Adolphe Yvon Genius of America c1870

A number of people have argued over the past few days that Hurricane Harvey will NOT boost the US housing market. As if any such argument would or should be required. Hurricane Irma will not provide any such boost either. News about the ‘resurrection’ of New Orleans post-Katrina has pretty much dried up, but we know scores of people there never returned, in most cases because they couldn’t afford to.

And Katrina took place 12 years ago, well before the financial crisis. How do you think this will play out today? Houston is a rich city, but that doesn’t mean it’s full of rich people only. Most homeowners in the city and its surroundings have no flood insurance; they can’t afford it. But they still lost everything. So how will they rebuild?

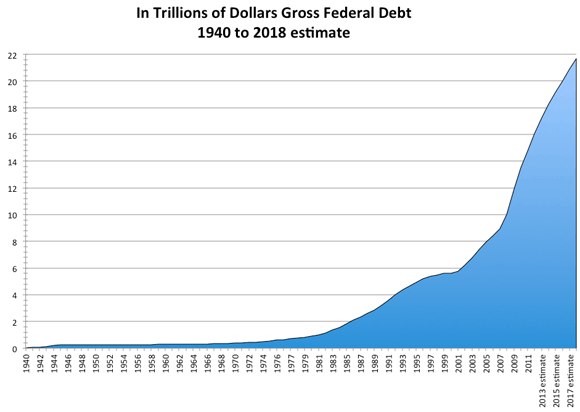

Sure, the US has a National Flood Insurance Program, but who’s covered by it? Besides, the Program was already $24 billion in debt by 2014 largely due to hurricanes Katrina and Sandy. With total costs of Harvey estimated at $200 billion or more, and Irma threating to cause far more damage than that, where’s the money going to come from?

It took an actual fight just to push the first few billion dollars in emergency aid for Houston through Congress, with four Texan representatives voting against of all people. Who then will vote for half a trillion or so in aid? And even if they do, where would it come from?

Trump’s plans for an infrastructure fund were never going to be an easy sell in Washington, and every single penny he might have gotten for it would now have to go towards repairing existing roads and bridges, not updating them -necessary as that may be-, let alone new construction.

Towns, cities, states, they’re all maxed out as things are, with hugely underfunded pension obligations and crumbling infrastructure of their own. They’re going to come calling on the feds, but Washington is hitting its debt ceiling. All the numbers are stacked against any serious efforts at rebuilding whatever Harvey and Irma have blown to pieces or drowned.

As for individual Americans, two-thirds of them don’t have enough money to pay for a $500 emergency, let alone to rebuild a home. Most will have a very hard time lending from banks as well, because A) they’re already neck-deep in debt, and B) because the banks will get whacked too by Harvey and Irma. For one thing, people won’t pay the mortgage on a home they can’t afford to repair. Companies will go under. You get the picture.

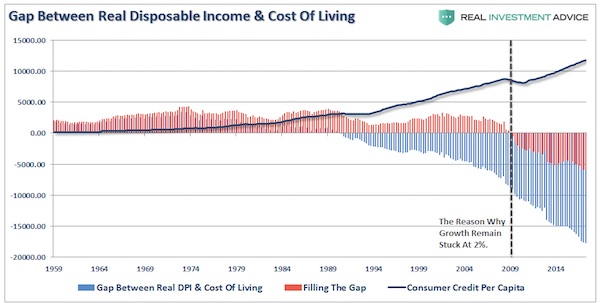

There are thousands of graphs that tell the story of how American debt, government, financial and non-financial, household, has gutted the country. Let’s stick with some recent ones provided by Lance Roberts. Here’s how Americans have maintained the illusion of their standard of living. Lance’s comment:

This is why during the 80’s and 90’s, as the ease of credit permeated its way through the system, the standard of living seemingly rose in America even while economic growth rate slowed along with incomes. Therefore, as the gap between the “desired” living standard and disposable income expanded it led to a decrease in the personal savings rates and increase in leverage. It is a simple function of math. But the following chart shows why this has likely come to the inevitable conclusion, and why tax cuts and reforms are unlikely to spur higher rates of economic growth.

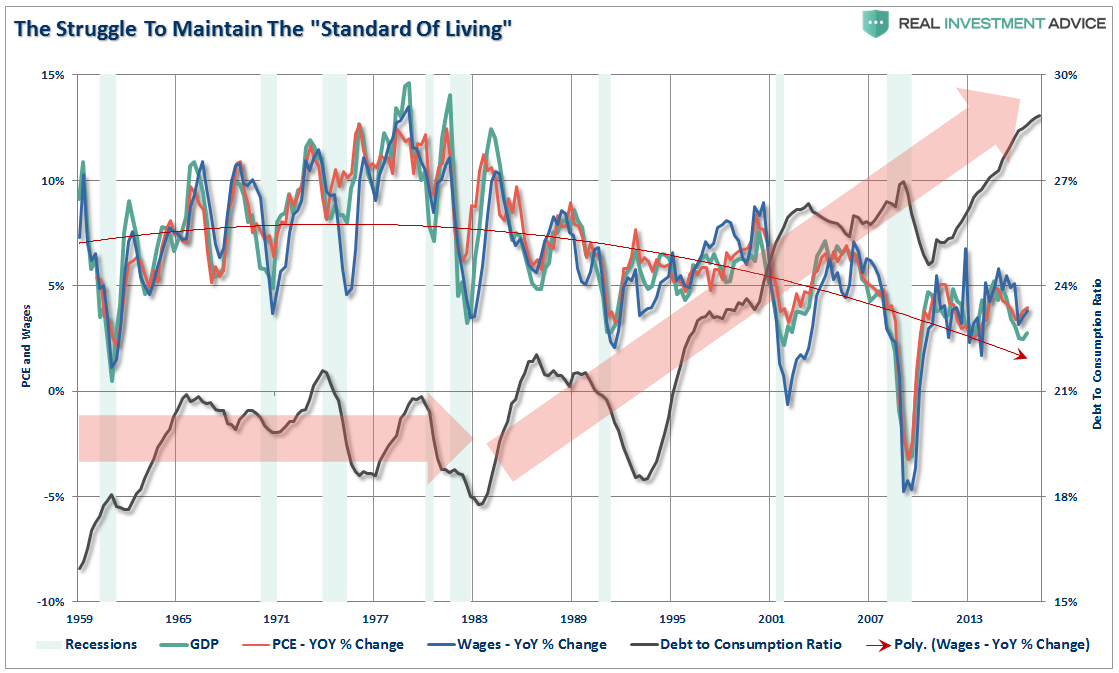

There’s no meat left on that bone. There isn’t even a bone left. There’s only a debt-ridden mirage of a bone. If you’re looking to define the country in bumper-sticker terms, that’s it. A debt-ridden mirage. Which can only wait until it’s relieved of its suffering. Irma may well do that. A second graph shows the relentless and pitiless consequences of building your society, your lives, your nation, on debt.

It may not look all that dramatic, but look again. Those are long-term trendlines, and they can’t just simply be reversed. And as debt grows, the economy deteriorates. It’s a double trendline, it’s as self-reinforcing as the way a hurricane forms.

Back to Harvey and Irma. Even with so many people uninsured, the insurance industry will still take a major hit on what actually is insured. The re-insurance field, Munich RE, Swiss RE et al, is also in deep trouble. Expect premiums to go through the ceiling. As your roof blows off.

We can go on listing all the reasons why, but fact is America is in no position to rebuild. Which is a direct consequence of the fact that the entire nation has been built on credit for decades now. Which in turn makes it extremely vulnerable and fragile. Please do understand that mechanism. Every single inch of the country is in debt. America has been able to build on debt, but it can’t rebuild on it too, precisely because of that.

There is no resilience and no redundancy left, there is no way to shift sufficient funds from one place to the other (the funds don’t exist). And the grand credit experiment is on its last legs, even with ultra low rates. Washington either can’t or won’t -depending on what affiliation representatives have- add another trillion+ dollars to its tally, state capitals are already reeling from their debt levels, and individuals, since they have much less access to creative accounting than politicians, can just forget about it all.

Not that all of this is necessarily bad: why would people be encouraged to build or buy homes in flood- and hurricane prone areas in the first place? Why is that government policy? Why is it accepted? Yes, developers and banks love it, because it makes them a quick buck, and then some, and the Fed loves it because it keeps adding to the money supply, but it has turned America into a de facto debt colony.

If you want to know what will happen to Houston and whatever part of Florida gets hit worst, think New Orleans/Katrina, but squared or cubed -thanks to the 2007/8 crisis.

Home › Forums › America Can’t Afford to Rebuild