M. C. Escher Reptiles 1943

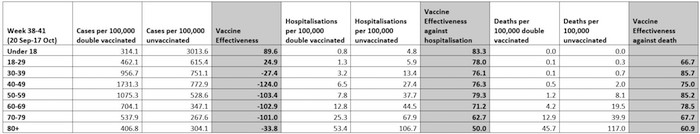

McCullough

https://twitter.com/i/status/1451686955096420357

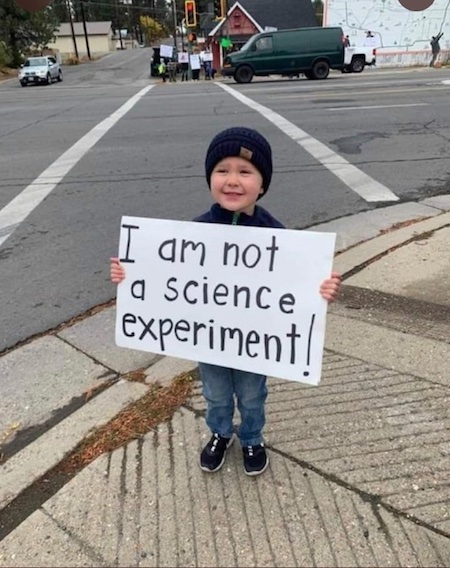

Science

https://twitter.com/i/status/1451818366272954375

Is it time to put a price on their heads? Run them out of town at the very least. If Congress won’t get rid of these guys, someone else will. I am sick to my stomach.

• Bipartisan Letter Demands Answers From Fauci On Cruel Puppy Experiments (Hill)

A bipartisan letter demands answers from the director of the National Institute of Allergy and Infectious Diseases and President Biden’s chief medical adviser. The White Coat Waste Project, the nonprofit organization that first pointed out that U.S. taxpayers were being used to fund the controversial Wuhan Institute of Virology, have now turned its sights on Anthony Fauci on another animal-testing-related matter — infecting dozens of beagles with disease-causing parasites to test an experimental drug on them. House members, most of whom are Republicans, want Fauci to explain himself in response to allegations brought on by the White Coat Waste Project that involve drugging puppies. According to the White Coat Waste Project, the Food and Drug Administration does not require drugs to be tested on dogs, so the group is asking why the need for such testing.

White Coat Waste claims that 44 beagle puppies were used in a Tunisia, North Africa, laboratory, and some of the dogs had their vocal cords removed, allegedly so scientists could work without incessant barking. Leading the effort is Rep. Nancy Mace (R-S.C.), writing a letter to the National Institutes of Health (NIH) saying the cordectomies are “cruel” and a “reprehensible misuse of taxpayer funds.” “Our investigators show that Fauci’s NIH division shipped part of a $375,800 grant to a lab in Tunisia to drug beagles and lock their heads in mesh cages filled with hungry sand flies so that the insects could eat them alive,” White Coat Waste told Changing America. “They also locked beagles alone in cages in the desert overnight for nine consecutive nights to use them as bait to attract infectious sand flies.”

Vanity Fair’s take.

• NIH Admits Funding Risky Virus Research in Wuhan (VF)

“I totally resent the lie you are now propagating.” Dr. Anthony Fauci appeared to be channeling the frustration of millions of Americans when he spoke those words during an invective-laden, made-for-Twitter Senate hearing on July 20. You didn’t have to be a Democrat to be fed up with all the xenophobic finger-pointing and outright disinformation, coming mainly from the right, up to and including the claim that COVID-19 was a bioweapon cooked up in a lab. The immediate target of Dr. Fauci’s wrath was Senator Rand Paul, who was pressing the nation’s top doctor to say whether the National Institutes of Health had ever funded risky coronavirus research at the Wuhan Institute of Virology. Based on new information disclosed by the National Institutes of Health, however, Paul might have been onto something.

On Wednesday, the NIH sent a letter to members of the House Committee on Energy and Commerce that acknowledged two facts. One was that EcoHealth Alliance, a New York City–based nonprofit that partners with far-flung laboratories to research and prevent the outbreak of emerging diseases, did indeed enhance a bat coronavirus to become potentially more infectious to humans, which the NIH letter described as an “unexpected result” of the research it funded that was carried out in partnership with the Wuhan Institute of Virology. The second was that EcoHealth Alliance violated the terms of its grant conditions stipulating that it had to report if its research increased the viral growth of a pathogen by tenfold. The NIH based these disclosures on a research progress report that EcoHealth Alliance sent to the agency in August, roughly two years after it was supposed to.

An NIH spokesperson told Vanity Fair that Dr. Fauci was “entirely truthful in his statements to Congress,” and that he did not have the progress report that detailed the controversial research at the time he testified in July. But EcoHealth Alliance appeared to contradict that claim, and said in a statement: “These data were reported as soon as we were made aware, in our year four report in April 2018.” The letter from the NIH, and an accompanying analysis, stipulated that the virus EcoHealth Alliance was researching could not have sparked the SARS-CoV-2 pandemic, given the sizable genetic differences between the two. In a statement issued Wednesday, NIH director Dr. Francis Collins said that his agency “wants to set the record straight” on EcoHealth Alliance’s research, but added that any claims that it could have caused the SARS-CoV-2 pandemic are “demonstrably false.”

EcoHealth Alliance said in a statement that the science clearly proved that its research could not have led to the pandemic, and that it was “working with the NIH to promptly address what we believe to be a misconception about the grant’s reporting requirements and what the data from our research showed.” But the NIH letter—coming after months of congressional demands for more information—seemed to underscore that America’s premier science institute has been less than forthcoming about risky research it has funded and failed to properly monitor. Instead of helping to lead a search for COVID-19’s origins, with the pandemic now firmly in its 19th month, the NIH has circled the wagons, defending its grant system and scientific judgment against a rising tide of questions. “It’s just another chapter in a sad tale of inadequate oversight, disregard for risk, and insensitivity to the importance of transparency,” said Stanford microbiologist Dr. David Relman. “Given all of the sensitivity about this work, it’s difficult to understand why NIH and EcoHealth have still not explained a number of irregularities with the reporting on this grant.”

A 3-month trial to direct the rest of your life.

• The Current Covid-19 Mass Vaccinations Are A Public Health Experiment (Geert)

First, there is no precedent to the use of non-replicating viral vaccines in mass vaccination campaigns conducted during a pandemic, or even epidemic, of a highly mutable virus. The challenge of such an undertaking becomes even more difficult as more infectious antigenic variants had already been circulating by the time the first mass vaccination campaigns were initiated (i.e., Alpha, Beta, and Gamma variants). Their spread was featured by distinct temporal and geographic patterns, the underlying mechanism of which was not understood. Prior to the start of this universal vaccination program no single publication existed that came even close to suggesting that mass vaccinations using vaccines that permit transmission could be successful in extinguishing a pandemic of a highly mutable virus.

No such publication exists to this day, and the idea becomes even more preposterous when considering several infectious variants had already expanded in prevalence by the time the vaccines were rolled out. There is ample evidence from similarly highly mutable RNA viruses like Influenza virus and Enterovirus that expansion in prevalence of antigenic variants is driven by selective immune pressure on viral infectiousness exerted by antibodies, and that antigenic variation diminishes or even abolishes the protective neutralization capacity of Influenza virus or Enterovirus vaccines directed at a specific antigenic lineage (1, 2). Consequently, nonreplicating monovalent enteroviral vaccines, for example, are only used at scale in vaccination campaigns of vulnerable target groups (e.g., children) deployed to fight recurrent epidemics of life-threatening enterovirus infection (e.g., EV-A71) in the Asia Pacific region (3).

Interestingly, the US FDA did not approve these vaccines due to ‘concerns about the effectiveness against different pandemic strains, safety, and quality control of vaccine production’ (3). Mass vaccination programs previously conducted to combat viral epidemics/pandemics (e.g., smallpox, polio, measles, yellow fever) have nothing in common with the ongoing mass vaccination campaigns today as those viruses are very different in terms of their pathogenesis, transmissibility, route of infection, potential reservoirs, predominant effector mechanisms involved in antiviral immunity, susceptibility of population segments, as well as with regard to the vaccines used (all prior vaccination campaigns involved live-attenuated virus). In addition, vaccine efficacy as assessed during clinical trials is different from viral effectiveness, which reflects how well a vaccine performs in the field.

Viral effectiveness, therefore, depends on the level of infectious pressure exerted by the viral population and the level of immune selection pressure exerted by the host population (among other factors). Those can be very different from the ones prevailing during clinical trials. This particularly applies when the vaccine is used in mass vaccination campaigns rolled out in the middle of a pandemic of more infectious variants. Because of large-scale pharmaceutical (e.g., mass vaccination) and nonpharmaceutical (e.g., infection-prevention measures) human interventions, significant changes in viral infectious pressure and population-level immune pressure can suddenly take place and dramatically accelerate or slow down the evolutionary dynamics of a pandemic, especially if more infectious variants are circulating.

Whereas the final target population should have the same profile as the one enrolled in the vaccine trials, current Covid-19 (C-19) vaccines are now administered to several segments of the population that have not been part of the pivotal clinical trials that enabled their authorization for emergency use (e.g., children, elderly, pregnant women, women of childbearing age, individuals who previously recovered from Covid-19 disease). Furthermore, the follow-up of study participants in the clinical trials did not extend beyond 3 months as the WHO had declared the pandemic a health emergency of international concern. Short-term results from clinical vaccine trials that were conducted on a small subset of a specific target population during a short period of a pandemic caused by a specific SARS-CoV-2 lineage (most notably the original Wuhan strain) cannot even be considered informative for vaccine effectiveness of mass vaccination campaigns deployed globally across almost all population segments over a prolonged period of a pandemic trajectory involving several waves of infection caused by several different more infectious viral variants.

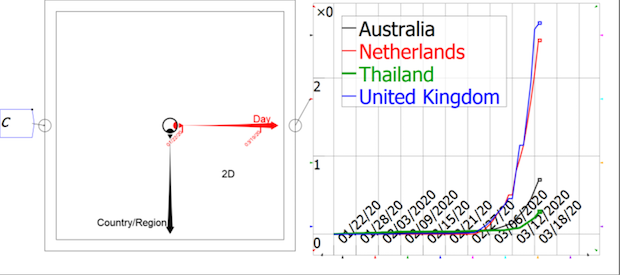

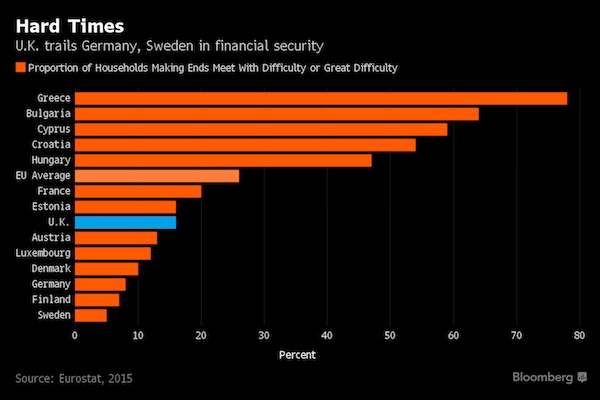

It’s the 40-49 group that comes out worst in all of the stats these days.

• Infection Rates for Vaccinated Aged 40-79 Double the Rates in Unvaccinated (DS)

Another week, another Vaccine Surveillance report (now published by the U.K. Health Security Agency (UKHSA), the successor to Public Health England), and with it more worrying news on the vaccine front. Infection rates in the double-vaccinated compared to the unvaccinated continue to rise, meaning unadjusted vaccine effectiveness continues to decline. Infection rates are now higher in the double-vaccinated compared to the unvaccinated by 124% in those in their 40s, 103% in those in their 50s and 60s and 101% in those in their 70s, corresponding to unadjusted vaccine effectiveness estimates of minus-124%, minus-103% and minus-101% respectively. For those over 80 the unadjusted vaccine effectiveness is minus-34% while for those in their 30s it is minus-27%. For 18-29 year-olds it is 25%, so still positive but low, while for under-18s it is 90%, the only age group showing high efficacy.

Vaccine effectiveness against emergency hospital admission and death continues to hold up, though with some indication of gradual slide, particularly in older age groups. The UKHSA has continued to receive criticism for publishing this data, with claims that the figures used for the unvaccinated population are unreliable and likely too high, artificially suppressing the infection rate and vaccine effectiveness. Cambridge statistician Professor David Spiegelhalter put out a scathing tweet on these lines on Friday, but he didn’t elaborate on his claim or link to an article explaining it further. Professors Norman Fenton and Martin Neil have argued that in fact the PHE/UKHSA data may underestimate the number of unvaccinated rather than overestimate them, which would have the reverse effect.

Either way though, what wouldn’t change is the fact of the large and fast decline in effectiveness against infection. This is now generally acknowledged among many scientists (likely caused by waning over time or new variants or both), though has not had the logical impact on Government policy one might have expected and hoped for of eliminating the rationale for vaccine passports and mandates. A further point revealed for the first time in this week’s surveillance report is that the vaccines may actually hobble the body’s ability to develop the strongest immunity once infected. As noted by Alex Berenson, the report mentions (in passing) that “recent observations from U.K. Health Security Agency (UKHSA) surveillance data” show that “N antibody levels appear to be lower in individuals who acquire infection following two doses of vaccination”.

“In the Book of Leviticus, it is said ‘Do not stand idly by while your neighbor’s blood is shed.’”

• Israeli Doctors, Scientists Tell FDA Of Severe Concerns Over Vaccine Data (AFD)

An independent Israeli group of physicians, lawyers, scientists, and researchers called the Professional Ethics Front today advised the U.S. Food and Drug Administration (FDA) regarding the upcoming FDA discussion on administering COVID-19 vaccines to children aged 5-11, expressing “severe concerns” regarding the reliability and legality of official Israeli COVID vaccine data. “We are aware that the state of Israel is perceived as ‘the world laboratory’ regarding the safety and efficacy of the Pfizer-BioNTech COVID-19 vaccine, as reflected by statements made by Dr. Albert Bourla, Dr. Anthony Fauci, and other senior figures in leading health authorities throughout the world,” the letter reads. “It is therefore our understanding that the data and information coming from Israel play a crucial role in critical decision-making processes in regards to COVID-19 vaccination policies.

“We thus see it of utmost importance to convey a message of warning and raise our major concerns regarding potential flaws in the reliability of the Israeli data with respect to the Pfizer-BioNTech COVID-19 vaccine, as well as many significant legal and ethical violations that accompany the data collection processes.” The letter elaborates: “We believe that the significant failures underlying the Israeli database, which have been brought to our attention by numerous testimonies, impair its reliability and legality to such an extent that it should not be used for making any critical decisions regarding the COVID-19 vaccines.” “This document briefly outlines the main failures that lead to this unfortunate, albeit inevitable, conclusion,” the notice reads. “We emphasize that we can expand and clarify further, as well as provide references, in relation to each of the failures described below.

[..] The Israeli Professional Ethics Front concludes its notice to the FDA: “In accordance with the accepted perception established after World War II, the findings of experiments obtained in illegal and immoral ways should not be relied upon. We believe that the same rules should apply to the findings of the current experiment in Israel, since these findings were obtained through significant legal and ethical infringements. Our conclusion is further reinforced by the significant doubts about the reliability of the data reported by Israel, as detailed above, and the consequent major concern that their use might be misleading and thus disrupt the decision-making processes pertaining to the Pfizer-BioNtech COVID-19 vaccines.

“In the Book of Leviticus, it is said ‘Do not stand idly by while your neighbor’s blood is shed.’ In the spirit of those words, we implore the committee to take into consideration our urgent warnings and adopt utmost precaution when referring to the Israeli data concerning the safety and efficacy of the Pfizer-BioNtech COVID-19 vaccines.”

Fire everyone at the FDA too. Seriously, get rid of these people.

• FDA Buries Data on Seriously Injured Child in Pfizer’s Clinical Trial (Siri)

When Stephanie and Patrick de Garay enrolled their 12-year-old child Maddie and her two brothers in Pfizer’s Covid-19 clinical trial, they believed they were doing the right thing. That decision has turned into a nightmare. Maddie, a previously healthy, energetic, full of life child, was within 24 hours of her second dose reduced to crippling, scream-inducing pain that landed her in the emergency room where she described feeling like someone was “ripping [her] heart out though [her] neck.” Over the next several months the nightmare continued, during which Maddie was hospitalized several times and suffered numerous systemic injuries, requires a tube through her nose that carries her food and medicine, and a wheelchair for assistance.

Ms. de Garay documented every detail of Maddie’s injury and reported it to the principal investigator for the Pfizer trial at Cincinnati Children’s Hospital where the vaccine clinical trial was occurring and where Maddie was treated and admitted. They first tried to treat Maddie as “a mental patient,” telling the family it was psychological and in Maddie’s imagination. Then they claimed it was unrelated to the vaccine (copy of recording with hospital below), and when that argument failed, Pfizer listed this traumatic adverse event as “functional abdominal pain” when reporting to the FDA. Ms. de Garay reported what occurred to the CDC and FDA through VAERS in June 2021 but nobody from these agencies sought additional information or followed-up with the de Garays.

Ms. de Garay also reached out to Dr. Nath, a Chief in the NIH’s National Institute of Neurological Disorders and Stroke, responded by stating he was “Sorry to hear of your daughter’s illness” and that “We have certainly heard of a lot of cases of neurological complications form [sic] the vaccine and will be glad to share our experience with them.” Unfortunately, other than a call arranged by Maddie’s neurologist, there was no follow-up or response from NIH or any other federal health agency. Even after Ms. de Garay did a press event on June 28, 2021 with Senator Ron Johnson, neither Pfizer nor any health agency reached out in any manner to address Maddie’s injury or obtain any additional information.

I saw the doc from the Nebraska AG when it came out, but it was a PDF made up entirely of images of the text. Not very user friendly for me.

• On The Primacy Of The Physician-Patient Relationship (HCR)

I have not written much at this site, or any site, in recent years due to being kept busy supporting litigation regarding bad healthcare information technology as an expert witness. A recent letter, however, so caught my eye regarding both current events and my past writing about bad health IT, that I decided to write about it. It is perhaps a poignant reminder of the craziness of the times in which we physicians find ourselves that a well researched letter on the primacy of the doctor-patient relationship, and the non-interference with that relationship by outside forces based on opinions of non-clinicians, half-baked ideas, overzealous government, media hysteria to garner audience share, etc. comes not from the hallowed halls of academia or a prestigious medical journal – but from a state Attorney General, namely, of Nebraska.

The letter, dated Oct. 14, 2021 and entitled “Prescription of Ivermectin or Hydroxychloroquine as Off-Label Medicines for the Prevention or Treatment of Covid-19”, is located at this link: https://ago.nebraska.gov/sites/ago.nebraska.gov/files/docs/opinions/21-017_0.pdf, It was requested by Dannette R. Smith, the Chief Executive Officer of the Nebraska Department of Health and Human Services. I recommend reading it in its entirety. In this 48-page letter, arguments regarding sanctioning of Nebraska physicians for their decisions on how to treat their patients with FDA-approved drugs for off-label purposes are discussed in significant detail and with significant literature references. The letter reaches the conclusion that:

“… Based on the available data, we do not find clear and convincing evidence that a physician who first obtains informed consent and then utilizes ivermectin or hydroxychloroquine for COVID-19 violates the UCA (Nebraska Uniform Credentialing Act). This conclusion is subject to the limits noted throughout this opinion. Foremost among them are that if physicians who prescribe ivermectin or hydroxychloroquine neglect to obtain informed consent, deceive their patients, prescribe excessively high doses, fail to check for contraindications, or engage in other misconduct, they might be subject to discipline, no less than they would be in any other context … Allowing physicians to consider these early treatments will free them to evaluate additional tools that could save lives, keep patients out of the hospital, and provide relief for our already strained healthcare system.”

No matter one’s opinion on the specifics of this particular controversy, the primacy of the physician-patient relationship – absent extreme circumstances of malfeasance/malpractice – is a principle that should not now, and should never need a 48 page letter for its justification.

No.

• Generation Covid-19: Are The Kids Going To Be All Right? (Age)

To be a young adult in late 2021 is to have come of age while COVID-19 put your life on hold. Gone were the dreams of big 18th birthday bashes and a bustling university life. Career ambitions were deferred, exotic holidays abroad with friends a distant dream. Jobs evaporated and social lives shrivelled. For this generation, unemployment reached 10.8 per cent last month, while participation rates – the number of 15 to 24-year-olds either working or looking for work – slumped to just 51.3 per cent, from 55 per cent in March last year. As Melbourne awakens from its sixth lockdown, a generation of the city’s youth are coming to terms with the loss of almost two years of their early adult lives. No other group of young people across the country has suffered quite like those in Melbourne.

Whether it be school-leavers whose gap-year plans have been scuttled, or uni students struggling to stay afloat in remote university classes, COVID-19 has irreparably changed the course of these young people’s personal and professional lives. Now taking their first steps forward in a post-lockdown city, parents and peers alike are wondering: will the kids be all right? “I’ve just turned 21, and there’s only a few more weeks left of my degree,” says Thomas, who does not want his surname published. “I’ve made an application for a postgrad in law – which was my original plan – but if I get accepted, I think I’m going to defer and take the year off. “As a student who was already struggling with chronic mental illness, these last two years have been hell. I feel like what should’ve been some of the most freeing years of my life have been robbed from me. “I need a break.”

He’s far from alone. A longitudinal study of Australia’s young people conducted by the Department of Education, Skills and Employment showed 23 per cent of 20-year-olds lived with a serious mental health illness in 2020, up from just 7 per cent in 2014. It showed young people are in insecure work at higher rates than six years ago (39 per cent were in permanent work in 2020, compared with 43 per cent in 2014) and were underemployed at higher rates (42 per cent would prefer to work more hours, compared with 32 per cent in 2014). Unsurprisingly, given these numbers, 70 per cent of surveyed 20-year-olds were living with their parents, and of those who had moved out by 19, almost a third had been forced to move back in.

“Whether Baldwin believed the weapon was loaded or not only goes to the issue of whether this is murder rather than manslaughter..”

Reality is that Alec Baldwin intentionally pointed a firearm at a person and pulled the trigger. Exactly why he did so remains in question, as the slaughter did not occur during the “action” portion of filming — that is, he was not pointing it at one of the other actors in the film at the time. In fact he pointed it at cinematographer, killing her and and wounding the director behind her who the round also struck. This is, at best, voluntary manslaughter. I do not care if you’re on a movie set or otherwise; a firearm is handed to you with the action open and thus unable to discharge — always. A firearm is always loaded, even if you’re told it is not. You never point a firearm at anything you’re unwilling to destroy, even momentarily. And you never pull the trigger of a firearm until and unless you are pointing it at whatever you are willing to destroy.

That it is occasionally necessary in film production to violate one or more of these rules doesn’t change the rules. It simply means that you had damn well better make certain you’re not going to shoot someone as a result of doing so. In this particular case there is zero evidence Alec Baldwin had any valid reason within the context of the film to point that weapon, believed loaded or not, at a cinematographer. She was not an actor in the film. There is no claim that the weapon malfunctioned (e.g. was dropped) either; older guns, which would be rather common in a western, might not have the safety features of a modern firearm that prohibit them from firing if dropped or otherwise mishandled so that is not at issue in this instance. The evidence and presumption to this point is that the weapon was pointed at the cinematographer and the trigger depressed, both intentional acts.

Whether Baldwin believed the weapon was loaded or not only goes to the issue of whether this is murder rather than manslaughter; he had a duty to inspect what he was allegedly told was a “cold” weapon and verifying it was incapable of discharge if his part in the film required him to point it at, or where in the potential path of a projectile, a human is or could be. It is clear he did not do so and that, at minimum is killing by negligence, commonly known as voluntary manslaughter. If, as appears evident, he intentionally pointed the weapon at the cinematographer and pulled the trigger outside of a requirement to “shoot” at someone while filming was being rehearsed or was actually taking place (e.g. he was pissed off for some reason and that’s why he pointed the alleged “cold gun” at her and pulled the trigger) then I argue depravity is arguably present as well and that’s Murder 2. Baldwin must be arrested now. There is no reasonable means to claim this is an “accident”; Halyna was first the victim of felony assault with a deadly weapon when a firearm was pointed at her without lawful purpose and then was killed when, through an intentional act, it was discharged. I don’t give a crap how rich or famous Baldwin is

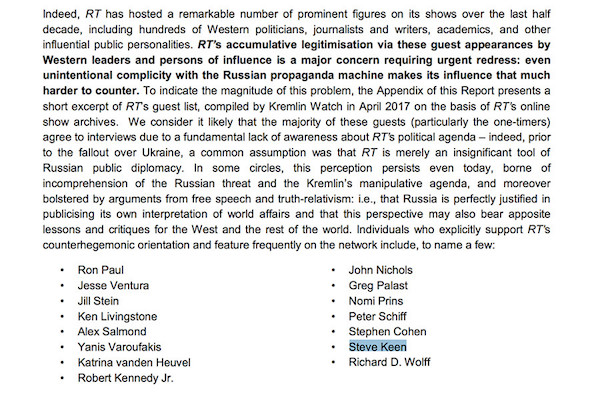

Steve has been doing a lot of climate work, and is running for office in Sydney.

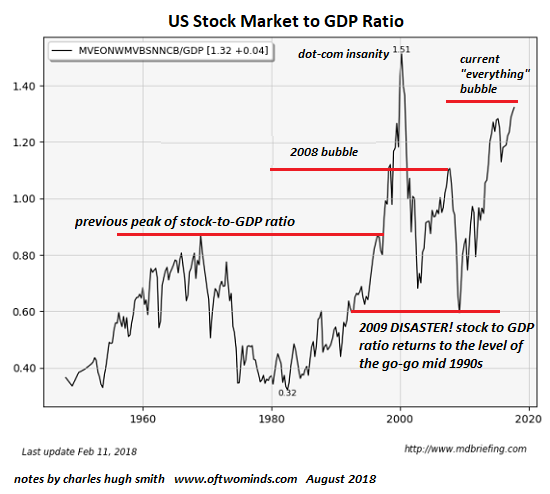

• From Economic Fantasy to Ecological Reality on Climate Change (Steve Keen)

This was an invited talk to the Oxford Department of International Development “Climate Change and the Challenges of Development Lecture Series”, on my criticisms of the application of neoclassical economics to climate change. I focused on the new paper by Dietz et al. that allegedly calculates the economic costs of tipping points: Dietz, S., J. Rising, T. Stoerk and G. Wagner (2021). “Economic impacts of tipping points in the climate system.” Proceedings of the National Academy of Sciences 118(34): e2103081118. Upon closer examination, this papers fails to consider tipping points in any credible way, and this is obvious in its incredible claim (in the original sense of the “not credible”), that: “Tipping points reduce global consumption per capita by around 1% upon 3°C warming and by around 1.4% upon 6°C warming. This is ridiculous: the tipping points they consider are:

• Arctic summer sea ice,

• The Greenland Ice Sheet,

• The West Antarctic Ice Sheet,

• The Atlantic Meridional Overturning Circulation (“Gulf Stream”),

• The Amazon Rainforest,

• The Indian Monsoon,

• Permafrost, and

• Ocean methane hydrates.If all 8 of these tripped–especially with a temperature 3-6°C above pre-industrial levels–we would be experiencing a climate utterly unlike anything Earth has seen for tens of millions of years. The thought that this would just reduce global consumption by just 1.4%–compared to what it would be if none of these tipping points were triggered–doesn’t pass what Nobel Laureate Robert Solow once called “the smell test”: “every proposition has to pass a smell test: Does it really make sense?”. I show why this paper stinks in Solow’s sense.

Dads on Duty

DADS ON DUTY: After a violent week of fighting at a Louisiana high school, parents knew something had to change. So, a group of dads decided to show up not just for their kids – but for the whole student body – to help maintain a positive environment. @SteveHartmanCBS has more. pic.twitter.com/Uux3qx48sd

— CBS Evening News (@CBSEveningNews) October 22, 2021

Swiss

Swiss Protest against the vaccine passports pic.twitter.com/goT9scShL2

— Luke Rudkowski (@Lukewearechange) October 23, 2021

Massive, powerful display of protest against vaccine passports in Bern, Switzerland. The protesters wear yokes to symbolize the desire of the ruling class to treat workers like livestock that they can drug at will.pic.twitter.com/qq9z5gVxef

— Michael P Senger (@MichaelPSenger) October 23, 2021

Milan

WATCH: Massive crowd demonstrates against vaccine passports in Milan.

— Election Wizard (@ElectionWiz) October 24, 2021

Udine

https://twitter.com/i/status/1452004619459104773

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.