Pablo Picasso Still life 1936

Just in: Shinzo Abe declared dead after being shot.

German parties this winter

Ingraham/Bexte

Keean Bexte on Ingraham Angle – Globalists want their hands on agriculture pic.twitter.com/IK9FOlyGSa

— Wittgenstein (@backtolife_2023) July 7, 2022

Tucker Eva

https://twitter.com/i/status/1545210414665007104

On the 8th day, God made a farmer.

https://twitter.com/i/status/1545035559029968896

“we need a ceasefire”and.. countries like Australia should be pushing for it since “no one in Washington is going to do it.”

• Ukraine Could Be Wiped Off The Map – Douglas Macgregor (RT)

Ukraine could disappear from the map unless the conflict with Russia is resolved peacefully, former Trump military adviser Colonel Douglas Macgregor said in an interview with Sky News Australia on Wednesday. When asked what more could be done to help Ukraine in the ongoing military conflict, Macgregor stated that “the longer this lasts, the more people are going to be needlessly slaughtered, the more damage will be done to Ukraine,” adding that it is now “effectively a failed state, it could be erased completely from the map.” Noting that Ukraine’s military has suffered enormous losses during the conflict and that Russian forces were “by no means overstretched or hurting at this point,”Macgregor argued that “we need a ceasefire”and that countries like Australia should be pushing for it since “no one in Washington is going to do it.”

“We can’t afford to fight this until there are no longer any Ukrainians left,” he insisted, noting that he has heard from people in Berlin, Paris, and London that there is growing support for a ceasefire or coming to “some sort of an arrangement” between Moscow and Kiev. The former adviser also commented on the prospects of Russian President Vladimir Putin agreeing to such a ceasefire, noting that he has “never been interested in all of Ukraine,” and that the territory currently under Russia’s control is the “traditional Russian-speaking area.” Macgregor noted that Ukrainian forces which were concentrated in the Donbass region were of “great concern” to Vladimir Putin, who feared these forces “would attack Russia,” and the US would “inevitably deploy theater ballistic missiles there to hold his [Putin’s] nuclear capability at risk.”

“He’s not going to withdraw, that’s out of the question,” the former top Pentagon adviser said, suggesting that if the two sides were unwilling to come to some sort of arrangement on a territorial basis, then an armistice should be achieved, lest the conflict grow into a “wider, regional war.” Russia sent troops into Ukraine on February 24, citing Kiev’s failure to implement the Minsk agreements, designed to give the regions of Donetsk and Lugansk special status within the Ukrainian state. The protocols, brokered by Germany and France, were first signed in 2014. Former Ukrainian President Petro Poroshenko has since admitted that Kiev’s main goal was to use the ceasefire to buy time and “create powerful armed forces.”

“..more of Zelensky’s troops will be killed, more Ukrainian cities will be turned to rubble, and more territory Kyiv will lose to the invaders.”

• No ‘Magic Bullet’ Can Turn The Tide For Ukraine (Davis)

Last Sunday when the remaining Ukrainian soldier withdrew from Lysychansk, Ukrainian President Volodymyr Zelensky said evacuating his troops from the city “where the enemy has the greatest advantage in fire power,” was the right call, but “means only one thing… That we will return thanks to our tactics, thanks to the increase in the supply of modern weapons.” While many in the West would like that to be true, the reality is very different: there is no basis upon which to hope for a future offensive to drive Russian troops out of conquered territories. The most likely result for the Ukrainian Armed Forces (UAF) if they continue fighting the Russians is that more of Zelensky’s troops will be killed, more Ukrainian cities will be turned to rubble, and more territory Kyiv will lose to the invaders.

A sober analysis of the capacity of the of the two armed forces, an assessment of the military fundamentals that have historically proven decisive on the battlefield, and an examination of the sustainability potential for both sides, make it plain that Russia will almost certainly win a tactical victory. Ukrainian Presidential Advisor Oleksiy Arestovych said that, to the contrary, the withdrawals in Severodonetsk and Lysychansk weren’t defeats at all, but instead “successful” in that he claimed they allowed Ukraine to “buy time for the supply of Western weapons and the improvement of the second line of defense, to create conditions for our offensive actions in other areas of the front.” This is a common belief in the West but one not borne out by the facts.

In some instances, fighting tenaciously in the face of considerable enemy superiority can prove to be the difference between victory and defeat. For example, in the famous Battle of the Bulge, the U.S. 101st Airborne Division refused to surrender in Bastogne even after it had been surrounded and cut off by the advancing German army. [..] The much-ballyhooed supply of “heavy weapons” from the West that both Zelensky and Arestovych claim is coming will not be enough to turn the tide. Not even close. Zelensky advisor Mykhailo Podolyak correctly noted that the minimum needed by Ukraine to have a chance at reaching parity with the Russian invaders would require modern kit in the range of 1,000 howitzers, 500 tanks, and 300 rocket launchers.

As detailed by The Kiel Institute for the World Economy, the sum total of all heavy weapons delivered or promised by the West through last week’s G7 and NATO summits amounts to a paltry 175 howitzers, 250 Soviet-era tanks, and an anemic dozen or so rocket launchers. To date, no other help is being considered. The ramifications of this mismatch should be clear: despite numerous and boisterous claims of Western support, it is militarily unsound for Ukraine to base its defense plans on the hope that major quantities of high quality Western heavy weapons will show up to help Ukraine stop the Russians. But there is a bigger, less obvious truth at play as well: even if Zelensky got everything on Podolyak’s list, it still would not likely change the battlefield dynamics.

“People in most countries do not want such a life and such a future,” he said. “They are simply tired of kneeling, humiliating themselves in front of those who consider themselves exceptional.”

• Putin Says If West Wants To Defeat Russia On Battlefield, ‘Let Them Try’ (AFP)

President Vladimir Putin on Thursday challenged the West to try and defeat Russia “on the battlefield” and said Moscow’s intervention in Ukraine marked a shift to a “multi-polar world.” Delivering one of his strongest speeches since he sent troops to Ukraine on February 24, Putin also raged against “totalitarian liberalism” that he said the West has sought to impose on the entire world. “Today we hear that they want to defeat us on the battlefield. Well, what can you say here? Let them try,” Putin told senior lawmakers on the 134th day of Russia’s offensive in Ukraine. He accused “the collective West” of unleashing a “war” in Ukraine and said Russia’s intervention in the pro-Western country marked the beginning of a shift to a “multi-polar world.”

“This process cannot be stopped,” he added. He also warned Kyiv and its Western allies that Moscow has not even started its military campaign in Ukraine “in earnest.” “Everyone should know that we have not started in earnest yet,” he said. “At the same time we are not refusing to hold peace negotiations but those who are refusing should know that it will be harder to come to an agreement with us” at a later stage. Putin said most countries did not want to follow the Western model of “totalitarian liberalism” and “hypocritical double standards.” “People in most countries do not want such a life and such a future,” he said. “They are simply tired of kneeling, humiliating themselves in front of those who consider themselves exceptional.”

Putin

Putin to West: You want to defeat Russia on the battlefield? Try it! But keep in mind that we haven’t even started anything serious yet. pic.twitter.com/JZF62zQbUh

— Putin Direct (@PutinDirect) July 7, 2022

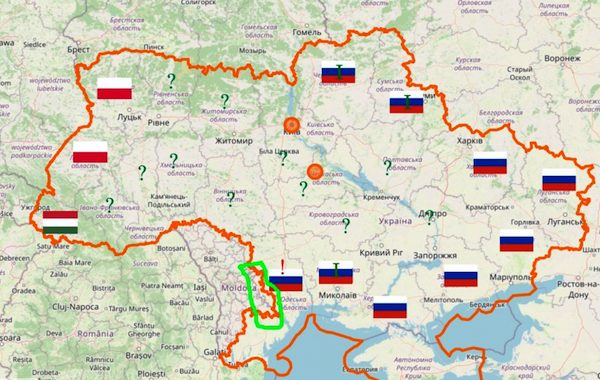

Not wiped off the map, but partitioned.

• Letter from a friend, an Average Russian (Saker)

* Lvov and Lutsk regions will be annexed by Poland (marked on the map with the Polish flag). Almost a certainty – both Polish and Ukrainian officials made statements about “common land” and Poland already started to take over some administration functions there. The Head of the Russian External Intelligence Service made 2 or 3 public statements about it too, and he very rarely goes public. Poles will find the opportune moment to move in a military “peacekeeping force” to solidify their hold. This will be neither smooth nor bloodless because of history – Ukrainian Nazi collaborators performed ethnic cleansings there, killing up to 100000 ethnic Poles during WW2.

Polish political leaders see this as a populist move to restore historical justice (it will work, too), Polish far-right groups see this as a huge unpaid blood debt, and Polish police and security services see modern Ukrainian neo-Nazis as big trouble to be eliminated (through thorough denazification or other means). They were fine with it as long as neo-Nazis were acting against Russia, but when borders solidify and it will be their territory to govern it will be another matter entirely. It’s not out of the question that all ex-Ukrainians will become second-class citizens, like Russians in Baltic states.

* Zakarpatye region of Ukraine will be annexed by Hungary (marked on the map with the Hungarian flag). Looks very probable, but I didn’t see Hungary making any definitive statements about it. Hungary has been steadily building its influence there since the Soviet Union broke up – supporting Hungarian schools, language, and culture, even going so far as issuing passports. Ukrainian neo-Nazis issued threats of ethnic violence because they want “Ukraine for Ukrainians”, which mandates a set of standards for everyone in Ukraine – Russophobia, language (Ukrainian, other languages are not allowed), “ethnic purity” (this stuff is disgusting to even type). This annexation will be pretty smooth and bloodless, like Crimea was, due to how thoroughly Hungary prepared the ground there. If there is any trouble it will be caused by Ukrainian neo-Nazis. Hopefully, Hungarian police and security services are up to the task to keep people safe there.

* Regions marked with the Russian flag will join Russian Federation, the process has already begun. A follow-up anti-terrorist operation by FSB and RosGuard has started as well because the current regime in Kiev (heavily influenced by US+UK governments and Ukrainian neo-Nazis) already started terrorist attacks there. Thankfully Russian security services have a lot of experience with this sort of thing (Chechnya, Syria). The region in the bottom left, with a red exclamation point is a special one – on May 2, 2014 people protested in Odessa against neo-Nazis, burning the neo-Nazi flags. In response, neo-Nazis shipped their well-organized militia groups into the city, drove the protesters into a building, and set it on fire. 42 people died burning alive, shot, falling to death, or beaten to death. They’ve also killed 8 other protesters on the street.

Ukrainian new government (heavily supported by the US) basically ignored it – police had orders to observe but not interfere, a lackluster investigation was started but never yielded any results, and neo-Nazis had support from local law enforcement. This was a pivotal moment in Ukrainian history – the neo-Nazis made a loud and bloody statement “our ideology is the law in Ukraine, we will kill anyone who disagrees”. There is a high symbolic value in taking the Odessa region, I want to see a memorial to this atrocity right in front of that building. Odessa city itself is (or was) very international (this is common for many warm-water ports around the globe actually, due to sea trade) – Jews, Russians, Ukrainians, and many other ethnicities.

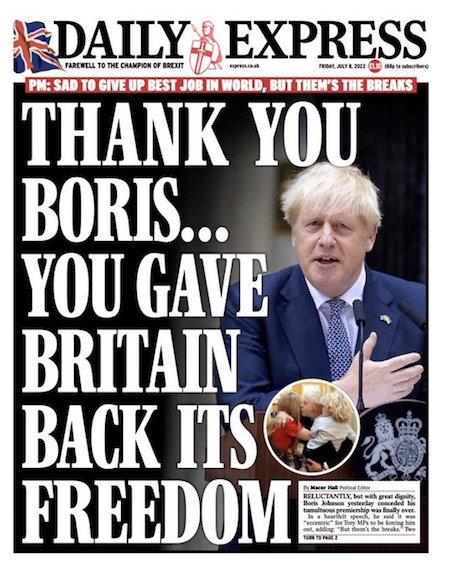

Is there even one politician left in the UK who’s not a WEF member?

• Britain: The Titanic Hits the Iceberg (Batiushka)

Possibly the greatest clown UK politics has ever seen is on his way out of the door. Ministers and aides, forty-one within twenty-four hours, have left his sinking ship. As for Johnson himself, he is spending his last days or hours rearranging the deckchairs with only the last yes-men by his side. The unsinkable Titanic is starting to go down. Let the band play. The Titanic is sinking. If you are a rat, get off now. Already, before Johnson has actually gone, some are speaking of a future Indian Prime Minster for the UK, the resigned Rishi Sunak, former Chancellor (Minister of Finance), married to the daughter of one of the richest billionaires in India. What an irony: the coloniser is colonised and the top job may go to a man from the most exploited and pillaged British colony of all.

Johnson is the first political victim of Western support for the bandit terrorists of the Ukraine. With swathes of his sanctions-hit population eating from foodbanks, people unable to afford travel or to heat and light their homes, shops closing down and strikes breaking out across the UK, but with billions of pounds to send to the Ukraine and waste on the already absurdly high spending on the military, Johnson’s political choices are being punished by the masses. His continual lies have destroyed all trust in him. The question is: Who will be the second to sink with the bad ship Titanic? Some suggest it will be Biden, in the mid-term elections in the USA on 8 November.

Frankly, he seems unlikely to be the second. It is only early July and the political situation of various political leaders in various European countries is so fragile that it is difficult to predict who or even how many will go before November. The fact that Johnson the Ignominious has been the first to be on his way to leave is significant. For Johnson, master of the moral vacuum, was the fanatic who supported the Fascist junta in Kiev more than any other Western leader, in rhetoric at least even more than Biden the Demented, master of the mental vacuum. Poets know all about poetic justice. Now atheists too should listen. Maybe, just maybe, given that Johnson has gone, there is a God who grants justice after all.

Curious behavior.

• White House Won’t Answer Questions About Joe, Hunter Biden Audiotape (Turley)

In yesterday’s White House press briefing, there was an extraordinary moment when White House press secretary Karine Jean-Pierre refused to discuss a 2018 voicemail from President Biden that showed that the President lied repeatedly in denying ever speaking with Hunter Biden about his foreign business dealings. Jean-Pierre refused to answer a question from Fox News’ Peter Doocy and then refused again to answer a question from RealClearPolitics reporter Philip Wegmann. The rest of the press seemed content with an answer that was not just openly evasive but contemptful of the press. It is continuing evidence of the success of the Biden campaign to get the media to maintain a false narrative that they helped create during the campaign.

As previously discussed, the recording clearly proves that President Biden has lied about his knowledge of these dealings. The audiotape of the President concerned a Times report on Dec. 12, 2018 detailing Hunter’s dealings with Ye Jianming, the head of CEFC China Energy Company. Ye was later arrested amid allegations of economic crimes. Biden associates reportedly worked on the Times to change aspects of the story and President Biden appears to view that effort as successful. The plan with the Bidens (which included Joe Biden’s brother) specified a proposed 10 percent share for Hunter for “the big guy.” According to Biden associate Tony Bobulinksi, that was a reference to Joe Biden. The voicemail, discovered on Hunter’s discarded laptop, reveals that Joe Biden was following the stories of his son’s alleged influencing peddling and specifically his Chinese dealings.

In his message, Biden tells Hunter, “Hey pal, it’s Dad. It’s 8:15 on Wednesday night. If you get a chance, just give me a call. Nothing urgent. I just wanted to talk to you. I thought the article released online, it’s going to be printed tomorrow in the Times, was good. I think you’re clear. And anyway if you get a chance, give me a call, I love you.” Some of us have written for two years that Biden’s denial of knowledge is patently false. Indeed, it is baffling how Attorney General Garland can ignore the myriad of references to Joe Biden in refusing to appoint a special counsel. Doocy asked the obvious question now that we have an actual audiotape of the President: “Why is there a voicemail of the president talking to his son about his overseas business dealings if the president has said he’s never spoken to his son about his overseas business dealings?”

Despite clearly contradicting the President, Jean-Pierre declared “Well, first I’ll say that what the president said stands. So if he — that’s what the president said, that is what stands.” Such an absurd response is only possible when you know that most of the media will go along with the evasion. [..] There is no plausible reason why the President would not be willing to answer a question about his own statement captured on audiotape. He is not denying that it is his voice, which appears obvious. He simply will not answer a question about whether he lied during the campaign and repeatedly as president. Again, this is only possible when you have the media in your pocket. Could you imagine if this was Trump caught on a tape and refusing to answer a question about the content?

And this is a lot more serious than just “curious”. Oil from the SPR to make Hunter a profit?

• Biden Sold a Million Barrels From SPR to China-Owned Gas Giant (FB)

The Biden administration sold roughly one million barrels from the Strategic Petroleum Reserve to a Chinese state-controlled gas giant that continues to purchase Russian oil, a move the Energy Department said would “support American consumers” and combat “Putin’s price hike.” Biden’s Energy Department in April announced the sale of 950,000 Strategic Petroleum Reserve barrels to Unipec, the trading arm of the China Petrochemical Corporation. That company, which is commonly known as Sinopec, is wholly owned by the Chinese government. The Biden administration claimed the move would “address the pain Americans are feeling at the pump” and “help lower energy costs.”

More than five million barrels of oil released from the U.S. emergency reserves, however, were sent overseas last month, according to a Wednesday Reuters report. At least one shipment of American crude went to China, the report said. The Biden administration also claimed the Unipec sale would “support American consumers and the global economy in response to Vladimir Putin’s war of choice against Ukraine” and combat “Putin’s price hike.” But as the war rages on, Unipec has continued to purchase Russian oil. In May, for example, the company “significantly increased the number of hired tankers to ship a key crude from eastern Russia,” Bloomberg reported. That decision came roughly one month after Unipec said it would purchase “no more Russian oil going forward” once “shipments that have arrived in March and due to arrive in April” were fulfilled.

The White House did not return a request for comment. Its decision to sell barrels from the country’s Strategic Petroleum Reserve to a Chinese conglomerate comes as the American public increasingly sours on Biden’s energy policies. According to a January Gallup poll, roughly three in four Americans are not satisfied with the federal government’s national energy policy, the highest level in roughly two decades. Power the Future founder Daniel Turner admonished Biden for selling “raw materials to the Communist Chinese for them to use as they want.”

“We were assured Biden was releasing this oil to America so it could be refined for gasoline to drive down prices at the pump. So right off the bat, they’re just lying to the American people,” Turner told the Washington Free Beacon. “What they’re saying they did and what they did are not remotely related.” Turner also said the decision highlights the Biden family’s “relationship with China.” Biden’s son, Hunter Biden, is tied to Sinopec. In 2015, a private equity firm he cofounded bought a $1.7 billion stake in Sinopec Marketing. Sinopec went on to enter negotiations to purchase Gazprom in March, one month after the Biden administration sanctioned the Russian gas giant.

Expect more.

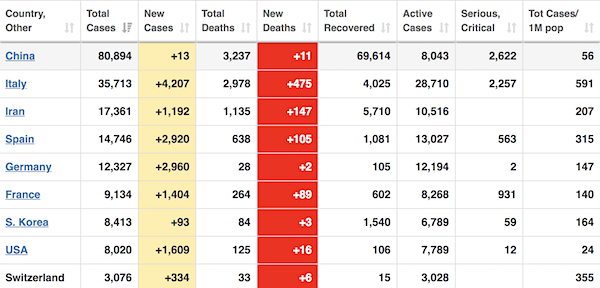

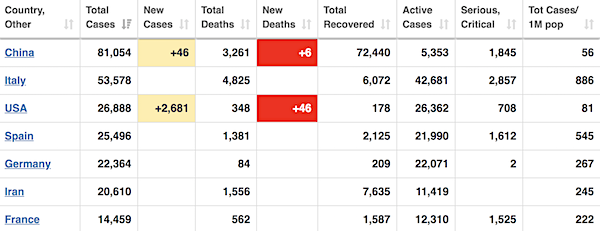

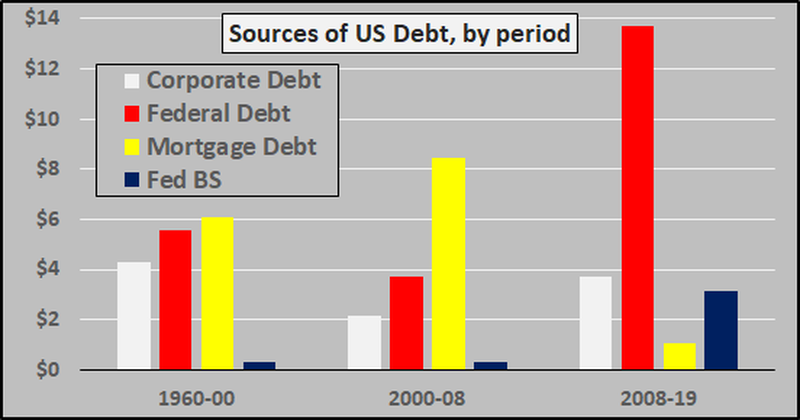

• What India and China Spend on Russian Oil (ZH)

India and China have both been spending more money on Russian oil in 2022 compared to 2021, but, as Statista’s Katharina Buchholz details below, for different reasons. China’s spending on the commodity rose by 78 percent between March and May 2021 and the same time period this year. According to a report by Bloomberg, this increase can be chalked up to the price increase of oil on the world market. China receives oil from Russia through pipelines crossing the countries’ shared border which makes delivery cheaper but also harder to increase. In addition, China had already been buying most oil that can be shipped out of Russia’s Pacific ports previous to the invasion of Ukraine, another factor showing that the increase in spending in China is for approximately the same amount of oil – which the country hasn’t majorly increased but also didn’t try to decrease since the Russian war in Ukraine started.

This shows that India has been buying additional shipments of Russian crude, which are – according to the report – those coming from Russian ports in the Western part of the country and would normally be shipped to Europe. But since European countries have decreased their buying of Russian oil, India has been accepted more shipments at a discounted prices as the route would normally be too long to be economically viable. The data also shows that despite India’s increase in shipments, the money it pays Putin’s regime is still far lower that the funds coming from China. While India paid $3.5 billion for the three-month period, China shelled out an much higher $15.7 billion.

He’s been warning for two years.

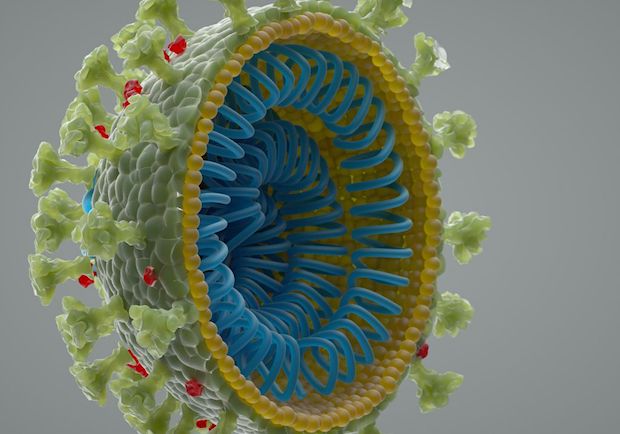

• The Immuno-epidemiological Consequences Of The Mass Vaccination (Geert)

The current SC-2 pandemic is still expanding as it is a pandemic of ‘more infectious’ variants and is thus enhancing the susceptibility of vaccinees to infection (infection-enhancing antibodies) while diminishing the susceptibility of the unvaccinated (infection-mediated training of innate cell-mediated immunity). In the pre-Omicron era, we saw more infectious variants becoming dominant; however, thanks to the neutralizing antibodies, vaccinees were still protected against disease. However, with the advent of Omicron and its growing resistance to neutralizing antibodies, vaccinees became more susceptible to infection; what we are now seeing is more virulent variants becoming dominant (Omicron subvariants BA.4 and BA.5[1]).

However, thanks to the virulence-neutralizing antibodies (which are the same as those enhancing infection at the upper respiratory tract!), vaccinees were still protected against severe disease (e.g., in case of BA.1 and BA.2). I’ve no doubt, however, that with the growing resistance of BA.4 and BA.5 to the virulence-neutralizing Abs, vaccinees will now rapidly become more susceptible to virulence. Due to repetitive activation of the immune system in C-19 vaccinees, several infectious diseases can now be spread asymptomatically by vaccinees. Due to widespread asymptomatic transmission in highly vaccinated countries and the subsequent rise in infectious pressure, infection-mediated immunity in certain subsets of the population no longer suffices to prevent productive infection.

This is now basically igniting the global spread of a number of acute, self-limiting microbial infections (e.g., ‘seasonal’ Flu, RSV but also vaccine-preventable viral and bacterial infections in countries that interrupted their childhood vax program due to Covid crisis) and also of some acute, self-limiting viral diseases (e.g., monkeypox, pandemic [avian H5N1] flu). In addition, depletion of cytotoxic CD8 T cells due to repetitive cycles of re-infection has also led to an increased recurrence/reactivation rate of chronic infections (e.g., herpetic diseases + CMV, EBV, CMV, HIV, tuberculosis..) and relapse or metastasis of certain cancers in vaccinees. In the summary appended, I am sharing my informed predictions on the health impact these pandemics will entail in different subgroups of a highly vaccinated population.

While these new pandemics are developing, the super C-19 pandemic I’ve been warning about is coming our way soon. In highly vaccinated countries, it will definitely overhaul the pandemics mentioned above. This is because massive replacement of ‘natural infection-acquired’ immunity to SC-2 by ‘imperfect’ vaccine-induced immunity is now driving the evolution of the C-19 pandemic in highly vaccinated countries. This will not be the case in poorly vaccinated countries where natural immunity has been largely preserved and the population is often much younger (e.g., African countries). Last, I’d like to repeat my advice: If you’re C-19 vaccinated: Make sure you’ve access to antivirals and antibiotics and that you’ve established a contact with an MD you can trust.

Plenty warnings about this, too.

• Lockdowns Have Demolished Our Immunity (DMA)

Australia is facing a devastating ‘multi-demic’ assault from a vicious cocktail of viruses attacking the nation, a top medical expert has warned.The country’s defences against a range of different diseases have dropped after Covid lockdowns left Aussies’ immune systems untested by common viruses. Now the rapid spread of killer bugs is being fuelled by cold, damp winter conditions, combined with staff returning to offices and commuting on packed trains and buses. And that’s on top of the new, more infectious Omicron variant BA.5 which is sweeping through the population. ‘We’re facing a multi-demic of respiratory viruses,’ Sydney University infectious disease expert Professor Robert Booy told the Courier-Mail.

‘There’s three or four of them causing trouble – influenza, RSV, para-influenza, adenovirus, HMPV… there are a lot. ‘Because were locked down for two years, the level of natural immunity dropped off against flu and Covid, so we have a lot of cases and deaths due to Omicron and the opening of a society with less natural immunity. ‘If you want to spread an infection, you open up society.’ NSW alone is facing a massive outbreak of RSV which can kill infants, with numbers skyrocketing tenfold from 355 to 3775 cases a week in under a month. Businesses across the east coast have also been decimated by staff falling ill as the range of viruses wreak havoc and spread like wildfire.

22 inventions

This video is a list of 22 inventions that could make the Earth a better place by cutting back on plastic & reducing garbage in the sea including whirlpool turbines, edible cutlery, water blobs, package-free shampoo, and toothpaste https://t.co/az91ouIAey pic.twitter.com/5eLPgvX5Fh

— Massimo (@Rainmaker1973) July 7, 2022

#MariaCallas and #MarilynMonroe at the birthday party for President John F. Kennedy, at Madison Square Garden, New York, on May 19, 1962.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.