Edouard Vuillard The two sisters 1899

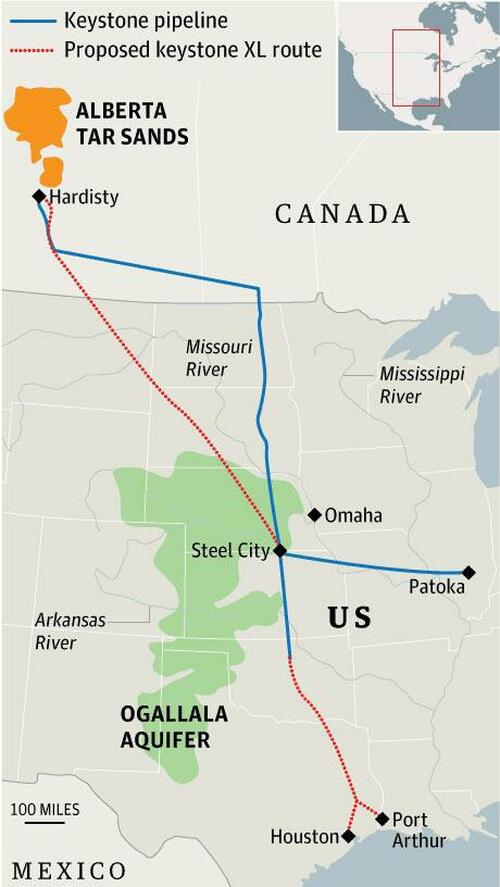

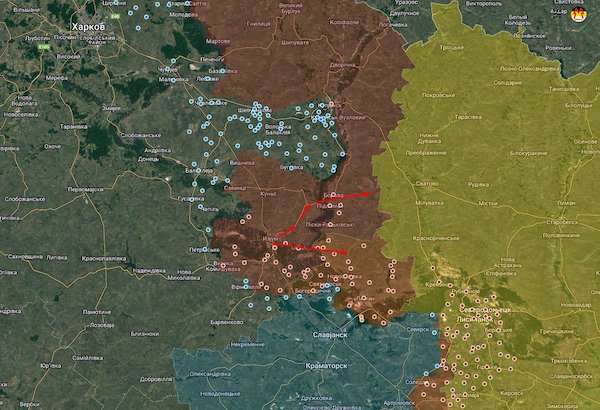

It’s not very clear what is happening with the Ukraine ‘counterattack’. It’s taken Russia by surprise, for sure, but there appears to have been hardly any fighting. The Russians simply withdrew, with very few casualties or wounded. And this map of the “salient” doesn’t look all that good for Ukraine. Fish in a barrel.

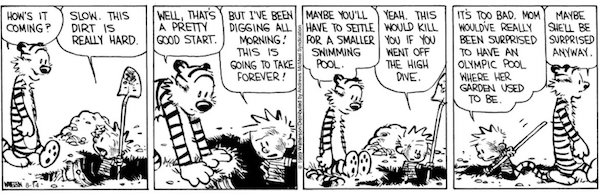

Bad start, Chuckie! That looks awful. In the internet age, people get to see these things.

"The servant must clear my desk for me. I can't be expected to move things." pic.twitter.com/0pZqY2Xopq

— Laura Kuenssberg Translator (@BBCLauraKT) September 10, 2022

Signalling at an aide through clenched teeth to move something out of his way pic.twitter.com/SSe8j8VeUz

— Emma Devlin (@theactualemma) September 10, 2022

Bannon

BANNON: We are winning! pic.twitter.com/adtCg7E1kh

— Wojciech Pawelczyk (@Woj_Pawelczyk) September 9, 2022

Invest!

• Zelensky To Headline US Defense Industry Conference (Hill)

Ukrainian President Volodymyr Zelensky will address U.S. defense contractors later this month when he headlines the annual Future Force Capabilities Conference and Exhibition hosted by the National Defense Industrial Association (NDIA). Zelensky is scheduled to speak at the event Sept. 21, according to the program for the event available on the NDIA’s website. Oleksii Reznikov, Ukraine’s minister of defense, is also scheduled to speak that day. News of the appearances was first reported by Reuters, which noted that the officials will speak via video link. Zelensky is expected to appeal for more weapons for his country during his speech, the outlet added.

News of the Ukrainian president’s speech to the NDIA — whose membership includes defense industry giants like Raytheon Technologies, Lockheed Martin and General Dynamics — comes as Kyiv looks to fend off Russia’s invasion as it drags through its sixth month. Eight defense contractors — including Raytheon, Lockheed and General Dynamics — attended a meeting at the Pentagon in April to discuss how the U.S. could speed up production to help Ukraine fend off Moscow’s war. The U.S. has committed $15.2 billion in security assistance to Ukraine since the beginning of the Biden administration, including $14.5 billion since Russia invaded Ukraine on Feb. 24.

“The U.S. is really preparing for a long war. … It’s actually preparing for endless war in Ukraine..”

• US Military Aid To Ukraine Grows To Historic Proportions (IC)

SINCE RUSSIA’S UNPROVOKED invasion of Ukraine in February, the U.S. government has pumped more money and weapons into supporting the Ukrainian military than it sent in 2020 to Afghanistan, Israel, and Egypt combined — surpassing in a matter of months three of the largest recipients of U.S. military aid in history. Keeping track of the numbers is challenging. Since the war started, U.S. officials have announced a flurry of initiatives aimed at supporting Ukrainian defense efforts while keeping short of a more direct involvement in the conflict. On Thursday, on a surprise visit to Kyiv, U.S. Secretary of State Antony Blinken announced a new $675 million package of U.S. military equipment as well as a $2.2 billion “long-term” investment to bolster the security of Ukraine and 17 of its neighbor countries.

Weeks earlier, President Joe Biden unveiled a $3 billion aid package, the largest yet, symbolically choosing Ukraine’s Independence Day for the announcement. The administration noted on that occasion that the total military assistance committed to Ukraine this year had reached $12.9 billion, more than $15.5 billion since 2014, when Russia annexed Crimea. And this month, Biden also asked Congress to authorize an additional $13.7 billion for Ukraine, including money for equipment and intelligence.

Because the assistance is drawn from a variety of sources — and because it’s not always easy to distinguish between aid that’s been authorized, pledged, or delivered — some analysts estimate the true figure of the U.S. commitment to Ukraine is much higher: up to $40 billion in security assistance, or $110 million a day over the last year. This assistance is believed to be playing an important role in the advances Ukraine is making in an ongoing offensive to retake territory seized by Russia earlier this year; the cities of Kupiansk and Izium are reported to have just been liberated. What is clear is that the volume and speed of the assistance headed to Ukraine is unprecedented, and that legislators and observers are struggling to keep up.

[..] “The U.S. is really preparing for a long war. … It’s actually preparing for endless war in Ukraine,” said Stephen Semler, co-founder of the Security Policy Reform Institute, a grassroots-funded U.S. foreign policy think tank that has been tracking the assistance. “They’re saying, ‘We’re only doing this long-term approach because Putin is the one insisting on doing so.’ And that could be right — but at the same time, it’s not like the U.S. is expressing much confidence in its diplomatic skills to end the conflict, rather than just trying to outlast Putin.”

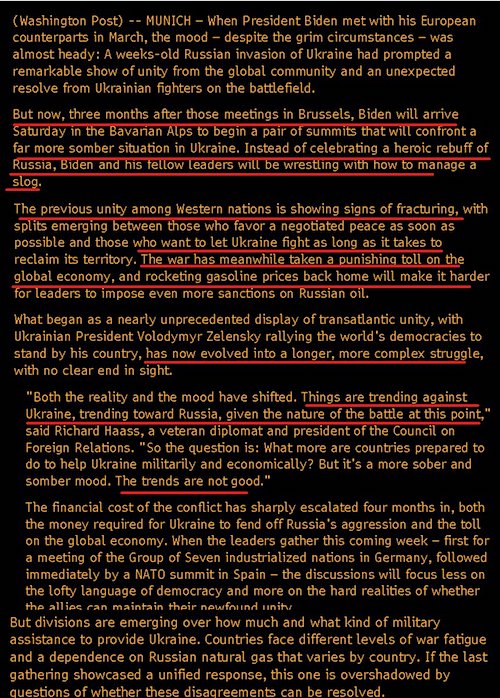

A lot of pressure on Putin to go big.

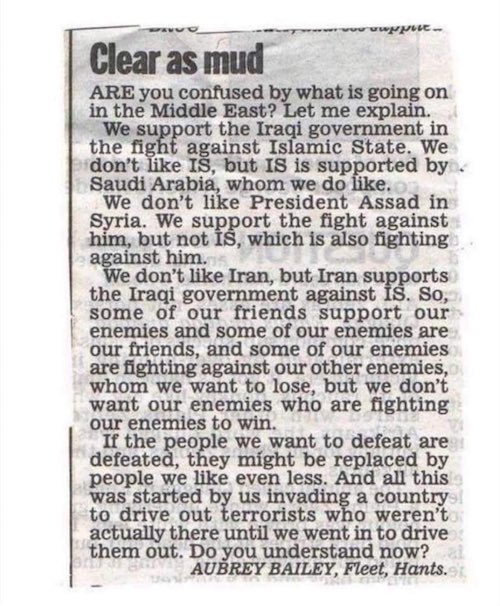

• The Izium Withdrawal – A Catalyst For ‘Starting In Earnest’ (MoA)

Russia pulled back from Kiev and started phase two of the war. Since then the Luhansk oblast and the land corridor to Crimea, especially Mariupol, have been won. The liberation of the Donetsk Republic has stalled. The number of Russian and allied forces fighting the war was kept steady or even decreased over time. Meanwhile the Ukrainian forces have grown manifold. They are getting a very significant amount of arms from ‘western’ sources and new promises to keep those supplies coming. Even when they are armed to a lesser degree, higher numbers of men do matter over time. This made potentially costly defeats, like recently at the Izium front, possible. The Russian military has readjusted to this threat by decreasing the held territory and by concentrating on the original aims of the war.

The Russian public, which at first did not fully understand why the war was necessary, has since grown in its awareness. It now understands the big game that is played against its country. It demands to adjust the level of resources put into the war to the one needed for a decisive victory. That is why Dima concludes that: “We can say that today was the best ever [..] day for the Russians in the territory of Ukraine.” It is now likely assured that they will be liberated. One way or another. I also believe that the withdrawal from the Izium region, which left behind a significant number of pro-Russian civilians under deadly threats from fascist ‘filtration’ groups, will be the catalyst for a significant escalation on the Russian side. I may, like so often, be wrong. There is still an intermediate play to come.

The 3rd Russian Corps, formed from well paid reservists, armed with new weapons and now reportedly deployed south of the Donbas region, might be a game changer. If it moves north, and manages to role up the Ukrainian fortifications at the Donetsk line from behind, it may become the decisive force. But the establishment of the mobile Ukrainian forces that in recent days moved, largely unopposed, towards the Oskol river, is a new card which the Ukrainians can play again against any weak spot in the Russian lines. The Russian public, softly led by the Kremlin through Russian media, is now likely to demand more. That must not mean the total mobilization of the Russian military. ‘Western’ claims that Russia is isolated are wrong. It has many friends it can call upon to contribute to its efforts. Diversion moves against the U.S. military in many regions of the world are just one of several possibilities.

Time is always the third force on the battlefield. Both opponents have to play against it. Europe is currently starving itself by boycotting Russian energy resources. That is unsustainable and it will, over time, have to stop following its current U.S. directed policies. Economically the Ukraine is broke and it can not, despite foreign subsidies, sustain a long war. There are also potential political changes within the U.S. that will play a role. Still, the game must be won on Ukrainian grounds. Russia must up its game. On July 7, in a session with Duma leaders and party factions heads, Putin said: “Today we hear that they want to defeat us on the battlefield. Well, what can I say? Let them try. We have already heard a lot about the West wanting to fight us ”to the last Ukrainian.“ This is a tragedy for the Ukrainian people, but that seems to be where it is going. But everyone should know that, by and large, we have not started anything in earnest yet.” Well, now may be the time to do so.

There appear to be a lot of foreign fighters involved.

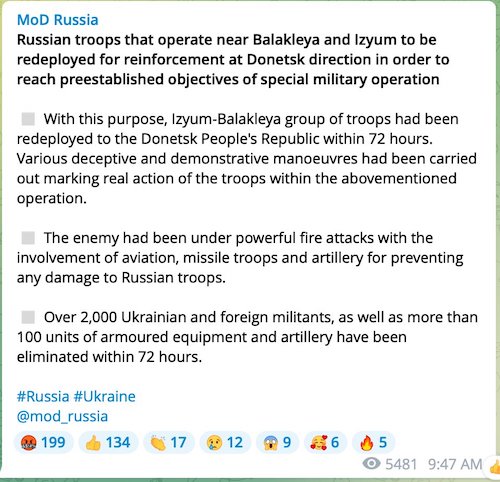

• Russian Military Explains Partial Withdrawal (RT)

The Russian Defense Ministry has confirmed withdrawal of troops from multiple locations across Ukraine’s Kherson region. The development comes amid a Ukrainian offensive in the area. “In order to achieve the goals of the special military operation, a decision was made to regroup troops in the areas of Balakleya and Izyum in order to build up efforts in the Donetsk direction,” the Russian military said in a statement on Saturday. The troops stationed in the area have been “re-deployed” over the past three days into territory of the Donetsk People’s Republic, the ministry claimed. During the operation, the military has performed a “number of distracting and demonstration activities imitating the real action of troops,” it added, without providing any further detail on said maneuvers.

In order to prevent “damage to Russian troops,”the military has been subjecting Ukrainian units in the area to “powerful” artillery, missile and aircraft attacks, the ministry said, claiming destruction of over 100 armor pieces and artillery, as well as elimination of “more than 2,000 Ukrainian and foreign fighters” in the past three days. The withdrawal comes amid a massive Ukrainian offensive that was launched in Kharkov Region on Thursday. The assault was preceded by attempts to advance in other areas, namely near the Russia-controlled southern Ukrainian city of Kherson.

Ramstein.

• Are We Indeed Headed Into WWIII And What Can Save Us? (Doctorow)

Izyum is close to the Russian-Ukrainian border southeast of Kharkov and is a major logistical base for munitions and weaponry that are sent onward to support the Donbas operation. The latest information on the Russian side appears to be that the Russians have now dispatched large numbers of reservists to this area to hold their positions. They also speak of intense artillery duels. We may well assume that both sides have experienced heavy loss of life. As yet, the outcome is unforeseeable. Meanwhile, Russian war correspondents on the ground in Donetsk insist that the Russian advance towards Slavyansk, in the center of the former Donetsk oblast, is continuing without pause, which suggests that the strikes on their munitions stores claimed by the Ukrainians have not been totally effective. If Slavyansk is taken in the coming few weeks, then Russia will quickly assume control of the entire territory of the Donbas.

In last night’s talk show program, host Vladimir Solovyov said that this latest push in the Ukrainian counter-offensive was timed to coincide with the gathering at the Ramstein air base, Germany of top officials from NATO and other allies under the direction of the visiting U.S. Secretary of Defense Lloyd Austin. If the Ukrainian efforts were failing in the field, then the cry would go up: we must provide them with more weapons and training. And if the Ukrainian efforts in the counter-offensive were succeeding, those in attendance at Ramstein would hear exactly the same appeal to aid Kiev.

Though Evening with Solovyov, on air from about 23.00 Moscow time, offered viewers some few minutes of video recordings from the opening of the Ramstein gathering, far more complete coverage was provided to Russian audiences a few hours earlier by the afternoon news show Sixty Minutes. Here, nearly half an hour on air was given over to lengthy excerpts from CNN and other U.S. and European mainstream television reporting about Ramstein. Host Yevgeni Popov read the Russian translation of the various Western news bulletins. His presentation clearly sought to dramatize the threat and to set off alarm bells.

For his part, Vladimir Solovyov went beyond presentation of the threat posed by the United States and its allies to analysis of Russia’s possible response. He spoke at length, and we may assume that what he was saying had the direct approval of the Kremlin, because his guests, who are further removed from Power than he is, were, for the most part, allowed only to talk blather, such as the critique by one panelist of a recent pro-Ukraine, anti-Russia article in The New York Review of Books by Yale professor Timothy Snyder, who counts for nothing in the big strategic issues Russia faces today.

So, what did Solovyov have to say? First, that Ramstein marked a new stage in the war, because of the more threatening nature of the weapons systems announced for delivery, such as missiles with accuracy of 1 to 2 meters when fired from distances of 20 or 30 kilometers thanks to their GPS-guided flight, in contrast to the laser-guided missiles delivered to Ukraine up till now. In the same category, there are weapons designed to destroy the Russians’ radar systems used for directing artillery fire. Second, that Ramstein marked the further expansion of the coalition or holy crusade waging war on Russia. Third, that in effect this is no longer a proxy war but a real direct war with NATO and should be prosecuted with appropriate mustering of all resources at home and abroad.

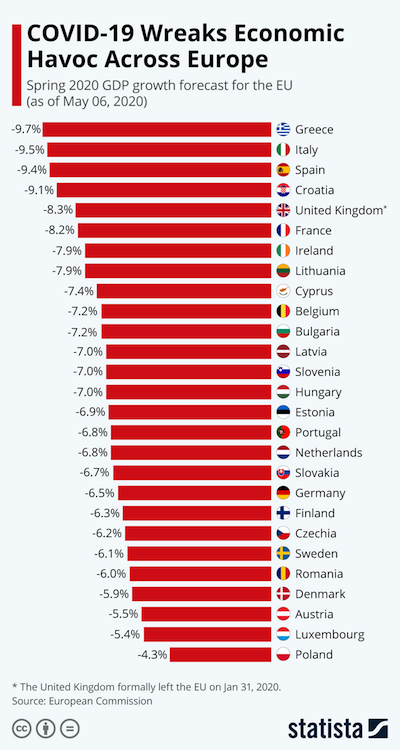

“There are few continents in such a difficult situation as ours, but only our continent is making its own life so much harder..”

• EU Has Run Out Of Energy – Orban (RT)

Hungary’s Prime Minister Viktor Orban has blamed the European Union’s energy shortfall on bureaucrats and environmentalists, saying his own country is protected from the crisis. “If we want to dig to the bottom of the problems, we always end up in the same place: the issue of energy. And the situation is that Europe has run out of energy,” Orban wrote in a Facebook post on Saturday. The premier blamed the situation on“fundamentalist greens and the bureaucrats”playing “geopolitical games,” arguing that the bloc is refusing to use “different energy sources” for “political reasons,” driving up the cost of living and damaging its industries.

“There are few continents in such a difficult situation as ours, but only our continent is making its own life so much harder,” Orban said, pledging to do everything “needed by the homeland.” We will not have any shortage of energy. This is not a prediction, this is a statement of fact. There will be gas in Hungary and enough electricity. In late August Hungary secured a deal with Russian energy giant Gazprom for additional natural gas supplies, pumped via Serbia. Hungary is one of the few EU member states to comply with the Moscow’s ruble payment requirement for gas deliveries.

However, Budapest is also moving to cut energy consumption. Earlier this week, the government introduced an 18-degree Celsius temperature cap in all public institutions across the country. The authorities have also instituted a mandatory slashing of gas consumption for state institutions, except hospitals and social housing facilities. Hungary has repeatedly criticized EU sanctions against Russia introduced over the conflict in Ukraine. Budapest argues that the restrictions have failed to produce the intended result, while disrupting the supply of natural gas to the bloc and sending energy prices to unprecedented highs.

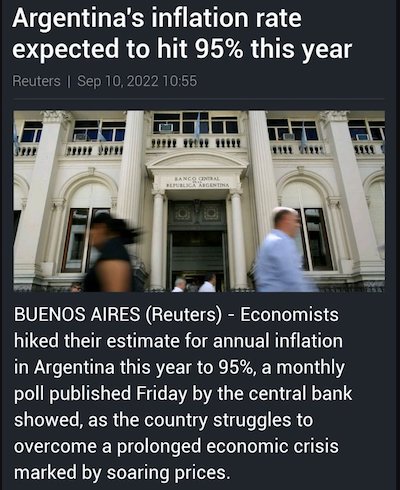

“..natural gas prices soared 261.3% year-on-year and electricity costs were up 38.5%..”

• Greek Citizens Saving On Food To Pay For Energy (RT)

A growing number of Greeks are cutting back on food to pay their taxes and energy bills, a survey by the General Confederation of Greek Workers and the Labor Institute has shown. When asked if rising prices had forced them to spend less on basic food items, 20% of respondents answered “much less” and 51% answered “less,” while a quarter reported “little” change in their spending habits and only 4% said the situation had not changed for them at all. A majority noted that the change in their spending habits had come from the necessity to pay more for energy. Nearly half of respondents (47%) said they expected a “difficult winter” as energy prices continue to rise, while one in five said they may not be able to pay for energy bills in the coming months “at all.”

“The Greek economy and society, after years of austerity, are facing a new wave of price increases and revaluation of basic goods, and stagnant incomes threaten the purchasing power of many households and social groups,” the authors of the survey conclude. They suggest that the cost of living crisis in the country could be solved only through government intervention, for instance, by hiking the minimum wage, reducing excise taxes on energy and food, and imposing a tax on energy companies’ excess profits.

The Greek government is already subsidizing energy bills for its residents, having started the practice last year. Last month, it vowed to spend almost €2 billion ($1.98 billion) subsidizing growing power bills in September, covering up to 100% of the increase for the poorest households. However, analysts say subsidies may not be enough, with inflation remaining close to its highest level in nearly three decades – 11.4% – as of last month, while natural gas prices soared 261.3% year-on-year and electricity costs were up 38.5%, according to data from the Hellenic Statistical Authority (ELSTAT).

Inevitable all over Europe. Who will sink into a depression?

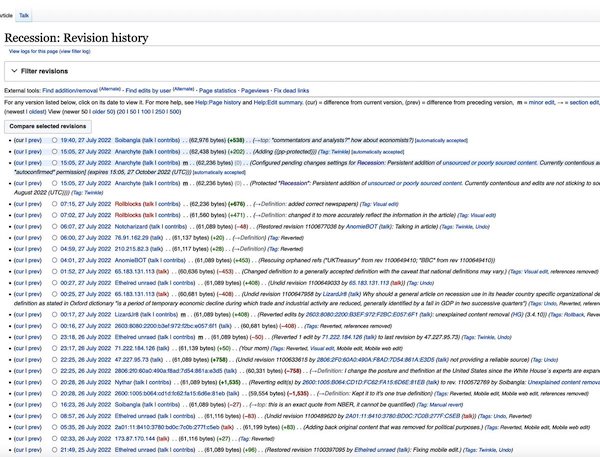

• German Recession ‘Inevitable’ – Deutsche Bank

The engine of European economic development, Germany, is set for a contraction, Deutsche Bank CEO Christian Sewing warned this week, as cited by CNBC. According to the media outlet, Sewing said in a speech at the Handelsblatt Banking Summit in Frankfurt that the war in Ukraine “destroyed a number of certainties” on which the global economic system had been predicated over the past few decades. He reportedly cited disrupted global value and supply chains, along with a bottleneck in the labor market and a shortage of gas and electricity leading to soaring costs, as key reasons why the Eurozone inflation is at record highs. “As a result, we will no longer be able to avert a recession in Germany. Yet we believe that our economy is resilient enough to cope well with this recession — provided the central banks act quickly and decisively now,” Sewing reportedly stated.

The Deutsche chief pointed out that, for now, many in Germany still have pandemic savings to fall back on in order to meet skyrocketing energy costs, while most companies remain “sufficiently financed.” “But the longer inflation remains high, the greater the strain and the higher the potential for social conflict,” he warned. Sewing also urged the German leaders to accelerate the nation’s decoupling from China. He indicated that China accounts for around 8% of German exports and 12% of imports, while more than one-tenth of the sales of companies listed on the German DAX stock index go to China. “Reducing this dependency will require a change no less fundamental than decoupling from Russian energy,” the chief executive said.

Threatening your fellow members. Nice.

• Hungary On ‘Edge Of Abyss’ In EU – Czech Minister (RT)

Hungary’ stance on Russia and the conflict in Ukraine could potentially see it exiting the EU, the Czech European affairs minister has warned. The EU is “a unity of many voices” that always finds common ground despite any disputes, Mikulas Bek told Cesky Rozhlas Plus radio on Thursday. “Negotiations are often tough in the EU, and many countries could engage in them. But Hungary, in my opinion, has come a long way, reaching the edge an abyss, and now it has to decide whether to go back from that edge or risk a jump, the consequences of which I don’t even want to speculate on,” the minister said. On the prospects of Budapest leaving the EU altogether, Bek said it’s theoretically possible.

Budapest has remained relatively neutral since the launch of Moscow’s military operation in Ukraine in late February, and refused to send weapons to Kiev unlike many of its neighbors. It has been critical of the EU sanctions against Russia, calling them ill-conceived and self-defeating. Hungary, which is heavily dependent on Russian energy, is exempt from the bloc-wide ban on Russian oil. The Czech European affairs minister, whose country currently presides over the EU Council, pledged to work hard in the coming months to make sure Hungary stays in line with European policies. “A small positive sign” was that Budapest backed down on its demand to remove three prominent Russia businessmen – Alisher Usmanov, Pyotr Aven and Viktor Rashnikov – from EU sanctions earlier this week, Mikulas Bek added.

Listening to George Webb in the video below, something tells me Paul Huck won’t be the Special Master. Which is a shame. But then again, shame is all the US has left by now.

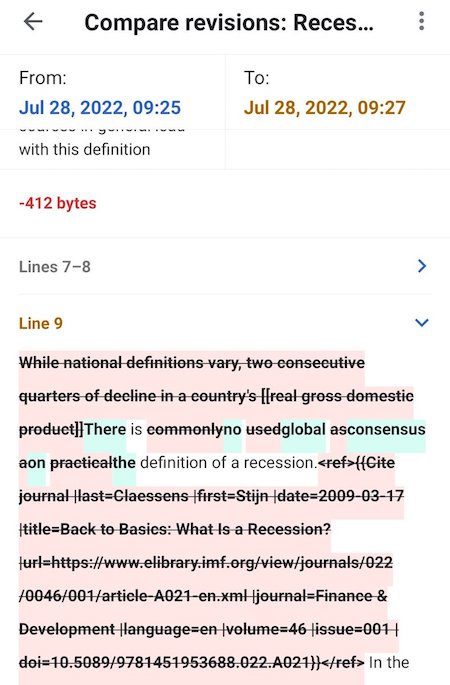

• Trump Team And DOJ Suggest Rival ‘Special Master’ Candidates (G.)

The US justice department and lawyers for Donald Trump were unable to agree Friday night on who to have as the so-called special master to review for potential privilege protections the materials that the FBI seized from the former president’s Mar-a-Lago resort earlier this month. The justice department and Trump met a deadline to submit a joint filing but failed to reach consensus on most of the key issues at stake: not only the identity of the special master but also the scope of the work, and who should pay for the added expense. With both sides unable to agree on who should serve as the special master, the justice department and Trump’s lawyers each proposed two candidates, saying they would inform the judge overseeing the case, Aileen Cannon, on their positions after the weekend.

The justice department proposed two retired federal judges: former US district court judge Barbara Jones, who has previously served as a special master, and Thomas Griffith, a former US appeals court judge for the DC Circuit and a lecturer at Harvard Law School. Trump’s lawyers proposed a federal judge and an attorney in Florida: former US district court chief judge Raymond Dearie, one of four judges who authorized a wiretap on former Trump 2016 campaign aide Carter Page, and former Florida deputy attorney general Paul Huck. The disagreements between the two parties on the already contentious special master issue – the government earlier filed a notice of appeal against the order appointing the arbiter – were more numerous than the areas of consensus.

On what materials should be examined, the justice department said the special master should not review documents with classified markings or potentially subject to executive privilege, while Trump’s team said all documents should be reviewed. “The special master should not review documents with classification markings; should not adjudicate claims of executive privilege (but should submit to [the National Archives] any documents over which such claims are made),” the justice department said. On what access each side should get to the documents, the justice department said it wanted to review proposed protection designations before they went to the special master, while Trump said they should remain protected to protect the process.

Mafia fight between Barr and Trump – mud wrestling heavyweight on the Florida scene. Trump taps Paul Huck to expose Barr’s Mena operation buddies and Wasserman-Schultz’s Ukrainian Bogacheva operation with one appointment! pic.twitter.com/jQ9G8m8sFN

— George Webb – Investigative Journalist (@RealGeorgeWebb1) September 10, 2022

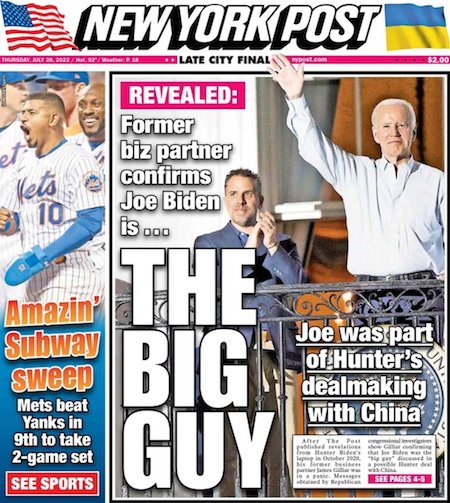

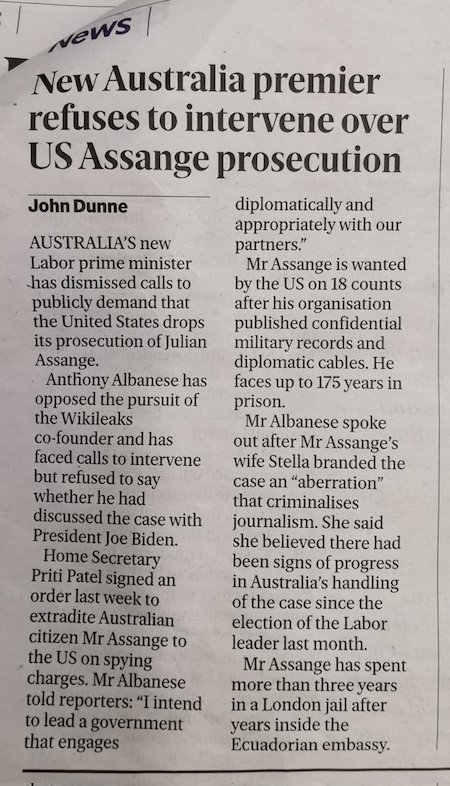

“Initially we were told that Trump possessed “classified documents relating to nuclear weapons” that he might sell to a foreign government like Saudi Arabia. This shocking accusation has been quietly dropped.”

• Declassify the Documents From Trump’s Basement (Leonard Goodman)

Whatever your feelings about former President Trump, there are reasons to be skeptical when government officials say it was necessary to raid his Florida home to recover classified documents that threatened national security. Like the former president, I was once accused by the government of mishandling classified information connected to my representation of a detainee at Guantanamo Bay. There was nothing in my client’s file that posed any danger to national security. My client was an innocent shopkeeper who was sold to the Americans back in 2003 when the U.S. was paying bounties to corrupt Afghan warlords to turn in Al Qaeda or Taliban fighters, and then shipping those men 8,000 miles to our newly built prison camp in Cuba. The government decided to classify every document in the detainee files as “secret,” not to protect national security, but so it could lie with impunity and tell the American people that the prisoners at Gitmo were the “worst of the worst,” and “terrorists” captured on the battlefield.

I never revealed any classified information. I got into trouble after writing an article criticizing the government’s practice of classifying certain evidence above the security clearance level of the detainee’s lawyer, making it impossible to challenge. Following a hearing at the Department of Justice, I was allowed to keep my security clearance long enough to see my client released back to his home and his family after 12 years of unjust imprisonment. I was never in serious legal jeopardy. But the experience opened my eyes to the ways that our government abuses its power to classify information as “secret” to protect its own officials from embarrassment or criminal exposure. Since 9/11, the people most aggressively pursued for mishandling classified materials are whistleblowers, not traitors.

Chelsea Manning and Julian Assange revealed official crimes such as the murder of unarmed Iraqi civilians and journalists. Daniel Hale revealed that our drone assassination program regularly slaughters innocent civilians, contrary to public statements about surgical strikes. John Kiriakou revealed inconvenient facts about our torture program. Edward Snowden revealed an illegal mass surveillance program. All these truth-tellers were aggressively pursued under the Espionage Act. Assange may die in prison for telling the truth about the crimes of our leaders.

While Trump may not fit the mold of a selfless whistleblower, there is still cause for concern. First, the official justifications for the raid on Mar-a-Lago are highly suspect. Initially we were told that Trump possessed “classified documents relating to nuclear weapons” that he might sell to a foreign government like Saudi Arabia. This shocking accusation has been quietly dropped. Now we are told that the government has “grave concern” that Trump might blow the cover on “clandestine human sources” described in the mainstream media as the “lifeblood” of our intelligence community. “Disclosure could jeopardize the life of the human source,” a former legal adviser to the National Security Council told the New York Times.

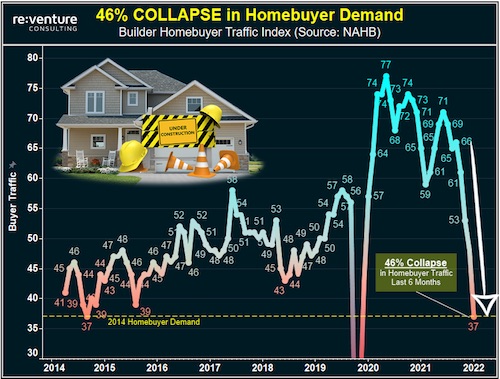

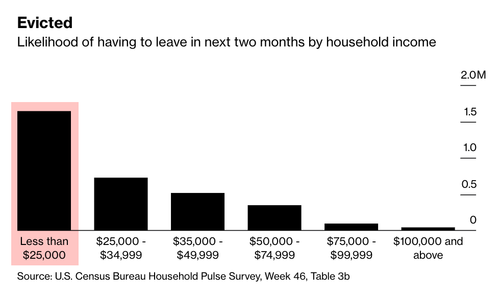

“..despite a calculated increase in home value of $1.5 trillion..”

“Consider this the cost of going green.”

• US Household Net Worth Drops $6.1 Trillion in Q2 (CTH)

In the second quarter (April, May, June) 2022, the total U.S. household wealth dropped $6.1 trillion, despite a calculated increase in home value of $1.5 trillion. The majority of the loss is connected to a drop in Corporate Equity (stock market) and household investment in the stock market. FED “The net worth of households and nonprofit organizations declined $6.1 trillion to $143.8 trillion in the second quarter. The value of stocks on the household balance sheet declined by $7.7 trillion, while the value of real estate increased by $1.5 trillion.” Keep in mind this is backward looking data, and after a period of decelerating rates of growth, the overall real estate market is now in a period of decline as calculated for the most recent month of July [DATA].

The equity position of homeowners is now considerably less than the equity position when the feds calculated the second quarter household wealth (two months ago). Part of the issue goes back to what we have been discussing with inflation and specifically energy driven increases in fuel and electricity. Inflation sucks money out of the economy, making people less wealthy. Energy inflation sucks money exponentially faster out of each household, potentially making the already working-class poor, much poorer. The higher prices paid for housing, food, fuel and energy do not contribute to anything, the increased costs are just sucked out of the consumers’ pockets without generating any additional value. It just costs more to live, and that reduces wealth. Consider this the cost of going green.

“..more than 11 million reports of adverse effects..” “We know that these numbers just about represent between 1% and 10% of all real events.”

• Declaration Of International Medical Crisis Over ‘Covid-19 Vaccines’ (DS)

We, the medical doctors and scientists from all over the world, declare that there is an international medical crisis due to the diseases and deaths co-related to the administration of products known as ‘COVID-19 vaccines’. We are currently witnessing an excess in mortality in those countries where the majority of the population has received the so-called ‘COVID-19 vaccines’. To date, this excess mortality has neither been sufficiently investigated nor studied by national and international health institutions. The large number of sudden deaths in previously healthy young people who were inoculated with these ‘vaccines’, is particularly worrying, as is the high incidence of miscarriages and perinatal deaths which have not been investigated.

A large number of adverse side effects, including hospitalisations, permanent disabilities and deaths related to the so-called ‘COVID-19 vaccines’, have been reported officially. The registered number has no precedent in world vaccination history. Examining the reports on CDC’s VAERS, the U.K.’s Yellow Card System, the Australian Adverse Event Monitoring System, Europe’s EudraVigilance System and the WHO’s VigiAccess Database, to date there have been more than 11 million reports of adverse effects and more than 70,000 deaths co-related to the inoculation of the products known as ‘Covid vaccines’. We know that these numbers just about represent between 1% and 10% of all real events.

Mike Davis

“He knows that he’s just wrong as a matter of law here….I’m not sure where [Barr] is coming up with these theories. It doesn’t sound like he read Judge Cannon’s opinion because it was a pretty even-keeled, reasoned opinion. He clearly didn’t read it” – @mrddmia to @IngrahamAngle pic.twitter.com/6Lij6UiIeg

— The Article III Project (A3P) (@Article3Project) September 9, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.