James McNeill Whistler Arrangement in Pink, Red and Purple 1883-4

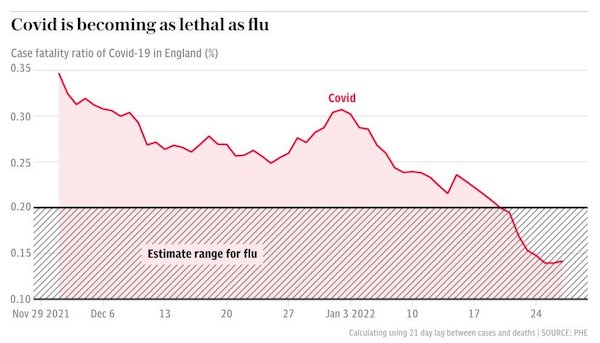

PCR “We have built this crisis with this new definition of “cases”.

https://twitter.com/i/status/1488981740303572993

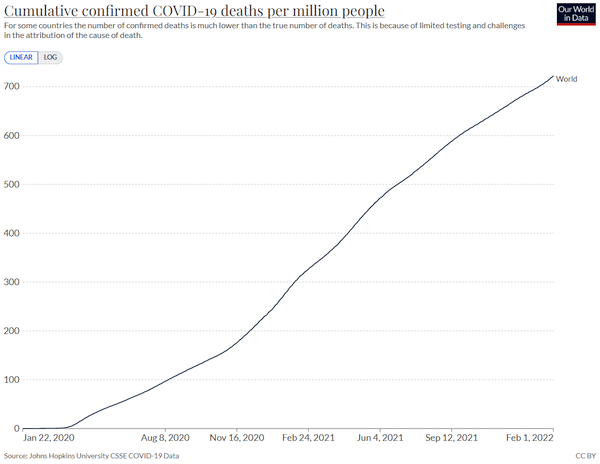

The 10 billion, 90%-efficacy vaccine shots have caused the noticeable trend break downwards.

Bunch of idiots

Kilmeade: We were lead by a bunch of idiots pic.twitter.com/fuIsO2nICy

— Wittgenstein (@backtolife_2019) February 2, 2022

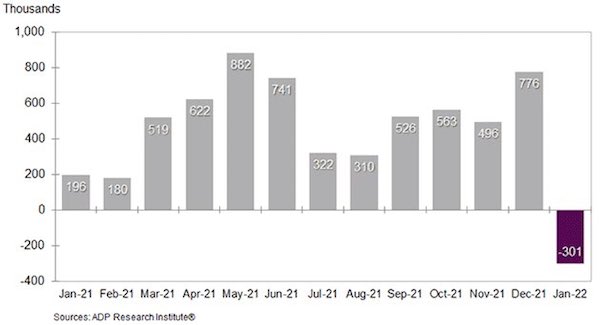

ADP predicts huge job losses. Watch tomorrow.

Dave Collum: ”The job market is not tight, it’s broken.”

1/ The fact that Imperial College did such a study tells you they KNEW no-one was going to die. You can’t take that risk, even if they volunteer. 2/ It was an early version of the virus, which a/ no longer exists, and b/ was 10-100x more lethal than Omicron. And they still already knew there would be no deaths.

• Deliberate Infections Give Unique Covid Insight (BBC)

The world’s first Covid “challenge trial” – which deliberately infected people – gives a unique view on the early stages of the disease. The virus was given to 36 young, healthy and unvaccinated volunteers, at the Royal Free hospital, in London. The results show where and when the virus takes hold in the body – and that some resist the infection. Future challenge trials could help find the next generation of Covid vaccines and drugs. They allow scientists to study the earliest stages of an infection, even before symptoms develop. Each of the volunteers, aged 18-30, had an identical dose of Covid – equivalent to the amount in a single droplet propelled out of somebody’s nose during the peak of their Covid infection – squirted up their nose. But only half of them became infected.

And understanding how the others – unvaccinated and without immunity from previous infections – resisted the virus will be the focus of future research. In those that did develop an infection, the virus took off rapidly, the first symptoms and positive test results appearing within just 42 hours. The previous consensus had been it took five days from exposure to the virus to first symptoms. And while the virus takes a foothold in the throat, the greatest amount was found when it moved up to the nose, leading the researchers to stress the importance of facemasks covering both. “It’s a really unique study,” Prof Christopher Chiu, from the Institute of Infection, at Imperial College London, said.

The amount of virus peaked about five days after the infection and remained detectable up to 12 days later. Symptoms were mild but some volunteers had a prolonged loss of their sense of smell. Prof Chiu said: “Lateral flow tests correlate very well with the presence of infectious virus. “Even though in the first day or two they may be less sensitive, if you use them correctly and repeatedly, and act on them if they read positive, this will have a major impact on interrupting viral spread.” The virus used was an early variant taken from a patient at the start of the pandemic. Further studies will explore more recent versions.

The damage to healthcare will last for a long time.

“.. I know which doctors I will trust when all this is over.”

• Letter From NHS Clinical Scientist Who is Quitting Over the Covid Vaccines (DS)

“[..] a letter from an NHS Clinical Scientist of some 25 years – currently employed at an NHS University Hospital Trust but who has just resigned – to Health Secretary Sajid Javid to tell him why she is quitting over the complicity of the health service in the national scandal that is the Covid vaccine rollout.”

A core principle in healthcare is to ensure that patients are given free access to all information, to enable them to make a proper and informed choice about any treatment. As a scientist, I have been and still am gravely concerned about the Government and NHS misrepresentation of these vaccines as ‘safe and effective’ – a mantra still promoted by our Government and media, despite the overwhelming evidence demonstrating otherwise of the MHRA Yellow Card scheme and worldwide databases for reporting adverse effects. Worryingly, the great majority of GPs have not being raising awareness of this scheme, leading to significant under-reporting and, consequently, under-estimation of the actual situation.

I personally have spoken to people who, after experiencing bad reactions to the first dose, have been encouraged by doctors to continue regardless and take the second, with serious consequences for their health. They had never heard of the MHRA Yellow Card scheme and wouldn’t know how to make a report. Misinformation starts from the seniors: I have been told (in writing) by Human Resources senior staff at my hospital that that vaccines have been “licensed”, genuinely oblivious to the fact that MHRA has granted only emergency approval. I have been appalled by the NHS willingness to trample over the concept of personalised medicine in the promotion of products still in phase three trials. There has been no stratified analysis of the balance of risks and benefits.

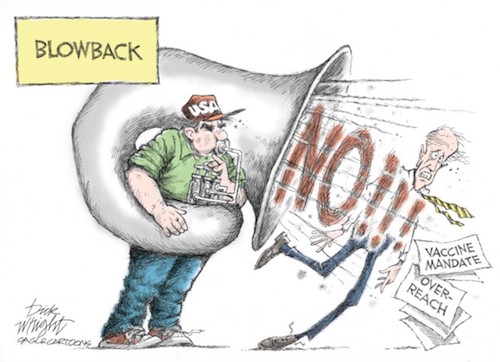

No scientific reference to real data from the pandemic statistics nor to those of the adverse effects – deaths and life-limiting injuries – reported globally. No mention of the unavailability of medium and long term safety data, which may not be relevant for the elderly but it certainly is for the young. No information about alternative treatments. This is not the NHS I joined and embraced. Primum non nocere: first, do no harm. Equally important is the right to bodily autonomy, including the right to refuse any treatment or medication. Enshrined in law for the protection of all human beings, this core principle extends to everybody, patients and healthcare staff alike. The Government mandate, offering NHS workers the alternative between taking an experimental product against their best judgement or lose their livelihood, can hardly be portrayed as ‘free choice’.

I hope it is clear that the motivation of NHS staff across all professions in resisting this coercion is founded on ethical grounds. Doctors, nurses, pharmacists, clinical scientists – we all feel that our integrity would be compromised, that the fundamental principle of trust, at the core of our unique relationship with the patients we serve, would be irreparably transgressed; and that this erosion of professional ethics would carry the inherent danger of establishing coercion as an acceptable practice in future, with NHS staff imposing procedures on patients against their will – the victim becoming the perpetrator. From a patient prospective, I know which doctors I will trust when all this is over.

“Duh, of course ivermectin works and we’ve known it all along, it just doesn’t work as well as [insert big pharma drug here]”

• Has The Red Carpet Been Rolled Out For A Mainstream Pivot On Ivermectin? (QTR)

I couldn’t help but think when this Japanese study popped up yesterday that the timing sure would be convenient now for the mainstream media to start a pivot on ivermectin. Now that Moderna has received official FDA approval for its vaccine and Pfizer is happily seeking Emergency Use Authorization to jab kids as young as 6 months – and now that major drug manufacturers have had their antiviral Covid pills approved – maybe it can finally be time to pump the brakes on the ivermectin hysteria and allow the truth and reason to nudge their way in. In other words, the fat pigs are finally finished stuffing their gluttonous faces at the trough of the FDA, stocked with newly-printed U.S. dollars.

Unable to physically consume anymore, and noticing that all but a few molecules of feed are even left, they can now reluctantly relinquish their positions at the front of the line and waddle away, leaving the rest of the animals a chance to squabble over the remains. All of the major pharmaceutical companies (and their lobbyists) finally getting the approvals that they want for all of their Covid drugs may roll out the red carpet for us to finally embrace reality and the truth, which I believe is that ivermectin has efficacy. What we’re seeing now in the media is a massive pivot regarding Covid. With the emergence of omicron and many geographic locations around the world lifting their Covid restrictions – and most notably politicians understanding they can’t win an election by locking us in our home [..] the media pivot on Covid has been pronounced since 2022 began.

And not unlike the pivot we’ve already seen on the lab leak and whether or not vaccines would end the virus, I’m expecting we see a similar pivot on ivermectin. Of course, I could be wrong. I don’t mind being wrong. I exist on the fringe, as my readers know. In the words of Peter Venkman: “If I’m wrong, nothing happens! We go to jail – peacefully, quietly. We’ll enjoy it!” But if I’m not…and the narrative on ivermectin does in fact change to wind up as “Duh, of course ivermectin works and we’ve known it all along, it just doesn’t work as well as [insert big pharma drug here]” everybody responsible for suppressing over the last 2 years needs to be held accountable for what, in my opinion, may wind up amounting to crimes against humanity.

Pointless and endless.

• New Zealand To End Quarantine Stays And Reopen Its Borders (Fox)

New Zealand’s government on Thursday said it will end its quarantine requirements for incoming travelers and reopen its borders, a change welcomed by thousands of citizens abroad who have endured long waits to return home. Since the start of the pandemic, New Zealand has enacted some of the world’s strictest border controls. Most incoming travelers need to spend 10 days in a quarantine hotel room run by the military, a requirement that has created a bottleneck at the border. The measures were initially credited with saving thousands of lives and allowed New Zealand to eliminate or control several outbreaks of the coronavirus.

But, increasingly, the border controls have been viewed as out-of-step in a world where the virus is becoming endemic, and in a country where the omicron variant is already spreading. The bottleneck forced many New Zealanders abroad to enter a lottery-style system to try and secure a spot in quarantine and passage home. The shortcomings of the system were highlighted over the past week by pregnant New Zealand journalist Charlotte Bellis, who was stranded in Afghanistan after New Zealand officials initially rejected her application to return home to give birth. After international publicity, officials backed down and offered her a spot in quarantine, which she has accepted.

The border changes mean that vaccinated New Zealanders returning from Australia will no longer need to go into quarantine from the end of this month, and vaccinated New Zealanders returning from the rest of the world can skip quarantine by mid-March. They will still be required to isolate at home. However, most tourists will need to wait until October before they can enter the country without a quarantine stay. And anybody who isn’t vaccinated will still be required to go through quarantine.

Why does Facebook need to get into this?

• US Truckers Got Booted Off Of Facebook (Kirsch)

I just got off the phone with Brian Brase who is organizing the US truckers. He’ll be on the VSRF call tomorrow (register at vacsafety.org). They got kicked off of Facebook because Facebook said they violated their QAnon policy. I suggested Substack and Brian said, “What’s that?” So I suggested I might be able to help them find a group of people who could run the IT for them to provide the truckers and their supporters a way to communicate. If you have both the time and expertise to do this, please volunteer using this form and we’ll get these guys re-platformed ASAP.

They lost $200 billion in market cap overnight.

• Facebook Stock In Free-fall (RT)

Shares of Facebook’s parent company Meta went into a nosedive after the markets closed on Wednesday, following an underwhelming quarterly report, the first since CEO Mark Zuckerberg announced the name change. The stock stood strong at $323 a share when the markets closed at 4 pm EST, but collapsed to $249 just half an hour later, for a loss of almost 23%. In just the first eleven minutes of after-hours trading, $16 billion in Meta’s market cap had been wiped out. What triggered the sell-off was Meta’s quarterly report showing lower revenue, earnings per share, and the numbers of daily and monthly active users than expected by investors.

Whereas the investors expected around $30.15 billion, Facebook’s figures showed $27-$29 billion, CNBC reported, citing a Refinitiv survey of market analysts. According to the same source, earnings per share came in at $3.67, short of the expected $3.84. The number of daily active users (DAU) stood at 1.93 billion, less than the expected 1.95 billion, while the monthly active users (MAU) also undershot the 2.95 expectation, ending up at 2.91 billion, according to Street Account. This is the first quarterly report since Zuckerberg announced his social media behemoth would be changing its name to Meta, to better represent its focus on the upcoming “metaverse” and encompass the existing Facebook, Instagram and WhatsApp brands.

Awkward walk back.

• Ukraine Invasion No Longer ‘Imminent’ – White House (RT)

The US government is no longer using the word ‘imminent’ in its narrative around the alleged Russian ‘invasion’ of Ukraine, White House spokeswoman Jen Psaki told reporters, on Wednesday, explaining that it was sending an unintended message. “I used it once. I think others have used that once, and we stopped using it because I think it sent a message that we weren’t intending to send, which was that we knew that President Putin had made a decision,” Psaki said at a press briefing. “I would say the vast majority of times I’ve talked about it, I’ve said he could invade ‘at any time,’” she added. Psaki’s remarks come after the US envoy to the UN backtracked from the use of ‘imminent’ in an interview with NPR aired on Tuesday.

“No, I would not say that we are arguing that it’s imminent,” Ambassador Linda Thomas-Greenfield told the broadcaster. The official transcript of Psaki’s January 25 briefing says otherwise, however. Asked whether the Russian invasion of Ukraine – which the US media and intelligence agencies have claimed since late October would happen any day now – was still “imminent,” here’s what Psaki had to say. “When we said it was imminent, it remains imminent,” she told one reporter. “Well, ‘imminent’ has a pretty intense meaning. Doesn’t it?” she said in answer to the very next question. “And it’s still the belief that it’s imminent?” was the followup, to which Psaki replied, “Correct.”

3,000 troops vs 130,000 Russia?!

• Russia Condemns Destructive US Troops Boost In Europe (BBC)

Russia has condemned a US decision to send extra troops to Europe to support its Nato allies amid continuing fears of a Russian invasion of Ukraine. Moscow said it was a “destructive” step which heightened tension and reduced the scope for a political solution. The Pentagon said 2,000 US troops would be sent from North Carolina to Poland and Germany, and a further 1,000 already in Germany would go to Romania. Russia has some 100,000 troops near Ukraine. It denies planning to invade. The tensions come eight years after Russia annexed Ukraine’s southern Crimea peninsula and backed a bloody rebellion in the eastern Donbas region.

Moscow accuses the Ukrainian government of failing to implement the Minsk agreement – an international deal to restore peace to the east, where Russian-backed rebels control swathes of territory and at least 14,000 people have been killed since 2014. Responding to US President Joe Biden’s decision to deploy extra troops to Europe this week, Russian Deputy Foreign Minister Alexander Grushko said it was a “destructive” and an “unjustified” step. Speaking on Wednesday, Mr Grushko added that it would “delight” the Ukrainian authorities, who would continue sabotaging the Minsk agreement “with impunity”. The Pentagon earlier said the American troops being deployed would not fight in Ukraine – but would ensure the defence of Washington’s allies. Their deployment is in addition to the 8,500 troops the Pentagon put on alert last month to be ready to deploy to Europe if needed.

“They said one thing, they did another,” Putin said. “As people say, they screwed us over, well they simply deceived us.”

• America’s Putin Psychosis (Ritter)

The war of words between Russia and the United States over Ukraine escalated further on Tuesday as Russian President Vladimir Putin responded for the first time to the U.S. written reply to Russia’s demands for security guarantees that were expressed in the form of a pair of draft treaties submitted by Moscow to the U.S. and NATO in December. “It is already clear…that the fundamental Russian concerns were ignored. We did not see an adequate consideration of our three key requirements,” Putin said at a press conference that followed his meeting with Hungarian Prime Minister Viktor Orban in Moscow.

Putin said the U.S. had failed to give “adequate consideration of our three key demands regarding NATO expansion, the renunciation of the deployment of strike weapons systems near Russian borders, and the return of the [NATO] bloc’s military infrastructure in Europe to the state of 1997, when the Russia-NATO founding act was signed.” He detailed what he alleged was NATO’s long history of deception, re-emphasizing the 1990 verbal commitment by former U.S. Secretary of State James Baker that NATO would not expand “an inch” eastward. “They said one thing, they did another,” Putin said. “As people say, they screwed us over, well they simply deceived us.”

With some 130,000 Russian troops deployed in the western and southern military districts bordering Ukraine, and another 30,000 assembling in neighboring Belarus, U.S. policy makers are scrambling to figure out what Russia’s next move might be, a choice most U.S. policy makers believe boils down to diplomacy or war. Rather than examine the situation from the perspective of Russian national security interests, however, these officials have placed the fate of European peace and security in the hands of a single individual: Vladimir Vladimirovich Putin.

“European natural gas topped $60 per million Btu, equivalent to an oil price of an astonishing $350 per barrel.”

• Don’t Blame Putin for Europe’s Energy Crisis (FP)

Europe typically depends on Russia for more than one-third of its natural gas use. Although Russia has been sending less to Europe this winter, it is fulfilling its long-term contractual commitments. The difference now is that it has all but cut off the additional supplies it usually sells on the spot market. If Russia were to cut or reduce contracted deliveries to Europe as well—which half a century of energy relations suggests is unlikely—it would be exceedingly difficult and expensive for Europe to replace lost Russian gas flows. Spot prices, already skyrocketing to unprecedented levels, would go even higher as European buyers tried to pull in LNG supplies otherwise headed for Asia, energy-intensive industries would shut down, and even household heating and electricity use would likely need to be rationed to prevent power outages.

But even if Russian gas flows continue uninterrupted, Europe still faces an energy crisis this year and, more importantly, in the years to come. By late summer of 2021, it was already evident that Europe was facing a looming energy crisis with gas storage levels unusually low. As winter set in, prices predictably soared to record levels, reaching such heights late last year that many industrial firms shut down production. In Britain, nearly 30 power utilities went bankrupt. European natural gas topped $60 per million Btu, equivalent to an oil price of an astonishing $350 per barrel. (Brent crude sells for around $90 a barrel, and the comparable U.S. gas price is around $4.) European household energy bills will rise another 50 percent this year, according to Bank of America.

Faced with public backlash and worries about the impact on the macroeconomy, governments with few other options to keep prices in check have resorted to subsidizing energy costs for people feeling the pinch. Denmark has announced it plans to send checks to households using natural gas for heating to offset the rise in prices. Norway, France, and several other European countries have done the same. Energy prices have eased in recent weeks, but only because Europe has been lucky with the weather. Winter temperatures have not been as cold as feared. The same has been true of Asia, allowing Europe to draw some cargoes of LNG that otherwise would have been needed there.

Is this the end? The MSM start eating each other, like here the Guardian devouring CNN, in the same way that CNN’s Cuomo and Zucker go after each other. Because: they have no viewers left.

CNN calls itself “the iconic network”, Brian Stelter goes after Rogan saying he’s not credible because he doesn’t have a large media corporation like CNN behind him. He does have 25x more viewers though.

NOTE: wonder if the Guardian knows it’s part of “Media” too, and losing trust.

• Why Is Trust In Media Plummeting? Just Look At What’s Happening At CNN (G.)

Media outlets are supposed to report the news not become it. On Wednesday CNN found itself coming afoul of that rule when Jeff Zucker abruptly resigned from his position as network president amid lurid circumstances. In a memo sent to colleagues, Zucker explained he was stepping down after failing to disclose a “consensual relationship” with a close colleague. While Zucker didn’t name the colleague directly, Allison Gollust, CNN’s executive vice-president and chief marketing officer, has confirmed her involvement in a memo to employees. Hang on a minute. Is a powerful man really resigning from a big job because he had a consensual relationship with a colleague? That’s not the usual way of things; many men have been accused of far worse transgressions and still managed to cling to power.

Well here’s some context: Gollust happens to be the former communications director for disgraced former New York governor Andrew Cuomo. And Zucker’s relationship with Gollust came up during an internal investigation into former anchor Chris Cuomo, who was fired from CNN in December after using his job to help his brother, Andrew, combat sexual harassment allegations (leading some commentators to dub CNN the “Cuomo Nepotism Network”.) Zucker stood by Chris Cuomo for months when his conflict-of-interest scandal first hit but eventually fired him a few days after the anchor was accused of sexual misconduct by a junior colleague at another network. Like his brother, it seems Chris holds a grudge. Two sources told Politico that it was Cuomo’s legal team, which is still negotiating his exit from the network, who flagged the relationship between Zucker and Gollust.

A reporter from media startup Puck News has also claimed that CNN received a letter from Cuomo’s lawyers asking for all communications between Zucker, Gollust and Cuomo to be preserved. While Zucker may not be having a very good week, Donald Trump (whose views on CNN are common knowledge) is having a ball. “Jeff Zucker, a world-class sleazebag who has headed ratings and real-news-challenged CNN for far too long, has been terminated for numerous reasons, but predominantly because CNN has lost its way with viewers,” Trump wrote in a statement. I hate to say it, but Trump has a point. You don’t have to be a cynic to reckon that CNN’s dismal ratings may factor into Zucker’s sudden departure: CNN had record ratings during the Trump years but has seen viewership plummet recently.

The Cuomo scandal certainly hasn’t helped the network’s credibility: during the early days of the pandemic Chris Cuomo repeatedly interviewed his brother on air and it was largely treated like hilarious banter instead of a clear conflict of interest. And that’s hardly been the only embarrassment the network has suffered: last year Jeffrey Toobin, CNN’s chief legal analyst exposed himself on a Zoom call with colleagues. While the New Yorker fired Toobin from his staff writer position, CNN gave him a little tap on the wrist and put him back on the air.

Optimistic headline.

• World Leaders Support Joe Rogan (RT)

Brazilian President Jair Bolsonaro and El Salvador President Nayib Bukele both came out in defense of American podcast host Joe Rogan this week after critics, including the White House, encouraged Spotify to censor his show. The campaign – which has attempted to get Rogan’s Spotify show censored after he expressed skepticism over Covid-19 vaccines for young people and hosted several vaccine-skeptic doctors – was bolstered on Tuesday after White House Press Secretary Jen Psaki said there was “more that can be done” by Spotify to crack down on speech which goes against the national Covid-19 line. Psaki’s comments were condemned by free speech activists in the US, who claimed they were unconstitutional and amounted to the state pressuring a private company to censor dissidents.

The two world leaders also came out in defense of Rogan’s right to free speech. In a statement, Bolsonaro said, “I’m not sure what [Rogan] thinks about me or about my government, but it doesn’t matter.” “If freedom of speech means anything, it means that people should be free to say what they think, no matter if they agree or disagree with us. Stand your ground! Hugs from Brazil.” Bukele – who has been accused of threatening freedom of the press in his county by criticizing ‘fake news’ journalists – used Psaki’s comments to mock critics who claim free speech “is under attack in El Salvador,” and appeared to argue that the White House’s interference in the Rogan matter amounted to a more egregious attack on free speech than anything his administration is accused of doing. Following calls for Rogan to be censored, Spotify announced it would start adding a ‘content advisory’ to shows that discuss the Covid-19 pandemic. The advisories will direct listeners to allegedly ‘trusted sources’ on the coronavirus, including scientists and academics.

“WikiLeaks was formerly based in France and Assange’s children live in the country, but his lawyers admitted in 2020 that the fact that he is not on French soil would complicate the process.”

• MPs Push For Julian Assange To Be Granted Political Asylum In France (EN)

Four French MPs are pushing for Julian Assange to be offered asylum in France amid the WikiLeaks founder’s ongoing fight against extradition from the UK to the US. Jennifer De Temmerman, Jean Lassalle, Cedric Villani and Francois Ruffin are due to speak at a press conference in Paris on 1 February where they will explain why Assange — currently in prison in the UK — should be given sanctuary in France. Assange’s defence team announced in February 2020 that it would be seeking asylum for him in France, ahead of the hearing in the UK on whether the 50-year-old should be extradited to the US for trial.

Two years on, Assange continues to fight extradition to the US, where would face trial over the release of a trove of classified military documents more than a decade ago. In December 2021, Britain’s High Court overturned a ruling by a lower court that Assange could not be extradited due to concerns over his mental health. In January, Assange won the right to appeal this decision to the UK Supreme Court, further delaying his possible extradition. WikiLeaks was formerly based in France and Assange’s children live in the country, but his lawyers admitted in 2020 that the fact that he is not on French soil would complicate the process.

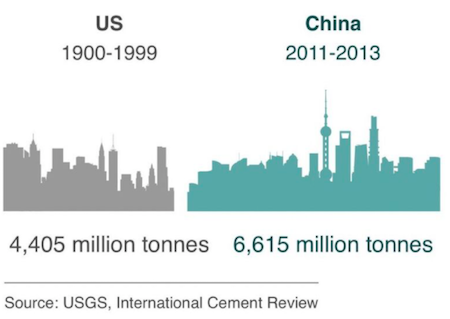

Cement use. 3 years vs 100 years.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.