Prohibition sale June 24 1920

$160 billion and counting.

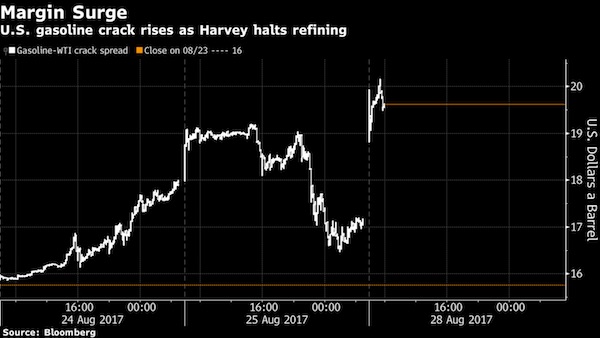

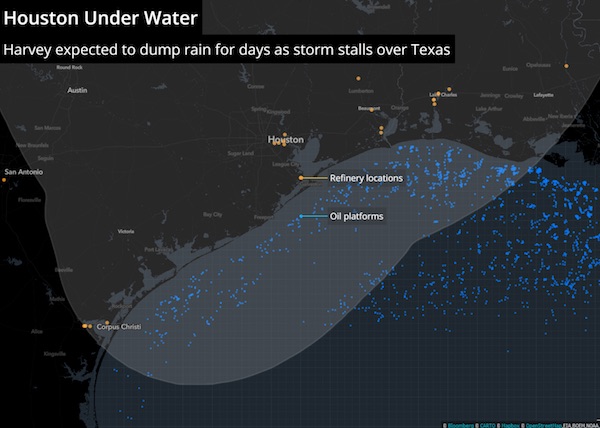

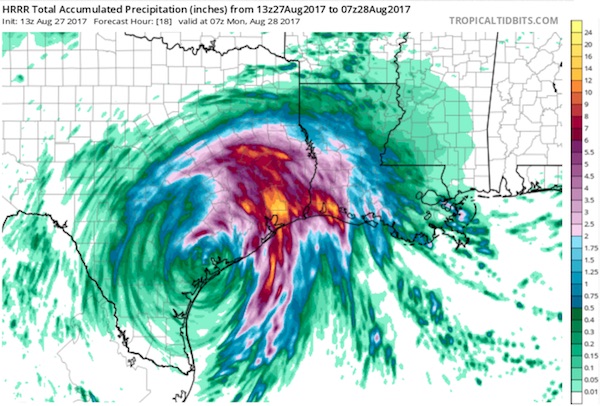

• Hurricane Harvey the Costliest Natural Disaster in US History (H.)

Hurricane Harvey is predicted to be the costliest natural disaster in the history of the U.S., with a damage cost exceeding Hurricanes Sandy and Katrina. AccuWeather predicts that the damage cost will hit $160 billion. AccuWeather, a private weather firm, notes that the storm’s cost represents 0.8% of the national GDP, which is now at $19 trillion. “Business leaders and the Federal Reserve, major banks, insurance companies, etc. should begin to factor in the negative impact this catastrophe will have on business, corporate earnings and employment. The disaster is just beginning in certain areas,” AccuWeather founder Dr. Joel N. Myers said in a statement.

“Parts of Houston, the United States’ fourth largest city will be uninhabitable for weeks and possibly months due to water damage, mold, disease-ridden water and all that will follow this 1,000-year flood.” Before Harvey, the costliest hurricane to hit the U.S. was Hurricane Katrina, which caused $108 billion in damage along the Gulf Coast in 2005. The second-costliest was Hurricane Sandy, which caused $75 billion in damage in 2012. Hurricane Ike, the last storm to make landfall in Texas before Harvey, caused $37.5 billion in damage in 2008. [..] The Associated Press reports that 80% of Harvey’s victims do not have flood insurance. Thousands of families will have to take on more debt or spend much more to fix their homes. Others will sell their property to move out.

Robert Hunter, director of insurance at the Consumer Federation of America, estimated that flood damage alone cost at least $35 billion. Hunter explained to the AP that if you don’t have flood insurance, you can apply for federal disaster benefits. However, these are low interest loans that will add more debt. Homeowners insurance covers water damage caused by wind damage, but not if the water comes through the floor or walls, the AP explains. “Homeowners with water damage can get paid through their homeowners insurance but only if wind blows out a window or sends a roof aloft first, allowing the water in,” the AP notes. “If the water rushes through the floorboard or walls, you’re not covered.”

Read more …

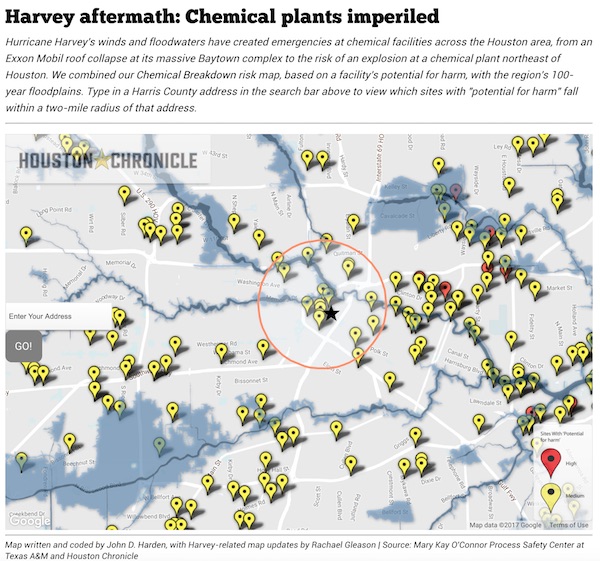

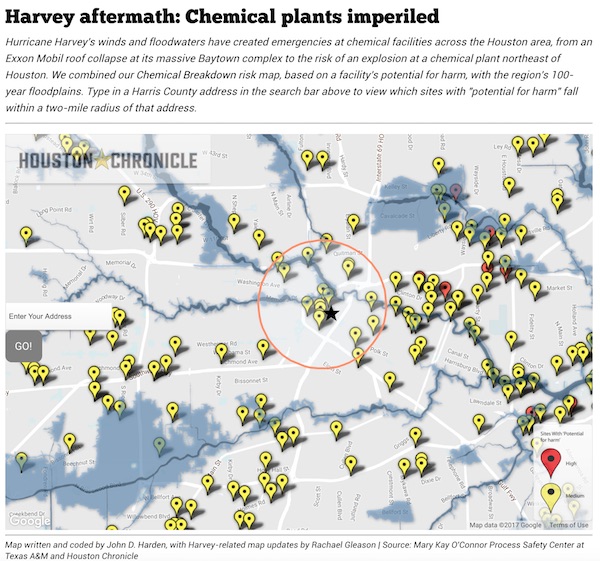

There have been scores of chemicals released into the air already in the area.

• “No Way To Prevent Imminent Explosion” At Texas Chemical Plant (ZH)

[..] in a potentially disastrous outcome from the Harvey flooding, a chemical plant in Crosby, Texas belonging to French industrial giant Arkema, has announced it is evacuating workers due to the risk of an explosion, after primary power was knocked out and flooding swamped its backup generators. The French company said the situation at the plant “has become serious” and said that it is working with the Department of Homeland Security and the State of Texas to set up a command post in a suitable location near our site. The plant, which produces explosive organic peroxides and ammonia, was hit by more than 40 inches of rain and has been heavily flooded, running without electricity since Sunday. The plant was closed since Friday but has had a skeleton staff of about a dozen in place.

Following the flood surge, the plant’s back-up generators also failed. The threat emerged once the company could no longer maintain refrigeration for chemicals located on site, which have to be stored at low temperatures. The plant lost cooling when backup generators were flooded and then workers transferred products from the warehouses into diesel-powered refrigerated containers. On Tuesday afternoon, the company released a statement which admitted that “refrigeration on some of our back-up product storage containers has been compromised due to extremely high water, which is unprecedented in the Crosby area. We are monitoring the temperature of each refrigeration container remotely.” It then warned that “while we do not believe there is any imminent danger, the potential for a chemical reaction leading to a fire and/or explosion within the site confines is real.”

One day later, and with the torrential rains finally over, has the situation at the giant peroxide chemical plant stabilized? Unfortunately, according to Reuters, the answer is no. Speaking to reporters on Wednesday afternoon, Richard Rowe, the chief executive of Arkema’s American operations said that “the company has no way of preventing chemicals from catching fire or exploding at its heavily flooded plant.” Rowe added that the company now expects chemicals on site to catch fire or explode within the next six days. Since the plant remains flooded by about six feet of water, “the company has no way to prevent” this worst-case outcome. Anticipating the worst, the company earlier evacuated all remaining workers, while Harris County ordered the evacuation of residents in a 1.5-mile radius of the plant that makes organic chemicals.

Read more …

Insult. Injury.

• Texans To Be Hit With New Insurance Law (Ind.)

The embattled populations of southeastern Texas, may soon encounter a new obstacle in their quests to rebuild their lives after Harvey when a new state insurance law that makes it harder for consumers to receive full claims goes into effect Friday. The new law decreases the chances that an insurance company will be forced to pay claim delay penalties and plaintiff attorneys’ fees related to weather-involved claims — a protection that may discourage struggling households from pursuing legal action even if they think the insurance companies are offering less of a payout than they should. Under the new regulations, insurance companies will enjoy greater freedoms to push back on insurance claims, and the first wave of such claimants are likely to be coming from areas impacted by Harvey.

Residents reeling from Harvey now have until just Friday to assess the damages to their homes that may still be under water, and to notify their insurance company of nay damages if they want to avoid navigating that new law. After Friday, new legal restrictions will be in place that make things more difficult for consumers, and interest rates imposed on insurance companies to deter late payments will be cut nearly in half. “Without this law, and as the law currently is until Friday, I think insurance companies would be more responsive to claims,” Kir Pittard, a Dallas attorney, wrote on Facebook of the new law. “After Friday, there won’t be the incentive because the penalty for delays have been reduced.” To put it bluntly, a lot of residents in the impact area of Harvey may face a long battle ahead to replace the roofs torn off their homes from high winds, activists say.

“Insurance companies already had a lot of power, and the bill gives them a lot more power. As we know, too often insurance companies wrongfully withhold payments, they delay payments, they deny claims,” Ware Wendell, the executive director of consumer watchdog group Texas Watch, told The Independent. “So, we’re very concerned that people are going to have blue tarps on their homes instead of roofs.”

Read more …

Nomi sees central banks the same way I do.

• A Decade of G7 Central Bank Collusion – And Counting… (Nomi Prins)

Since late 2007, the Federal Reserve has embarked on grand-scale collusion with other G-7 central banks to manufacture a massive amount of money. The scope and degree of this collusion are historically unprecedented and by admission of the perpetrators, unconventional in approach, and – depending on the speech – ineffective. Central bank efforts to provide liquidity to the private banking system have been delivered amidst a plethora of grandiose phrases like “unlimited” and “by all means necessary.” Central bankers have played a game with no defined goalposts, no clock rundown, no max scores, and no true end in sight. At the Fed’s instigation, central bankers built policy on the fly. Their science experiment morphed into something even Dr. Frankenstein couldn’t have imagined.

Confidence in the Fed and the U.S. dollar (as well as in other major central banks globally) has dropped considerably, even as this exercise remains in motion, and even though central bankers have tactiltly admitted that their money creation scheme was largely a bust, though not in any one official statement. On July 31, 2017, Stanley Fischer, vice chairman of the Fed, delivered a speech in Rio de Janeiro, Brazil. There, he addressed the phenomenon of low interest rates worldwide. Fischer admitted that “the effects of quantitative easing in the United States and abroad” are suppressing rates. He also said there was “a heightened demand for safe assets affecting yields on advanced-economy government securities.” (Actually, there’s been heighted demand for junky assets, as well, which has manifested in a bi-polarity of saver vs. speculator preference.)

What Fischer meant was that investors are realizing that low rates since 2008 haven’t fueled real growth, just asset bubbles. Remember, Fischer is the Fed’s No. 2 man. He was also a professor to former Fed Chair Ben Bernanke and current European Central Bank President Mario Draghi. Both have considered him to be a major influence in their economic outlook. The “Big Three” central banks – the Fed, the European Central Bank and the Bank of Japan – have collectively held rates at a zero% on average since the global financial crisis began. For nearly a decade, central banks have been batting about tens of trillions of dollars to do so. They have fueled bubbles. They have amassed assets on their books worth nearly $14 trillion. That’s money not serving any productive, real-economy purpose – because it happens to be in lock-down.

Read more …

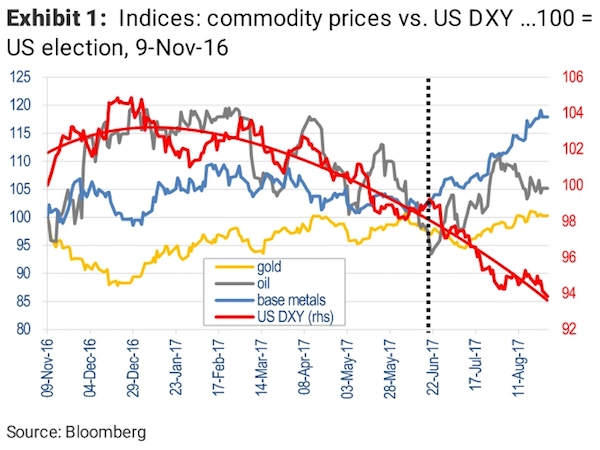

When the reserve currency sinks, strange things can happen.

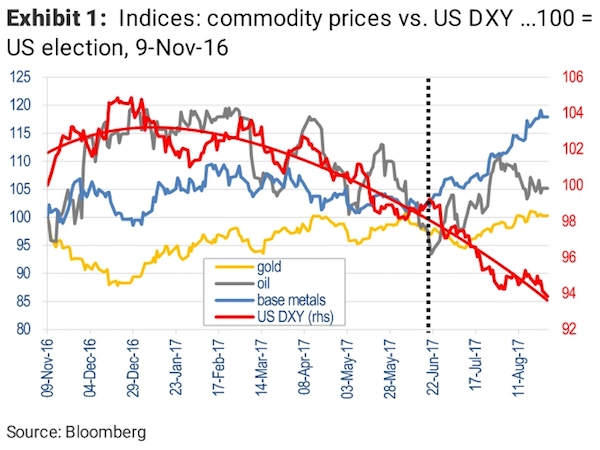

• It’s Time For Your Reminder That Most Commodities Are Priced In US Dollars (BI)

The commodity rally since June has been impressive, and it could be tied to weakness in the US dollar. Those sharp increases — ranging between 15-40% — have had Morgan Stanley strategists slightly puzzled. On one hand, bulk commodities such as iron ore and coal have benefited from steady increases in demand. “Similarly, restocking in zinc and nickel markets have helped lift prices of those trades,” the analysts said. However, they added that fundamentals alone can’t explain the rise in the prices of copper, aluminium and lead. That suggests some of the price action is being driven by an external factor: the recent weakness in the US dollar. The analysts noted that this is the second commodity rally within the last year that’s been directly connected to the US dollar.

But the first one was the other way round — commodities staged a 4-week rally in the wake of the US election last November, when the US dollar was also rising. So why the difference? According to Price and Bates, it’s because the outlook for inflation has now largely reversed. “Post-election, markets positioned for new inflation risk, on the promise of a US infra-build story,” they said. But infrastructure reform is yet to get off the ground amid political gridlock in Washington, and US inflation remains stuck below the Federal Reserve’s target rate of 2-3%. Currency markets have reacted by driving the US dollar lower throughout most of 2017. So it follows that commodities priced in US dollars have benefited from a fall in the greenback while overall commodity-demand remains unchanged.

Read more …

Try it in a smaller country first?!

• A Universal Basic Income Would Grow The Economy (Vox)

A universal basic income could make the US economy trillions of dollars larger, permanently, according to a new study by the left-leaning Roosevelt Institute. Basic income, a proposal in which every American would be given a basic stipend from the government no strings attached, is often brought up as a potential solution to widespread automation reducing demand for labor in the future. But in the meantime, its critics typically allege that it is far too expensive to be practical, or else that it would spur millions of Americans to drop out of the labor force, wrecking the economy and depriving the government of a tax base for funding the plan. The Roosevelt study, written by Roosevelt research director Marshall Steinbaum, Michalis Nikiforos at Bard College’s Levy Institute, and Gennaro Zezza at the University of Cassino and Southern Lazio in Italy, comes to a dramatically different conclusion.

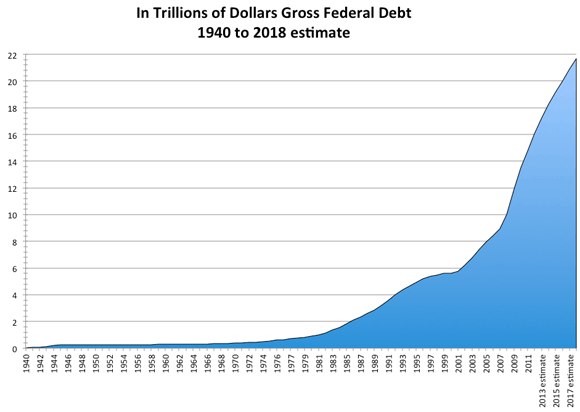

And it does so using some notably rosy assumptions about the effects of large-scale increases to government spending, taxes, and deficits, assumptions that other analysts would dispute vociferously. Their paper analyzes three different models for a universal basic income: • A full universal basic income, in which every adult gets $1,000 a month ($12,000 a year) • A partial basic income, in which every adult gets $500 a month ($6,000 a year) • A child allowance, in which every child gets $250 a month ($3,000 a year) They find that enacting any of these policies by growing the federal debt — that is, without raising taxes to pay for it — would substantially grow the economy. The effect fades away within eight years, but GDP is left permanently higher. The big, $12,000 per year per adult policy, they find, would permanently grow the economy by 12.56 to 13.10% — or about $2.5 trillion come 2025.

It would also, they find, increase the%age of Americans with jobs by about 2%, and expand the labor force to the tune of 4.5 to 4.7 million people. They also model the impact of the plan if it’s paid for with taxes. That amounts to large-scale income redistribution, which, the authors argue, would stimulate the economy, because lower-income people are likelier to spend their money in the near-term than rich people are. Thus, they find that a full $12,000 a year per adult basic income, paid for with progressive income taxes, would grow the economy by about 2.62% ($515 billion) and expand the labor force by about 1.1 million people.

These are extremely contentious estimates, borne of controversial assumptions about the way the economy works and the effects that a basic income would have on it. Many, if not most, economic modelers would come to very different conclusions: that a basic income discourages work, that raising taxes to pay for it could have profound negative economic impacts, and that not paying for it and exploding the deficit is a recipe for fiscal and economic ruin. But the authors argue that the economic model they’re using, run by the Bard College Levy Economics Institute, uses more realistic assumptions than alternative models, and is particularly well-suited for predicting a UBI’s impact.

Read more …

Part of Yanis’ plans for Greece. A parallel system.

• The Promise of Fiscal Money (Varoufakis)

any attempt to bring treasuries and central banks back under one roof would expose politicians to accusations of trying to get their grubby hands on the levers of monetary policy. But another response to the new reality is available: Leave central banks alone, but give governments a greater say in domestic money creation – and, indeed, greater independence from the central bank – by establishing a parallel payments system based on fiscal money or, more precisely, money backed by future taxes. How would fiscal money work? For starters, it would “live” on the tax authority’s digital platform, using the existing tax file numbers of individuals and companies. Anyone with a tax file number (TFN) in some country receives a free account linked to their TFN.

Individuals and firms will then be able to add credit to their TFN-linked account by transferring money from their normal bank account, in the same way that they do today to pay their taxes. And they will do so well in advance of tax payments because the state guarantees to extinguish in, say, a year €1,080 of the tax owed for every €1,000 transferred today – an effective annual interest rate of 8% payable to those willing to pay their taxes a year early. In practice, once, say, €1,000 has been transferred to one’s TFN-linked account, a personal identification number (the familiar PIN) is issued, which can be used either to transfer the €1,000 credit to someone else’s TFN-linked account or to pay taxes in the future. These time-stamped future tax euros, or fiscal euros, can be held for a year until maturity or be used to make payments to other taxpayers.

Smartphone apps and even government-issued cards (doubling as, say, social security ID) will make the transactions easy, fast, and virtually indistinguishable from other transactions involving central bank money. In this closed payments system, as fiscal money approaches maturity, taxpayers not in possession of that vintage will fuel rising demand for it. To ensure the system’s viability, the Treasury would control the total supply of fiscal money, using the effective interest rate to guarantee that the nominal value of the total supply never exceeds a%age of national income, or of aggregate taxes, agreed by the legislature. To ensure full transparency, and thus trust, a blockchain algorithm, designed and supervised by an independent national authority, could settle transactions in fiscal money.

Read more …

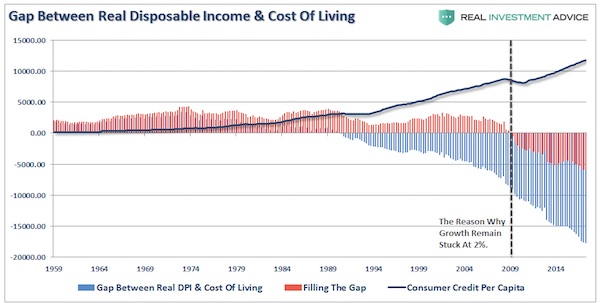

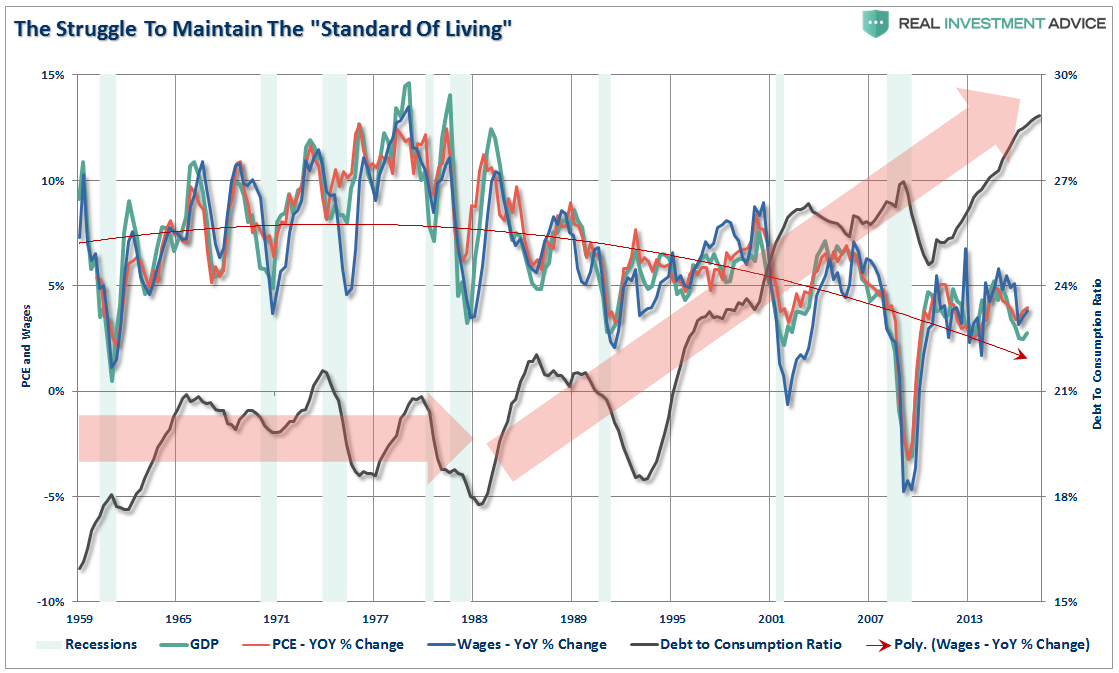

Is it low savings or high debt levels?

• America and China’s Codependency Trap (Stephen Roach)

Caught up in the bluster of the US accusations being leveled at China, little attention is being paid to the potential consequences of Chinese retaliation. Three economic consequences stand out. First, imposing tariffs on imports of Chinese goods and services would be the functional equivalent of a tax hike on American consumers. Chinese producers’ unit labor costs are less than one fifth those of America’s other major foreign suppliers. By diverting US demand away from Chinese trade, the costs of imported goods would undoubtedly rise sharply. The possibility of higher import prices and potential spillover effects on underlying inflation would hit middle-class US workers, who have faced more than three decades of real wage stagnation, especially hard.

Second, trade actions against China could lead to higher US interest rates. Foreigners currently own about 30% of all US Treasury securities, with the latest official data putting Chinese ownership at $1.15 trillion in June 2017 – fully 19% of total foreign holdings and slightly higher than Japan’s $1.09 trillion. In the event of new US tariffs, it seems reasonable to expect China to respond by reducing such purchases, reinforcing a strategy of asset diversification away from US dollar-based assets that has been under way for the past three years. In an era of still-large US budget deficits – likely to go even higher in the aftermath of Trump administration tax cuts and spending initiatives – the lack of demand for Treasuries by the largest foreign owner could well put upward pressure on borrowing costs.

Third, with growth in US domestic demand still depressed, American companies need to rely more on external demand. Yet the Trump administration seems all but oblivious to this component of the growth calculus. It is threatening trade sanctions not only against China – America’s third-largest and fastest-growing major export market – but also against NAFTA partners Canada and Mexico (America’s largest and second-largest export markets, respectively). As the reactive pathology of codependency would suggest, none of these countries can be expected to acquiesce to such measures without curtailing US access to their markets – a counter-response that could severely undermine the manufacturing revival that seems so central to the Trump presidency’s promise to “Make America Great Again.”

In the end, China’s economic leverage over America is largely the result of low US domestic saving. In the first quarter of 2017, the so-called net national saving rate – the combined depreciation-adjusted saving of businesses, households, and the government sector – stood at just 1.9% of national income, well below the longer-term average of 6.3% that prevailed over the final three decades of the twentieth century. Lacking in saving and wanting to consume and grow, the US must import surplus saving from abroad to close the gap, forcing it to run massive current-account and trade deficits with countries like China to attract the foreign capital.

Read more …

“..the now-notorious 2011 standoff led S&P Global Ratings to downgrade U.S. sovereign debt for the first time. The episode wiped $2.4 trillion off U.S. stocks.”

• Financial Firms Fear Turmoil Over Fraught US Debt Ceiling Talks (R.)

Financial firms are sounding alarm bells and dusting off contingency plans over fears an increasingly dysfunctional U.S. Congress may fail to reach a deal to raise the country’s debt limit. Several lobbyists, representing dozens of bankers, investors and credit rating agencies, told Reuters they are worried that dynamics at play in Washington – a bitterly divided Republican party and unpredictable President Donald Trump – could rule out a deal before an October deadline. Policymakers have vowed to provide disaster relief to areas affected by Hurricane Harvey, boosting hopes the debt limit battle could be included in an agreement on a legislative package.

But the acrimonious atmosphere following Trump’s remarks about the Charlottesville protests this month, which cost him key backers in the business community and raised worries about his ability to broker a deal, still lingers. The debt ceiling is a legal cap on how much money the government can borrow to fund its budget deficits and meet debt obligations. Failure to raise it from the current $19.8 trillion could lead to default, sending shockwaves across global markets. “The stakes here are incredibly high. The economic impact associated with debt default is so immense,” said Rob Nichols, president and CEO of the American Bankers Association (ABA), one of the country’s key financial lobby groups. “We’re monitoring this extremely closely and we will mobilize as needed throughout September.”

While leading lawmakers and the administration have pledged it will get done, some corners of financial markets are already on edge. After all, Goldman Sachs estimated that failure to lift the cap would force a government spending cut equal to between 3 and 4% of U.S. gross domestic product, which would have crippling economic consequences. Moreover, previous debt limit negotiations went down to the wire, and the now-notorious 2011 standoff led S&P Global Ratings to downgrade U.S. sovereign debt for the first time. The episode wiped $2.4 trillion off U.S. stocks.

Read more …

“U.S. gold is currently officially valued at $42.22 per ounce on the Treasury’s books versus a market price of $1,285 per ounce”

• Weird Things Are Happening With Gold (Rickards)

The first strange gold story involves Germany… The Deutsche Bundesbank, the central bank of Germany, announced that it had completed the repatriation of gold to Frankfurt from foreign vaults. The German story is the completion of a process that began in 2013. That’s when the Deutsche Bundesbank first requested a return of some of the German gold from vaults in Paris, in London and at the Federal Reserve Bank of New York. Those gold transfers have now been completed. This is a topic I first raised in the introduction to Currency Wars in 2011. I suggested that in extremis, the U.S. might freeze or confiscate foreign gold stored on U.S. soil using powers under the International Emergency Economic Powers Act, the Trading With the Enemy Act or the USA Patriot Act.

This then became a political issue in Europe with agitation for repatriation in the Netherlands, Germany and Austria. Europeans wanted to get gold out of the U.S. and safely back to their own national vaults. The German transfer was completed ahead of schedule; the original completion date was 2020. But the German central bank does not actually want the gold back because there is no well-developed gold-leasing market in Frankfurt and no experience leasing gold under German law. German gold in New York or London was available for leasing under New York or U.K. law as part of global price-manipulation schemes. Moving gold to Frankfurt reduces the floating supply available for leasing, making it more difficult to keep the manipulation going.

Why did Germany do it? The driving force both in 2013 (date of announcement) and 2017 (date of completion) is that both years are election years in Germany. Angela Merkel’s position as chancellor of Germany is up for a vote on Sept. 24, 2017. She may need a coalition to stay in power, and there’s a small nationalist party in Germany that agitates for gold repatriation. Merkel stage-managed this gold repatriation with the Deutsche Bundesbank both in 2013 and this week to appease that small nationalist party and keep them in the coalition. That’s why the repatriation was completed three years early. She needs the votes now.

The truly weird gold story comes from the United States… Secretary of the Treasury Steve Mnuchin and Senate Majority Leader Mitch McConnell just paid a visit to Fort Knox to see the U.S. gold supply. Mnuchin is only the third Treasury secretary in history ever to visit Fort Knox and this was the first official visit from Washington since 1974. The U.S. government likes to ignore gold and not draw attention to it. Official visits to Fort Knox give gold some monetary credence that central banks would prefer it does not have. Why an impromptu visit by Mnuchin and McConnell? Why now? The answer may lie in the fact that the Treasury is running out of cash and could be broke by Sept. 29 if Congress does not increase the debt ceiling by then. But the Treasury could get $355 billion in cash from thin air without increasing the debt simply by revaluing U.S. gold to a market price. (U.S. gold is currently officially valued at $42.22 per ounce on the Treasury’s books versus a market price of $1,285 per ounce.)

Read more …

Naked power plays.

• ‘More Europe’ Won’t Solve Europe’s Fiscal Quandary (BBG)

To a certain cast of people, the solution to every problem in Europe is “more Europe” – even, or especially, those problems that have been caused by Europe. The economic crisis that began a decade ago has exposed many flaws in the European economic model. The solution? Some are calling for a euro-zone budget and a euro-zone finance minister. France’s new president, Emmanuel Macron, is dedicated to the idea. Berlin has signaled conditional support. And Brussels is always happy to accrue more power. The idea makes superficial sense: Monetary union, most people now accept, doesn’t really work without fiscal union. The European Central Bank is constantly under pressure to loosen monetary policy to help the weakest euro members, and to keep it tight to help the strongest. But currency is a blunt instrument.

The “more Europe” thinking is that if the EU had a large budget, it could redistribute wealth to more directly help struggling members. (This is what happens in the U.S.) A powerful finance minister would oversee member countries to keep deficits and debts down and prevent debt crises. Except that that doesn’t make much sense: As Martin Sandbu points out, the U.S. federal budget, hovering at around 20% of GDP, isn’t enough to act as much of a macro-economic stabilizer, and nobody contemplates an EU budget of even that scale in the foreseeable future. Regardless, the so-called debt crises in the euro zone were not ultimately caused by deficits and debts as such, but by monetary phenomena. The euro made Mediterranean countries uncompetitive, leading to slow growth and debt and deficits, and the interest on those debts spiked only when the implicit euro-zone-wide guarantee on those debts was called into question by Germany.

What of Germany, which is essential to any EU reform effort? Germany historically, and Angela Merkel especially, has always been keen on more European integration – but also doesn’t want to pay for it. German Finance Minister Wolfgang Schaeuble has favored the idea of an EU budget – with a little-noticed but all-important asterisk. EU countries’ access to a European macroeconomic stabilization fund would be conditioned on “the bailout fund having more say over national debt and budgets,” he told the German Bild newspaper. In other words, Germany would be happy to pay a little something toward a macro-economic stabilization fund in exchange for having practical control over the budgets of all the euro-zone countries.

The commitment to pay into the fund is probably not daunting, because the budgetary orthodoxy rules Germany would come up with would be unattainable, and the money would probably never be spent. In other words, Macron and the “more Europe” camp are willing to hand Germany control over the euro zone’s finances, in exchange for … well, perhaps nothing. It’s an offer that Merkel can’t refuse.

Read more …

No, it’s not ideal. But at least all-out chaos like in Libya has been prevented.

• Victory For Assad Increasingly Likely As World Loses Interest In Syria (G.)

In recent months, as supplies of aid, money and weapons to Syria’s opposition have dwindled, it had clung to the hope that ongoing international political support would prevent an outright victory for Bashar al-Assad and his backers. Not any more. An announcement earlier this week by Jordan – one of the opposition’s most robust supporters – that “bilateral ties with Damascus are going in the right direction” has, for many, marked a death knell for the opposition cause. Within the ranks of the political opposition, and regional allies, the statement was the opening act of something that all had dreaded: normalisation with a bitter foe. And without anything much to show for it.

Emphasising his words, Jordanian government spokesman Mohammad al-Momani said: “This is a very important message that everyone should hear.” And indeed, the about-face in Amman was quickly noted in Ankara, Doha, and Riyadh, where – after seven and a-half years of war – states that were committed to toppling the Syrian leader are now resigned to him staying. Returning from a summit in the Saudi capital last week, opposition leaders say they were told directly by the foreign minister, Adel al-Jubeir, that Riyadh was disengaging. “The Saudis don’t care about Syria anymore,” said a senior western diplomat. “It’s all Qatar for them. Syria is lost.”

In Britain too, rhetoric that had demanded Assad leave the Presidential Palace, as a first step towards peace, has been replaced by what Whitehall calls “pragmatic realism”. The foreign secretary, Boris Johnson, last week couched Assad’s departure as “not a precondition. But part of a transition.” Rex Tillerson, the US secretary of state, has openly delegated finding a solution to Syria to Russia. Donald Trump, meanwhile, has pledged to close a CIA-run programme, which had sent weapons from Jordan and Turkey to vetted Syrian rebel groups for much of the past four years. Washington has adopted a secondary role in twin, ailing, peace processes in Geneva and Astana and has focused its energies on fighting Isis, not Assad.

Read more …

How long ago is it that Justin vowed to fix this? “.. more than 100 reserves still lack housing, electricity or running water “

• ‘Our Society Is Broken’: Canada’s First Nations Suicide Epidemic (G.)

The suicide epidemic affecting First Nations communities across Canada has been a national crisis for decades, but it attracted international headlines after three indigenous communities were moved to declare a state of emergency in response to a series of deaths. In the spring of 2016, Attawapiskat First Nation reserve in Ontario declared a state of emergency after 11 young people tried to commit suicide in one night – adding to the estimated 100 attempts made over 10 months among this community of 2,000 people. Not long after, it was revealed that six people, including a 14-year-old girl, had killed themselves over a period of three months in the Pimicikamak Cree Nation community of northern Manitoba. In the aftermath, more than 150 youths in this remote community of 6,000 were put on suicide watch.

Then in June this year, another First Nations reserve in Ontario lost three 12-year-old girls who had reportedly agreed a suicide pact. This string of tragic events has seen media and government turn the spotlight on an issue too often ignored in Canada. Across the country, suicide and self-inflicted injury is the leading cause of death for First Nations people below the age of 44. Studies show young indigenous males are 10 times more likely to kill themselves than their non-indigenous male counterparts, while young indigenous females are 21 times more likely than young non-indigenous females. [..] The government has been criticised for its lack of support and funding for First Nations communities, which total 1.4 million people – just under 4.3% of Canada’s population. “We call that injustice,” says Roderick McCormick, an expert in indigenous health and suicide at Thompson Rivers University in Kamloops BC.

He suggests a complex web of severe poverty plus lack of education and basic necessities underpins the rise in suicides among indigenous youths. “In terms of educational opportunities, healthcare and child welfare, the government is doing an injustice by not adequately funding our communities,” McCormick says. “When these remote reserves compare themselves to other communities across Canada, there is a huge gap that has become really evident.” Recent research has found more than 100 reserves still lack housing, electricity or running water – with almost 90 of them being advised to boil their drinking water. Another study by the Canadian Centre for Policy Alternatives found that 60% of children on these reserves are living in poverty. “The communities I represent are living in abject poverty,” Wilson says. “My people are the poorest in this country, and that’s not right.”

Read more …