NPC District National Bank, Dupont branch, Washington, DC 1924

Vested interests at stake.

• The Big Guns Are Out: Soros, Rothschild Warn Of Brexit Doom (ZH)

Just yesterday, we recounted the story of “Black Wednesday” when on September 16, 1992, the UK was forced out of the EU’s exchange-rate mechanism, or ERM, when the BOE tapped out and allowed the British pound to float freely, leading to 15% losses in the sterling. As we noted, this was George Soros’ infamous trade which “broke the Bank of England” and made the Hungarian richer by over $1.5 bilion. 24 years later Soros is back, and this time he is warning against the kind of devaluation that made him a billionaire and which he believes will be unleashed by Brexit, when in a Guardian Op-Ed he wrote that U.K. voters are “grossly underestimating” the true costs of a vote to leave the EU, saying that there would be an “immediate and dramatic impact on financial markets, investment, prices and jobs.”

[..] It is notable that Soros’ warning comes just days after that of Jacob Rothschild himself who said in another Op-Ed, this time for The Times, that leaving the EU could lead to a “damaging and disorderly situation” in the UK as he urged Britons to vote ‘remain’. Just like Soros, Lord Rothschild, suddenly exhibiting a rare strain of humanitarian concern, said readers should not “risk the wellbeing of our country”and European countries are “better off together”. He said that “at present we enjoy being a permanent member of the UN security council and we are essential to the G8 and Commonwealth. But diplomacy, defence, the environment and our values of being a liberal democracy will all be at risk” adding that “I can see no good reason why we should accept our playing a diminished role on the world stage,” especially if his own personal fortune would be jeopardized.

Finally, completing the doom loop, was none other than Chancellor George Osborne who, according to the Telegraph, “refused to rule out suspending trading on the London stock market if Britons vote to leave the EU on Friday morning… The threat from the Chancellor, made in an LBC radio interview on Monday evening, after the market had closed could force shares down in London as early as Tuesday morning.”

Everyone’s broke.

• When Brexit Has Come And Gone, The Real Problems Will Remain (ZH)

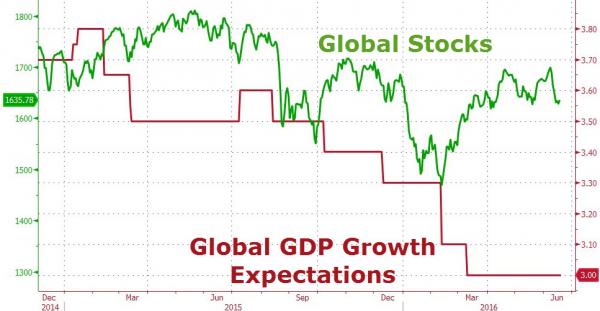

In a few days, Brexit will come and go, and just a few days later it will be forgotten, as either outcome will be far less dramatic than has been widely predicted by the same fearmongering economist pundits who have been wrong about everything else for the past 8 years. Ironically, the better outcome for the market is precisely a Brexit as the panic selloff will prompt central banks around the globe to boost enough monetary stimulus to send risk assets to new all time highs. What will remain, however, are the real problems. Here is SocGen with a useful reminder of just what those are, and why the market may have already forgotten that just one week ago the Fed threw in the towel when addressing precisely these problems. From SocGen’s Andrew Lapthone:

“Global equity markets continued to struggle last week, with the MSCI World index off 1.8% pushing the index back into red for the year. Big losses were seen in Japan with the Topix 500 down 6% and the volatile Mothers index crashing 18.5% over the week as the yen continued to strengthen. According to the BOE measure, the trade-weighted yen is now up more than 20% over the past year and back to where it stood three years ago. In the battle for the weakest currency, Japan looks to have thrown in the towel.

Whatever the outcome of the Brexit vote this week investors will still be facing the prospect of negative rates and negative yields on a huge range of bonds, massive corporate leverage with worryingly rising delinquencies and of course expensive equity markets and falling profits. To that extent these political events are a distraction from the main event, weak global economic growth and perverse asset markets. So whilst the market preference for the status quo might be celebrated in the short-term, actually when the fog clears all of the problems will still be there.”

Forcing companies to raise wages?!

• IMF Calls On Japan To ‘Reload’ Abenomics (Nikkei)

Japan needs bolder income policies such as penalizing profitable companies that do not increase wages, the IMF said on Monday after concluding its annual economic assessment of the country. Despite initial success, progress under Abenomics, Prime Minister Shinzo Abe’s trademark economic policies, has stalled in recent months. The inflation rate has dropped to negative territory again, while economic growth has remained anemic.The IMF now expects Japan’s economy to grow by about 0.5% in 2016, before slowing to 0.3% in 2017, with potential growth sliding to close to zero by 2030, due to the declining demographic. “Abenomics needs to be reloaded,” the IMF said in its report and argued that income policies combined with labor market reforms should “move to the forefront” of the country’s fight against lagging growth.

“The government can introduce a ‘comply or explain’ mechanism for profitable companies to ensure that they raise base wages by at least 3% and back this up by stronger tax incentives or – as a last resort – penalties,” the IMF wrote. Promoting intermediate contracts that balance job security and wage increases will “reinforce income policies,” it added. “Our perception is that much of the stasis of inflation [in Japan] comes from the legacy, the history of having negative inflation,” said David Lipton, first deputy managing director at the IMF, in a press conference in Tokyo. “Certainly firms have at this point the cash flow and resource at hand to provide some wage increases. There are wage increases evident in a wide range of companies across this economy, so our thought is to suggest that this be a broader practice and that it be more uniform.”

“..Mr Rajan has been an acerbic critic of zero rates and quantitative easing by the western central banks…”

• India’s Rockstar Central Banker Defeated As Modi Revolution Stalls (AEP)

India’s bid to become the ‘economic super-tiger’ of Asia is in serious doubt after an assault on the independence of the central bank and failure to deliver on promised reforms. The country has been the darling of the emerging market universe since the Hindu nationalist Narendra Modi swept into power in May 2014 promising a blitz of Thatcherite reform and a bonfire of the diktats, but key changes have been blocked in the legislature. The government has turned increasingly populist. Matters have come to a head with the de facto ouster of Raghuram Rajan, the superstar governor of the Reserve Bank of India (RBI), rebuked for keeping monetary policy too tight. It is part of a pattern of attacks on central banks by politicians across the world, and the latest sign that the glory days of the monetary overlords are waning.

Mr Rajan has been battling criticism for months but threw in the towel over the weekend, sending tremors through the Indian financial markets and provoking a flurry of warnings from global investors. “He has decided not to wait until he is refused a second term,” said Lord Desai from the London School of Economics. “This is ‘Rexit’ – India’s equivalent of ‘Brexit. It looks very bad for India and will not go down well in financial markets. He was defeated by the crony capitalists up against him,” he said. The government has dampened the impact with by relaxing barriers to foreign investment in the country, but it may have underestimated the totemic status of Mr Rajan outside India. He is seen by funds as the guarantor of good practice and market integrity. Mr Rajan is a former chief economist for the IMF, famed for warning that the US subprime debt bubble was out of control long before the Lehman crisis blew up in 2008.

[..] Mr Rajan has been an acerbic critic of zero rates and quantitative easing by the western central banks. He blames them for flooding the international system with excess liquidity that emerging markets could not easily control. This fueled dangerous boom-bust asset cycles. While QE might have ‘worked’ for the US, UK, and Europe – the jury is out even for them – Mr Rajan argues that the policy is a “Pareto sub-optimal” for the world as a whole, and ultimately increases the danger of a deflation-trap in the future. The Fed and the leading central banks of the West have never really answered his critique.

I was going to say the Empress has no clothes, but I don’t want that image lingering on my retina.

• Yellen Makes ‘Uncertainty’ New Mantra (R.)

The U.S. Federal Reserve’s dwindling confidence in its own outlook and resulting confusion among investors are creating a policy problem that may require chief Janet Yellen to lay out her own views more forcefully. The Fed chair’s next communications test comes on Tuesday and Wednesday during her semi-annual testimony to U.S. lawmakers, less than a week after the central bank kept interest rates unchanged near record lows and lowered its projections for hikes in 2017 and 2018. A self-described consensus builder, Yellen sees her job as reflecting the whole committee’s views rather than setting an agenda for others to follow.

“I think that’s a very laudable intent, but sometimes that produces a lack of clarity,” said former Fed staffer and current partner at Cornerstone Macro LLC Roberto Perli. “Sometimes there is a consensus for one reason and then next time there is a consensus for a different reason so the story shifts and people get confused.” In fact, Fed policymakers’ deepening uncertainty about their own projections has resulted in the central bank sending mixed messages – repeatedly ratcheting up rate hike expectations only to tone them down later.

Important point: “Whatever it takes” was orchestrated specifically to expel any market doubt with regard to the viability and sustainability of European monetary integration.

• “Whatever It Takes” Wasn’t Enough (Noland)

Back in 2012, Mario Draghi recognized how even the notion that a country might exit the euro could unleash market dynamics that would rather quickly place Europe’s markets and banking system in peril. “Whatever it takes” was orchestrated specifically to expel any market doubt with regard to the viability and sustainability of European monetary integration. On the back of a wall of liquidity and inflating securities markets, Draghi’s gambit held things together for a few years. That said, the ECB bet the ranch – and was compelled to ante up in response to market instability early this year. The outcome of the game is very much in doubt. While Britain is not even a member of the euro, Brexit provides a test of ECB policymaking. Is Europe robust or fragile?

Has relative financial stability been nothing more than a brittle ECB-fabricated façade? Are the forces mounted against integration and cooperation too powerful to disregard? Is European integration – along with the euro currency – viable long-term? It’s an untimely test, with confidence in Europe’s banks already waning. It’s furthermore an untimely test because of faltering confidence in the ECB and contemporary global central banking more generally. Global market instability has again resurfaced and there will be no resolution next week. The FOMC has confounded Fed watchers with its abrupt pivot back to ultra-dovishness. There shouldn’t be much confusion. Global market fragility has reemerged, and the Fed’s rapid retreat has confirmed the seriousness of what’s unfolding.

Central banks have thrown everything at the problem, yet markets remain as vulnerable as ever. At least the world was not facing the downside of China’s historic Credit Bubble back in 2012. The Fed has never admitted that global concerns have been dictating U.S. monetary policy since 2012. It has now become clear, throwing the analysis of policymaking into disarray. The harsh reality is also increasingly apparent: global monetary management is dysfunctional and central bankers have become perplexed – without a backup plan. Such an uncertain backdrop is pro-currency market instability and pro-de-risking/deleveraging.

Nobody has a reason to use the yuan.

• The World’s Newest “Reserve” Currency Is Anything But (Balding)

Last week’s decision by MSCI not to include Chinese shares in its primary emerging-markets stock index has been viewed – widely and rightly – as a blow to China’s hopes of internationalizing its financial sector. There’s worse news, though: Even the progress China’s made thus far is in danger of going into reverse. MSCI’s choice is a sharp contrast to the one made by the IMF last December, when it promised to begin including the Chinese yuan in its basket of “special drawing rights.” The move essentially conferred global reserve status on the currency, despite the fact that China arguably didn’t meet the conditions for inclusion: It was debatable whether the yuan could be considered “freely usable,” and in any case, it was hardly used. At its peak in August 2015, the yuan accounted for 2.79% of global payments, compared to 44.8% for the U.S. dollar.

The idea was that compromising now would encourage leaders in China to fulfill their pledges to liberalize the yuan fully by 2020. In fact, since the IMF’s decision, the yuan has if anything grown less international, not more. Since March 2015, yuan deposits in the three largest offshore centers – Hong Kong, Taiwan and Singapore – have fallen 16%, to a total of 1.24 trillion yuan or about $188 billion. The currency is being used in even fewer international transactions than before: Its share of global payments stood at 1.82% in April 2016. The fact that only a quarter of those international payments included a partner other than China or Hong Kong means that only about 0.5% of all yuan transactions are truly international in scope. This places the currency somewhere between those of Scandinavian powerhouses Norway and Denmark.

Absolutely completely madness. The casino keeps adding new slot machines and crap tables.

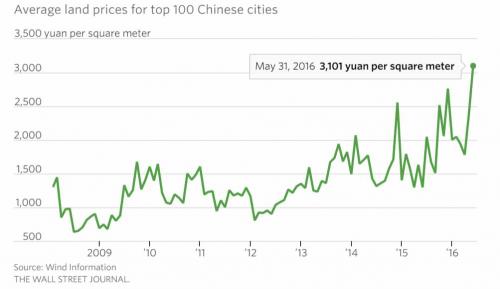

• China’s Developers Can’t Stop Overpaying for Property (WSJ)

If the cost of flour is higher than the price of bread, what should a baker do? Chinese property developers are choosing to buy more flour. Prices for land, the main ingredient of the property world, have hit record highs in auctions this year in many Chinese cities. The average land price per square meter for the top 100 cities in the first five months of this year jumped nearly 50% from the same period last year, according to Wind Information. Some land prices are even higher than housing prices nearby.

State-owned developer Poly Real Estate, for instance, bought a piece of land in a Shanghai suburb for 5.5 billion yuan ($835.5 million) last month. This translates to roughly 44,000 yuan per square meter of buildable space. Houses in the region meanwhile go for around 40,000 yuan per square meter. After taking into account construction costs, taxes and other expenses, property prices would have to nearly double for the developer to make money. Prime land in the biggest cities always costs a lot, but increasingly the voracious buyers are showing up in less prime locations and smaller cities. In Suzhou, a city near Shanghai, with a population of 1.1 million, land sales in the first five months of this year have already exceeded the total of last year. And average prices have doubled.

It’s the same they do with raw materials: “..After winning an auction, financial firms with access to cheap funding can apply for a loan with the land as collateral..”

• China’s ‘Land Kings’ Return as Housing Prices Rise (WSJ)

The “land kings” are back. That had been a nickname for Chinese developers paying sky-high prices for land parcels during China’s property boom earlier this decade, which left so-called ghost cities of unsold housing across China. Now, with housing prices in China’s larger cities again rising rapidly, frothy bids for land parcels are back. On June 8, Logan Property Holdings agreed to pay 14.1 billion yuan ($2.14 billion) for a piece of land in Shenzhen’s Guangming district, the largest-ever price tag in the southern Chinese city. Logan says it didn’t overpay, calling the price “relatively favorable” in a hot market. Earlier in June, a joint venture between two firms, one of which is backed by state-owned Power Construction Corp. of China, outbid 17 rivals with an 8.3 billion yuan offer for a plot in Shenzhen’s Longhua district.

The soaring land prices show the challenges facing the government as it tries to prevent property bubbles. Moves to stimulate China’s slowing economy and to trim excess housing in smaller cities across the country—such as interest-rate cuts and eased mortgage rules—have fed into speculative demand for homes in top-tier cities that are now scrambling to cool prices. Average housing prices in 70 Chinese cities were about 5% higher in May than a year earlier, the fifth straight month of increases. In top-tier cities, prices were up 19% to 53%. But land prices are shooting up not just in Shenzhen, Shanghai and Beijing, but also in lower-profile cities such as Hangzhou, Hefei and Zhengzhou. Officials face a dilemma in trying to tame land prices: Land is commonly used as debt collateral; a sharp drop in valuation could trigger defaults and produce a wave of bad loans, hurting the economy. On the other hand, runaway land prices make it harder for ordinary Chinese to afford apartments.

[..] There is also concern that financial firms with little experience as builders are viewing land as an opportunity for arbitrage. After winning an auction, financial firms with access to cheap funding can apply for a loan with the land as collateral, and use that to extend a construction loan at a higher rate to a partner, which is typically a property developer.

“Like an oil lease, you’re easily disposable..”

• Energy-Related Loan Losses Rising (B.)

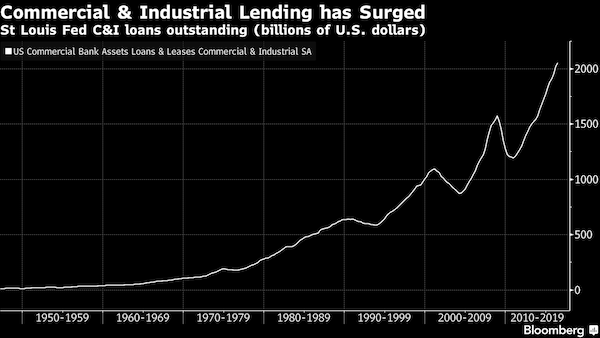

“Like an oil lease, you’re easily disposable,” the villainous J.R. Ewing quipped to his beauty queen wife in the 1970s television series Dallas. Readers of the latest edition of the Federal Reserve Bank of Dallas’s quarterly southwest economy publication might want to keep that quote in mind. News from the oil patch — the 11th Fed district that encompasses the shale heartland — is not encouraging, as it reveals a sharper rise in souring energy-related loans. “The persistence of relatively low oil prices has begun taking a toll on district bank customers,” the Dallas Fed said in its report.

“Oil-price hedges become less effective the longer prices stay low, and the cushion built by energy firms during the good times gets thinner. Cash flow becomes stretched and collateral loses its value, further pressuring borrowers.” That forces them closer to default unless banks are able to keep their lending spigots open. Many of these loans fall under the umbrella of commercial and industrial (C&I) lending — a category which has been surging in conjunction with commercial real estate (CRE) lending in recent years. While regulators have kept a somewhat lazy eye on rising CRE loans since even before the 2008 financial crisis (and certainly after it), the boom in C&I lending has been met with far less scrutiny — resulting in charts which look like this:

“..millions of electric customers in Southern California were warned they could suffer power outages of up to 14 days this summer..”

• California Power Grid Prepares For Heatwave, Power Outages (R.)

California will have its first test of plans to keep the lights on this summer following the shutdown of the key Aliso Canyon natural gas storage facility as temperatures in the Los Angeles area are forecast to hit triple digits this week. With record-setting heat and air conditioning demand expected in Southern California, the state’s power grid operator issued a so-called “flex alert,” urging consumers to conserve energy to help prevent rotating power outages – which could occur regardless. Electricity demand is expected to rise during the unseasonable heatwave on Monday and Tuesday, with forecast system-wide use expected to top 45,000 megawatts, said the California Independent System Operator (ISO), which manages electricity flow through the state.

That compares with a peak demand of 47,358 MW last year and the all-time high of 50,270 MW set in July 2006. That could put stress on the power grid, particularly with the shut-in of Aliso Canyon, following a massive leak at the underground storage facility in October. The facility, in the San Fernando Valley, is the second largest storage field in the western United States, according to federal data, and therefore crucial for power generation. All customers, including homes, hospitals, oil refineries and airports are at risk of losing power at some point this summer because a majority of electric generating stations in California use gas as their primary fuel. In April, millions of electric customers in Southern California were warned they could suffer power outages of up to 14 days this summer due to the closure.

“The Border Force Act gives the Australian government the power to jail, for up to two years, anybody employed by the department..”

• Australia Whistleblower Loses Job After Speaking Out On Refugee Camps (G.)

The trauma specialist who condemned the treatment of asylum seekers and refugees in Australia’s offshore detention regime as the worst “atrocity” he has seen has had his contract to work on Nauru terminated. Psychologist Paul Stevenson, whom the Australian government awarded an Order of Australia for his work counselling victims of the Bali bombings, had undertaken 14 deployments to Nauru and to Manus Island in Papua New Guinea. He was due to return to Nauru on Thursday. But after he spoke publicly to the Guardian about his experiences working within Australia’s offshore detention regime – describing conditions in the camps as “demoralising … and desperate” – he was told his contract had been summarily cancelled.

PsyCare, the company through which he was employed to provide counselling to guards working in offshore detention, informed him by email his employment had been terminated. Stevenson said the news was not unexpected. “But the public needs to hear about the consequences people face for speaking out, and to understand the level they go to in minimising access.” [..] The Border Force Act gives the Australian government the power to jail, for up to two years, anybody employed by the department or its contractors who speaks publicly about conditions inside the offshore detention regime, including doctors advocating for better healthcare, or other workers exposing sexual and physical abuse of detainees.

Home › Forums › Debt Rattle June 21 2016