Harris&Ewing Car exterior. Washington & Old Dominion R.R. 1930

The amount of nonsense that can be held in just a few words is breathtaking. Nobody knows what deflation is. The IMF and Shinzo Abe: the deaf and the blind.

• IMF Calls For Overhaul Of Abenomics (R.)

The IMF on Monday urged Japan’s government to overhaul its stimulus policies by moving income policies and labor market reform to the forefront, supported by more monetary and fiscal stimulus. “Under current policies, the high nominal growth goal, the inflation target, and the primary budget surplus objective all remain out of reach within the timeframe set by the authorities,” the IMF said in a statement after “Article 4” annual consultations on economic policy with Japan.

The global lender called for a more flexible monetary policy framework with the Bank of Japan abandoning a specific calendar date for achieving its 2% inflation target. It added that Japan would need to raise the sales tax to at least 15% to strike the right balance between growth and fiscal sustainability. “Without bolder structural reforms and credible fiscal consolidation, domestic demand could remain sluggish, and any further monetary easing could lead to overreliance on depreciation of the yen,” the IMF said.

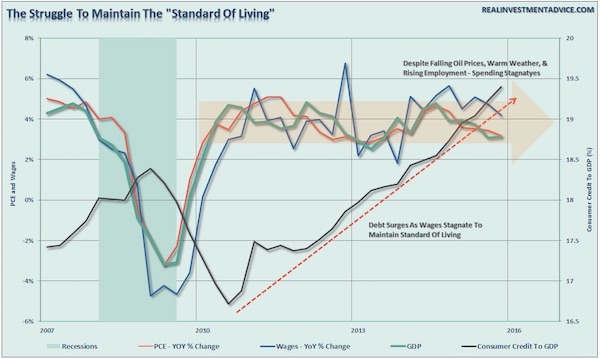

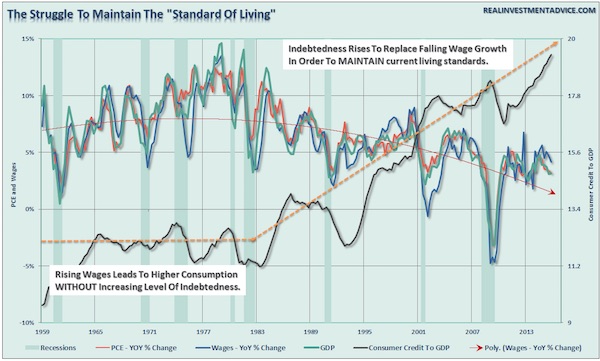

Strong graphs.

• The Economy Is Not What It Seems (Roberts)

Economic cycles are only sustainable for as long as excesses are being built. The natural law of reversions, while they can be suspended by artificial interventions, can not be repealed. More importantly, while there is currently “no sign of recession,” what is going on with the main driver of economic growth – the consumer? The chart below shows the real problem. Since the financial crisis, the average American has not seen much of a recovery. Wages have remained stagnant, real employment has been subdued and the actual cost of living (when accounting for insurance, college, and taxes) has risen rather sharply. The net effect has been a struggle to maintain the current standard of living which can be seen by the surge in credit as a percentage of the economy.

To put this into perspective, we can look back throughout history and see that substantial increases in consumer debt to GDP have occurred coincident with recessionary drags in the economy.

A nation built on debt.

• Asking Prices For Homes In England And Wales Rise To Record High (G.)

Asking prices for homes in England and Wales have risen to a new record high, and sales are being agreed quicker than at any point since 2010, according to latest figures from the property website Rightmove. The site, which measured asking prices for just under 150,000 properties listed over the past month, said they had risen by 0.8% in June, to an average of £310,471 – 5.5% higher than in June 2015. Asking prices have risen every month so far in 2016, and Rightmove said the rush for properties ahead of April’s stamp duty increase for second homes and the availability of cheap mortgages had supported the market. As a result of increased buyer demand, the average time taken to sell a property dropped to 57 days, compared with 60 in May and 65 in June 2015.

The headline figures do not suggest that the looming EU referendum is having an impact on buyers’ decisions, but Rightmove said there were signs that sellers were sitting tight until the outcome is known. “Fewer new sellers are coming to market, with this month’s numbers being 5.3% below the monthly average for this time of year since 2010,” the monthly report said. “The most reluctant are owners of larger homes, those with four or more bedrooms, with 6.6% fewer sellers over the same time period. Given the well-documented structural shortages of housing supply any longer-term reluctance of owners to come to market would be a worrying trend.”

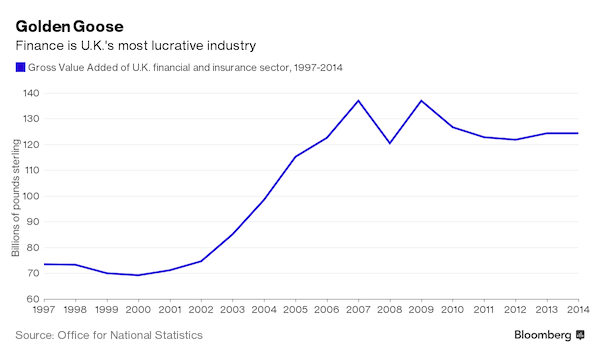

Far too big.

• City of London Fears Brexit Will End Golden Age (BBG)

Gooses don’t come much more golden than the City of London. The narrow lanes of the Square Mile, lined with handsome neoclassical stone and gleaming modern glass, are at the heart of a British financial sector that paid 66 billion pounds ($94 billion) in tax last year and employs more than 2 million people nationwide. It is oft-resented, has helped push the capital’s house prices out of reach for many, and required a bailout of more than 100 billion pounds from taxpayers less than a decade ago. It is also without a doubt the country’s most lucrative industry. Yet ahead of a June 23 referendum on European Union membership, many of the City’s leading lights are deeply worried about its future.

Since almost exactly 30 years ago, when Conservative Prime Minister Margaret Thatcher liberalized finance through a package of reforms so dramatic they were dubbed the “Big Bang,” London has become the undisputed financial capital of a united Europe – a status that now hangs in the balance. “Just because the City is strong at the moment doesn’t mean that it has a perpetual right to remain so,” said Marcus Agius, 69, the chairman of Barclays during the 2008 global financial crisis. “Brexit would be an act of supreme folly. In the future we would look back and wonder: ‘Why the hell did we do that? What were we thinking?’”

“..remaining in a collapsing tower of bad debt will guarantee a far worse economic outcome and catastrophic confrontations between Europe’s ever narrowing core and ever widening periphery..”

• Brexit Is The Best Outcome (Gambles)

Imagine this week that the exit vote prevails, the U.K. government stands down and in a ripple effect not seen in Europe since the fall of the Berlin Wall, the immediate dissolution of the EU is announced and there is a return to national currencies. Equities would plunge and trading in the euro currency would be suspended. European bourses would go into free-fall, continuing even after the U.K., the U.S. and others initially appear to stabilize. Each country’s no longer fungible euro would be converted into national currencies and chaos would reign until many EU national governments bail out banks. The uncertainty caused would puncture China’s debt bubble, hitting emerging and developed markets.

After a few years of global pain, by 2018 to 2020 peripheral Europe, the U.K., the U.S. and ‘healthier” emerging economies might begin to recover. Recovery in Germany and China, however, may take far longer. Until now Germany has successfully re-imposed the costs of the reckless euro borrowing spree on debtor banks, individuals, corporations and even governments. A break-up of either the euro or the EU would expose German banks’ vulnerable underbellies, having effectively underwritten the euro project in exchange for German control over sovereign budgets. Sounds scary? In my view, this would be the best long term outcome.

However, it’s extremely unlikely to happen. Either U.K. voters will decide to remain or, if the leave campaign wins, the U.K. government and Eurocrats will desperately cling on to power. This may delay the collapse but would leave a far more painful journey with a much more severe conclusion ahead. [..] The EU has already facilitated the destruction of private and sovereign balance sheets with reckless levels of record debt that can never be repaid. This is why leaving now will precipitate a global economic drama. It’s also why remaining in a collapsing tower of bad debt will guarantee a far worse economic outcome and catastrophic confrontations between Europe’s ever narrowing core and ever widening periphery.

“The EU elite feel too secure and have too much to lose.”

• Brexit – The End of the Universe (Rose)

[..] The EU spends millions every year maintaining the illusion that it is one of the great European achievements. The problem is that it has not been the case for a long time. It has become the enforcer of a now-liberal agenda, converting the particular interests of big business into European law. So we have an anti-democratic EU under German hegemony furthering the interests of large corporations – I doubt this is what the people of Europe want or deserve. The words of the British playwright Dennis Potter apply to the current situation in the EU: “They are not interested in our development or emancipation. That is the quality of an occupying force.” This is a conclusion the Greeks reached years ago.

It has been interesting to follow the stages of the Brexit campaign. Initially it seemed to be a referendum concerning David Cameron’s government. Then the role of immigration took centre stage. Now the question of national sovereignty and the lack of democracy in the EU has become an important debating point. There is even a nascent debate among the British left if the EU can be re-democratised, which is rather odd, seeing that it never was a democratic organisation. There seems to be little hope of the EU being reformed. The EU elite feel too secure and have too much to lose. A democratic EU is completely useless for them, especially for the Germans.

Schäuble has recently joined those calling for a stop to further EU integration. Germany no longer needs integration, which implies compromise, when it is already calling the shots. As I was recently in Brussels a member of an NGO explained that Germany is very content with the current EU situation. They dictate policy. There may be resistance here and there, but these cases are never existential for Germany and its clients. Brexit however offers Britain a unique opportunity. Once out of the EU, who are the Tories going to blame when it becomes clear that it is mainly they who are ruining Britain, not the EU or the immigrants?

The closer they try to make the union, the more violent the reactions will be.

• The Progressive Argument For Leaving The EU Is Not Being Heard (G.)

The British economy has become increasingly dominated by the fortunes of the financial sector, with the bankers responsible for the worst slump since the 1930s escaping pretty much scot free. London and the rest of the UK have become two countries, which explains why hostility to the EU increases with distance from the capital. Nor is this phenomenon confined to the UK. It has become commonplace to bracket growing support for leave in poorer parts of Britain with Donald Trump’s emergence as the Republican candidate in this year’s US presidential election, but populist and anti EU sentiment is on the rise across Europe.

The US research company Pew conducted a survey earlier this year to test sentiment towards the EU. In Britain, 48% said they had an unfavourable view of the EU and 44% said they had a favourable view. In France, the anti-EU sentiment was much more pronounced at 61% and 38% in favour, while in Germany there had been an eight-point drop in support for the EU in the past year, leaving those in favour only narrowly ahead at 50% against 48% . The impact of the great recession in Europe has been exacerbated by monetary union, a policy blunder of catastrophic proportions. The euro has been responsible for the slow growth and high unemployment that has angered the French, and the high debts and that have alarmed the Germans.

Stir in the unexpectedly large flows of refugees from the Middle East and North Africa, and you have a toxic mix. Last summer, when the Greek debt crisis was at its most intense, Europe’s leaders came up with a plan. The “five presidents’ report” laid down a step-by-step approach to a United States of Europe, with banking union followed by a common budget and finally political union. Getting even the least controversial part of this agenda – banking union – past sceptical European electorates has proved impossible. Yet the alternative approach, breaking up the euro and giving countries more control over their own economic destiny, is seen as not just potentially dangerous but also a betrayal of the idea of ever-closer union.

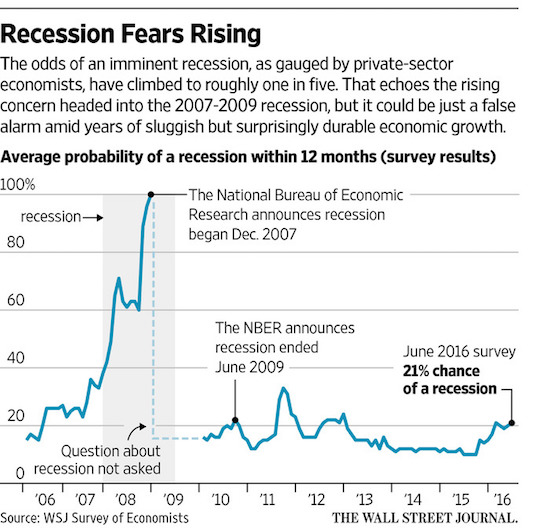

Useless talk about how hard forecasting is.

• Economic Gauges Raise Specter of Recession (WSJ)

Gut-wrenching gyrations in financial markets early in the year helped summon the specter of a new recession. Now, warning signs are coming mostly from the U.S. economy itself. Hiring is slowing, auto sales are slipping and business investment is dropping. America’s factories remain weak and corporate profits are under pressure. All are classic signs of an economic downturn, and forecasters have certainly noticed. In a Wall Street Journal survey this month, economists pegged the probability of a recession starting within the next year at 21%, up from just 10% a year earlier. Some economists think the risk is even higher. Whether this proves to be the precursor to a recession or yet another false alarm could take years to sort out.

Uneven economic growth throughout the seven-year expansion has delivered several such scares that passed. But plenty of gauges are pointing to a decent chance of a recession starting within the next 18 months. “Like everybody, I can see clouds on the horizon,” said Stanford University economist Robert Hall, chairman of the National Bureau of Economic Research committee that will—eventually—identify the start date of the next recession. But, he said, “Nobody’s very good at predicting. I don’t even try.” Financial-market convulsions at the start of the year stoked worries about a possible recession. But continued strength in the labor market reassured most economists about the resilience of the expansion, and markets largely calmed.

While the economy is still adding jobs, the recent hiring slowdown has spooked some forecasters. May’s growth in payrolls—just 38,000 jobs—was the weakest month of hiring since U.S. employers stopped shedding jobs in 2010. Barclays economist Michael Gapen noted that since 1960, persistently slower hiring compared with the recovery average, as seen in recent months, “more often than not” was followed by a recession in the next nine to 18 months.

M5S won’t be happy about not getting Milan.

• Italy PM Renzi Suffers Setback As 5-Star Makes Breakthrough (R.)

Italian Prime Minister Matteo Renzi was trounced by the anti-establishment 5-Star Movement in local elections in Rome and Turin on Sunday, clouding his chances of winning a do-or-die referendum in October. The result represented a major breakthrough for 5-Star, which feeds off popular anger over widespread corruption, with the party’s Virginia Raggi, a 37-year-old lawyer, making history by becoming the first woman mayor in the Italian capital. “A new era is beginning with us,” said Raggi, who won 67% of the vote in the run-off ballot. “We’ll work to bring back legality and transparency to the city’s institutions.”

As a consolation for Renzi, his center-left Democratic Party (PD) held on to power in Italy’s financial capital Milan and in the northern city of Bologna, beating more traditional, center-right candidates in both places. Renzi has said he would not step down whatever the results on Sunday. Instead, he has pinned his future on the referendum on his constitutional reform that, he says, will bring stability to Italy and end its tradition of revolving-door governments. But the losses in Rome and Turin suggest he might struggle to rally the nation behind him, with opposition parties lined up to reject his reform and even his own PD divided over the issue.

[..] The PD’s defeat in Rome had been expected after widespread criticism of its management of the city over the past three years, with its mayor forced to resign in 2015 in a scandal over his expenses. But the loss in Turin, a center-left stronghold and home of carmaker Fiat, was a major shock. The incumbent, Piero Fassino, a veteran party heavyweight, was swept aside by 5-Star candidate Chiara Appendino, 31, who overturned an 11-point gap after the first round to win 55% of the vote. “It will be difficult (for the PD) to downplay what happened,” wrote Massimo Franco, leading political commentator for the Corriere della Sera newspaper.

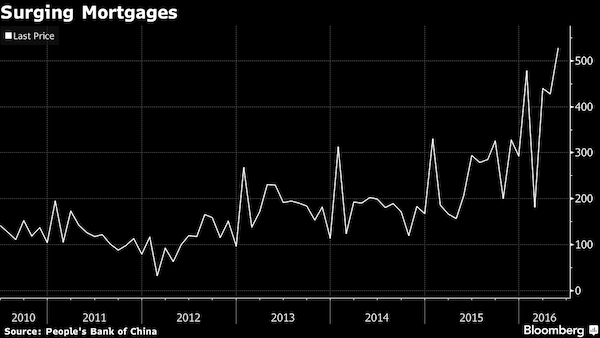

How to make even Bizarro jealous: ..the recovery is almost hitting the ceiling.. That mortgages graph is frightening by the way.

• China’s Housing Market in Flux as Price Recovery Tapering Off (BBG)

The recovery in China’s housing market that helped underpin the economy in the first half is showing signs of tapering off. New-home prices excluding government-subsidized housing climbed in 60 cities in May, down from 65 in April, among the 70 tracked, the National Bureau of Statistics said Saturday. With less of a boost from a recovering property market likely in the second half, the government will need to find other drivers such as infrastructure investment to meet its growth goal of at least 6.5% this year, according to Shen Jianguang at Mizuho. “The housing market is in flux,” Shen said. “The government is likely to step up policies to encourage home-buying in places where demand is weak and inventories of unsold housing are still high as the destocking policy didn’t yield the expected results.

” Faced with a massive pile of unsold homes in smaller cities, the government and central bank since late 2014 had unleashed a range of measures aimed at improving demand for homes to clear the overhang. While inventory levels may not have budged much, mortgage demand has, rising to a record last month, according to the latest data from the central bank. Still, the recovery in home prices last month abated as local governments put curbs in top economic centers like Shanghai and Shenzhen where prices have been surging, while they deployed home-buying stimulus in smaller cities to clear the glut of unsold residences. “This market rebound since last May has been fueled by credit and easing measures, making it unsustainable in some regions,” said Xia Dan at Bank of Communications. “Now the recovery is almost hitting the ceiling.”

Some send nude selfies to get a better loan.

• Chinese Bare All for Credit (BBG)

Talkative people pay back loans. The very talkative default. Too taciturn is no good either. Also, don’t take out a loan at 4 a.m. Those are lessons from online lenders in China that are tracking people’s behavior – via apps on their mobile phones – and taking it into account when deciding what their credit ratings should be. Chinese consumers don’t mind handing over personal details that would spark outrage in the West, in exchange for lower interest rates. The Chinese willingness to share is key to China’s plan to create the largest repository of online data on its citizens and their habits in the world. More than 80% of what’s collected is in the hands of the government, which will make it largely available for private sector use, Chinese Premier Li Keqiang recently told an audience in China that included Dell CEO Michael Dell.

WeLab Ltd., a Hong Kong-based online lender that makes loans in China, looks at what apps people have downloaded, where they go using the phone’s GPS tracker, their social networks and their school records. It offers discounted interest rates for each extra piece of personal information that helps profile customers for credit ratings. In Hong Kong, for example, giving WeLab access to a Facebook account gets a 5% discount on the cost of a loan, and access to LinkedIn gets you 10% off, on loans with interest rates that otherwise reach as high as 20%. “Chinese people have no issue handing over their personal data, giving you their credit card number, giving you their bank account,” said GGV Capital’s Jenny Lee, whose firm has invested in data-hungry tech giants such as Alibaba. “Look at the whole internet finance sector, people are giving you their bank statement so you can do profiling.”

Another record. We’re number 1!

• World Refugee Day: 65.3 Million People Displaced (R.)

A record 65.3 million people were uprooted worldwide last year, many of them fleeing wars only to face walls, tougher laws and xenophobia as they reach borders, the United Nations refugee agency said on Monday. The figure, which jumped from 59.5 million in 2014 and by 50% in five years, means that 1 in every 113 people on the planet is now a refugee, asylum-seeker or internally displaced in a home country. Fighting in Syria, Afghanistan, Burundi and South Sudan has driven the latest exodus, bringing the total number of refugees to 21.3 million, half of them children, the UNHCR said in its “Global Trends” report marking World Refugee Day.

“The refugees and migrants crossing the Mediterranean and arriving on the shores of Europe, the message that they have carried is that if you don’t solve problems, problems will come to you,” U.N. High Commissioner for Refugees Filippo Grandi told a news briefing. “It’s painful that it has taken so long for people in the rich countries to understand that,” he said. “We need action, political action to stop conflicts, that would be the most important prevention of refugee flows.” A record 2 million new asylum claims were lodged in industrialized countries in 2015, the report said. Nearly 100,000 were children unaccompanied or separated from their families, a three-fold rise on 2014 and a historic high.

Germany, where one in three applicants was Syrian, led with 441,900 claims, followed by the United States with 172,700, many of them fleeing gang and drug-related violence in Mexico and Central America. Developing regions still host 86% of the world’s refugees, led by Turkey with 2.5 million Syrians, followed by Pakistan and Lebanon, the report said.

Our friend Erdogan.

• Turkish Border Guards Shoot and Kill 8 Syrian Refugees, 3 Children (G.)

Eight Syrian refugees have been shot dead by Turkish border guards as they tried to escape war-torn northern Syria, a human rights watchdog has claimed. Three children, four women and one man were killed on Saturday night, according to the Syrian Observatory for Human Rights. It said a total of 60 Syrian refugees had been shot at the border since the start of the year. Six of this weekend’s casualties were from the same family, said the observatory’s founder, Rami Abdelrahman. “I sent our activists to hospital there, we have video [of the corpses], but we haven’t published it because there are children [involved],” he said.

The Local Coordination Committees, a network of activists inside Syria, supported the claim, reporting that one of the children was as young as six. Syrian refugees have been making illegal crossings of the Turkish border as Jordan, Turkey and Lebanon have made it virtually impossible for them to leave Syria legally. There have been reports of shootings on the border since at least 2013, and rights groups fear that the number of incidents has increased since European countries, including Britain, began pressing Turkey to curb migration flows towards Europe late last year.

Home › Forums › Debt Rattle June 20 2016