DPC On the beach, Coney Island 1907

Seen a whole new bunch of utterly sickening videos again. As I said a few days ago, nothing has changed with policing in the US other than that now everyone has a camera.

But i don’t think it’s much use to post all that mindless violence here.

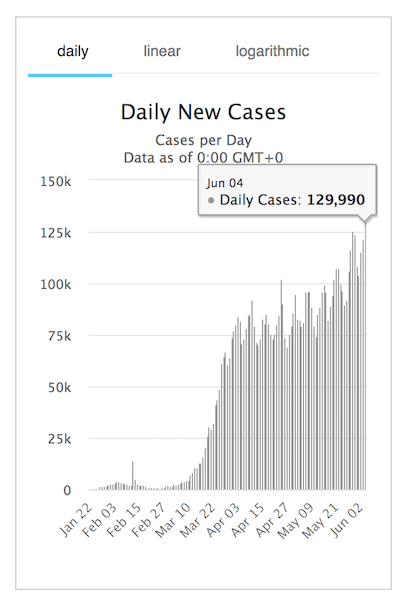

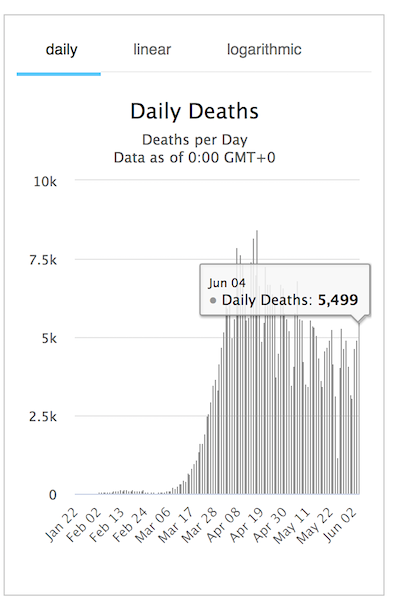

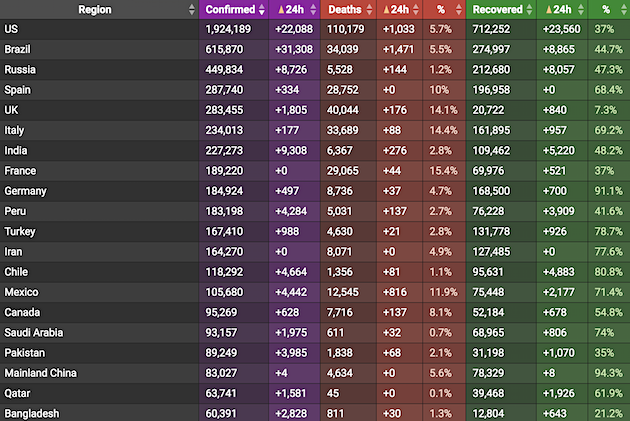

Worldometer puts global new cases for June 4 at + 129,990. A new record. The increase in cases warrants much more attention than it gets.

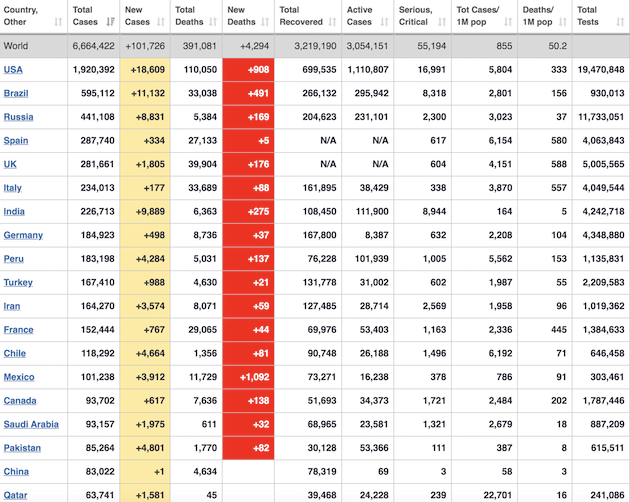

New cases past 24 hours in:

• US + 22,406

• Brazil + 31,890

• Russia + 8,831

• India + 9,908

• Chile + 4,664

• Pakistan + 3,895

• Mexico + 4,442

New daily highs in Covid-19 cases and deaths for India, Brazil, South Africa, and Mexico.

Another 20,000+ cases and another 1,000+ dead in the United States.

Worldometer puts global new deaths for June 4 at + 5,499.

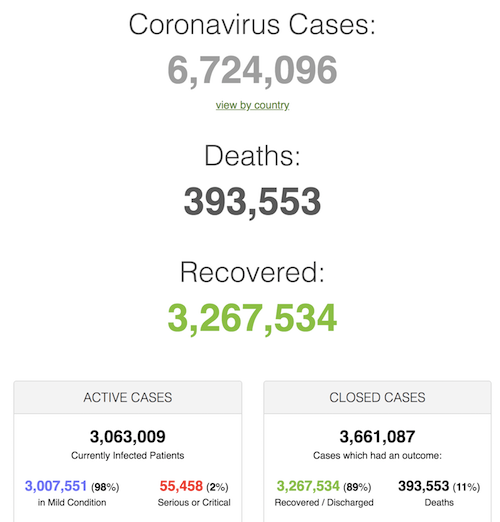

• Cases 6,724,096 (+ 127,595 from yesterday’s 6,596,501)

• Deaths 393,553 (+ 5,132 from yesterday’s 388,421)

From Worldometer yesterday evening -before their day’s close-:

From Worldometer:

From COVID19Info.live:

Happy Nonfarm Payroll Friday Eve!

My hats off to Ellen Zentner’s group at @MorganStanley

They’ve been spot on with their payrolls forecasts thus far. Let’s see if their winning streak continues.

@SoberLook pic.twitter.com/ecVN84Hmey

— Danielle DiMartino Booth (@DiMartinoBooth) June 5, 2020

A curious initiative.

Today we launch #IPAC#standtogether pic.twitter.com/bt19tb3bVB

— Inter-Parliamentary Alliance on China (@ipacglobal) June 4, 2020

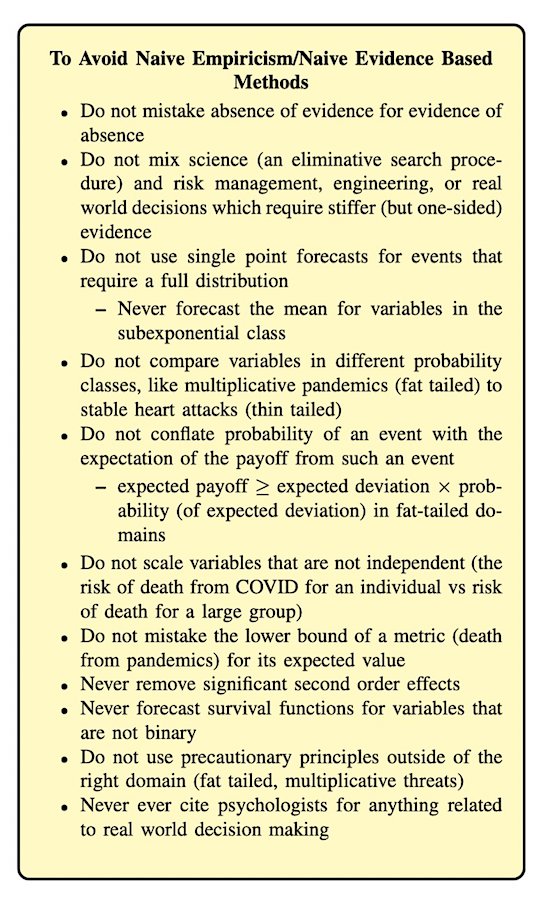

Taleb principles

Pakistan may be more inclined towards lifting a lockdown due to its poverty, but the cost will in the end almost certainly be much higher because of it, both in economic terms and in lives.

• After Pakistan’s Lockdown Gamble, COVID19 Cases Surge (R.)

Four weeks ago, with its most important festival coming up and millions of people facing starvation as economic activity dwindled, Pakistan lifted a two-month-long coronavirus lockdown. Prime Minister Imran Khan has said despite rising infections and deaths, the country would need to learn to “live with” the virus to avert pushing tens of millions living on daily wages into destitution. Now, a Reuters review of government data shows over 20,000 cases of the virus were identified in the three weeks before the lockdown was lifted, and more than double that figure were identified in the three weeks since. To be sure, testing rates have also increased. But of those tested, the daily average of positive results climbed from on average 11.5% in the three weeks before the lockdown was lifted, to 15.4% on average in the subsequent three weeks.

The ratio is around 23% this week, according to the data. Pakistan has officially identified over 80,000 cases of COVID-19, with 1,770 confirmed deaths. “Those numbers are concerning, since they do suggest there may still be widespread transmission in certain parts of the country,” said Claire Standley, assistant research professor at the Department of International Health at Georgetown University. [..] According to a letter seen by Reuters, a committee of experts backed by the local health department in Pakistan’s most populous province, Punjab, told the provincial government the lockdown needed to continue. The letter said random testing suggested more than 670,000 people in the provincial capital Lahore had likely contracted the virus, many of them asymptomatic.

Pakistan lifted its lockdown on May 9, about two weeks before the Eid al-Fitr festival that marks the end of the Islamic holy month of Ramadan and is celebrated with family gatherings and feasting. Transport and most businesses have re-opened but cinemas, theatres and schools remain closed. There has been growing debate among experts globally on whether populous developing nations can afford comprehensive social distancing measures to contain the coronavirus while avoiding economic ruin.

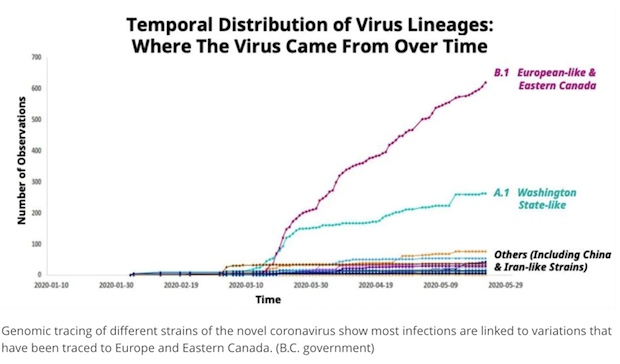

Very useful research, albeit a bit too localized.

• Most COVID-19 Cases In BC Have Strains From Europe And Eastern Canada (CBC)

Strains traced to Europe and Eastern Canada are by far the largest source of COVID-19 infections in B.C., according to new modelling presented by the provincial government Thursday. Provincial Health Officer Dr. Bonnie Henry revealed the results of genomic tracing of different strains of the virus, showing that of those samples that have been sequenced, early cases linked to travel from China and Iran appear to have been well contained, leading to relatively few other infections. But beginning in March, with an outbreak that began with the Pacific Dental Conference in Vancouver, infections with strains from Eastern Canada and Europe spiked dramatically.

“One of the people that we knew was positive and had attended that conference had previously been in Germany during his incubation period before he became ill,” Henry said. Strains traced to Washington state have also been linked to a large number of cases, particularly in long-term care homes in the Vancouver Coastal Health region. Henry explained that this kind of tracing is possible because the genome of the virus changes relatively quickly, but not as fast as diseases like influenza. She also announced nine new confirmed cases of the virus on Thursday, for a total of 2,632 to date. No new deaths have been recorded, leaving B.C.’s total at 166.

The new cases announced Thursday include four people who have already recovered, people that Henry described as epidemiologically linked to previous patients who have tested positive. This means these four people were close contacts of known cases and developed symptoms of COVID-19, but may not have had access to testing at the time.

As I commented yesterday: when they say they “can no longer vouch for the veracity of the primary data sources”, that means they never could, because they never had access to the data or the sources. We know this because it’s not as if either has dramatically changed since publication, or they would have mentioned it.

• Authors Retract Influential Lancet Article That Found HCQ Risks (R.)

An influential medical journal article that found hydroxychloroquine increased the risk of death in COVID-19 patients was retracted on Thursday, adding to the controversy around a drug championed by U.S. President Donald Trump. Three of the authors of the article retracted it, citing concerns about the quality and veracity of data in the study. The anti-malarial drug has been controversial in part due to support from Trump, as well as implications of the study published in British medical journal the Lancet last month, which led several COVID-19 studies to be halted. The three authors said Surgisphere, the company that provided the data, would not transfer the dataset for an independent review and that they “can no longer vouch for the veracity of the primary data sources.”

The fourth author of the study, Dr. Sapan Desai, the chief executive of Surgisphere, declined to comment on the retraction. [..] Another study published in the New England Journal of Medicine that relied on Surgisphere data and shared the same lead author, Harvard Medical School Professor Mandeep Mehra, was also retracted for the same reason. The observational study published in the Lancet on May 22 said it looked at 96,000 hospitalized COVID-19 patients, some treated with the decades-old malaria drug. It claimed that those treated with hydroxychloroquine or the related chloroquine had higher risk of death and heart rhythm problems than patients who were not given the medicines.

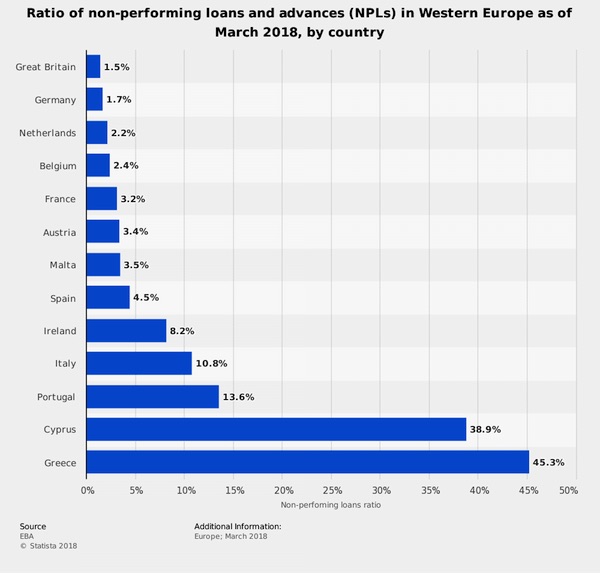

The idea: save the banks so they can lend money at higher rates than they borrow at from the ECB. Utterly crazy and useless.

• ECB Gives Another Shot Of Stimulus As Economy Reels (R.)

Just months after a raft of crisis measures, the ECB again expanded its money-printing scheme to cushion a potential fall in output of up to 12% this year, even as governments spend record amounts to preserve jobs while restrictions keep businesses shuttered. “The euro area economy is experiencing an unprecedented contraction,” ECB President Christine Lagarde said. “There has been an abrupt drop in economic activity as a result of the coronavirus pandemic and the measures taken to contain it.” The ECB’s move, coming just weeks after Germany’s Constitutional Court tried to curb its powers, was also seen as an act of defiance, with one of the European Union’s most powerful institutions making clear it would not take orders from national courts.

Thursday’s decision extended the ECB’s emergency bond purchase scheme to mid-2021 and increased it by 600 billion euros to 1.35 trillion euros. That should allow the bank to buy up most of the new debt euro zone governments are issuing to overcome the pandemic. Three sources told Reuters that figure was a compromise after policymakers discussed an expansion of between 500 billion and 750 billion euros. Markets rallied on the decision, with bond yields on the bloc’s periphery tumbling, suggesting the measures would give a bigger boost to nations such as Italy and Spain, both hit hard by the pandemic and struggling with high debt levels.

Ten-year Italian yields fell by 14 basis points, but perhaps more importantly the gap between Italian and German bonds, a key benchmark, narrowed by 16 basis points. The ECB’s bond purchases come on top of big German spending plans and an ambitious European Union fiscal package, pointing to the biggest coordinated effort in the euro’s 20-year history. ECB staff dramatically revised downward their baseline scenario for euro zone output this year to a contraction of 8.7% from the modest 0.8% rise they forecast only in March.

Short Thread: Yesterday's new data for the #PEPP program has shown that #ECB deviated from capital keys by massively "over"buying Italian bonds and to a lesser extent "over"buying German and Spanish bonds. In contrast massively "under"buying French bonds. (1/N) pic.twitter.com/eaBFCZ8D5v

— Nils Sonnenberg (@zonnbergo) June 3, 2020

After ten years of Abenomics failure, here comes deflation again. Only now Abe can blame a virus.

• Japan’s Household Spending Falls At Record Pace As Virus Stalls Economy (R.)

Japan’s household spending fell at the fastest pace on record in April as the coronavirus shut down travel and dining-out in the world’s third-largest economy, and prospects of higher jobs losses chilled consumer sentiment. The dismal number will keep policymakers under pressure to prevent a larger decline in the economy, which is expected to fall deeper into recession this quarter. Household spending tumbled 11.1% in April from a year earlier, government data showed on Friday, marking the fastest pace of decline since comparable data became available in 2001. The decline was slower than a median forecast of a 15.4% fall and followed March’s 6.0% decline.

Many analysts expect consumption to have bottomed out in April or May, as businesses re-open after last month’s lifting of nationwide lockdowns. But any rebound will be slow and fragile, as companies and households remain wary of spending, they say. “Unless effective vaccines are developed, a strong recovery cannot be expected for the foreseeable future,” said Takeshi Minami, chief economist at Norinchukin Research Institute. Friday’s data showed some winners and losers. Spending on bars, plane tickets, hotels and amusement parks tanked by around 90% as households were forced to stay home, the data showed.

On the other hand, stay-home policies boosted spending on pasta by 70%, instant noodles by 43% and sanitary goods like face masks by 124%, it showed. Overall, however, an expected rise in job losses and the hit to household sentiment from the pandemic will weigh on consumption, analysts say. “A lot of people are out of work and couldn’t look for jobs during lockdowns in April. Wages are likely to fall too, which will weigh on consumption,” said Yoshiki Shinke, chief economist at Dai-ichi Life Research Institute. “Japan’s economy will rebound in July-September if there’s no renewed spike in infections. Even so, it may take until 2023 or 2024 for the economy to return to pre-COVID levels.”

“Any confrontation between these two great powers is unlikely to end as the Cold War did, in one country’s peaceful collapse..”

• China Can’t Take Over US Security Presence in SE Asia: Singapore PM (SCMP)

The US security presence “remains vital to the Asia-Pacific region,” and China would be unable to take over that role in Southeast Asia even with its increasing military might, Singapore Prime Minister Lee Hsien Loong said. In an article published by Foreign Affairs on Thursday, Lee wrote that China’s competing maritime and territorial claims in the South China Sea meant that countries in the region will “always see China’s naval presence as an attempt to advance those claims”. He also wrote that many Southeast Asian nations are “extremely sensitive” about perceptions that China has influence on their sizeable ethnic Chinese minorities.

“Despite its increasing military strength, China would be unable to take over the United States’ security role,” he wrote, adding that a US withdrawal in North Asia would compel Japan and South Korea to contemplate developing nuclear weapons to counter North Korea’s growing threat. Lee’s article comes as tensions between the US and China continue to escalate, with the world’s biggest economies sparring on everything from 5G networks to the South China Sea to responsibility for the Covid-19 pandemic. Singapore has been one of the most outspoken countries in Asia calling for the US and China to avoid a destructive clash that would force smaller countries to choose sides.

“Asia-Pacific countries do not wish to be forced to choose between the United States and China,” Lee wrote, echoing comments he’s made previously. “They want to cultivate good relations with both.” Lee warned that if the US tried to contain China, or if Beijing sought to build an exclusive sphere of influence in Asia, the two countries “will begin a course of confrontation that will last decades and put the long-heralded Asian century in jeopardy”. “Any confrontation between these two great powers is unlikely to end as the Cold War did, in one country’s peaceful collapse,” he wrote.

You mean worse damage to kids than the school system itself inflicts? I’d say it’s a toss-up at best.

• US Schools Lay Off Hundreds Of Thousands, Setting Up Lasting Harm To Kids (R.)

In April alone, 469,000 public school district personnel nationally lost their jobs, including kindergarten through twelfth-grade teachers and other school employees, a Labor Department economist told Reuters. That is more than the nearly 300,000 total during the entire 2008 Great Recession, according to a 2014 paper by three university economists financed by the Russell Sage Foundation. The number of public school teachers hasn’t recovered from that shakeout, reaching near-2008 levels only in 2019. Multiple school district administrators, public officials and teaching experts have warned that the current school personnel job loss will last for years, hurting the education of a generation of American students. It also could be a drag on economic recovery, for one thing because school districts are big employers.

The Labor Department reported on May 8 that 20.5 million non-farm workers lost jobs in April, including 980,000 government workers. Of those, 801,000 were local government employees. Although the Labor Department report does not break out the number, 469,000 of the 801,000 local government workers were K-12 public school teachers and other school personnel, the department economist told Reuters. School districts in poor areas face the most punishing blows. A Brookings Institution paper in April predicted that education layoffs “would come at the worst possible time for high-poverty schools, as even more students fall into poverty and need more from schools as their parents and guardians lose their own jobs.”

Low-income districts are particularly troubled because of plunging revenue amid the Covid-19 recession. Districts rely for revenue on local property taxes and state subsidies. Poorer districts, where property tax revenue is low, rely on states for most of their income. With states hit hard by falling income and sales taxes, aid to school districts is dwindling in many places. [..] April was an especially cruel month for education. The Labor Department report said that in addition to the 469,000 K-12 personnel, state-run colleges and universities laid off 176,000 professors and other employees. Private schools, including well-known colleges and universities and K-12 private schools, were down by 457,000.

Don’t choose sides. There is only one.

• Medical Martial Law: Liberalism’s Final Capitulation (Pear)

Liberals elected Barack Obama in 2008, laughed, cheered, cried, and then they went to sleep for eight years. They thought that Obama would do the heavy lifting for them. Instead he went from bombing three countries to bombing seven, after winning the Nobel Peace Prize for nothing. Obama looked the other way as the Police Occupied Zuccotti Park, Black Lives Didn’t Matter, and Dakota Pipelined. Obama imprisoned and tortured whistleblowers, and he became the deporter-in-chief. He bailed out the banks, while millions of families lost their homes. Obamacare enriched insurance companies and big-pharma. Gitmo stands as the legacy of Obama’s droning wedding parties and funerals, and for all his broken promises. His answer to climate change was Artic drilling, and fracking the USA.

Obama and the liberal class are the reason we have Trump. The rich do not care about any of the liberal class’s identity politics and correctness. It costs the rich nothing to make those concessions. The liberals are not willing to fight for anything of importance, and the corporatists know it. The corporatists don’t care if Trump or Biden is the next president. Bernie or bust! Fugget about it: Bernie Sanders is just a sheepdog, a foil, a professional wrestler, and Kabuki theater. Bernie is the Senator from Lockheed and Israel. He is a carnival huckster, herding the liberal suckers into the big tent. The DNC will be happy to keep Trump. They get to keep their jobs, their power, their influence, and the gravy train keeps on rolling.

Nancy Pelosi will still get her kicks from gourmet chocolate, Alexandria Ocasio-Cortez will keep making arm-waving rants to an empty House, Ilhan Omar will kowtow to the Zionist lobby, and the Congressional Black Caucus will vote against blacks. Liberals will grandstand politically correct platitudes, while the banks, corporations, military-industrial complex, Israel, and the well-connected get unlimited hand-outs. Lest I forget, fake liberal Rachel Maddow and her ilk in the media will still get paid $30 thousand a night for “Russia-Russia-Russia!”, and the New York Times will endorse every regime-change war, just as it has done for the past 150 years. And Liberals will commiserate with each other, preach to their dwindling choir, blame everybody except themselves, and waste another four years without organizing any opposition.

Even Malcolm X said it about the liberal party. Stop giving your vote away. If you're SO mad, why have you voted Democrat the last 60 years in these cities you're burning!#Trump#protest#UnitedWeStand #WalkAwayFromDemocratspic.twitter.com/6v2v89x52Q

— IndySpanglish (@IndySpanglish) June 3, 2020

Much ado about nothing at all. Clickbait.

• Trump Fires Back At Critics Murkowski, Mattis And Kelly (JTN)

President Trump on Thursday unleashed Twitter attacks against former Defense Secretary James Mattis, former Chief of Staff John Kelly and sitting Republican Sen. Lisa Murkowski, pledging to see the latter unseated during her next election. Trump said he will campaign against Murkowski and endorse a candidate who challenges her. Earlier on Thursday, Murkowski said that she is “struggling” with whether to support the president in the upcoming election. “Few people know where they’ll be in two years from now, but I do, in the Great State of Alaska (which I love) campaigning against Senator Lisa Murkowski. She voted against HealthCare, Justice Kavanaugh, and much else,” Trump tweeted.

“Get any candidate ready, good or bad, I don’t care, I’m endorsing. If you have a pulse, I’m with you!” Trump also tweeted the text of a note in which his former attorney John Dowd excoriated James Mattis, the former Defense Secretary who on Wednesday issued a scathing rebuke of the president. The president urged people to read the note that Dowd wrote lambasting Mattis. “Perhaps, your anger is borne of embarrassment for your own failure as the leader of Central Command,” Dowd said to Mattis in the note.

I thought this letter from respected retired Marine and Super Star lawyer, John Dowd, would be of interest to the American People. Read it! pic.twitter.com/I5tjysckZh

— Donald J. Trump (@realDonaldTrump) June 4, 2020

And Trump’s former Chief of Staff John Kelly did not escape the president’s fiery criticism on Thursday either. The Washington Post quoted Kelly disputing Trump’s claim that he fired Mattis and requested his resignation. “The president did not fire him. He did not ask for his resignation,” Kelly said. “The president has clearly forgotten how it actually happened or is confused. The president tweeted a very positive tweet about Jim until he started to see on Fox News their interpretation of his letter. Then he got nasty. Jim Mattis is an honorable man.” Trump lobbed several tweets about Kelly, including one in which he said Kelly “was totally exhausted by the job, and in the end just slinked away into obscurity.”

The problem with asking for someone to give you a letter of resignation, which you do as a courtesy to help them save face, is that it is then harder to say you fired them. I did fire James Mattis. He was no good for Obama, who fired him also, and was no good for me!

— Donald J. Trump (@realDonaldTrump) June 4, 2020

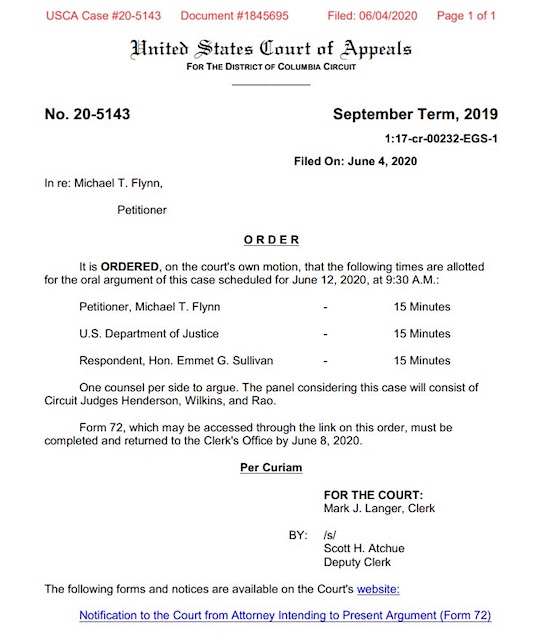

Rosenstein has resolved not to go quiet.

• Rosenstein Slams McCabe, Obstruction Theories, 1000 Former Prosecutors (Turley)

Yesterday, we did our first live blogging on a hearing with former Deputy Attorney General Rod Rosenstein. There was a lot of broken china after the hearing was over. Indeed, the most interesting aspect was that some of the greatest damage for the Democratic narrative occurred during ill-considered questions from Sen. Mazie Hirono (D., HI) who elicited a series of answers supporting the Trump Administration and the purpose of further hearings. Rosenstein ultimately supported the need for further investigations into FBI misconduct, supported the Durham investigation, categorically dismissed claims that Trump committed obstruction of justice, and most importantly stated that he would not have signed off on the continued surveillance under the FISA for Carter Page if he knew the truth about claims of Russian collusion.

That was just a few of the highlights. He also dismissed objections from former FBI Deputy Director Andrew McCabe and the “1000 prosecutors” who were so widely cited as claiming that there was clear criminal conduct by Trump. The most important moment came at the beginning of Rosenstein’s testimony when he acknowledged that there were serious flaws and misconduct involved in the Russian investigation and that, if he knew then what he knows now, he would have put a stop to it, including refusing to sign off on the continued of the FISA surveillance on Page. He also repeatedly said in contradiction to the Democratic senators that he believed that there was a need for further investigation and that much more needs to be known about what occurred, including the source of “disinformation” in the Steele dossier and whether Steele was used by Russian intelligence and other sources for nefarious purposes.

On the investigation of U.S. Attorney John Durham, Rosenstein repeatedly endorsed the need to look into the entire Russian investigation and added “Attorney General Barr is trusting US attorney Durham to do that. I think that’s a reasonable decision.” Rosenstein also acknowledged that we still need to know more about the disinformation and that an investigation is warranted on the Steele dossier and other related issues.

And now come the rest. Everyone but Obama and Biden. But that won’t save them.

• The Hunt For The Origins Of The Russia Collusion Narrative (JTN)

Hollywood once gave us the Cold War thriller called “The Hunt for Red October.” And now the U.S. Senate and its Republican committee chairmen in Washington have launched a different sort of hunt made for the movies. Armed with subpoenas, Sens. Lindsey Graham, R-S.C., and Ron Johnson, R-Wis., want to interrogate a slew of Obama-era intelligence and law enforcement officials hoping to identify who invented and sustained the bogus Russia collusion narrative that hampered Donald Trump’s early presidency. And while Graham and Johnson aren’t exactly Sean Connery and Alex Baldwin, they and their GOP cohorts have a theory worthy of a Tom Clancy novel-turned-movie: The Russia collusion investigation was really a plot by an outgoing administration to thwart the new president.

[..] For much of the last two years, the exact theory that congressional Republicans held about the bungled, corrupt Russia probe — where collusion between Donald Trump and Vladimir Putin was ultimately disproven and FBI misconduct was confirmed — was always evolving. But after explosive testimony this week from former Deputy Attorney General Rod Rosenstein, who openly accused the FBI of keeping him in the dark about flaws, failures and exculpatory evidence in the case, the GOP believes it may prove the Russia case was a conspiracy to use the most powerful law enforcement and intelligence tools in America to harm Trump.

[..] “There are millions of Americans pretty upset about this,” Graham said this week. “There are people on our side of the aisle who believe this investigation, Crossfire Hurricane, was one of the most corrupt, biased criminal investigations in the history of the FBI. And we’d like to see something done about it.” Graham tried to take action to approve 50-plus subpoenas from the Senate Judiciary Committee to witnesses on Thursday but was forced to delay a week. Johnson, meanwhile, successfully secured about three dozen subpoenas to get documents and interviews with key witnesses from his Senate Homeland Security and Governmental Affairs Committee.

Evidence is growing, Johnson said, that there was not a “peaceful and cooperative” transition between the Obama and Trump administrations in 2017. “The conduct we know that occurred during the transition should concern everyone and absolutely warrants further investigation,” he said. With Rosenstein’s testimony now behind them, the senators have some lofty targets for interviews or testimony going forward, including fired FBI Director James Comey, his deputy Andrew McCabe, ex-CIA Director John Brennan, and the former chiefs of staff for President Barack Obama and Vice President Joe Biden.

We try to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the interaction.

Thank you.

OMG! WTH! Can you imagine @JoeBiden being @POTUS? He can’t answer a simple question or make a simple statement even with the help of the idiots at @TheView!Did u catch some of their faces.They can’t believe it either #JoesNotSorry #WalkAway pic.twitter.com/rWZmViMSWe

— Malik Obama (@ObamaMalik) June 4, 2020

Obama, Biden And Democratic Party Desperately Try To Co-Opt Protest. They Think We’re Stupid!

Support the Automatic Earth in virustime.