Salvador Dali Self-portrait in the studio 1919

Trump Larry King 1987

Someone Always Cared. pic.twitter.com/qhKJkQ2TEX

— il Donaldo Trumpo (@PapiTrumpo) October 18, 2022

Malhotra

"Until proven otherwise, it is likely that Covid mRNA vaccines played a significant or primary role in all unexplained heart attacks, strokes, cardiac arrhythmias, & heart failure since 2021" @DrAseemMalhotra

Full interview out today@10DowningStreet @theresecoffey pic.twitter.com/INi41xwykX

— James Freeman (@JamesfWells) October 18, 2022

Maher

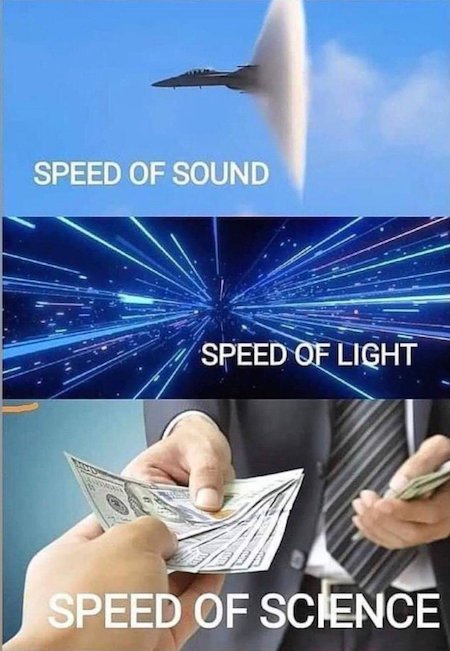

We're now learning just how bad the "collateral damage" is post-pandemic. pic.twitter.com/ECw649U7do

— Bill Maher (@billmaher) October 18, 2022

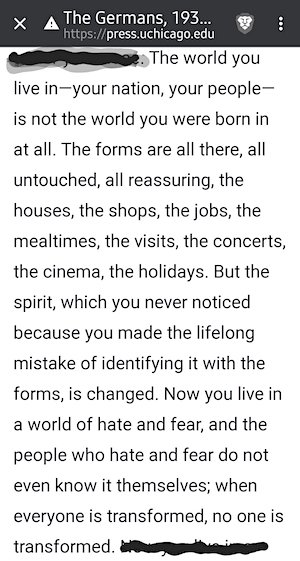

“The text of the tribute letter may have originated with Spanish biologist and film-maker Fernando López-Mirones, or France’s General Christian Blanchon.”

• People Who Resisted Covid Jabs Are ‘Superheroes’ (Blanchon)

Even if I were fully vaccinated, I would admire the unvaccinated for standing up to the greatest pressure I have ever seen, including from spouses, parents, children, friends, colleagues, and doctors. People who have been capable of such personality, courage, and such critical ability undoubtedly embody the best of humanity. They are found everywhere, in all ages, levels of education, countries, and opinions. They are of a particular kind; these are the soldiers that any army of light wishes to have in its ranks. They are the parents that every child wishes to have and the children that every parent dreams of having. They are beings above the average of their societies; they are the essence of the peoples who have built all cultures and conquered horizons.

They are there, by your side, they seem normal, but they are superheroes. They did what others could not do; they were the tree that withstood the hurricane of insults, discrimination, and social exclusion. And they did it because they thought they were alone and believed they were alone. Excluded from their families’ Christmas tables, they have never seen anything so cruel. They lost their jobs, let their careers sink, and had no more money… but they didn’t care. They suffered immeasurable discrimination, denunciations, betrayals, and humiliation… but they continued. Never before in humanity has there been such a casting; we now know who the resisters are on planet Earth.

Women, men, old, young, rich, poor, of all races and all religions, the unvaccinated, the chosen ones of the invisible ark, the only ones who managed to resist when everything fell apart. Collapsed. You’ve passed an unimaginable test that many of the toughest marines, commandos, green berets, astronauts, and geniuses couldn’t pass. You are made of the stuff of the greatest that ever lived, those heroes born among ordinary men who shine in the dark.

“..Ukraine is preparing a massive strike on the Kakhovka hydroelectric plant, located on the Dnieper River.”

• Russian General In Charge Of Ukraine Operation Speaks Out

Army General Sergey Surovikin on Tuesday spoke to the media for the first time since assuming overall command of the ongoing Russian military operation in Ukraine. Describing the situation as particularly “tense” around the city of Kherson in his statement to the broadcaster Rossiya-24, he added that the military may be forced to make “difficult decisions.” “The NATO command of the armed forces of Ukraine has long been demanding offensive operations in the Kherson direction from the Kiev regime, regardless of any casualties – both in the Armed Forces of Ukraine and among the civilian population,” Surovikin stated. The Russian military is aware of Kiev’s plans to use “prohibited” means of waging war in the Kherson area, Surovikin added.

Namely, Ukraine is preparing a massive strike on the Kakhovka hydroelectric plant, located on the Dnieper River, as well as launching massive rocket and artillery attacks on Kherson itself. “These actions can lead to the destruction of the infrastructure of this large industrial center and massive casualties among the civilian population,” Surovikin said. In the ongoing effort to dislodge the Russian military from its positions, Kiev is pouring its reserves en masse into the frontline, the general said. The vast majority of those reserves are “territorial defense units, who have not been properly trained,” Surovikin added. Such troops have low morale, thus they are propped up by “barrier squads”composed of hardline nationalists “who shoot anyone trying to leave the battlefield,” he claimed.

“The enemy’s daily losses amount to hundreds of casualties. We have a different strategy. <…> We are not aiming at fast-paced offensives, we spare every soldier and methodically grind the enemy’s attacking forces. This not only minimizes our own losses, but also significantly reduces the amount of victims among the civilian population.” “The enemy is the criminal regime that pushes Ukrainian citizens towards death. We are one people with Ukrainians and only wish for Ukraine to be a state independent from the West and NATO and friendly towards Russia,” Surovikin said. Surovikin assumed overall command of Russian troops participating in the military operation earlier in October. The general has significant combat experience, ranging from hostilities in Chechnya to the operation in Syria, for which he was awarded the title of Hero of Russia back in 2017.

According to media reports, Surovikin was given the nickname ‘General Armageddon’ by his colleagues over his hardline and unorthodox approach to warfare. His elevation into the new role has coincided with Russia ramping-up aerial bombings across Ukraine, with cruise missiles and suicide drones attacking crucial infrastructure sites in the country.

“..Washington is in a position to “encourage the Ukrainians to agree to a ceasefire..”

• US Should Not Listen To Kiev, Former Ambassador To Moscow Says (RT)

The Ukraine crisis was preventable but now seems doomed to further escalation, the last US ambassador to the Soviet Union has warned. Washington is making the mistake of delegating to Kiev many of the decisions about American involvement, he added. Kiev does “not know best what is in the security interests of the American people, and that should be the primary concern of any American government,”Jack Matlock wrote in an article published on Monday by the website Responsible Statecraft. The Ukrainians, “under the stress of war, may not be the best judges of their own ultimate security interests,” he argued. Matlock cited a situation from his own time as the top US diplomat in Moscow. He recalled a moment in 1990 when the leadership of Soviet Lithuania declared independence from the USSR right before the Soviet Union itself ceased to exist, and requested “immediate recognition” from the US.

Washington had never formally recognized the three Baltic states, which were captured during World War II, as parts of the Soviet Union. Nevertheless, Matlock advised against acting on the Lithuanian request. “I had total sympathy with the Lithuanian aspirations but had to explain that it would be a mistake to do so until Lithuania was in fact free. Why? Because, in 1990, US recognition would almost certainly have precipitated a Soviet crack-down which the US could not counter without risking nuclear war,”he explained. Matlock said it is natural for Americans to admire “the valiant resistance” that the Ukrainians have demonstrated against Russia, but that “does not mean that Ukraine has to recover all the territory it inherited in 1991.” He explained that people in some regions claimed by Kiev may resist a return to its control, given that they consider the 2014 overthrow of the Ukrainian government to be a US-organized coup.

The former ambassador noted that Kiev had multiple opportunities to avert war. He believes that Russia would not have sent troops into Ukraine in February if Kiev “had been willing to abide by the Minsk agreement, recognize the Donbas as an autonomous entity within Ukraine, avoid NATO military advisors, and pledge not to enter NATO.” Now, however, neither side seems willing to take a pause in hostilities and let diplomacy take hold, he said, adding that the longer the conflict continues, the harder it will be to avoid the “utter destruction” of Ukraine.“The reality is that if the war continues Russia is capable of damaging Ukraine more than Ukraine can damage Russia without risking a wider war,” Matlock said. He concluded that Washington is in a position to “encourage the Ukrainians to agree to a ceasefire” and urged it to do so.

“..Kalin said that Vladimir Putin wants negotiations now.”

• Erdogan Still Wants To Bring Putin And Zelenskyy Together (RT)

Turkish President Recep Tayyip Erdogan still wants to meet Ukrainian leader Volodymyr Zelenskyy and Russian President Vladimir Putin, the Spokesperson of the President of Turkiye, Ibrahim Kalin said, Report informs. Kalin said that Vladimir Putin wants negotiations now – after Russia annexed four regions of Ukraine: “Despite all the difficulties, the door of diplomacy should be kept open. The President of Turkiye can do it.”

“..we need a consolidated society, and this consolidation can only be based on sovereignty, freedom, creation, and justice. Our values are humanity, mercy and compassion.”

The partial mobilisation of 300,000 Russian reservists is nearly complete. Their presence in Donbass will free up the regulars to advance further, although some of the land taken by Kiev forces in September has already been taken back and more is liberated every day. After seven days of aerial attacks (only two days of them reported in the Western media) on Ukrainian infrastructure, especially on power supplies, even Zelensky has today admitted that 30% of the Kiev regime power stations have been destroyed throughout the Ukraine. This is all in response to his terrorism in Zaporozhye, Donetsk, Belgorod, Moscow (Daria Dugina), and on Nordstream and the Crimean Bridge. What else did he expect? France is on strike. Italy is fed up and wants arms deliveries to the Kiev Neo-Nazis to stop.

In the bankrupt UK, to the amazement of all, Truss is still ‘present’, but the Daily Mail website reports that many pubs will have to close for the winter. The landlords cannot afford to pay for heating bills. In Germany, the Health Minister, Karl Lauterbach, has warned of the risk of even hospitals having to close because of the energy crisis. Some ask: But why did the Russian Federation not start the liberation campaign last February by turning up the pain dial there and then? The answer is simple. It is not just that the Federation underestimated the utter stupidity of NATO and the Kiev junta. It is much more than that, it is quite simply that Russia never did wanted to inflict pain on ordinary Ukrainians and on its own Union soldiers. Ordinary Ukrainians have NEVER been the enemy. Russian targeting has always been of the NATO-supplied and NATO-trained Kiev military.

Russians are not Americans who spray the bushes with machine gun bullets and the trees with Agent Orange, or who blast Hamburg and Dresden off the map like the British. They target. They are not terrorists. Have you not read President Putin’s 30 September speech? Please listen again: ‘I want the Kiev authorities and their true handlers in the West to hear me now, and I want everyone to remember this: the people living in Lugansk and Donetsk, in Kherson and Zaporozhye have become our citizens, forever.…We call on the Kiev regime to cease fire and all hostilities immediately; to end the war it unleashed back in 2014 and to return to the negotiating table. We are ready for this, as we have said more than once. But the choice of people in Donetsk, Lugansk, Zaporozhye and Kherson will not be discussed.

The decision has been made, and Russia will not betray it. …We will defend our land with all the forces and resources we have, and we will do everything we can to ensure the safety of our people. This is the great liberating mission of our nation.’ Today, we are fighting so that it would never occur to anyone that Russia, our people, our language, or our culture can be erased from history. Today, we need a consolidated society, and this consolidation can only be based on sovereignty, freedom, creation, and justice. Our values are humanity, mercy and compassion.

Scott Ritter ‼️ pic.twitter.com/1PwZWJKXV7

— Ignorance, the root and stem of all evil (@ivan_8848) October 18, 2022

Targeted. But the story is they hit apartment buildings at random.

• Russia Destroys Power And Water Infrastructure Across Ukraine (RT)

Ukraine said Russia had destroyed almost a third of its power stations over the past week as Moscow stepped up a pre-winter campaign to strike infrastructure, a move the West says is a calculated attempt to disrupt and demoralize. Missiles struck power-generating facilities in a clutch of Ukrainian cities home to millions of people and several people were killed. Moscow acknowledged targeting energy plants, while Ukraine said water infrastructure had also been hit. “The situation is critical now across the country … the whole country needs to prepare for electricity, water and heating outages,” Kyrylo Tymoshenko, deputy head of the Ukrainian president’s office, told Ukrainian television.

At least one man died when a Russian missile reduced his apartment in the southern river port of Mykolaiv to rubble. “They (Russians) probably get pleasure from this,” said Oleksandr, the owner of a local flower shop damaged in the attack. “They get pleasure from us feeling bad. I think they want us to bomb and shell (their) city buildings. But we won’t do that to be different from them.”

“..eventually the destabilization of the USA: perhaps with civil war and revolution in the USA, resulting from its own inevitable economic collapse..”

“note: the author is not Russian, knows no Russians and has never been to Russia”

• Cui Bono? The Big Picture (Blair)

First of all, we need to be absolutely clear that this insane FUBAR Ukraine situation was 100% concocted, fabricated and engineered by the USA, certainly since the droolin’ Nuland / lamebrained McCain / CIA Maidan coup of 2014, but even dating back before that. There are few situations in life where one party can be found to be 100% guilty and evil and morally bankrupt, and where the other party is 100% acting in self defence and self preservation. However history will show that with respect to this Ukraine situation, the USA was 100% the evil aggressor and Russia was 100% acting in self preservation and in defense of civilian Russian speakers in Ukraine. This is truly a war of good against evil and in case you still haven’t got the message yet, let me repeat: the USA Deep State is EVIL.

This reality is indisputably obvious to any semi-comatose person remotely interested in historical, documented FACTS. For those with any remaining doubts, they need to listen to this comprehensively researched three part podcast summary by a journalist and a military historian (both Anglophones). They actually obtained their information from Western mainstream media sources before those reports and articles mysteriously vanished from the Google search algorithms (or were relegated to 500th priority on the search list) after 24 Feb 2022. It is unfortunate that the stupid sheeple of the West, probably 99% of the “golden billion”, believe the exact opposite of the Truth, which is testimony to the incredible effectiveness of the relentless lying propaganda pooped out from the AngloEuroZionist mainstream media sewer outlets ever since 24 Feb 2022.

Until the two recent terrorist bombings (Nordstream pipelines and Kerch bridge), Russia had been reacting in a highly restrained manner to the US and US proxy aggravations. The US started provocations many years ago and contemptuously rebuffed multiple opportunities for peaceful settlements. Russia will soon end it. How? With the humiliating defeat of Ukraine for sure, but more widely we will see the economic devastation of Europe (apart from those who buy energy in Rubles – eg Hungary and Turkey) and eventually the destabilization of the USA: perhaps with civil war and revolution in the USA, resulting from its own inevitable economic collapse. The latter two eventualities were never Russia’s intended goal, but will be unintended consequences of the malicious actions of the US and EU themselves, blowback or karma if you like.

Another big plan down the drain.

• EU Won’t Introduce Gas Price Cap For Now As Countries Disagree (Az.)

The European Union is unveiling a new emergency package to tackle the energy crunch, betting on steps to bolster solidarity among member states. But the bloc will refrain from immediate gas-price caps amid political divisions and concerns over security of supply, Report informs referring to Bloomberg. The European Commission plans to propose measures to avoid extreme price spikes in energy derivatives and to use the EU’s joint purchasing power as a leverage in negotiations with global gas suppliers, according to a draft document seen by Bloomberg News. The bloc’s executive arm, also wants to launch a new liquefied natural gas index to better reflect the region’s energy reality after a cut in supplies of pipeline gas from Russia. At stake is the future of the bloc’s $17 trillion economy, which the energy crisis threatens to push into recession as companies and consumers reel from high power and gas bills.

The EU is trying to balance demands by more than a half of the EU’s 27 member states to limit gas prices with the need to avoid undermining its single market or deepening economic splits among member states. “This is the moment to act, for this winter and beyond,” according to the draft document. “The current situation causes economic and social hardship, placing a heavy burden on citizens and on the economy. Rising energy costs are leading to reduced purchasing power for citizens and loss of competitiveness for companies.” The EU’s executive arm is also seeking authority from national governments to propose – only as a last resort – price limits on transactions on the Dutch Title Transfer Facility, whose main index is the benchmark for all gas traded on the continent.

“They also cannot buy US-produced LNG due to the Jones Act, which bans the movement of ships between US ports..”

• US Warned Of Winter Blackouts – WSJ (RT)

New England could face blackouts in the coming months as more global shipments of liquefied natural gas (LNG) are being directed to Europe, the Wall Street Journal reported on Monday, citing power producers. According to the report, the surging LNG demand across the ocean amid dwindling gas flow from Russia puts the supplies needed to provide electricity to the US’ northeastern region – including Maine, Vermont, New Hampshire, Massachusetts, Connecticut, and Rhode Island – in jeopardy. These states have limited pipeline capacity and rely on LNG imports from abroad for more than a third of their gas supply during periods of peak demand, according to the Energy Information Administration.

They also cannot buy US-produced LNG due to the Jones Act, which bans the movement of ships between US ports.Europe is also a much more attractive buyer for LNG suppliers than New England. According to the news outlet, while the European benchmark price for natural gas was over $100 per one million British thermal units, gas prices in New England rarely climb above $30. Earlier this year, the governors of some New England states sent a letter to US Energy Secretary Jennifer Graholm asking her to dispel the Jones Act and allow for domestic LNG imports to the region. However, there are no reports so far regarding a change in legislation.

The situation in the region is expected to be especially dire if there are prolonged cold spells, as gas volumes would be redirected from power generation to heating homes. According to ISO New England, the region’s power-grid operator, an extremely cold winter could result in the need for rolling blackouts to balance the supply and demand for electricity. Analysts warn that supply shortages may also drive power producers to purchase gas on the spot-market, which would result in larger bills.

What you’re paying for. Limitless.

• Lawmakers Seek Emergency Powers For Pentagon’s Ukraine War Contracting (DN)

Bipartisan legislation introduced in the Senate would grant the Pentagon wartime procurement powers, allowing it to buy massive amounts high-priority munitions using multi-year contracts to help Ukraine fight Russia and to refill U.S. stockpiles. The Senate Armed Services Committee’s chairman, Sen. Jack Reed, D-R.I., and ranking member, Sen. Jim Inhofe, R-Okla., proposed the legislation as an amendment to the annual defense authorization bill, which the Senate is expected to vote on in November. It was offered instead of the critical munitions acquisition fund that the Pentagon and some lawmakers sought for the same purposes, before Senate appropriators rejected it. The amendment, the text of which was released last week, offers multi-year contracting authorities typically reserved for Navy vessels and major aircraft.

As drafted, it would let the Pentagon lock in purchases of certain munitions made by Lockheed Martin, Raytheon Technologies, BAE Systems and Kongsberg over fiscal 2023 and 2024, a step aimed at encouraging manufacturers to expand production lines for sought-after munitions. The Pentagon would also be permitted to team with NATO to buy weapons for its members in mass quantities, and for Ukraine-related contracts, the legislation would ease several key legal restrictions on Pentagon procurement through fiscal 2024 – a sign lawmakers see the war dragging on. The intent of the legislation is to spur the Pentagon and industry to move more aggressively by removing bureaucratic barriers, with an eye not only on Russia but the potential for a confrontation with China over Taiwan, according to a senior congressional aide [..]

“Whether you want to call it wartime contracting or emergency contracting, we can’t play around anymore,” the aide said. “We can’t pussyfoot around with minimum-sustaining-rate buys of these munitions. It’s hard to think of something as high on everybody’s list as buying a ton of munitions for the next few years, for our operational plans against China and continuing to supply Ukraine.” If the language becomes law, the Department of Defense would be allowed to make non-competitive awards to arms manufacturers for Ukraine-related contracts, an idea spearheaded in legislation from Sen. Jeanne Shaheen, D-N.H., and 13 other senators.

“..25,300 terminals were sent to Ukraine, but, at present, only 10,630 are paying for service..”

• Pentagon Considering Paying For Musk’s Starlink Network In Ukraine (G.)

The Pentagon is considering paying for Elon Musk’s Starlink satellite network in war-torn Ukraine, Politico reported on Monday, citing two US officials involved in the discussions. The most likely source of funding would be the US Department of Defense’s Ukraine security assistance initiative, designed to support the country as it fights Russia, the report added. Musk had said on Friday that SpaceX could not indefinitely fund Starlink in Ukraine, but backtracked over the weekend to assert the rocket company would continue to fund the service in the country. He said in a tweet on Monday that SpaceX had already withdrawn its request for funding, an acknowledgement that such a request was made.A Pentagon spokesman said the defense department would not speculate on future security assistance announcements before they occur.

A separate report in the Financial Times said the European Union was also weighing funding Starlink in Ukraine, citing three officials with knowledge of the decision. Musk, the world’s richest person and chief executive of Tesla Inc, recently said SpaceX spends nearly $20m a month maintaining satellite services in Ukraine and that the company has spent about $80m to enable and support Starlink there. “To be precise, 25,300 terminals were sent to Ukraine, but, at present, only 10,630 are paying for service,” Musk tweeted on Monday. Starlink has helped Ukraine’s civilians and military stay online during the war, with Ukraine’s vice prime minister, Mykhailo Fedorov, last week saying Starlink’s services helped restore energy and communications infrastructure in critical areas.

“Russian Foreign Ministry spokeswoman Maria Zakharova noted that this summer, NATO conducted military drills not far from Bornholm.”

• Details Of Nord Stream Probe Shared By Media (RT)

The blasts that ripped through the Nord Stream 1 and 2 gas pipelines last month were likely caused by sabotage, the Wall Street Journal reported on Monday, citing German officials familiar with the investigation. Earlier, the Russian Foreign Ministry said that NATO had conducted a military exercise this summer close to the location where the leaks were found. According to the outlet, while German investigators have so far failed to definitively identify the culprits, they are “working under the assumption that Russia was behind the blasts.” Moscow has repeatedly denied that it had anything to do with the incident.

German officials reportedly believe that the alleged attack was not likely to have been conducted by a military submarine, given that the Baltic Sea around Denmark’s Bornholm Island, where the explosions occurred, is relatively shallow. This would make it difficult for underwater vessels to operate without being detected. According to one theory, an explosive device may have been dropped from a ship and detonated remotely, sources told the WSJ. [..] Moscow has denounced the incident as a terrorist attack and called for an investigation into the matter. Russian Foreign Ministry spokeswoman Maria Zakharova noted that this summer, NATO conducted military drills not far from Bornholm.

She was apparently speaking about the BALTOPS 2022 exercises held in June, in which ‘’deep-sea equipment’’ was used intensively. According to Germany’s Interior Ministry, Sweden rejected a plan to set up a joint investigation team with Berlin and Denmark. Stockholm argued that its own findings are too sensitive to share even with other EU member states, Reuters reported. All three nations have said they will not grant access to the investigation to Russia. This prompted Moscow to summon the German, Danish, and Swedish envoys, while declaring that it would not recognize the results of the probe unless Russian experts are invited to take part.

“At least 50 metres of the gas pipeline appeared to be missing..”

Well, it’s there somewhere. More interesting: is Sweden, after refusing a joint probe with Germany and Denmark, let alone Russia, now also going to refuse a Gazprom repair of the pipeline?

• Nord Stream 1: First Underwater Images Reveal Devastating Damage (G.)

The first underwater images taken of the ruptured Nord Stream 1 pipeline reveal the devastating damage caused by what Danish police have described as “powerful explosions” under the Baltic Sea. Swedish newspaper Expressen on Tuesday published photographs and film footage taken by an underwater drone at the site near the island of Bornholm where the gas pipeline between Russia and Germany ruptured on 26 September. They appear to show long tears in the seabed near the concrete-reinforced steel pipe that was not merely cracked but torn apart in an act of suspected sabotage. At least 50 metres of the gas pipeline appeared to be missing, Expressen said. Three separate investigations are currently trying to assess the full extent of the damage to the two twin pipelines, Nord Stream 1 and 2, and collect evidence as to who was behind the sabotage.

A German government official on Monday confirmed there would be no joint investigations team working on clearing up the pipeline blast as initially envisioned, but three separate investigations carried out by Danish, Swedish and German authorities would coordinate closely. According to German news magazine Der Spiegel, the offer of a joint investigation was rejected by the Swedish side, with a state prosecutor from the country telling Reuters that “there is some information in our investigation that is confidential because it is directly linked to national security”. A preliminary investigation by Danish authorities established the leak had been caused by “powerful explosions”, Copenhagen police said in a statement on Tuesday.

Getting serious.

• Germany Facing Retail Collapse – Der Spiegel (RT)

Germany’s retail industry is in jeopardy amid rising energy costs and a sharp decline in consumption, Der Spiegel reported on Monday, citing the German Retail Federation (HDE). According to the organization’s forecasts, the first to face the risk of bankruptcy are smaller stores in city centers. Retail turnover in Germany started to decrease in August. According to the Federal Statistical Office, sales in real terms fell by 1.3% compared to July, and by 4.3% versus August 2021. Food sales were down 1.7% from July and 3.1% year-on-year, reaching their lowest level since 2017. Textiles and shoes, household appliances, and construction supplies were other segments seeing a decline in sales.

An HDE spokesman said that the financial assistance promised by the German government to ease energy price spikes should be used to support retail stores. “If this does not happen, we will face a disaster in many urban centers,” he said, as cited by the news outlet. However, he thinks the crisis can be avoided through investments and new creative ideas, although this would require cooperation between retailers and the authorities. “In the current acute crisis, everything is becoming a little more difficult. The money pots will certainly not get fuller for the time being… If the concepts are to work, all stakeholders in the municipalities would have to work together – from the top of the town hall to city marketing, retail and gastronomy to cultural providers and citizens,” he stated.

“By adding the shots to the childhood schedule, the CDC [..] will transfer liability for vaccine injuries to the federal government..”

• CDC To Vote On Permanently Shielding Pfizer, Moderna From Vaccine Liability (JS)

A CDC committee will convene this week and likely vote Thursday to deliver permanent legal indemnity to Pfizer and Moderna, through the process of adding the drug companies’ mRNA injections to the child and adolescent immunization schedules. By adding the shots to the childhood schedule, the CDC’s Advisory Committee on Immunization Practices (ACIP) will transfer liability for vaccine injuries to the federal government’s National Vaccine Injury Compensation Program (VICP), allowing for Pfizer and Moderna to finally bring an FDA approved shot to the market without opening itself up to lawsuits. Moreover, it will act as another windfall for companies that have already brought in hundreds of billions of dollars in revenues, by requiring these vaccinations for children who attend public schools.

In March 2020, the federal government invoked the PREP Act, which gave Pfizer and Moderna a tort liability shield due to the declared “public health emergency,” which the government is reportedly going to revoke in early 2023. The companies’ emergency use authorization shots have since been protected by the federal government through this 2005 congressional action. [..]The Health Resources & Services Administration has clarified what needs to happen for a vaccine to become liability free. “For a vaccine to be covered, the Centers for Disease Control and Prevention (CDC) must recommend the category of vaccine for routine administration to children or pregnant women, and it must be subject to an excise tax by federal law.”

The Dossier has reported extensively on the coordinated effort by Big Pharma and the Biden Administration to delay the rollout of an FDA approved COVID vaccine, with legal experts suspecting the process is in place to protect Pfizer and Moderna from legal liability from vaccine injuries. Once described as the cure to the coronavirus, the novel mRNA shots have resulted in catastrophic failure, with a side effect profile exponentially higher than advertised. Thanks to a fraudulent, deceptive marketing campaign, assisted by top federal officials and high-profile pharmaceutical executives, the drugmakers and the federal government convinced millions of Americans to take shots that were much more dangerous (especially for young men), and much less effective than advertised.

The CDC is about to add the Covid vaccine to the childhood immunization schedule, which would make the vax mandatory for kids to attend school. pic.twitter.com/Ga0EJZIVbI

— Tucker Carlson (@TuckerCarlson) October 19, 2022

RFK

RFK Jr. went on Dr. Drew’s show today and explained how anchors like CNN’s Anderson Cooper makes a $12M salary that’s 80% funded by Pharmaceutical companies via ads. pic.twitter.com/yxrcpJzpdR

— Kate (@KateTalksTruth) October 19, 2022

“.. the interview summary states that work “remained intentionally uncompensated while Joe Biden was vice president.”

• Joe Biden KNEW of Hunter’s Shady Business Dealings: Whistleblowers (PM)

New whistleblower documents obtained by Senator Chuck Grassley have revealed that President Biden “was aware of Hunter Biden’s business arrangements and may have been involved in some of them.” On Monday morning, Grassley sent a letter to Attorney General Merrick Garland, FBI Director Christopher Wray, and US Attorney for Delaware David Weiss outlining new whistleblower allegations that claim the FBI has “significant, impactful and voluminous evidence with respect to potential criminal conduct by Hunter Biden and James Biden,” according to Fox News. The whistleblowers allege that the FBI has documents relating to information on Mykola Zlochevsky, who is the owner of Burisma Holdings, where Hunter Biden sat on the board.

“The documents in the FBI’s possession include specific details with respect to conversations by non-government individuals relevant to potential criminal conduct by Hunter Biden,” Grassley wrote. “These documents also indicate that Joe Biden was aware of Hunter Biden’s business arrangements and may have been involved in some of them,” Grassley said. The Senator added that it is “unclear whether the FBI followed normal investigative procedure to determine the truth and accuracy of the information or shut down investigative activity based on improper disinformation claims in advance of the 2020 election.” “It is also unclear whether US Attorney Weiss has performed his own due diligence on these and related allegations,” Grassley continued.

Grassley, alongside Senator Ron Johnson, led an investigation into Hunter Biden starting in 2019, which discovered that officials within the Obama administration “knew” of Hunter Biden’s “problematic” position on the board, saying that it interfered “in the efficient execution of policy with respect to Ukraine.” Hunter Biden joined the board in April of 2014, while his father was serving as vice president and running US-Ukraine relations and policy for the administration. Additionally, Grassley noted an FBI interview with Tony Bobulinski, Hunter Biden’s ex-business partner, from October 2020, where he stated that Hunter Biden and his uncle, James Biden, had created a business agreement with foreign nationals connected to the Chinese government during Biden’s vice presidency.

Grassley said that the interview summary states that work “remained intentionally uncompensated while Joe Biden was vice president.” “After Joe Biden left the vice presidency, the summary makes clear that Hunter Biden and James Biden worked with CEFC and affiliated individuals to compensate them for that past work and benefits they procured for CEFC,” Grassley said. Hunter Biden, James Biden, and their business partners created a joint venture, known as SinoHawk Holdings, that would be a “vehicle to accomplish that financial compensation.” The venture was a partnership between the two Bidens, and CEFC Chairman Ye Jianming. 50 percent of SinoHawk was owned by Oneida Holdings, which according to the summary, was made up of five evenly divided LLCs, two of which went to Hunter and James Biden, and 10 percent, Bobulinski revealed, was “to be held for Joe Biden.”

Aluminum

— healthbot (@thehealthb0t) October 18, 2022

Cockatoo

Physics says energy would be lost due to inefficiency of the wheel, and it wouldn't make a complete loop with the bird on it. This cockatoo actually learned to move in a way that adds energy to the system, allowing it to make a complete loop [full video: https://t.co/u7nrU3rkTz] pic.twitter.com/lGCDYBkl0j

— Massimo (@Rainmaker1973) October 18, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.