NPC Hessick & Son Coal Co. Washington 1925

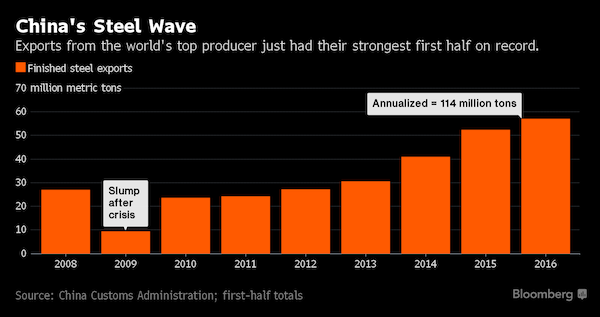

And that is with record steel exports. Not the first time I ask this: where would China exports be without that?

• China June Exports, Imports Both Fall More Than Forecast (R.)

China’s exports fell more than expected in June as global demand remained stubbornly weak and as Britain’s decision to leave the European Union clouds the outlook for one of Beijing’s biggest markets. Imports also shrank more than forecast, indicating the impact of measures to stimulate growth in the world’s second-largest economy may be fading, after encouraging import readings in May. Exports fell 4.8% from a year earlier, the General Administration of Customs said on Wednesday, adding that China’s economy faces increasing downward pressure and the trade situation will be severe this year. Imports dropped 8.4% from a year earlier. That resulted in a trade surplus of $48.11 billion in June, versus forecasts of $46.64 billion and May’s $49.98 billion.

Economists polled by Reuters had expected June exports to fall 4.1%, matching May’s decline, and expected imports to fall 5%, following May’s 0.4% dip. The marginal import decline in May was the smallest since late 2014, and had raised hopes that China’s domestic demand was picking up. “The world economy still faces many uncertainties. For example, Brexit, expectations of an interest rate hike by the Federal Reserve, volatile international financial markets, the geopolitical situation, the threat of terrorism … these will affect the confidence of consumers and investors globally and curb international trade,” customs spokesman Huang Songping told a news conference. “We believe China’s trade situation remains grim and complex this year. The downward pressure is still relatively big.”

“Sales advanced 23% from a year earlier..”

• China’s Steel Exports Jump to Second Highest Amid Tensions (BBG)

China’s steel exports climbed to the second-highest level on record in June, as shipments from the world’s biggest producer ramp up amid escalating trade tensions. Sales advanced 23% from a year earlier to 10.94 million metric tons, according to China’s customs administration. That’s only eclipsed by shipments in September last year, when the country sent 11.25 million tons overseas. Exports in the first six months were 57.12 million tons, the seventh on-year increase in a row and the most ever for the period.

China’s record supplies have fueled global trade tensions as too many producers compete for sales. An EU investigation launched last week into imports from five countries is “symptomatic of the rising protectionism in global steel markets as a result of overcapacity,” according to a note from Macquarie.“There’s a lot of trade friction but overall Chinese steel prices are relatively low, demand is steady, and together with the renminbi’s depreciation, the Chinese exports are very competitive,” Helen Lau, an analyst at Argonaut Securities Asia Ltd., said from Hong Kong. “It’s encouraging for Chinese mills and good for overseas consumers, but it’s not what foreign mills want to see.” Faced with its slowest growth in decades, China is exporting its steel surplus. Shipments will accelerate in the second half as prices decline and margins at mills are squeezed, Ren Zhuqian, chief analyst at Mysteel Research, said last month, forecasting exports could reach 117 million tons for the year, higher than last year’s record 112.4 million tons.

Cleansing.

• Great American Oil Bust Rages on; Defaults, Bankruptcies Soar (WS)

Junk bonds, trading like stocks since February, have skyrocketed and yields have plunged. But that doesn’t mean the bloodletting is over. The trailing 12-month US high-yield bond default rate jumped to 4.9% at the end of June, the highest since May 2010 as the Financial Crisis was winding down, Fitch Ratings reported today. The first-half total of $50.2 billion of defaults already exceeds the $48.3 billion for the entire year 2015. Energy companies accounted for 56% of those defaults. The energy sector default rate shot up to 15%. Within it, the default rate of the Exploration & Production (E&P) sub-sector soared to 29%! And the default party isn’t over: “Despite the run-up in prices since the February trough, there will be additional sector defaults, with Halcon Resources expected to file imminently,” Fitch reported.

Issuance of junk bonds in the first half has plunged 34% from a year ago, to $120.5 billion, according to the Securities Industry and Financial Markets Association (SIFMA), as junk-rated energy companies are having one heck of a time borrowing money and issuing bonds. The fact that investors – who’ve now been burned for nearly two years – are reluctant to extend new credit to teetering oil & gas companies precipitates their default and bankruptcy. Fitch: “The combination of high energy and metals/mining default rates and lower year to date issuance has been a one-two punch for the high yield bond market this year,” said Eric Rosenthal, Senior Director of Leveraged Finance. “The question going forward is whether macro events will disrupt markets and restrain issuance for the remainder of the year.”

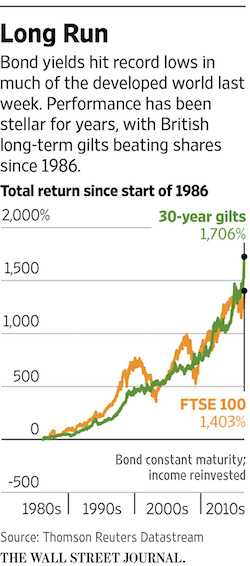

“Call me old-fashioned, but I don’t like investments where if you’re right you don’t make any money..”

• Gundlach Says Wall Street’s Suffering ‘Mass Psychosis’ (MW)

This market is dealing with a “mass psychosis.” That’s the latest perspective on the state of Wall Street from Jeff Gundlach, the star money manager who founded DoubleLine Capital. Late Tuesday, during his regular webcasts to discuss markets, Gundlach sounded perplexed that investors’ demand for the perceived safety of government bonds has driven 10-year Treasury notes to record lows, even as the Dow Jones Industrial Average and the S&P 500 index scored fresh record highs Wednesday. Treasury yields, which have come off their 2016 nadir, are still hovering below their levels before the U.K.’s decision to exit the European Union sent global stock markets spiraling down. Bond prices move inversely to yields. Gundlach used the following chart in his Tuesday webcast presentation to highlight the historic moves in Treasury yields:

“There’s something of a mass psychosis going on related to the so-called starvation for yield,” said Gundlach, whose fund manages about $100 billion. “Call me old-fashioned, but I don’t like investments where if you’re right you don’t make any money,” he said. Gundlach believes that the benchmark 10-year note will move above 2% soon, but perhaps not until sometime next year. Some market participants see the benchmark’s yield tumbling further before that rise happens. Tom Di Galoma, managing director at Seaport Global, predicts the 10-year yield will slip below 1% over the next six to nine months, citing the anemic European economy in the wake of Brexit and concerns over the world’s second-largest economy, China. Meanwhile, the 10-year yield slipped below 1.47% midday Wednesday as U.S. stocks were struggling for a fourth straight session of gains, extending a record run.

“..our monetary politburo would overtly conspire and coordinate with the White House and Capitol Hill to bury future generations in crushing public debts.”

• Helicopter Money – The Biggest Fed Power Grab Yet (David Stockman)

The Cleveland Fed’s Loretta Mester is a clueless apparatchik and Fed lifer, who joined the system in 1985 fresh out of Barnard and Princeton and has imbibed in its Keynesian groupthink and institutional arrogance ever since. So it’s not surprising that she was out flogging – albeit downunder in Australia – the next step in the Fed’s rolling coup d’ etat. We’re always assessing tools that we could use,” Mester told the ABC’s AM program. “In the US we’ve done quantitative easing and I think that’s proven to be useful. “So it’s my view that [helicopter money] would be sort of the next step if we ever found ourselves in a situation where we wanted to be more accommodative.” This is beyond the pale because “helicopter money” isn’t some kind of new wrinkle in monetary policy, at all.

It’s an old as the hills rationalization for monetization of the public debt – that is, purchase of government bonds with central bank credit conjured from thin air. It’s the ultimate in “something for nothing” economics. That’s because most assuredly those government bonds originally funded the purchase of real labor hours, contract services or dams and aircraft carriers. As a technical matter, helicopter money is exactly the same thing as QE. Nor does the journalistic confusion that it involves “direct” central bank funding of public debt make a wit of difference. Suppose Washington issues treasury bonds to the 23 primary dealers on Wall Street in the regular manner. Further, assume that some or all of these dealers stick the bonds in inventory for 3 days, 3 months or even 3 years, and then sell them back to the Fed under QE (and most likely at a higher price).

So what! The only thing different technically about “helicopter money” policy is the suggestion by Bernanke and others that the treasury bonds could be issued directly to the Fed. That would just circumvent the dwell time in dealer (or “investor”) inventories but result in exactly the same end state. In that event, of course, Wall Street wouldn’t get the skim. But that’s not the real reason why helicopter money policy is so loathsome. The unstated essence of it is that our monetary politburo would overtly conspire and coordinate with the White House and Capitol Hill to bury future generations in crushing public debts.

“It is outright panic-driven momentum.”

• 35-Year-Old Bond Bull Is on Its Last Legs (WSJ)

They have been saying it for 35 years. But after 3Ω decades of stunning returns, the biggest bond bull market in history looks to be entering its final stages. Why? Changing politics and the perverse, looking-glass world of negative yields. Bonds are meant to be safe, dull investments. But there is nothing boring, and not a lot of safety, in Japanese government bonds this year: The 40-year has returned an extraordinary 48% in six months, including the paltry coupon, and other long-dated JGBs have also had their best returns on record. U.K. and German long-dated bonds have produced similar returns to those after the collapse of Lehman. Returns on U.S. Treasurys are less exotic, but the 30-year has returned 22% this year—a gain big enough to worry longtime bond watchers.

It would have been easy to make the mistake of thinking the bull run in bonds was over many times since then-Federal Reserve Chairman Paul Volcker got it started by taking control of inflation. The bet that the Japanese bond market—which long had the lowest yields in the world—would finally buckle has lost so much money for so many people that it is known as the “widowmaker” among traders. That hasn’t stopped Eric Lonergan, who runs a multistrategy fund for M&G in London. He has 15% of his fund betting against long-dated JGBs, and has endured a brutal move in the market against him in the past few weeks. Yet, he believes the likelihood is that the market will soon turn. “This is price driving price and is hugely, hugely vulnerable,” he said. “It is outright panic-driven momentum.”

Did consumer confidence perhaps fall because Carney et al -the media!- spread all their fear stories before the Brexit referendum?! And now they can all go: I told you so!

• Bank of England To Cut Interest Rates To Halt UK Recession (G.)

The Bank of England could cut interest rates and inject billions of pounds into the financial system as early as Thursday as policymakers seek to prevent Britain sliding into recession after the EU referendum. Under pressure to stem further falls in sterling, Mark Carney, the governor, is expected by financial markets to halve the 0.5% base rate on Thursday and reignite the Bank’s quantitative easing programme. Speculation has intensified in recent days after Carney dropped heavy hints that action would be needed to turn around an economy suffering badly as a result of the vote to leave the EU.

Several City economists said it was crucial for the central bank to step in and maintain the flow of cheap credit to the economy at a time when business and consumer confidence had fallen to levels last seen after the financial crash. A slump in the pound to a 31-year low has also undermined confidence among City investors concerned that the UK’s growth prospects will be damaged by leaving the single market. Markets have put an 80% probability on a move by the Bank by Thursday. Howard Archer, chief economist at IHS Global Insight, said: “With the UK economic outlook weakened by the Brexit vote, there can be little doubt – if any – that the Bank of England will enact some stimulus following the July MPC [monetary policy committee] meeting.

The only question really seems to be what action will the MPC take?” Carney said in a speech last month that the loss of confidence highlighted by a string of negative surveys meant “some monetary policy easing will likely be required over the summer”. A closely watched consumer confidence index from market researchers GfK last week recorded the biggest drop in sentiment for 21 years, following the Brexit vote.

Britain gets exactly what it needs. Where is the joy?

• UK Housing Sales Forecast To Fall Sharply This Summer After Brexit (G.)

The number of homes changing hands is expected to slump this summer in the wake of the UK’s vote to leave the EU, with estate agents and surveyors more pessimistic about the housing market than at any point since the late 1990s. Inquiries from buyers fell for the third month running in June, and the number of sales agreed dropped sharply as the Brexit vote fuelled uncertainty in the market, according to the latest monthly survey by the Royal Institution of Chartered Surveyors (Rics). New buyer inquiries declined “significantly” during the month, it said, with 36% more respondents reporting a drop than an increase – the lowest reading since the financial downturn was beginning in mid-2008.

Over the same period, the supply of properties coming onto the market fell in every region except Northern Ireland, Rics said, and sales fell for a third consecutive month. Looking ahead over the next three months, 26% more Rics members expected sales to drop further than expected a busier housing market. “This is the most negative reading for near-term expectations since 1998,” Rics said. The numbers of surveyors in London reporting falling prices slipped deeper into negative territory in June, with nearly half of surveyors in the capital reporting falls rather than rises. Price falls were particularly concentrated in central London.

The referendum is not the only factor behind the dip in activity. The stamp duty hike on second homes, which came into force on 1 April, has also disrupted the market. Rics’s chief economist, Simon Rubinsohn, said: “Big events such as elections typically do unsettle markets so it is no surprise that the EU referendum has been associated with a downturn in activity. “However even without the buildup to the vote and subsequent decision in favour of Brexit, it is likely that the housing numbers would have slowed during the second quarter of the year, following the rush in many parts of the country from buy-to-let investors to secure purchases ahead of the tax changes.”

Australia Insolvencies +14%, Debt Agreements +25%, Bankruptcies +7%

“..we all know at heart there is precisely one person to blame: Australian economist Steve Keen, now exiled in God-forsaken London. Were it not for Keen’s incessant fearmomgering about the Australian housing bubble, property values in Sydney alone would now be worth more than the sum total of property values in the US, China, UK, Mars, and Uranus combined.”

• Steve Keen Accused Of Causing Australia’s Coming Recession (Mish)

It appears there are a bit of credit difficulties down under. Cash-strapped Australian personal insolvencies, bankruptcies, and debt agreements experience their sharpest rise in seven years. Please consider Struggling Aussies Rack Up Debt.

“Alarming new figures released yesterday by the Australian Financial Security Authority found personal insolvencies in the June quarter climbed by nearly 14% compared to the June 2015. Debt agreements — an agreement between a debtor and a creditor where creditors agree to accept a sum of money from the debtor – rose by nearly a massive 25%. Bankruptcies increased by 7%. Veda’s general manager of consumer risk Angus Luffman said multiple factors were to be blamed for a stalling of consumer credit. “The continuing slowdown in residential property markets, coupled with weak wages growth and subdued retail sales growth had all contributed to the continued slowdown seen in the June credit demand index,’’ he said.

“Turnover for household goods which is often big-ticket items like whitegoods and couches which are financed by credit has slowed significantly in recent months.” Australian Bureau of Statistics lending data released yesterday found total new lending commitments including housing, personal, commercial and lease finance dropped by 3.2% in May, the second consecutive fall. Lending totalled $67.5 billion in May which was down seven per over the year and sat at a 17-month low. HSBC chief economist Paul Bloxham blamed the cooling of the housing market for the softening of the willingness to borrow.”

While others point the finger every which way, we all know at heart there is precisely one person to blame: Australian economist Steve Keen, now exiled in God-forsaken London. Were it not for Keen’s incessant fearmomgering about the Australian housing bubble, property values in Sydney alone would now be worth more than the sum total of property values in the US, China, UK, Mars, and Uranus combined. Were it not for Keen, every property owner down under could retire now and live off the perpetual appreciation of their property wealth.

“..Nigel Farage and 20 other Ukip MEPs will get to vote on the terms of Britain’s exit, while the British government, led by remain supporter Theresa May, will have to accept the EU’s terms..”

• Britain’s MEPs Ushered Quietly Off Stage As The EU Show Goes On (G.)

[..] Paradoxically, British MEPs are expected to vote on the UK’s EU divorce treaty, expected to be thrashed out by David Davis, the secretary of state for exiting the EU. Although the British government will be treated as a foreign country, there is nothing in the EU rulebook that prevents British MEPs from having a say when the European parliament votes on the British divorce treaty under article 50. This throws up the odd situation that Nigel Farage and 20 other Ukip MEPs will get to vote on the terms of Britain’s exit, while the British government, led by remain supporter Theresa May, will have to accept the EU’s terms. British diplomats also find themselves in a peculiar Brexit limbo.

They will have to decide how hard to fight Britain’s corner on EU legislation that will exist for years after the UK has left. The most likely outcome is that British diplomats will continue to press British interests, because EU legislation could still affect the UK after Brexit. Norway implements all EU directives as the price of being in the EU single market – the “pay without a say” model that politicians in Oslo think the British would loathe. It is the scenario envisaged by Cameron when he promised an EU referendum in 2013. “Even if we pulled out completely, decisions made in the EU would continue to have a profound effect on our country,” he said in a Bloomberg speech. “But we would have lost all our remaining vetoes and our voice in those decisions.”

British diplomats might push British interests, but they could be frozen out of the informal wheeling and dealing. “Politics is about the future and if someone at the table has no position any more, [the others] will do deals without them,” says Dirk Schoenmaker, a senior fellow at the Bruegel thinktank. He predicts that “the big three” that decide financial regulation – Germany, France and the UK – will be cut down to a big two. “It is quite clear, from 23 June onwards the big deals in this area will be made by Germany and France, without the UK.”

Spain’s backdoor to hurt its already shattered people.

• Spain’s Banks are Suddenly “Too Broke To Fine” (DQ)

After eight years of chronic crisis mismanagement, moral hazard and perverse incentives have infected just about every part of the financial system. Earlier this week, the U.S. Congress published the findings of a three-year investigation into why the Department of Justice chose not to punish HSBC and its executives for their violations of US anti-money laundering laws and related offenses – because doing so would have had “serious adverse consequences” for the financial system – the “Too Big To Jail” phenomenon, a perfect, all-purpose, real-world Get-Out-of-Jail-Free card. But now there’s “Too Broke to Fine.” Today over a dozen Spanish banks were given a life-line by the EU’s advocate general, Paolo Mengozzi, that could be worth billions of euros in savings for the banks.

For millions of Spanish mortgage holders, it could mean billions of euros in lost compensation. Just over seven years ago, when conditions were beginning to sour for Spain’s banking system, 40 out of 42 Spanish banks decided to insert “floor clauses” in their mortgage contracts. These effectively set a minimum interest rate — typically between 3% and 4.5% — for all their variable-rate mortgages (which are very common in Spain), even if the Euribor dropped far below that figure. This, in and of itself, was not illegal. The problem is that most banks failed to properly inform their customers that the mortgage contract included such a clause. Those that did, often told their customers that the clause was an extreme precautionary measure and would almost cerainly never be activated.

After all, they argued, what are the chances of the euribor ever dropping below 3.5% for any length of time? At the time (early 2009), Europe’s benchmark rate was hovering around the 5% mark. Within a year it had crashed below 1% and is now languishing deep below zero. As a result, most Spanish banks were able to enjoy all the benefits of virtually free money while avoiding one of the biggest drawbacks: having to offer customers dirt-cheap interest rates on their variable-rate mortgages. For millions of Spanish homeowners, the banks’ sleight of hand cost them an average of €2,000 per year in additional interest payments, during one of the worst economic crises in living memory. Many ended up losing their homes.

Nice but very biased: “You have good jobs that make it possible to pay the taxes and your expenses.” Err.. no, too many don’t, and that’s why Leave won. You may have a master’s on engineering, but if you can’t understand these dynamics, what’s that worth?

• What It’s Like To Be A Non-EU Citizen (Trninic)

[..] let me tell you a few things about the life of a non-EU citizen. When I came to Austria from Bosnia in 2003 to study at Technical University of Graz, I had to undergo various administrative and non-administrative checks. At one point, I and all my fellow Bosnian students had to show proof we didn’t have pneumonia, typhus – which I somewhat understand. But we even had to prove we did not have RABIES. Rabies! In the 21st century! My home country is only about 300 kilometers from Austria and yet we were treated as if we came from 200 years ago, at least. On top of that, we had – and still have – the pleasure of needing a visa every year and paying for it, of course. We even paid tuition for college, though the Austrians and EU students did not.

But that was the deal, and I personally was happy to be able to work the lowest level student jobs and in return get a decent education. The common attitude was “deal with it!” and so we did. After college, I got my first job at a big construction company. The trick? I worked with a Bosnian contract. It was an all-in contract, written for slaves. But hey, I had a job. I was one of three people in my branch office who had a master’s degree in engineering (much less went to college), spoke three foreign languages, drove 50,000 kilometers per year, yet I was still paid less than everyone. But I dealt with it. If the company was to say at any moment I was fired, I had two months to leave the country or find a new company.

Many highly qualified non-EU citizens live this kind of life day-to-day and the only thing on our minds is, “What the hell was on the UK’s mind when they voted LEAVE?” The UK always was the “favorite (and the spoiled) kid of the EU family.” It kept its currency. It had more favorable EU conditions and it always behaved a bit stand-offish toward the rest of the Europe, if we are honest. The UK has about 52 million residents and pays about €5 billion to EU fund per year (€96 per citizen). By comparison, Austria has 8 million residents and pays about €1 billion per year to EU fund (€125 per citizen).

Great story.

• The Fake Biodiesel Factory That Pumped Out Real Money (BBG)

The biodiesel factory, a three-story steel skeleton crammed with pipes and valves, squatted on a concrete slab between a railroad track and a field of storage tanks towering over the Houston Ship Channel. Jeffrey Kimes, an engineer for the Environmental Protection Agency, arrived there at 9 a.m. on a muggy Wednesday in August 2011. He’d come to visit Green Diesel, a company that appeared to be an important contributor to the EPA’s fledgling renewable fuels program, part of an effort to clean the air and lessen U.S. dependence on foreign fuel. In less than three years, Green Diesel had reported producing 50 million gallons of biodiesel. Yet Kimes didn’t know the company. He asked other producers, and they weren’t familiar with Green Diesel either.

He thought he ought to see this business for himself. Kimes, who works out of Denver, was greeted at the Green Diesel facility by a man who said he was the plant manager. He was the only employee there, which was odd. “For a big plant like that, you’re going to need a handful of people at least to run it, maintain it, and monitor the process,” says Kimes, a 21-year EPA veteran. The two toured the grounds, climbing metal stairways and examining the equipment. The place was weirdly still and quiet. Some pipes weren’t connected to anything. Two-story-high biodiesel mixing canisters sat rusting, the fittings on their tops covered in garbage bags secured with duct tape. Kimes started asking questions.

“They showed me a log, and from that you could see they hadn’t been producing fuel for a long period of time,” he says. An attorney for Green Diesel showed up. Kimes asked how he could reconcile the lack of production with what Green Diesel had been telling the EPA. The attorney said he didn’t know, he’d been hired only the day before. “It was obvious what was going on,” Kimes says. The next day, he appeared at Green Diesel’s office in Houston’s upscale Galleria neighborhood, 15 miles from the plant, hoping to collect production records and other information. Someone stuck him in a conference room. Soon he was on the phone with the lawyer from the day before, who told him not to speak with any more Green Diesel employees.

Kimes went back to Denver and started calling Philip Rivkin, Green Diesel’s founder and chief executive. He wasn’t available. And he never would be. That fall, Rivkin left Houston to live in Spain with his wife, their teenage son, a $270,000 Lamborghini Murcielago Coupe, and a $3.4 million Canadair Challenger jet. A passport Rivkin obtained in Guatemala, where he moved after living for an undetermined period in Spain, shows him with dark hair, a double chin, a lazy eye, and an impassive look. It’s one of the few publicly available photographs of the man. Now serving a 10-year sentence at the federal prison in Bastrop, Texas, Rivkin declined through his lawyer, Jack Zimmermann, to be interviewed for this story.

Home › Forums › Debt Rattle July 14 2016