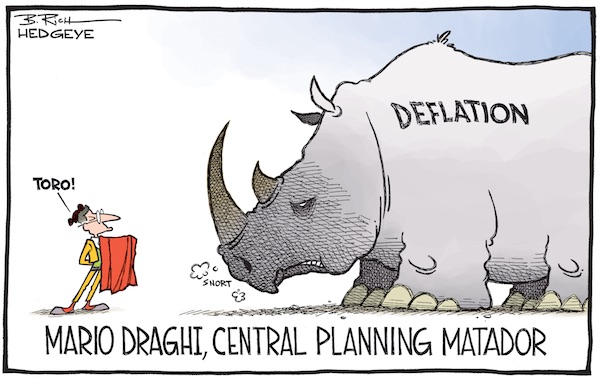

Tyrone Siu|Reuters Deflation

As yet another day of headlines shows, see the links and details in today’s Debt Rattle at the Automatic Earth, deflation is visible everywhere, from a 98% drop in EM debt issuance to junk bonds reporting the first loss since 2008 to corporate bonds downgrades to plummeting cattle prices in Kansas to China’s falling demand for iron ore and a whole list of other commodities.

The list is endless. It is absolutely everywhere. And it’s there every single day. But how would we know? After all, we’re being told incessantly that deflation equals falling consumer prices. And since these don’t fall -yet-, other than at the pump (something people seem to think is some freak accident), every Tom and Dick and Harry concludes there is no deflation.

But if you wait for consumer prices to fall to recognize deflationary forces, you’ll be way behind the curve. Always. Consumer prices won’t drop until we’re -very- well into deflation, and they will do so only at the moment when nary a soul can afford them anymore even at their new low levels.

The money supply, however it’s measured, may be soaring (Ambrose Evans-Pritchard makes the point every other day), but that makes no difference when spending falls as much as it does. And it does. The whole shebang is maxed out. And the whole caboodle is maxed out too. All of it except for central banks and other money printers.

Everyone has so much debt that spending can only come from borrowing more. Until it can’t. We read comments that tell us the global markets are reaching the end of the ‘credit cycle’, but can the insanity that has ‘saved’ the economy over the past 7 years truly be seen as a ‘cycle’, or is it perhaps instead just pure insanity? There’s never been so much debt on the planet, so unless we’re starting a whole new kind of cycle, not much about it looks cyclical.

Also, though we hear this all the time, the collapse in spending does not happen because people are ‘saving’, but we wouldn’t know that from the ‘official’ numbers, because when people pay down their debts, that is counted as ‘saving’.

So you have debt collectors at the front door (and the back) and you’re about to be evicted or lose your car, and then when you pay them with what you would really need to feed your kids with, and sell your furniture, and sell your TV, economic models tell you you’re actually saving.

That’s the sort of accounting retardation that keeps us from ever understanding what bind we’re really in. When deflation starts and commodities prices begin plunging -and they would have to be first, there’s no better barometer-, we’re told to think that only when what we pay for goods and services goes down, do we have deflation. And when we pay off our debts with our very very last pennies, they tell us we’re saving.

Of course we could have known long ago what’s happening not only if these faulty definitions weren’t so infectiously widespread, but also if our central banks wouldn’t have engaged in stimulus related actions, ostensibly meant to save the economy but which are in reality just yet another means of wealth transfer away from you and me.

What all the stimulus has done is suspend us in a Wile E. moment fashion, in which things look sort of OK while we’re busy frantically paddling our feet, but in which we’re just as sure as Mr. E. to eventually plummet to the ground, albeit with much less predictable results than in his case (he’s always fine after 10 seconds max).

Stimulus, whether disguised as QE or anything else, keeps us from recognizing the reality of the situation, and the deflation, that we’re in. But then someone gets nervous about their investments, or their loans, their stocks, and before you know it they all do, and everything turns out to be based on leveraged debt, of which they can’t get any anymore, and they all want their money back all at the same time, and you hear a big loud Poof!

One more time, this is deflation. This is what it looks like, what it smells like and what it quacks like.

Home › Forums › What Deflation Quacks Like