every business runs smoothly; “Flying dragon in the heavens” refers to the most economically prosperous period; “Arrogant dragon will have cause to repent” refers to recession in the economic cycle, which suggests things will develop in the opposite direction when they reach an extreme; “A flight of dragon without heads” indicates that in the prosperous period, monopoly will emerge, while after the economy enters recession, monopoly would disintegrate and be replaced instead by a pattern of free competition, which is a symbol of good performance for the economy.

[..] Guanzi is said to be the record of thoughts and remarks by Qi’s famous premier Guan Zhong and his School in the Spring and Autumn Period, which was between 475 B.C. and 221 B.C… Thought on demand management policy as well as fiscal and monetary policies is all covered in Guanzi. There are extensive discussions on the proper fiscal policy that should be undertaken during an economic depression in the Chapter Cheng Ma the sixty-ninth of Guanzi. “When people lose their fundamentals of living in years with frequent floods and droughts, the monarch can recruit those who live in extreme poverty and give them payment through the activities like constructing the palace. Therefore, the purpose of constructing pavilions is to appease national economic fluctuations rather than for enjoyment.” This is the earliest description of policy in Chinese history with characteristics of Keynesianism.

Ambrose has a hobby horse.

• Fossil Fuel Companies Risk Plague Of Climate Change Lawsuits (AEP)

Oil, gas and coal companies face the mounting risk of legal damages for alleged climate abuse as global leaders signal an end to business-as-usual and draw up sweeping plans to curb greenhouse gas emissions, Bank of America has warned. Investors in the City are increasingly concerned that fossil fuel groups and their insurers are on the wrong side of a powerful historical shift and could be swamped with exhorbitant class-action lawsuits along the lines of tobacco and asbestos litigation in the US. “It is setting off alarm bells that there could be these long tail risks,” said Abyd Karmali, Bank of America’s head of climate finance. Mr Karmali said the United Nations’ “COP21” climate summit in Paris in December is likely to be a landmark event that starts to shut the door on parts of the fossil industry.

“It is a non-exchangeable, one-way ticket to a low-carbon economy,” he said. Christiana Figueres, the UN’s top climate official, said 155 countries have already put forward detailed plans covering 88pc of global CO2 emissions, and others are expected to join before the deadline expires. “It is unstoppable. No amount of lobbying at this point is going to change the direction,” she told a Carbon Tracker forum in London. Mrs Figueres said the mood has changed entirely since the failed summit in Copenhagen in 2009. This time China is fully on board. “China is already spending more on renewables than any other country. It is going to introduce its own emissions trading scheme in 2017,” she said. Mrs Figueres said the pledges are not yet enough to cap the rise in average global temperatures to two degrees Centrigrade above pre-industrial levels by 2100 – the “two degree world” deemed the safe limit.

But the Paris accord does promise to “bend” the trajectory to 2.7 degrees and will almost certainly be followed by a series of deals that brings the ultimate target within sight. “We think most countries will be able to over-achieve,” she said. While the exact contours are still unclear, Paris is likely to sketch a way towards zero net emissions later this century. It implies that most fossil fuel reserves booked by major oil, gas and coal companies can never be burned. A deal would also send a moral signal with legal ramifications. Mark Carney, the Governor of the Bank England, warned last month that by those who had suffered losses from climate change may try to bring claims on third-party liability insurance. He specifically mentioned the parallel of asbestos claims in US courts, which have mounted over the years to $85bn and devastated some Lloyd’s syndicates.

Like Gordon Brown selling England’s gold reserves. Timing is everything.

• US Plans to Sell Down Strategic Oil Reserve to Raise Cash (Bloomberg)

The U.S. plans to sell millions of barrels of crude oil from its Strategic Petroleum Reserve from 2018 until 2025 under a budget deal reached on Monday night by the White House and top lawmakers from both parties. The proposed sale, included in a bill posted on the White House website, equates to more than 8% of the 695 million barrels of reserves, held in four sites along the Gulf of Mexico coast. Sales are due to start in 2018 at an annual rate of 5 million barrels, rising to 10 million by 2023 and totaling 58 million barrels by the end of the period. The proceeds will be “deposited into the general fund of the Treasury,” according to the bill. The sale is the second time the U.S. has raised cash from the reserve, created as a counter-balance to the power of Arab producers after the first oil crisis of 1973-74.

The U.S. may sell also additional barrels to cover a $2 billion program from 2017 to 2020 to modernize the strategic reserve, including building new pipelines. The White House on Tuesday urged lawmakers to support the budget deal, including the proposed partial sale of the SPR, saying it was “a responsible agreement that is paid for in a balanced way.” Supporters of the sale argue the U.S. doesn’t require such a big emergency reserve as rising domestic production on the back of the shale boom offsets the need for imports. Critics, including oil analysts and former U.S. energy officials, say using the underground reserve as a piggy bank makes it less effective in meeting its intended purpose: combating a “severe energy disruption.” What’s more, the government would be selling at a time when oil is unlikely to have recovered from its slump over the past 18 months.

VW must cut investments. They might as well cut their entire diesel division.

• VW Posts $3.85 Billion Quarterly Loss, First In 15 Years (Bloomberg)

Volkswagen AG, Europe’s largest automaker, posted a €3.48 billion operating loss for the third quarter, worse than analysts’ estimate of a €3.27 billion loss. The company made €3.23 billion profit in the third-quarter a year ago. The historic loss comes amid a widening global emissions scandal after it was revealed software was used to cheat official exhaust analysis checks. The company also announced it would cut its 2015 profit target, saying earnings before interest and tax would drop “significantly.”

Afraid it’s too late now. Deflation comes first. Oil is down for the count. Next, watch real estate.

• Canada Can Show That Ending Austerity Makes Sense (Paul Krugman)

Canadians were less caught up than the rest of us in the ideology of bank deregulation. As a result, Canada was spared the worst of the 2008 financial crisis. Which brings us to the issue of deficits and public investment. Here’s what the Liberal Party of Canada platform had to say on the subject: “Interest rates are at historic lows, our current infrastructure is aging rapidly, and our economy is stuck in neutral. Now is the time to invest.” Does that sound reasonable? It should because it is. We’re living in a world awash with savings that the private sector doesn’t want to invest and is eager to lend to governments at very low interest rates. It’s obviously a good idea to borrow at those low, low rates, putting those excess savings, not to mention the workers unemployed due to weak demand, to use building things that will improve our future. [..]

Since 2010 public investment has been falling as a share of GDP in both Europe and the US, and it’s now well below pre-crisis levels. Why? The answer is that in 2010 elite opinion somehow coalesced around the view that deficits, not high unemployment and weak growth, were the great problem facing policymakers. There was never any evidence for this view; after all, those low interest rates showed that markets weren’t at all worried about debt. But never mind – it was what all the important people were saying, and all that you read in much of the financial press. And few politicians were willing to challenge this orthodoxy. Those who should have stood up for public spending suffered a striking failure of nerve.

Britain’s Labour Party, in particular, essentially accepted Conservative claims that the nation was facing a fiscal crisis and was reduced to arguing at the margin about what form austerity should take. Even President Barack Obama temporarily began echoing Republican rhetoric about the need to tighten the government’s belt. And having bought into deficit panic, centre-left parties found themselves in an extremely weak position. Austerity rhetoric comes naturally to right-wing politicians, who are always arguing that we can’t afford to help the poor and unlucky (although somehow we’re able to afford tax cuts for the rich). Centre-left politicians who endorse austerity, however, find themselves reduced to arguing that they won’t inflict quite as much pain. It’s a losing proposition, politically as well as economically.

Now come Justin Trudeau’s Liberals, who are finally willing to say what sensible economists have been saying all along. And they weren’t punished politically – on the contrary they won a stunning victory. So will the Liberals put their platform into practice? They should. Interest rates remain incredibly low: Canada can borrow for 10 years at only 1.5%, and its 30-year inflation-protected bonds yield less than 1%. Furthermore, Canada is probably facing an extended period of weak private demand thanks to low oil prices and the likely deflation of a housing bubble. Let’s hope, then, that Trudeau stays with the programme. He has an opportunity to show the world what truly responsible fiscal policy looks like.

“.. its cut-down nature has prompted the web’s inventor, Tim Berners-Lee, to advise people to “just say no” to it.”

• EU Net Neutrality Laws Fatally Undermined By Loopholes (Guardian)

Supporters of net neutrality have accused the European Union of undermining its own net neutrality laws after MEPs voted down amendments aimed at closing loopholes. Net neutrality is the principle that internet service providers should treat all online content equally without blocking or slowing down specific websites on purpose or allowing companies to pay for preferential treatment. The European parliament voted through new rules intended to enshrine that principle in law, but critics say they are fatally undermined by a number of loopholes which “open the door to an end to net neutrality”. An attempt to close those loopholes through amendments failed to gain enough support from MEPs to pass.

Following the vote, the regulations are immediately in force in all EU member states, but national regulators, who are ultimately responsible for overseeing the implementation of the rules, will not be expected to start enforcement for six months. Among the exceptions opposed by net neutrality supporters is one which allows providers to offer priority to “specialised services”, providing they still treat the “open” internet equally. Many had seen the exception as allowing providers to offer an internet fast lane to paying sites, leading to the Italian government to propose removing the exception from the draft regulations. The final draft, however, limits what services can be given priority to uses like remote surgery, driverless cars and preventing terrorist attacks. The regulation also requires that those specialised services cannot be offered if they restrict bandwidth for normal internet users.

A different exception is aimed at situations where the limitation is not speed, but data usage. The EU’s regulations allow “zero rating”, a practice whereby certain sites or applications are not counted against data limits. That gives those sites a specific advantage when dealing with users with strict data caps such as those on mobile internet. The new regulations allow national regulators to decide whether or not to allow zero rating in their own country. The most significant example of the practice is Internet.org, Facebook’s platform for spreading net access to the developing world. The service allows access for free to sites including Facebook and Wikipedia, but its cut-down nature has prompted the web’s inventor, Tim Berners-Lee, to advise people to “just say no” to it.

A tangled web.

• Territorial Disputes: The South China Sea (Bloomberg)

Some things are worth fighting for. What about a few desert islands occupied mainly by birds, goats and moles? China and Japan seem to think so, the rest of the world is alarmed and a look at other territorial disputes around the globe shows that stranger things have happened. There are about 60 such conflicts simmering worldwide. Most will bubble along, unresolved but harmless, 400 years after the Peace of Westphalia established the notion of national sovereignty. Others are more dangerous. China claims more than 80% of the South China Sea and has constructed artificial islands there for potential development. The U.S. sailed a warship through nearby waters in October, showing it doesn’t recognize the features in the Spratly Islands as having the same rights as Chinese territory.

Five other nations claim parts of the same maritime area: Vietnam, the Philippines, Brunei, Malaysia and Taiwan. China’s claim to the oil- and gas-rich waters dates to 1947. In November 2014, China and Japan agreed to disagree about century-old claims to a separate set of islands 1,000 miles to the northeast in the East China Sea. That was progress; a year earlier China had proclaimed an “air defense identification zone” over the islands. Taiwan stakes a claim, too and South Korea flew military planes through the self-proclaimed Chinese zone. President Barack Obama went to Japan in 2014 and promised to defend the disputed islands, called Senkaku in Japanese and Diaoyu in Chinese and administered by Japan since 1972. China is locked in a separate disagreement with India over the two countries’ land border.

Boots on the ground.

• US to Begin ‘Direct Action on the Ground’ in Iraq, Syria (NBC)

Defense Secretary Ashton Carter said Tuesday that the U.S. will begin “direct action on the ground” against ISIS forces in Iraq and Syria, aiming to intensify pressure on the militants as progress against them remains elusive. “We won’t hold back from supporting capable partners in opportunistic attacks against ISIL, or conducting such missions directly whether by strikes from the air or direct action on the ground,” Carter said in testimony before the Senate Armed Services committee, using an alternative name for the militant group. Carter pointed to last week’s rescue operation with Kurdish forces in northern Iraq to free hostages held by ISIS. Carter and Pentagon officials initially refused to characterize the rescue operation as U.S. boots on the ground.

However, Carter said last week that the military expects “more raids of this kind” and that the rescue mission “represents a continuation of our advise and assist mission.” This may mean some American soldiers “will be in harm’s way, no question about it,” Carter said last week. After months of denying that U.S. troops would be in any combat role in Iraq, Carter late last week in a response to a question posed by NBC News, also acknowledged that the situation U.S. soldiers found themselves in during the raid in Hawija was combat. “This is combat and things are complicated,” Carter said.

The poor were always going to be the first and worst victims.

• IMF Paints Gloomy Outlook For Sub-Saharan Africa (Reuters)

This year’s slump in commodity prices and the end of a flood of cheap dollars has pegged back African growth to its weakest in six years and things could get worse if the global economy continues to flounder, the IMF said on Tuesday. In its latest African Economic Outlook, entitled “Dealing with the Gathering Clouds”, the Fund said the poorest continent was likely to grow 3.75% this year and 4.25% next, a big drop from the years before and after the 2008/2009 financial crisis. “The strong growth momentum evident in the region in recent years has dissipated,” the report said. “With the possibility that the external environment might turn even less favourable, risks to this outlook remain on the downside.”

Hardest-hit have been sub-Sahara’s eight oil exporters – led by top producers Nigeria and Angola – although others such as Ghana, Zambia and South Africa were also suffering from weak minerals prices, power shortages and difficult financing conditions. However, the Fund noted some bright spots, most notably Ivory Coast, which is scheduled to expand as much as 9% this year due to an investment boom that followed the end of a brief civil war in 2012. This weekend’s overwhelmingly peaceful election, which President Alassane Ouattara – a former IMF official – is widely expected to win, has reinforced hopes Francophone Africa’s biggest economy has put its worst years behind it. With commodities revenues forecast to remain depressed for several years, governments have to work quickly to diversify revene sources by improving domestic tax collection, said Antoinette Sayeh, head of the IMF’s Africa department.

The poor, the young, the old and the sick.

• Children Hardest Hit By Europe’s Economic Crisis (Reuters)

Some 26 million children and young people in Europe are threatened by poverty or social exclusion after years of economic crisis, according to a study by the Bertelsmann Foundation which gave Greece the worst marks in the entire EU. Bertelmann’s Social Justice Index, an annual survey of social conditions in the 28-member bloc, found a yawning gap between north and south, and between young and old. In Spain, Greece, Italy and Portugal, the number of children and young people that are under threat because of their economic condition has increased by 1.2 million to 7.6 million since 2007, the study said. In addition, the number of EU citizens between 20 and 24 years old who are neither employed nor in education or training has risen in 25 of the 28 member states since 2008, with Germany and Sweden the only countries where the outlook for this age group has improved.

In Italy, 32% of people in their early 20s fall into this category, while in Spain it is 24.8%. “We cannot afford to lose a generation in Europe, either socially or economically,” said Aart De Geus, chairman of the executive board at Bertelsmann. “The EU and its member states must make special efforts to sustainably improve opportunities for younger people.” By contrast, the study found that a declining number of people aged 65 or older are at risk of poverty, because retirement benefits have not declined as strongly as incomes for younger citizens. Bertelsmann said three Europe-wide trends were exacerbating this gulf between young and old, including growing public debt, stagnating investment in education and research, and rising pressure on the financial viability of social security systems. Sweden, Denmark, Finland, the Netherlands and Czech Republic stood at the top of the social justice rankings, while Greece, Romania, Bulgaria, Italy and Spain were at the bottom.

And then there’s no reason to be left for the EU.

• The End Of Visa-Free Travel In Europe May Be Looming (Bloomberg)

Warnings of an end to visa-free travel intensified in the EU as Slovenia said it may join Hungary in fencing off its borders if the bloc fails to help countries on its southeastern fringe. Slovene Foreign Minister Karl Erjavec said the Adriatic nation will “adopt all measures” to ensure the safety of its citizens and migrants if the situation worsens and the accord reached Sunday in Brussels isn’t implemented, STA news service reported Tuesday. EU President Donald Tusk said the bloc must protect its external frontiers. He echoed an alarm issued Monday by Italian Foreign Minister Paolo Gentiloni, who said free-movement of people, one of the EU’s founding principles, may be at risk. “This challenge has the potential to change the European Union we have built,” Tusk told EU lawmakers on Tuesday in Strasbourg, France.

“It has the potential to create tectonic changes in the European political landscape, and these are not changes for the better.” The leaders of 11 EU and Balkan countries agreed on a 17-point plan on Sunday that offered short-term fixes for the 1 million or more migrants expected in the bloc this year. The deal includes sending about 400 policemen to help Slovenia control its borders, emergency housing for as many as 100,000 refugees, a stepped-up registration system and bolstering policing on the EU’s southeastern edge. Still, with winter approaching, countries continue to squabble over longer-term solutions. Many Balkan countries say they’re being overwhelmed after German Chancellor Angela Merkel said last month there could be no limit on asylum for those who meet the conditions. That coincided with a shift in the route taken by migrants that once led mainly through Libya to Italy. Now most are winding from Turkey to Greece, through the Balkan states, and then further north.

Complaining about a lack of coordination in the EU, countries have embarked on divergent policies. Many eastern members oppose a German-led push to redistribute the refugees across the bloc with mandatory quotas, saying the migrants don’t want to stay on their territory. Amid the bickering, Hungary has drawn criticism for fencing off its borders, while Slovenia has complained Croatia is waving migrants through. The Republic of Macedonia says its southern neighbor Greece is doing the same, without following the rules that arrivals must be registered in the first EU state they enter. Such squabbling helped prompt European Commission President Jean-Claude Juncker to call Sunday’s meeting in Brussels and he said on Tuesday that national cooperation already had improved.

“We are putting an end to all beggar-thy-neighbor policies,” Juncker told the European Parliament. “Instead, countries shall help their neighbors by telling each other what they are doing.”

The EU must compensate Greece for all costs, not ‘allow’ it to run a bigger deficit. That’s just crazy. And amoral.

• Migrant Crisis Could Prompt EU to Loosen Budget Deficit Rules (WSJ)

European Union governments will be able to offset some of the costs related to the migrant crisis from the EU’s budget deficit rules, according to a top EU official in charge of policing national budgets. Under EU rules, governments have to stick to a budget deficit of 3% of GDP or face fines. “It will be a country-by-country assessment, but we will bear in mind the cost entailed by refugee policies more than up to now,” European Commission chief Jean-Claude Juncker told the European Parliament in Strasbourg on Tuesday. Mr. Juncker said that given the “exceptionally serious problem” of the refugee crisis, there will be some room for maneuver for the Commission, the EU executive, when assessing the countries’ budget deficits.

“If a country is making huge efforts, there should be a commensurate understanding of what they have done. If a country is unable to prove it’s affected by the cost of refugee policies, then we won’t necessarily apply the flexibility of the Stability and Growth Pact to them,” Mr. Juncker said. Germany, the main destination country for refugees arriving in Europe, is expected to triple its budget for accommodating asylum seekers to an estimated €15 billion. Germany’s current deficit is within the EU rules, but that may change by the end of the year. Austria and Italy, two countries affected by the migration crisis and whose budgets are likely to surpass the 3% threshold, have already been pressing the Commission to exempt their refugee spending from the EU’s budget assessment.

Fiscal hawks, however, including Germany’s own finance minister, Wolfgang Schäuble, have been wary of supporting that call, for fear that other countries will seize the opportunity and offset budget expenditures which aren’t necessarily refugee-related. Greece, Croatia and Slovenia—all countries on the main migrant route into Europe—are already in breach of the 3% deficit rule. They are likely to get their deadlines for reaching 3% extended if they can prove that the refugee crisis has taken a toll on their already-strapped coffers.

The EU has no military. Nor would it solve anything. Separate countries do, but can they operate on reign territory?

• Slovenia Considers Calling For EU Military Aid (FT)

Slovenia, the tiny Balkan state struggling to cope with the migration crisis, has raised the idea of invoking a never-before-used “solidarity clause” in the EU treaties to formally request European aid and military support. Ljubljana recently floated the option of triggering Article 222, which enables military aid to EU nations overwhelmed by disasters, according to two officials familiar with the talks. It indicates the drastic steps under consideration to deal with a tide of asylum seekers arriving in Europe. The Alpine state of just 2m people has received 84,000 migrants over the past 10 days, leading the government to call in its national army as well as private security personnel to help its small police force. It received a further 8,000 migrants between Monday evening and Tuesday morning — a figure that exceeds the size of Slovenia’s army.

Against that backdrop, one Slovenian government official said invoking Article 222 was a “viable option” as a last resort. Ljubljana has not officially commented on the idea. Alarmed by the potential for Slovenia pulling the bloc’s emergency cord, EU officials have sought to head off a request, in part by arranging for EU countries to provide 400 police to help Ljubljana manage the crisis. Slovenian officials have put a brave face on the meagre results of Sunday’s summit of European leaders on the so-called western Balkans route, but are keeping up threats to take more aggressive steps. Miro Cerar, Slovenia’s prime minister, had warned the EU would “fall apart” unless the “unbearable” pressure was not eased promptly. His foreign minister Karl Erjavec hinted at the potential for a fence, saying “impediments” could be considered to stem the cross-border flows.

The solidarity clause states that EU member states “shall mobilise all the instruments at its disposal, including the military resources” in the event the requesting country is subject to a terrorist attack or is the victim or a man-made or natural disaster. It has never been invoked. Although the clause is explicit in the potential for military aid and the “spirit of solidarity”, it does not say the support would be automatic. Some EU officials are keen for the principle not to be tested. Up to half a million migrants have attempted to pass through the so-called Balkan corridor between Greece and Germany since the start of the year, overwhelming governments and inflaming already tense relations in the region.

Devastating.

• The Children’s Feet Are Rotting, In 1 Month All These People Will Be Dead (HP)

“There are thousands of children here and their feet are literally rotting, they can’t keep dry, they have high fevers and they’re standing in the pouring rain for days on end. You have one month guys, and then all these people will be dead”. Those were the final words of Dr Linda on the phone, a doctor that our volunteer organisations (Help Refugees and CalAid) had asked to fly out to Lesbos in response to an emergency cry for help from an overwhelmed volunteer on the ground. The weight of those words and the responsibility that comes with them felt crippling. But why are we, a film maker, a radio presenter, and a music assistant being tasked with this responsibility? Shouldn’t, as we had presumed, the large charities and governments be taking the charge of care for the precious lives arriving on Europe shores?

Another call came in – this time from volunteers in Serbia – the refugees are burning plastic bags to keep warm, they have nothing else, they are freezing to death, and the fumes from the bags are slowly poisoning them, please send help. Then another – this time from volunteers on Lesbos trying to find out how to order body bags en masse… will they have to resort this? Time will tell, but certainly people there have already started to die. We wished we could pick up the phone and call someone… who? A charity? An emergency team? The government? The army? How could we sit by and watch whilst these people die, and the handfuls of volunteers struggle and suffer too. But who is there to call? The charities are acting slowly, they have protocols to follow, political considerations, red tape, hierarchy and procedures.

Our government’s policy is not to help in Europe, and only to send aid to places like Syria, Lebanon in Jordan. So… it’s left to everyday people, untrained, unprepared, and overwhelmed, to deal with this crisis. Everyday people like us… a small group of friends who nine weeks ago decided to raise a little bit of cash, get a car load of goods and drive it to Calais. We’d heard from friends who’d been there some of the terrible stories of war and persecution, we knew that numbers were growing, that more children were coming everyday, and that conditions were dire. Our plan was to do our bit, pat ourselves on the back, and then go back to our lives feeling that we’d done something good for our fellow mankind.

Nature is a complex system.

• So Long And Thanks For All The Poo (WaPo)

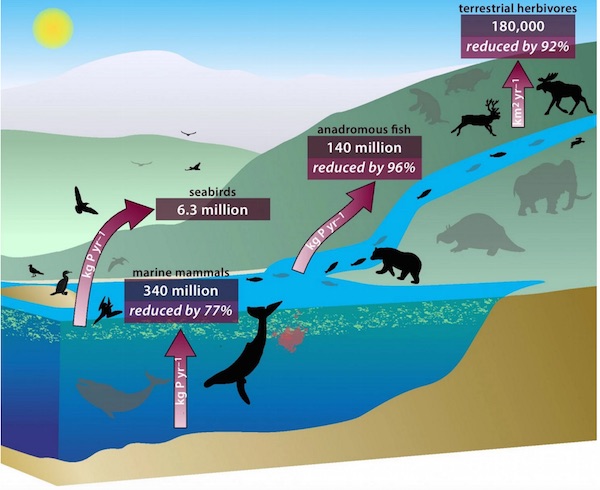

It only takes a glance at a history book and a look out the window to know that our planet has lost many of its biggest creatures: The world that was once home to mammoths and towering dinosaurs can now barely maintain stable populations of rhinos and whales. But according to a new study, we’ve got more to mourn than just the animals themselves. We’ve lost their feces, too — and that’s a bigger problem than you might think. Why should we miss steaming piles of dinosaur dung? According to research published Monday in the Proceedings of the National Academy of Sciences, megafauna play a greater role in the spread of nutrients across the planet than scientists ever realized. The research focused on modeling the distribution of phosphorus, a nutrient necessary for fertilizing plant growth.

Scientists know that animals help carry these nutrients around by, well, not pooping where they eat. Without this process, nutrients would end up following gravity onto the ocean floor, instead of spreading as high as the mountain tops. But these days most of the nutrient recycling that happens is due to bacteria — not wandering poopers. “I wanted to know whether the world of the past with all the endemic animals was more fertile than our current world,” lead study author Chris Doughty of Oxford University told The Post. “Large free-ranging animals are much less abundant than they once were. Today, if scientists were to study the role of animals they would find that it is important but small,” Doughty explained. “However, in the past, we hypothesize that it would have been at least an order of magnitude larger than today.

Essentially, we have replaced wild free-roaming animals with fenced domestic cattle that cannot move nutrients in the same way.” Some of these contributors — the massive land animals that once roamed our planet — are gone for good. But others are dwindling before our very eyes. In one example of the effect, the researchers found that whales — which have seen dramatic population loss in the last century, mainly due to hunting and habitat disruption — used to bring an estimated 750 million pounds of phosphorus up from the deep ocean to the surface each year. Since whales feed deep in the water and come up to breathe — and poop — at the surface, they’re great at helping to recycle these resources.

But today, the researchers estimate, whales only bring 165 million pounds of phosphorus up annually. That’s just 23% of their previous contribution. Phosphorus movement by birds and fish that come inland after eating in the sea (like salmon, for example) are just 4% what they once were.

Home › Forums › Debt Rattle October 28 2015